Tax-involved risk assessment method for real-estate project

A technology for risk assessment and real estate, which is applied in the fields of instruments, finance, and data processing applications, and can solve problems such as lack of clarity, low accuracy, and difficulty in keeping up with the standard cost

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

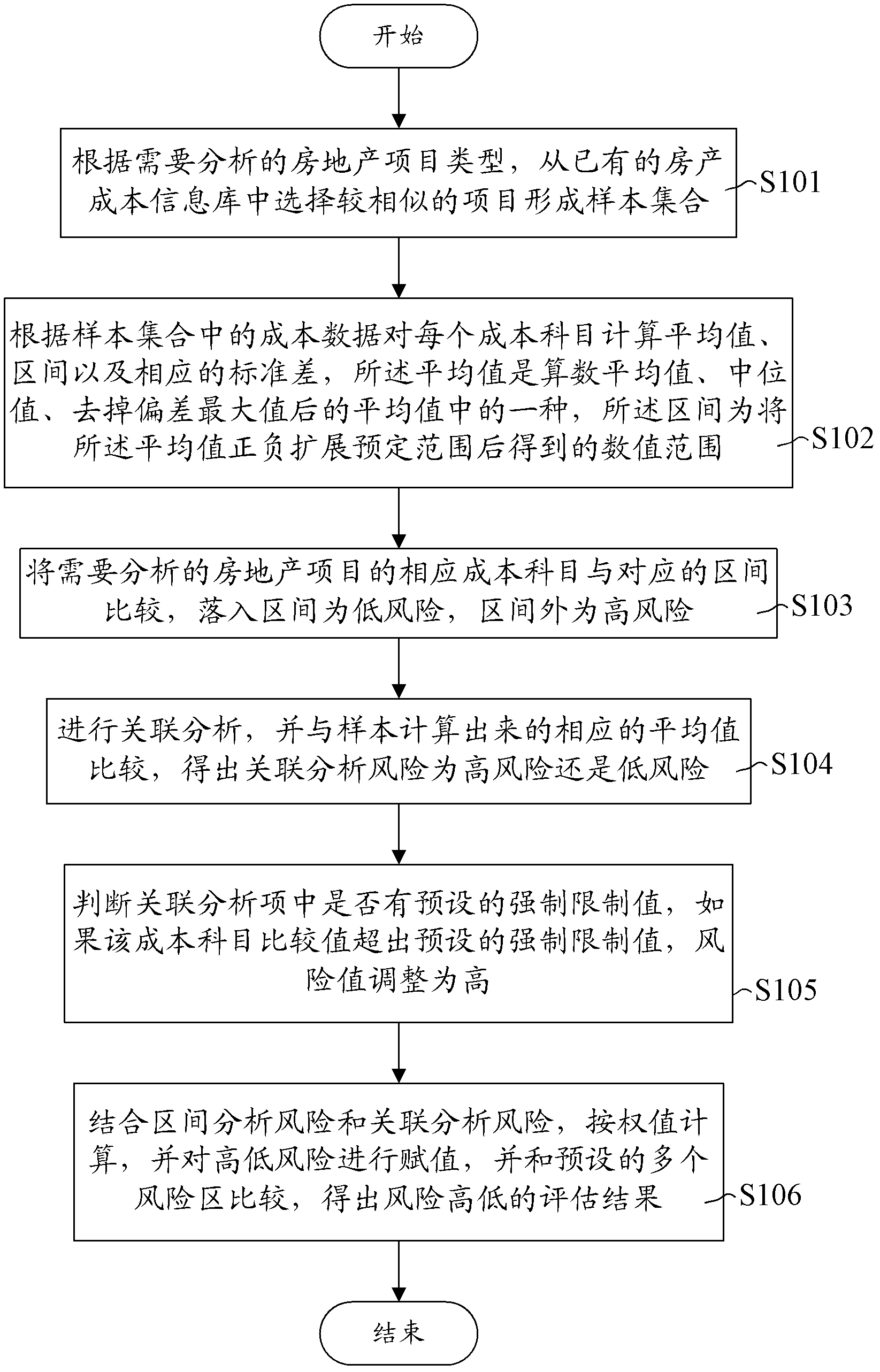

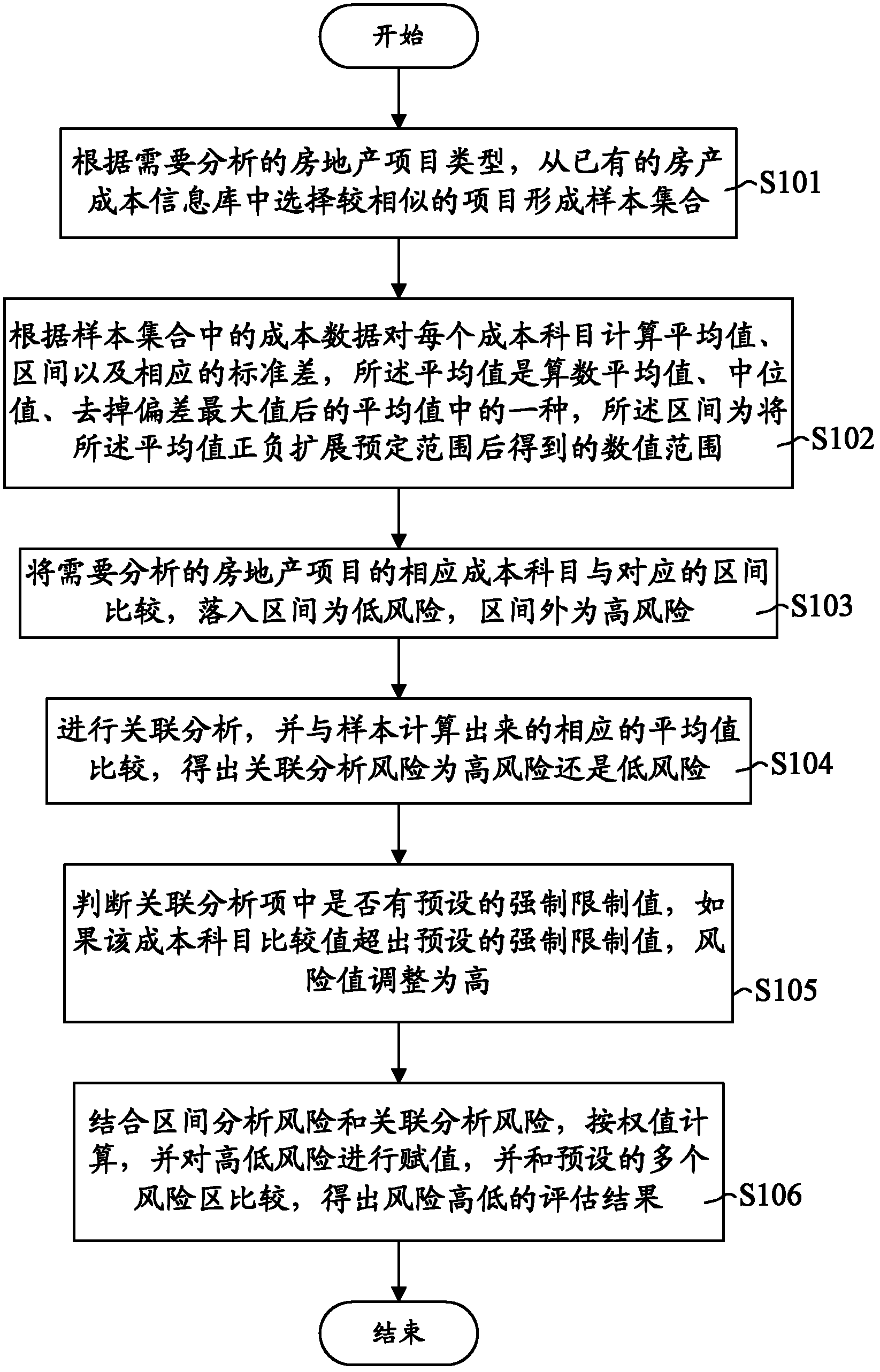

[0022] In order to solve the problem of inaccurate tax-related risk assessment of traditional real estate projects, a more accurate tax-related risk assessment method for real estate projects is proposed.

[0023] This method is based on the comparison of similar housing types. Firstly, it is necessary to divide real estate with different purposes such as residences, shops, and office buildings. It is also necessary to divide real estate with the same purpose according to structure, decoration, area or business district. In a word, the more satisfied the similarity condition is, the more accurate (precise) the analysis result (value) will be.

[0024] This method needs a real estate project cost information database, which can be established according to the data of the real estate land value-added tax liquidation audit report.

[0025] This method classifies real estate cost items, and risk analysis is based on each cost item.

[0026] The comparison of cost items themselves...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com