Credit score determination system and method, terminal and server

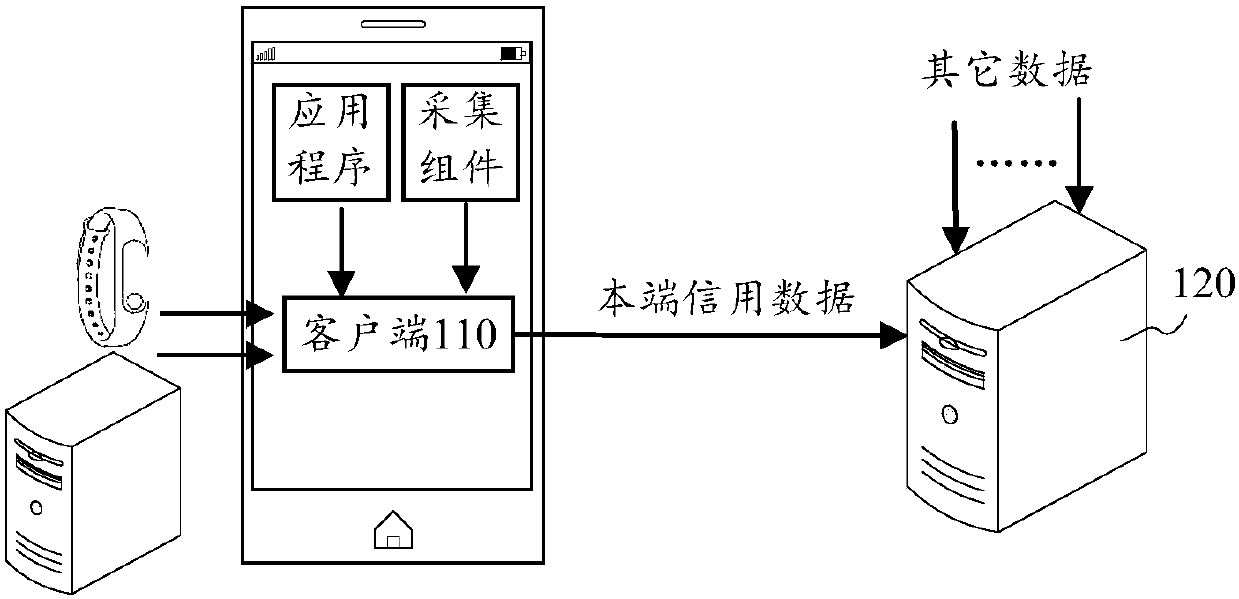

A server and credit technology, applied in instruments, data processing applications, finance, etc., can solve problems such as large amount of calculation, and achieve the effect of ensuring user privacy, reducing the amount of calculation, and reducing the pressure on data storage

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

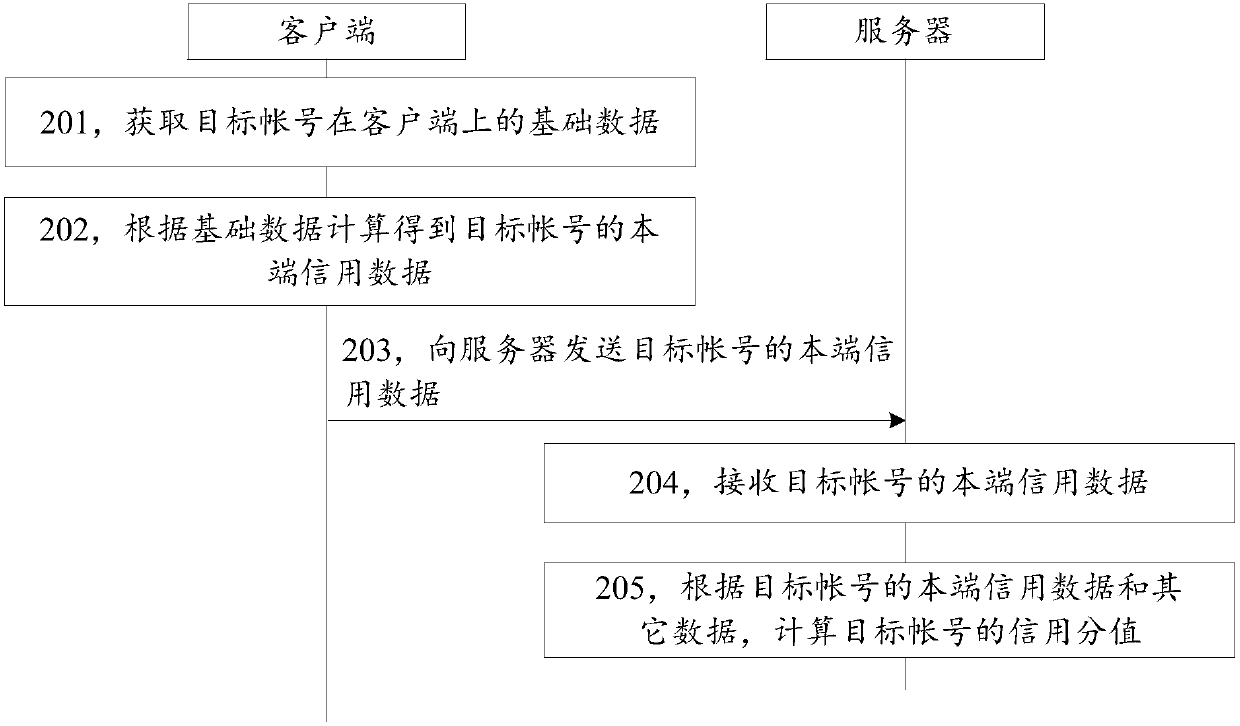

Image

Examples

Embodiment Construction

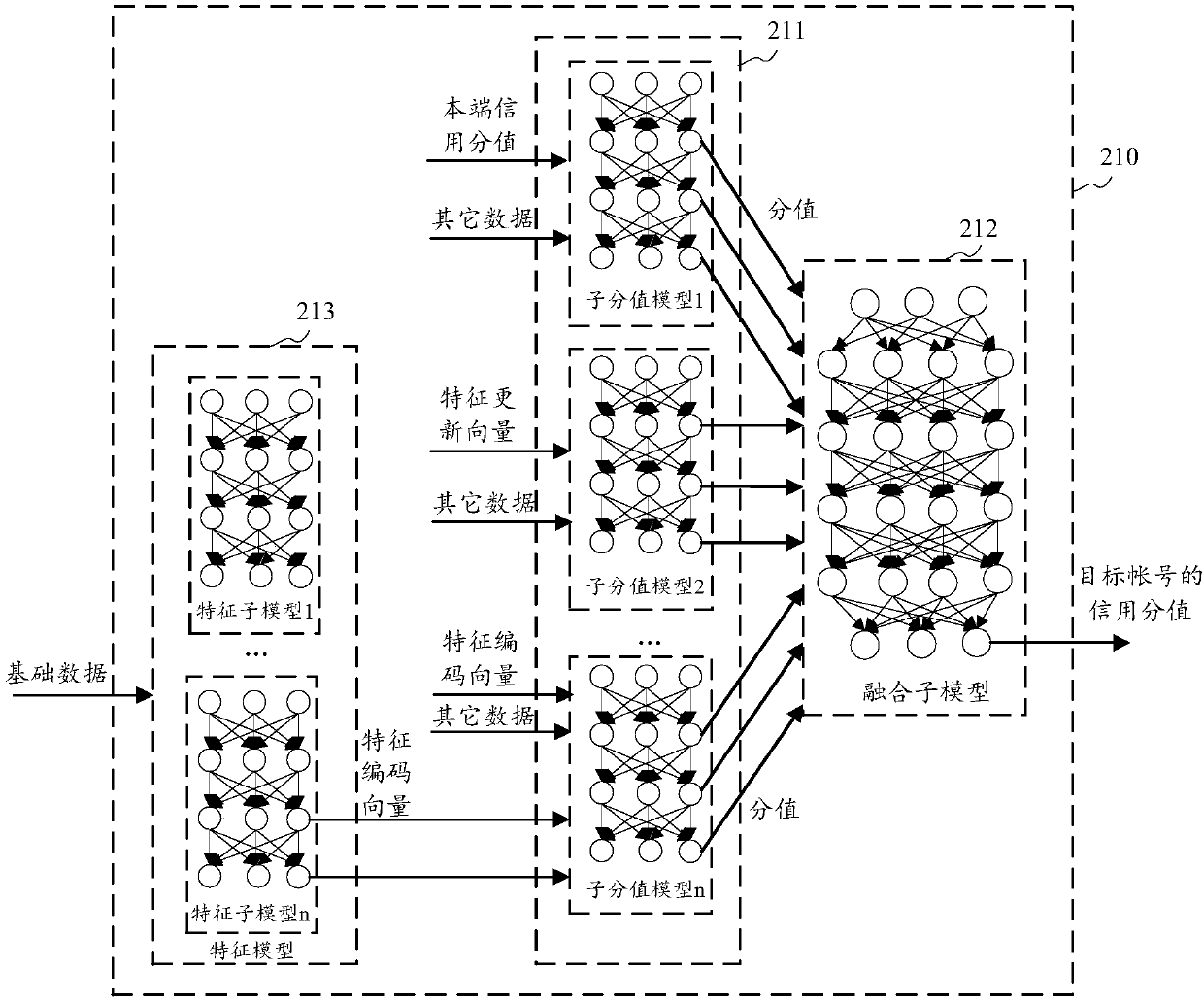

[0055] In order to make the object, technical solution and advantages of the present invention clearer, the implementation manner of the present invention will be further described in detail below in conjunction with the accompanying drawings.

[0056] First, several nouns involved in the embodiments of the present invention are introduced.

[0057] Credit score: refers to the score obtained by quantifying the credit of the target account using a computer model. Optionally, the computer model includes but not limited to: deep neural network (Deep Neural Network, DNN) model, recurrent neural network (Recurrent Neural Networks, RNN) model, embedding (embedding) model, gradient boosting decision tree (Gradient Boosting Decision Tree , GBDT) model, logistic regression (Logistic Regression, LR) model at least one.

[0058] The DNN model is a deep learning framework. The DNN model includes an input layer, at least one hidden layer (or middle layer) and an output layer. Optionally...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com