Intelligent centralized monitor method and system for bank personal business fraudulent conducts

A centralized monitoring and business system technology, applied in instruments, electrical digital data processing, finance, etc., can solve problems such as incomplete data analysis methods, no process execution mechanism, and difficulty in cross-system data collection, so as to achieve behavioral data integrity, The effect of improving the recognition rate

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0045] The present invention will be further described in detail below in conjunction with the accompanying drawings:

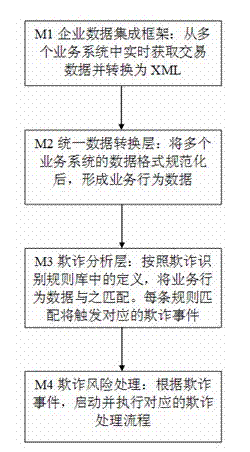

[0046] Such as figure 1 As shown, the method for real-time intelligent centralized monitoring of bank personal business fraud in the present invention includes the following four main steps:

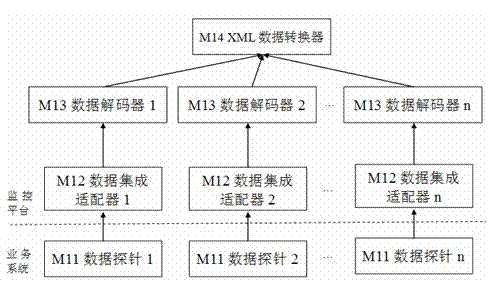

[0047] (1) Establish a lightweight enterprise data integration framework: M1 is a lightweight enterprise data integration framework that can simultaneously collect customer transaction data and customer attribute data from multiple bank personal business application systems, including: Customer profile data, customer transaction flow, transaction status, customer transaction environment, etc., and the frequency of data collection can be set to three modes: real-time, timed and batch according to needs. Generally speaking, the customer's transaction flow data and transaction status data are obtained in real time, the work status of tellers is collected regularly, and customer...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com