Financial anti-fraud analysis method and device, equipment and storage medium

An analysis method and technology of an analysis device, which are applied in finance, commerce, instruments, etc., can solve problems such as uneven quality of Internet financial products, property losses, loan losses, etc., and achieve the effects of improving system security, improving efficiency, and reducing direct economic losses.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

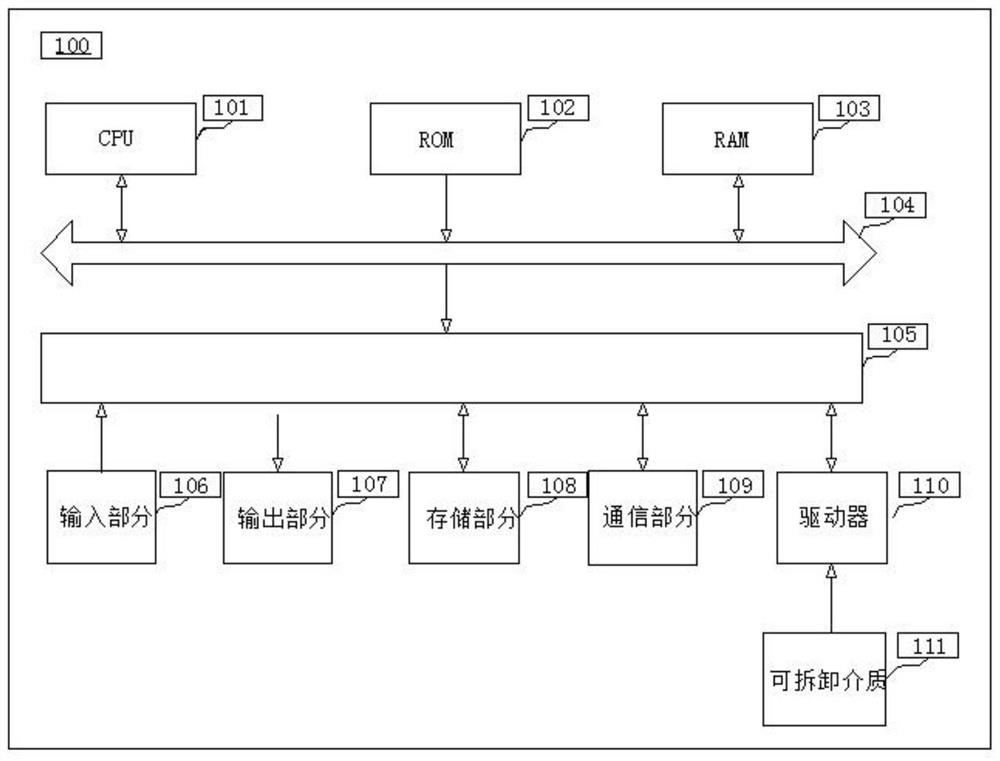

Image

Examples

Embodiment 1

[0034] A financial anti-fraud analysis method in this embodiment is characterized in that it comprises the following steps:

[0035] Step 1: Establish a blacklist database. The blacklist includes but is not limited to: 1. Untrustworthy, appeals, executions, drug abuse, etc. disclosed by the Public Security Bureau; 2. Bad lists of various credit data alliances.

[0036] Step 2: Obtain user information, and use the user information as the index condition to perform blacklist matching. The user information includes any one of the user's name, ID number, mobile phone number, bank card number, address, marital status, education background or Several options are available, which may also include obtaining legal person information associated with user information.

[0037] Step 3: If the matching fails, a first risk score is given according to the frequency of financial transactions performed on different platforms by the client or customer IP where the user information is located, a...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com