Fraud detection system, method, and device

a fraud detection and system technology, applied in the field of fraud detection systems, methods and devices, can solve the problems of increasing problems, time-consuming and expensive credit card fraud, and high operational costs (including resolution management) for the issuer, and increasing losses

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0039]Unless defined otherwise, all technical and scientific terms used herein have the same meaning as commonly understood by one of ordinary skill in the art to which this invention belongs.

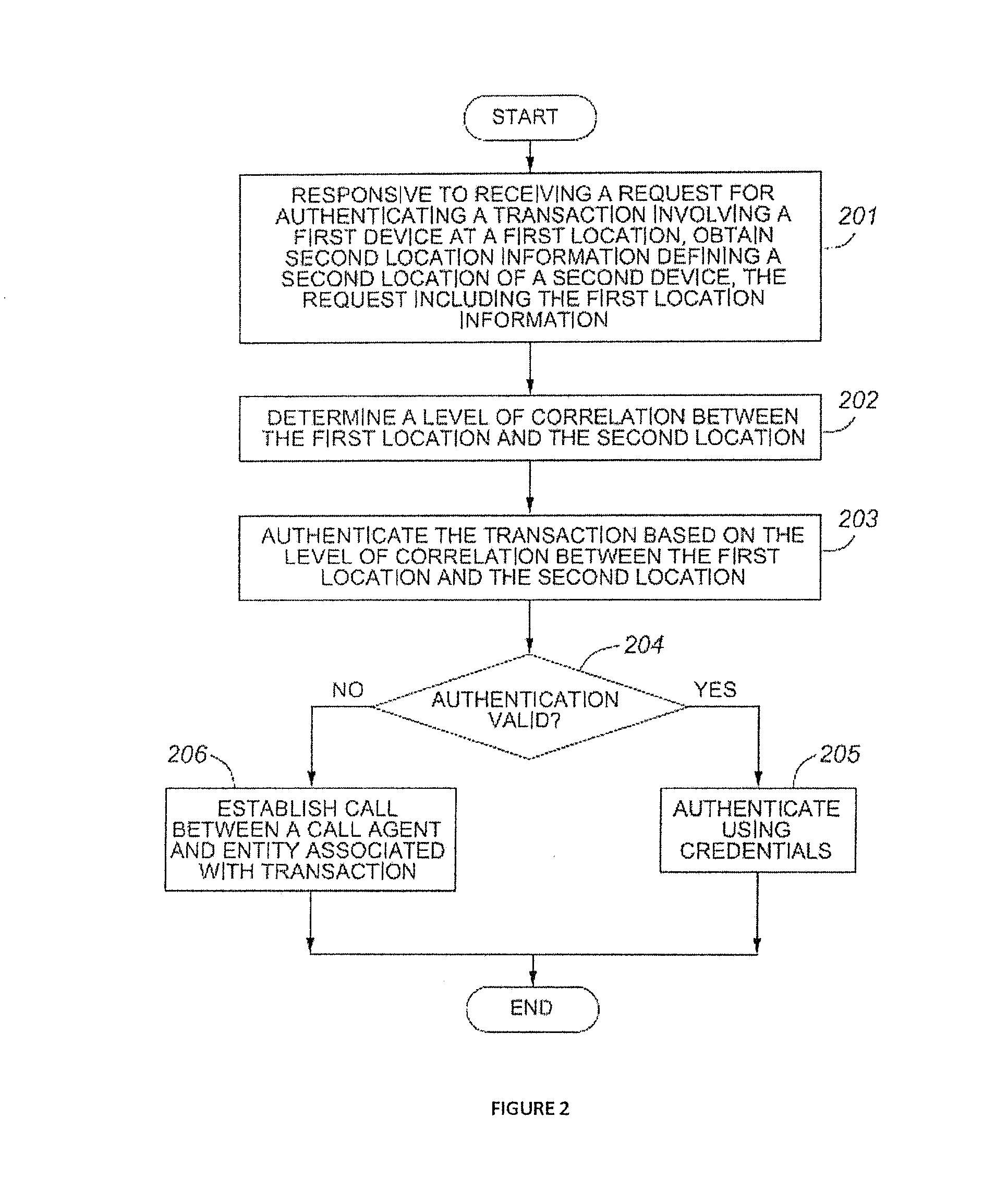

[0040]The present invention provides a fraud detection and resolution management system, method, system, and device which analyze a variety of dynamic characteristics to authorize financial transactions.

System Overview

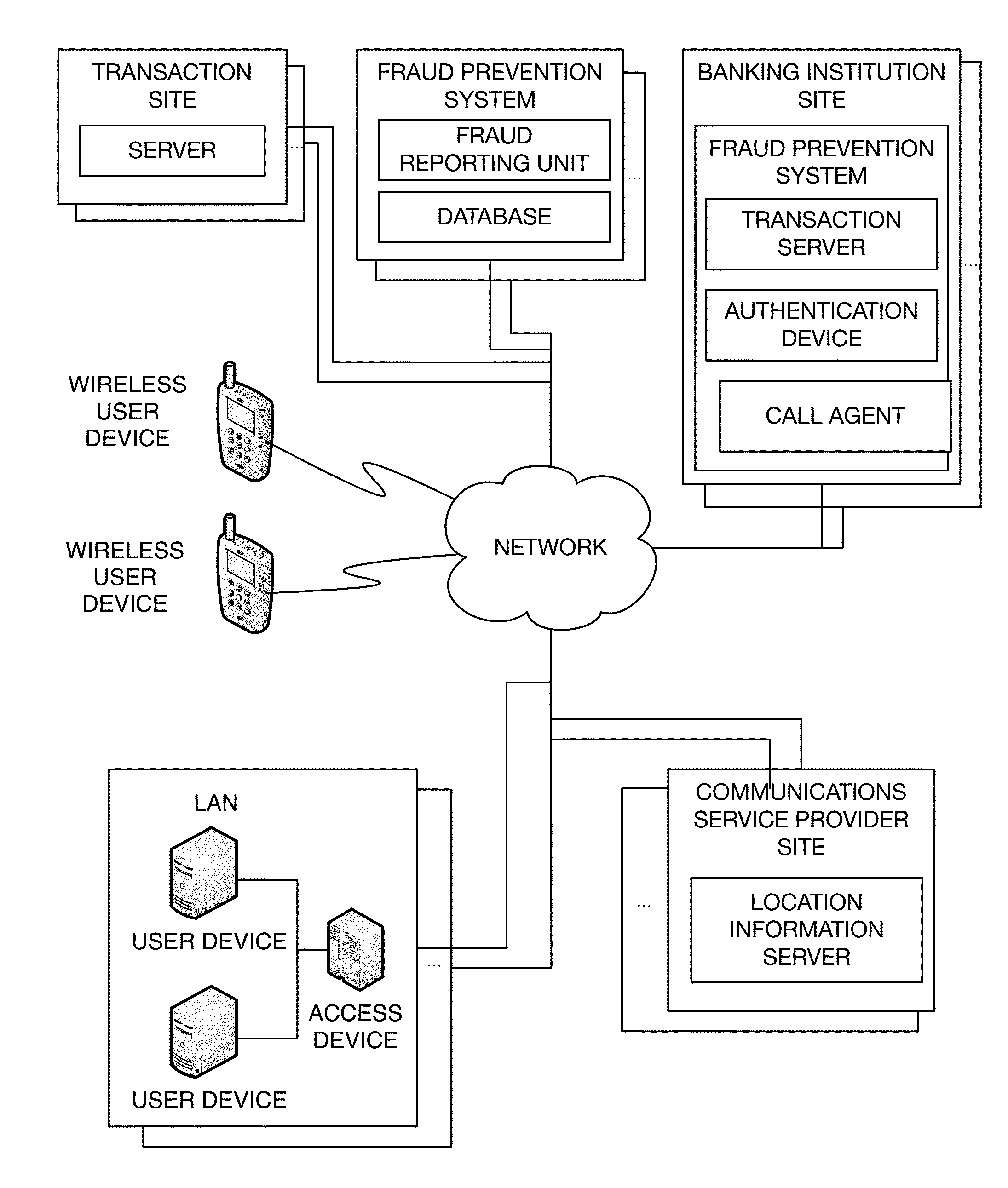

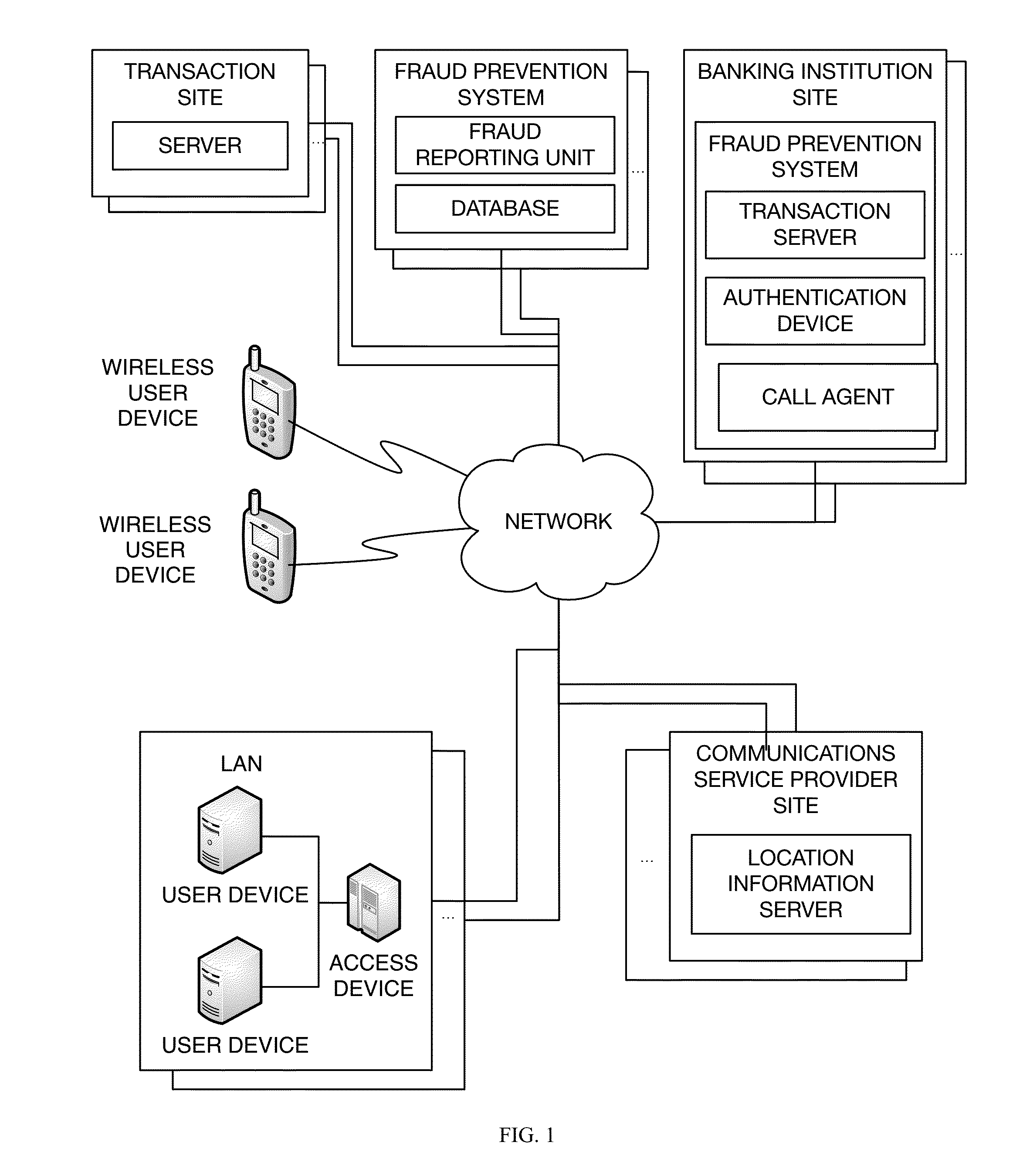

[0041]For illustrative purposes FIG. 1 shows an example of a networked fraud prevention system for transactions in accordance with an embodiment of the invention. The network communications system may include communications service provider sites, banking institution sites, fraud reporting centers, LANs (Local Area Networks), transaction sites, and wireless user devices coupled to a network.

[0042]More generally, the network communications system has a number of locations including communications service provider sites, banking institution sites, fraud reporting centers, and transa...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com