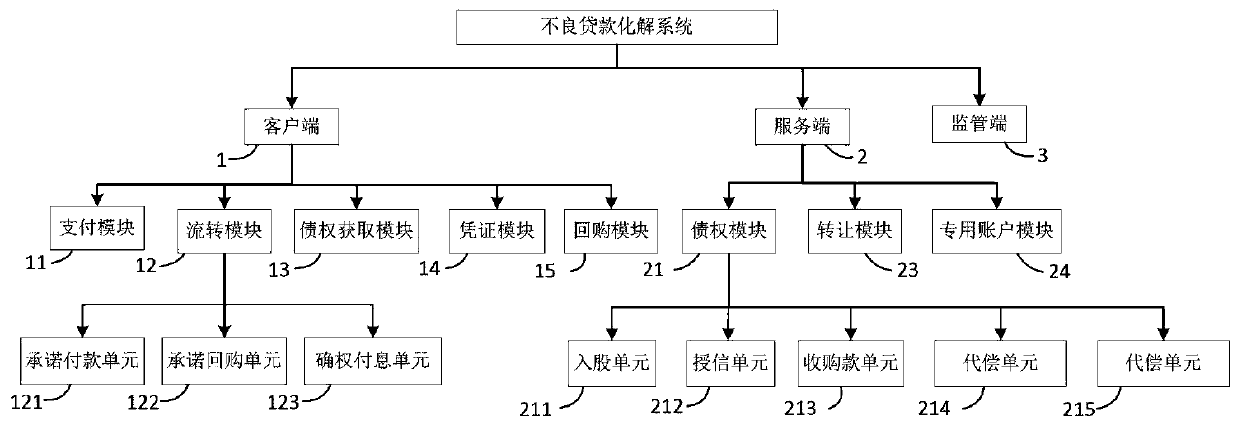

Bad loan resolution system and method

A non-performing and loan technology, applied in the field of financial services, can solve problems such as difficulty and compliance risks, and achieve the effect of delaying the period of guarantee compensation, improving debt repayment ability, and promoting production and operation

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

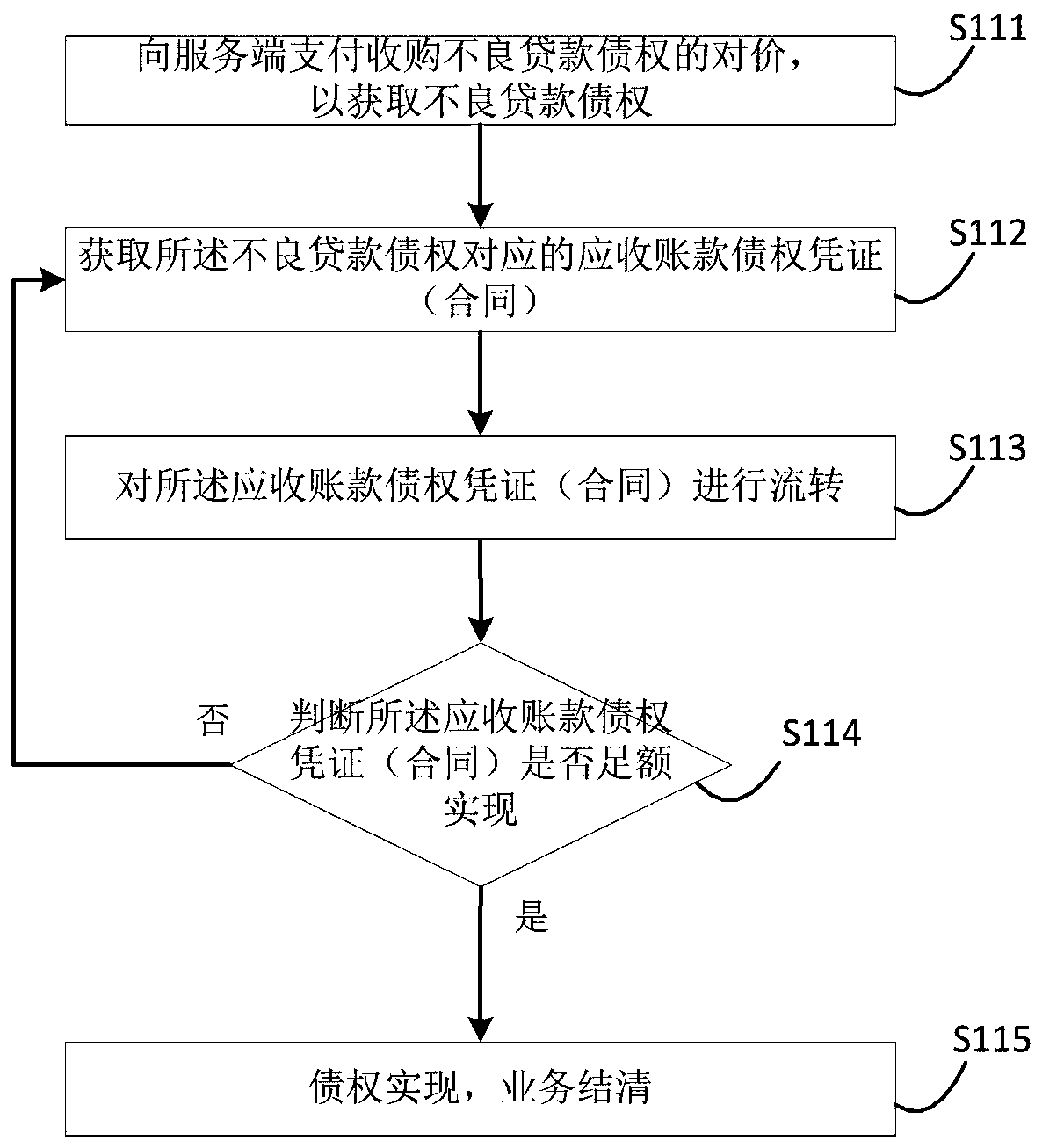

[0042] Below, the technical solution of the present invention will be described in detail through specific examples.

[0043] It should be noted that in this embodiment, the server 2 is a bank, the first client is a non-financial company, the second client is a third party, the third client is a debt management company, and the fourth client is a guarantee company. Among them, non-financial company is the abbreviation of state-owned non-financial asset management company, credit management company is the abbreviation of accounts receivable credit management company, credit certificate (contract) is the abbreviation of account receivable credit certificate (contract), credit certificate (contract) ) can exist in the form of paper, electronic or other media. Circulation refers to the creditor's rights recorded in the creditor's rights certificate (contract) through transfer, offset, pledge, etc. Features.

[0044] However, the client and the server are not limited to the above-...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com