Remote tax return system

a remote tax return and business method technology, applied in the field of remote tax return system, can solve the problems of not simplifying the customer's experience in preparing the tax return, online software is not able to answer satisfactorily, complex and iterative tax preparation process, etc., and achieves the effect of convenient use, economical and responsive to the customer

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

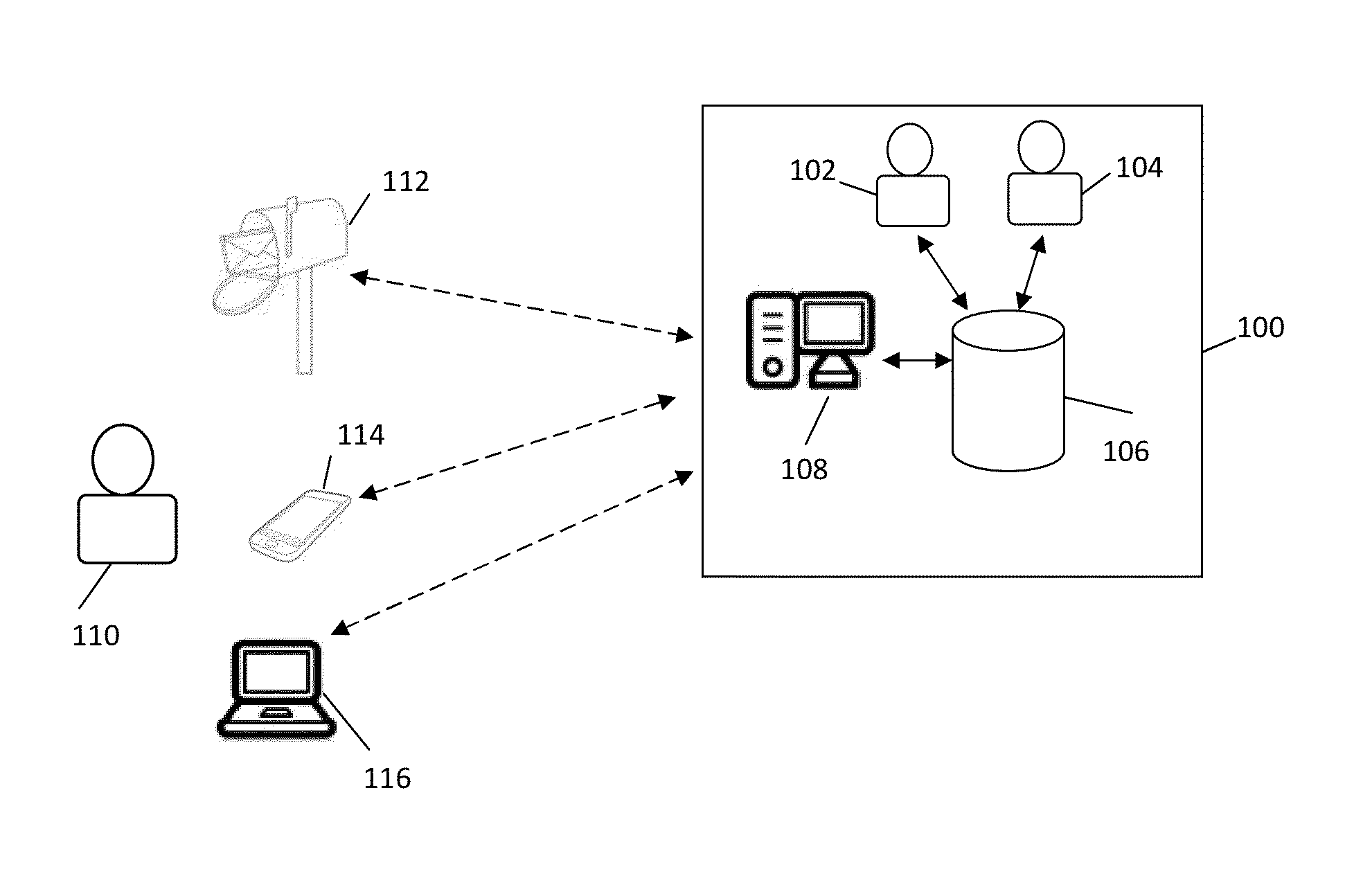

[0048]The present invention is now described with reference to the drawings.

[0049]In general, the present invention provides a method for preparation of tax returns of a customer remotely by using the services of one or more professional tax return preparer.

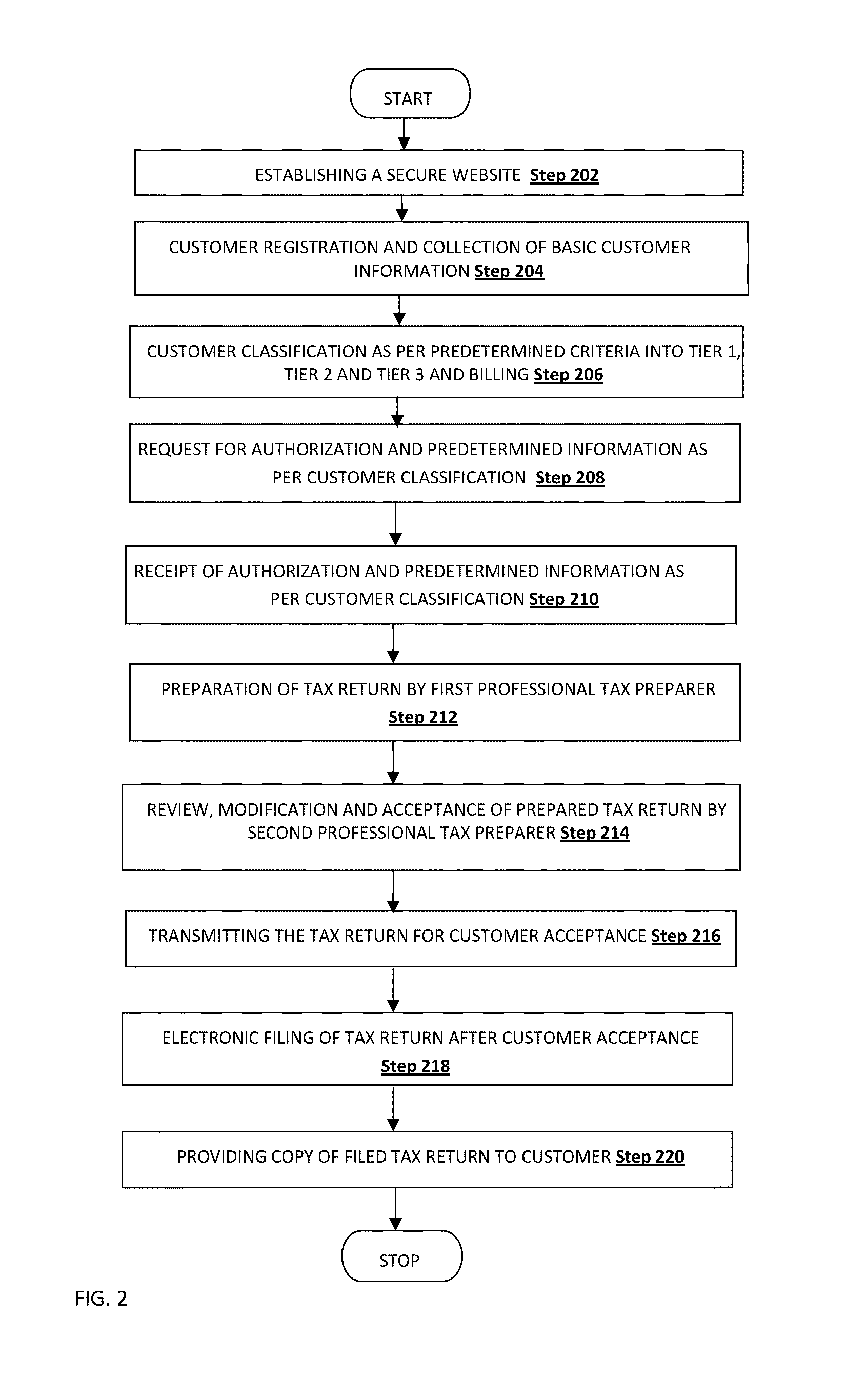

[0050]The present invention provides a business method for remote preparation of tax return services which offers a customer the advantage of customized tax return preparation from the convenience of home or any remote location at an economical rate and without loss of time, effort or responsiveness. A remote tax return preparation method in accordance with present invention comprises of:[0051](a) establishing a secure website offering tax return preparation services to a remote customer[0052](b) registering the customer for said service via a service channel such as the internet, telephone, email, mail[0053](c) collecting basic customer information including income, deduction and preference of service channel from the customer[0...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com