Personal credit assessment method and system based on fusion neural network feature mining

A neural network and credit evaluation technology, applied in the field of credit evaluation based on big data, can solve the problems of low derivative efficiency, inapplicability to general situations, and high calculation costs

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

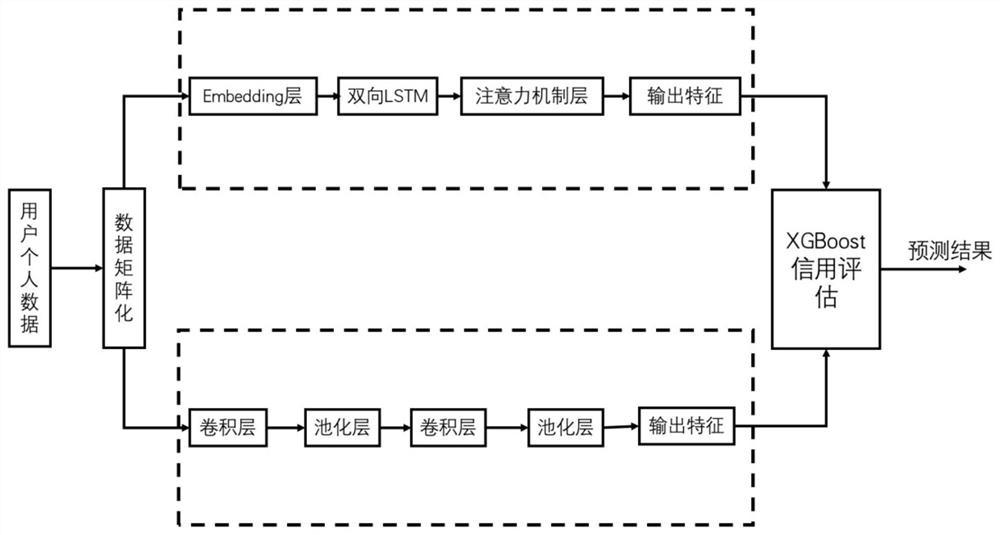

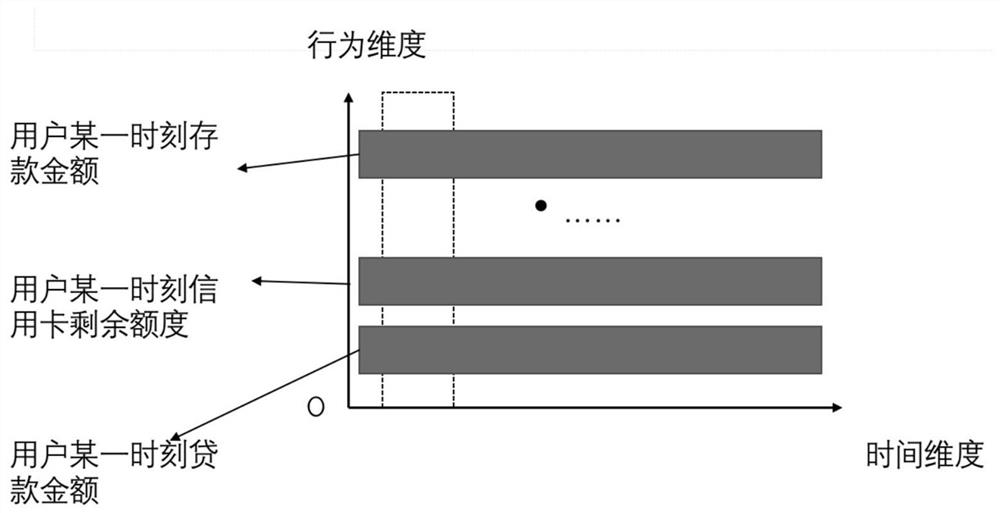

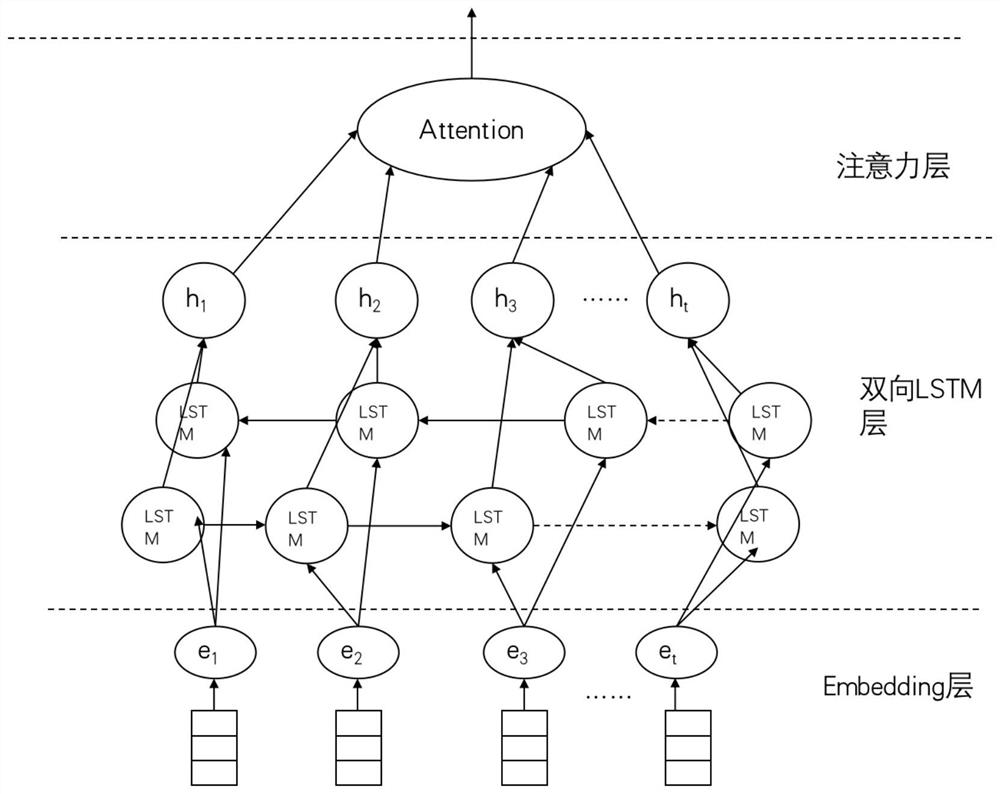

[0044] First of all, it needs to be explained that the present invention relates to big data processing technology, which is an application of computer technology in the field of big data. During the implementation of the present invention, the application of multiple software function modules will be involved. The applicant believes that, after carefully reading the application documents and accurately understanding the realization principle and purpose of the present invention, combined with existing known technologies, those skilled in the art can fully implement the present invention by using their software programming skills. The aforementioned software functional modules include but are not limited to: data preprocessing module, data matrix module, LSTM model, CNN model, XGBoost classifier, embedding layer, BiLSTM network, attention mechanism layer, convolution layer and pooling layer, etc. , Everything mentioned in the application documents of the present invention belo...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com