Credit risk assessment method

A risk assessment and credit technology, applied in data processing applications, instruments, finance, etc., can solve problems such as low efficiency, poor quality, and inability to meet bank assessment needs, to enhance anti-interference, prevent collapse, and improve security. Effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0028] The following will clearly and completely describe the technical solutions in the embodiments of the present invention with reference to the accompanying drawings in the embodiments of the present invention. Obviously, the described embodiments are only some, not all, embodiments of the present invention.

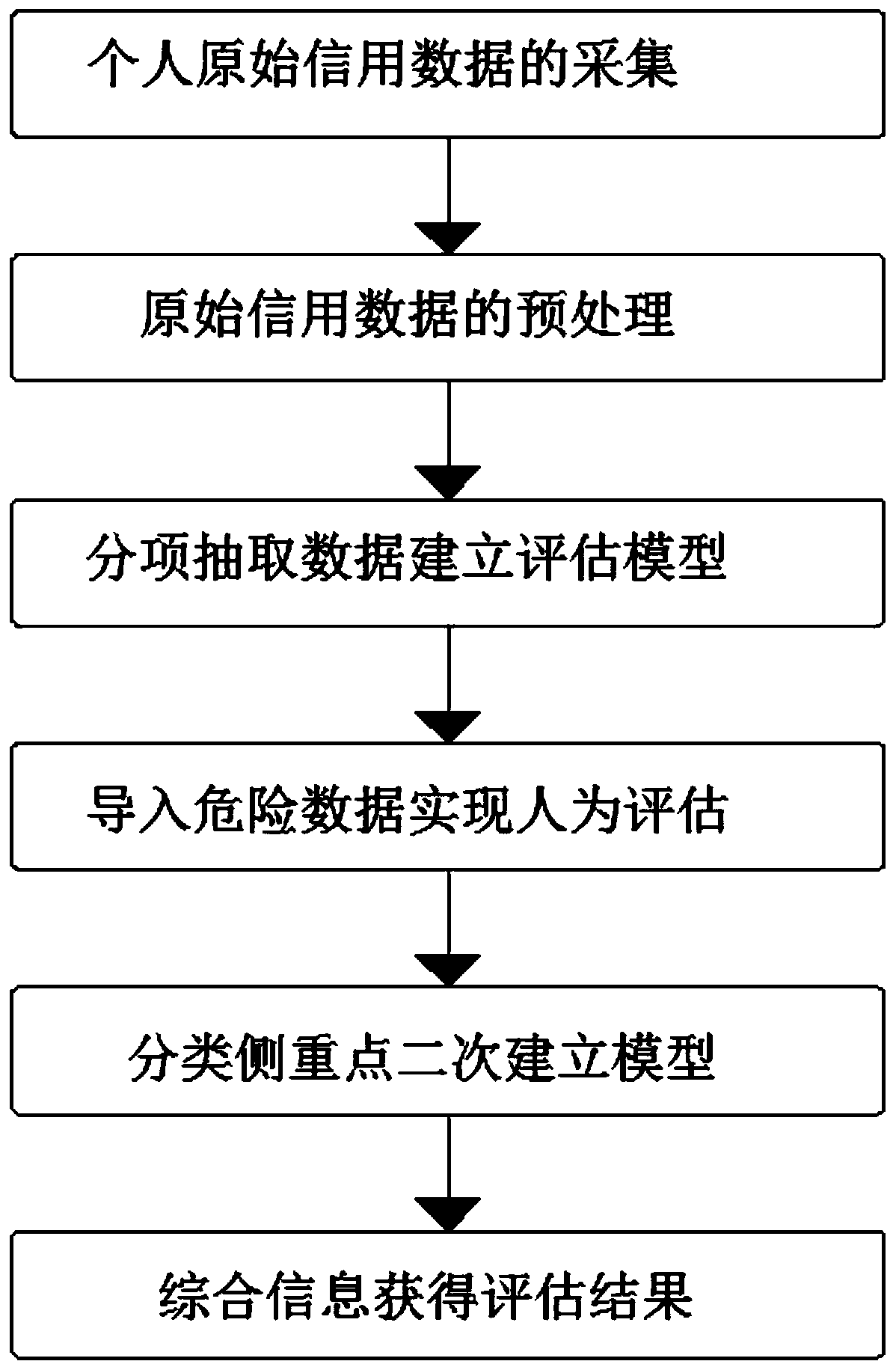

[0029] refer to figure 1 , a credit risk assessment method, including the following assessment steps:

[0030] S1: The collection of personal original credit data, using different methods of manual input or Internet import, comprehensively obtains all the credit-related initial metadata of the assessee before the assessment date, and other credit-related metadata related to the assessee Initial entry by individuals or enterprises to obtain a complete original database;

[0031] S2: The preprocessing of the original credit data, which accurately classifies the messy and disorderly data in the original database one by one according to the different categories and attr...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com