Enterprise credit evaluation method based on gray fuzzy

A credit evaluation, gray and fuzzy technology, applied in the field of enterprise credit evaluation of large-capacity multi-dimensional real-time data, can solve problems such as poor timeliness, poor reliability, and fuzzy

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

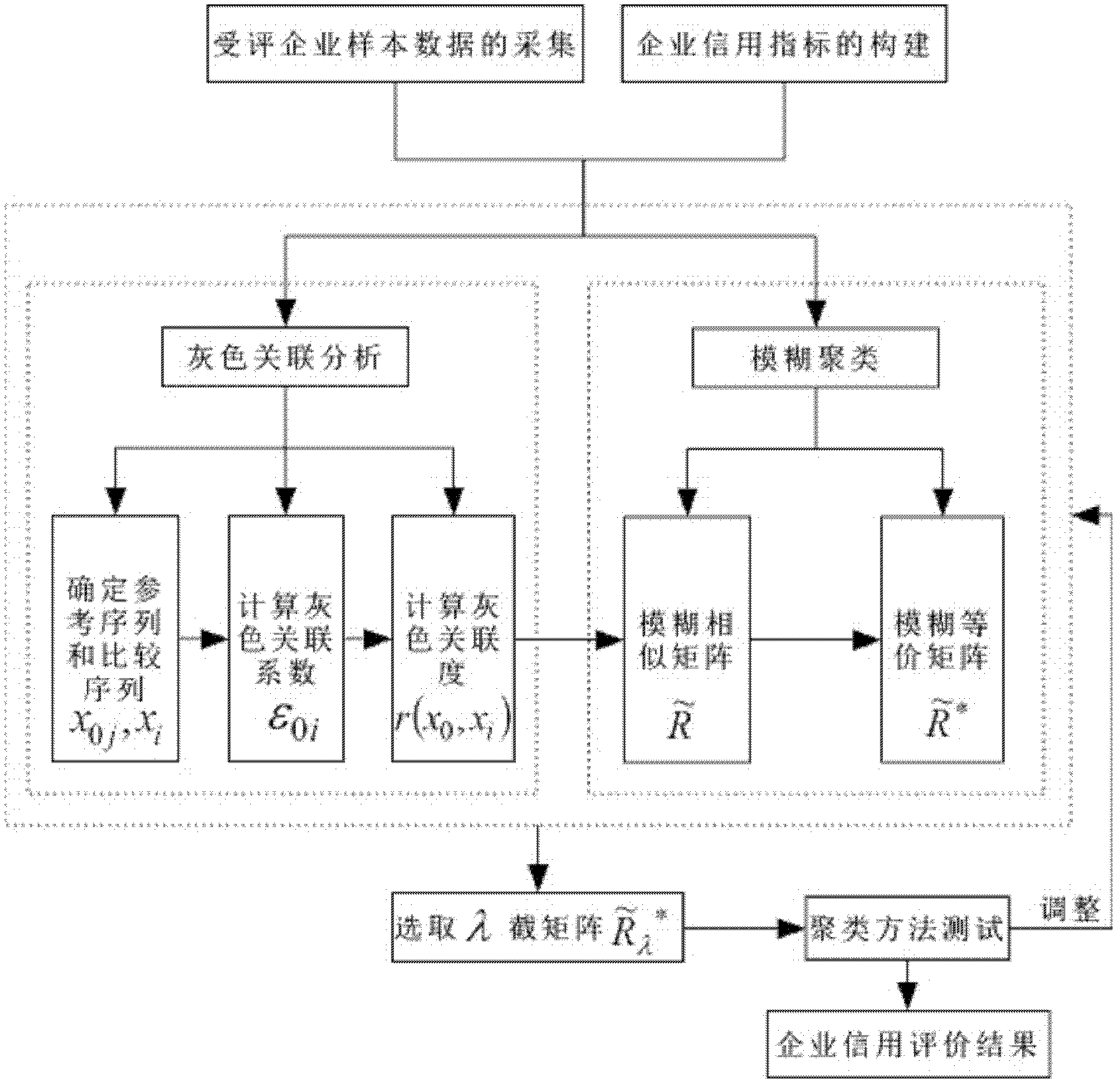

[0053] The present invention will be further described below in conjunction with the accompanying drawings.

[0054] refer to figure 1 , a gray fuzzy-based enterprise credit evaluation method, including the following steps:

[0055] 1) Multidimensional time series data initialization

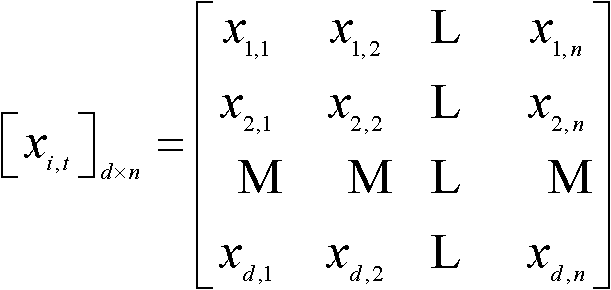

[0056] Time series refers to a sequence formed by arranging the values of a certain statistical indicator of a certain phenomenon at different times in chronological order. A d-dimensional time series of length n is defined as x i (t); {i=1, 2, L, d; t=1, 2, L, n}, where x i (t) means that when the time point is t, the i-th dimension variable x i value of .

[0057] This method stipulates that a d-dimensional time series of length n is represented in the form of a matrix as:

[0058] [ x i , t ] d ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com