Credit self-service acceptance system and method

A credit and acceptance machine technology, applied in data processing applications, instruments, finance, etc., can solve problems such as inconvenient distance, customers do not know where to apply for loans, and customers with poor credit, so as to prevent environmental and social risks, The effect of accurate and comprehensive credit investigation and efficient and transparent credit business

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0031] The present invention will be further described below in conjunction with the accompanying drawings and embodiments.

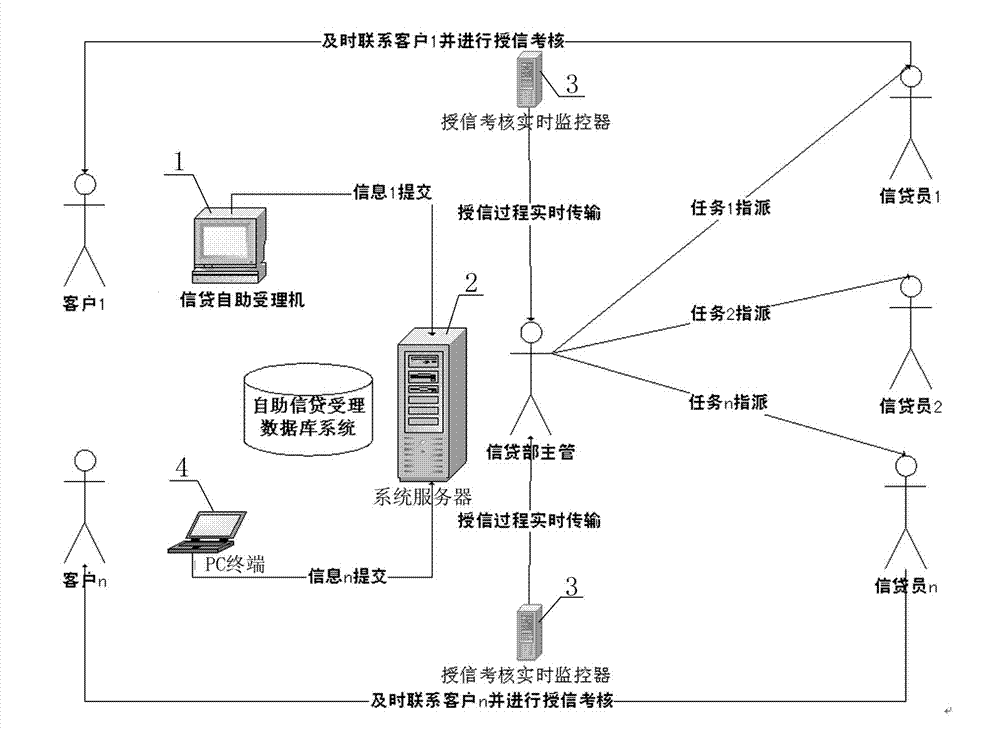

[0032] Such as figure 1 As shown, the principle diagram of the credit self-service acceptance system of the present invention is provided, which includes a credit self-service acceptance machine 1, a system server 2, a credit assessment real-time monitor 3, and a PC terminal 4. The shown credit self-service acceptance machine 1 is arranged on At the bank's business outlets, the credit self-service acceptance machine 1 is used to receive the credit application documents submitted by the applicant and scan the application documents. The credit self-service acceptance machine 1 uploads the scanned files to the system server 2 through the network. The system server stores the uploaded scanned files and distributes the business. The credit personnel obtain distribution tasks through the PC terminal 4 connected to the system server 2 in order to collect appli...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com