Financial risk assessment method and system based on big data technology

A risk assessment system and technology of big data technology, applied in the field of financial risk assessment methods and systems based on big data technology, can solve the problems of blocked risk assessment, insufficient coverage, low efficiency, etc., so as to reduce the amount of labor and avoid fraud. , the effect of reducing losses

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0029] The present invention will be further described in detail below in conjunction with the accompanying drawings.

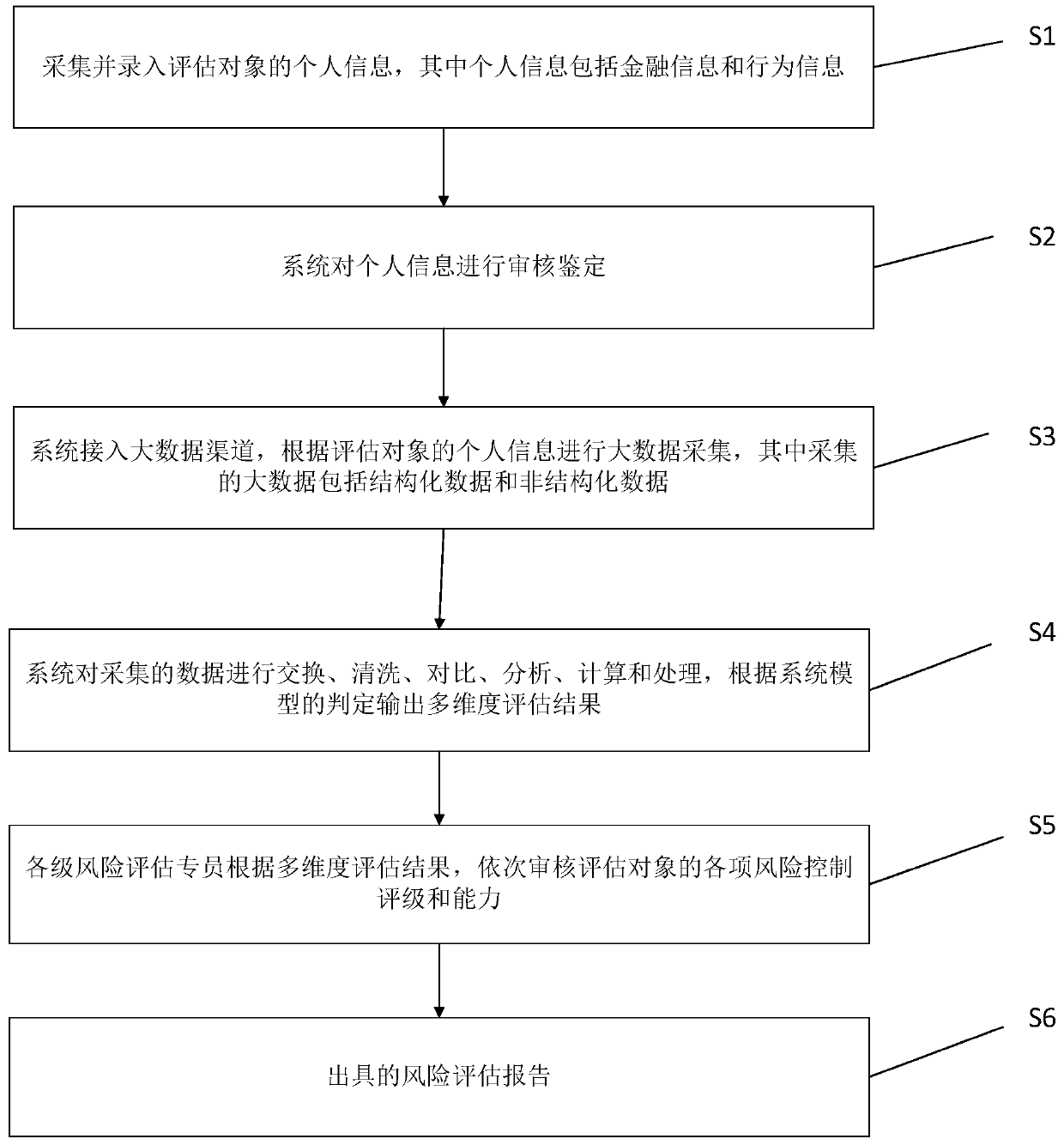

[0030] Such as figure 1 As shown, a financial risk assessment method based on big data technology is used to control the risk of credit investigation of loan objects in the credit business. The method includes the following steps:

[0031] S1: Collect and enter the personal information of the assessment object, where the personal information includes financial information and behavioral information;

[0032] S2: The system reviews and appraises the personal information;

[0033] S3: The system connects to big data channels, and collects big data according to the personal information of the assessment object, and the big data collected includes structured data and unstructured data;

[0034] S4: The system exchanges, cleans, compares, analyzes, calculates and processes the collected data, and outputs multi-dimensional evaluation results according to the judg...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com