Cross-border payment rapid settling method based on credit big data

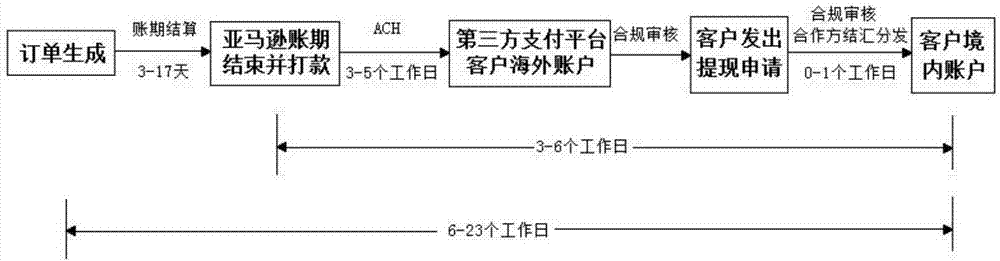

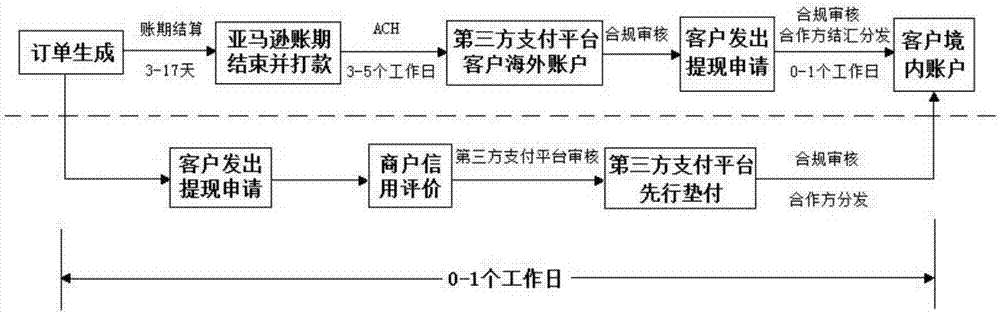

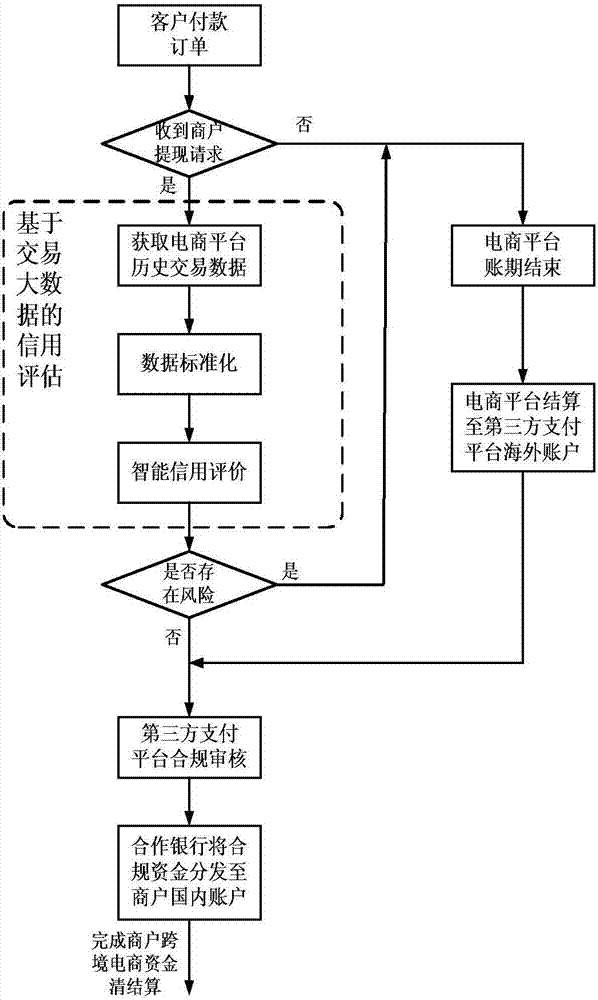

A big data and credit technology, applied in the field of cross-border payment, can solve problems affecting the efficiency of capital use, complex payment process, and increase the operational risk of cross-border merchants, so as to reduce capital cost and exchange rate, simplify cross-border settlement process, The effect of improving capital turnover efficiency

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

example 1

[0101] Merchant A,

[0102] x 1 = $50,000, X 2 = $3.5 million, X 3 = 30 months, X 4 = household appliances, X 5 =5,X 6 =4.9,

[0103] x 7 = 0.0003, X 8 =8,X 9 =4.8,X 10 =0.001,

example 2

[0105] Merchant B,

[0106] x 1 = $15,000, X 2 = $1 million, X 3 = 8 months, X 4 = Cosmetic, X 5 =10,X 6 = 3.8,

[0107] x 7 =0.02, X 8 =12,X 9 =4.3,X 10 =0.03

[0108] According to the above rules, merchant A's corresponding order funds go through the advance payment process, and merchant B's corresponding order funds go through the normal process.

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com