Method for managing fiscal cash registers by using GPS (global positioning system) equipment

The technology of a tax-controlled cash register and a GPS device is applied in the management application field of the tax-controlled cash register, which can solve the problems of the owner's economic loss and the wrong invoice amount.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment

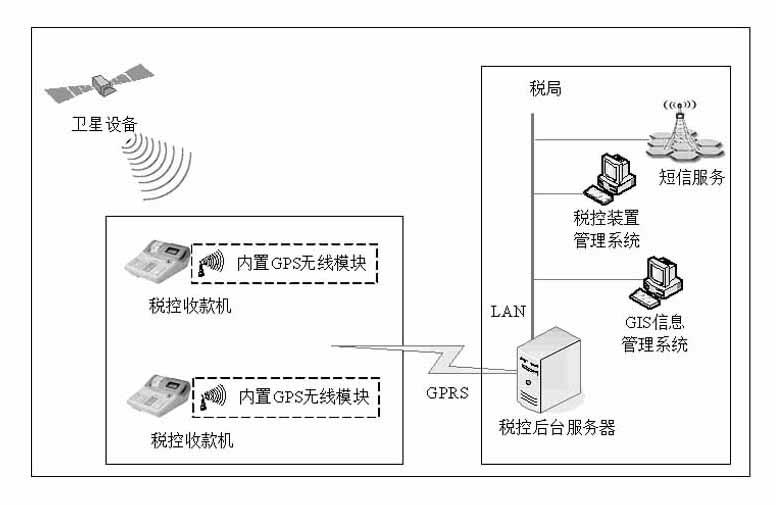

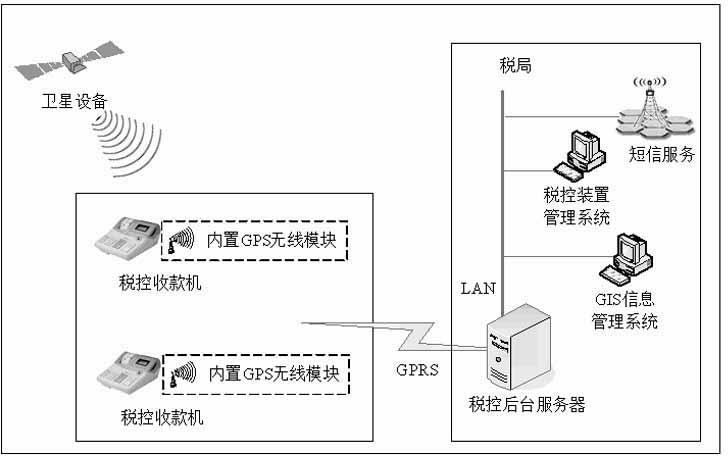

[0025] The method of the present invention utilizes the GPS wireless module device to spatially locate the tax control cash register, and utilizes the wireless transmission function of GPRS (wireless packet service) to monitor the tax control business data to achieve safe management of the tax control machine. The purpose of security management of invoicing data, the realization steps are as follows:

[0026] 1) When the tax-controlled cash register is issuing invoices, it can give early warning reminders for invoices whose billing limit exceeds a reasonable range, and can retain invoice details and abnormal billing data for a declaration cycle, and send these data to Tax control background server.

[0027] 2) The tax control cash register uses GPS equipment to establish a communication channel with the tax control background server deployed by the tax bureau on the Internet through GPRS (General Packet Radio Service). : The transmission message format defined in "Machine Spe...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com