Patents

Literature

61results about How to "Facilitates trade" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Real-time commodity trading method and apparatus

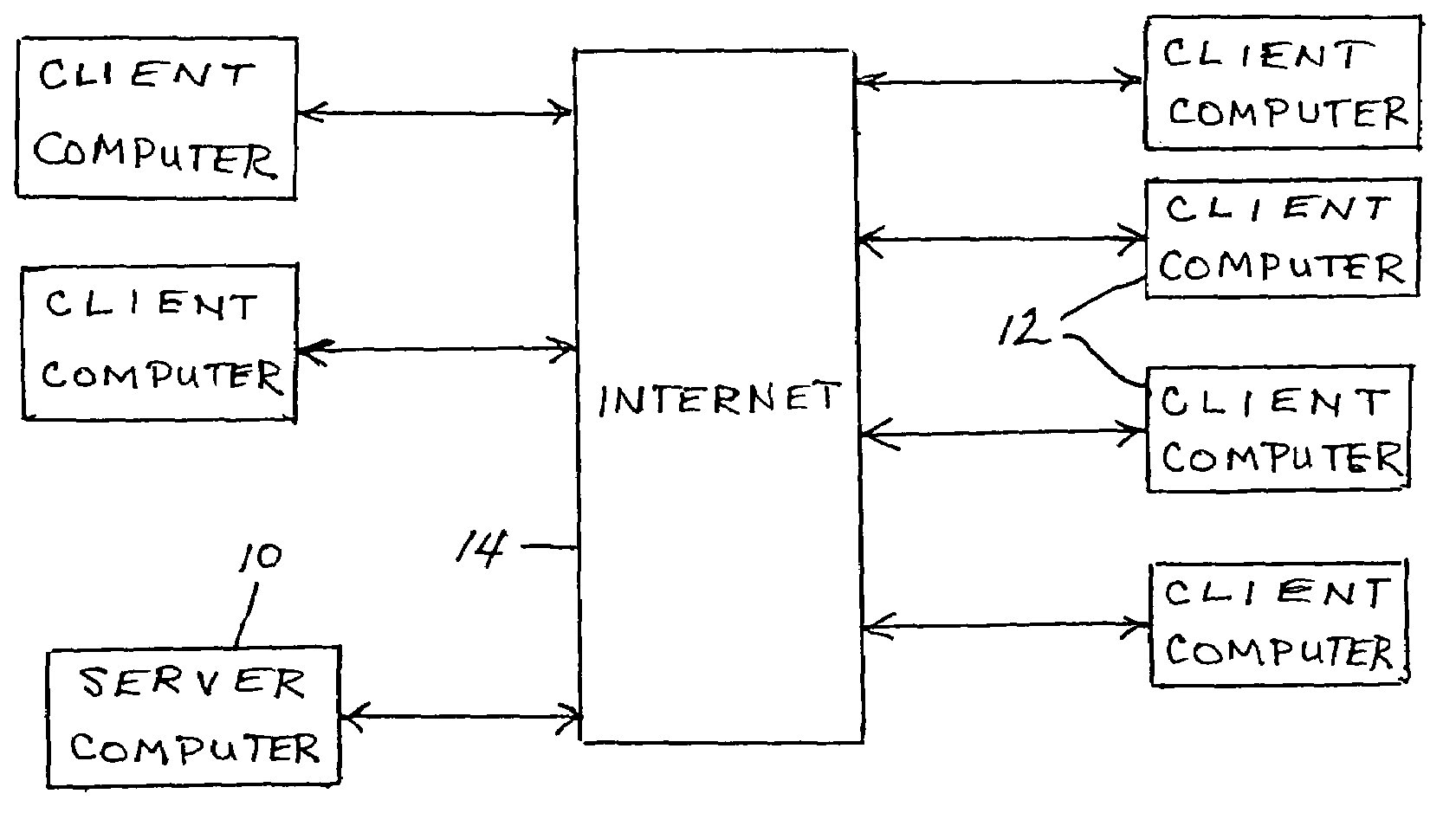

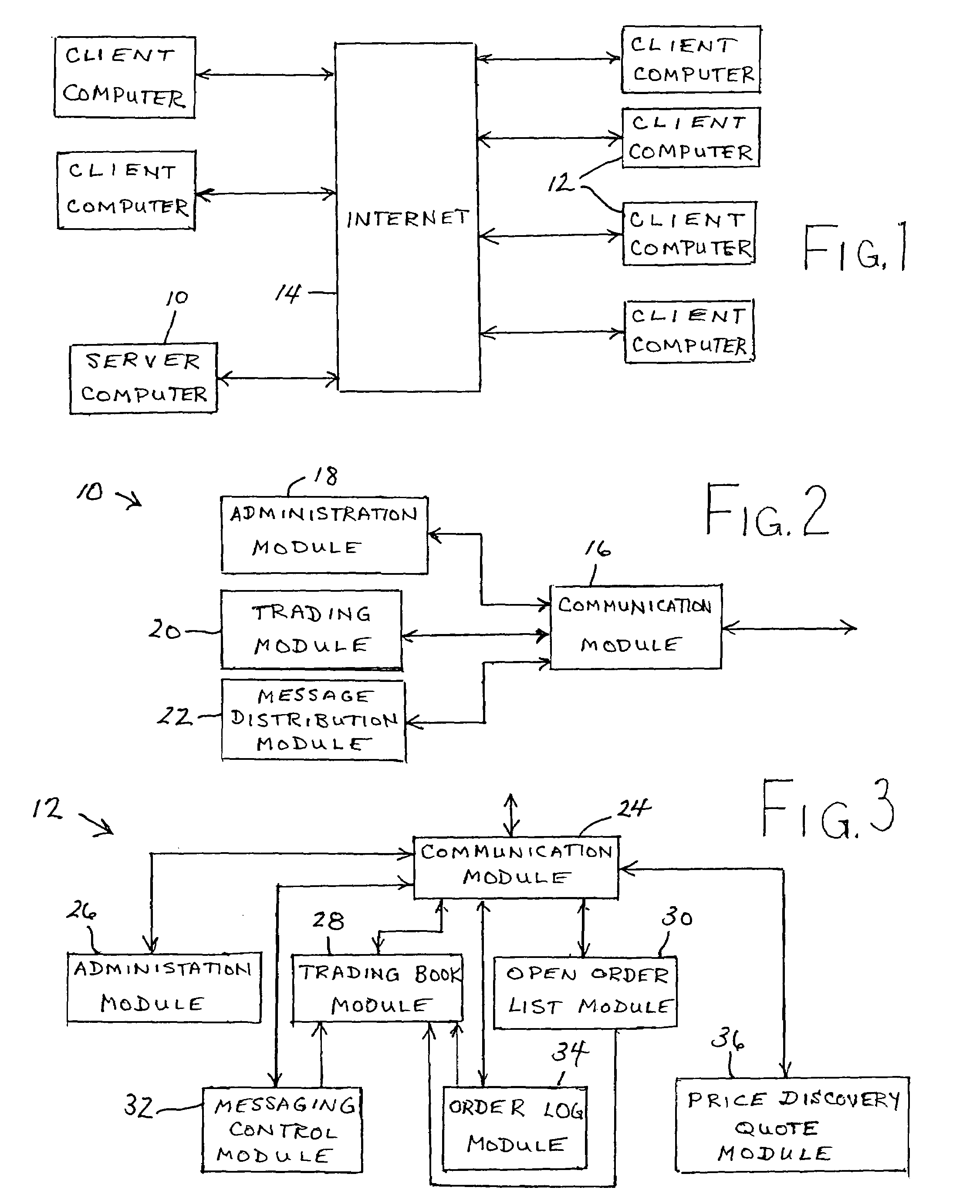

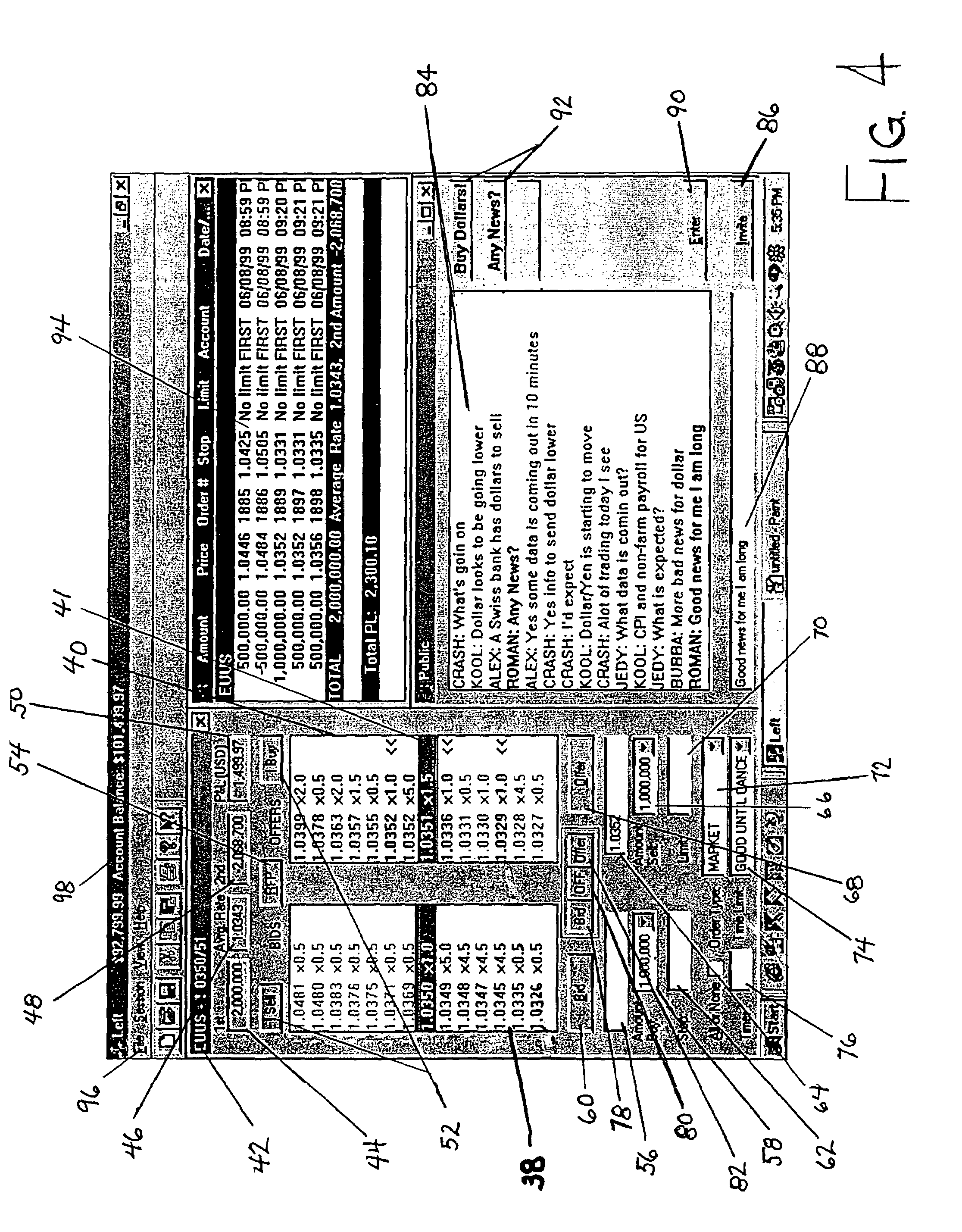

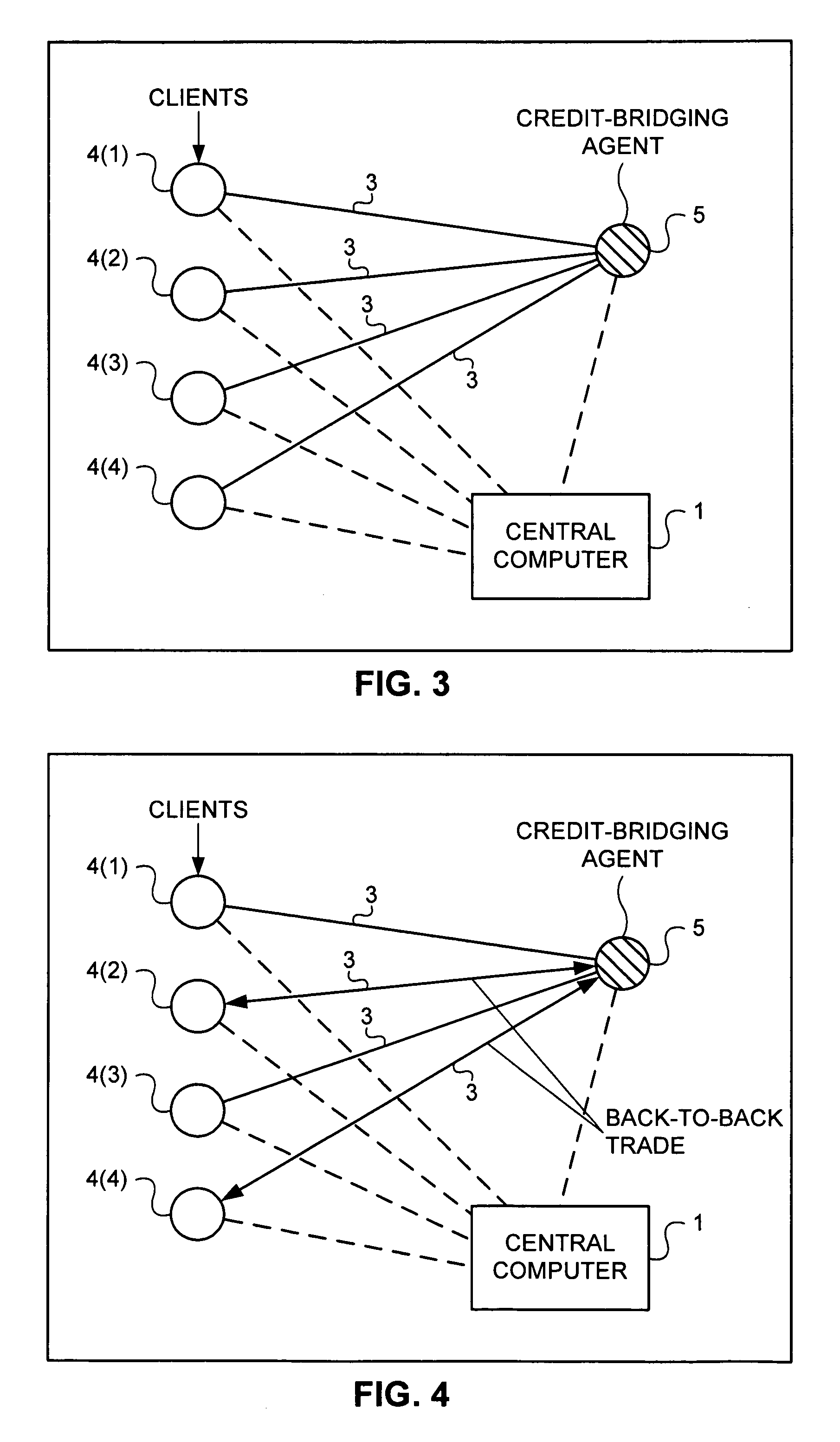

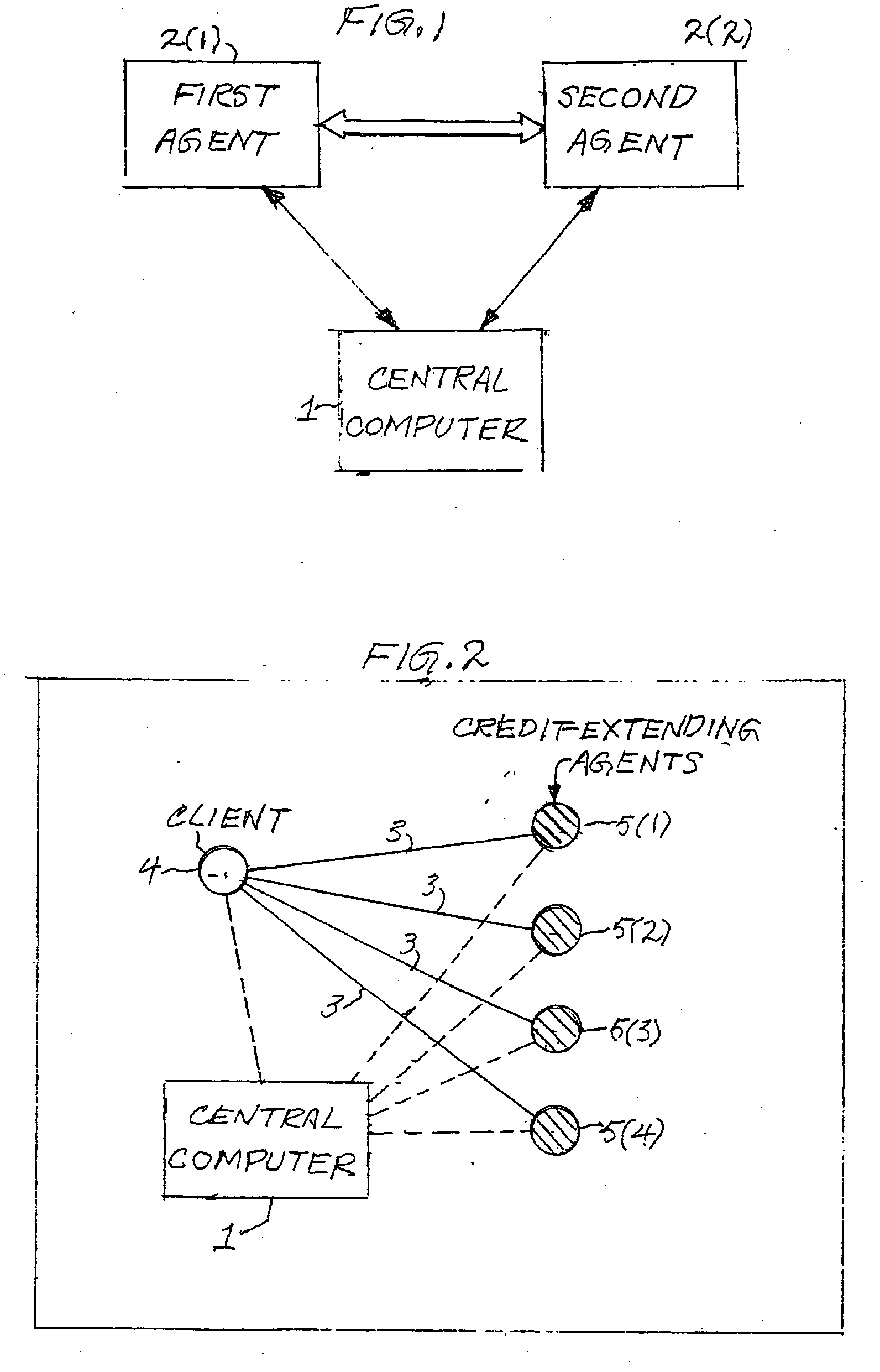

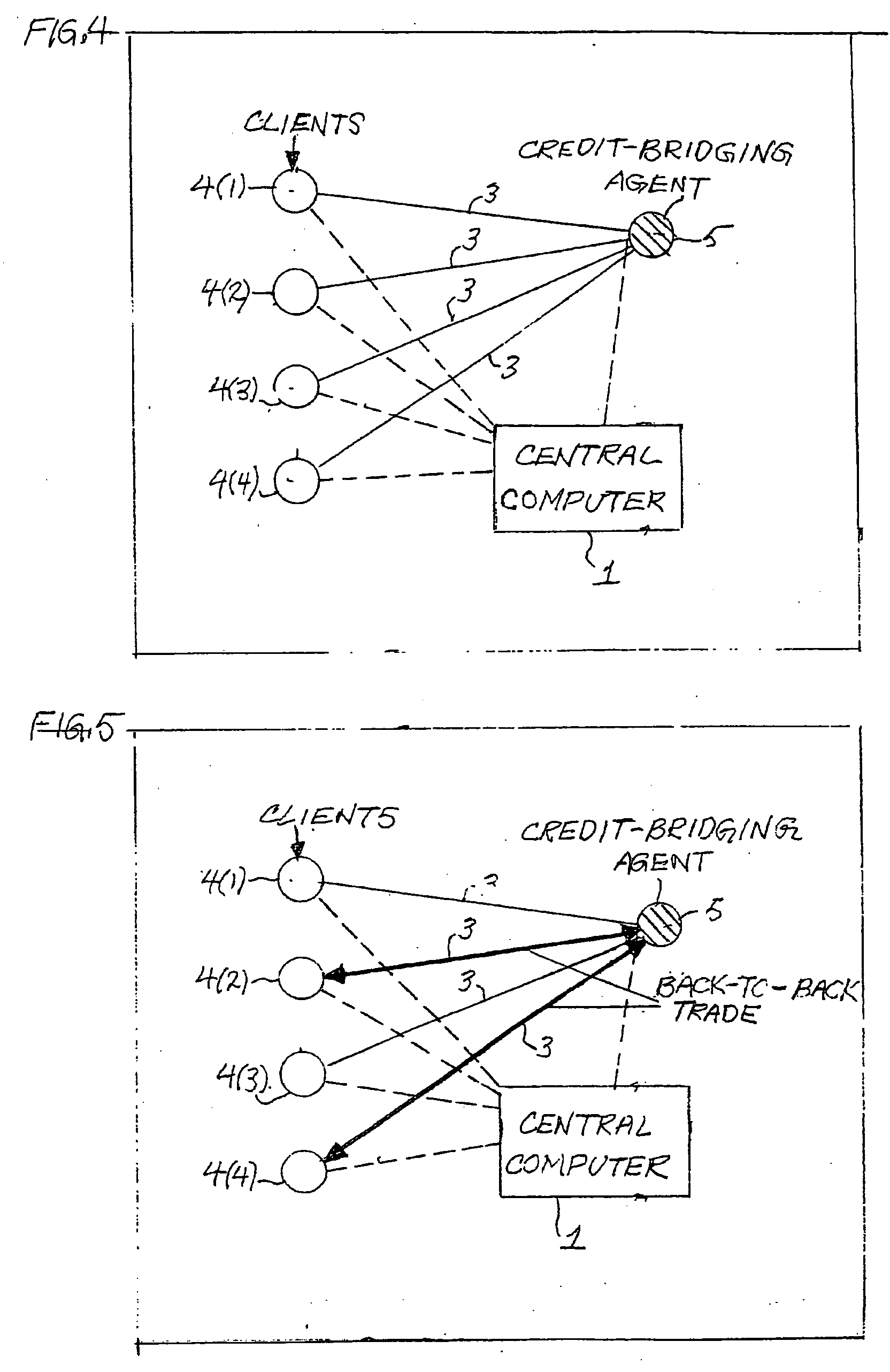

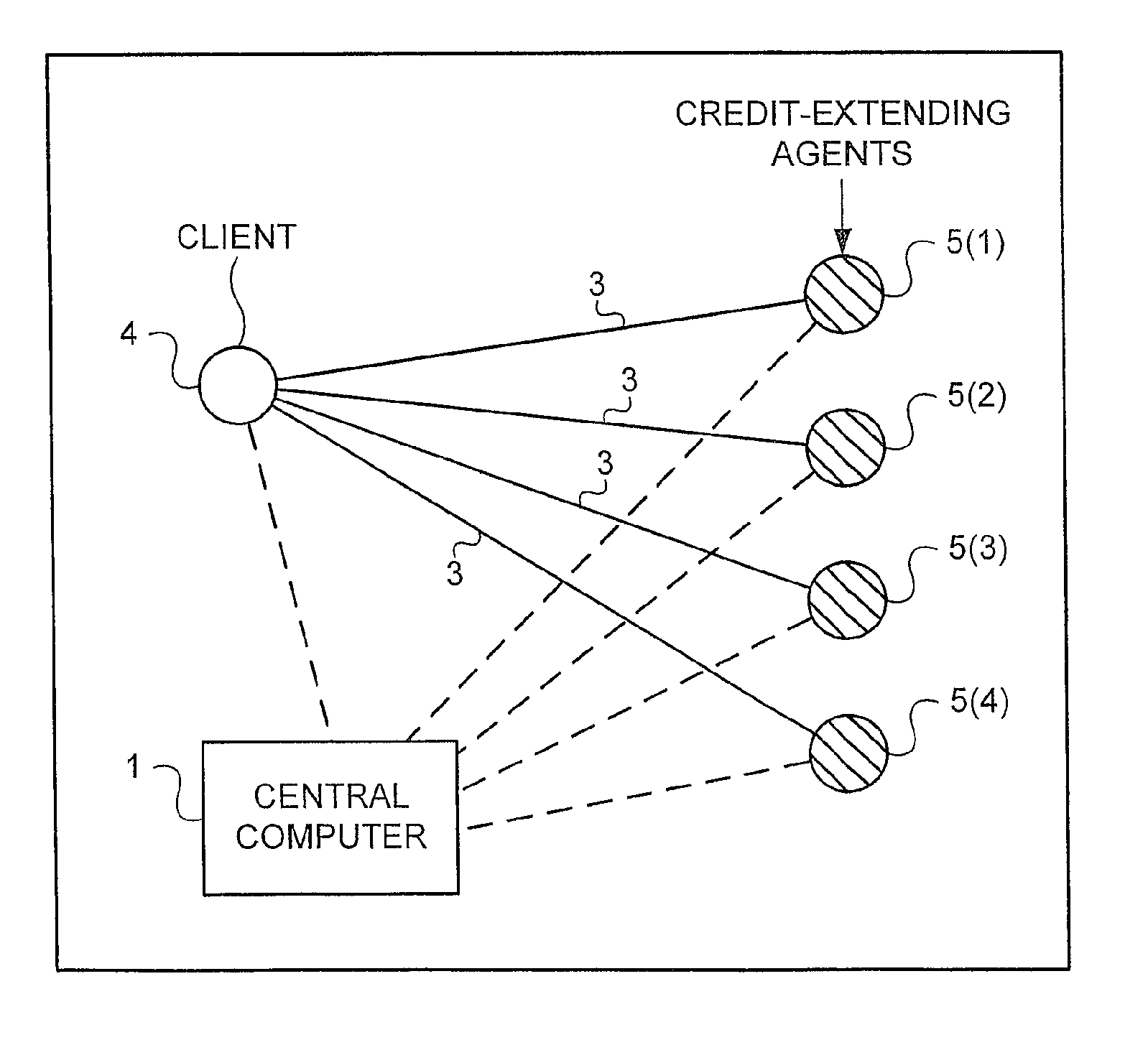

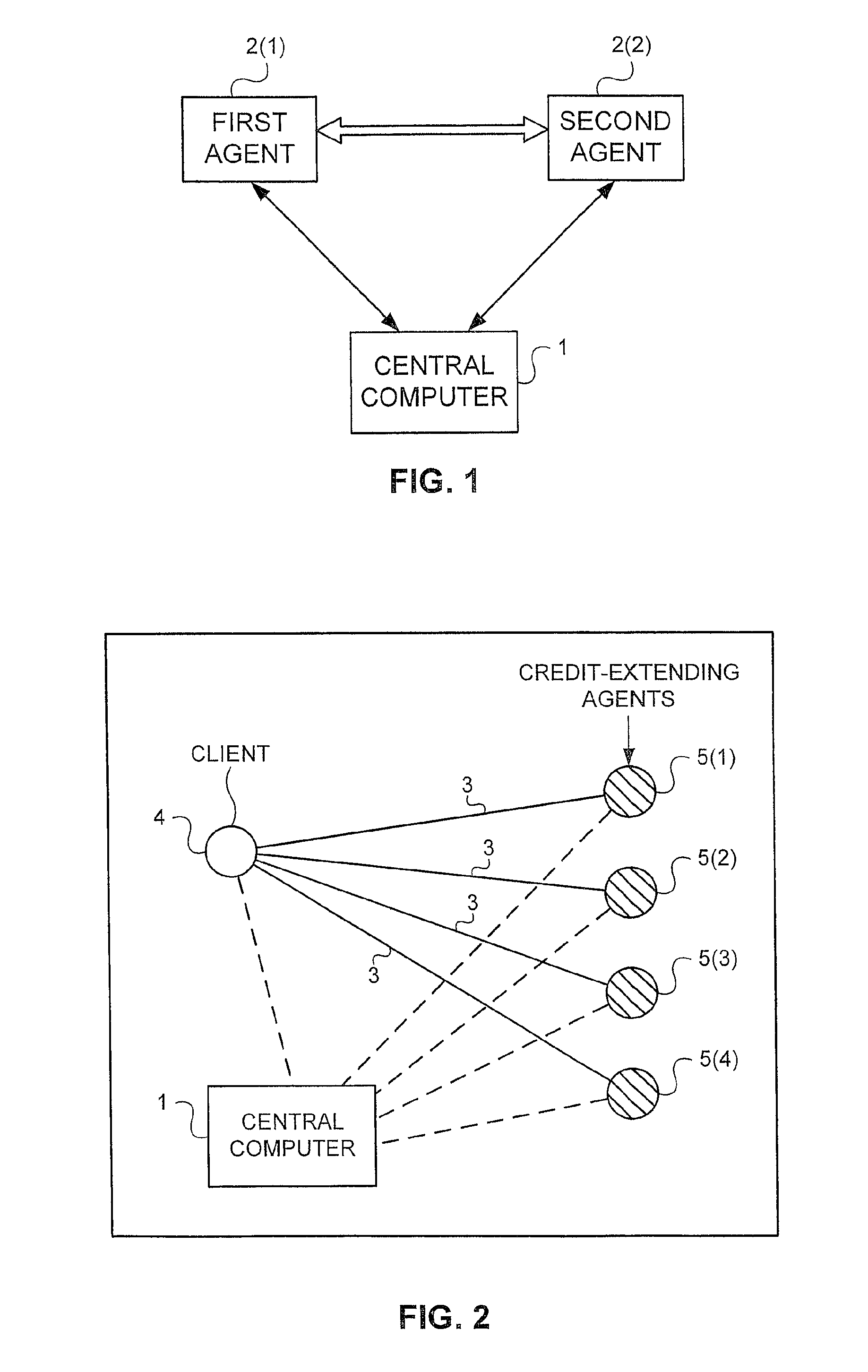

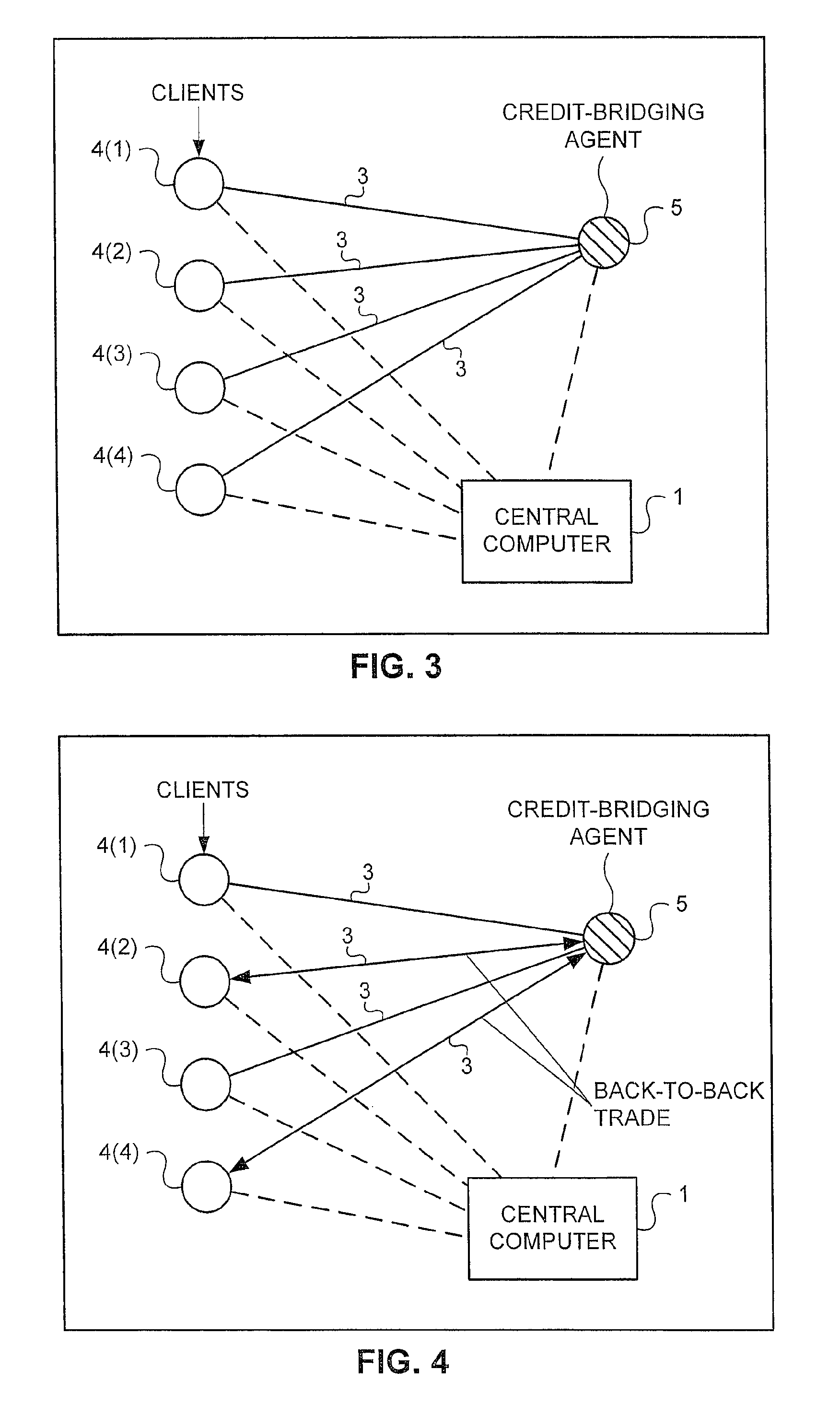

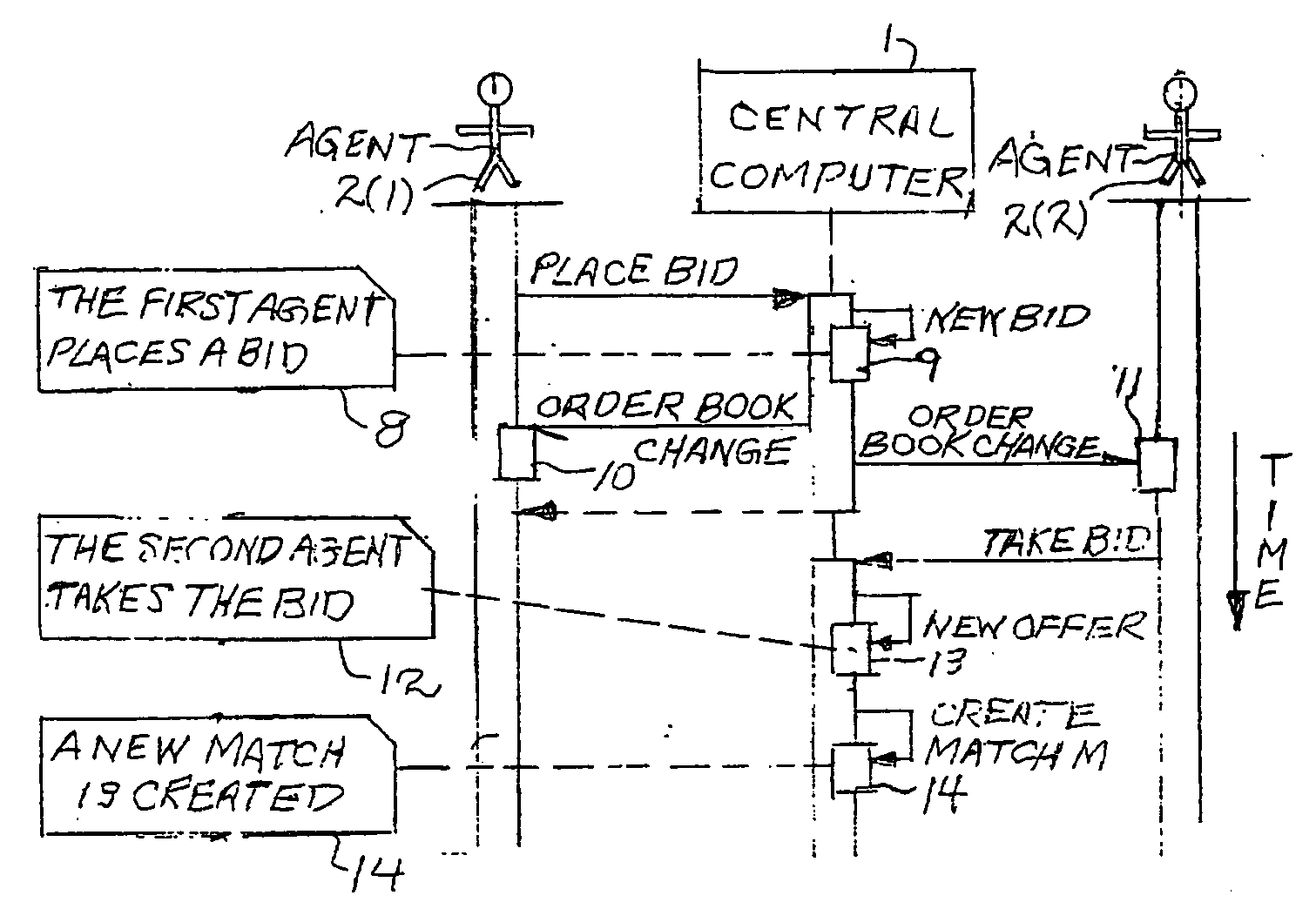

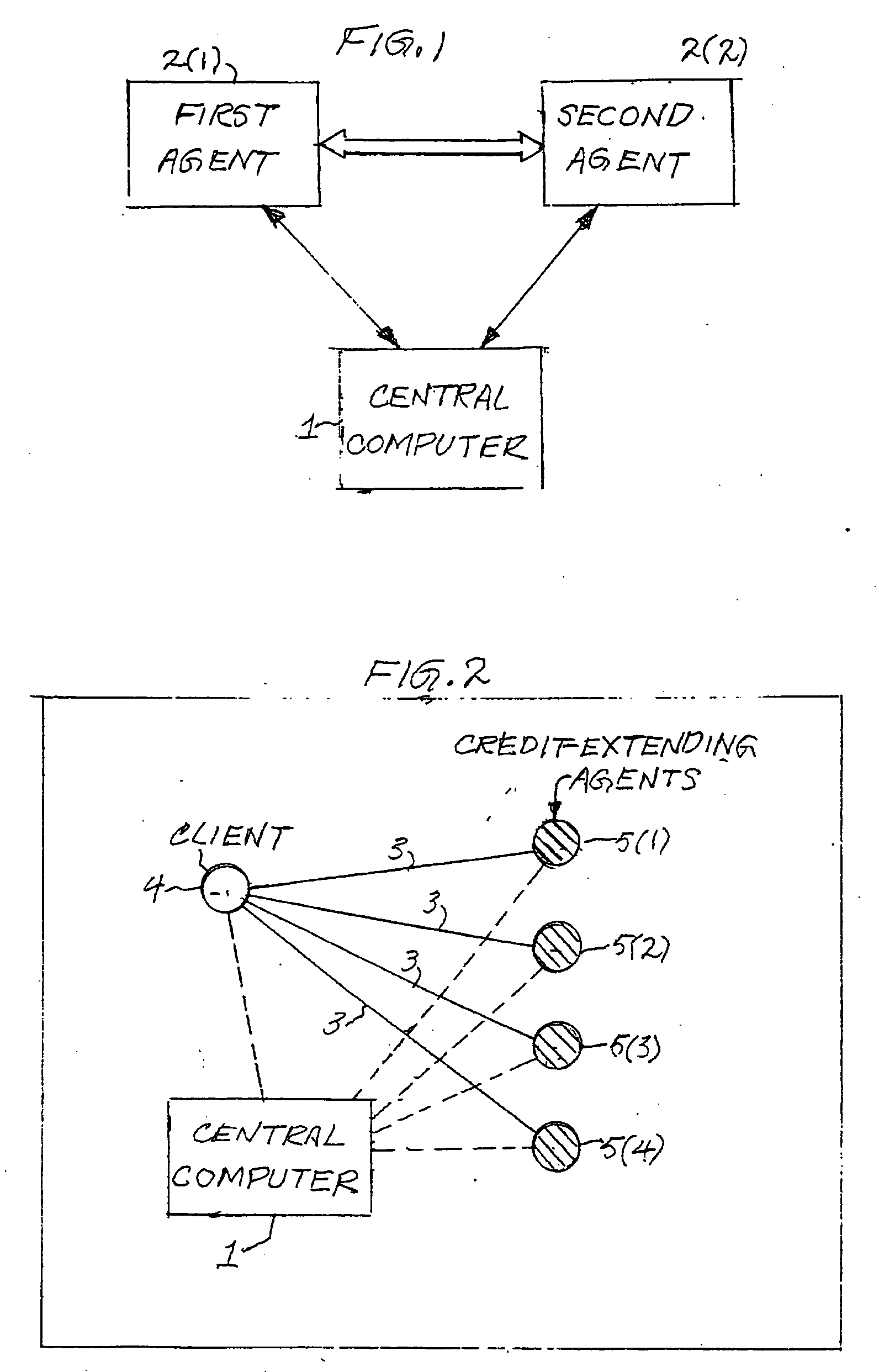

A method and a system including programmed general purpose digital computers on a computer network for effectuating the real-time trading of a commodity including, but not limited to, a currency. A commodity trading method implemented at a client or trader computer connected to a computer network (e.g., the Internet) includes (a) receiving, in encoded form via a computer network, a plurality of bids and a plurality of offers pertaining to a common commodity, (b) displaying the bids and offers on a computer monitor, (c) generating a trading offer including a trading rate or price per unit of the commodity and a number of units of the commodity, (d) automatically calculating a total stop amount for the trading offer, (e) automatically or electronically comparing the total stop amount with an amount in a client or trader account, and (f) transmitting a digital signal encoding the trading offer to multiple other clients via the computer network upon and only upon a determination that the total stop amount is less than an amount in the client account.

Owner:CUREX INNOVATIONS

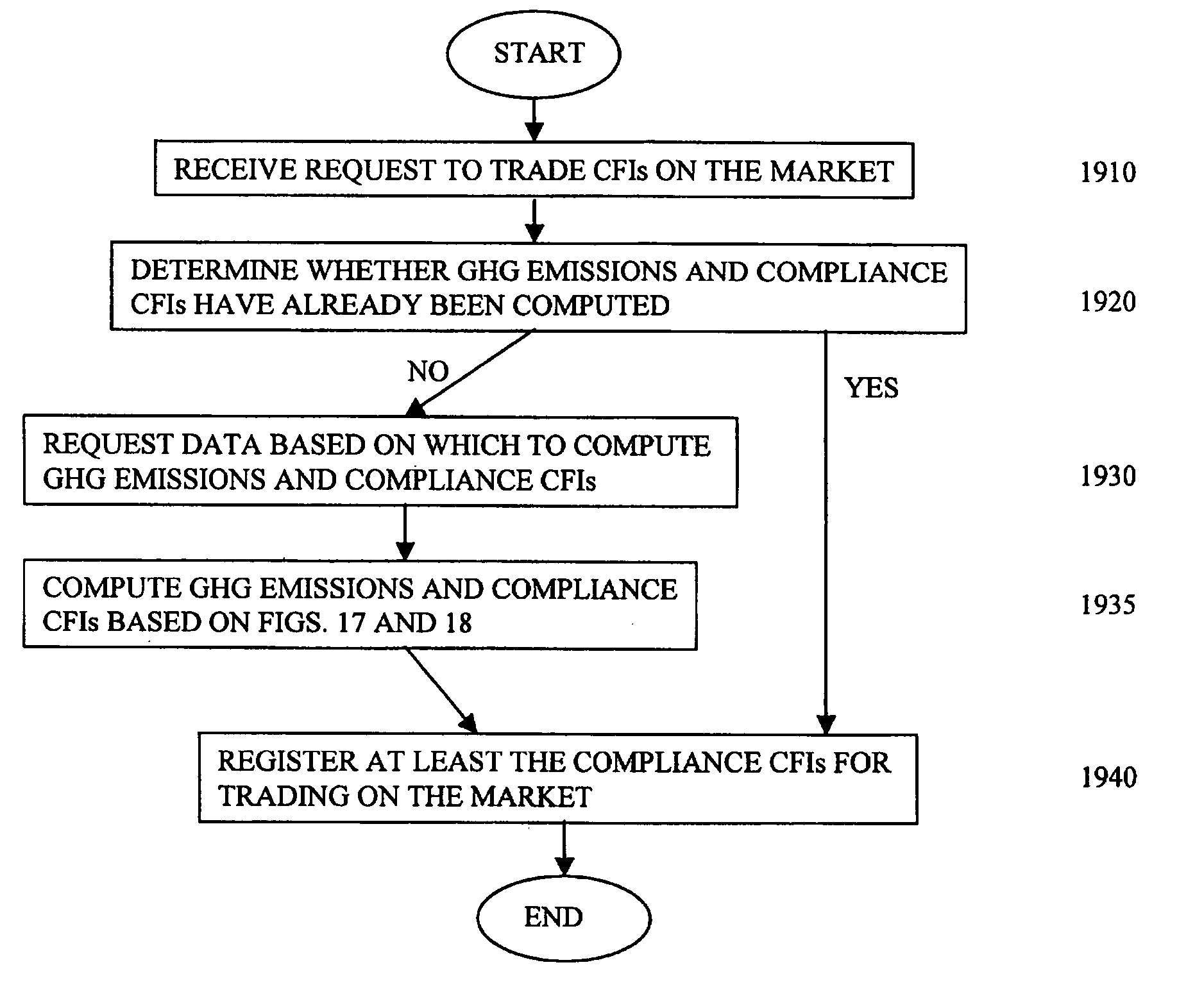

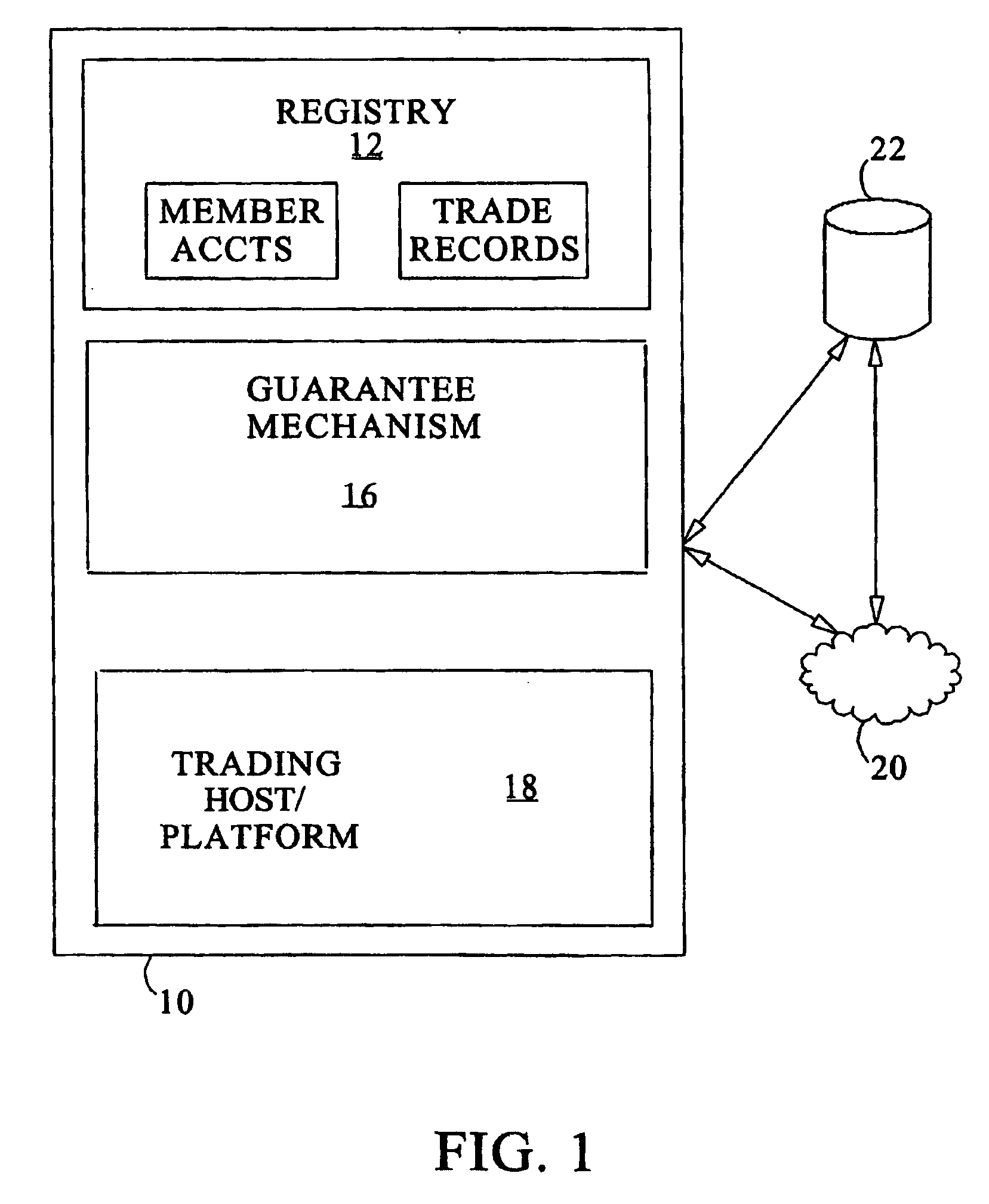

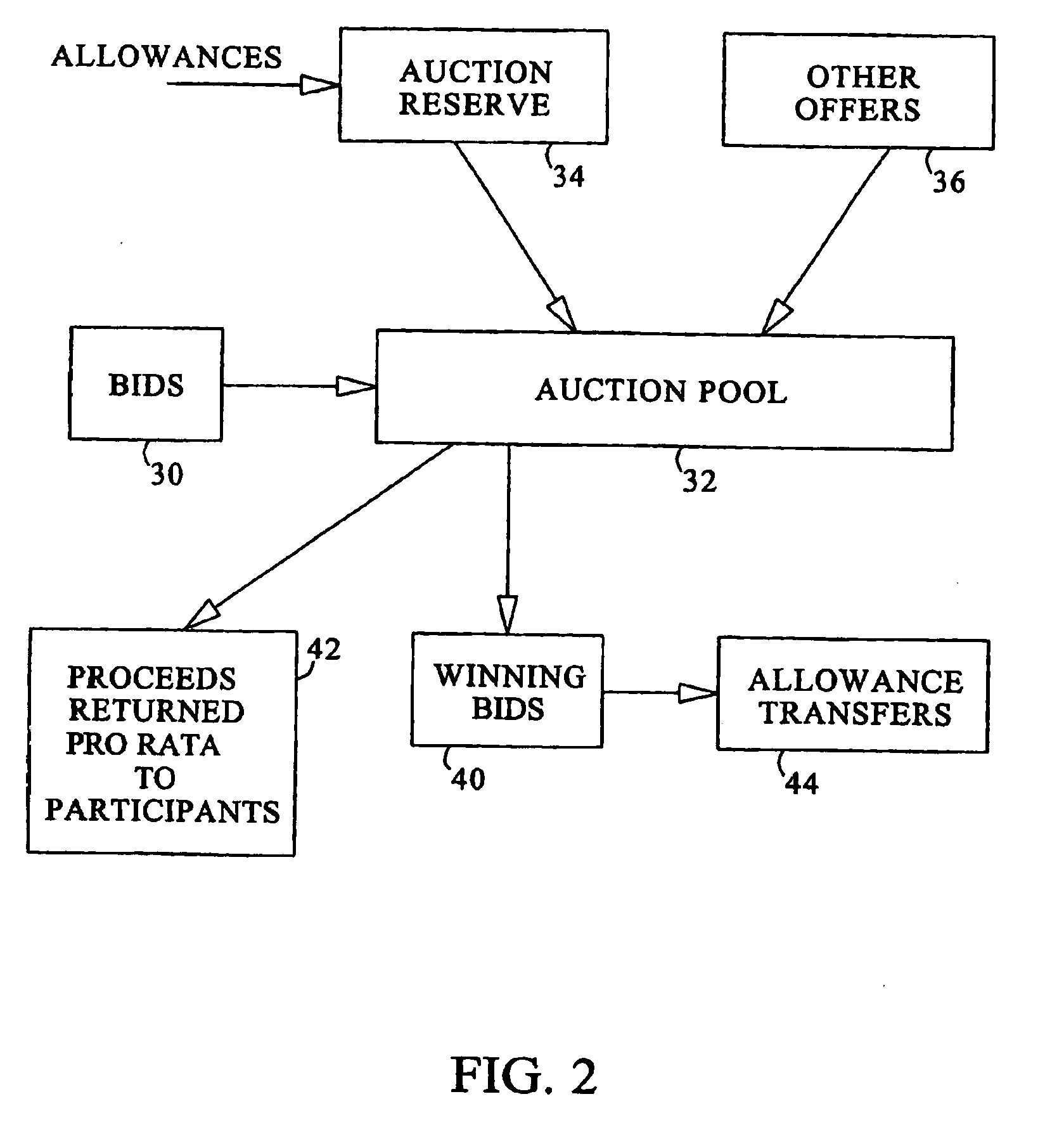

Systems and methods for trading emission reductions

InactiveUS20060184445A1Facilitates tradeAvoid problemsFinanceTechnology managementTime scheduleProgram planning

Systems and methods for facilitating trading of emission allowances and offsets among participants are described. In some embodiments, methods of facilitating such trading include establishing an emissions reduction schedule for certain participants based on emissions information provided by those participants; determining debits or credits for each certain participant in order to achieve the reduction schedule; creating financial instruments representing such debits and credits; and conducting trades of such financial instruments to transfer emission debits and credits between the participants to enable the certain participants to meet the reduction schedule. Also, trades of emission debits and credits are conducted between the participants to enable the certain participants to meet the reduction schedule. The systems of the invention are computer based and are linked via the internet to enable real time operation of the trading system to facilitate buying and selling of emission financial instruments by the participants.

Owner:CHICAGO CLIMATE EXCHANGE

Global electronic trading system

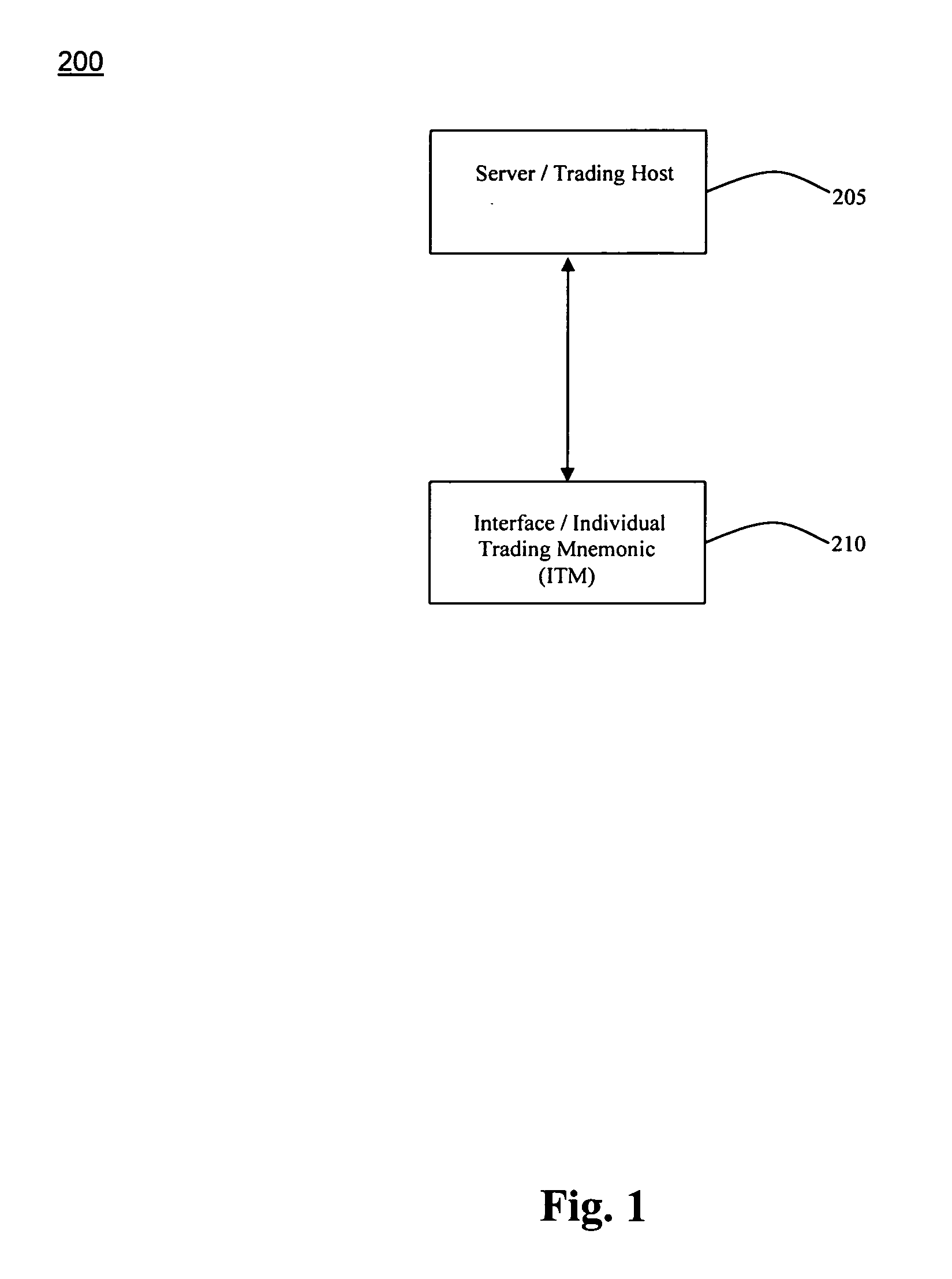

InactiveUS7130789B2Controlling the riskFacilitates tradeFinanceCurrency conversionComputer scienceElectronic trading

Owner:SETEC ASTRONOMY

Automated order book with crowd price improvement

Owner:XYLON LLC

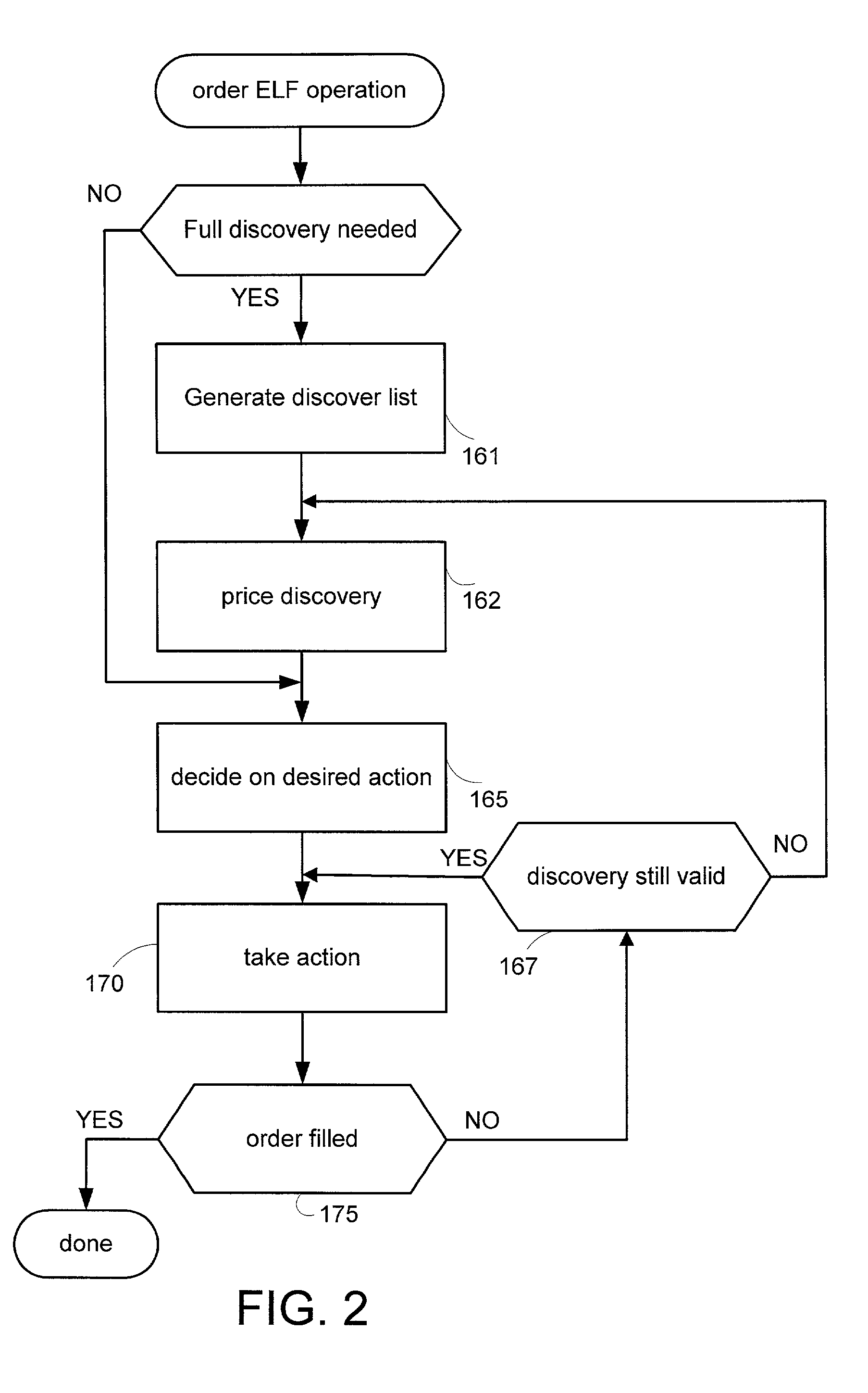

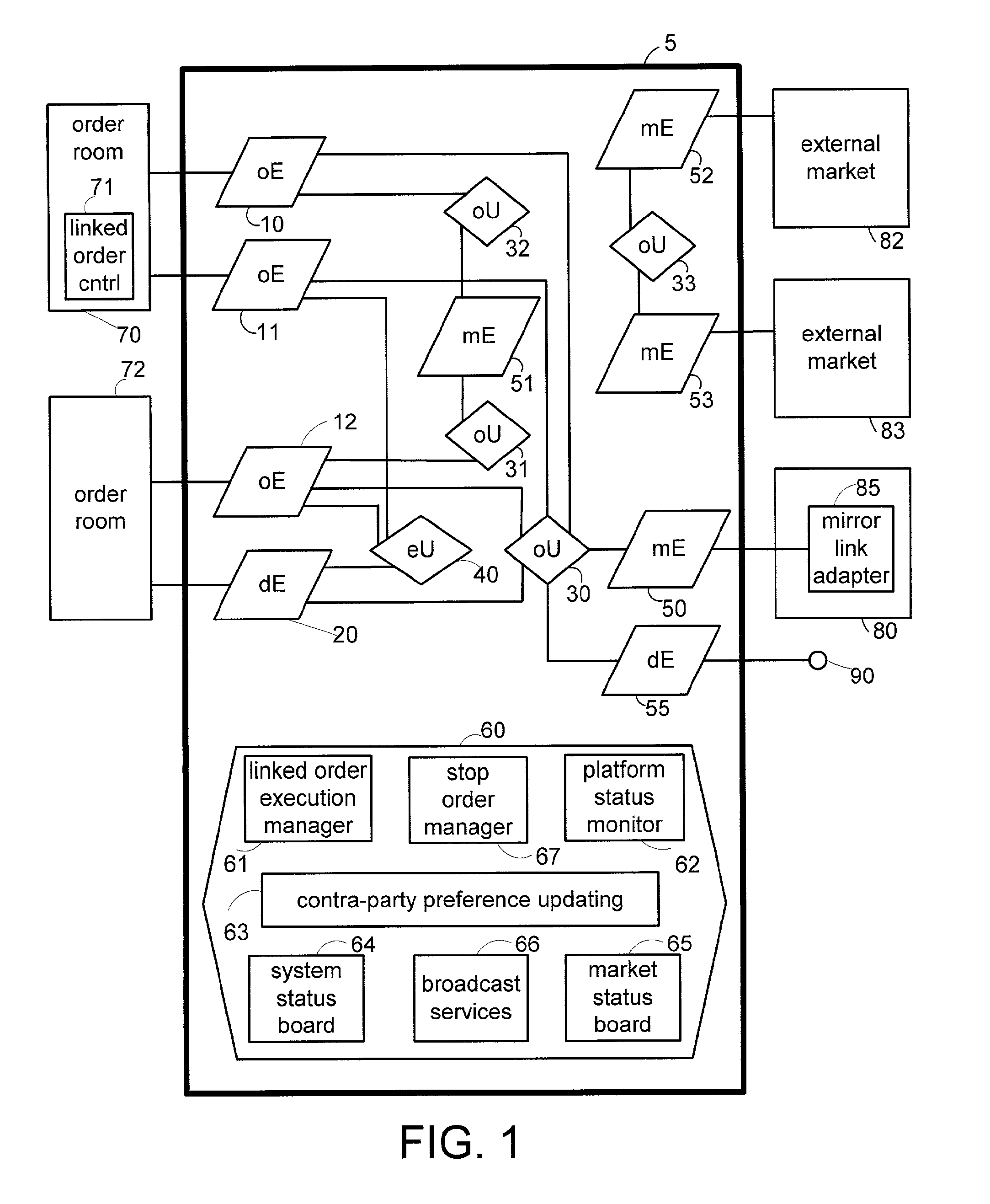

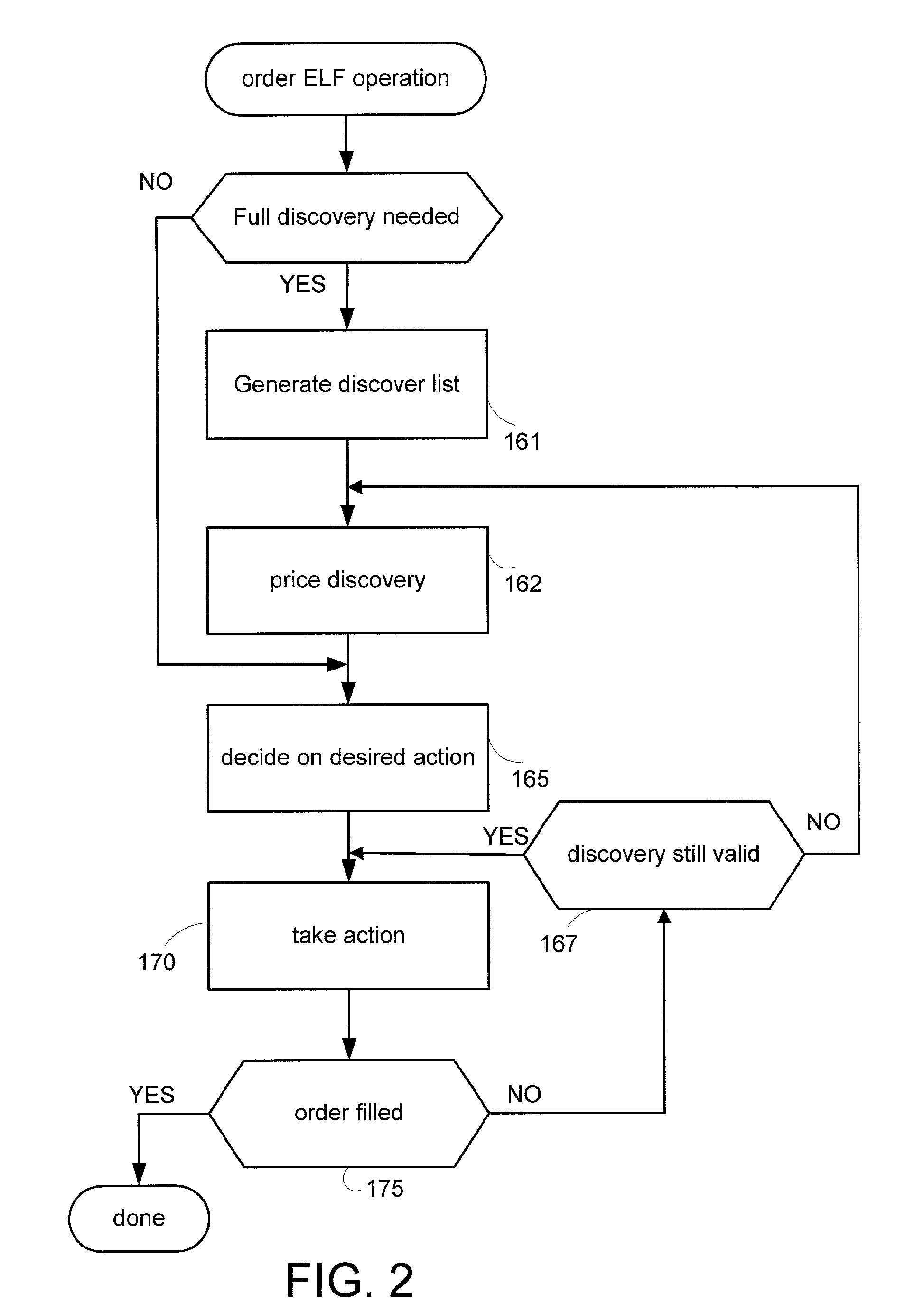

Decision table for order handling

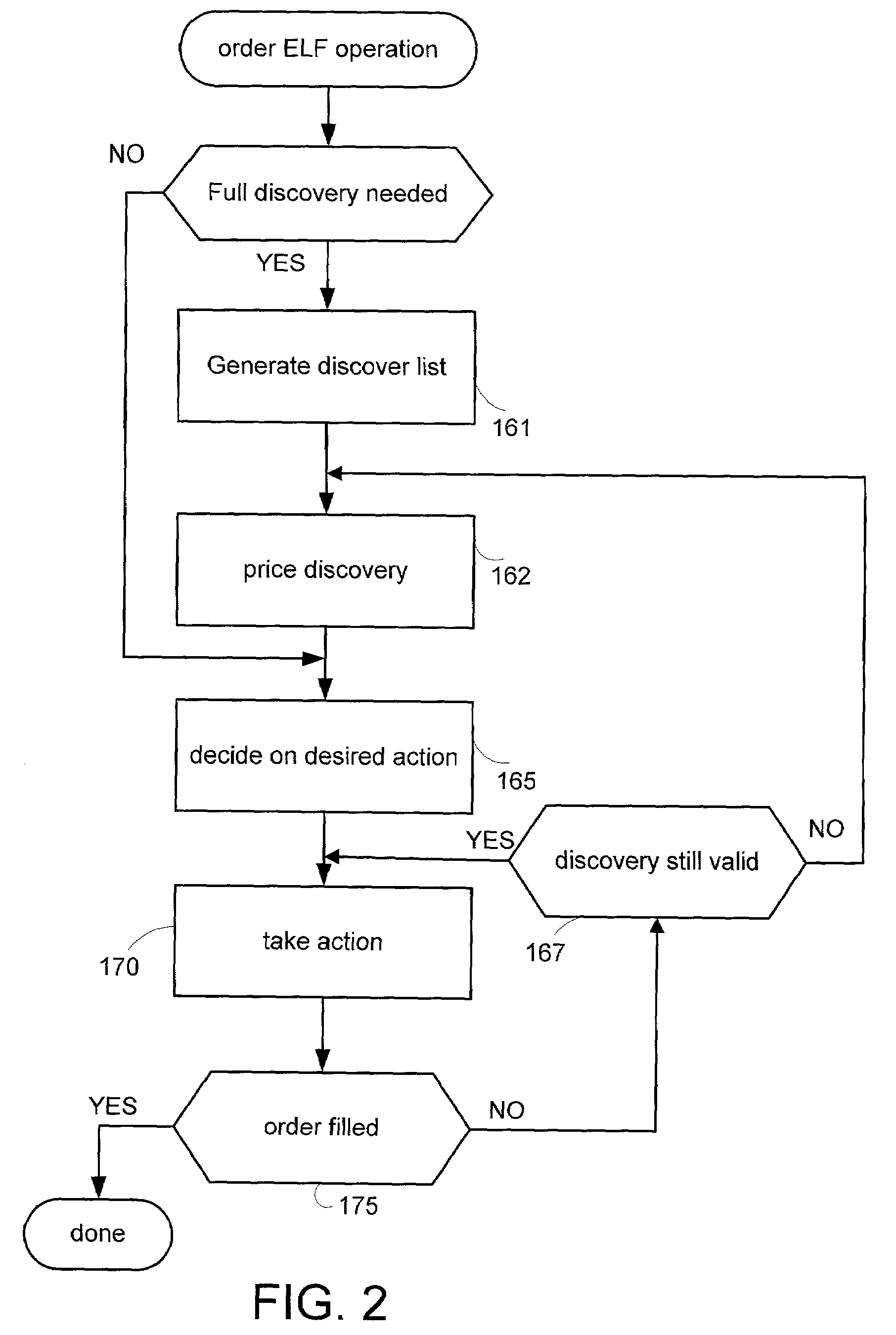

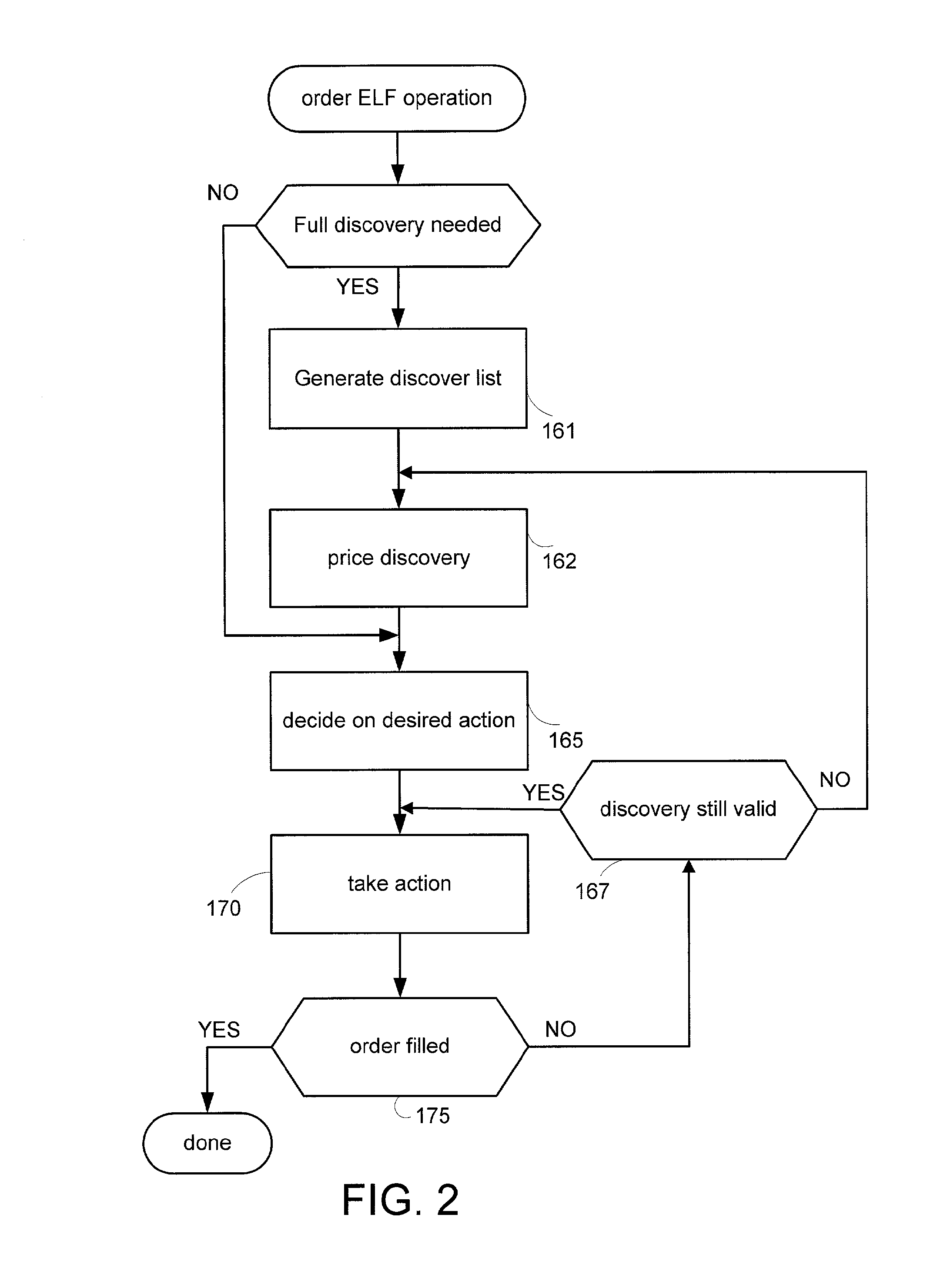

Trading processes and market processes interact with each other on a platform. Each of the trading processes has a trading strategy embodied in a decision table. Each of the market processes has a market methodology that may employ a decision table in like manner as the trading processes. Accordingly, the trading processes and market processes are easy to configure. The decision table comprises rules having conditions and actions that are to be performed when the conditions are true.

Owner:XYLON LLC

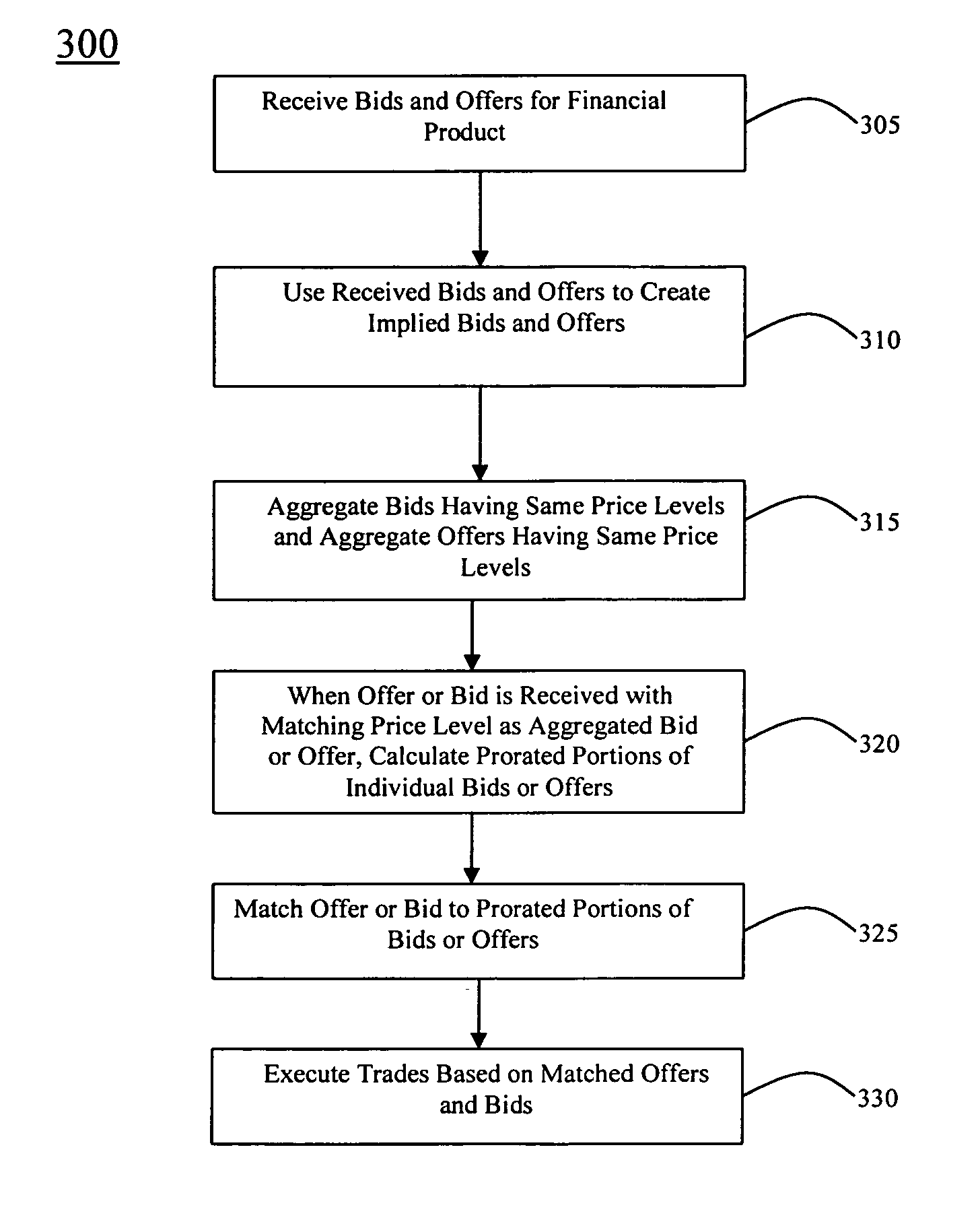

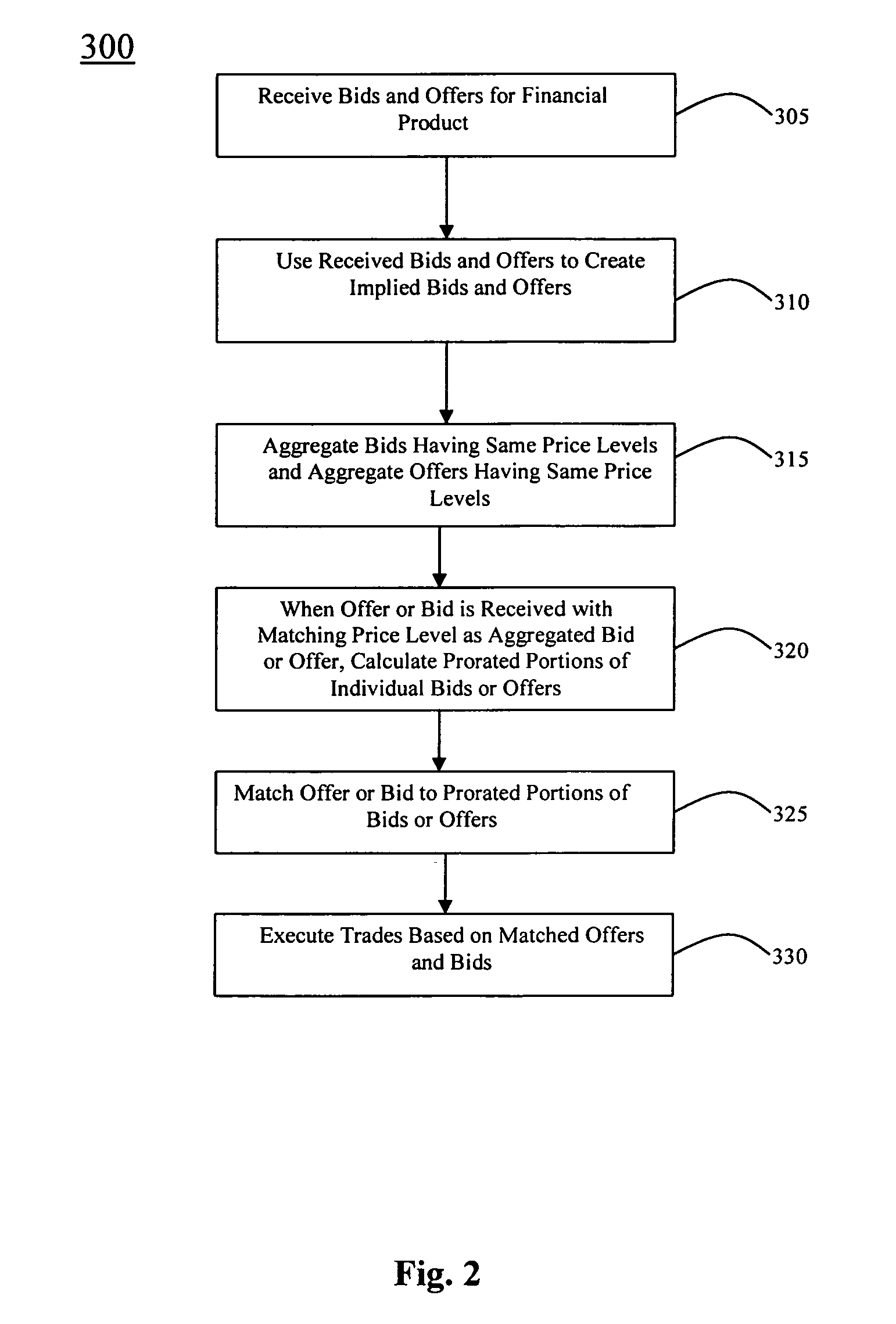

System and method for aggregation of implied bids and offers for short-term interest rate futures and options

A method and system for facilitating trading of financial products is provided. The method includes receiving bids and / or offers for a financial product and aggregating bids and offers that are at the same price level. For financial products that include calendar spreads, such as short-term interest rate futures or options, bids and / or offers may be implied in or implied out of other bids and offers by combining them appropriately. When an offer or bid having a matching price level to the aggregated bid or offer is received, the aggregated bid or offer is divided in a prorated proportion based on the number of lots in the matching offer or bid and based on the numbers of lots in the individual bids and offers that make up the aggregated bid or offer. Trades are then executed using the matching offers or bids and the corresponding prorated portions of the original bids or offers.

Owner:LIFFE ADMINISTRATION & MANAGEMENT

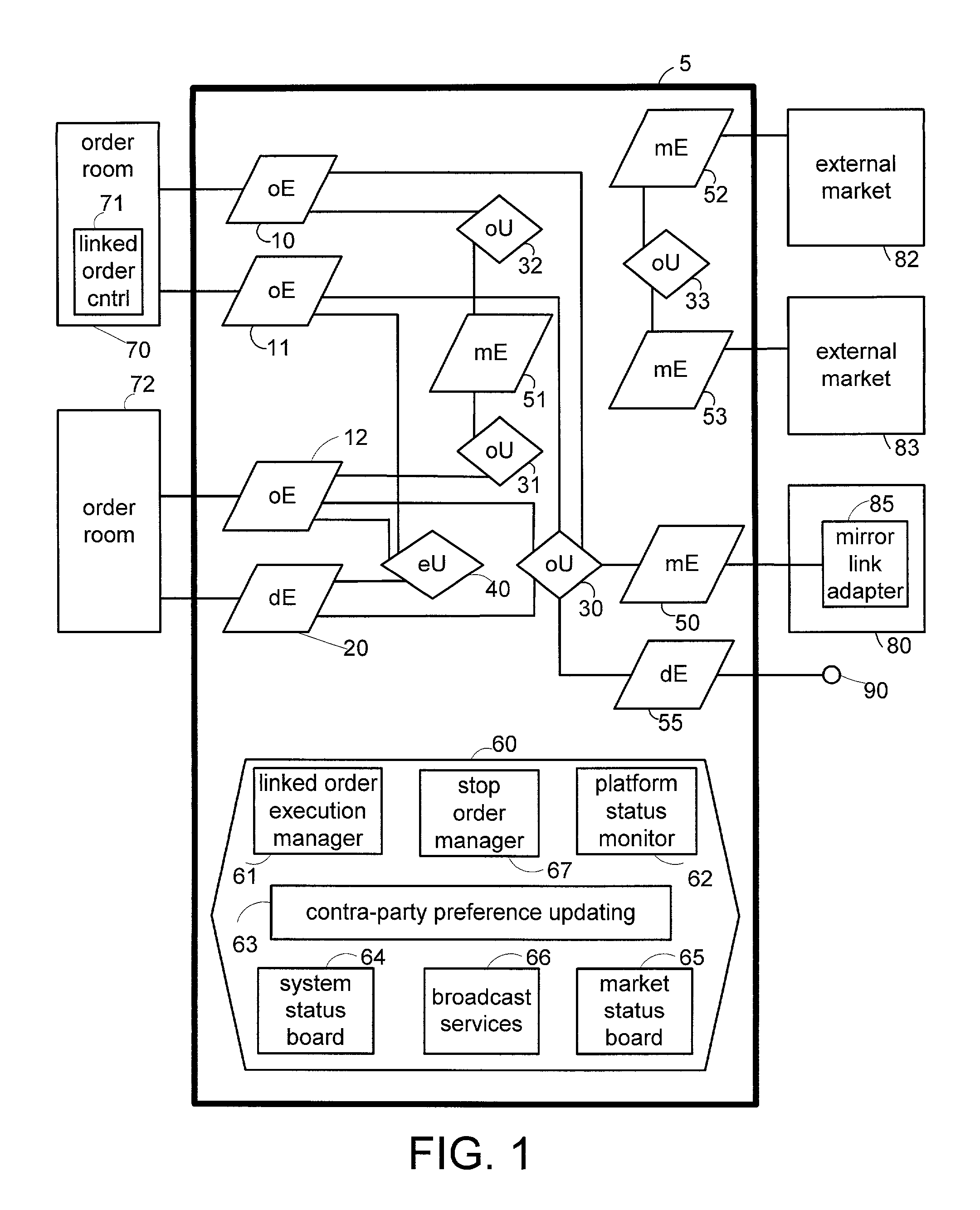

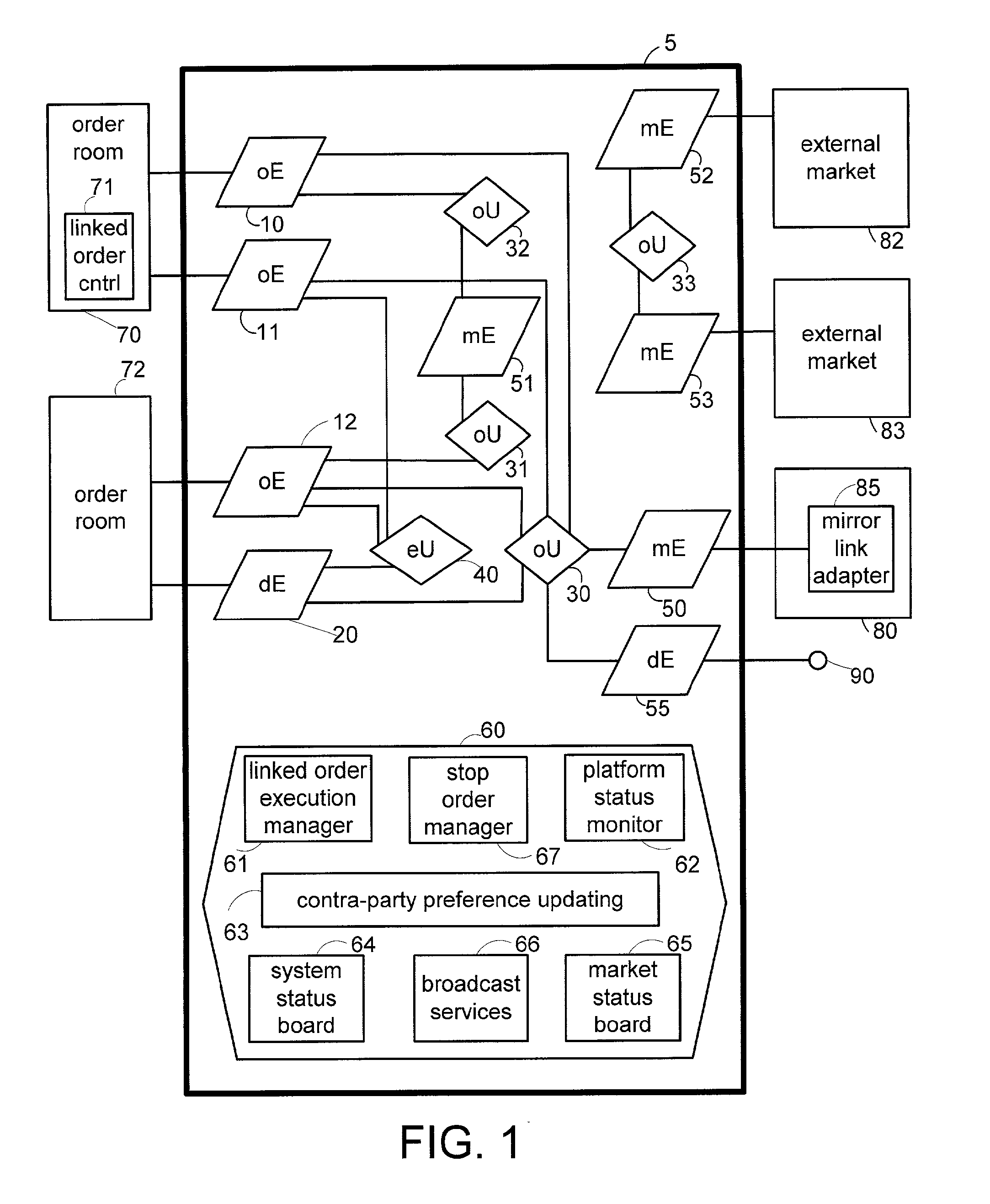

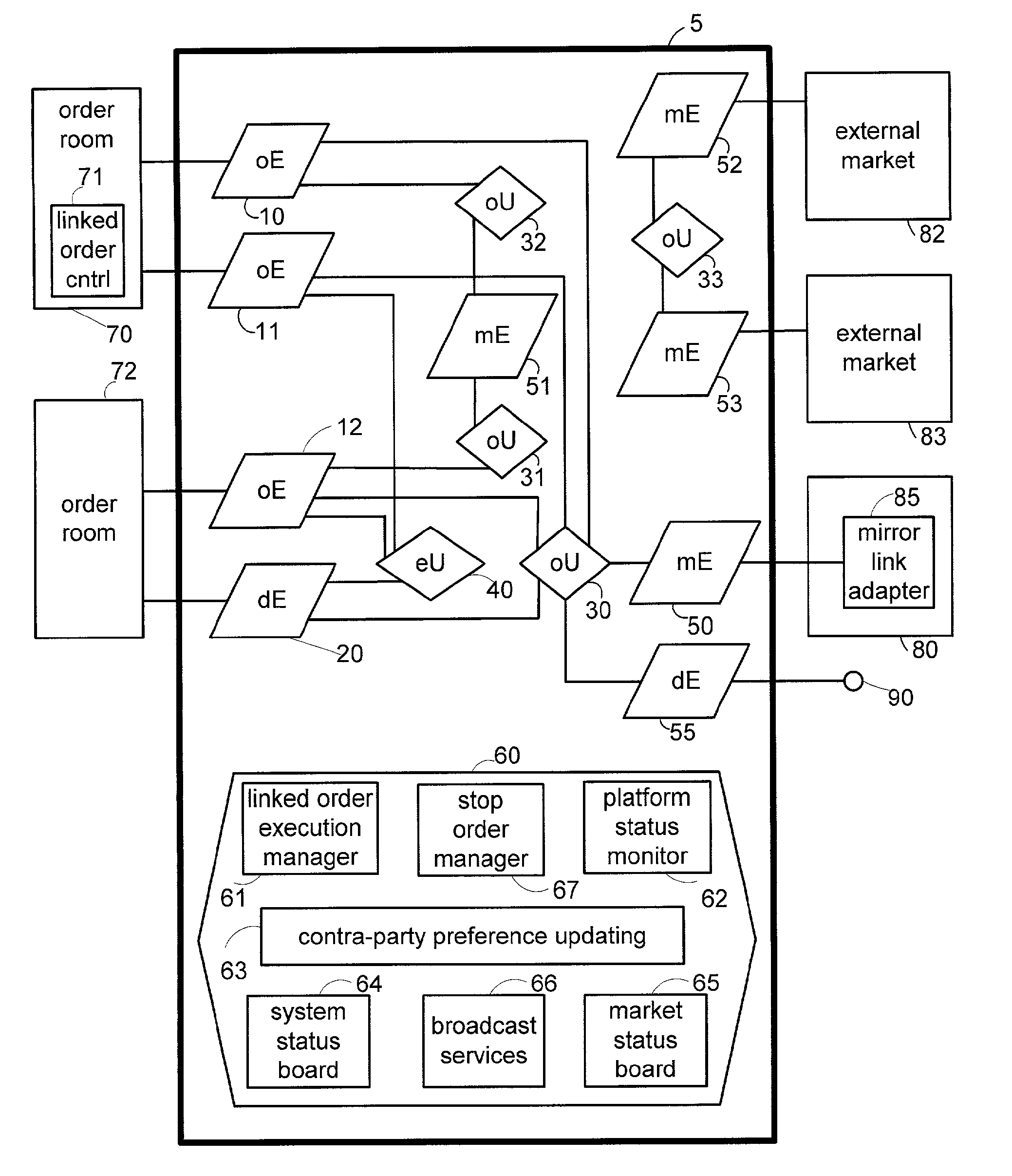

Routing control for orders eligible for multiple markets

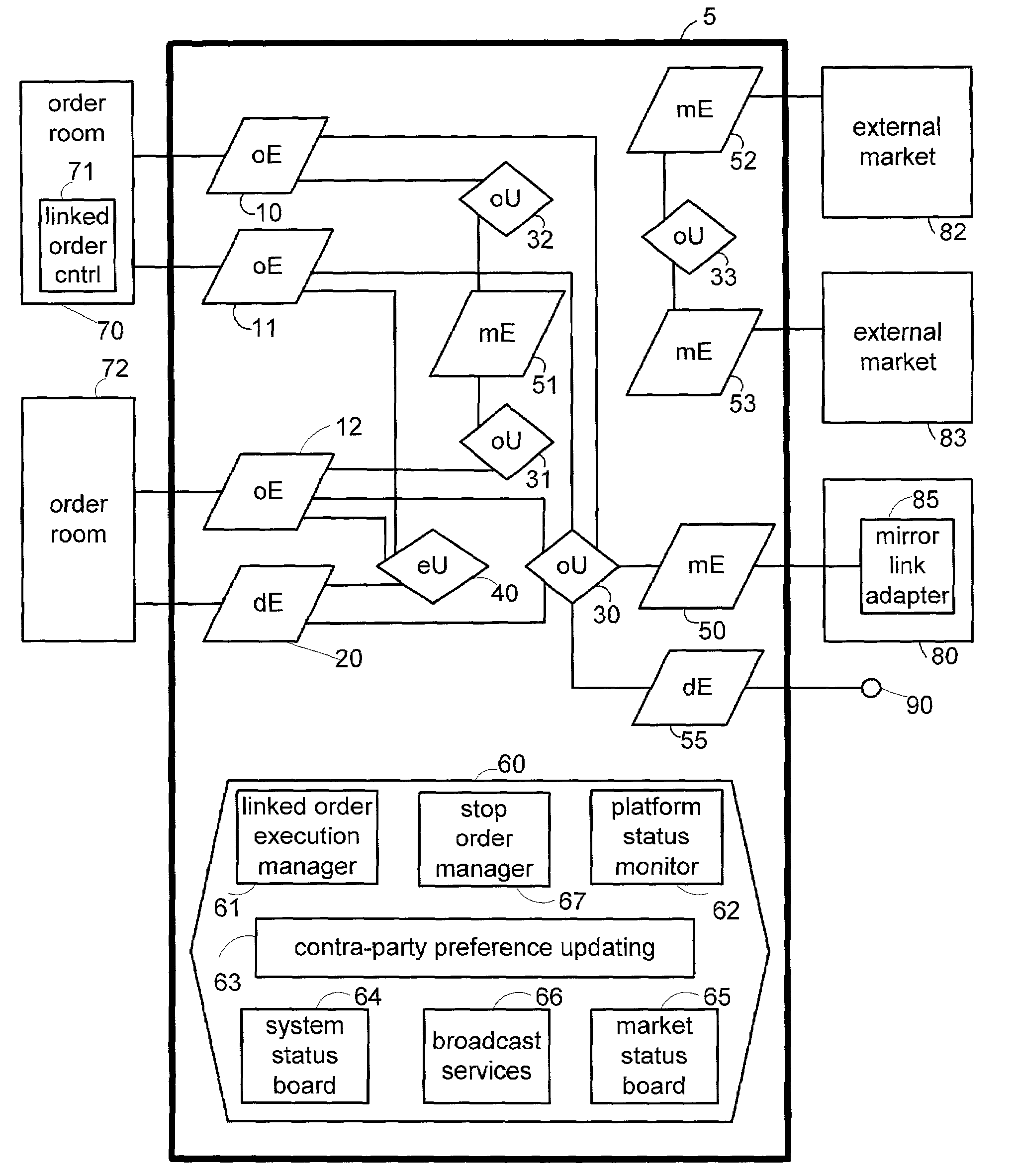

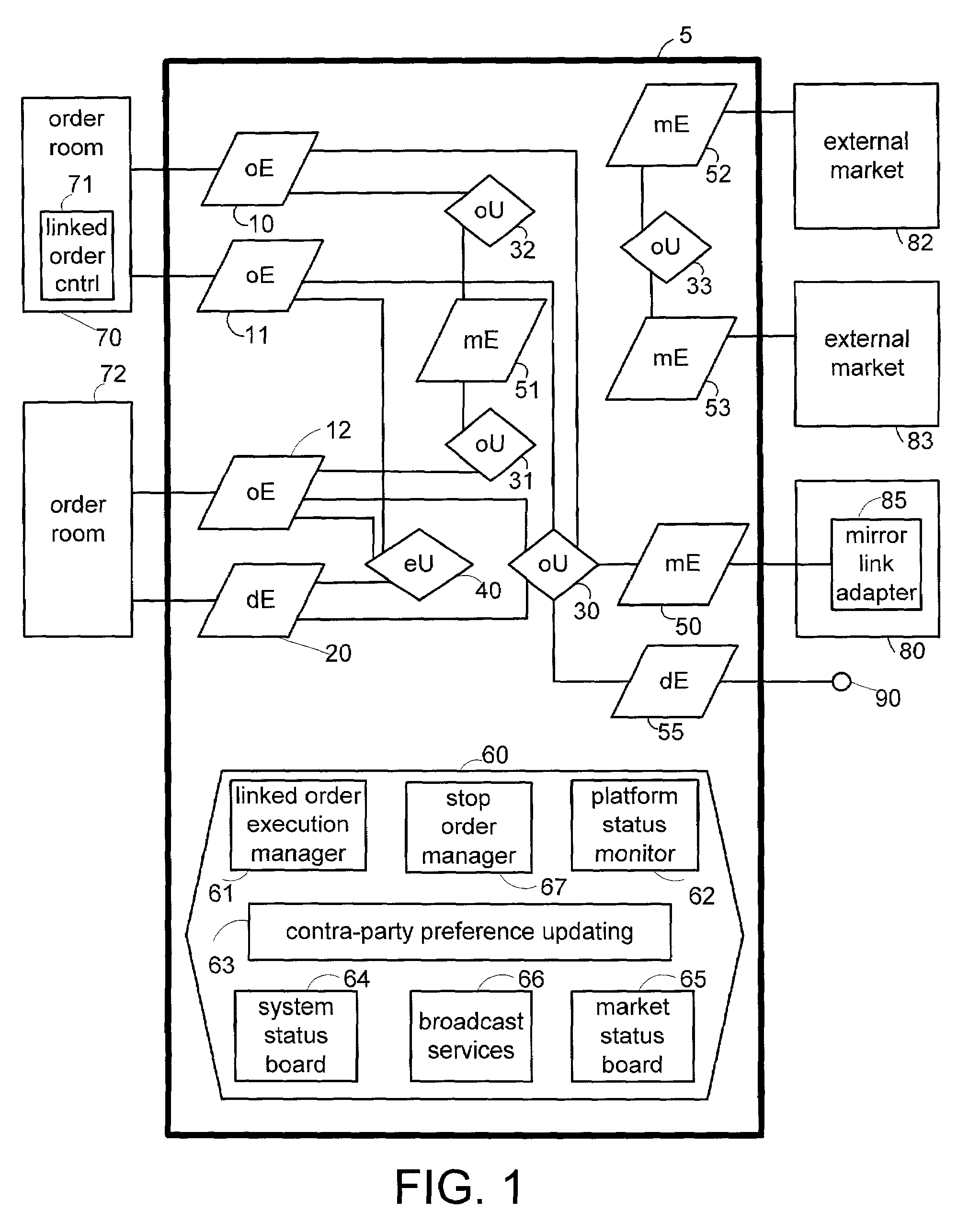

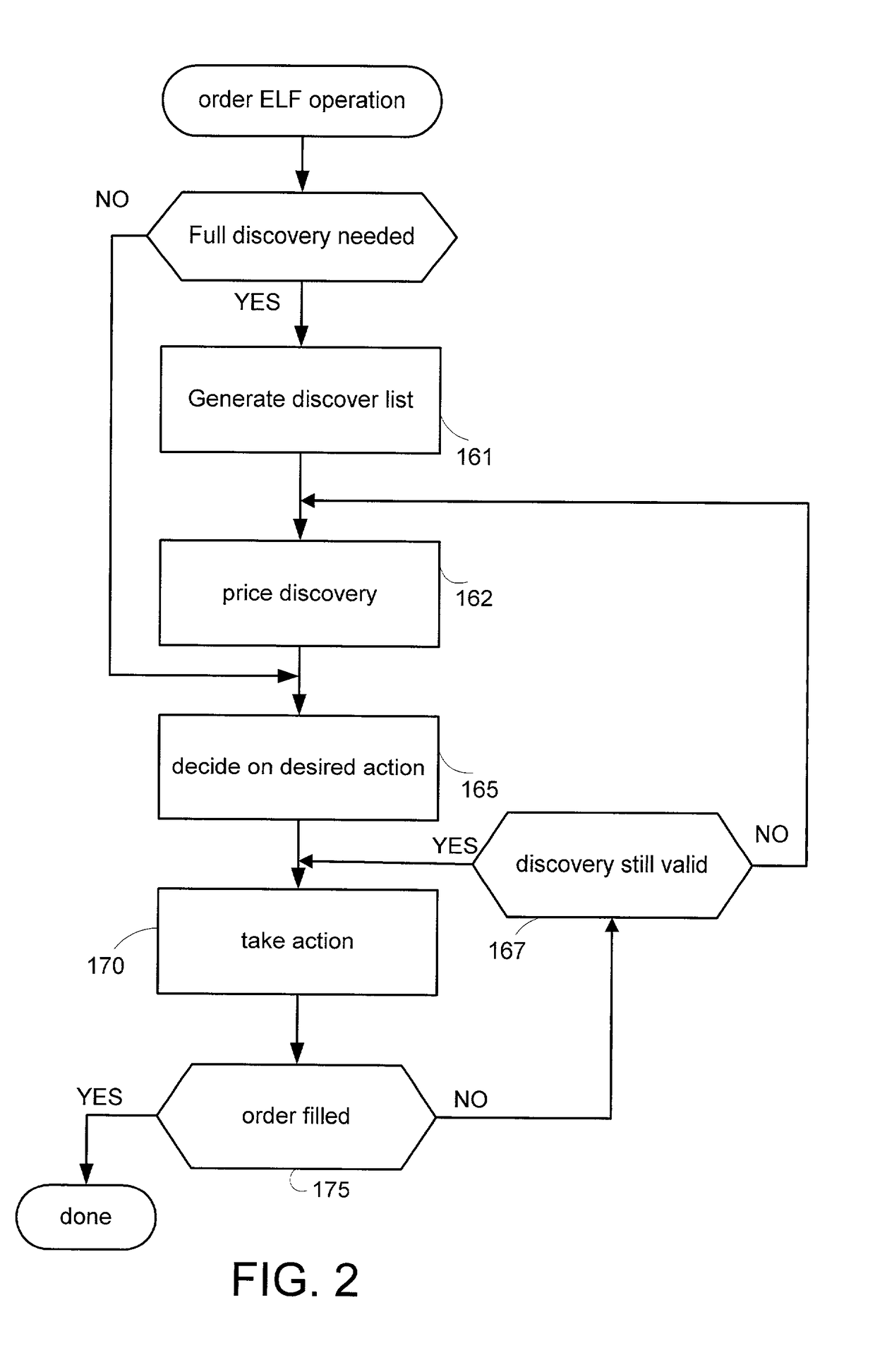

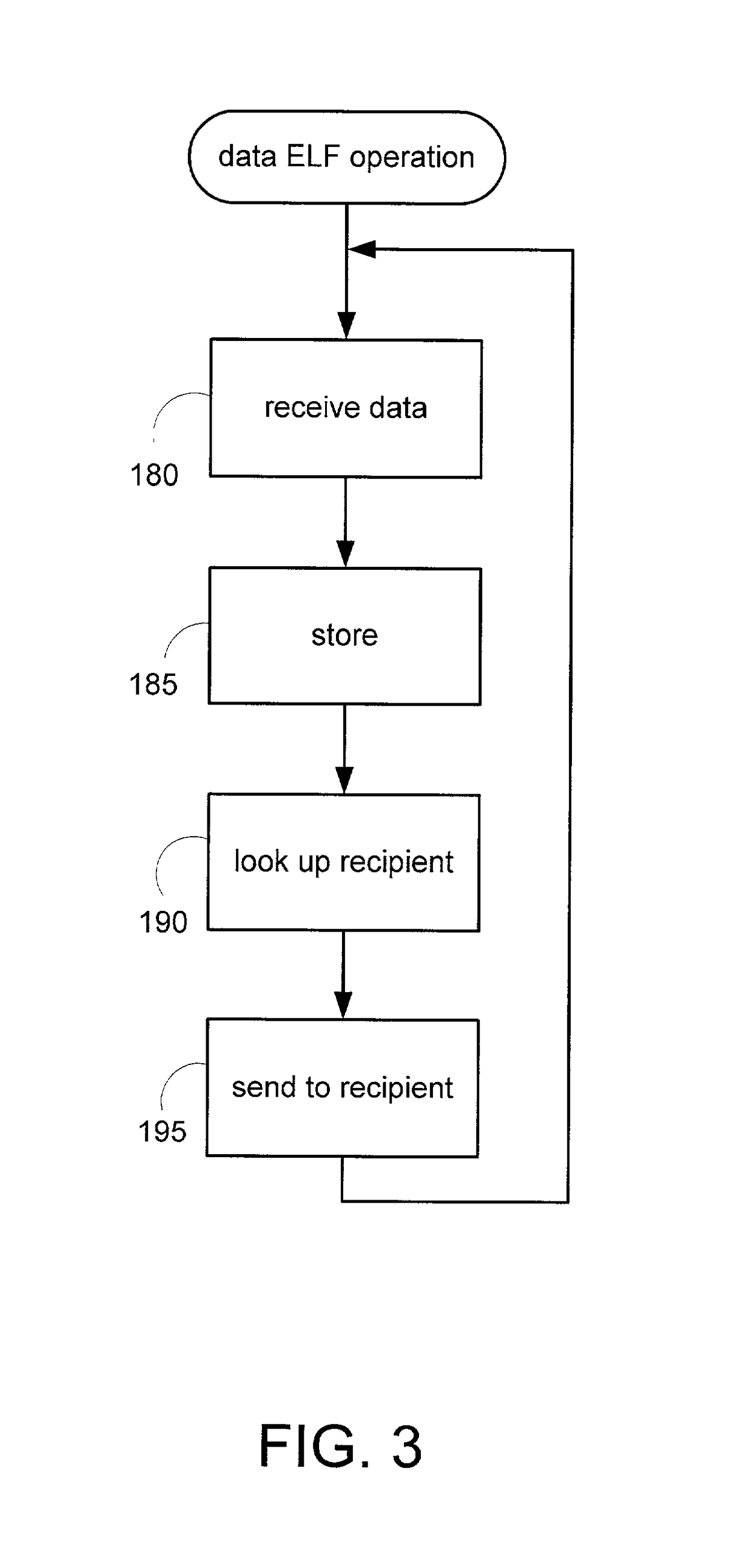

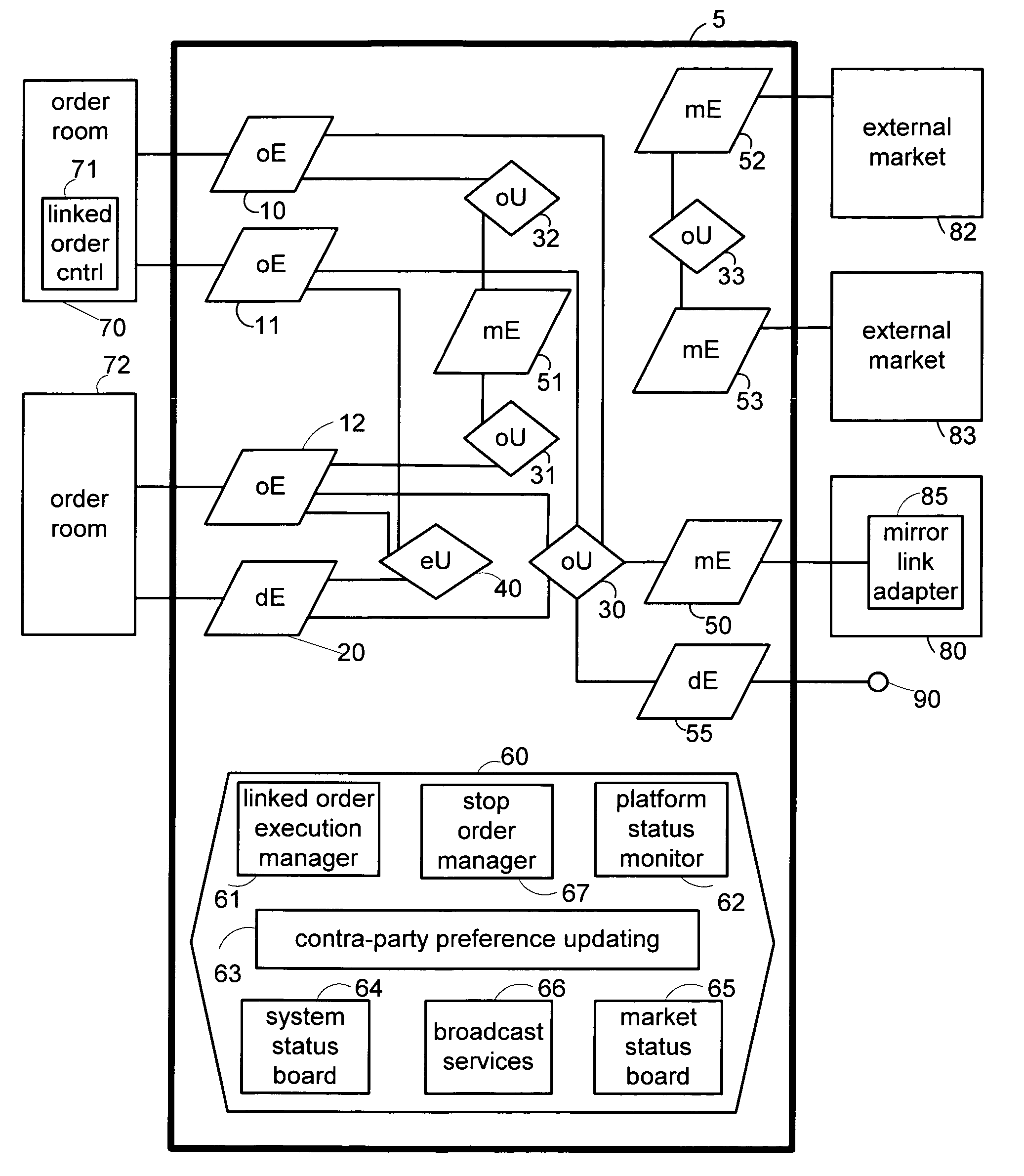

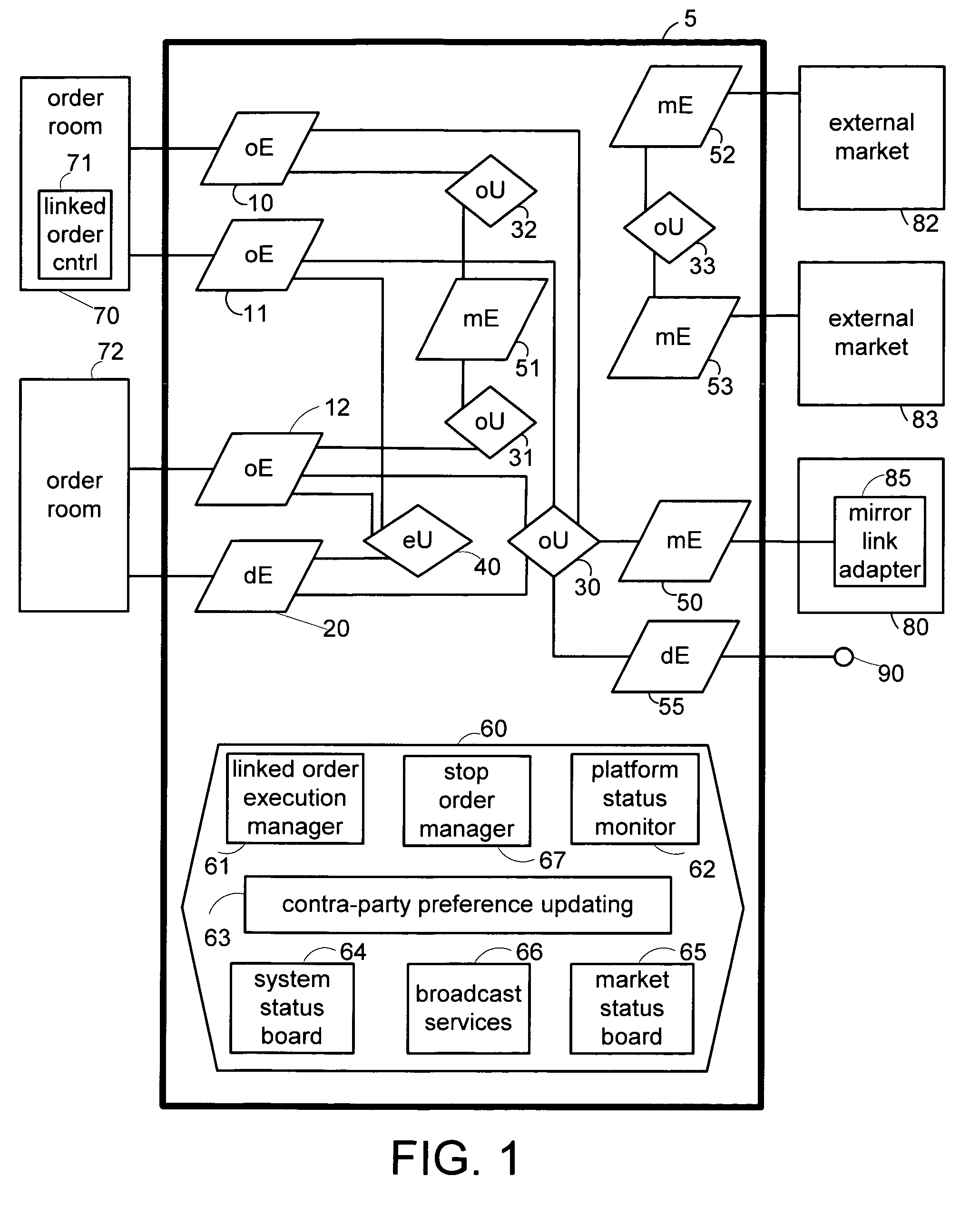

Trading processes are operative to route orders from order rooms to market processes, which process the orders according to respective market methodologies. The order routing strategy can be embodied in a decision table having rules with conditions and actions to be taken when the conditions are true. Accordingly, order rooms can readily configure and reconfigure trading processes.

Owner:XYLON LLC

Dynamic virtual network and method

InactiveUS20070033252A1Improve efficiencyMaximize compatibilityMultiple digital computer combinationsOffice automationBusiness-to-businessExchange network

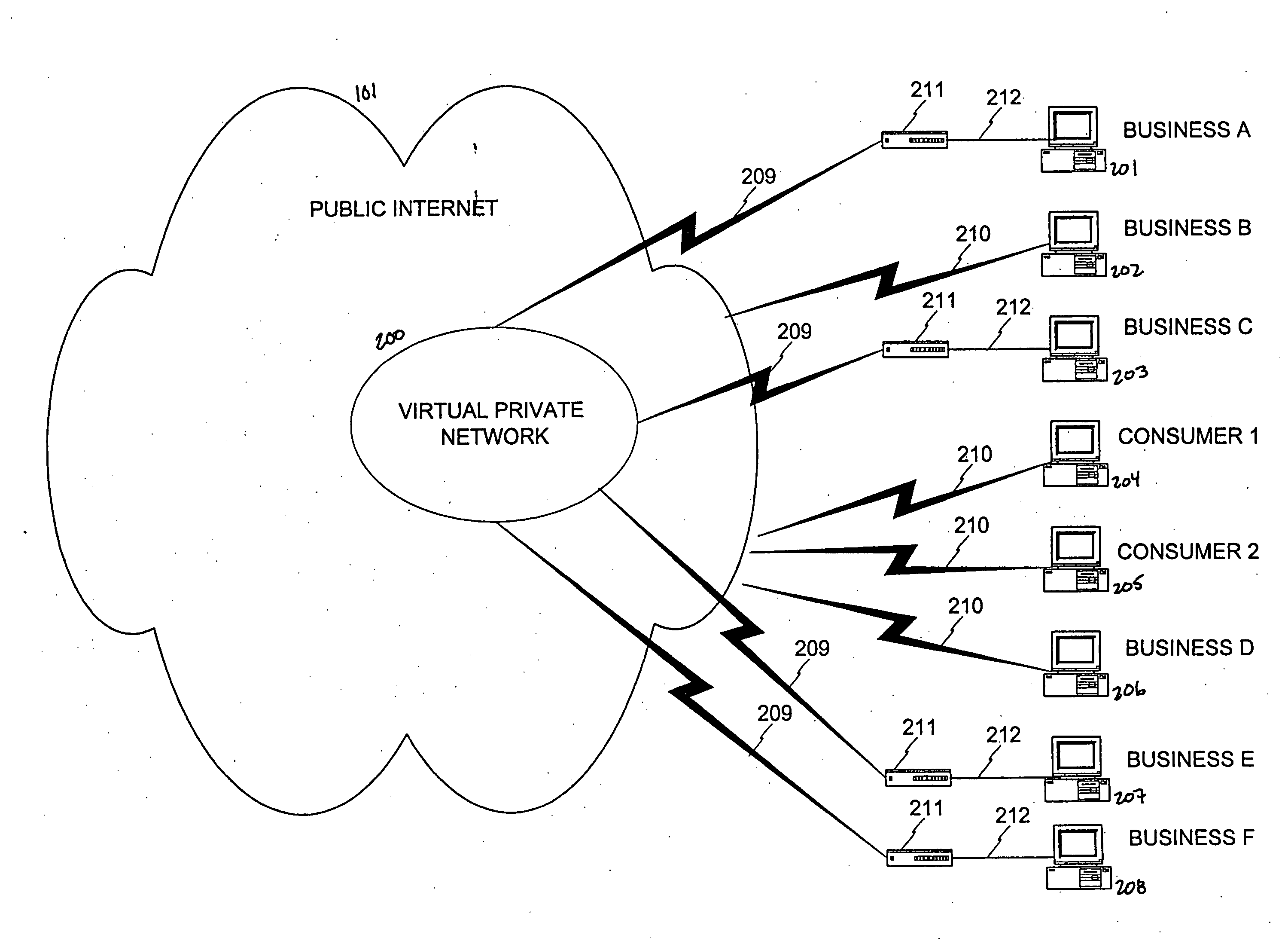

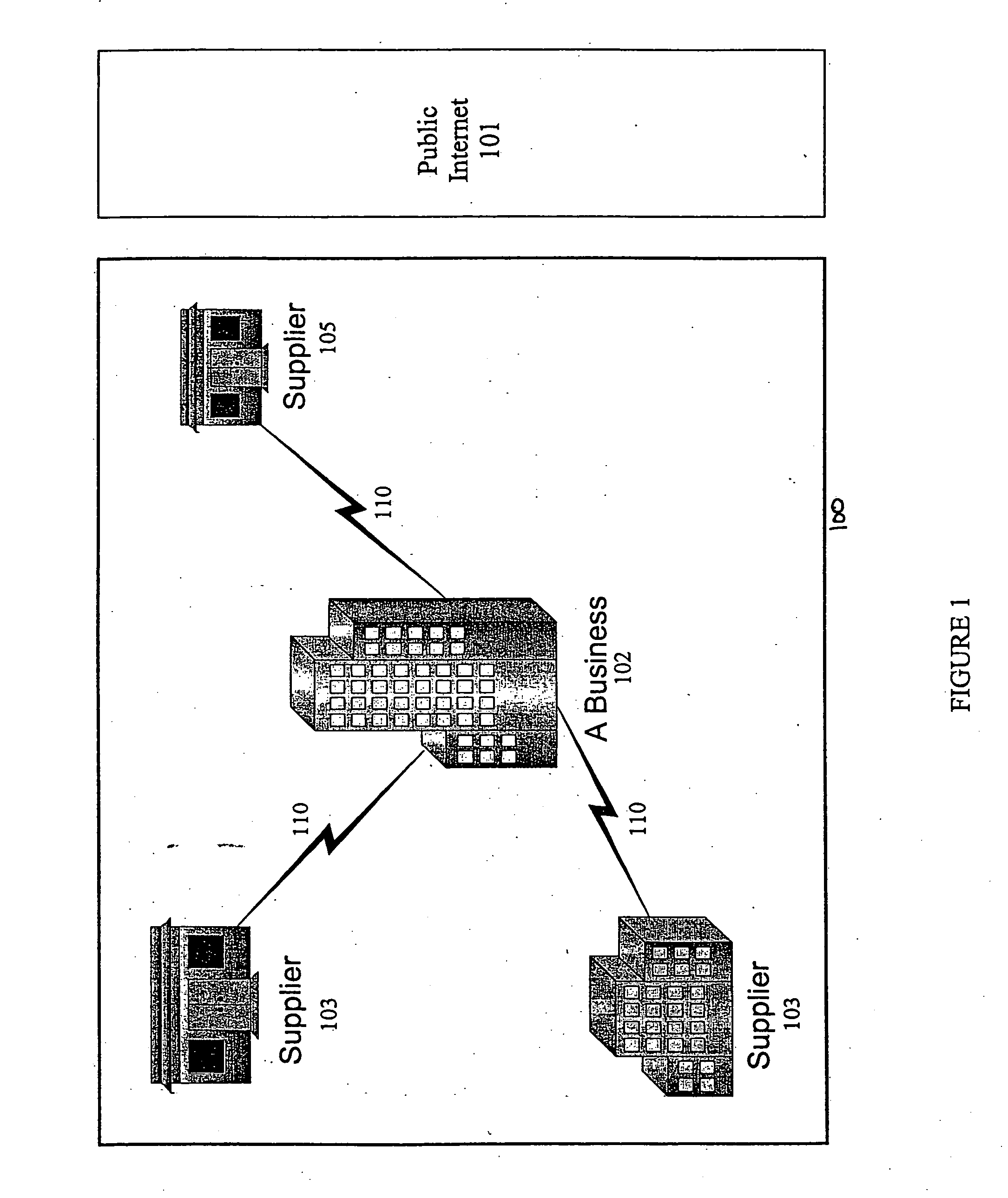

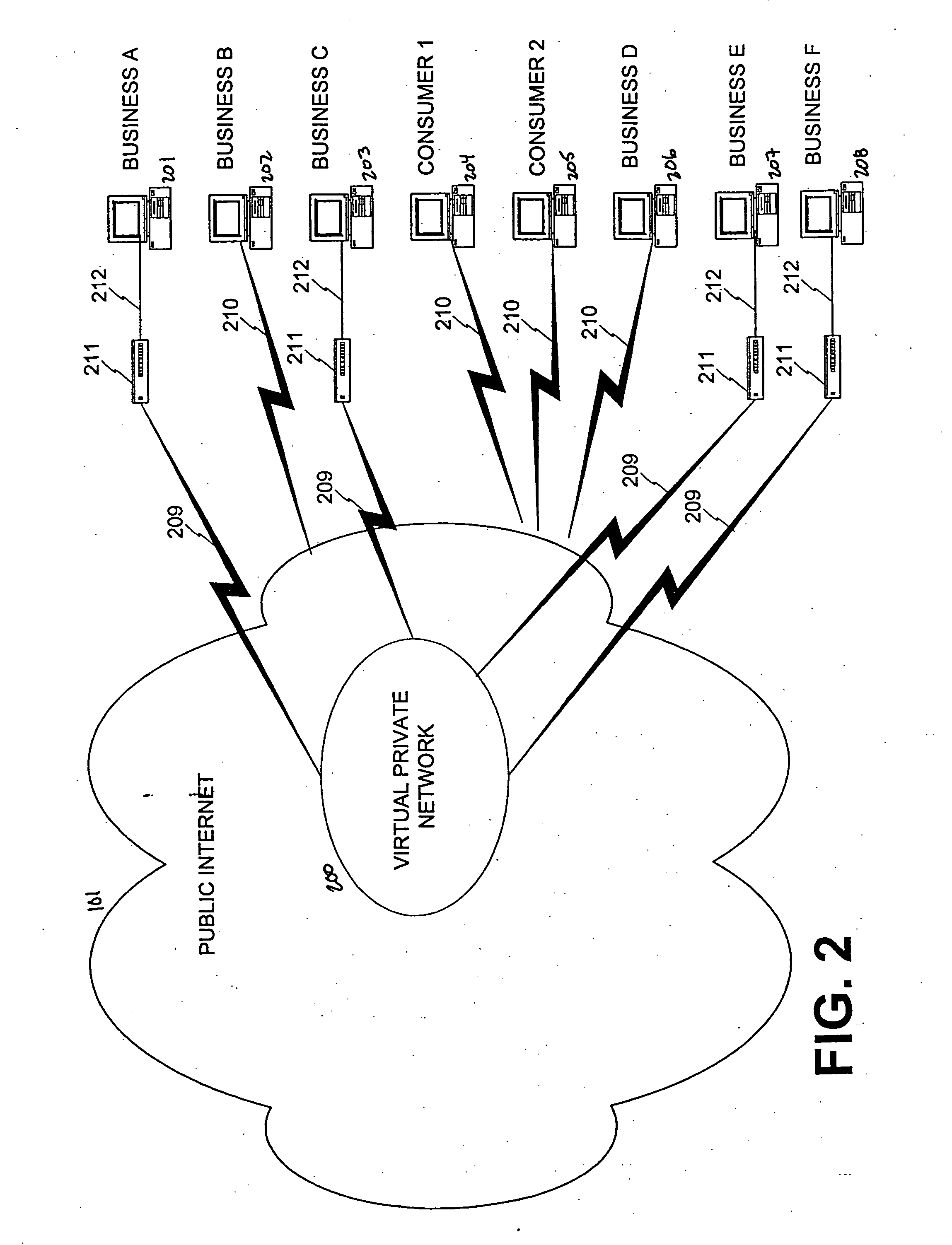

A system and method of operating hardware and services to allow participating members to find and establish partnerships, communicate, transact business and share information. The dynamic virtual network comprises the business exchange network, the network authority and the access device. The present invention employs the network authority, a neutral body regulating the trading partners and playing a passive role qualifying participating businesses, ensuring security and integrity, and guaranteeing non-repudiation of business transactions. The access device provides a number of services facilitating direct business-to-business relationships, communications, and transactions. The dynamic virtual network can also provide a set of services giving structure and organization beyond that of the public internet. These services enable participating businesses to find prospective partners, arrange partnerships, communicate with their partners, transact business and share information via the internet, exclusively among partners. The invention provides software and hardware to satisfy the specialized demands of business-to-business commercial transactions.

Owner:AMTECH SYST

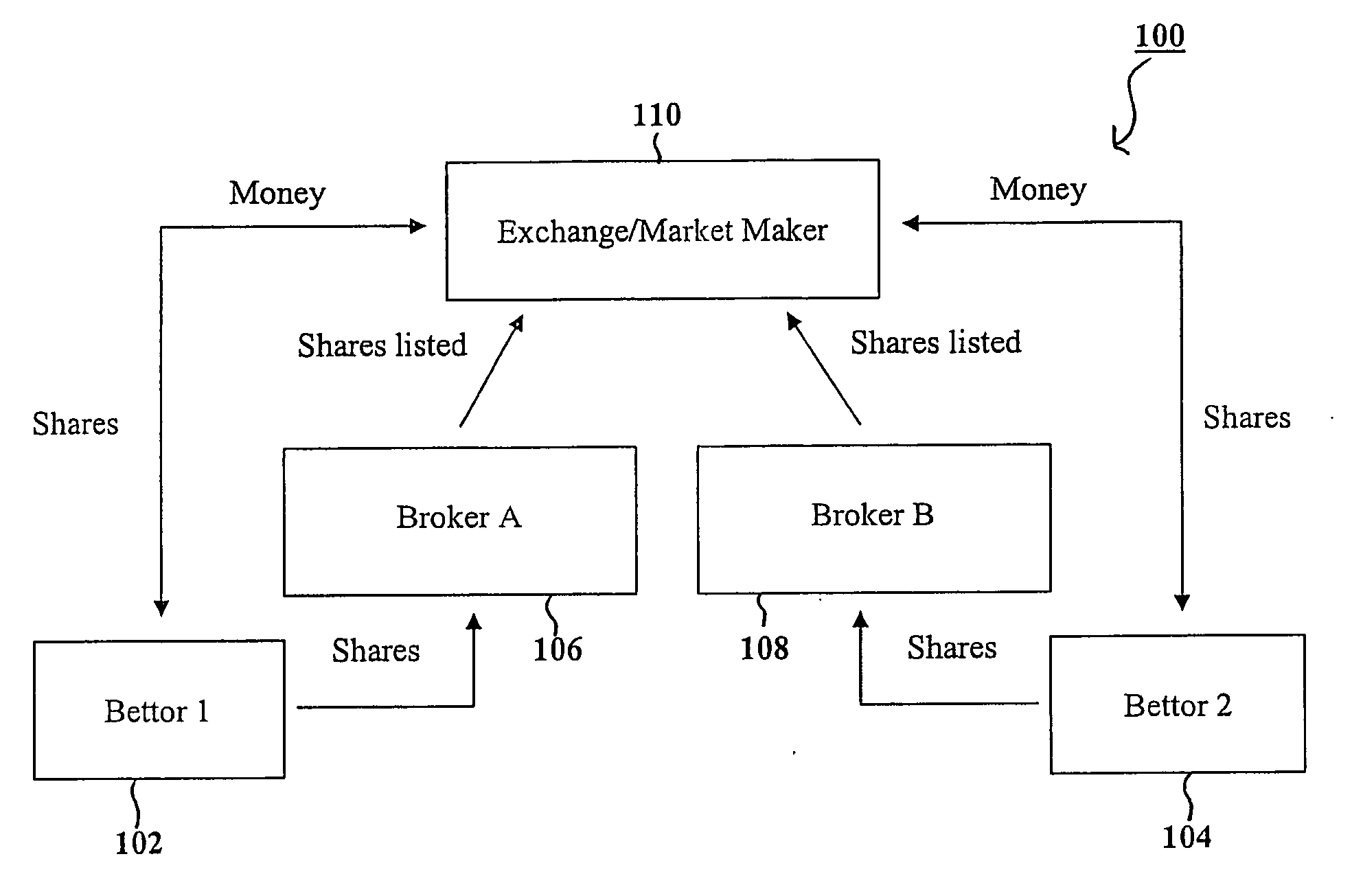

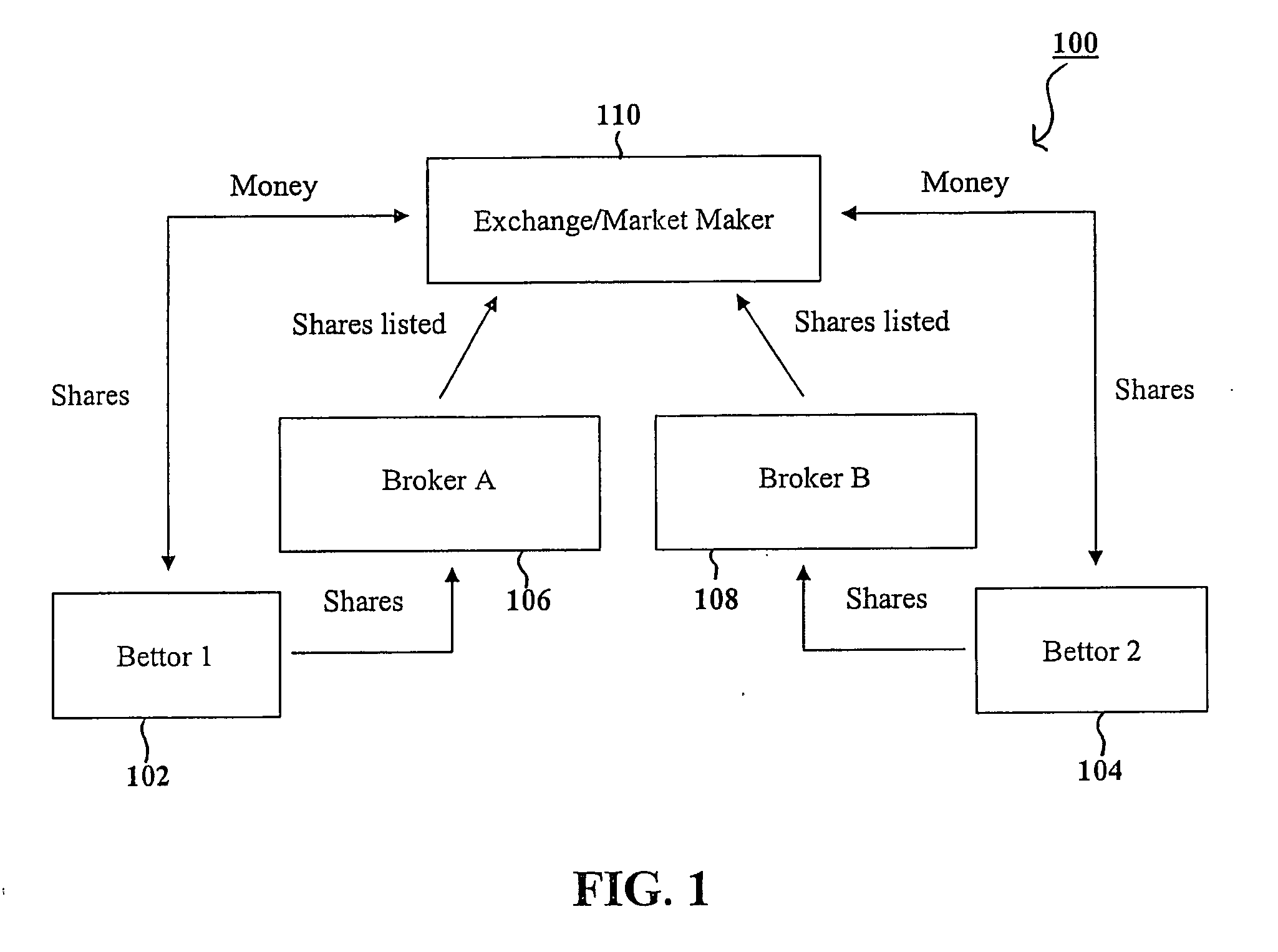

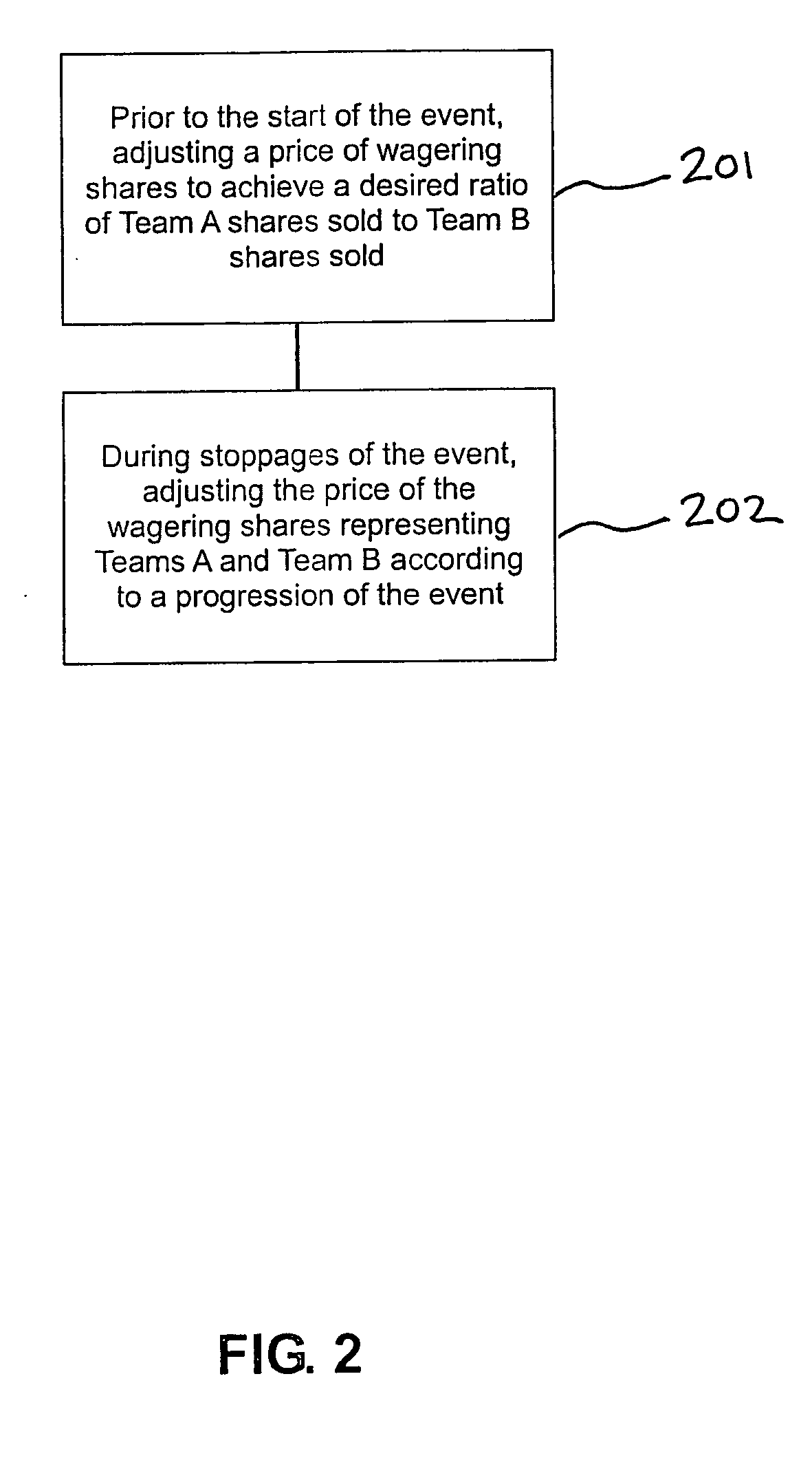

Sports wagering exchange and method therefor

InactiveUS20110065494A1AdaptableFacilitate communicationApparatus for meter-controlled dispensingVideo gamesPurchasingComputer science

A system and method for purchasing and trading wagering shares representing one of two possible outcomes of an event before and during the event. During each of one or more stoppages of the event, the price of the wagering shares representing a first outcome of the event and the price of the wagering shares representing a second outcome of the event are adjusted according to a progression of the event and to market supply and demand for the wagering shares. Purchasing, by bettors, of the wagering shares prior to the start of the event and trading, between the bettors, of the wagering shares prior to the start of the event and during each of the stoppages of the event is facilitated by an exchange.

Owner:SPORTS WAGERING EXCHANGE

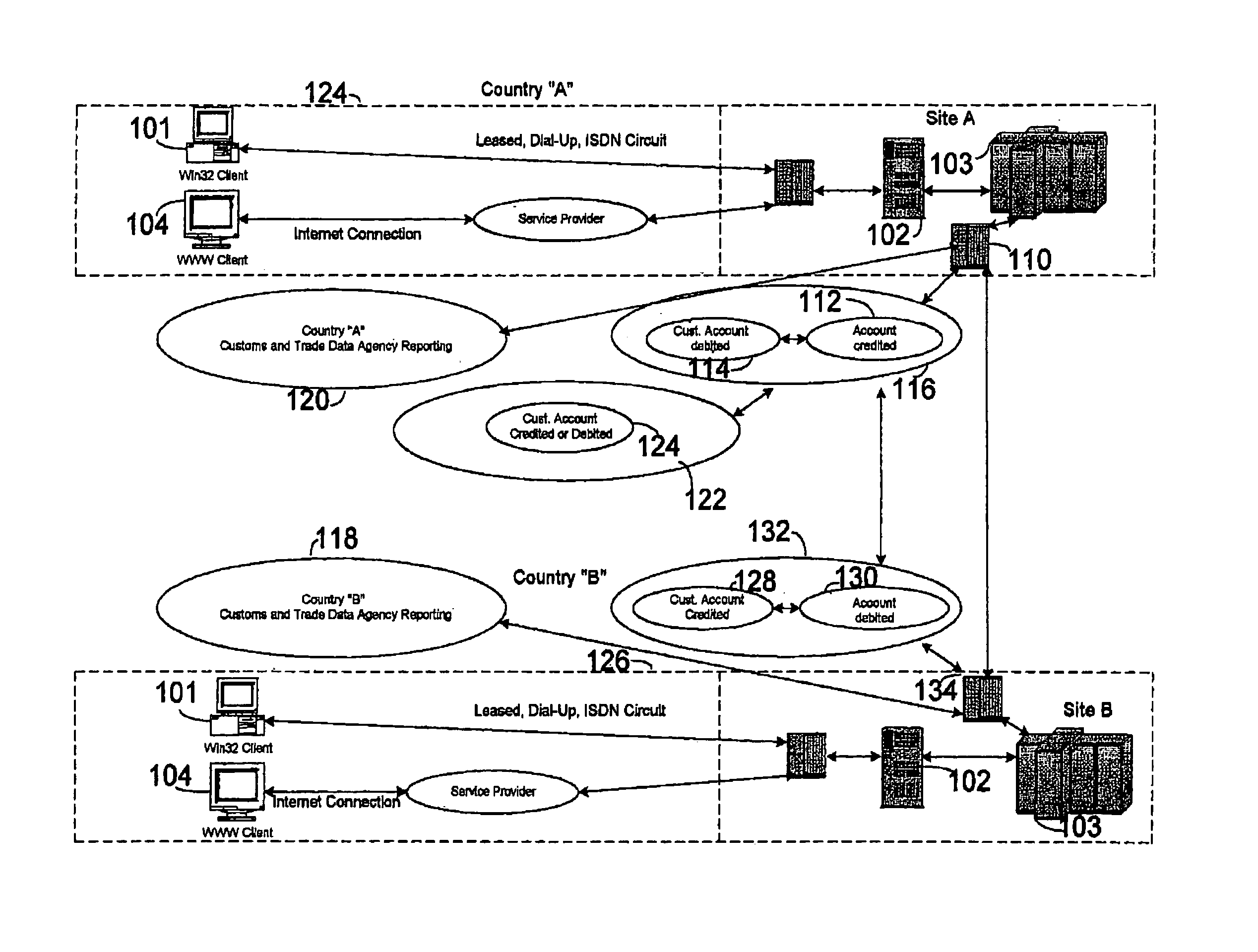

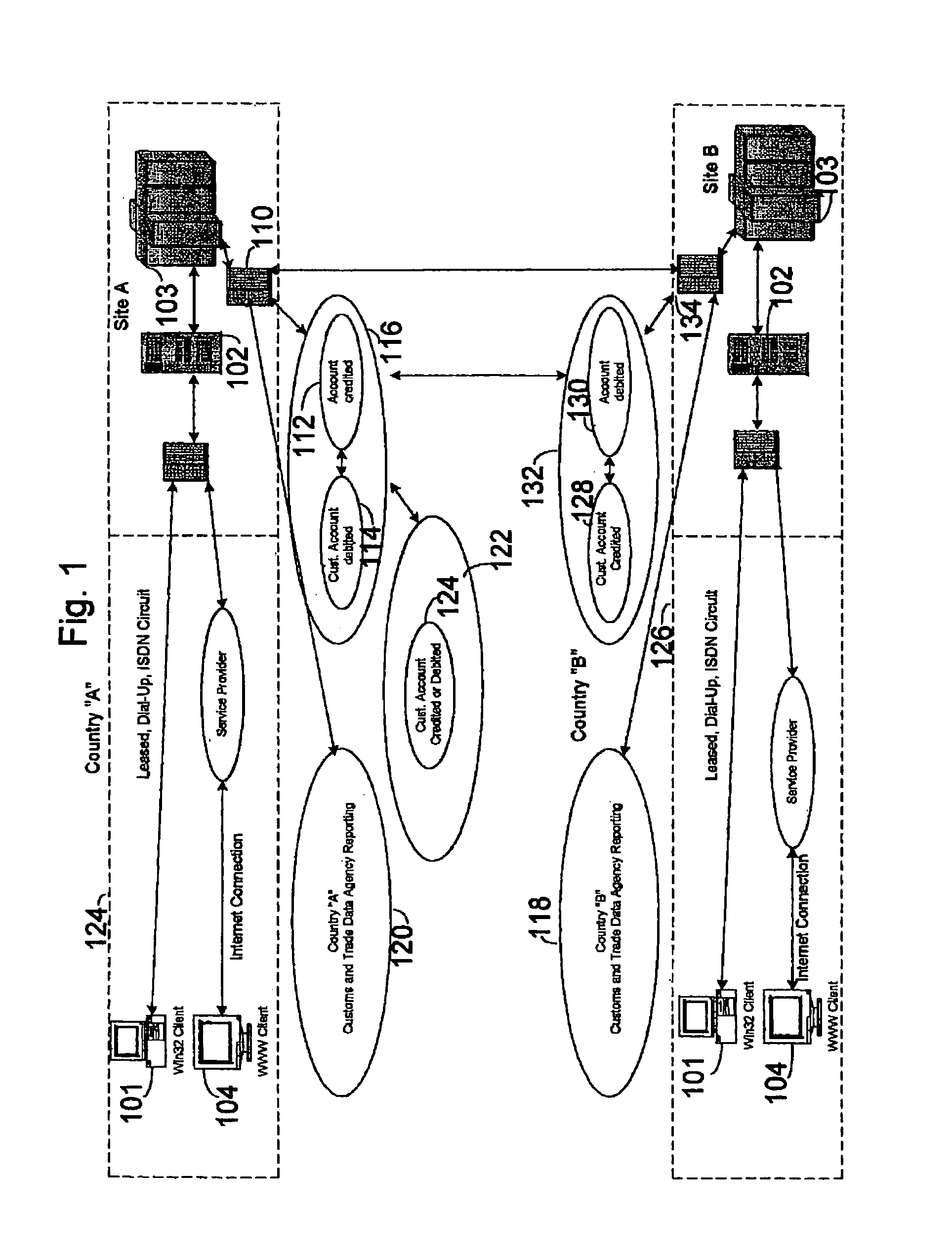

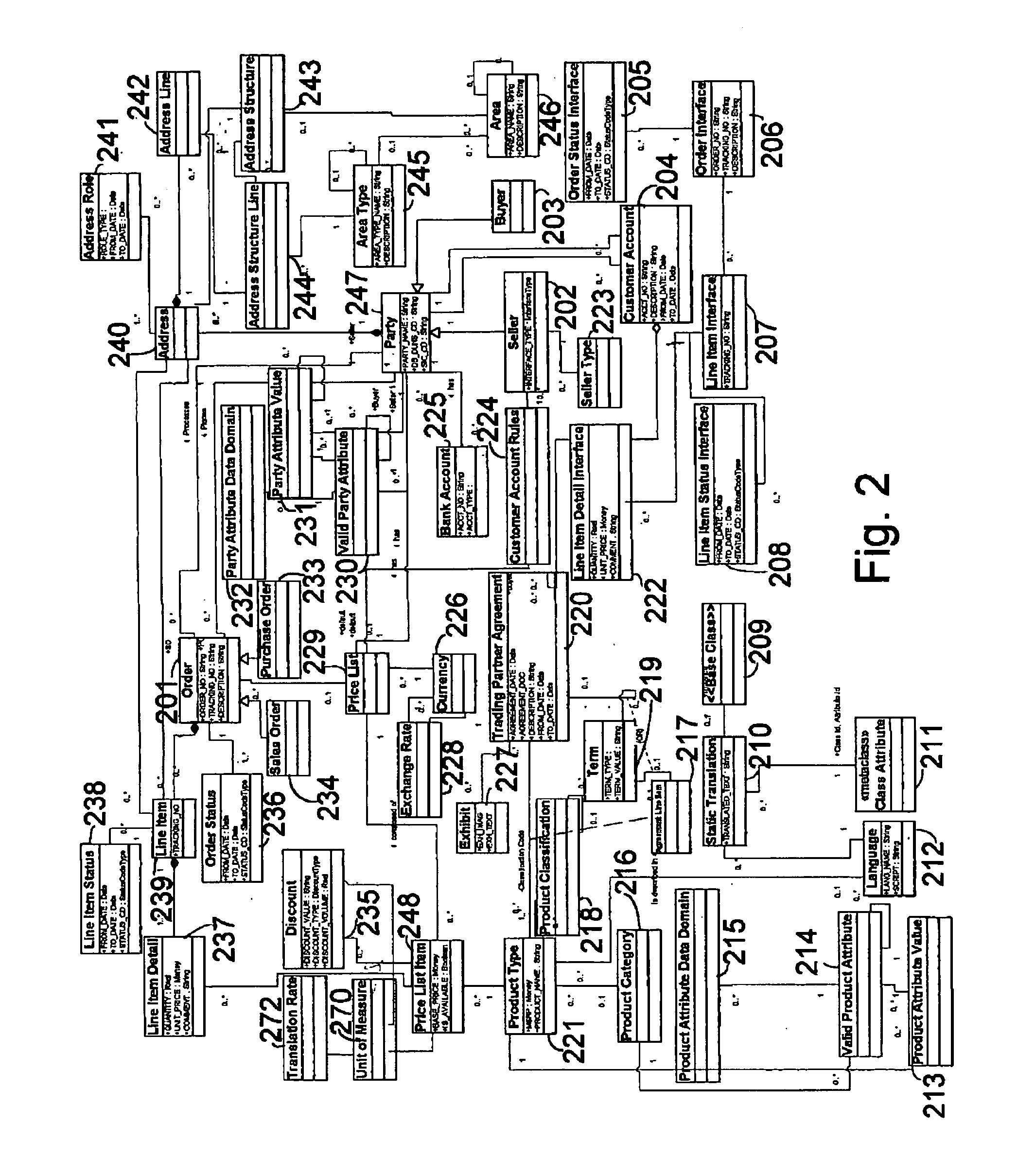

Networked international system for organizational electronic commerce

InactiveUS7333942B1Reduce import costsFacilitate business-to-business electronic commerceFinanceCash registersPaymentThe Internet

A networked computer architecture (AgoraNet) facilitates and conducts secure electronic commerce based on national deployment independent of the Internet. A “publish and subscribe” model is used in which vendors may publish catalogs and information about product and service offerings to AgoraNet applications hosted at a national site. Subscribing organizations may browse and search vendor data using a Global Naming Service as well as search engines, agents, queries and a subscription service. Buyers and Sellers may communicate directly using an integrated messaging system. Buyers may obtain quotations from Sellers and calculate the Total Landed (delivered) cost of goods prior to purchase. Buyers may place Blanket and standard Purchase Orders and track order shipments to destination. Sellers receive payment electronically for goods and services. Orders for goods and services may be translated to XML or EDI formats and transmitted directly to subscriber order processing systems or serve as input to standard or customized supply chain management applications hosted at AgoraNet sites using AgoraNet for transport.

Owner:D NET CORP

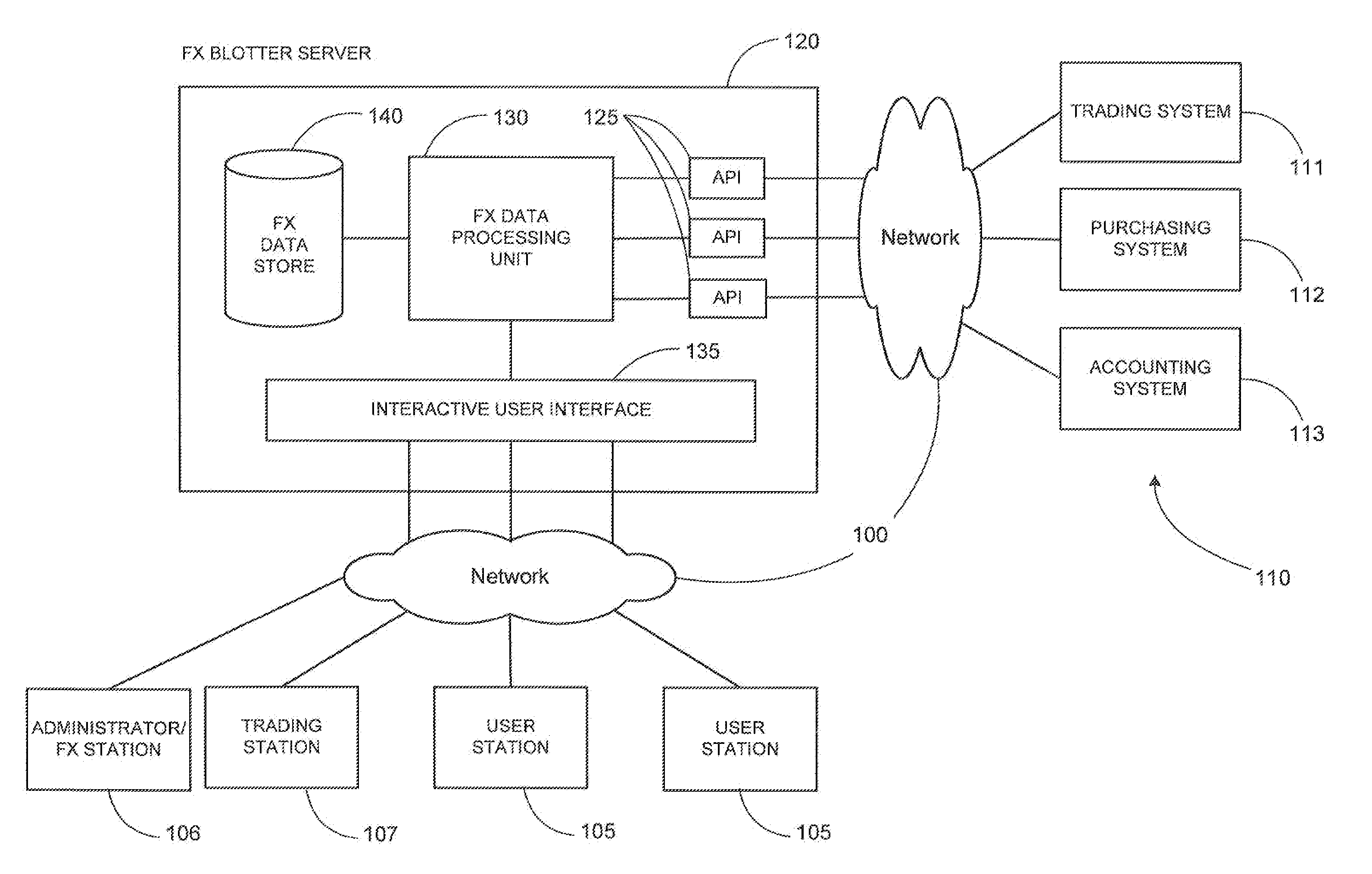

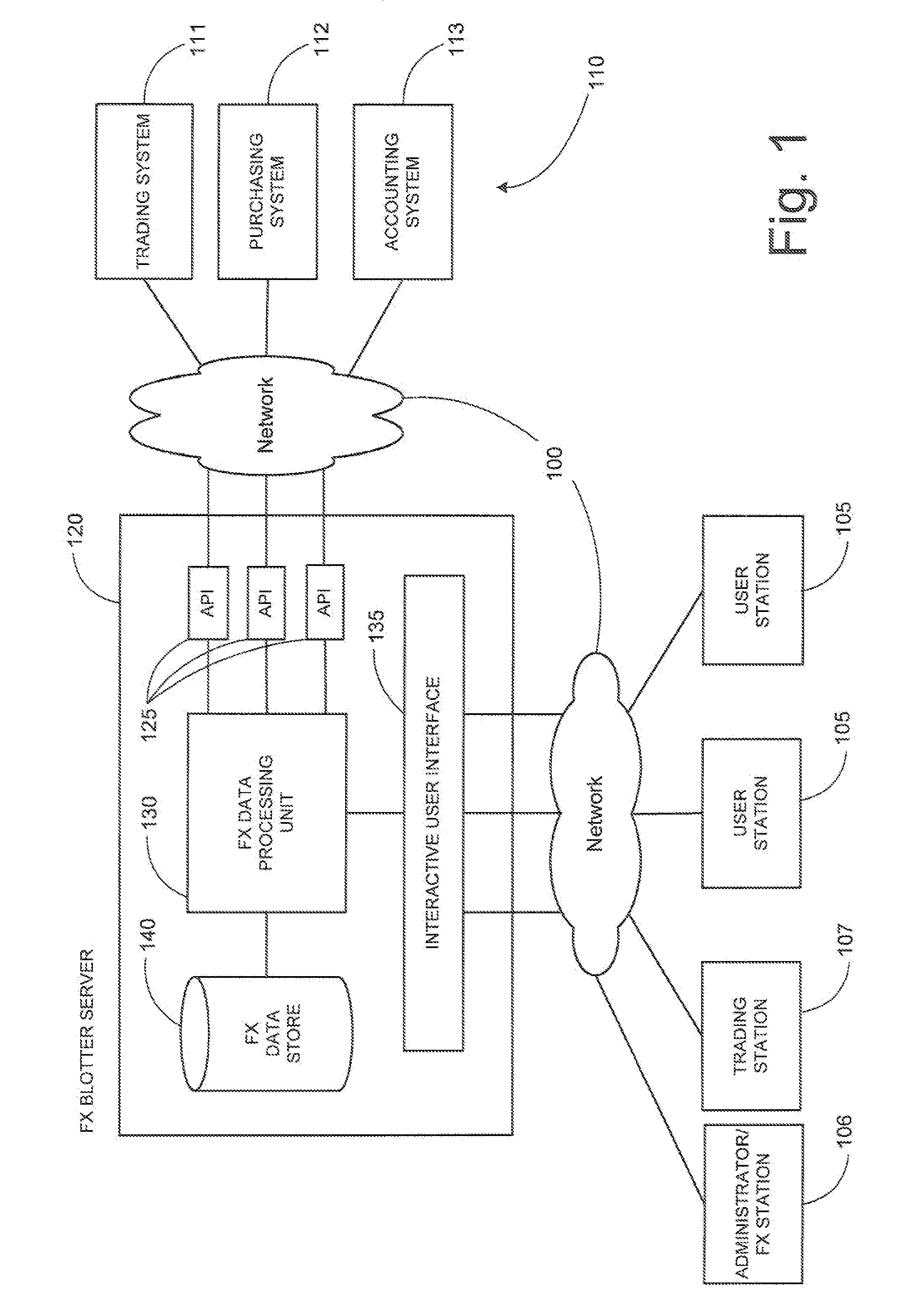

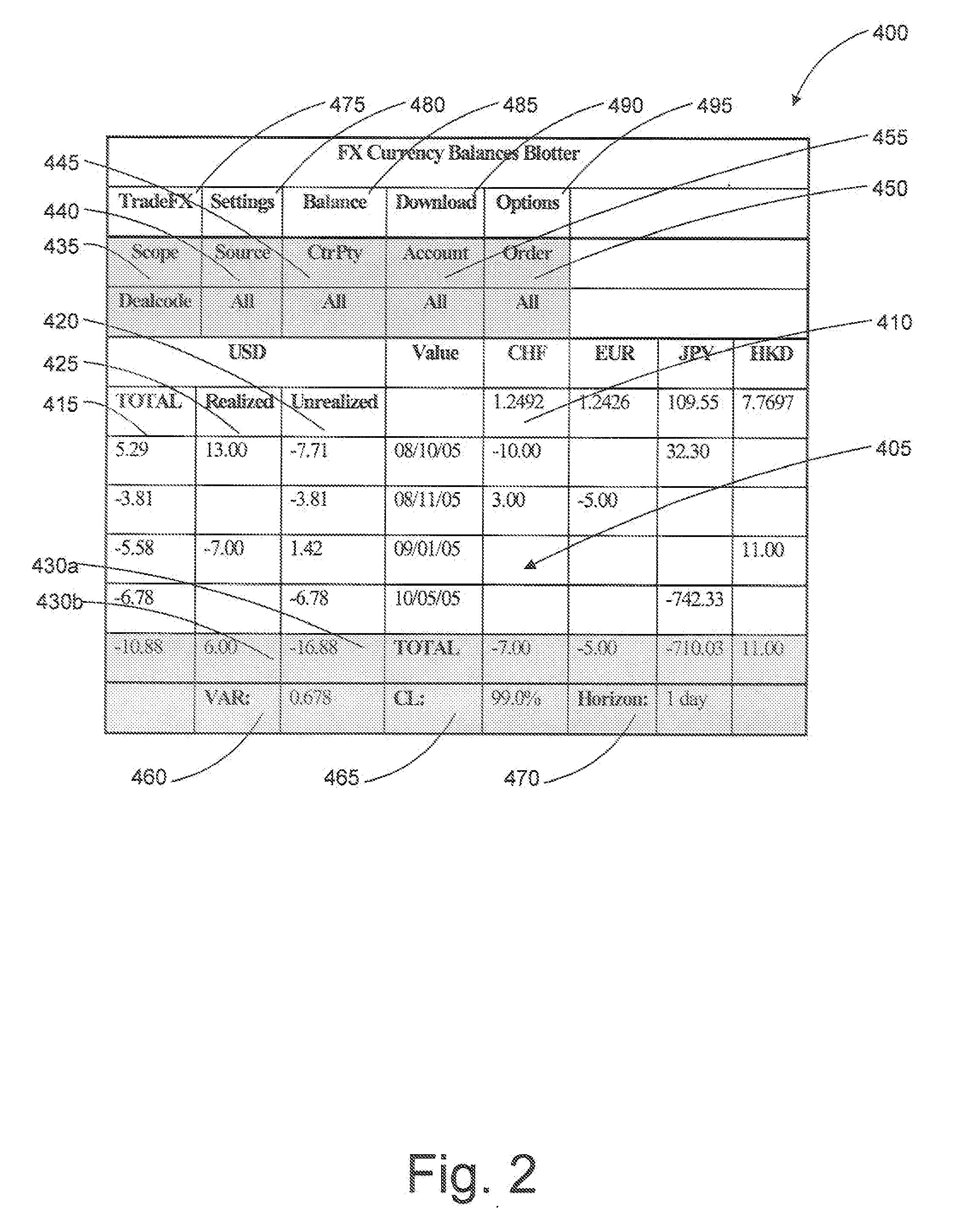

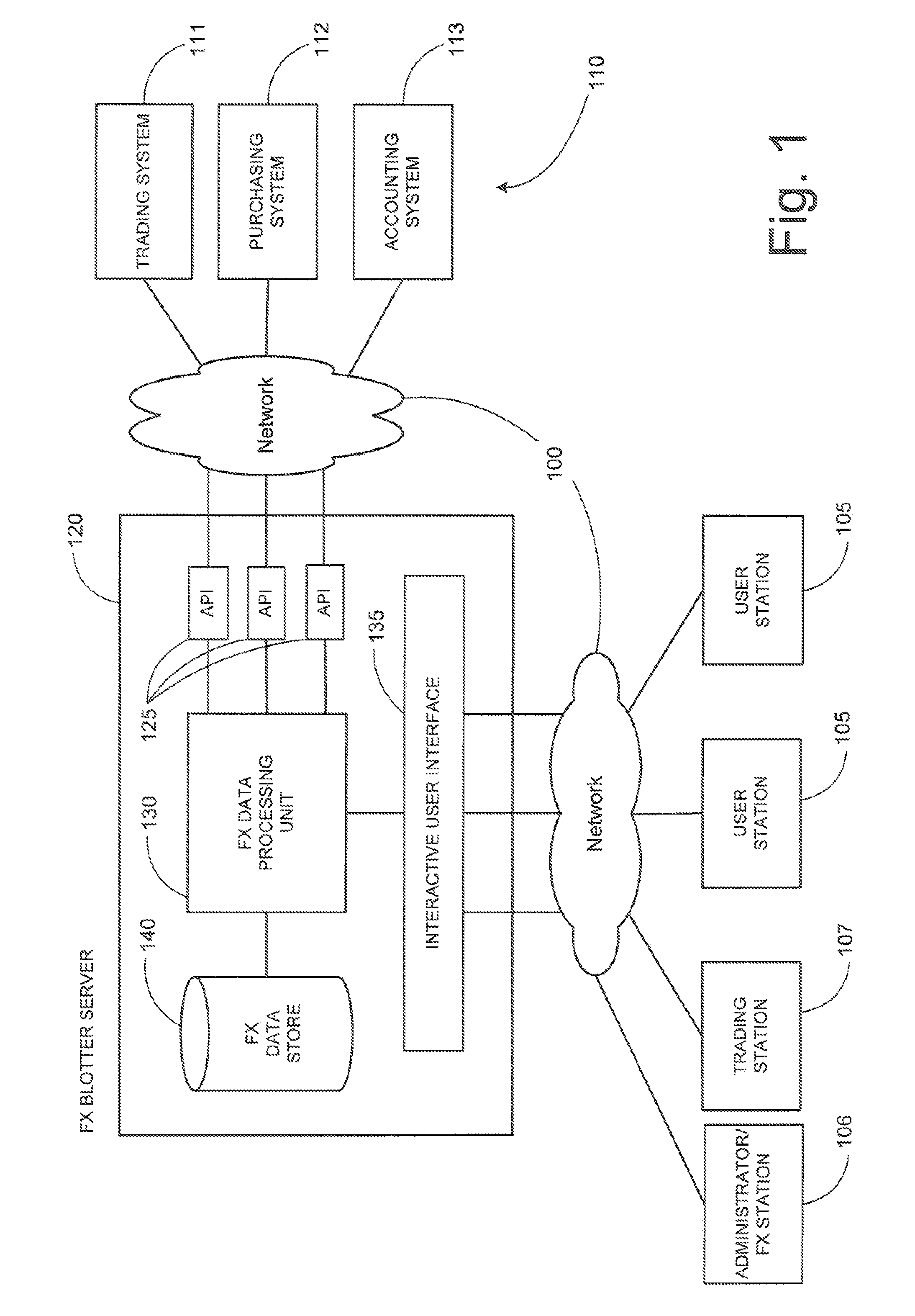

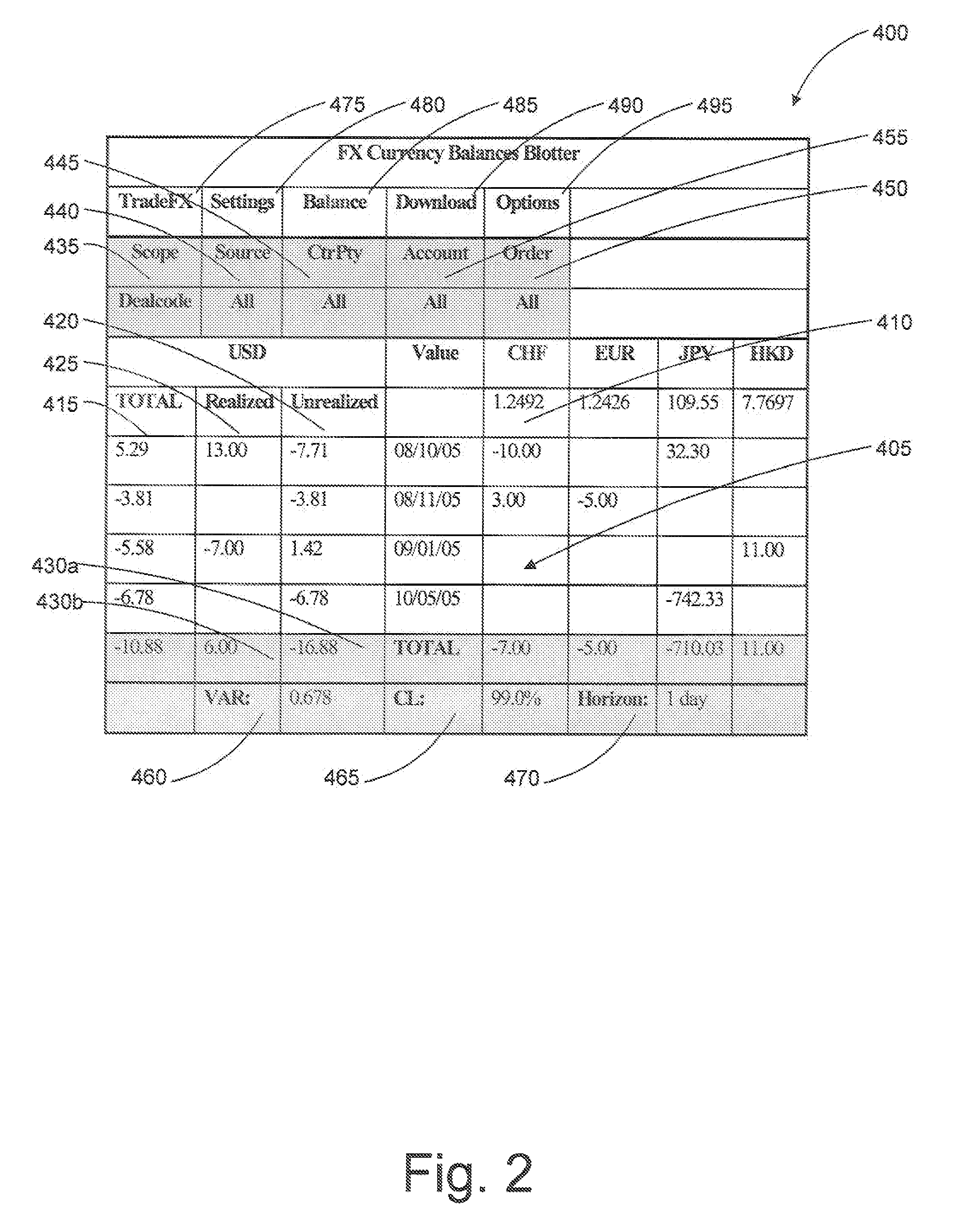

System and method for facilitating foreign currency management

ActiveUS20080027850A1Easy to manageReal time monitoringComplete banking machinesFinanceFinancial transactionOnline trading

Systems, methods, and computer program products for facilitating managing foreign currency exposure, such as that with respect to transactions in financial interests involving foreign currency exchange across multiple electronic trading platforms, financial systems, accounting systems or the like. Users may monitor their net foreign exchange (“FX”) exposure in different currencies and on different value dates due to trading in foreign exchange, foreign currency-denominated equities, fixed-income securities, commodities, services, goods and other transactions involving foreign currency exchange. Various tools may be provided for monitoring and managing FX exposures across multiple trading platforms through ready access to FX liquidity sources as well as for conducting financial transactions involving foreign currency exchange, such as FX hedging or other types of transactions.

Owner:BLOOMBER FINANCE LP

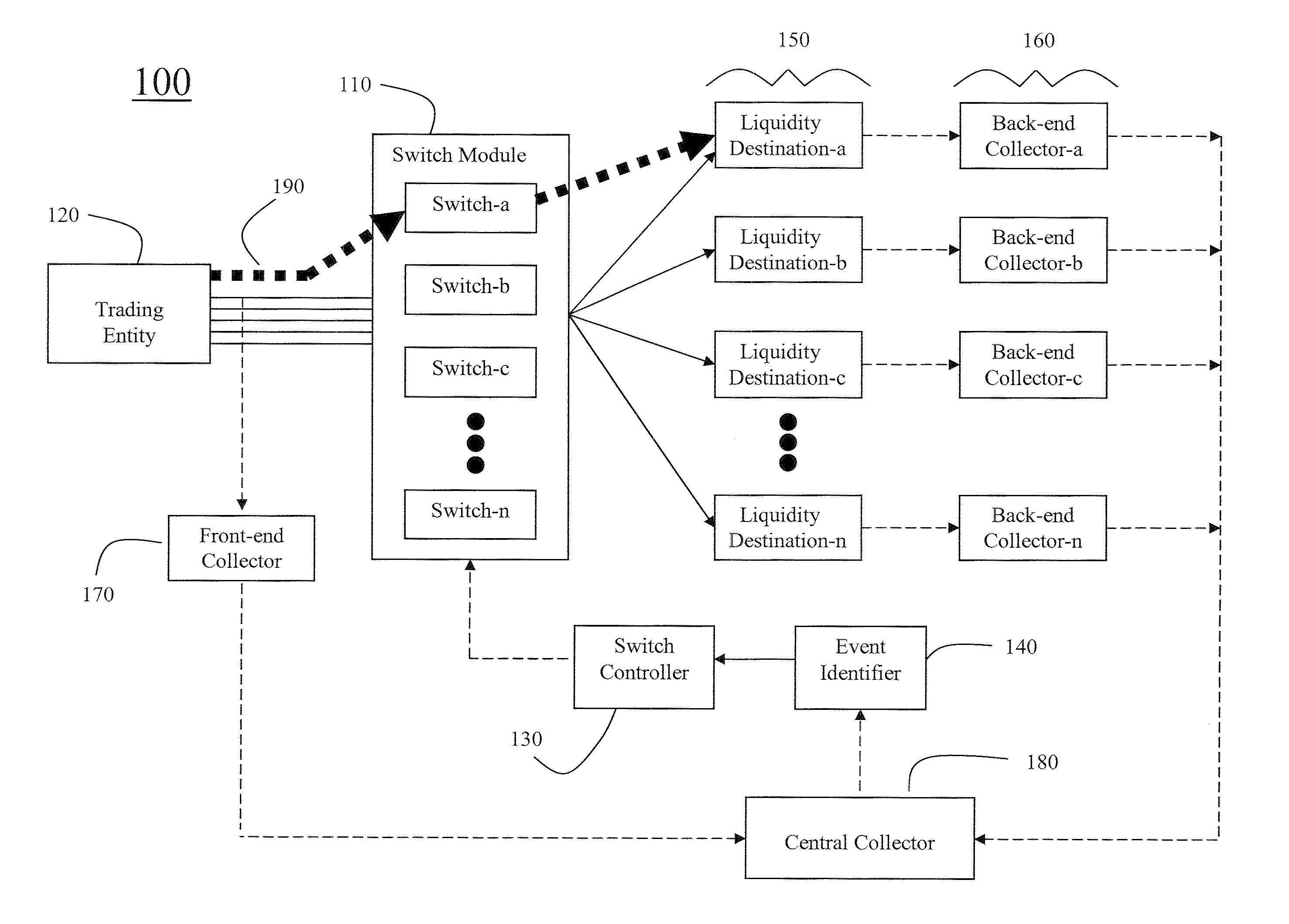

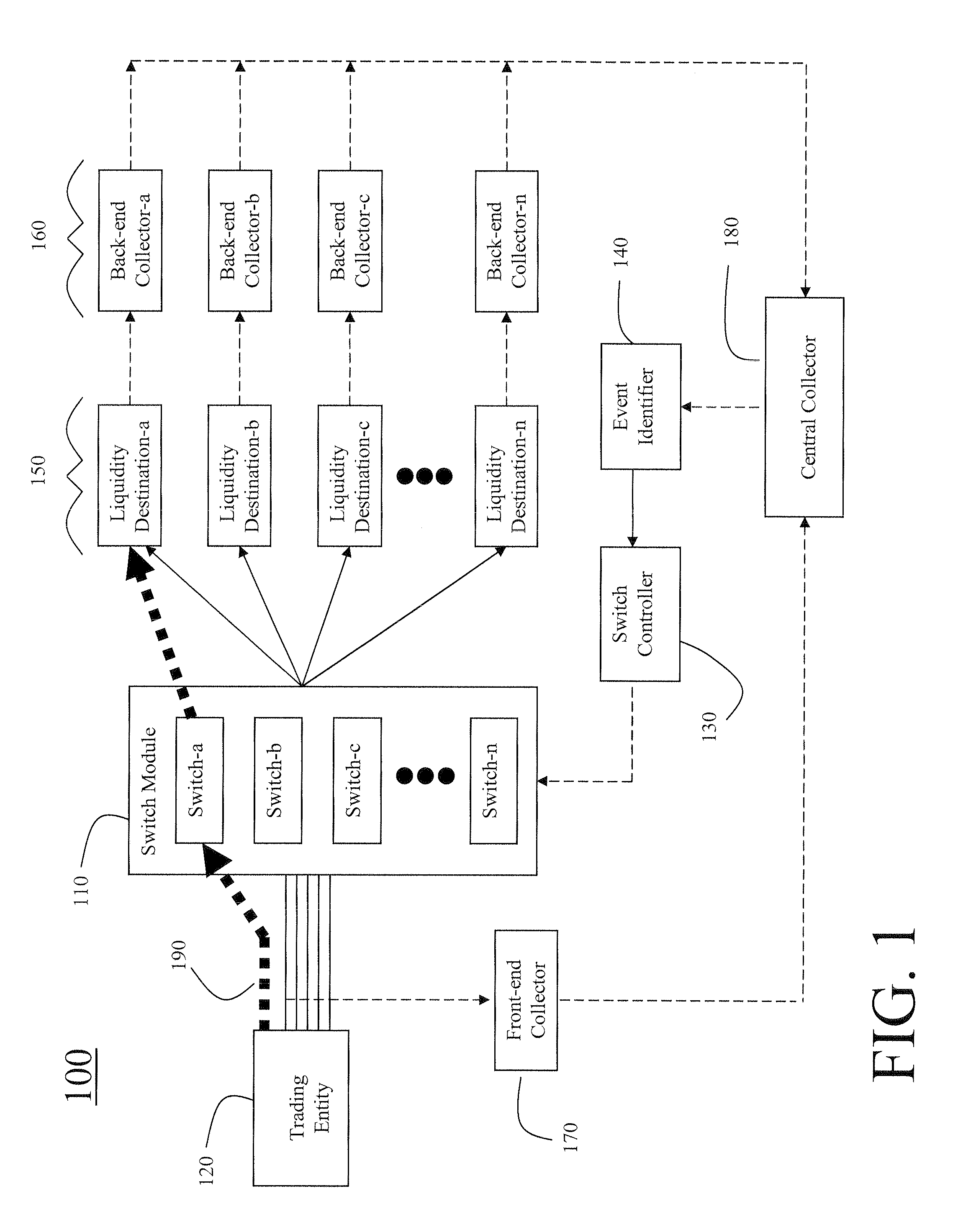

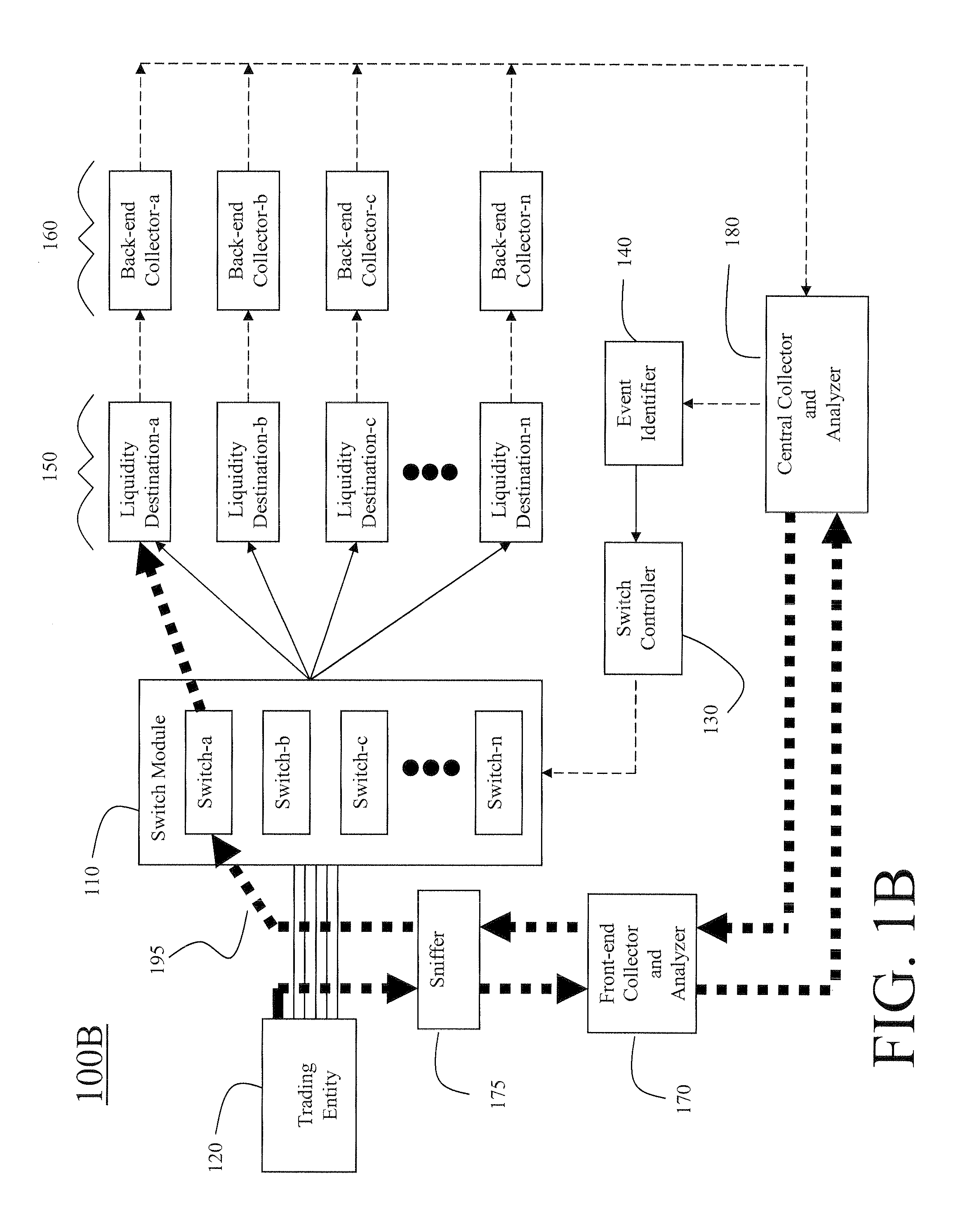

Method and system for canceling orders for financial articles of trades

Market data is monitored for purposes of canceling orders for financial articles of trade. Real-time data is collected from multiple liquidity destinations trading at least one financial article of trade. The real-time data comprises disparate data corresponding to associated liquidity destinations. The collected real-time data is normalized into a standardized form. A condition is defined of a trading market that includes one or both of submitted and executed transactions of financial articles of trade over the multiple liquidity destinations. The condition is associated with an entity. Through monitoring of the normalized real-time data, an event is identified in the trading market that matches the condition. Upon identification of the condition, at least one communication session between the entity and a corresponding liquidity destination is terminated causing a process at the corresponding liquidity destination to cancel pending or outstanding orders for financial articles of trades from the entity.

Owner:FTEN

Routing control for orders eligible for multiple markets

Trading processes are operative to route orders from order rooms to market processes, which process the orders according to respective market methodologies. The order routing strategy can be embodied in a decision table having rules with conditions and actions to be taken when the conditions are true. Accordingly, order rooms can readily configure and reconfigure trading processes.

Owner:XYLON LLC

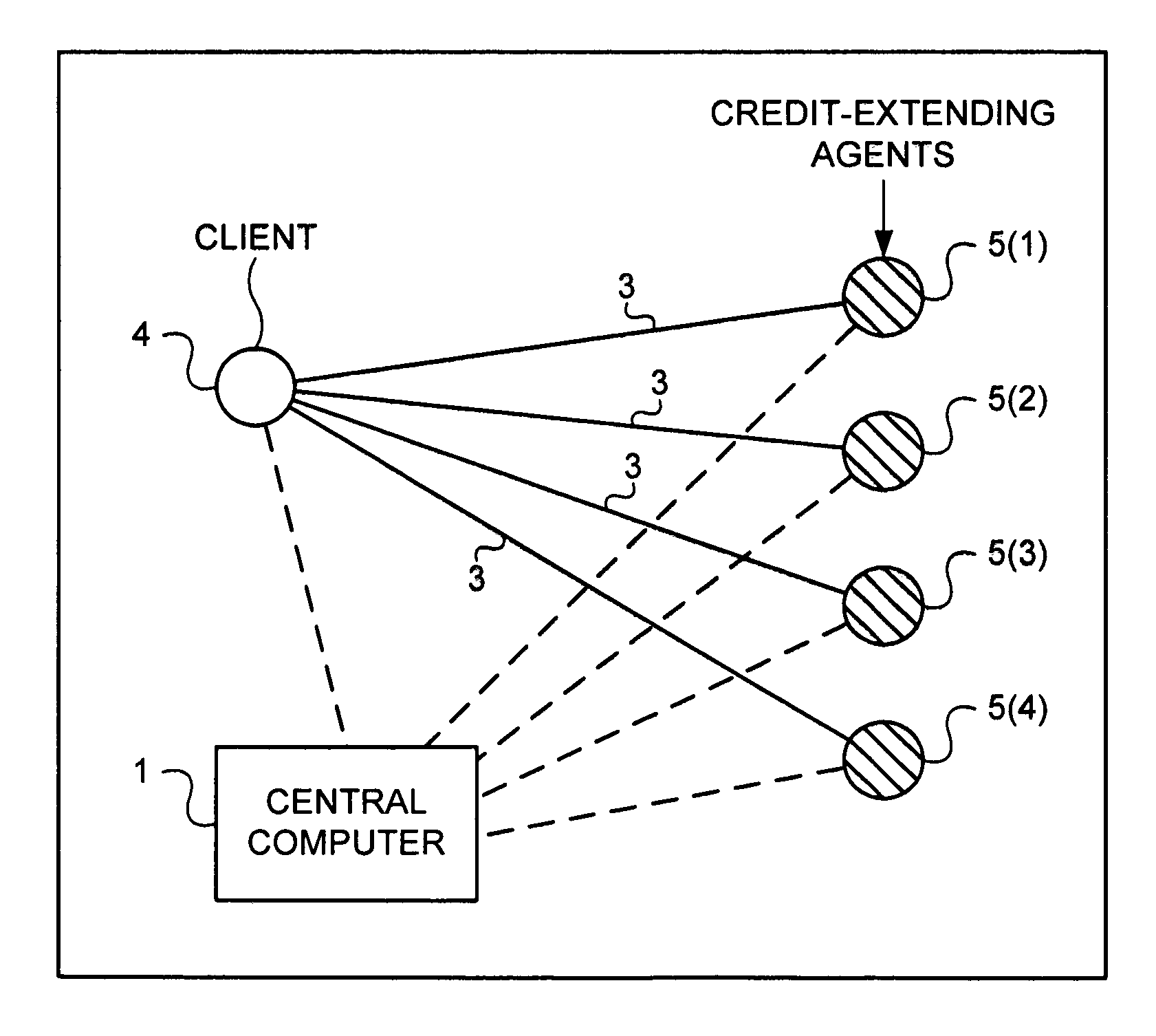

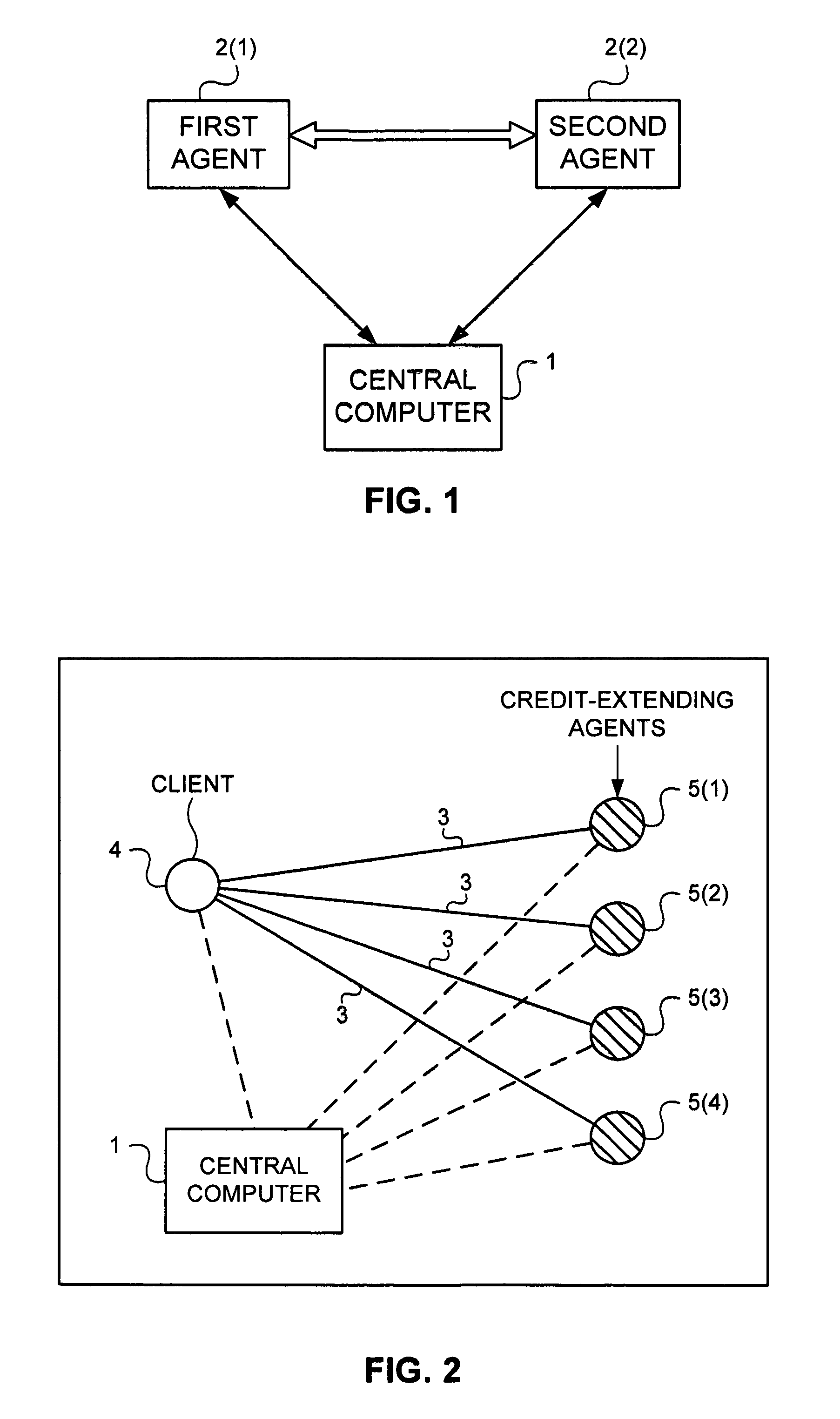

Method and system for network-decentralized trading with optimal proximity measures

InactiveUS20050131802A1Facilitates tradeControlling the riskFinanceCommerceComputer networkProximity measure

A method and system provide for conducting of trades. A request is transmitted from one party, about an item the party is willing to trade. Rules are specified about what will be acceptable. Responses are received from other parties concerning requests which are responsive to the rules. A trade is conducted with one or more parties responding in accordance with the rules.

Owner:SETEC ASTRONOMY

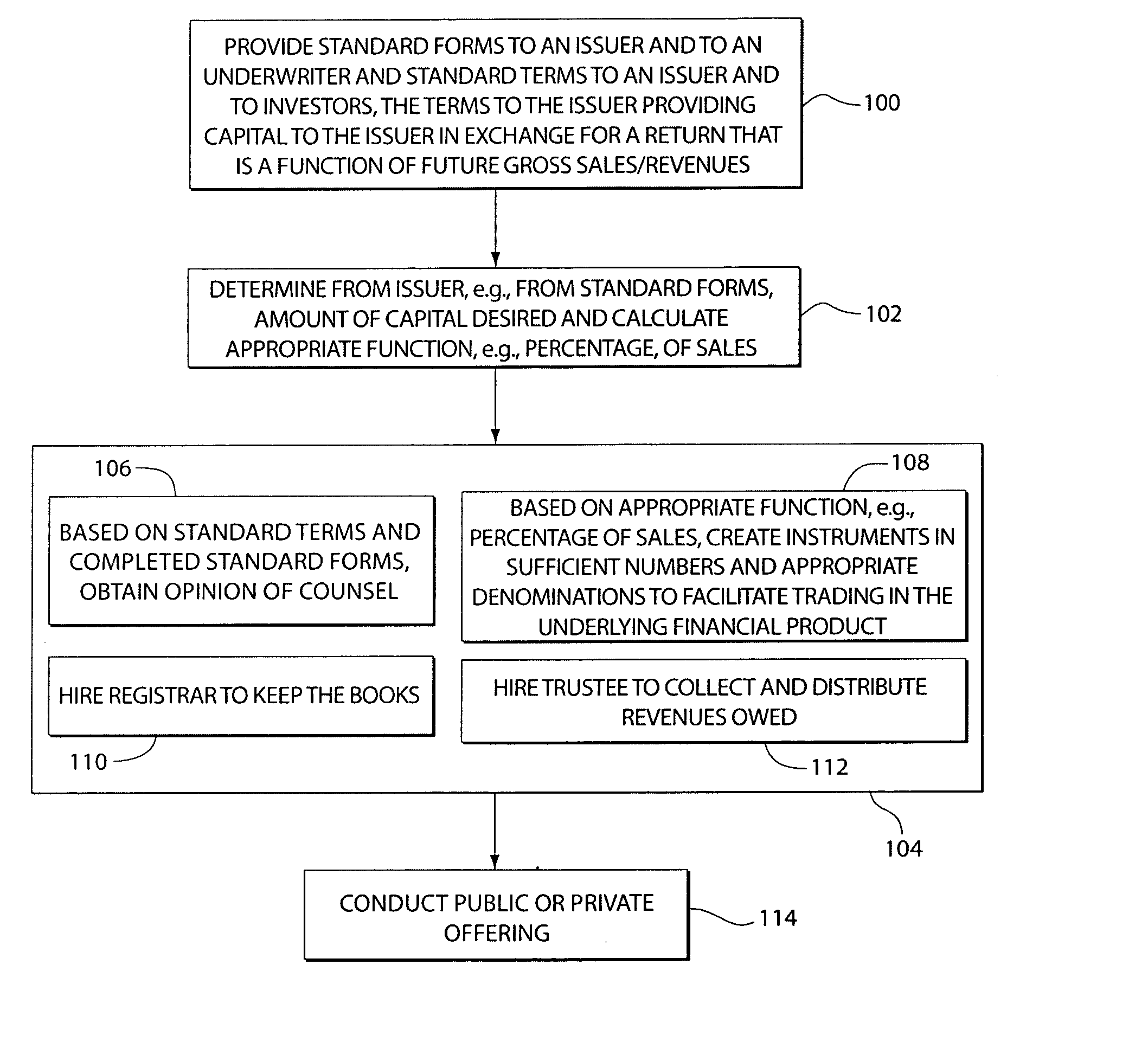

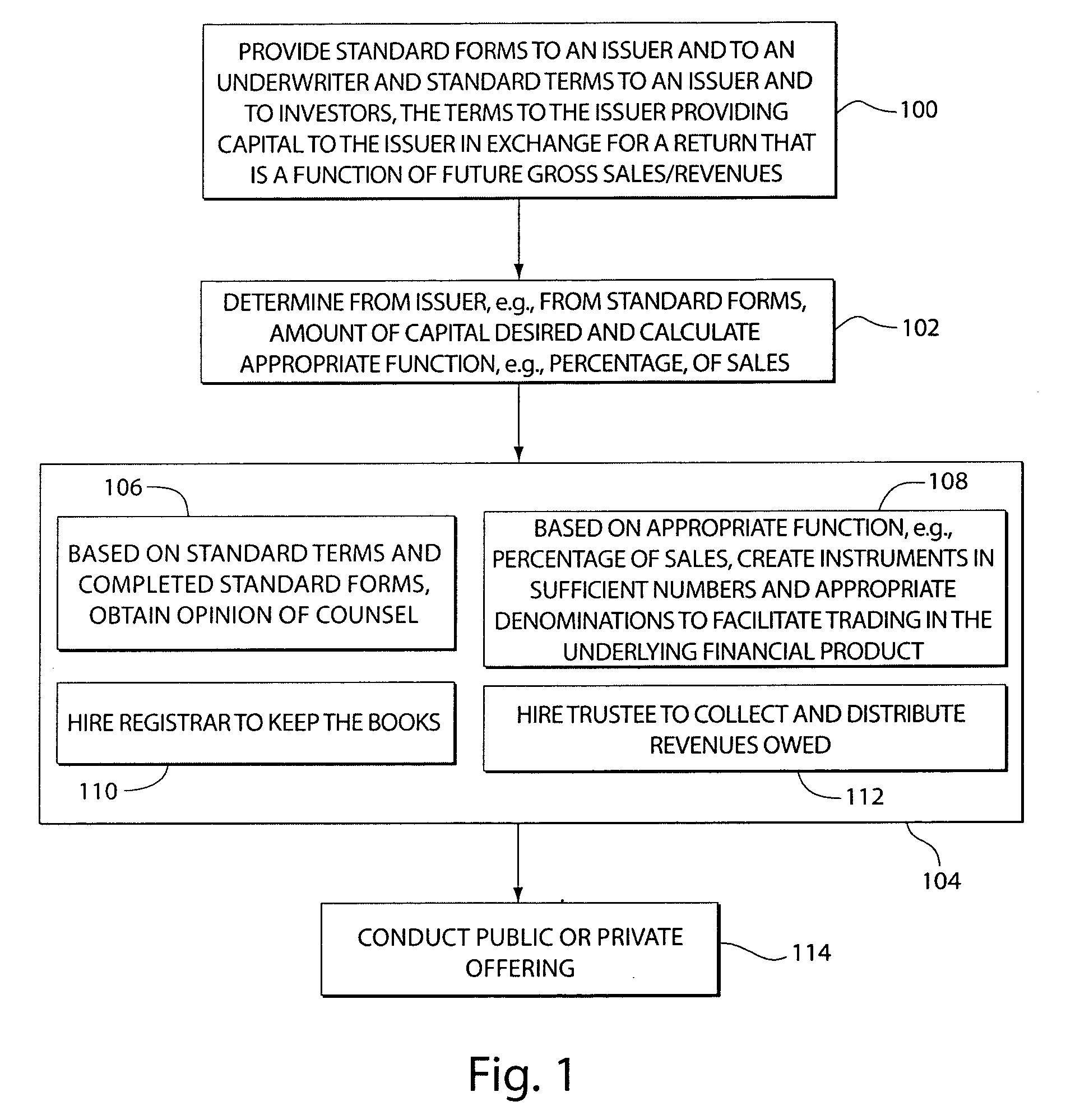

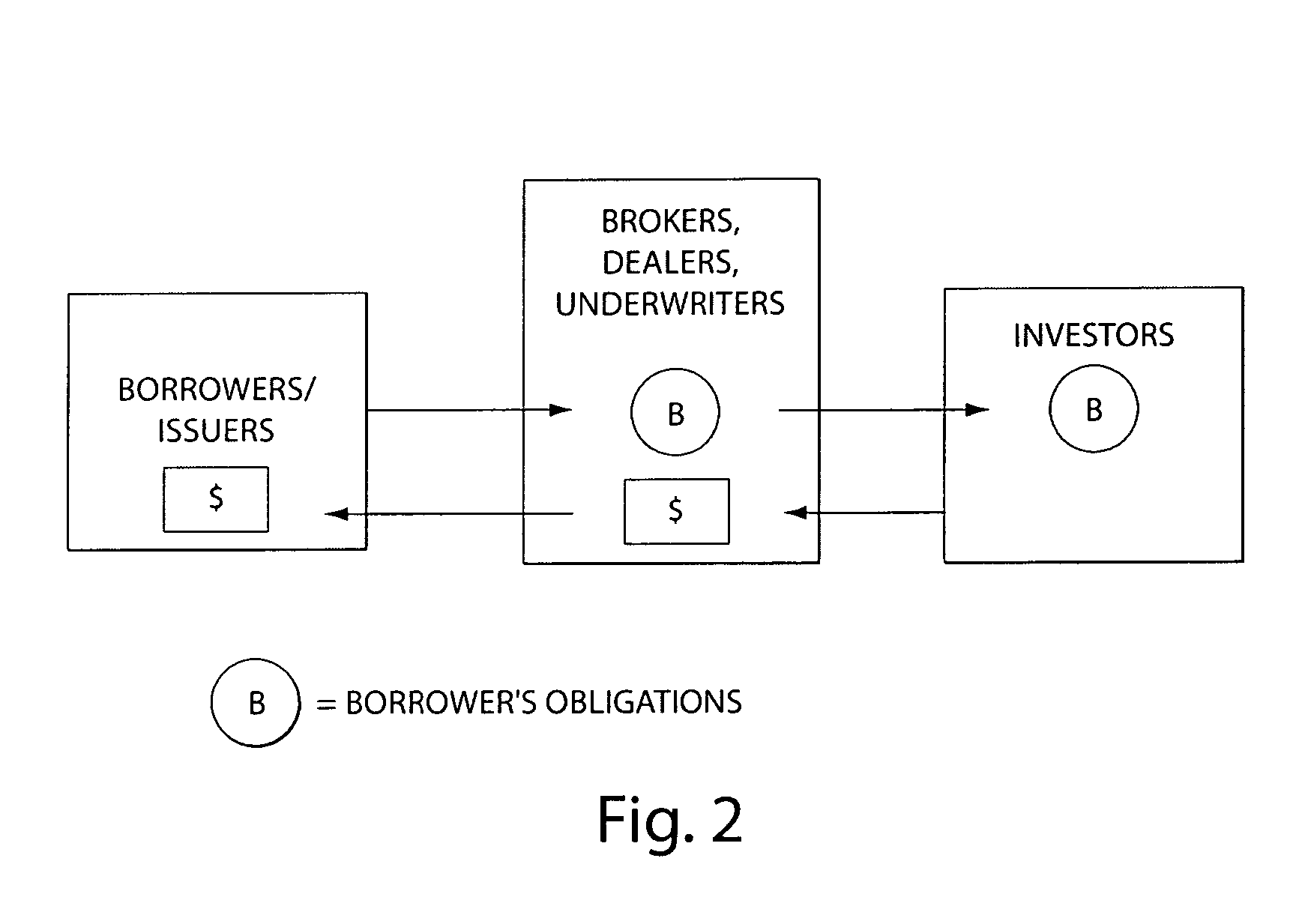

Securitization of sales participation certificates

InactiveUS20050222940A1Facilitates tradeLow costFinanceSpecial data processing applicationsStandard formData mining

Owner:TYKHE

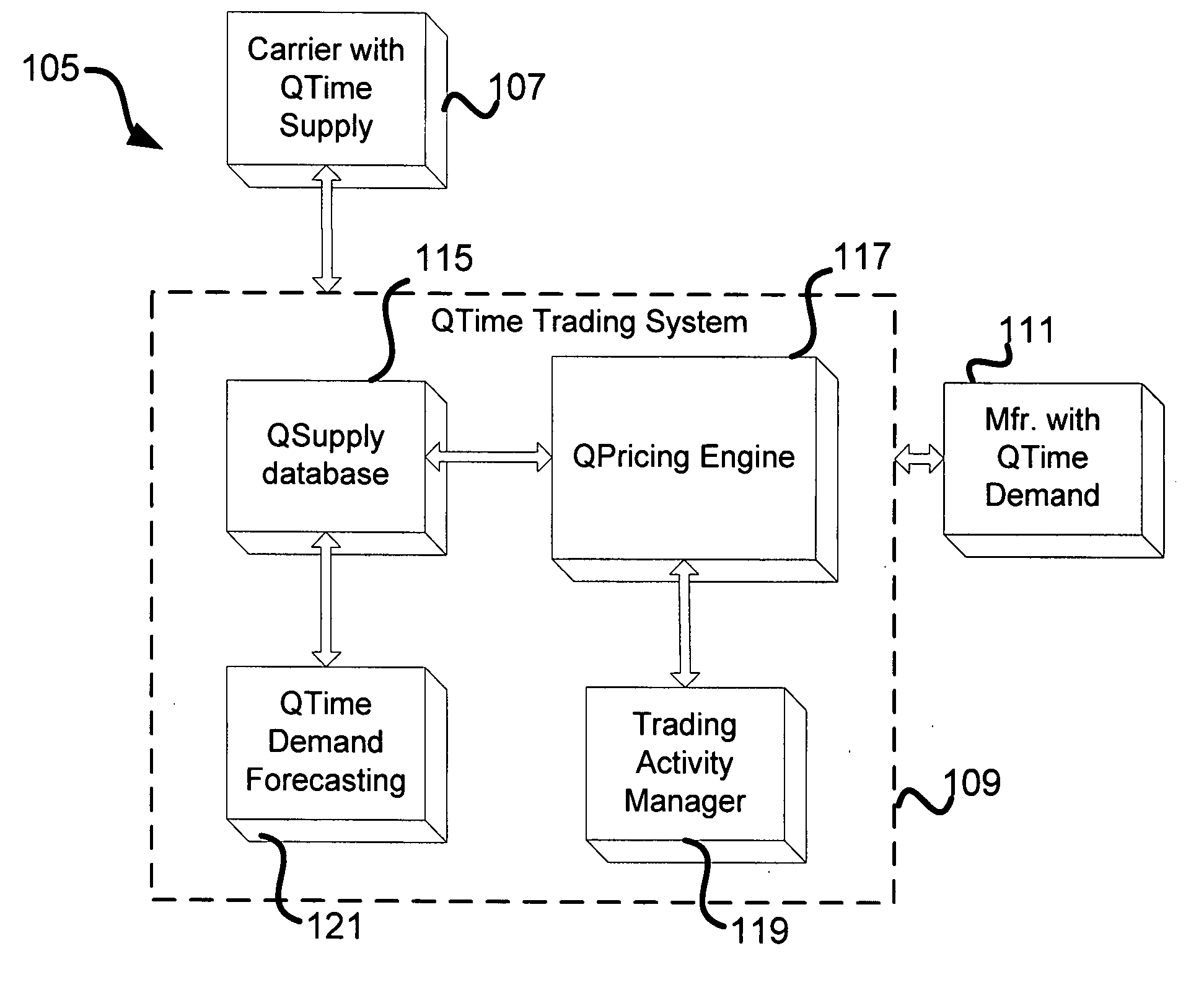

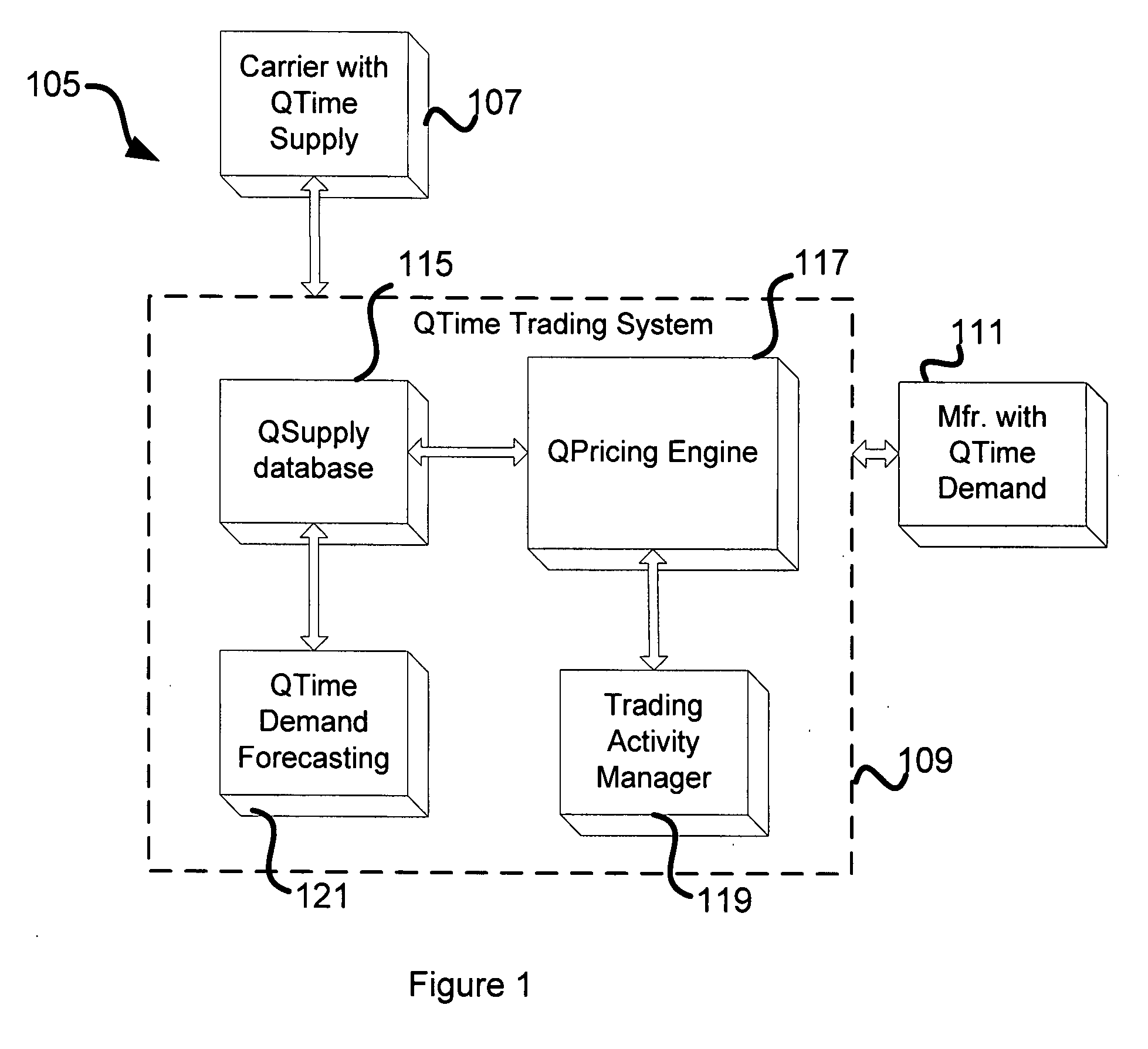

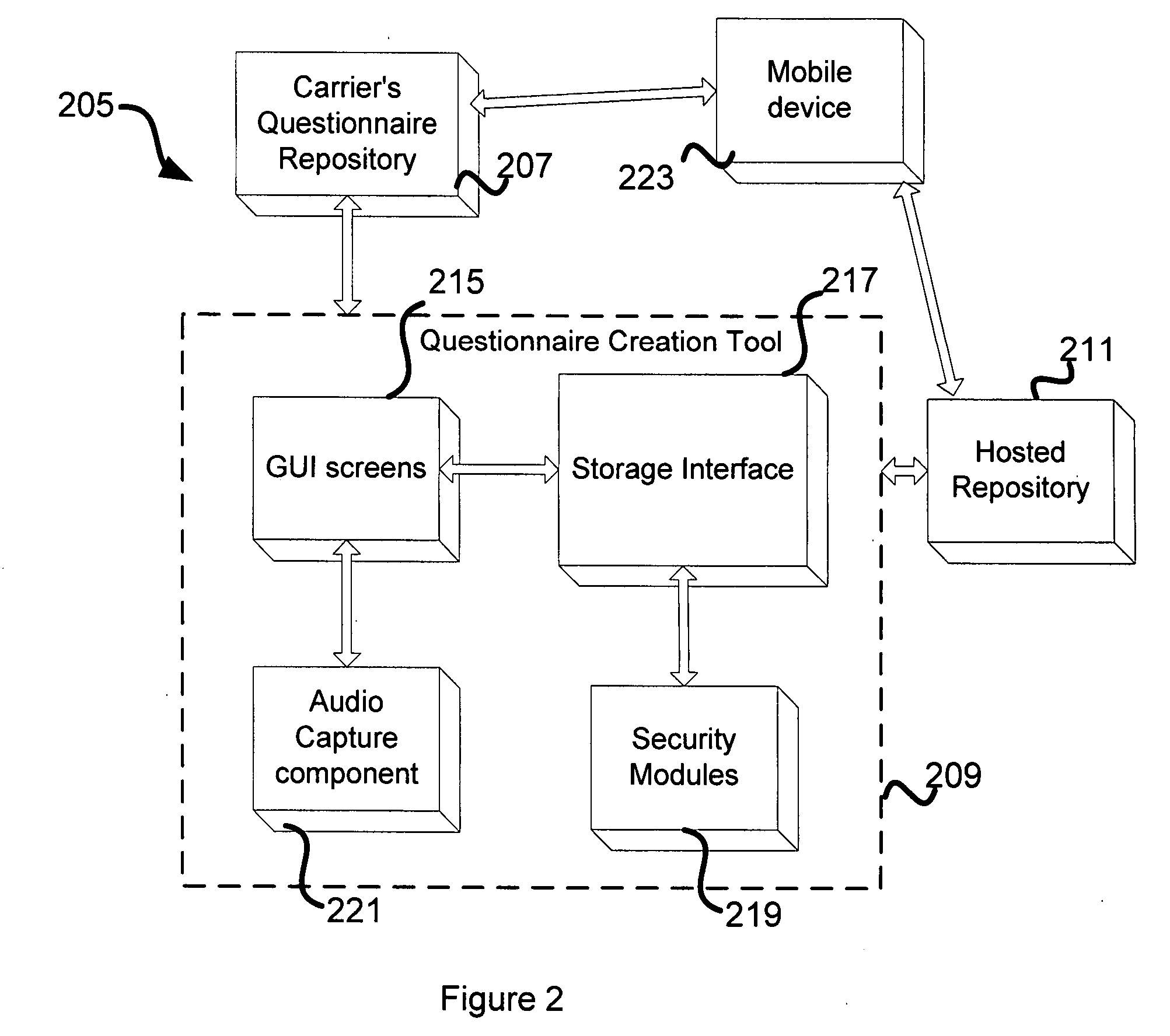

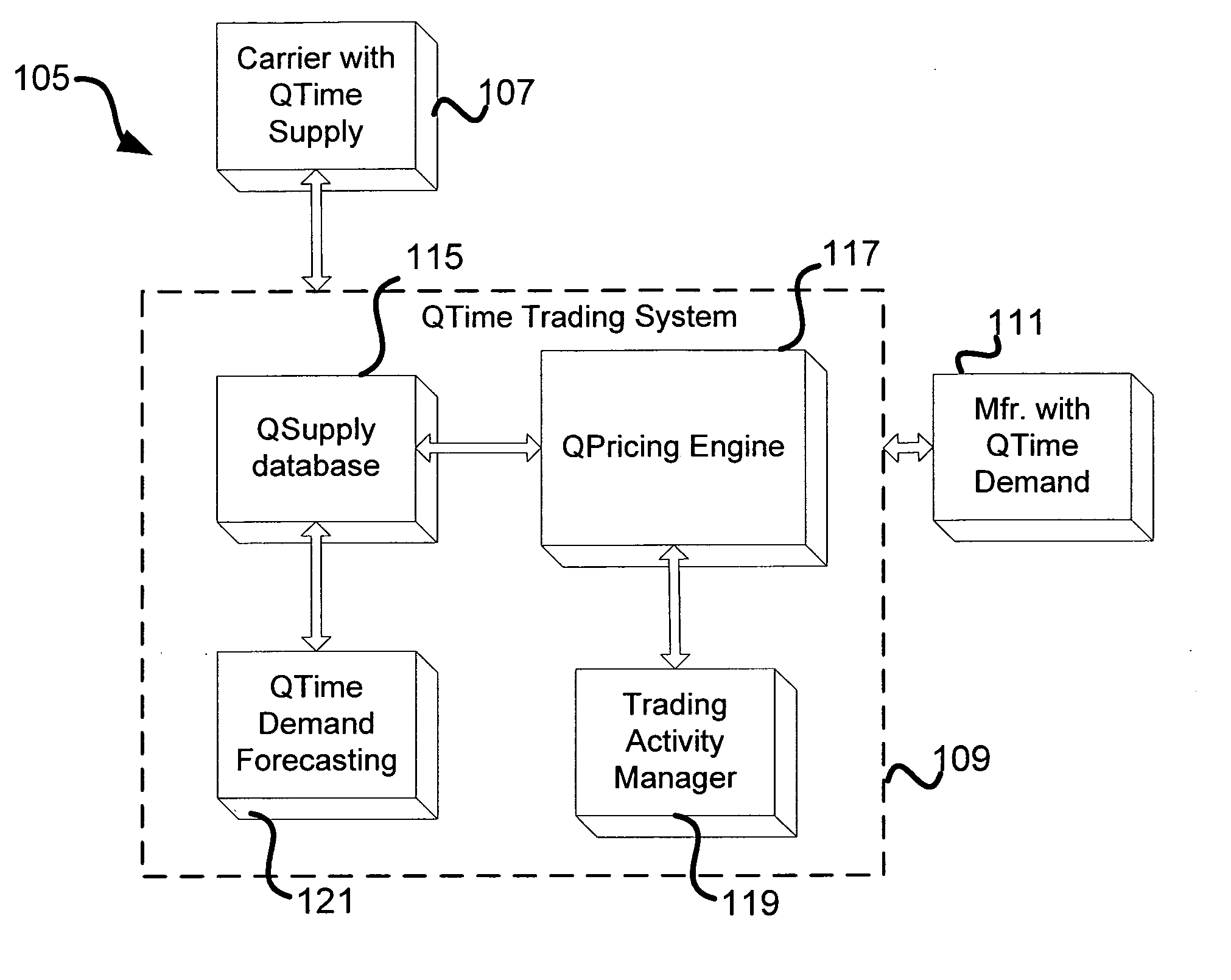

Trading system on user commitments to participate in questionnaires and other interactions

InactiveUS20080109278A1Facilitates tradeEasy to displayMarket predictionsFinanceBulk purchasingLibrary science

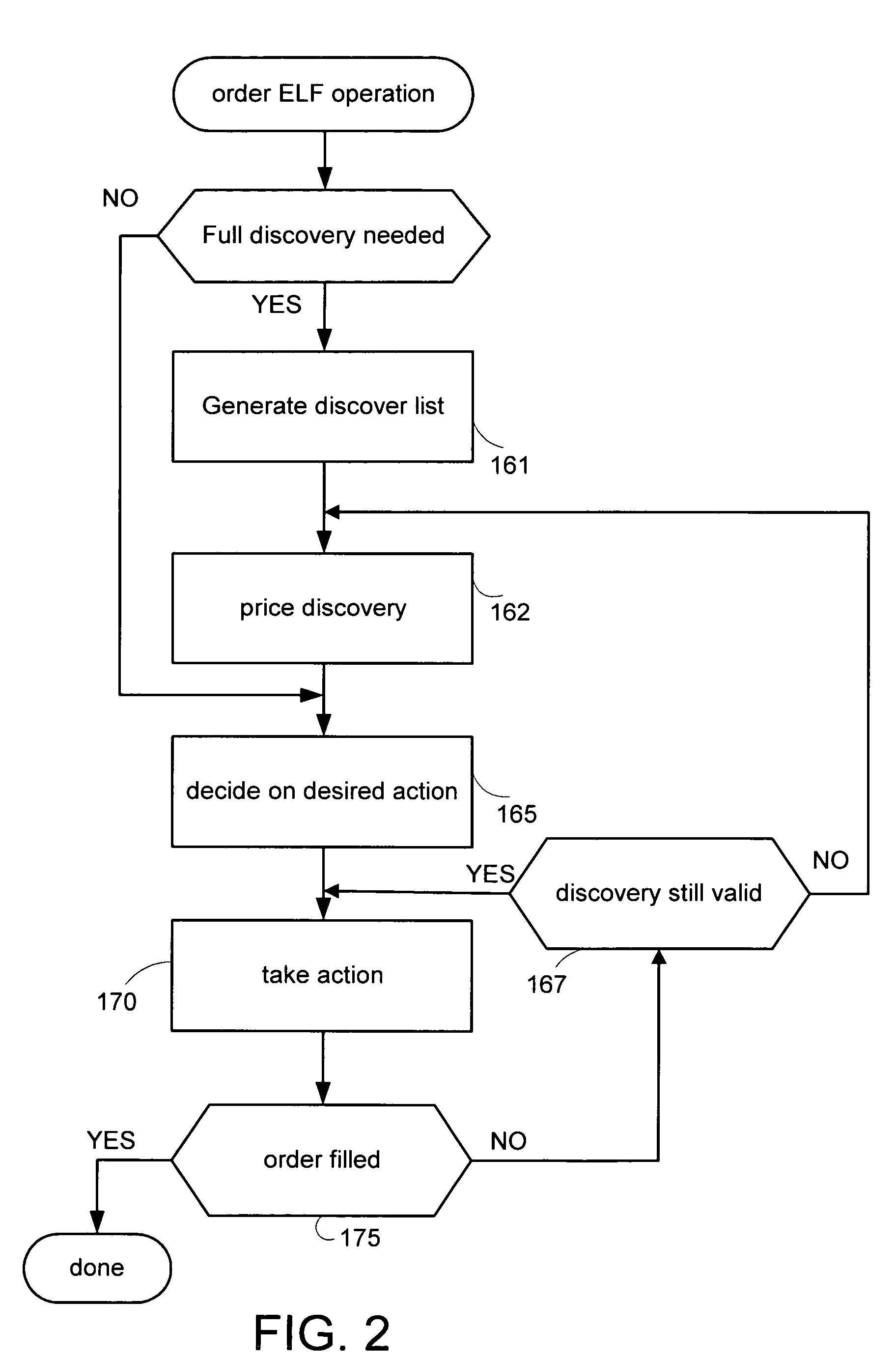

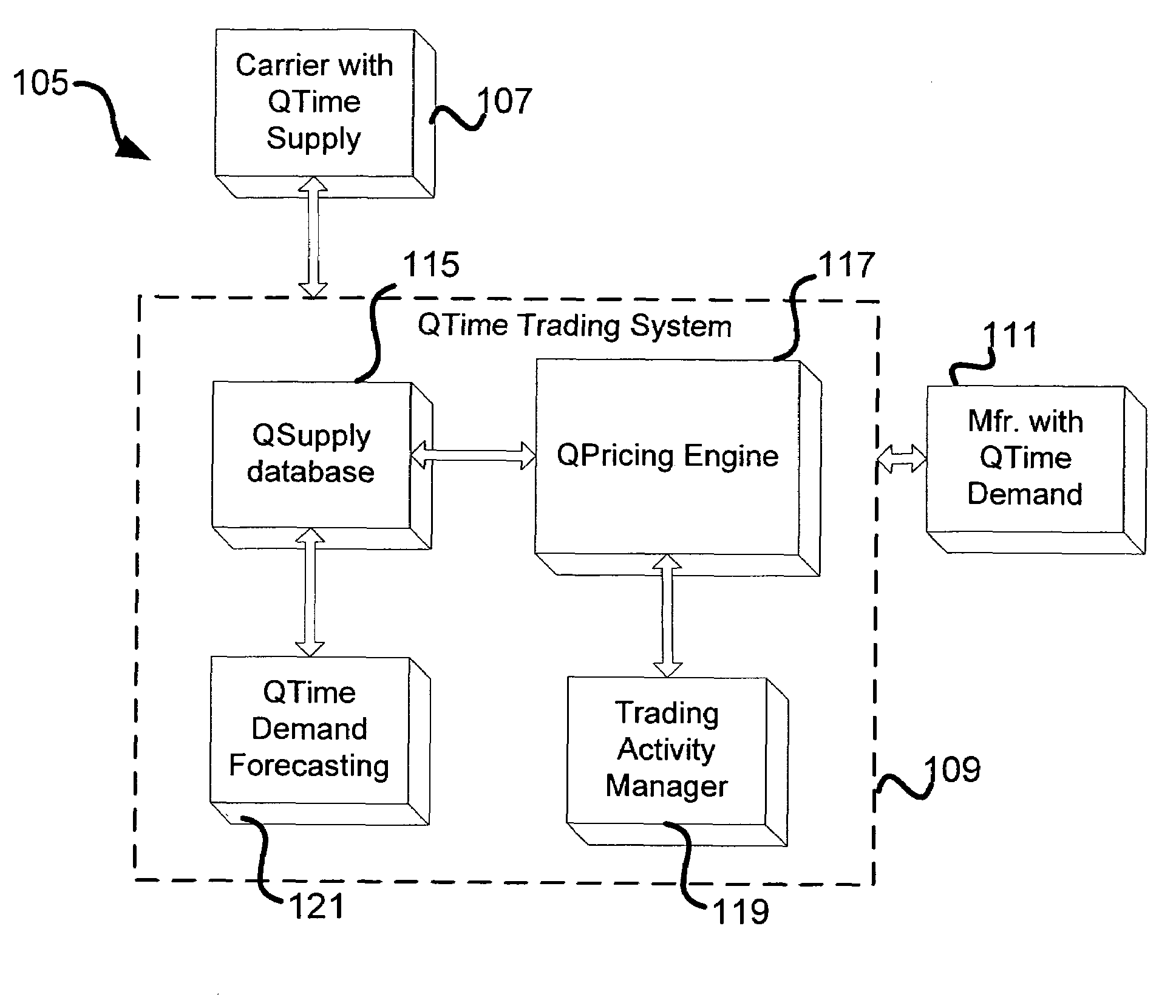

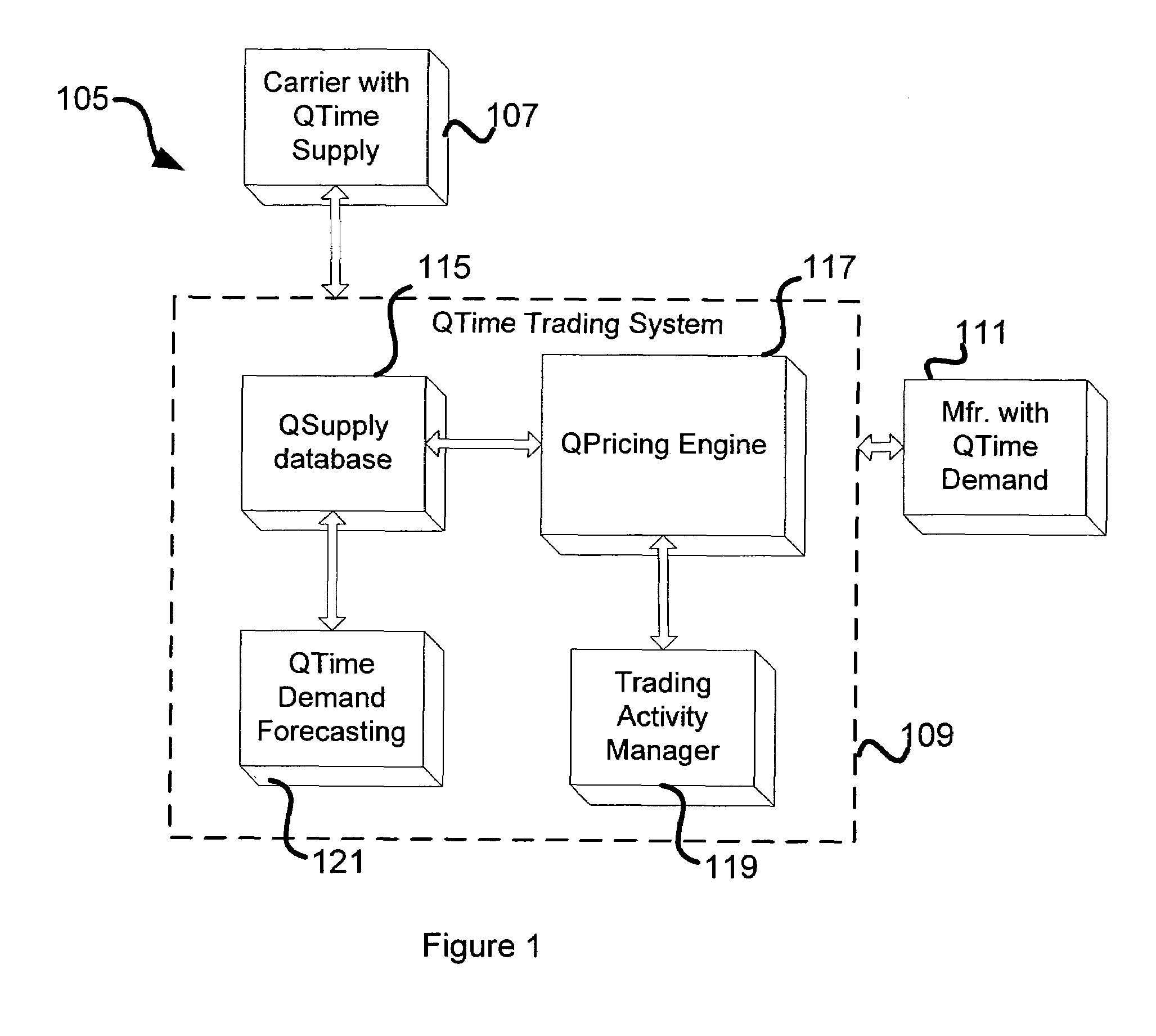

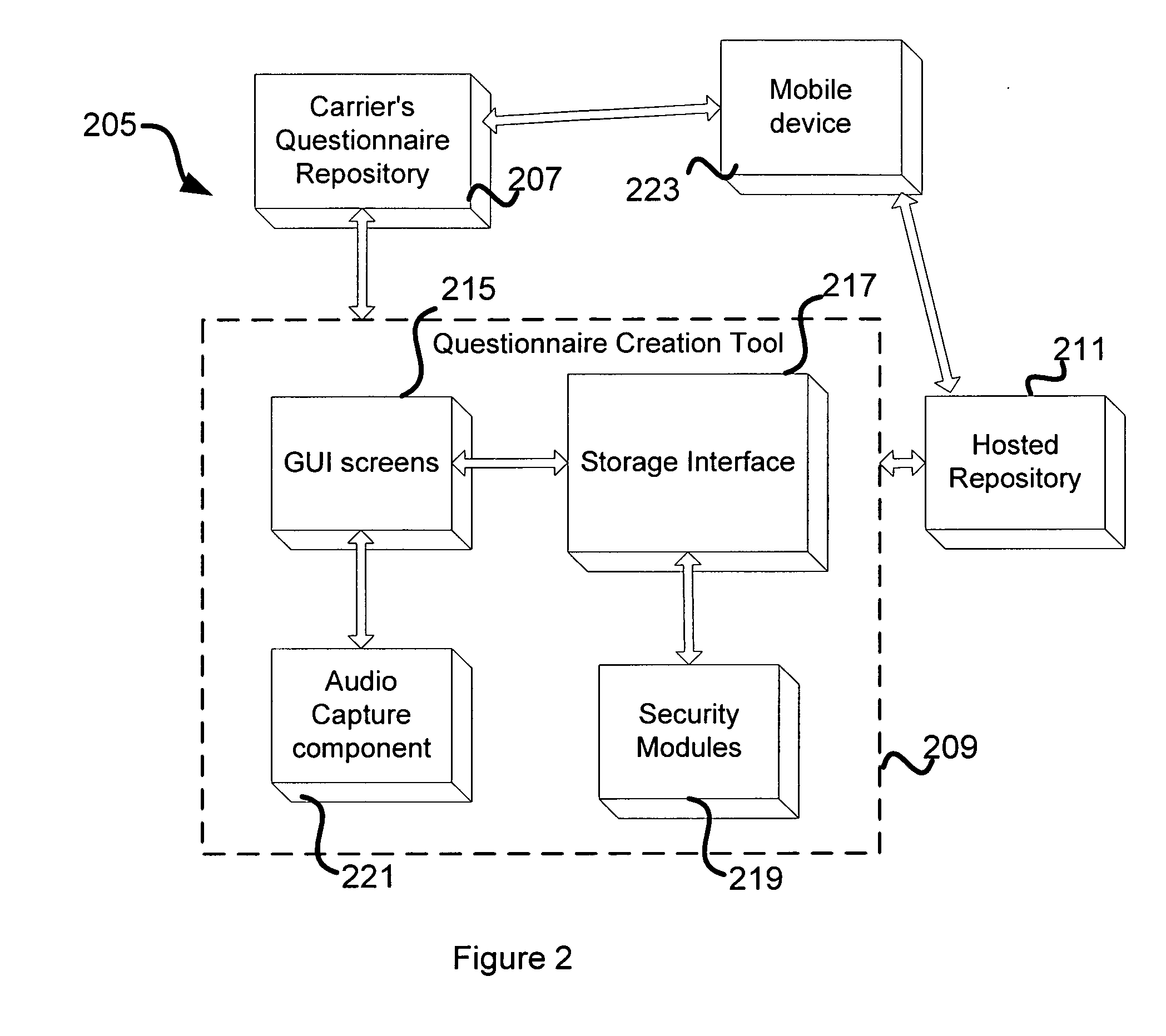

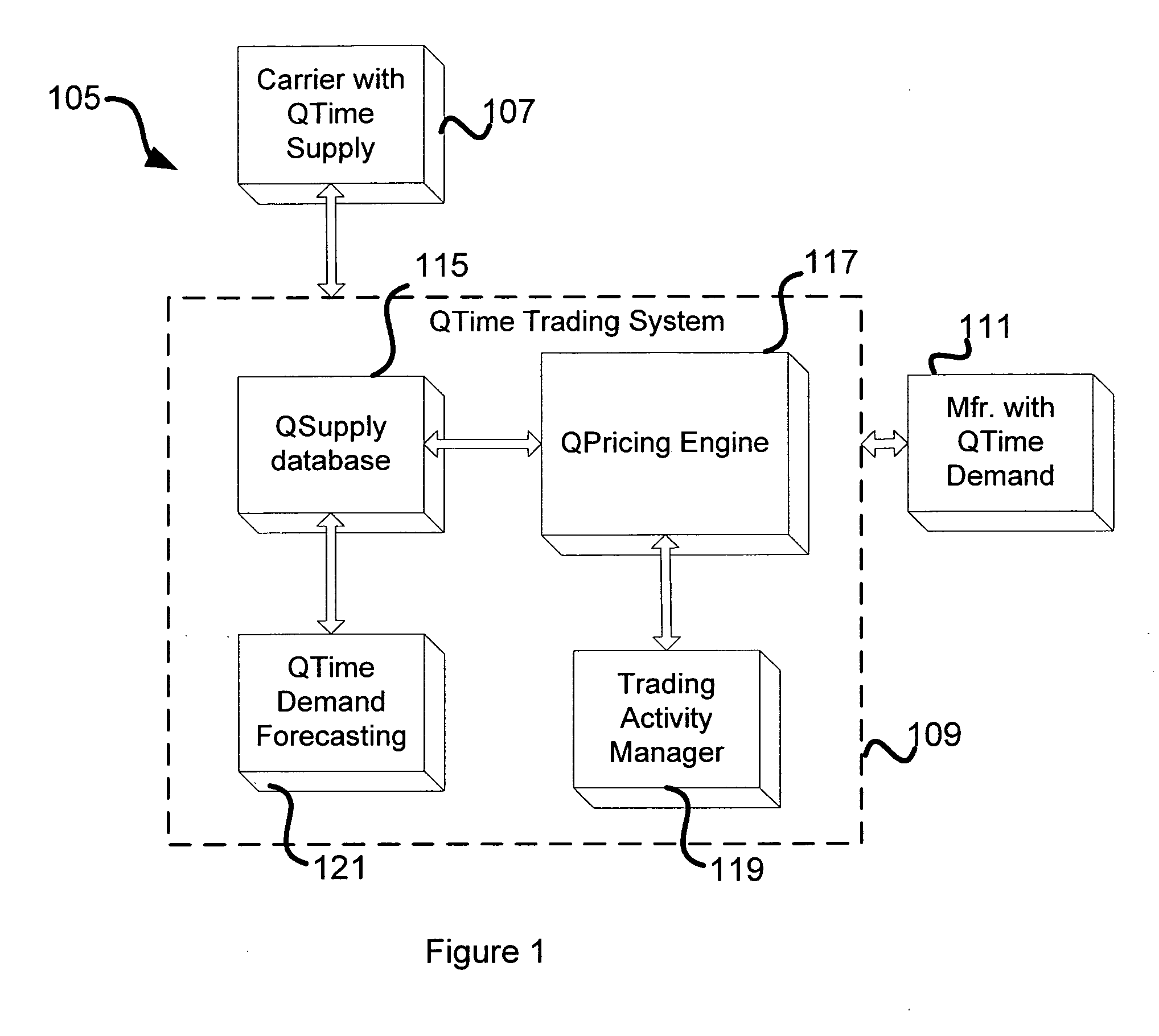

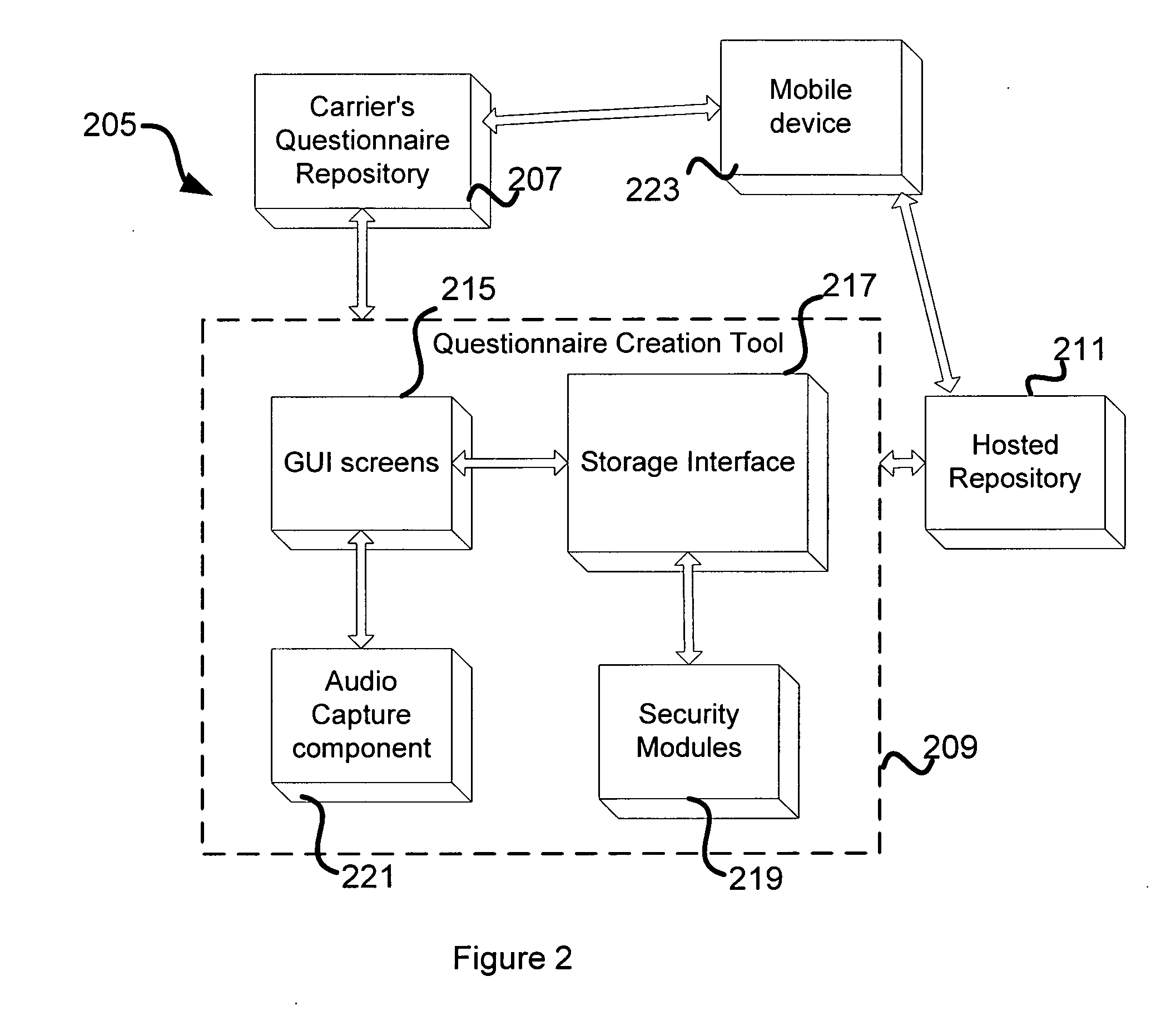

A questionnaire network makes it possible to create, disseminate, conduct questionnaires or surveys on mobile handsets and to collect results for processing and storage. The questionnaire network is powered by a questionnaire creation tool and a questionnaire trading system. A questionnaire trading system for QTime makes it possible for producers of QTime, such as carriers, and consumers of QTime, such as product manufacturers and advertising companies, to buy or sell QTime in bulk and to trade in QTime as a commodity. In one embodiment, supplementary information and preambles that are part of a questionnaire are captured in audio form using the questionnaire creation tool and are stored selectively along with the questionnaire in a carrier's questionnaire repository or separately at a hosted repository.

Owner:QUALTRICS

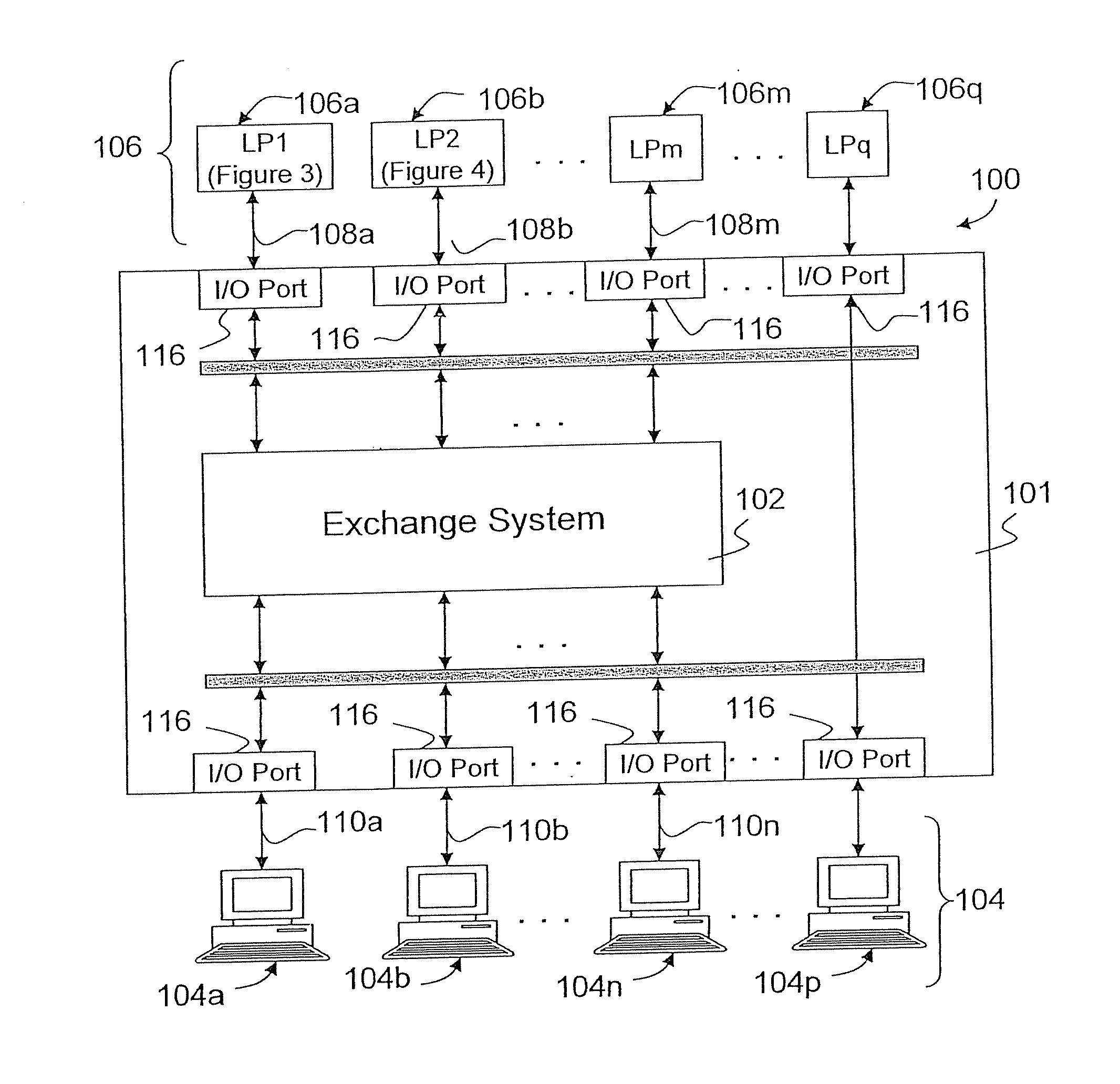

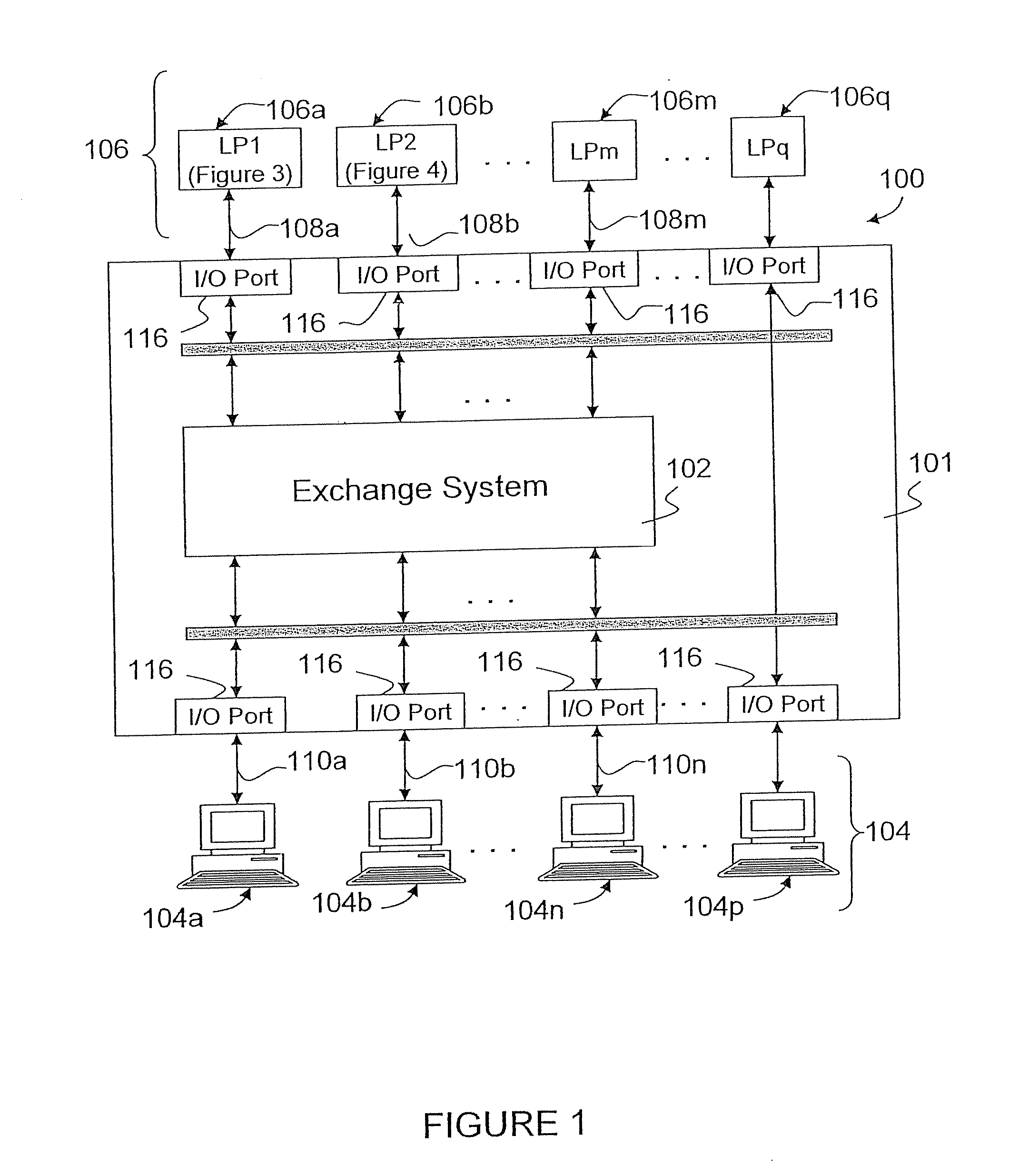

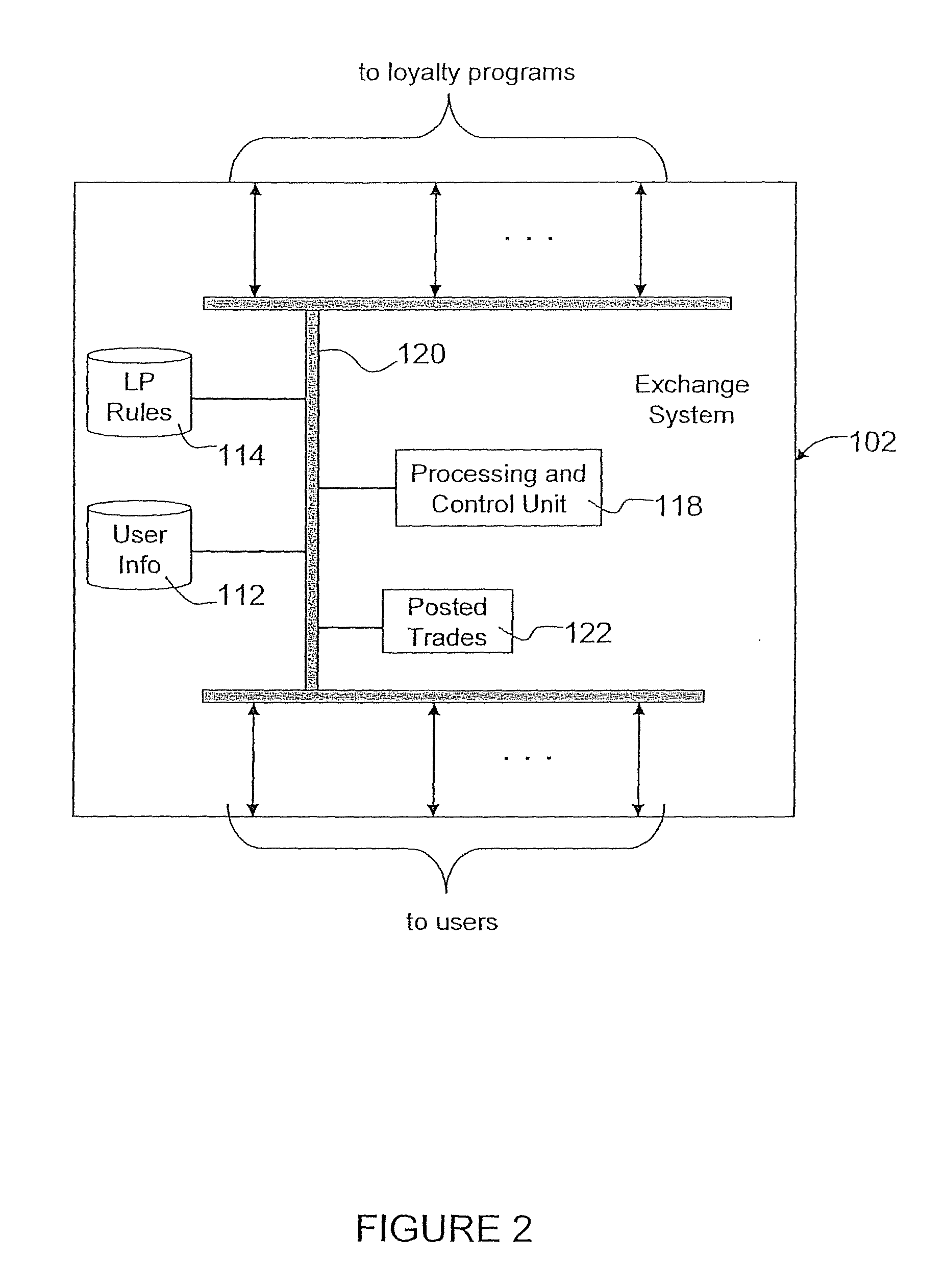

System and method for exchanging reward currency

Methods and systems are disclosed for allowing two users to exchange reward currency, such as points, between two different loyalty programs at an exchange rate that is set by and agreed upon by the users themselves. An offer to exchange X points of one loyalty program for Y points of another loyalty program is received from a user and is made available to other users. Another user satisfied with the offered exchange accepts the offer, and the account balances of the two users are adjusted. In some embodiments, a fee is charged to one or both of the users for effecting the trade. The fee is then forwarded to the loyalty programs. In other embodiments, the loyalty programs specify rules that must be complied with before a trade can occur.

Owner:POINTS COM

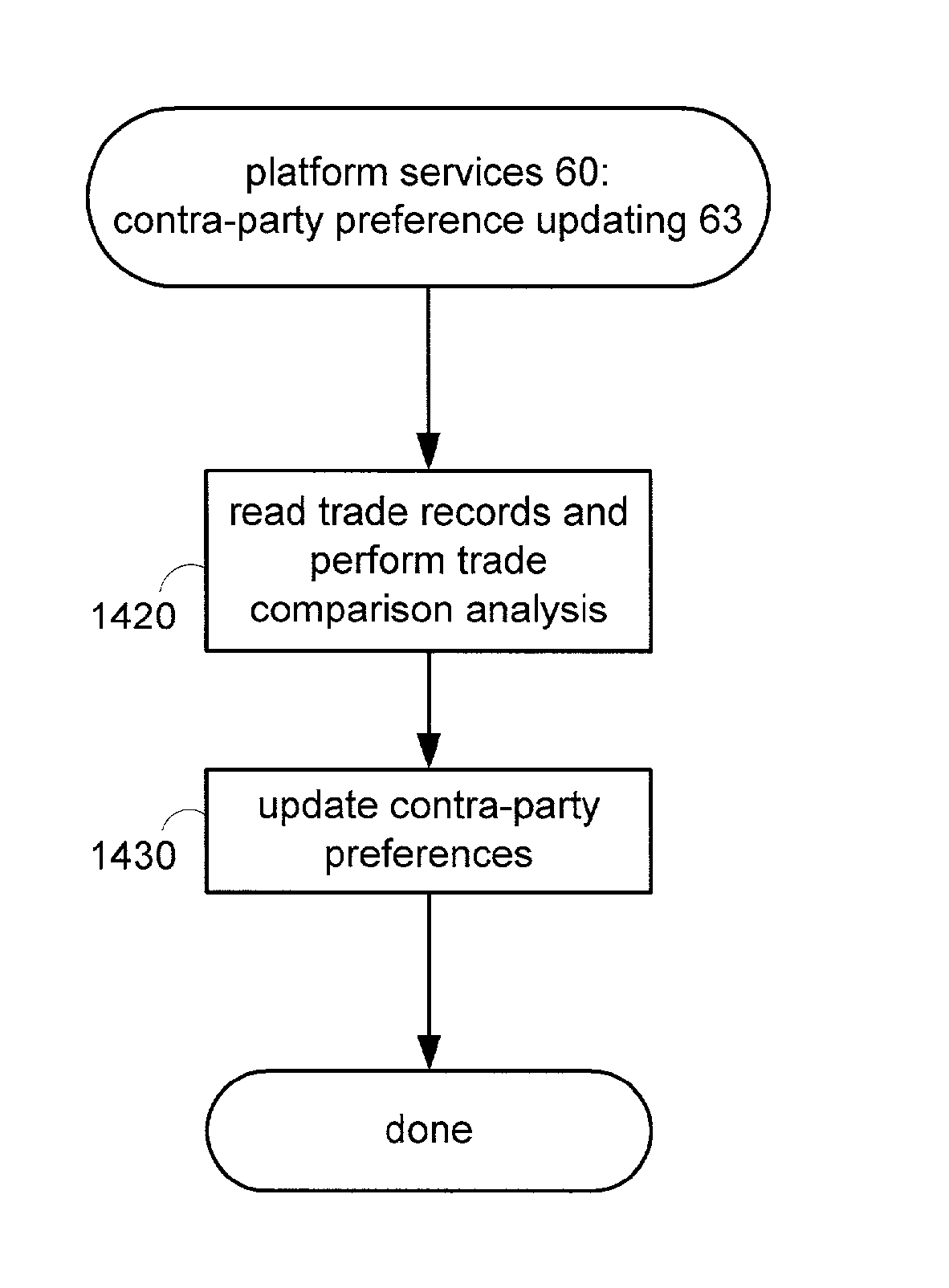

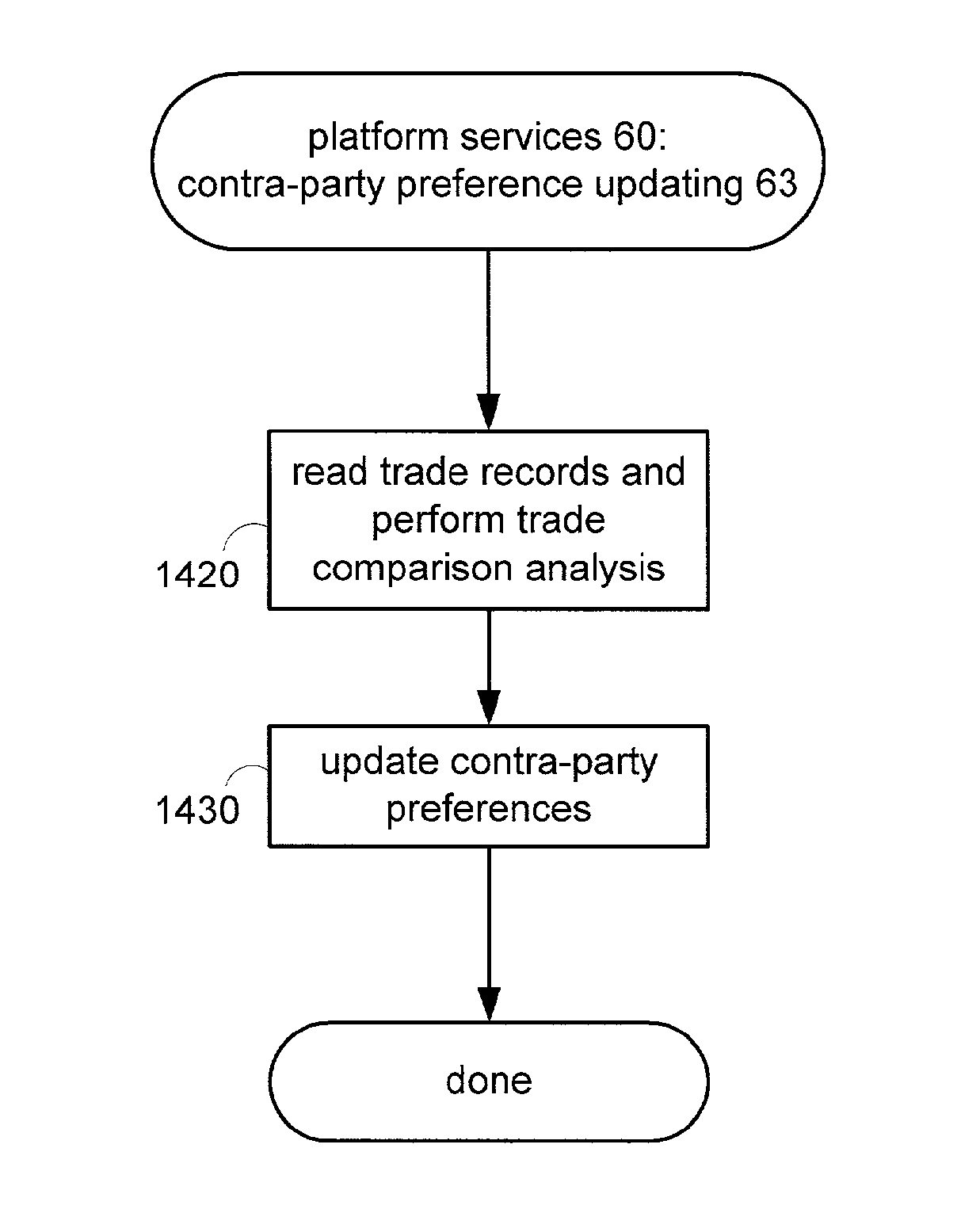

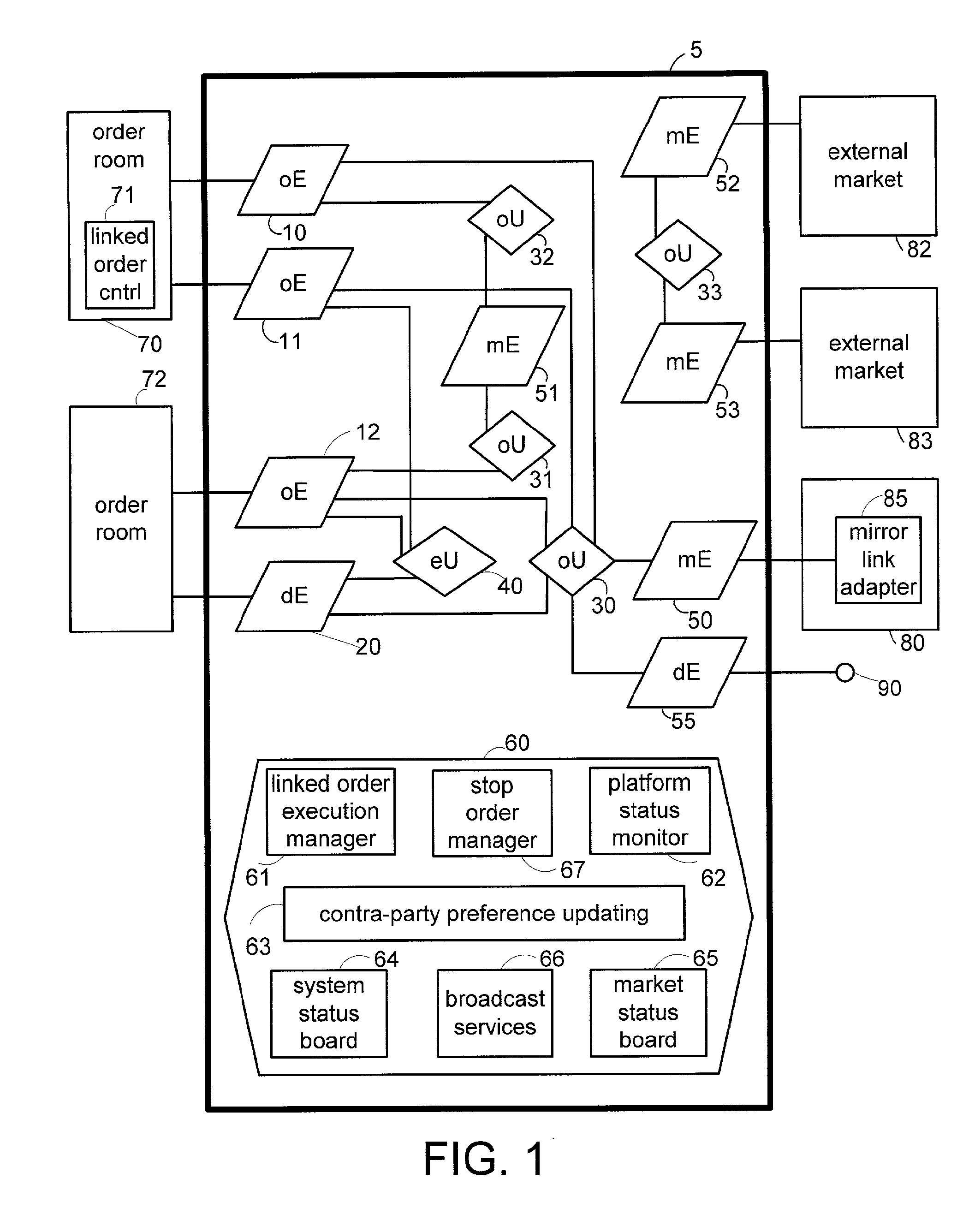

Automated preferences for market participants

A market process records trades between trading processes. A preference rating from each trading process to all other trading processes that it has traded with is updated based on the recorded trade, such as by comparing the recorded trade with a metric and determining whether or not the trading process profited from the trade. The metric may be a market price for the item traded at a time subsequent to or prior to the trade. The updating may be performed by the market process after each trade or at predetermined times, or the updating may be performed by a platform process. A trading process can designate itself as anonymous, maintaining its confidentiality but still being subject to contra-party preference rating. The market process may use the contra-party preference ratings to determine whether a trade may occur between two trading processes.

Owner:XYLON LLC

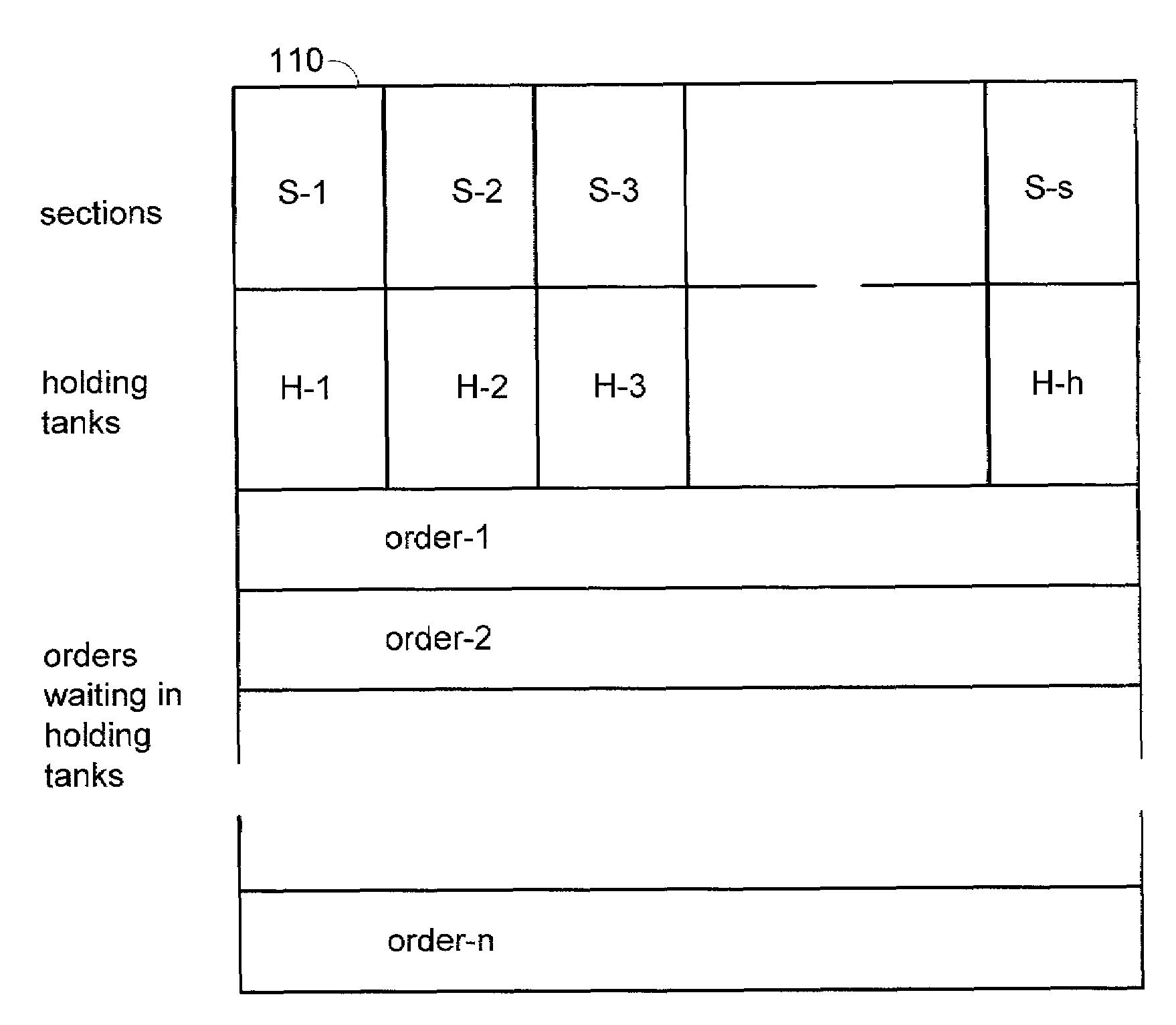

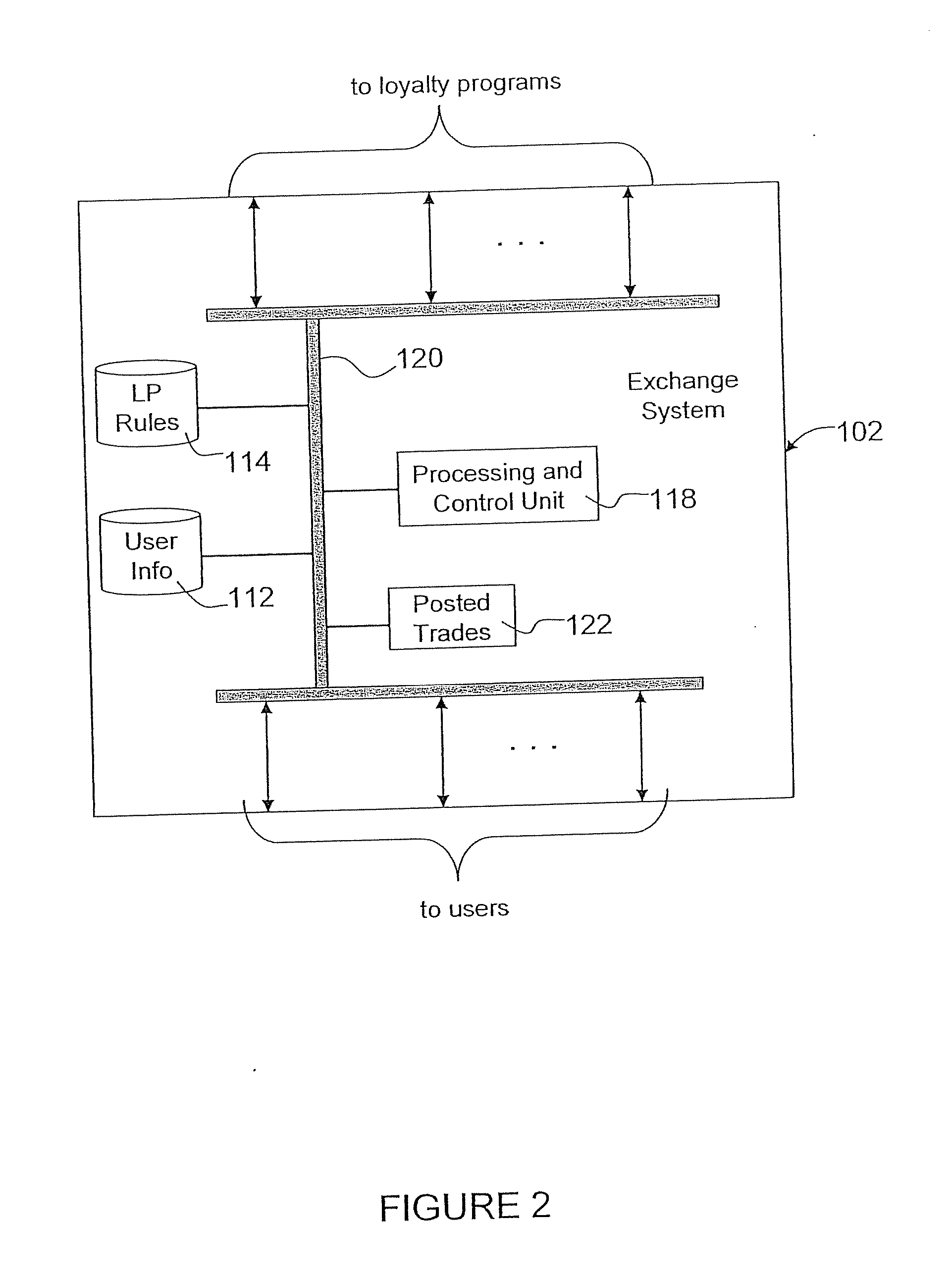

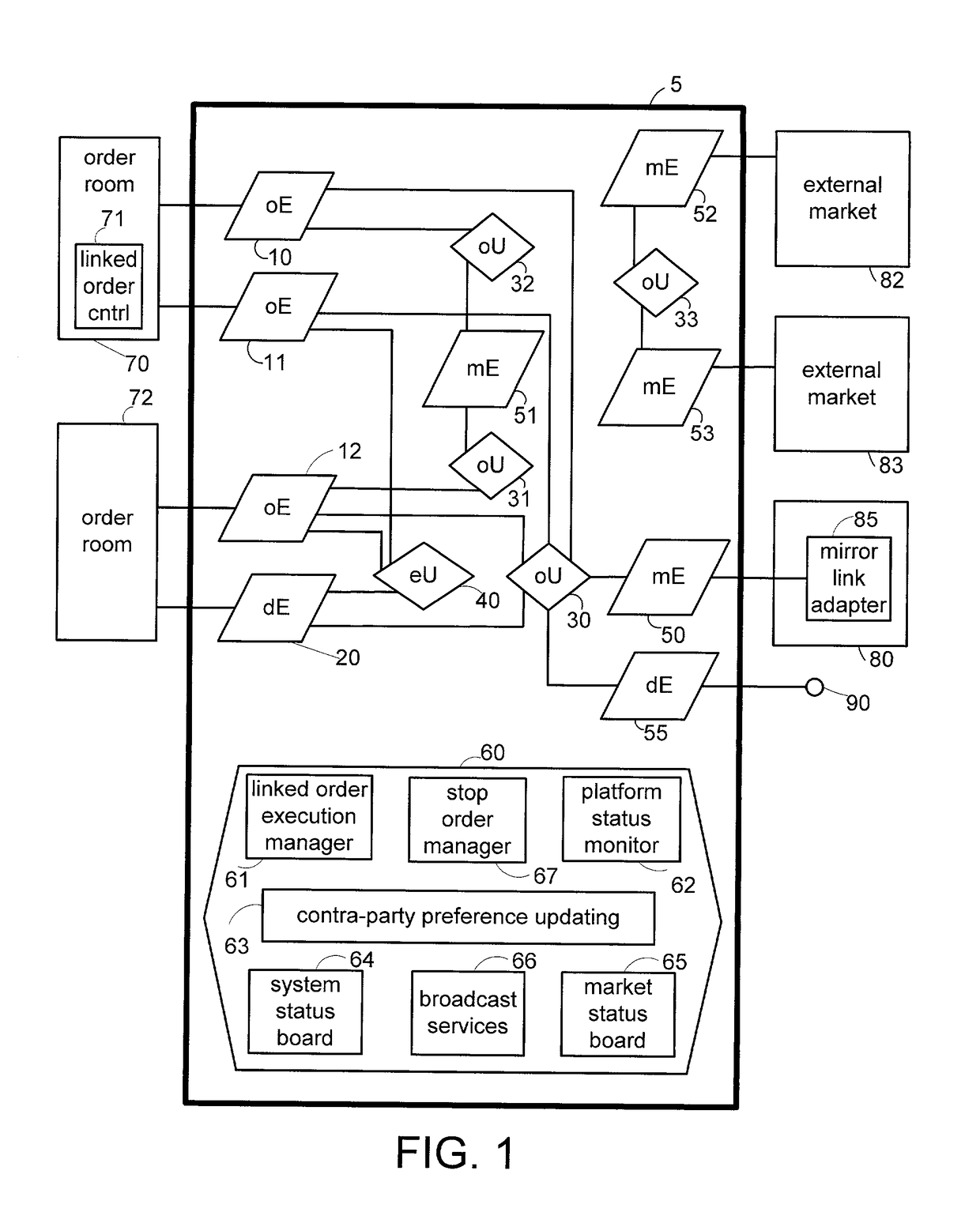

Platform for market programs and trading programs

A platform supports multiple processes, including market processes having respective market methodologies, trading processes having trading methodologies, platform processes providing services to the market processes and trading processes, and representation processes for coupling the market processes to external markets. The trading processes interact with each other and with external markets through the market processes.

Owner:XYLON LLC

Questionnaire network for mobile handsets and a trading system for contracts on user commitments to answer questionnaires

ActiveUS7261239B2Facilitates tradeEasy to displayMarket predictionsFinanceBulk purchasingLibrary science

Owner:QUALTRICS

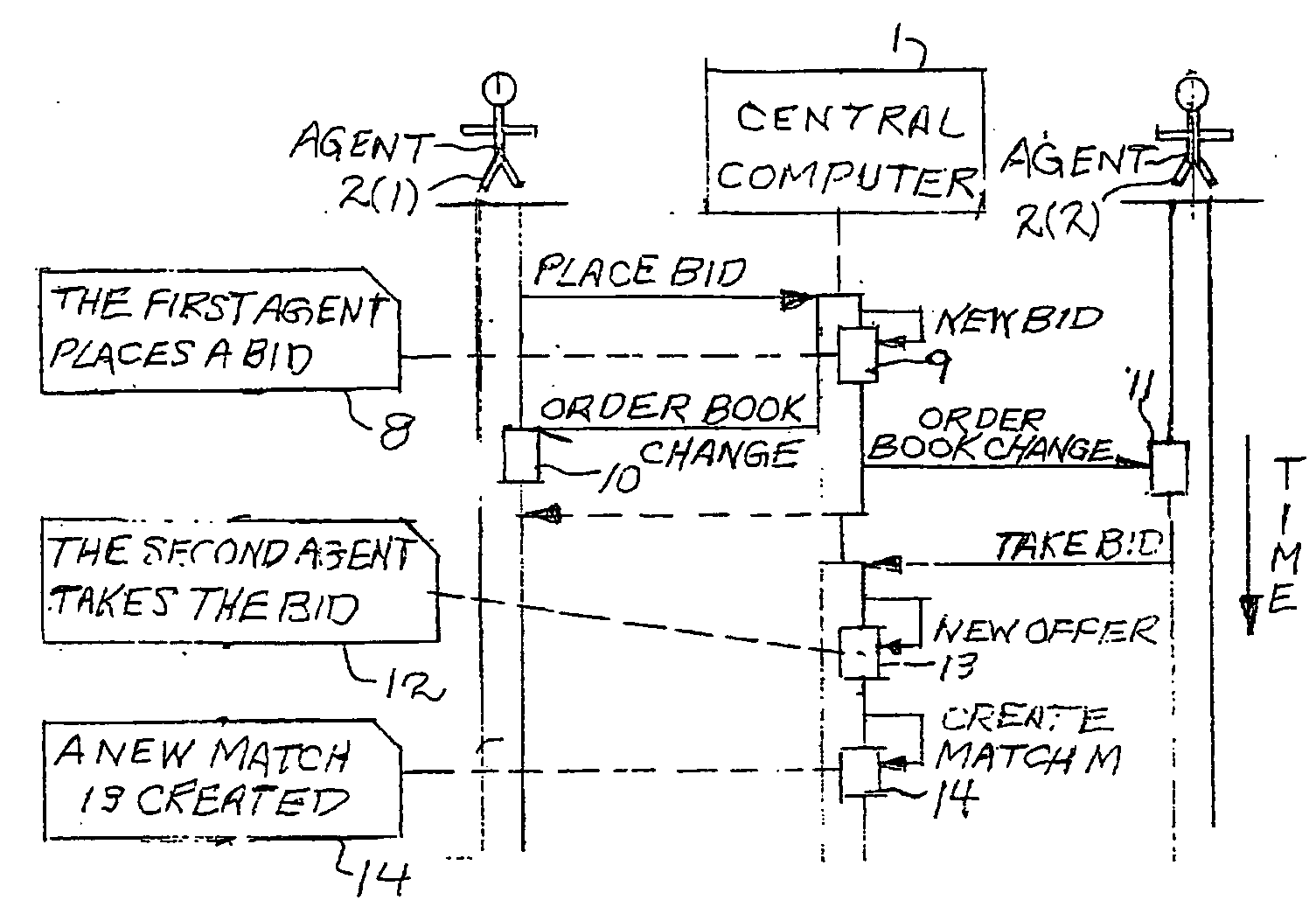

Single-period auctions network decentralized trading system and method

InactiveUS7970689B2Controlling the riskFacilitates tradeFinanceCommerceComputer scienceNetwork processing

A method and system serve for network dealing for conducting single-period auctions where there is one seller and at least one buyer, but typically multiple buyers. The method and system allow for posting of at least one or multiple items offered for sale on a network by a computer at the seller interconnected to other computers on the network. Bids are submitted by buyers for the items offered for sale with the seller requiring predetermined information about the buyer submitting bids before determining a selling price. The seller applies a selected set of criteria to strike out bids the seller does not wish to consider and applies a seller determined criteria to determine the price at which the seller is willing to sell the item(s).

Owner:SETEC ASTRONOMY

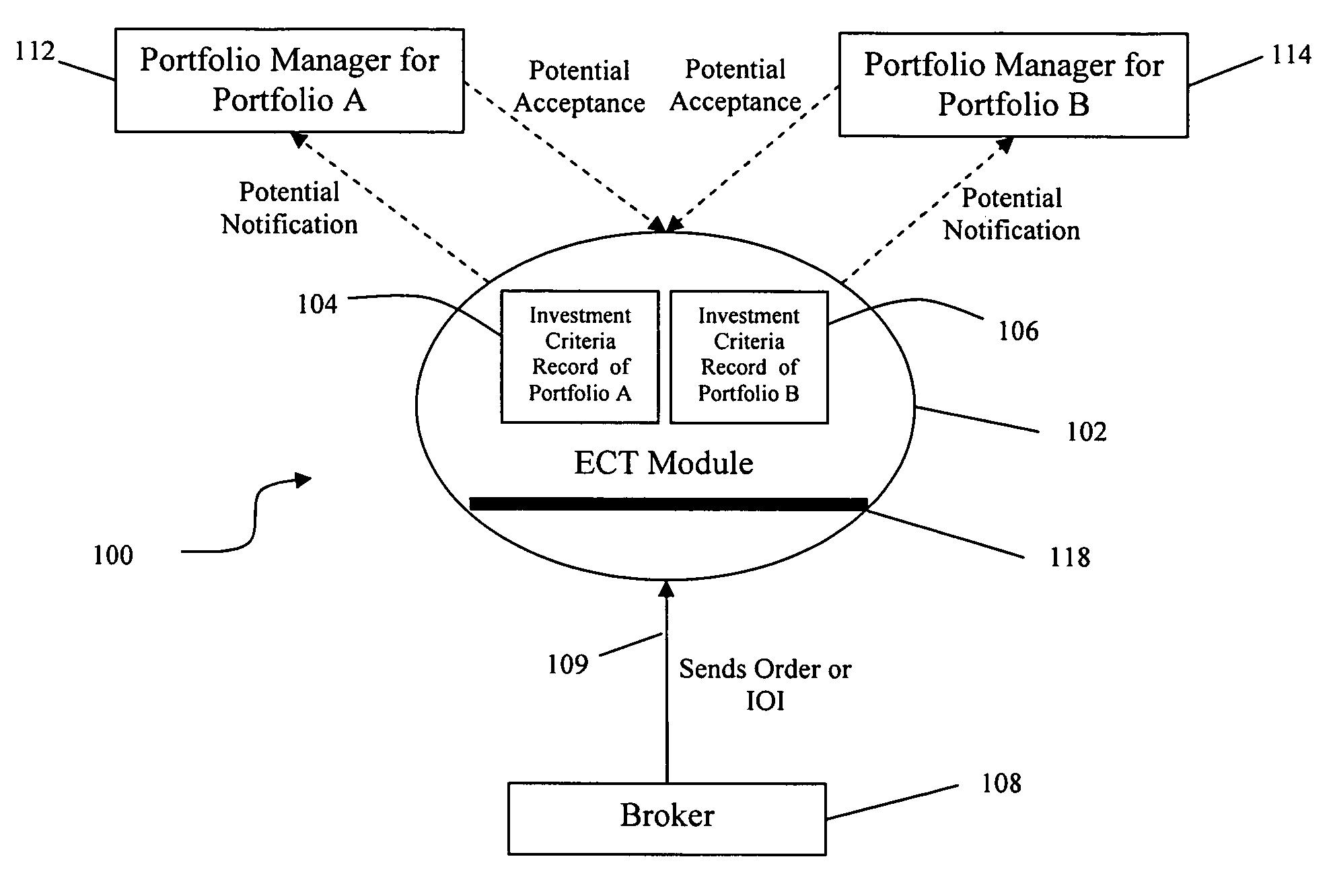

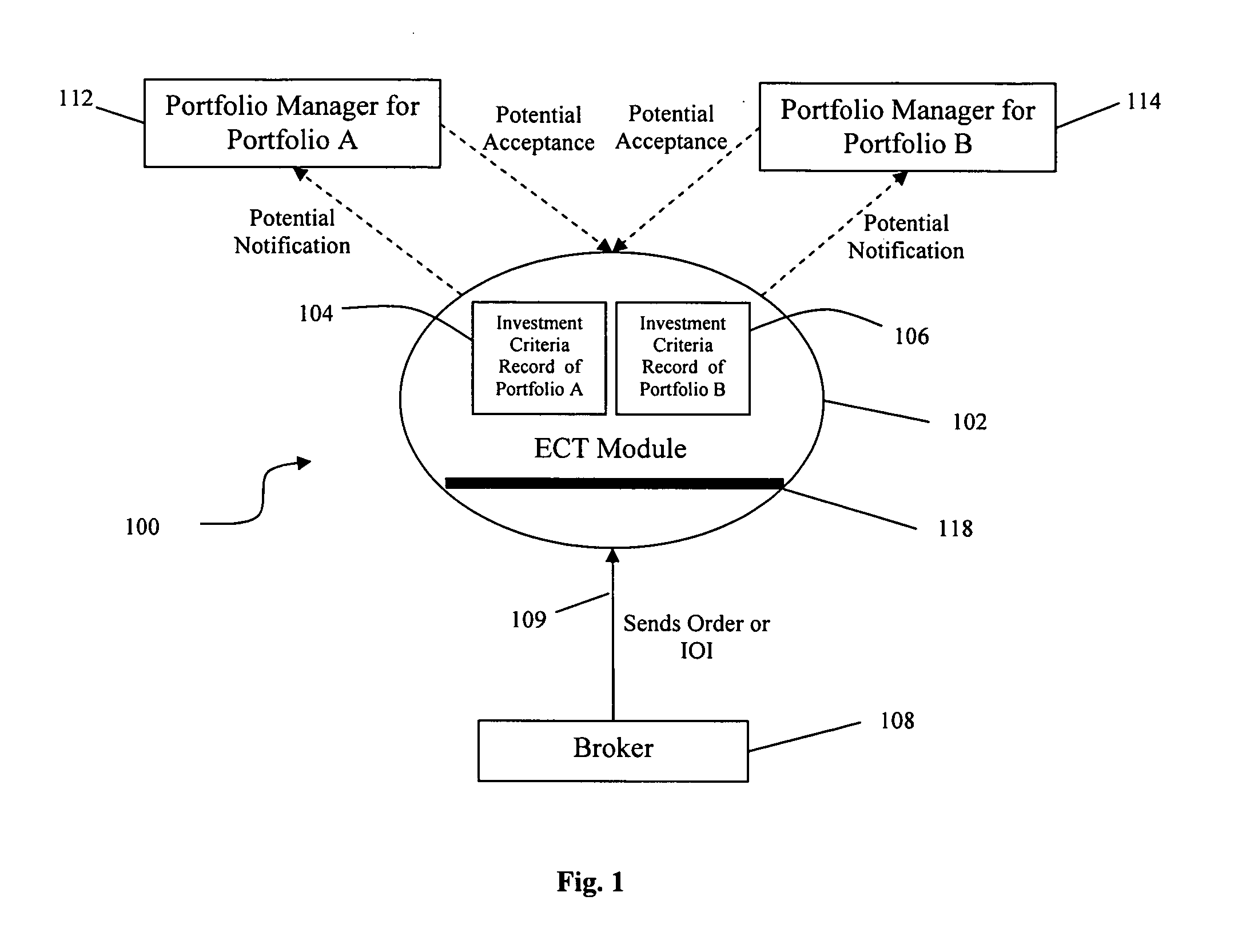

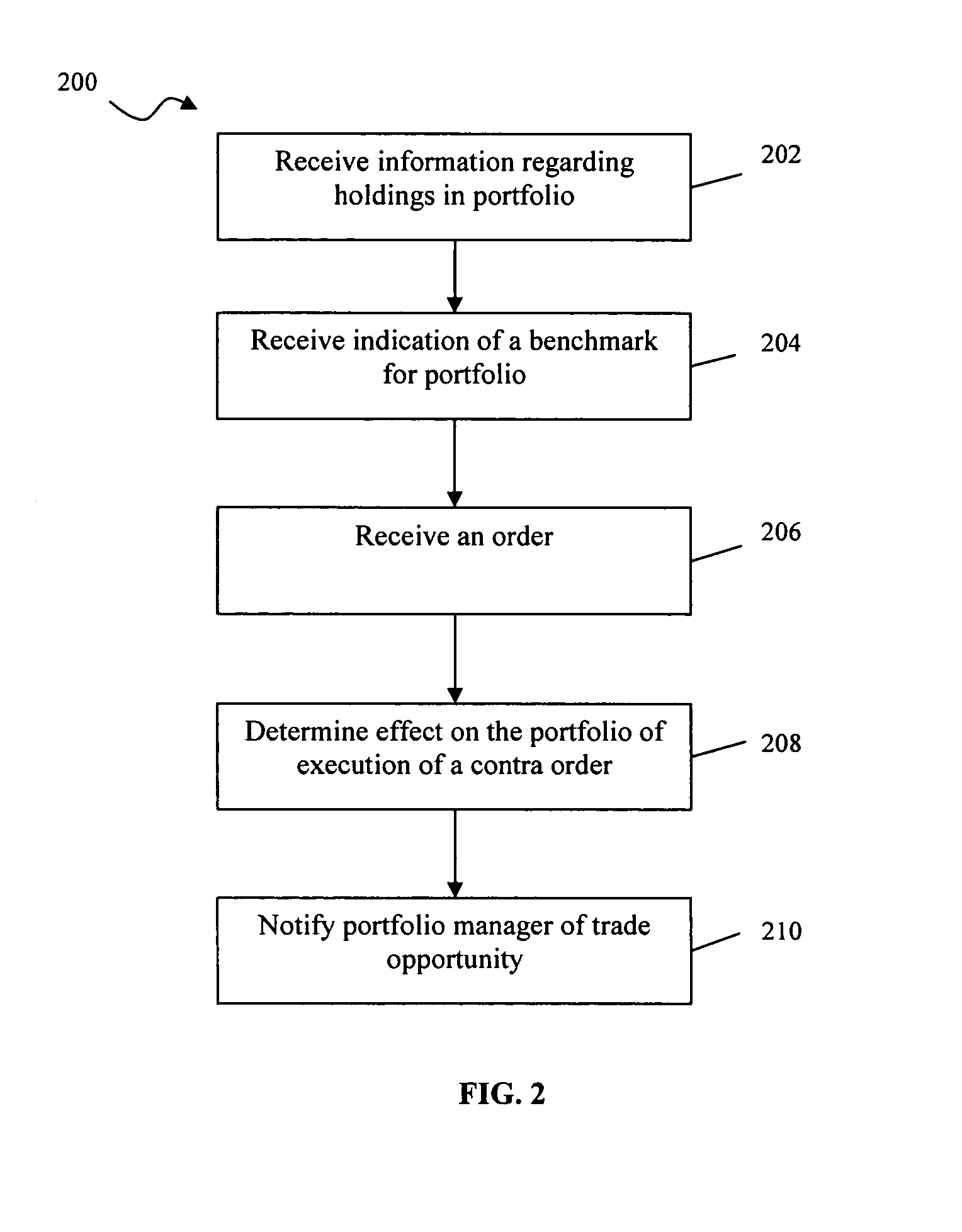

Electronic trade facilitation system and method

Systems and methods configured to alert a portfolio manager (or other asset manager, investor, or proxy) as to the presence of a trade opportunity, such as an order, acceptance of which would improve a portfolio managed by the portfolio manager. The systems and methods may facilitate trading in securities that are illiquid, and additionally may increase anonymity in placing orders.

Owner:UPSTREAM TECH

Routing control for orders eligible for multiple markets

Trading processes are operative to route orders from order rooms to market processes, which process the orders according to respective market methodologies. The order routing strategy can be embodied in a decision table having rules with conditions and actions to be taken when the conditions are true. Accordingly, order rooms can readily configure and reconfigure trading processes.

Owner:XYLON LLC

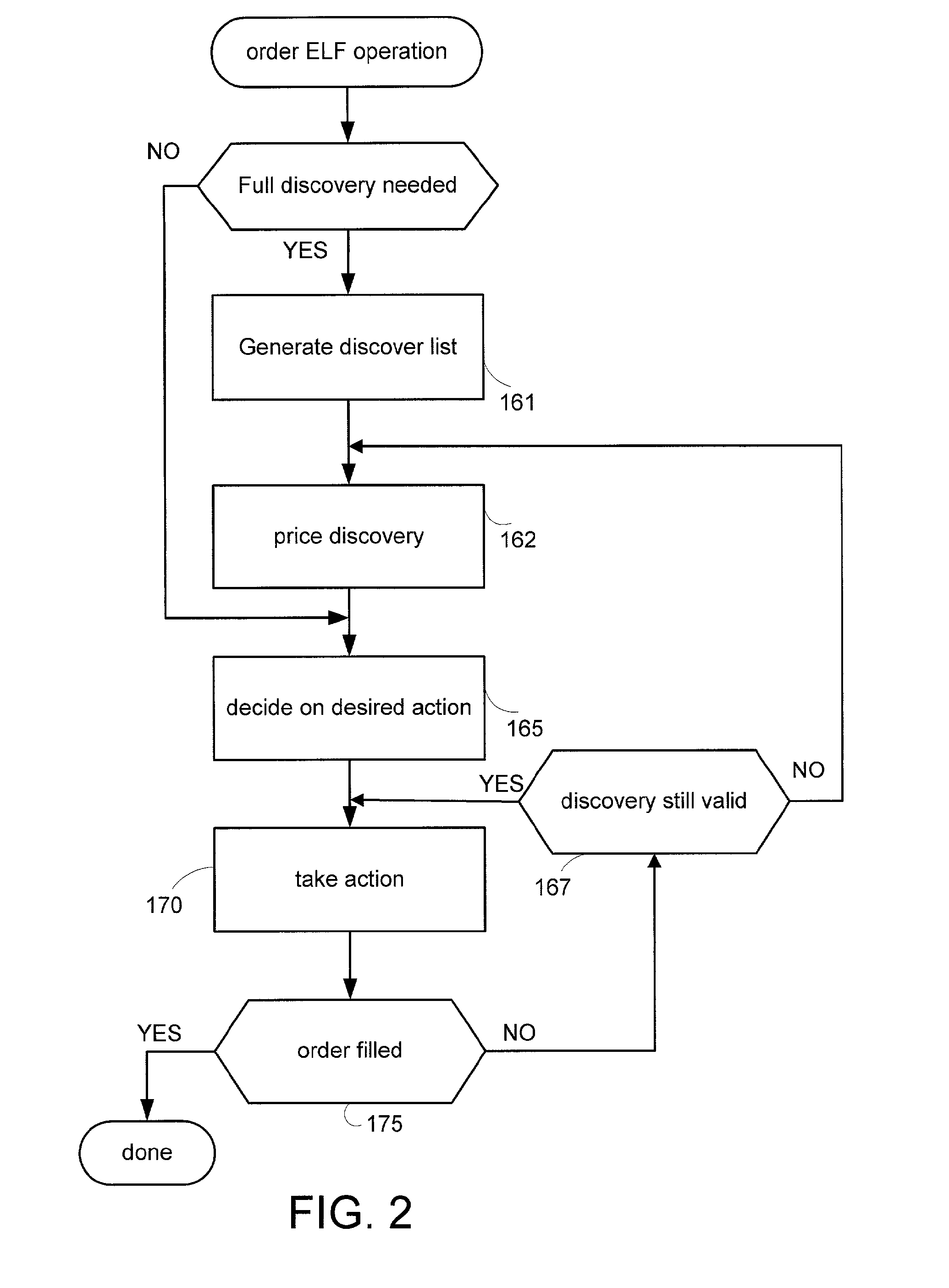

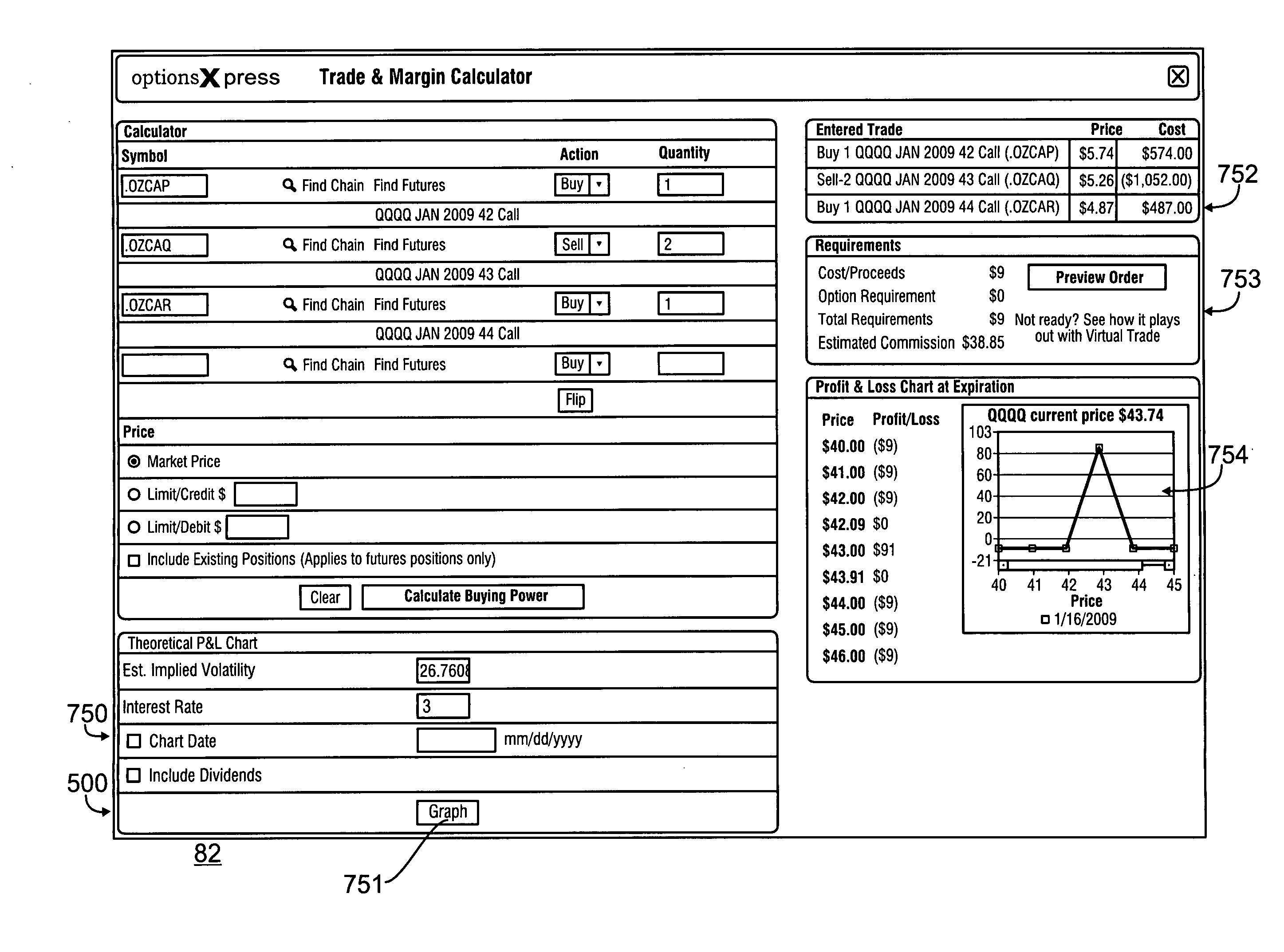

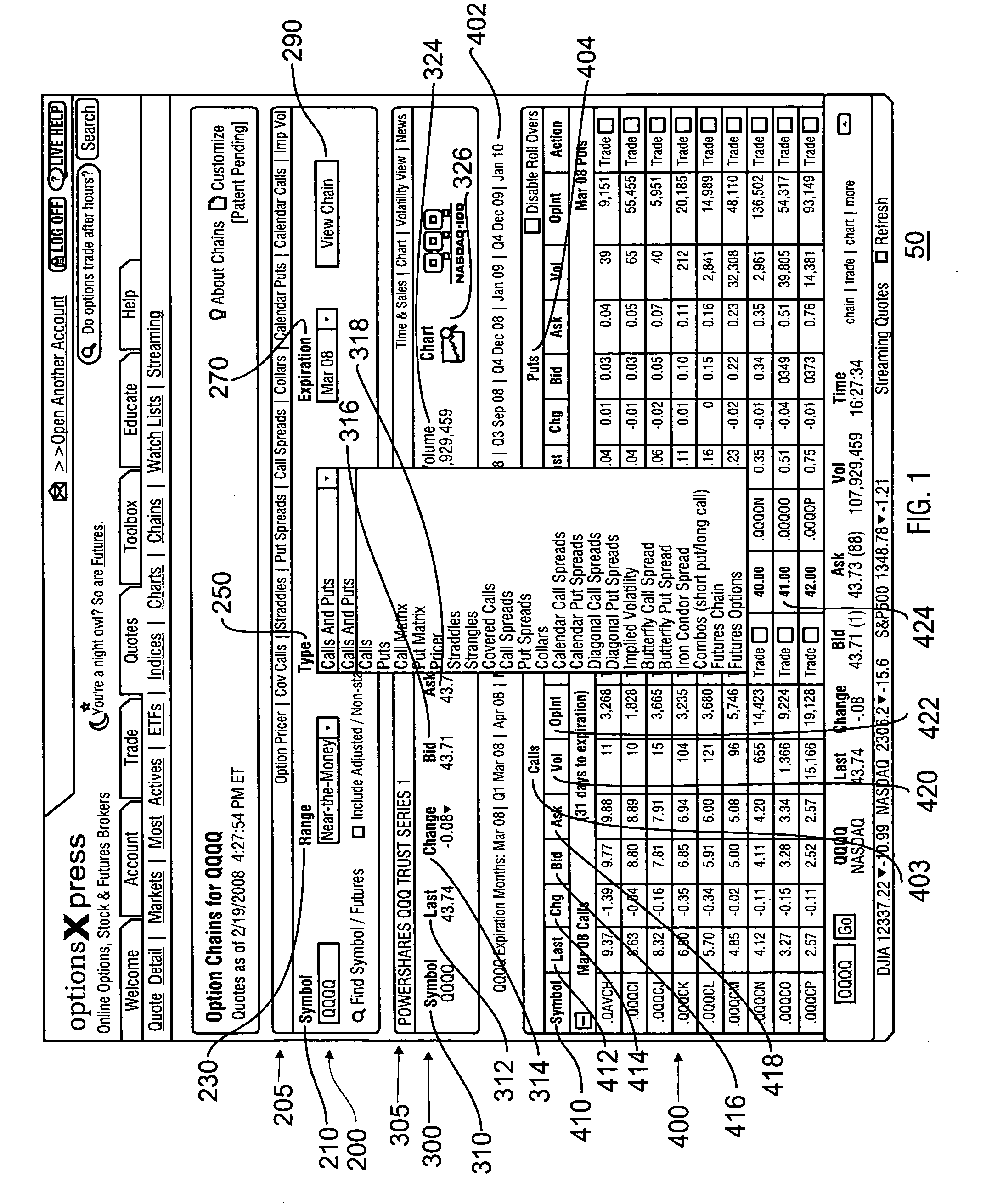

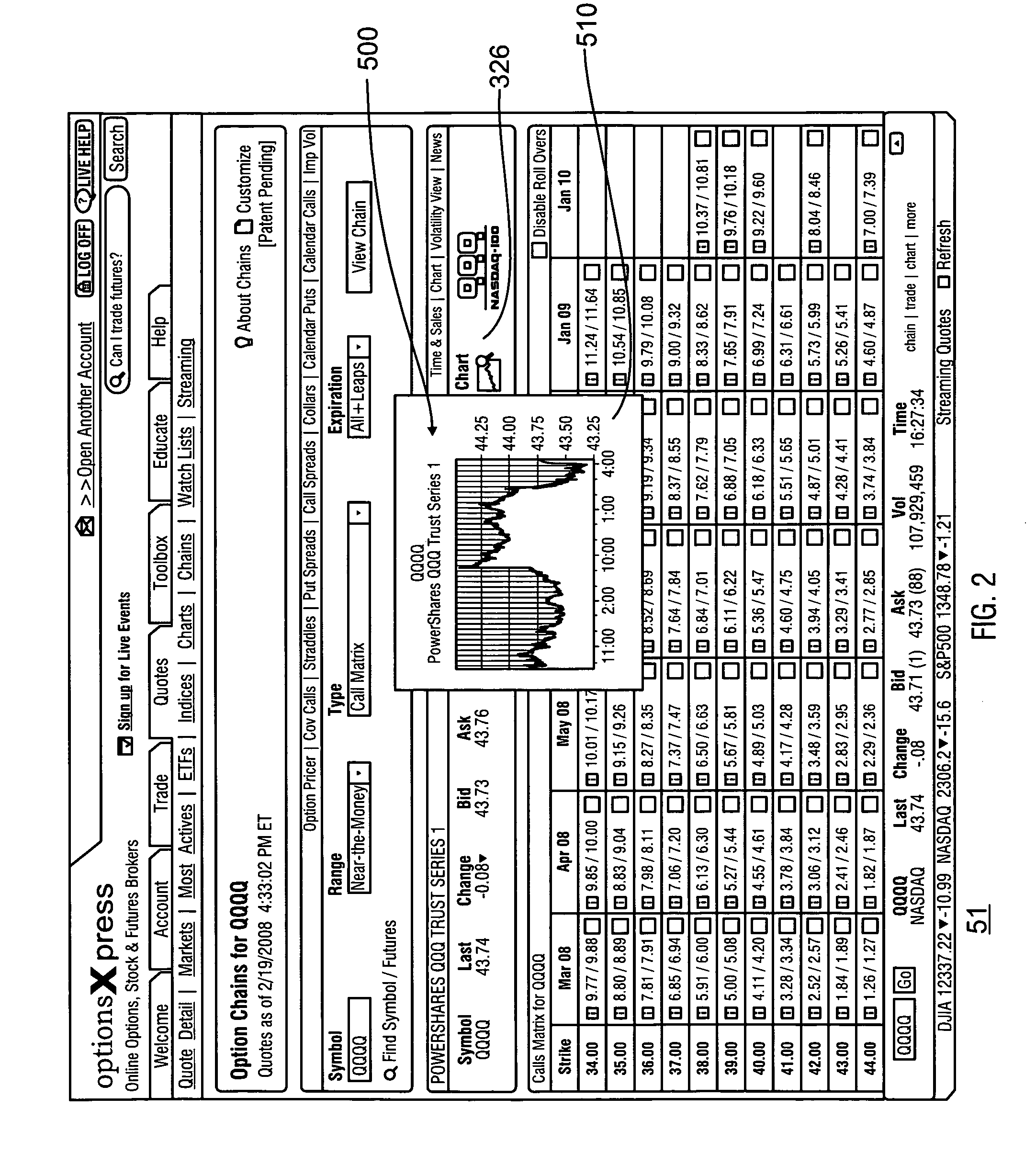

Trading system and methods

The present invention is directed to a system and method that facilitates the more fully informed and efficient trading of items of value, including securities. According to the present invention, certain embodiments permit a customer to determine the merits of and to execute a trade from a single screen. One embodiment of the present invention provides a single option chain trading screen enabling a customer to view a matrix of all available options for a given security, including the various strike prices, expiration dates, and whether they are calls or puts. Another embodiment provides a customer with a single option chain trading screen allowing a customer to “hover” at or near various icons to obtain supplemental information without leaving the trading screen, and use a triple-action selection component to ultimately execute a trade.

Owner:CHARLES SCHWAB & CO INC

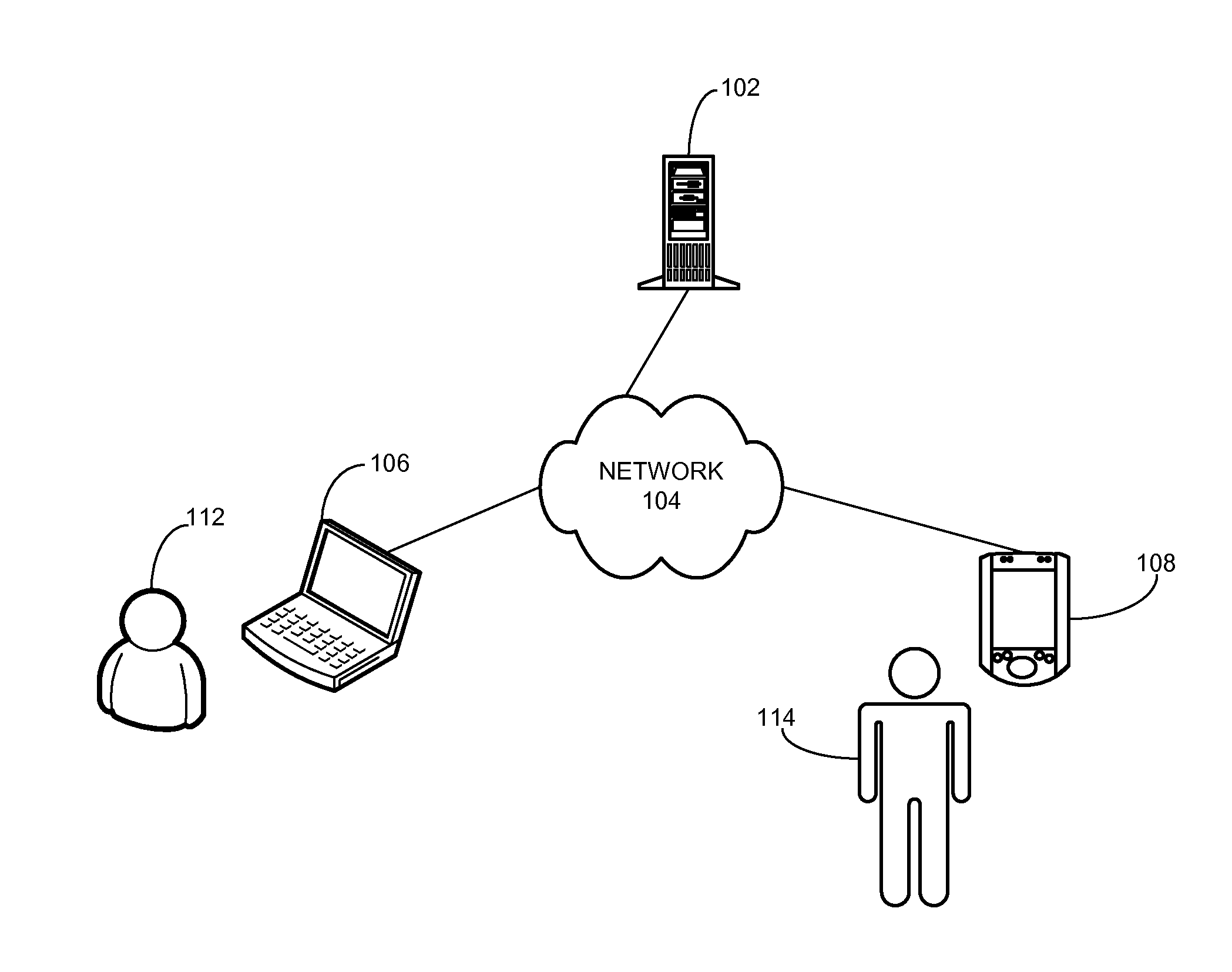

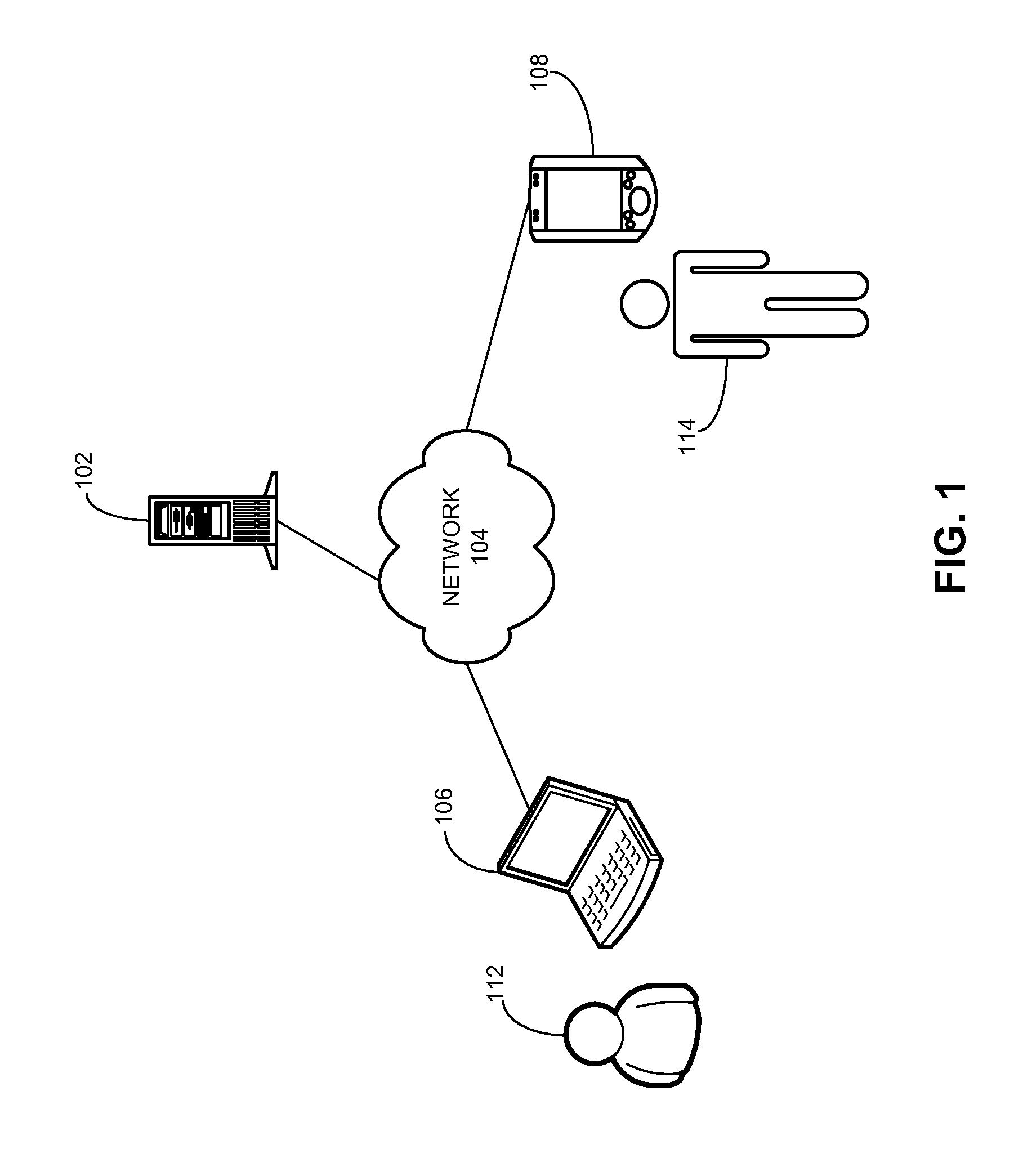

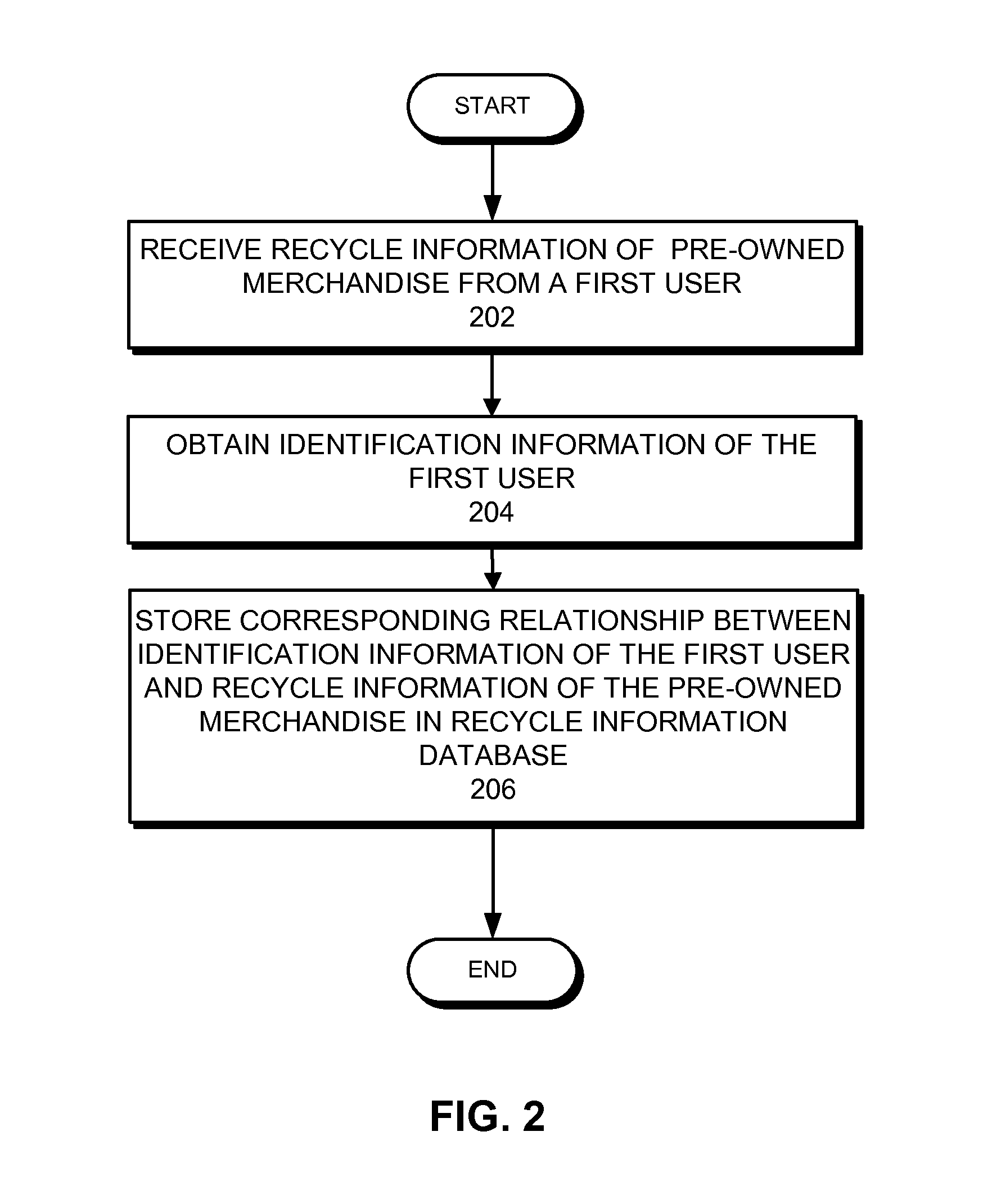

Method and system for providing a transaction platform for pre-owned merchandise

ActiveUS20160012503A1Facilitates tradeDigital data information retrievalBuying/selling/leasing transactionsWorld Wide WebData library

One embodiment of the present invention provides a system for facilitating trading of pre-owned merchandise. During operation, the system receives, at a server, recycle information associated with an item that a first user intends to purchase and stores the recycle information and identification information of the first user in a database. The recycle information specifies identification and price information associated with the item. The system receives, from a second user, a request for an offer price for a for-sale item. The system then queries the database to identify one or more users who intend to purchase the for-sale item, calculates offer prices provided by the identified users for the for-sale item, and provides a list of the identified users and the calculated offer prices to the second user.

Owner:ALIBABA GRP HLDG LTD

Questionnaire network for mobile handsets and a trading system for contracts on user commitments to answer questionnaires

ActiveUS20050150943A1Convenient recordingEasy to optimizeMarket predictionsFinanceBulk purchasingLibrary science

A questionnaire network makes it possible to create, disseminate, conduct questionnaires or surveys on mobile handsets and to collect results for processing and storage. The questionnaire network is powered by a questionnaire creation tool and a questionnaire trading system. A questionnaire trading system for QTime makes it possible for producers of QTime, such as carriers, and consumers of QTime, such as product manufacturers and advertising companies, to buy or sell QTime in bulk and to trade in QTime as a commodity. In one embodiment, supplementary information and preambles that are part of a questionnaire are captured in audio form using the questionnaire creation tool and are stored selectively along with the questionnaire in a carrier's questionnaire repository or separately at a hosted repository.

Owner:QUALTRICS

Single-period auctions network decentralized trading system and method

A method and system serve for network dealing for conducting single-period auctions where there is one seller and at least one buyer, but typically multiple buyers. The method and system allow for posting of at least one or multiple items offered for sale on a network by a computer at the seller interconnected to other computers on the network. Bids are submitted by buyers for the items offered for sale with the seller requiring predetermined information about the buyer submitting bids before determining a selling price. The seller applies a selected set of criteria to strike out bids the seller does not wish to consider and applies a seller determined, criteria to determine the price at which the seller is willing to sell the item(s).

Owner:SETEC ASTRONOMY

System and method for exchanging reward currency

Methods and systems are disclosed for allowing two users to exchange reward currency, such as points, between two different loyalty programs at an exchange rate that is set by and agreed upon by the users themselves. An offer to exchange X points of one loyalty program for Y points of another loyalty program is received from a user and is made available to other users. Another user satisfied with the offered exchange accepts the offer, and the account balances of the two users are adjusted. In some embodiments, a fee is charged to one or both of the users for effecting the trade. The fee is then forwarded to the loyalty programs. In other embodiments, the loyalty programs specify rules that must be complied with before a trade can occur.

Owner:POINTS COM

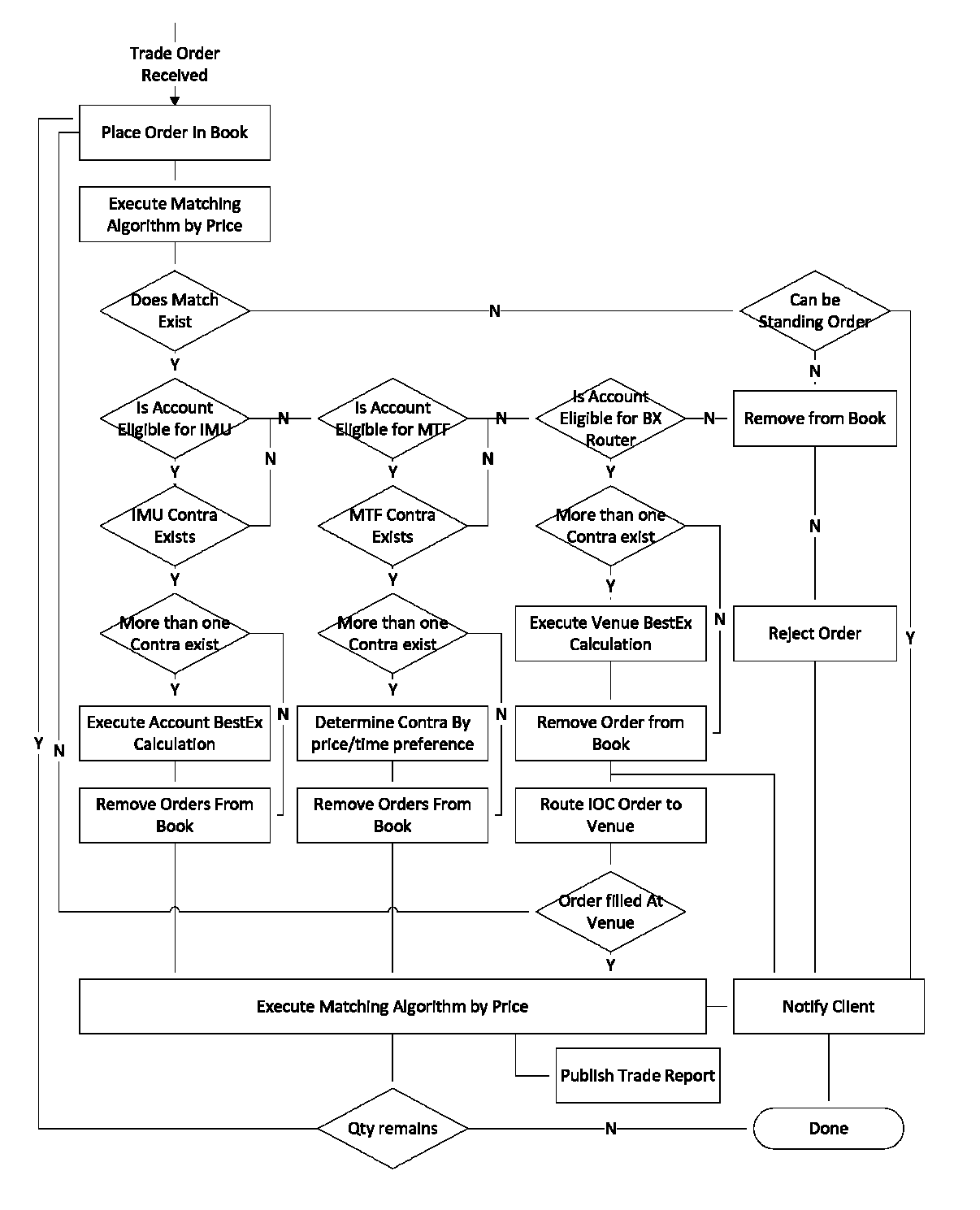

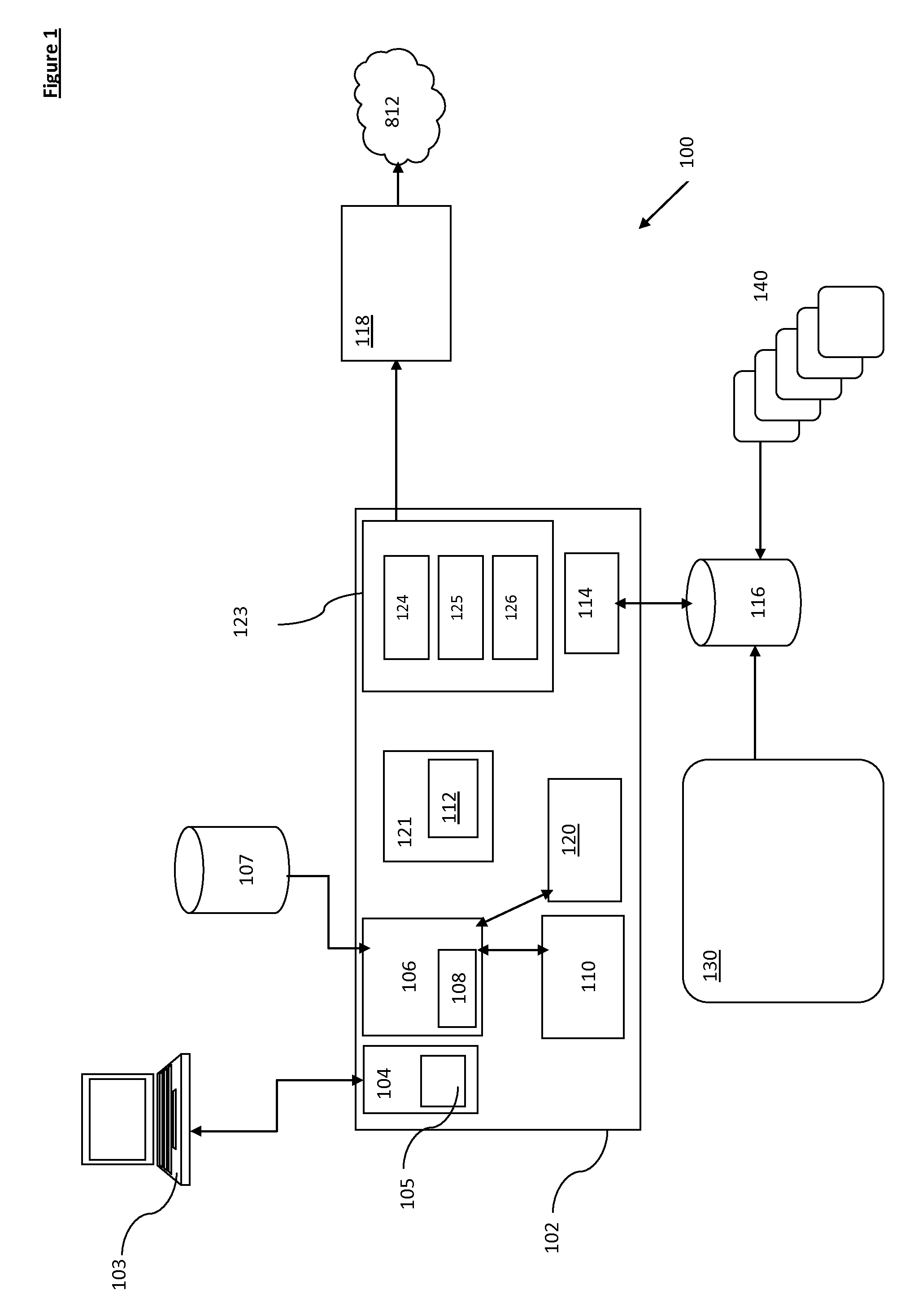

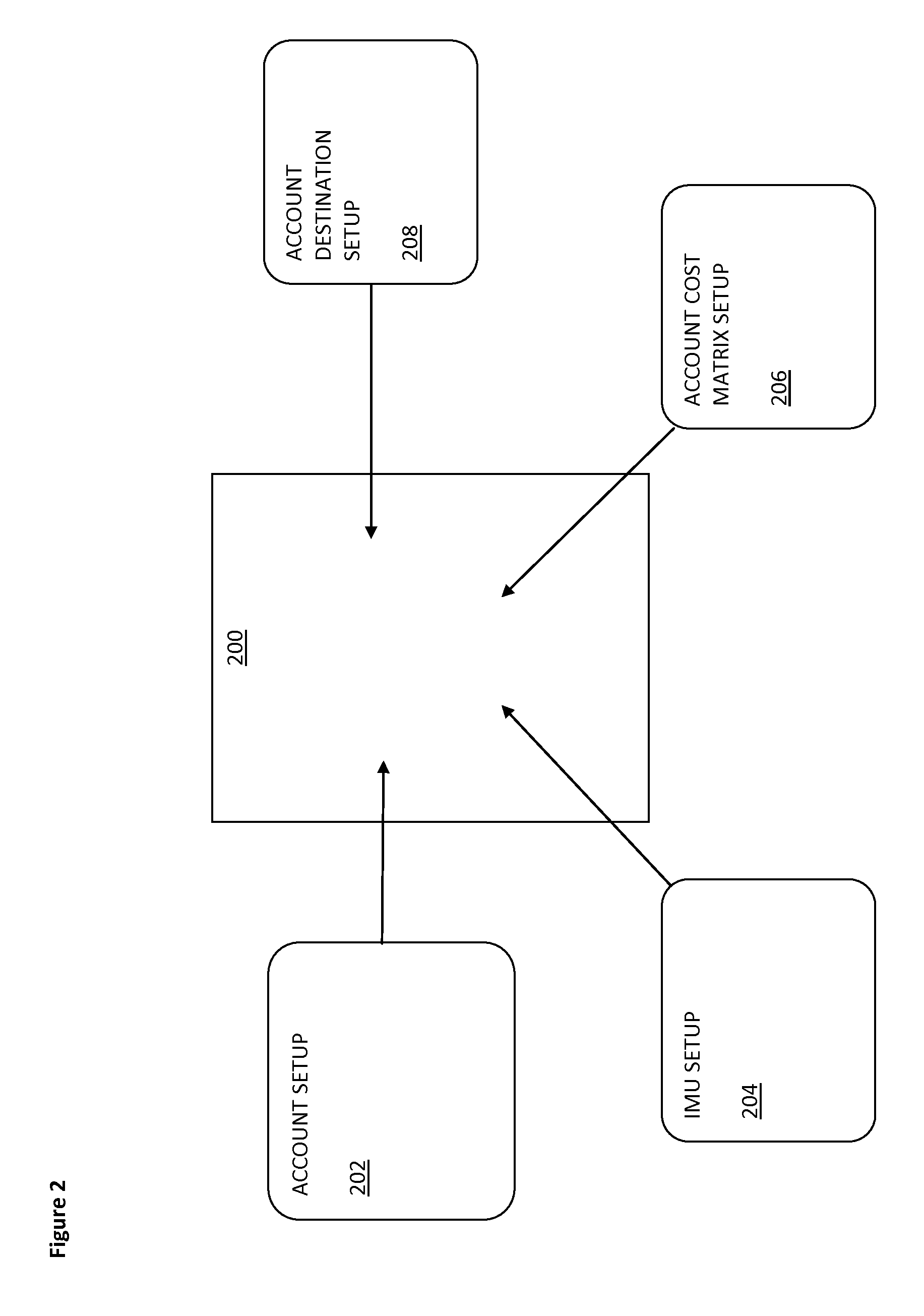

Trading system

A Computer apparatus configured to process transactions in fungible assets on behalf of account holders on a client controlled, order by order basis, via account controlled and configured private books of business and public books, as well as proactively route public orders to external venues based on analysis of account-specific best execution configurations including venue cost assignments and account-specific venue routing parameters.

Owner:OPENMATCH HLDG LLC

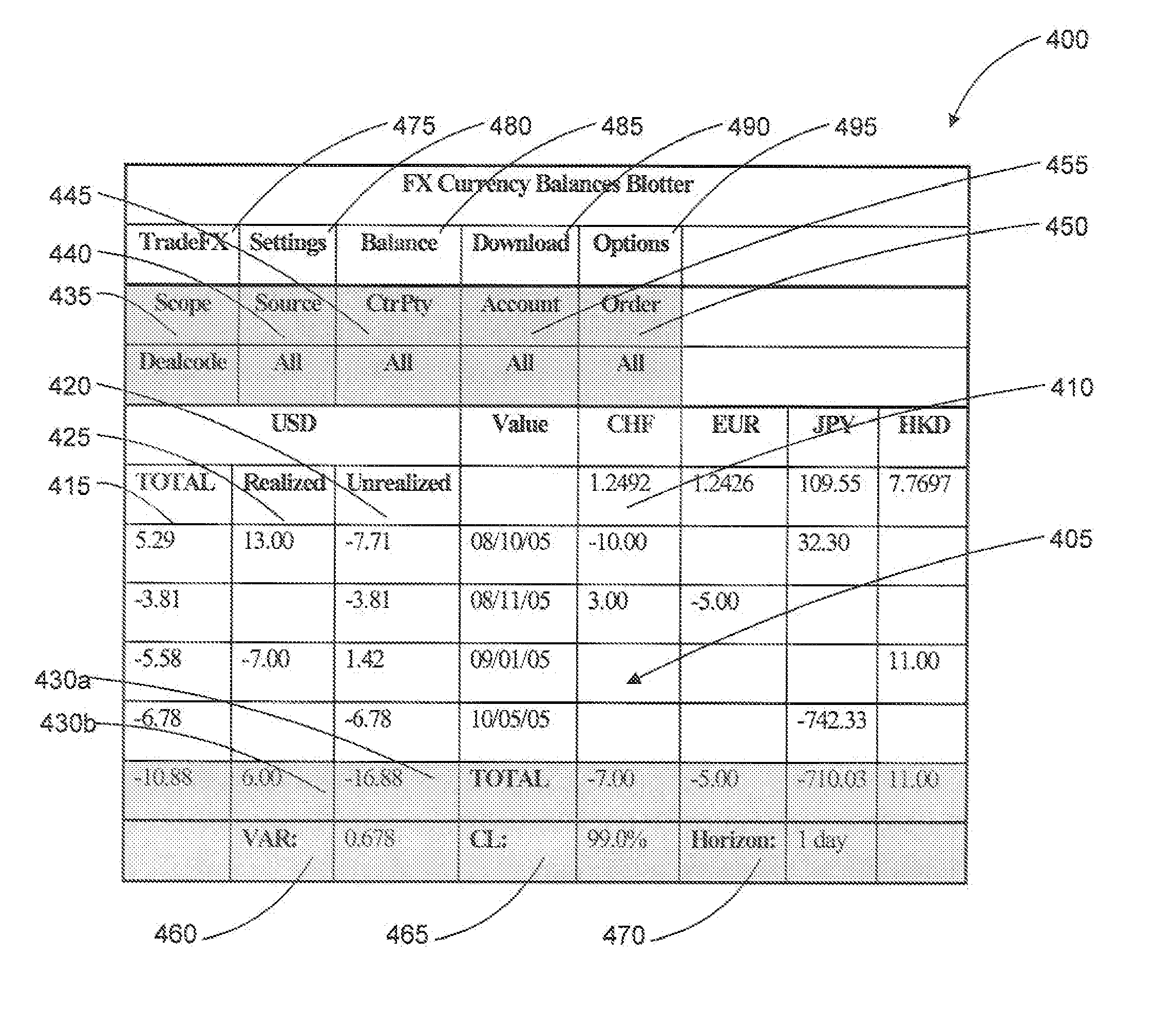

System and method for facilitating foreign currency management

ActiveUS8036966B2Real time monitoringFacilitate hedgingComplete banking machinesFinanceFinancial transactionOnline trading

Systems, methods, and computer program products for facilitating managing foreign currency exposure, such as that with respect to transactions in financial interests involving foreign currency exchange across multiple electronic trading platforms, financial systems, accounting systems or the like. Users may monitor their net foreign exchange (“FX”) exposure in different currencies and on different value dates due to trading in foreign exchange, foreign currency-denominated equities, fixed-income securities, commodities, services, goods and other transactions involving foreign currency exchange. Various tools may be provided for monitoring and managing FX exposures across multiple trading platforms through ready access to FX liquidity sources as well as for conducting financial transactions involving foreign currency exchange, such as FX hedging or other types of transactions.

Owner:BLOOMBER FINANCE LP

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com