Financial anti-fraud analysis method based on big data

An analysis method and big data technology, applied in the financial field, can solve problems such as consumer losses, closer transactions, and fraudulent behaviors, and achieve the effect of improving security, increasing accuracy, and ensuring accuracy.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0030] In order to make the technical means, creative features, goals and effects achieved by the present invention easy to understand, the present invention will be further described below in conjunction with specific embodiments.

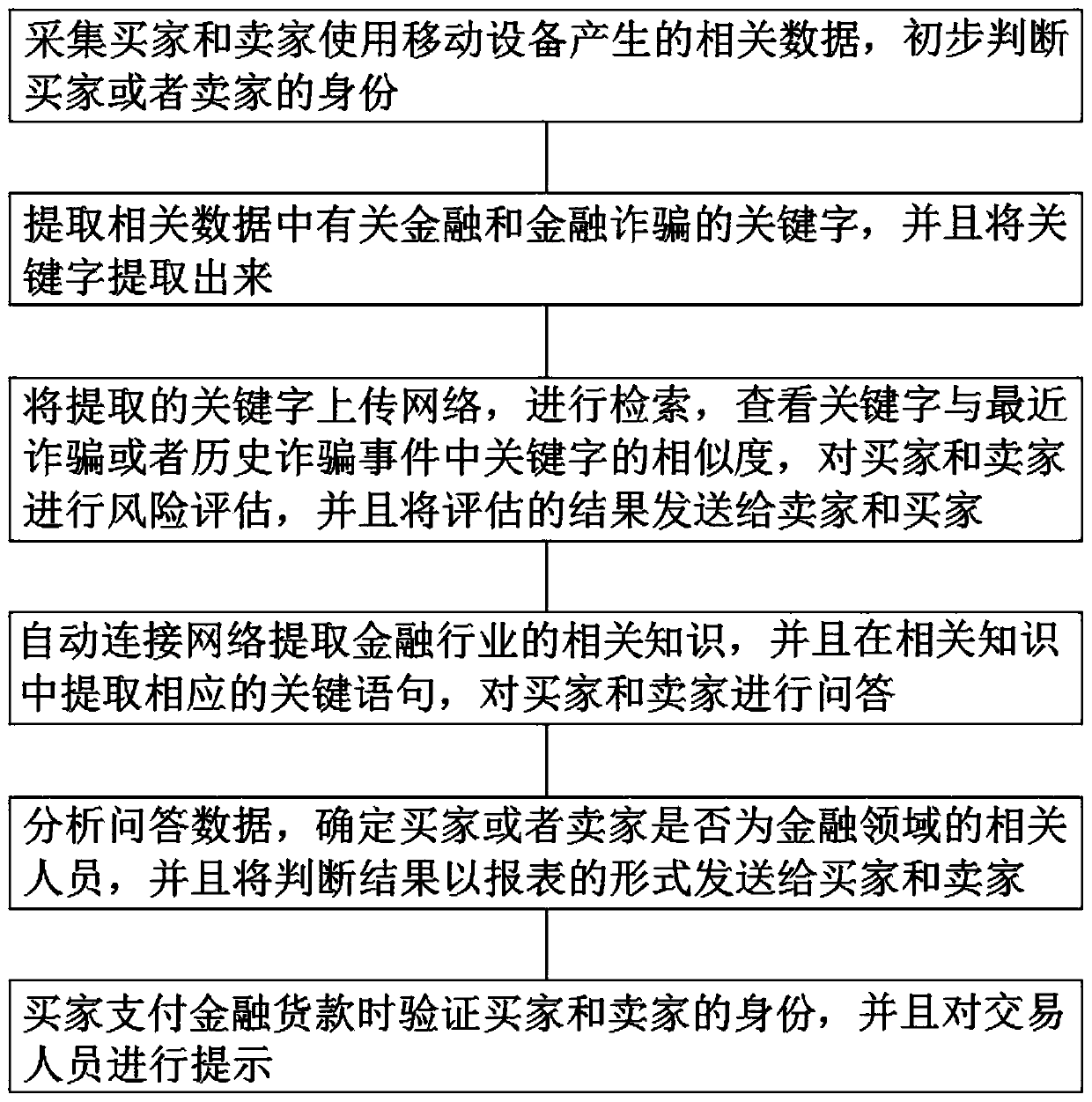

[0031] (1) Collect relevant data generated by buyers and sellers using mobile devices, and preliminarily determine the identities of buyers and sellers. Collecting buyers’ data includes but is not limited to collecting buyers’ identity information, buyers’ common equipment, buyer’s The location of the home, the communication information between the buyer and the seller, the time the buyer uses the mobile device, the credit of the buyer and the recent abnormal behavior of the buyer. The buyer can be an individual or a platform;

[0032] Collecting seller data includes but is not limited to the seller's phone number and address, the seller's sending URL information, the seller's IP address, the seller's email address, the seller's company information...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com