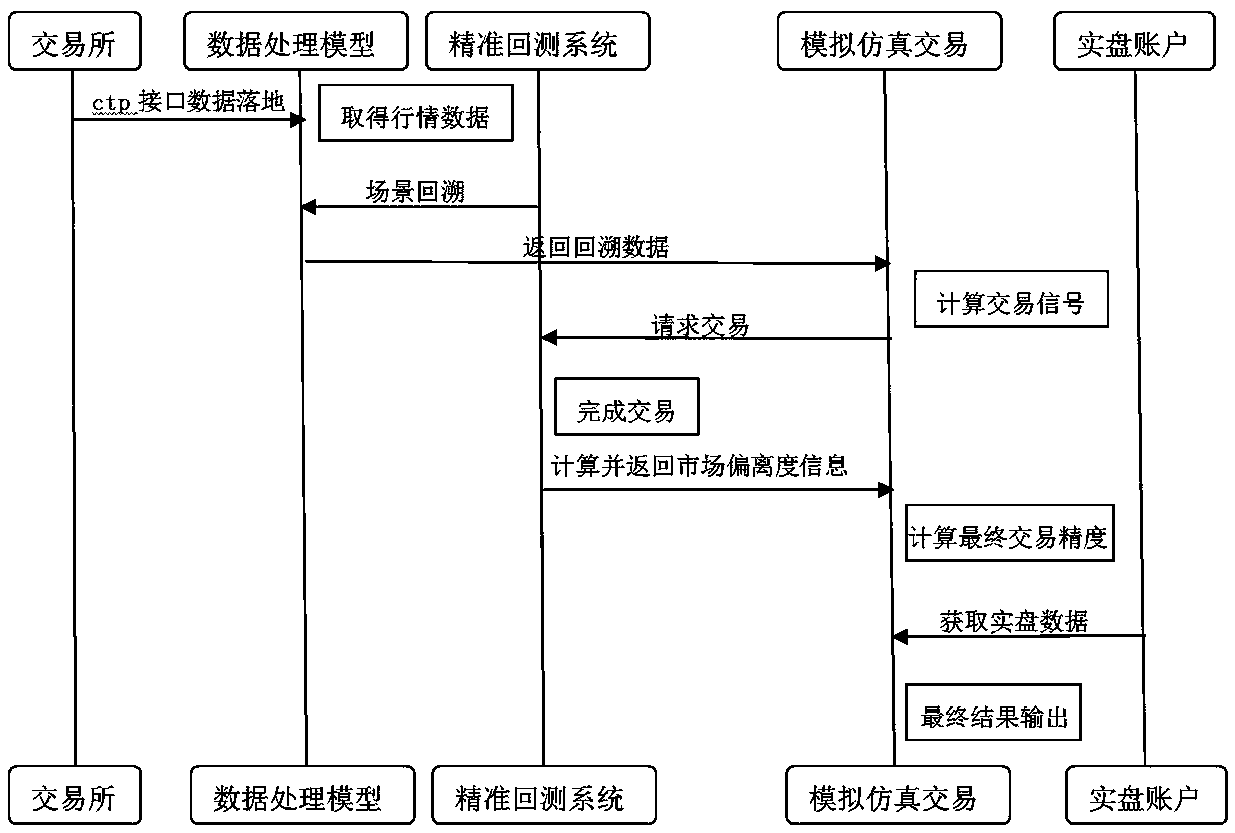

The invention discloses an aAccurate back test and evaluation system and method for a stocksecurities market quantitative investment strategy

A technology for evaluating systems and strategies, applied in instruments, finance, data processing applications, etc., can solve problems such as huge differences in expected effects and low accuracy of historical data, and achieve the effect of enhancing accuracy

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

[0083] The calculation of market deviation is illustrated with an example:

[0084] The strategy initiates a buy order for 20 lots of futures product A at a price of 50 yuan (0.5 yuan slippage). At this time, the opponent's order data shows that there are 100 lots with an average price of 50.15 yuan on the time slice at that time. Then in the backtest, the transaction will be confirmed with 50.5 yuan and 20 lots, and the result will be returned. At the same time, the impact value of this transaction on the market deviation of futures product A will be calculated as 20%. If until after the market closes, the main buying turnover is greater than the main selling turnover during the rest of the day, and the ratio between the two is 1.25, then the market deviation caused by the transaction as of the closing is 20%*1.25=25%; On the contrary, if until after the close of the market, the ratio between the transaction volume of the main buyer and the main seller during the rest of the ...

Embodiment 2

[0086] Examples of two-way verification of simulated / real transaction data:

[0087] A simulated real-time trading strategy whose influence on market deviation is always maintained between 0.001% and 0.0025%. In the past week, it was found that the deviation between the number of varieties held by it and the number of varieties held in the real offer process exceeded 5 varieties. At this time It was determined that the strategy failed in the short term. After analysis, it was found that the selection model of the initial product pool was deviated due to changes in the market capital wind direction. Although the trading product automatically selected by the strategy was verified to be effective in the simulated market, the market itself has corrected the real trading behavior. operate. At this time, it is necessary to readjust the product selection module in the strategy model, retest the historical data, and reload it into the simulated transaction after verifying the valid re...

Embodiment 3

[0089] For 5 million funds invested in the futures market, through historical backtesting from 2010 to 2017, the average deviation impact value of each pen is 0.0025%, and the cumulative impact is 0.038%. Reached 10.7179 million. The cumulative impact of deviation is still within 0.5% of the effective range, and the strategy is allowed to continue to be implemented.

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com