Tax refund method and system based on block chain and electronic equipment

A blockchain and auditor technology, applied in the field of communication, can solve problems such as high labor cost, low audit accuracy, and long tax refund process cycle, so as to reduce labor cost, reduce manpower input and time input, and shorten the tax refund cycle. Effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

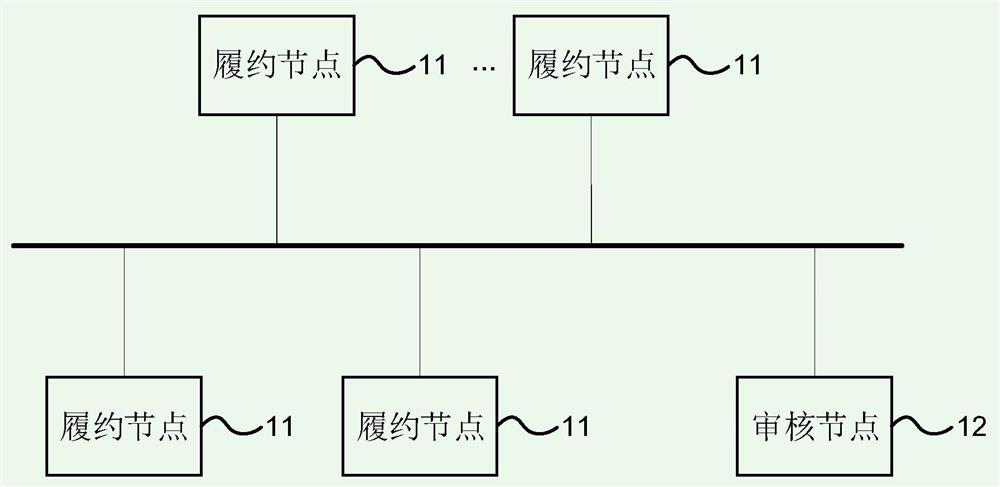

[0032] figure 1 A system block diagram of an embodiment of the blockchain-based tax refund system provided by the present invention. Such as figure 1 As shown, the blockchain-based tax refund system provided by the embodiment of the present invention includes: a plurality of fulfillment nodes 11 and at least one review node 12 .

[0033] Among them, the fulfillment node 11 corresponds to the performer of the transaction, and is used to store the fulfillment information for the transaction; the review node 12 corresponds to the reviewer of the tax refund application, and is used to obtain information from the corresponding fulfillment node 11 according to the transaction identifier input by the user. Obtain the performance information of the transaction uniquely identified by the transaction identifier, verify the performance information according to the preset strategy, and trigger the tax refund operation for the transaction when the verification is passed.

[0034] In the ...

Embodiment 2

[0038] Such as figure 1 shown in the above figure 1 On the basis of the illustrated embodiment, in the blockchain-based tax refund system provided by the embodiment of the present invention, the performance node 11 can also be used to store the performance data for the transaction, and the audit node 12 can also be used to In the case of , obtain the performance data for the transaction from the performance node 11, and trigger the tax refund review operation for the performance data.

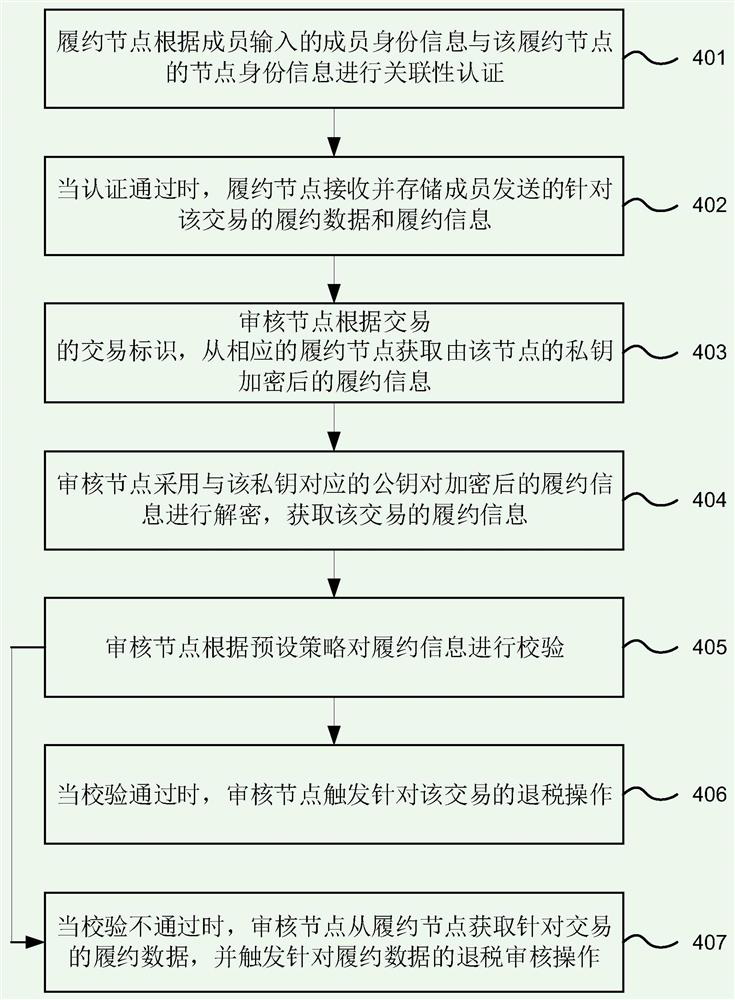

[0039]In the embodiment of the present invention, when the audit node 12 runs the smart contract to verify the acquired performance information for the transaction (including but not limited to: order information, logistics information, foreign exchange payment information and customs declaration information of the transaction), If the verification fails, it means that there is a problem in the obtained performance information, which does not meet the tax refund conditions. For the suspicious ...

Embodiment 3

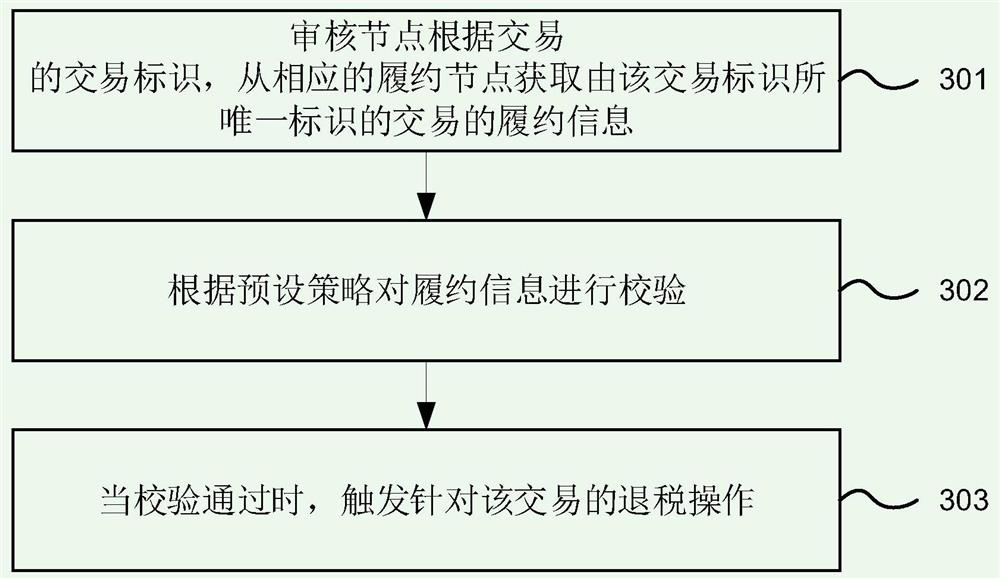

[0047] figure 2 It is a flowchart of an embodiment of the blockchain-based tax refund method provided by the present invention. The blockchain is composed of multiple performance nodes and at least one review node, wherein the performance node corresponds to the performance party of the transaction and is used to store the performance information for the transaction, and the review node corresponds to the reviewer of the tax refund application. Such as figure 2 As shown, the blockchain-based tax refund method includes the following steps:

[0048] S301. According to the transaction identifier of the transaction, the review node obtains the performance information of the transaction uniquely identified by the transaction identifier from the corresponding performance node.

[0049] In the embodiment of the present invention, the block chain technology is applied to the tax refund system, and according to the performance process of foreign trade transactions, different perfor...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com