Mutual fund card method and system

a card and mutual fund technology, applied in the field of mutual fund card methods and systems, can solve the problems of no mechanism to encourage consumers, no long-term benefits of credit card rebate systems, and no way to channel funds back, so as to increase the use of card payment instruments

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

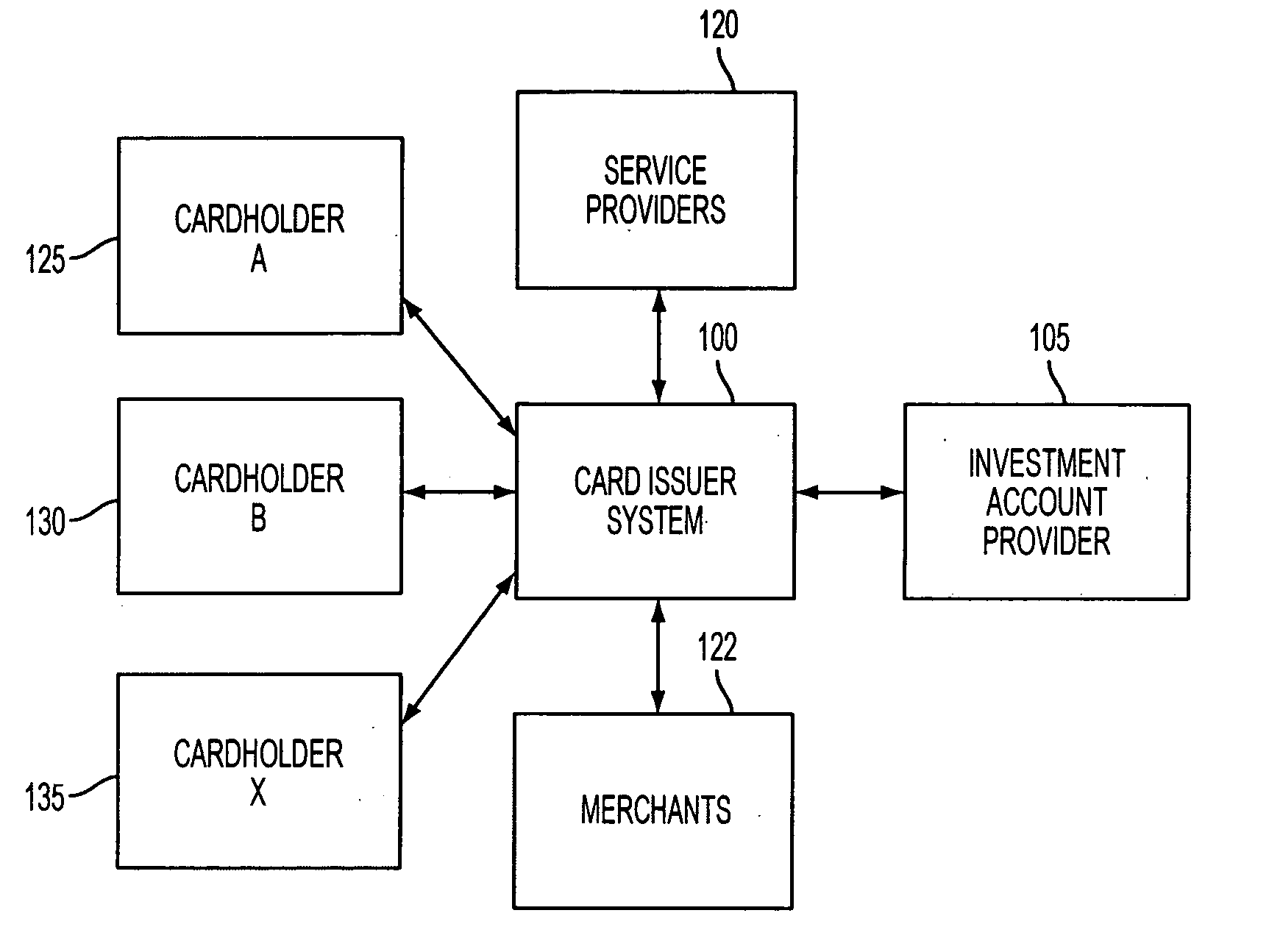

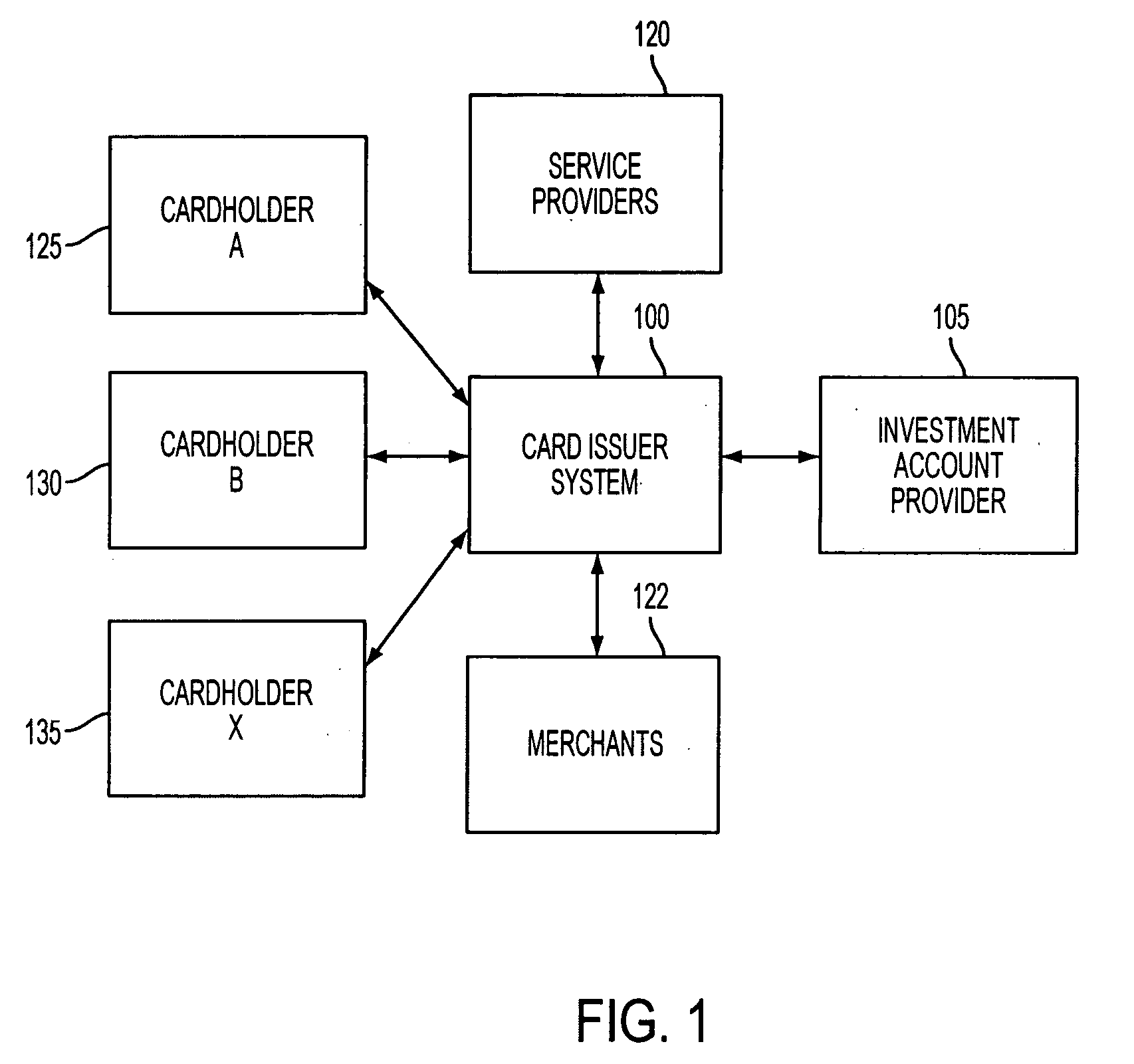

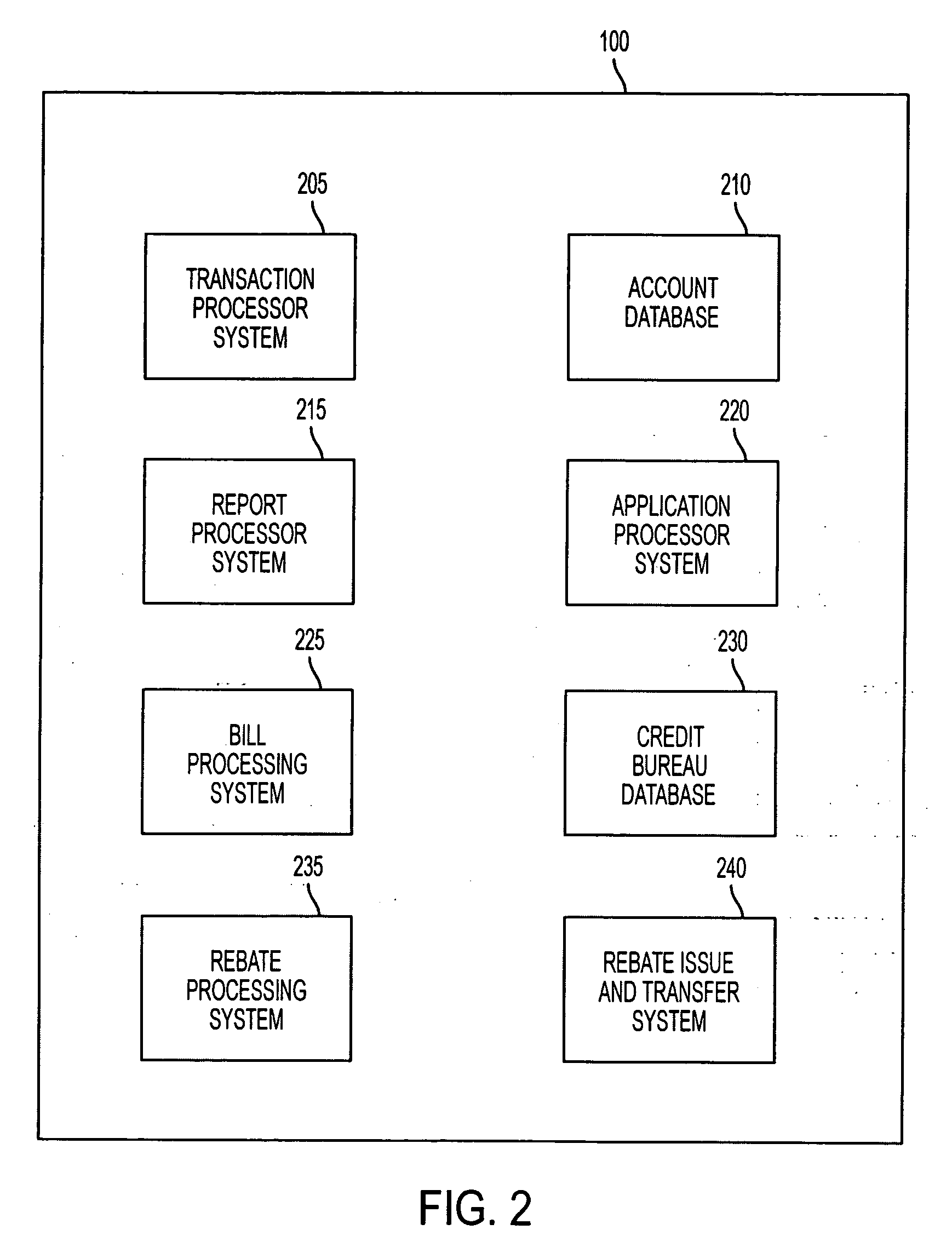

[0023] The present invention is directed to a method and apparatus for a card payment instrument with a rebate that is associated with an investment account, whereby rebates based on card usage are transferred to the investment account periodically for funding the investment account. The term “card payment instrument” is used herein to mean credit cards, multi-featured credit cards, debit cards, bank cards, stored value cards, transaction cards and like instruments. According to one embodiment of the invention a credit card is issued by a credit card issuer such as a bank in partnership with an investment account provider such as a brokerage company. Preferably, the brokerage company offers shares in a mutual fund investment program. A credit issuer such as a bank issues approved customers a credit card having a line of credit and a predetermined annual percentage rate (APR). The card is preferably marked with information of the identity of the issuing bank as well as the investment...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com