Establishment method of online lending credit risk assessment model based on multi-information source fusion

A risk assessment model and network lending technology, which is applied in the field of establishing a credit risk assessment model for online lending that integrates multiple information sources, and can solve problems such as inability to assess credit risk of online lending, conflicts between information sources and model assessment results, and single information sources. , to achieve the effect of reducing one-sidedness, reducing inconsistency, and high return on investment

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

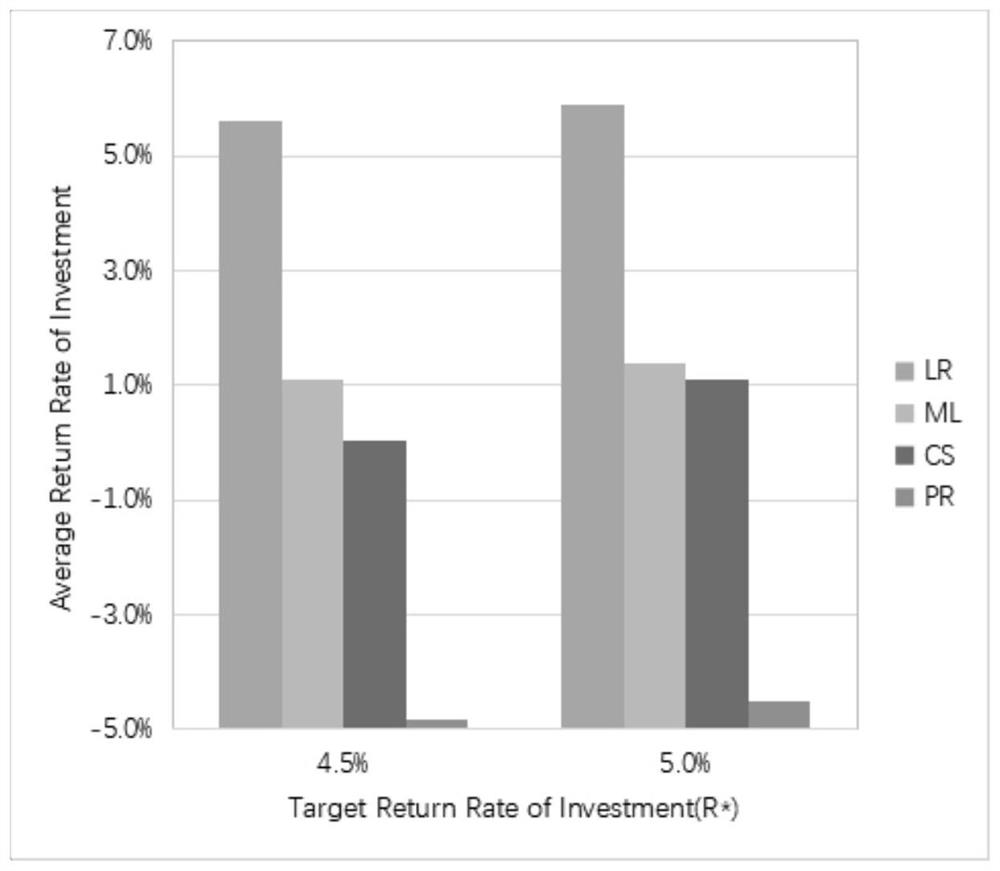

[0069] A method for establishing an online lending credit risk assessment model fused with multiple information sources includes the following steps:

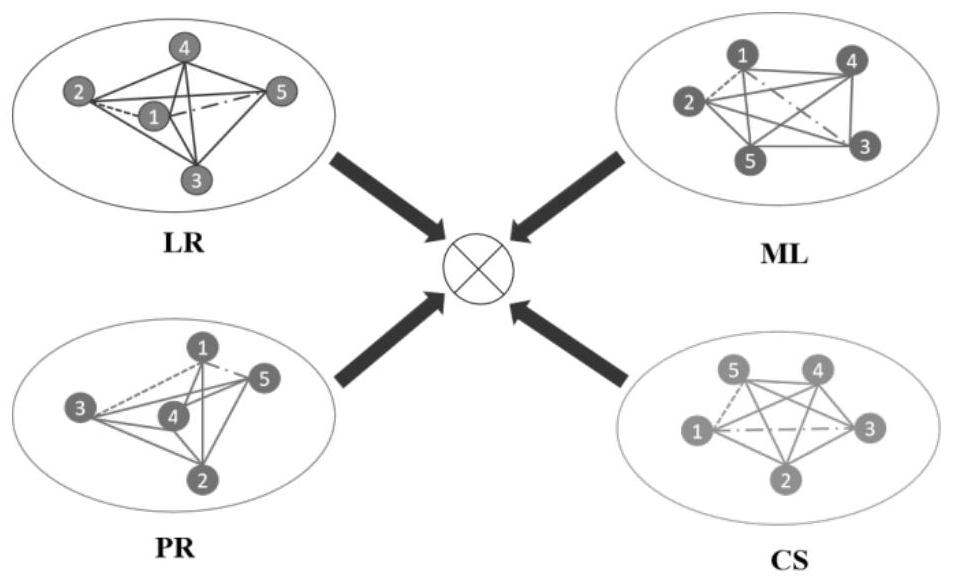

[0070] The first step: measure the loan similarity according to the borrower's information source; starting from the borrower's information source, by extracting the feature vector of the borrower's influence on the credit risk of online lending, and then constructing the loan similarity based on logistic regression and metric learning respectively. sex measurement model;

[0071] The second step: measure the similarity of loans according to the information sources of investors; through the quantification of investor behavior and investment relationship information, the PageRank method and investor composition scores are introduced to evaluate the similarity between loans;

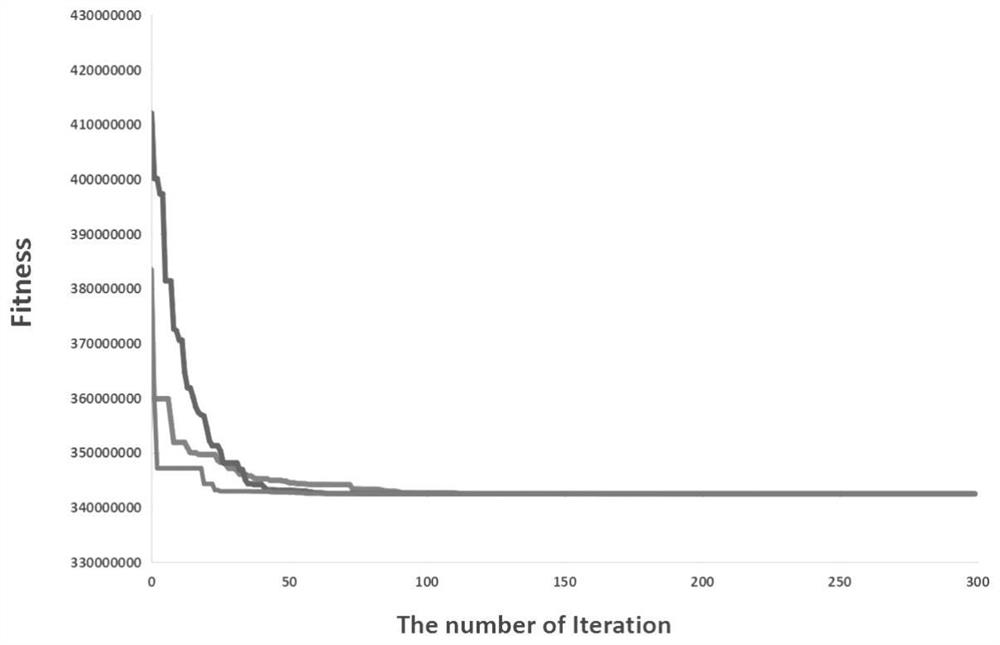

[0072] The third step: the integration of the fused loan similarity information by the minimum reverse order; in the first and second steps, based on diffe...

Embodiment 2

[0076] A method for establishing a credit risk assessment model for online lending based on the fusion of multiple information sources, wherein, the first step is to measure loan similarity according to the borrower's information source, which specifically includes the following steps;

[0077] (1), extract the risk features in the borrower information, and establish the feature vector of the borrower information as X={x 1 , x 2 , x 3 ,...,x 8}, where x 1 , x 2 and x 3 Respectively represent different risk characteristics; the risk characteristics of the borrower information include loan amount, loan interest rate, debt-to-income ratio of the borrower, FICO score of the borrower, current amount owed by the borrower, and default of the borrower in the past seven years Number of times, income of the borrower, number of consultations of the borrower in the last six months;

[0078] (2), according to the logistic regression algorithm to measure the similarity of the borrower...

Embodiment 3

[0092] A method for establishing a credit risk assessment model for online lending based on the fusion of multiple information sources, wherein the second step: measuring the loan similarity according to the investor's information source, specifically includes the following steps:

[0093] (1) Extract the investor's investment behavior and investment relationship information; the information extracted from the investor includes the investment secondary network G, the loan weight matrix Ω, and the investor weight matrix λ, specifically:

[0094] (a), G={U, V, E}, where U and V represent investors and loans respectively, E=(e ij ) m×n are the edges connecting them, each edge e ij The size of the investor u i on loan v j the investment amount;

[0095] (b), Ω=(ω ij ) m×n , where ω ij Indicates that the investor u i on loan v j The investment amount of investor u i The ratio of the total investment amount to n loans is calculated as:

[0096] (c), λ=(λ ij ) m×n , ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com