Trading system

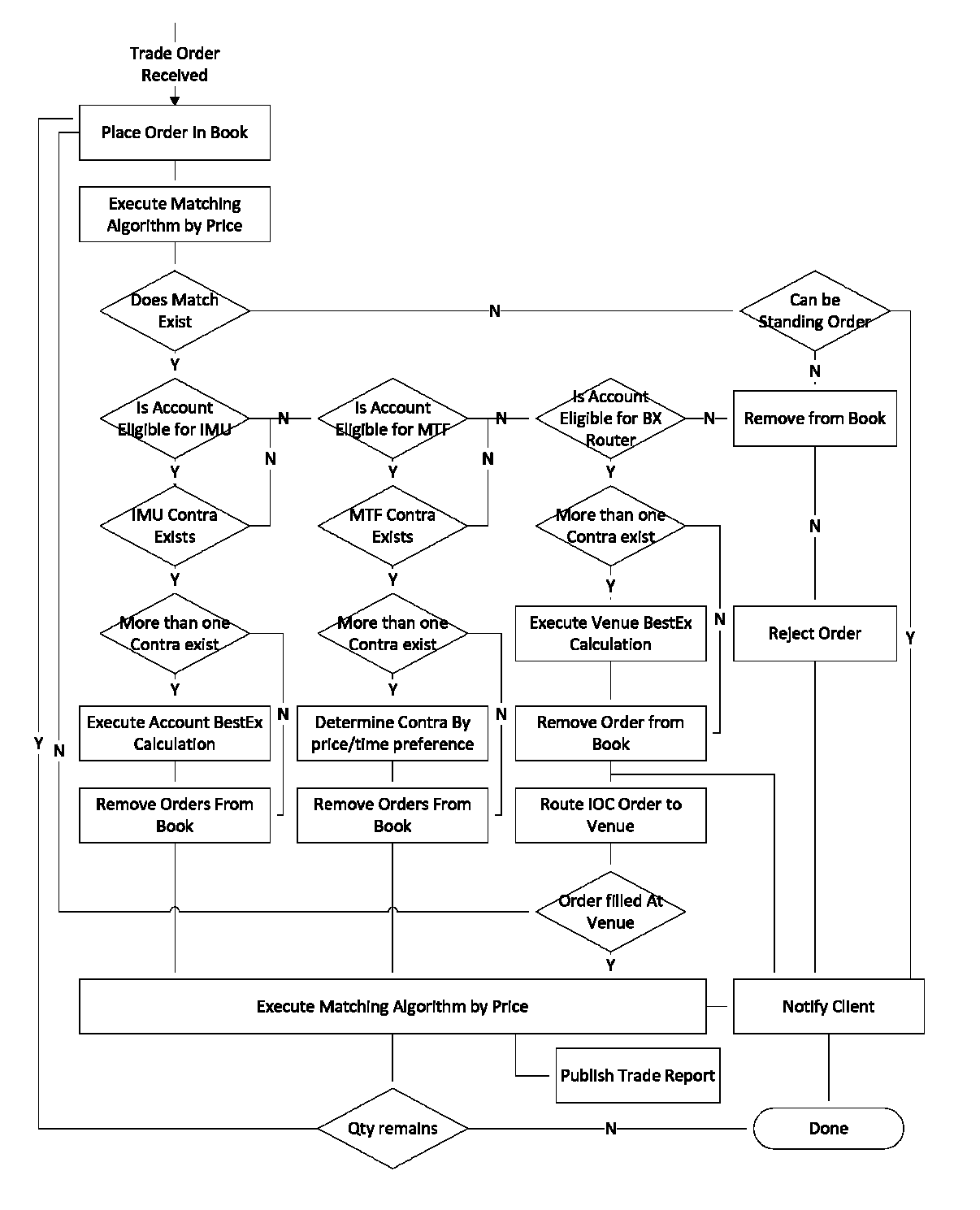

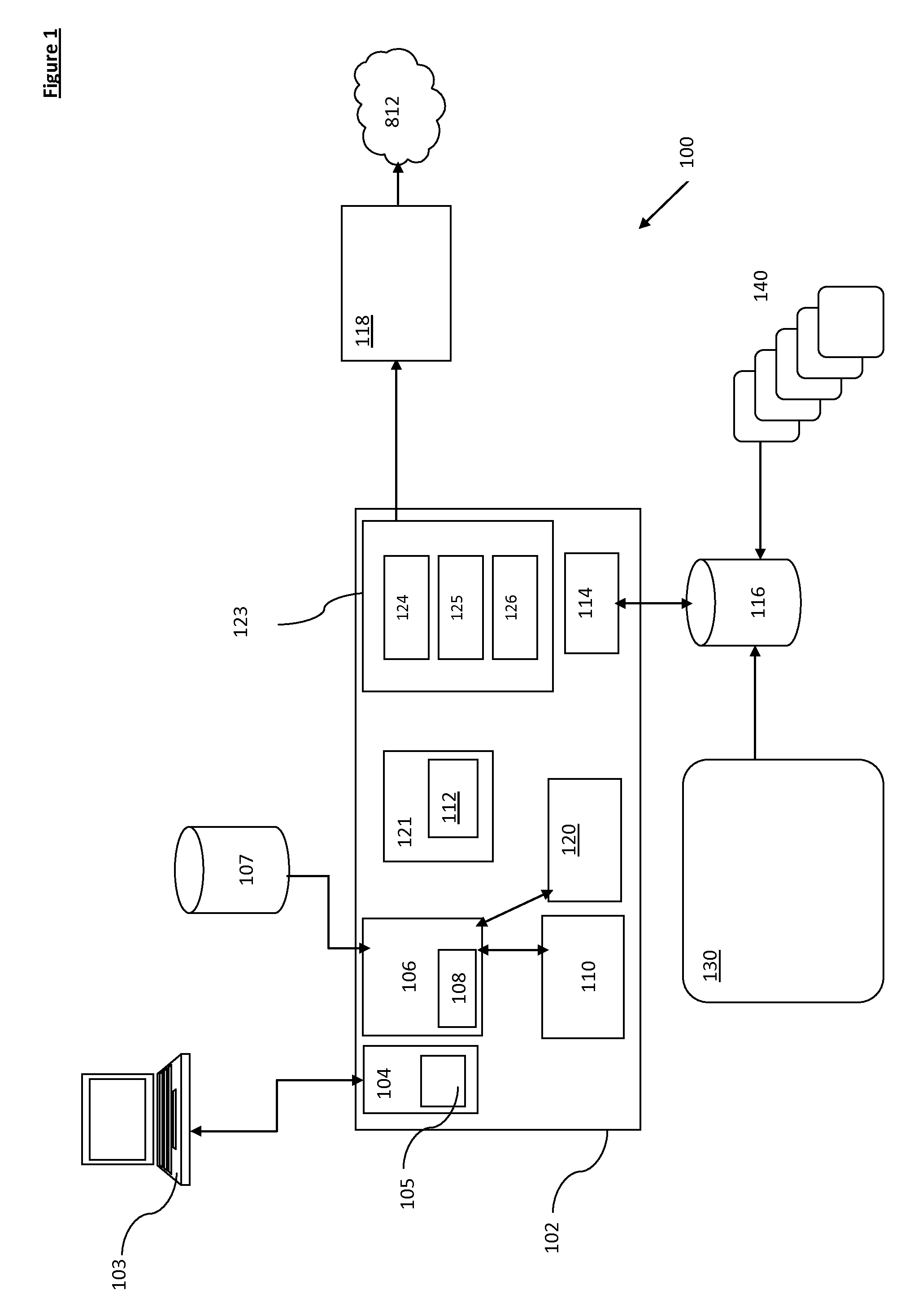

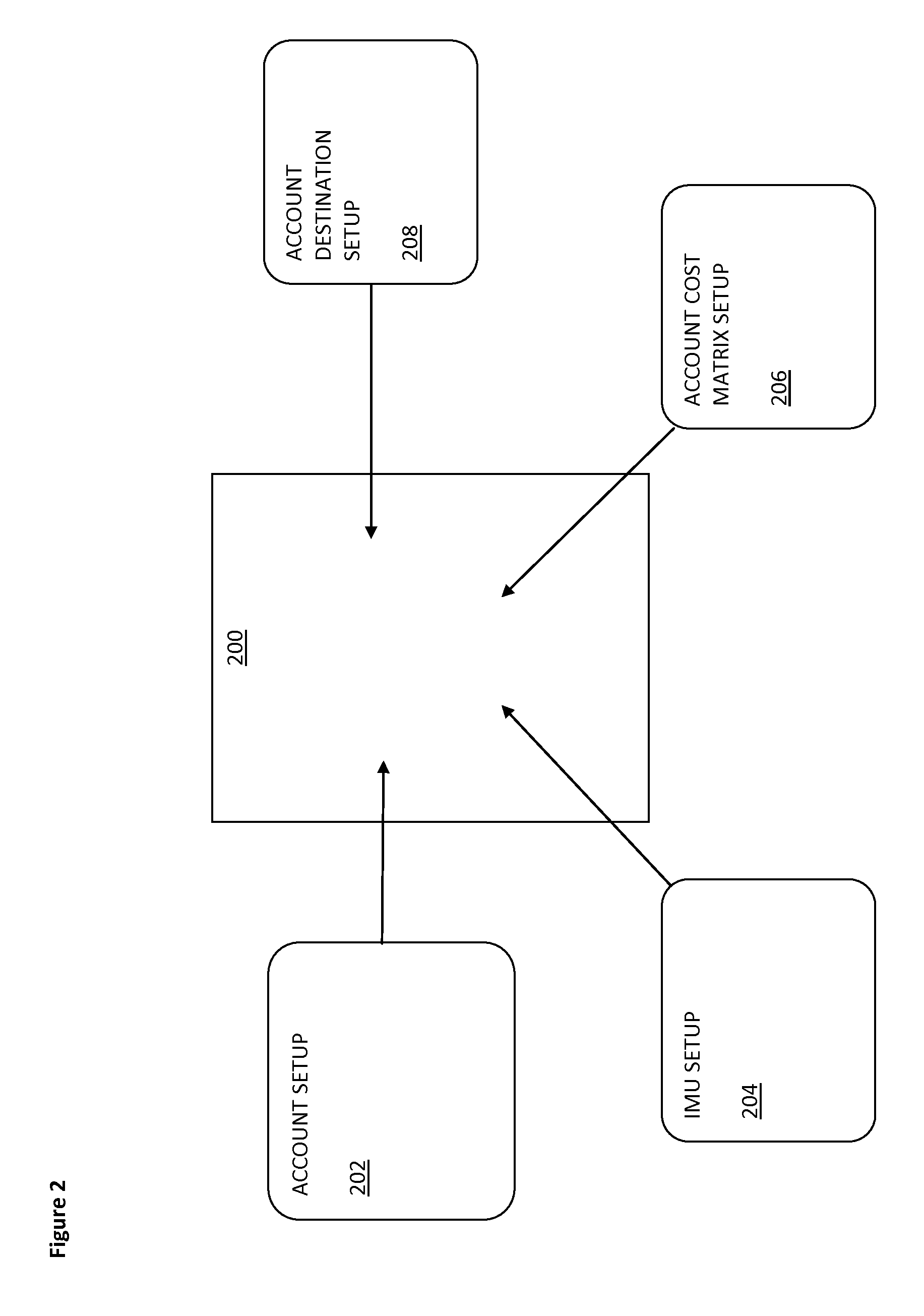

a trading system and computer technology, applied in the field of trading systems, to achieve the effect of facilitating trades, reducing network transactions, and facilitating transactions

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

example 1

[0209]This example demonstrates basic handling of an incoming Buy order according to an embodiment of the present invention. In this example, account holder ACCTA2 submits an order to BUY 50 shares of AAAA trading in GBP at a Limit price of 25.65. The incoming order is flagged as being eligible for IMU, MTF, and Best Execution calculations.

[0210]According to this example, the standing order book at the time the incoming order is entered into the system appears as follows:

[0211]

INSTRUMENT: AAAA · BASE CCY: GBPBIDASKORDERIDORIGINQTYFLAGSLIMITLIMITFLAGSQTYORIGINORDERIDCLORD01ACCTA110011125.3525.65001200LCLORD11CLORD02L 5000125.3525.65100150ACCTA3CLORD12CLORD03ST20000125.3525.70110100ACCTA4CLORD13CLORD04ACCTA325010025.3025.72001200STCLORD14CLORD05ST15000125.3025.72001100LCLORD15CLORD06ACCTA4 5011025.3025.72111100ACCTA2CLORD16CLORD07ACCTA210011125.3025.72111 50ACCTA1CLORD17

[0212]While potentially containing additional attributes, the incoming order contains the following information:

[021...

example 2

[0224]This example demonstrates basic handling of an incoming Sell order which is not fully executed based on the status of the standing book and the flags associated with the incoming Order and / or Account. In this example, ACCTA3 submits order to SELL 150 shares of AAAA trading in GBP at a Limit price of 25.35. The incoming order is flagged as being eligible for IMU Only and not eligible for MTF or Best Execution handling.

[0225]The standing order book at the time the incoming order is entered into the system appears as follows:

[0226]

INSTRUMENT: AAAA · BASE CCY: GBPBIDASKORDERIDORIGINQTYFLAGSLIMITLIMITFLAGSQTYORIGINORDERIDCLORD01ACCTA110011125.3525.65001200LCLORD11CLORD02L 5000125.3525.65100150ACCTA3CLORD12CLORD03ST20000125.3525.70110100ACCTA4CLORD13CLORD04ACCTA325010025.3025.72001200STCLORD14CLORD05ST15000125.3025.72001100LCLORD15CLORD06ACCTA4 5011025.3025.72111100ACCTA2CLORD16CLORD07ACCTA210011125.3025.72111 50ACCTA1CLORD17

[0227]While potentially containing additional attributes, ...

example 3

[0242]This example demonstrates an advanced processing scenario of an incoming Sell order that results in price improvement as well as best execution calculations at both the Account and Venue levels at various points throughout the handling of the incoming order. In this example, ACCTA1 submits order to Sell 500 shares of AAAA trading in GBP at a Limit price of 25.30. The incoming order is flagged as being eligible for IMU, MTF, and Best Execution calculations.

[0243]The standing order book at the time the incoming order is entered into the system appears as follows:

[0244]

INSTRUMENT: AAAA • BASE CCY: GBPBIDASKORDERIDORIGINQTYFLAGSLIMITLIMITFLAGSQTYORIGINORDERIDCLORD01ACCTA210011125.3525.65001200LCLORD11CLORD02L5000125.3525.65100150ACCTA3CLORD12CLORD03ST20000125.3525.70110100ACCTA4CLORD13CLORD04ACCTA325010025.3025.72001200STCLORD14CLORD05ST15000125.3025.72001100LCLORD15CLORD06ACCTA45011025.3025.72111100ACCTA2CLORD16CLORD07ACCTA210011125.3025.7211150ACCTA1CLORD17

[0245]While potentiall...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com