Rule engine-based method and system for monitoring exceptional service of bank

A technology of business and rules, applied in the financial field, can solve problems such as inability to understand whether the monitoring results are correct, poor comprehensibility, and difficult to understand defined formulas

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0058] In order to enable those skilled in the art to better understand the solutions of the embodiments of the present invention, the embodiments of the present invention will be further described in detail below in conjunction with the drawings and implementations.

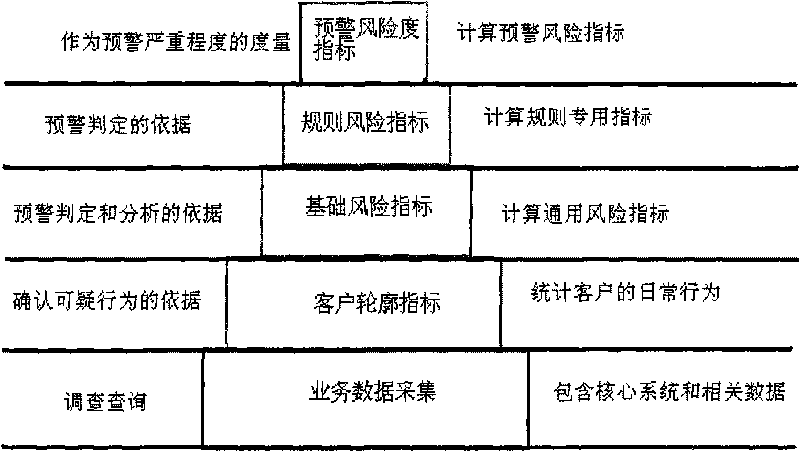

[0059] First, refer to figure 1 It is a schematic diagram of the KRI-based risk index quantification system of the present invention, which adopts a hierarchical design from bottom to top, and is divided into object profile index, basic risk index, rule risk index, risk measurement index, etc. based on business data mart. In order to adapt to the ever-changing requirements of regulatory agencies and the flexible setting of each financial institution's risk preference, the system also provides flexible configuration of parameters for indicators of each layer, and can use the rule engine to achieve graphical and flexible parameterization of risk warning rules configuration.

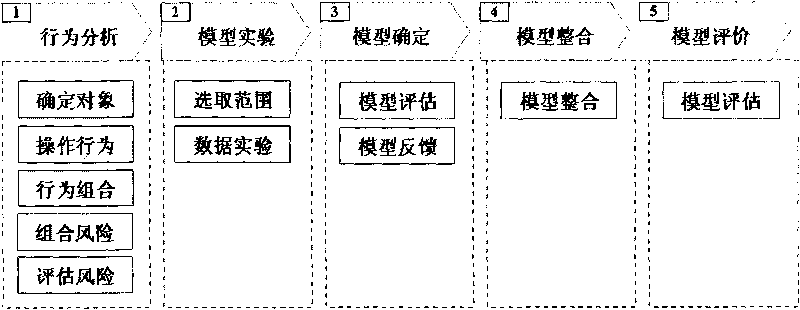

[0060] refer to figure 2 It is a sc...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com