Open end mutual fund securitization process

a technology of open end mutual funds and securitization process, which is applied in the field of new financial processes, can solve the problems of time-consuming, laborious, expensive and otherwise difficult to determine an exact n.a.v., and investors do not know what price will be paid for open end fund shares, so as to achieve greater diversification, reduce transaction costs, and diversify the effect of investment portfolio

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

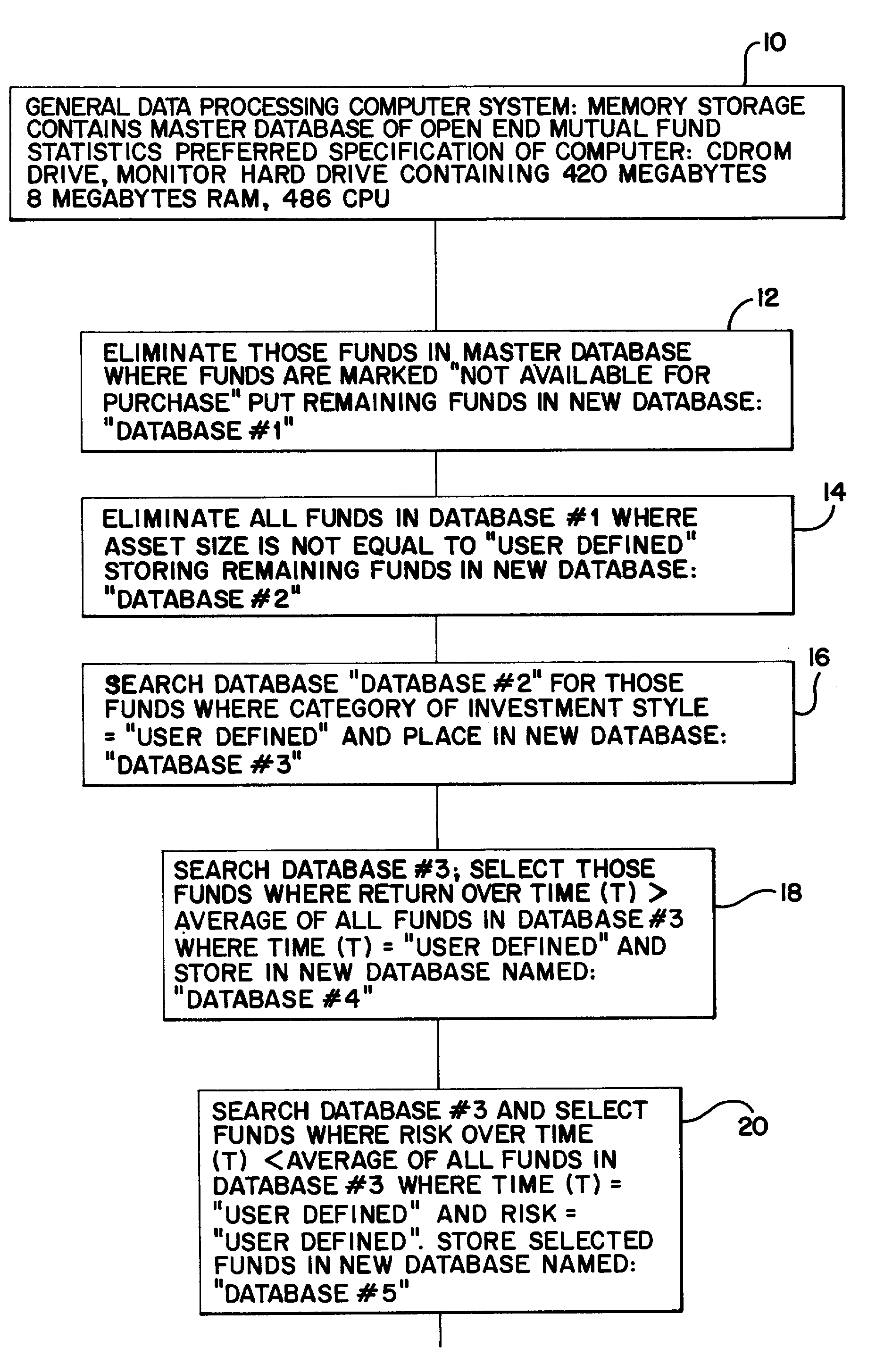

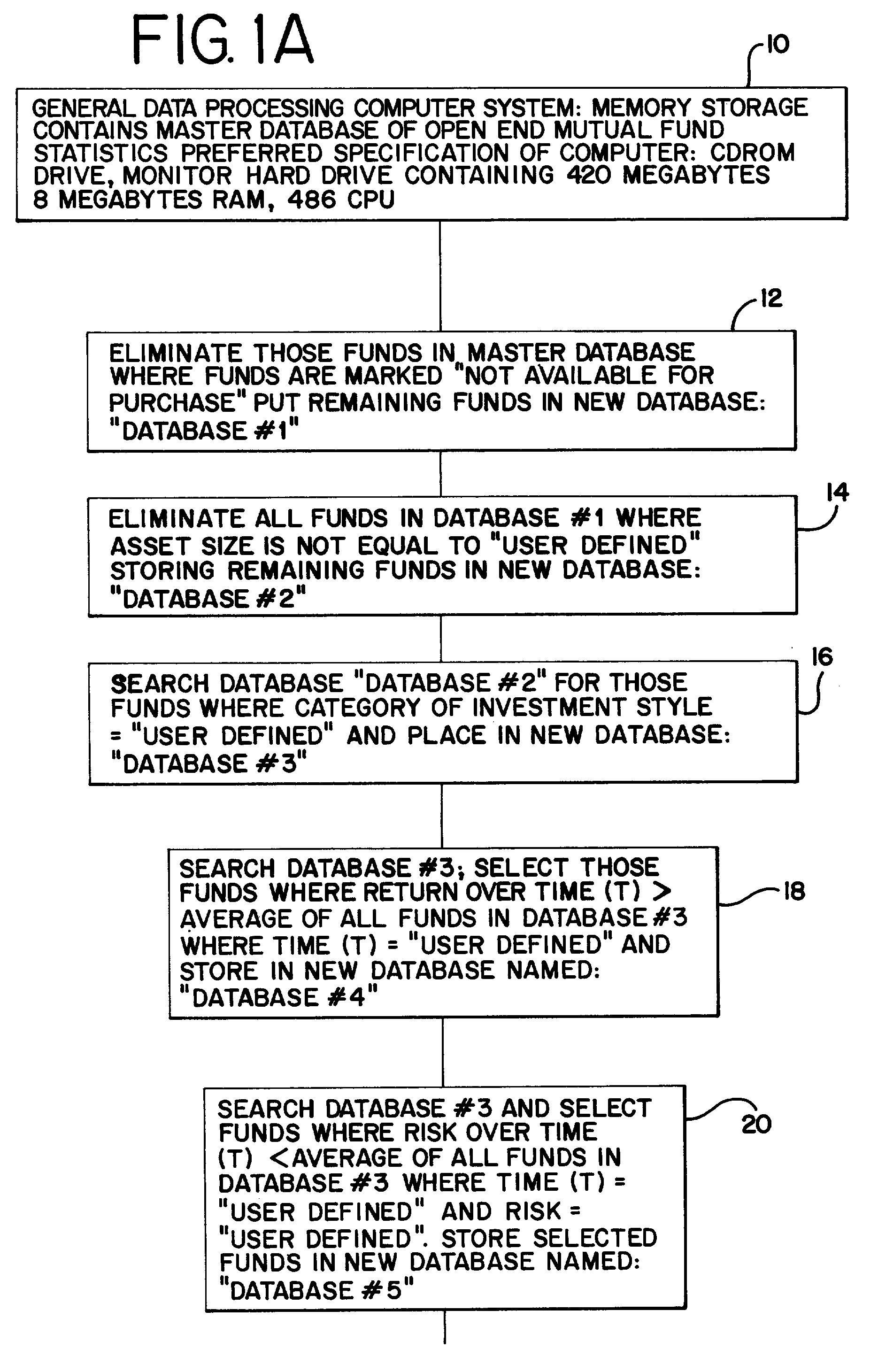

[0040] Referring to Figure lA, the box designated 10 represents an electronic database (a "master database") of extensive statistical information stored in a computer containing the entire universe of open end mutual fund statistics in existence registered in the defined country or geographic area. The preferred embodiment database includes extensive statistics for each open end fund. This information includes fund net asset value (N.A.V.) for each year, portfolio composition, investment objective, load adjusted and unadjusted return, maximum sales charge, median market capitalization, daily, monthly, quarterly, yearly, multi-year returns, mpt, beta, sharpe, R squared, standard deviation, historical risk / reward ratios, N.A.V. distribution adjusted earning, payout ratio, potential capital gains exposure, price / book ratio, price / earnings ratio, prospectus, purchase constraints, redemption fees, sector weighting, shareholder fees, total return, total return percentile, turnover ratio, ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com