Systems and methods for data mining and modeling

a data mining and modeling technology, applied in the field of systems and methods for data mining and modeling, can solve the problems of significant challenges, inability to perform significant amounts of financial data in a timely and meaningful manner, and inability to achieve comprehensible and timely manner

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0128]The present disclosure relates to systems for and methods of financial instrument attribute prediction and financial instrument visualization. According to some embodiments, a real-time performance evaluation and monitoring system may include providing a probability of a financial instruments price change based at least in part on historical and current market data. In one or more embodiments, financial instrument visualization may provide charts and analysis depicting variance in financial instrument returns versus an annualized return. Accurate estimations of the near-future performance of a financial instrument may help the owner or a financial instrument trader evaluate the risks and benefits of holding the financial instrument. The near-future performance of a financial instrument may be determined by way of mathematical models and a high-speed computational process, system, and method that may utilize extremely large historical market data-sets in real-time.

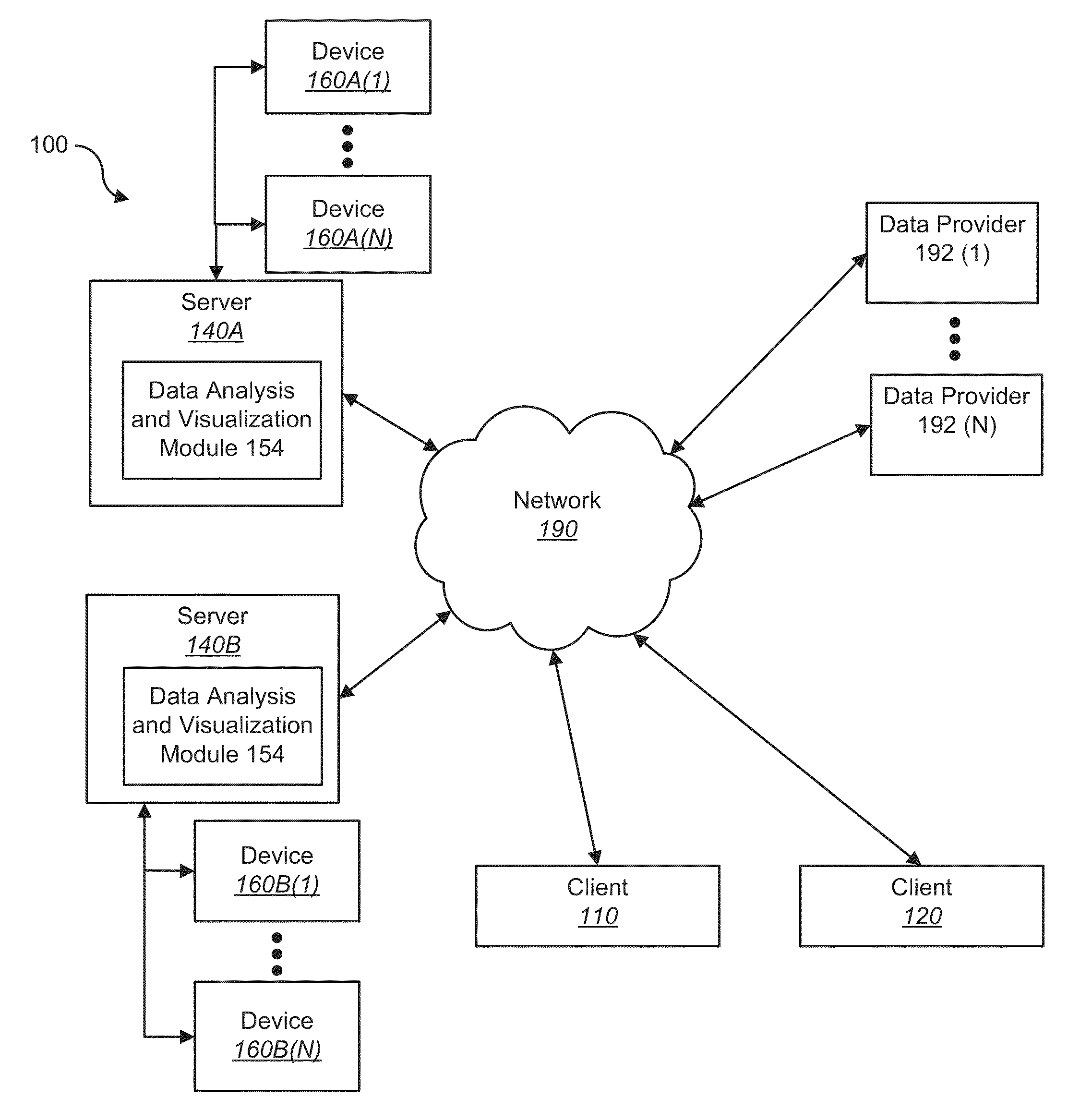

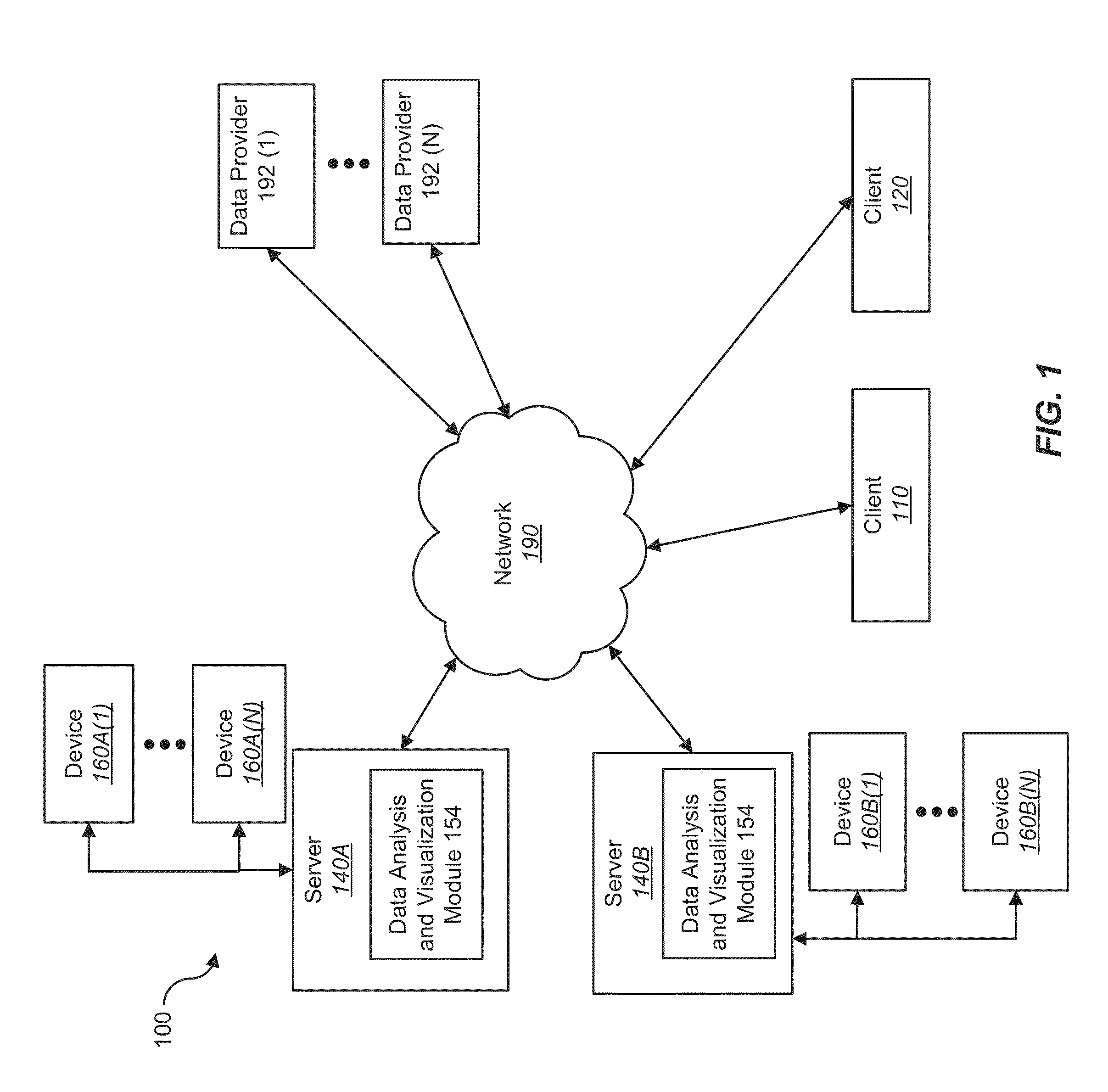

[0129]Turning...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com