Patents

Literature

596 results about "Third-Party Payments" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Third-Party Payment. When a student's tuition, fees, and/or bookstore purchases are billed directly to an outside agency or organization (not a family member nor owned by you or a family member), the process is termed “third-party billing”.

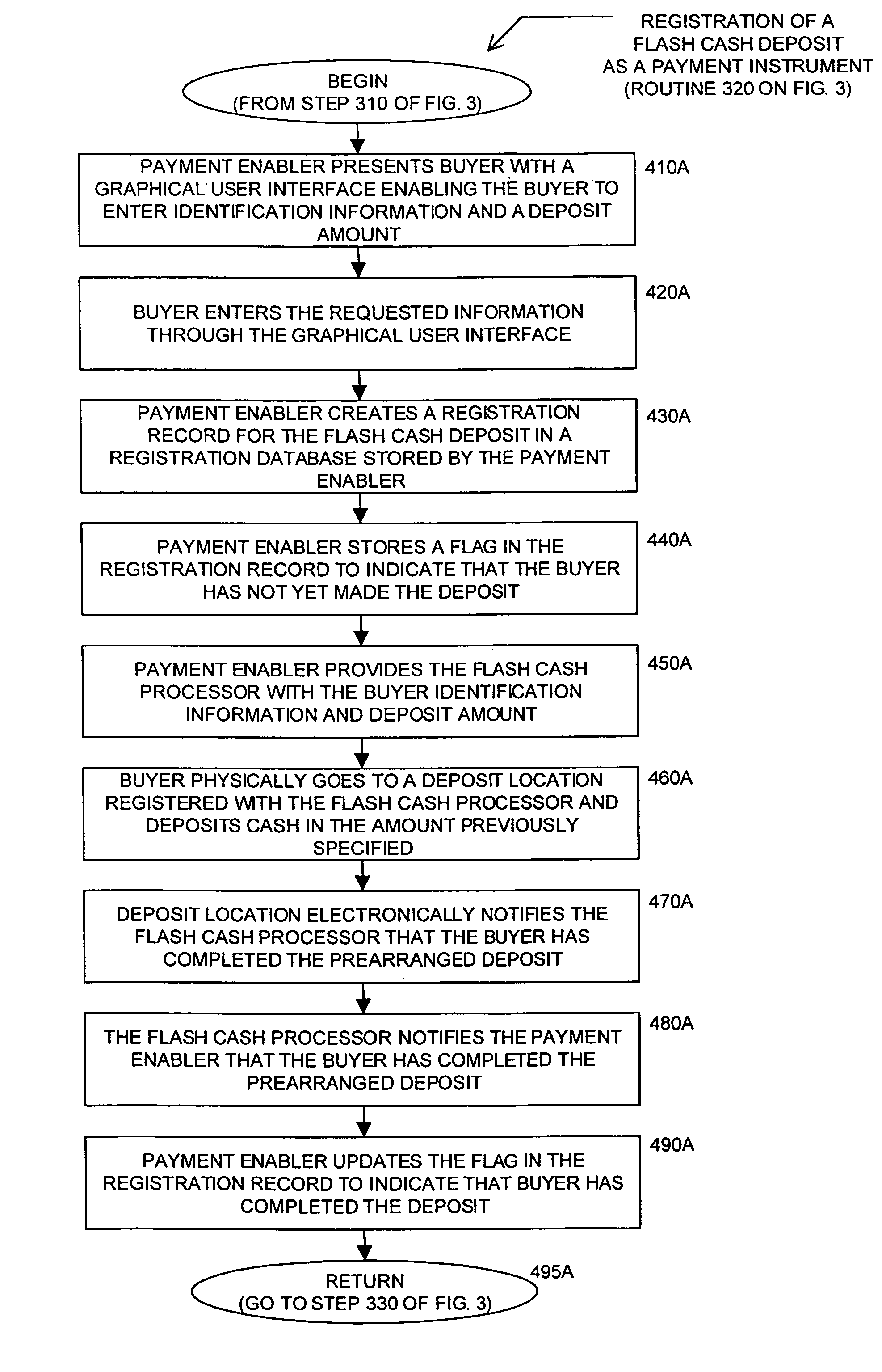

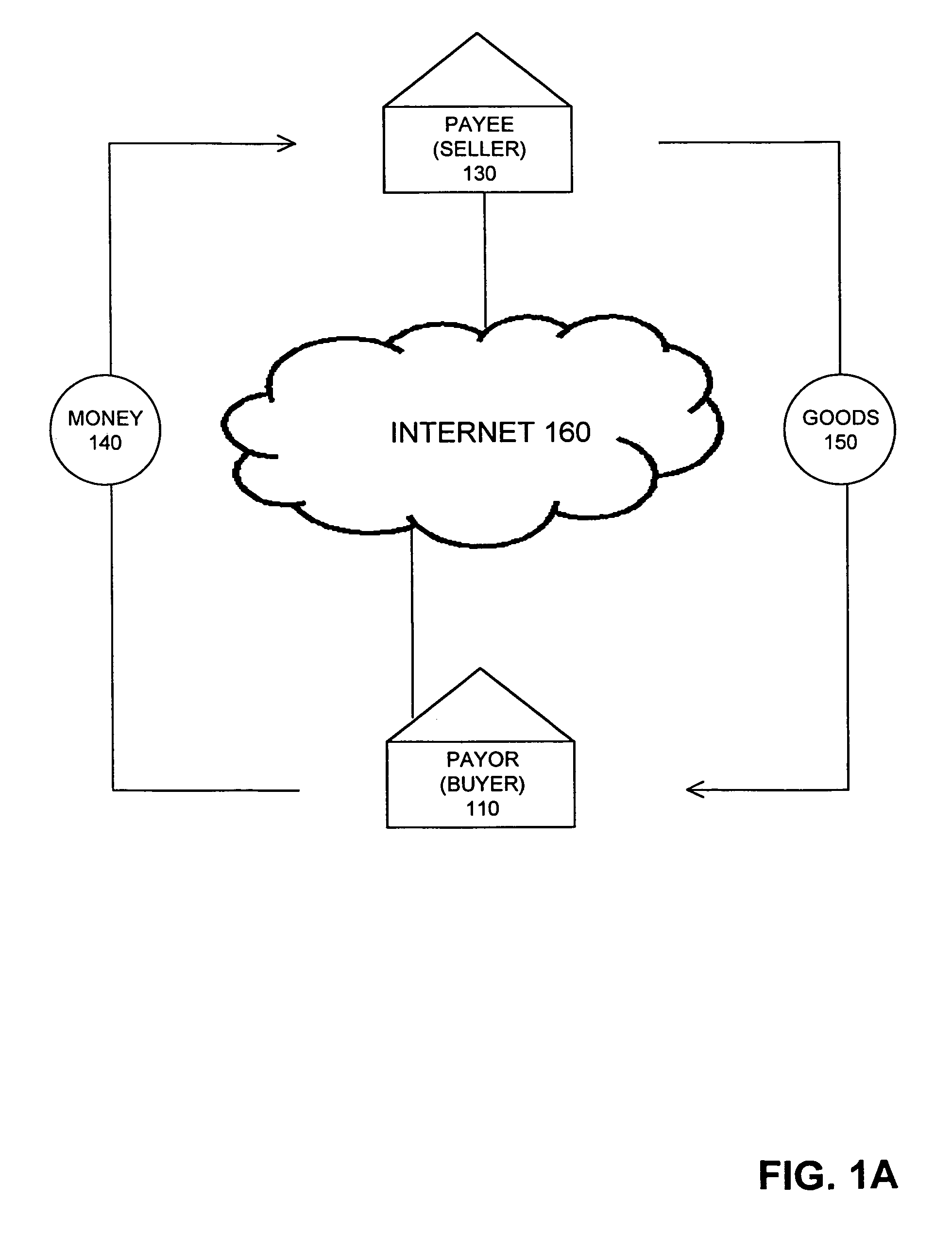

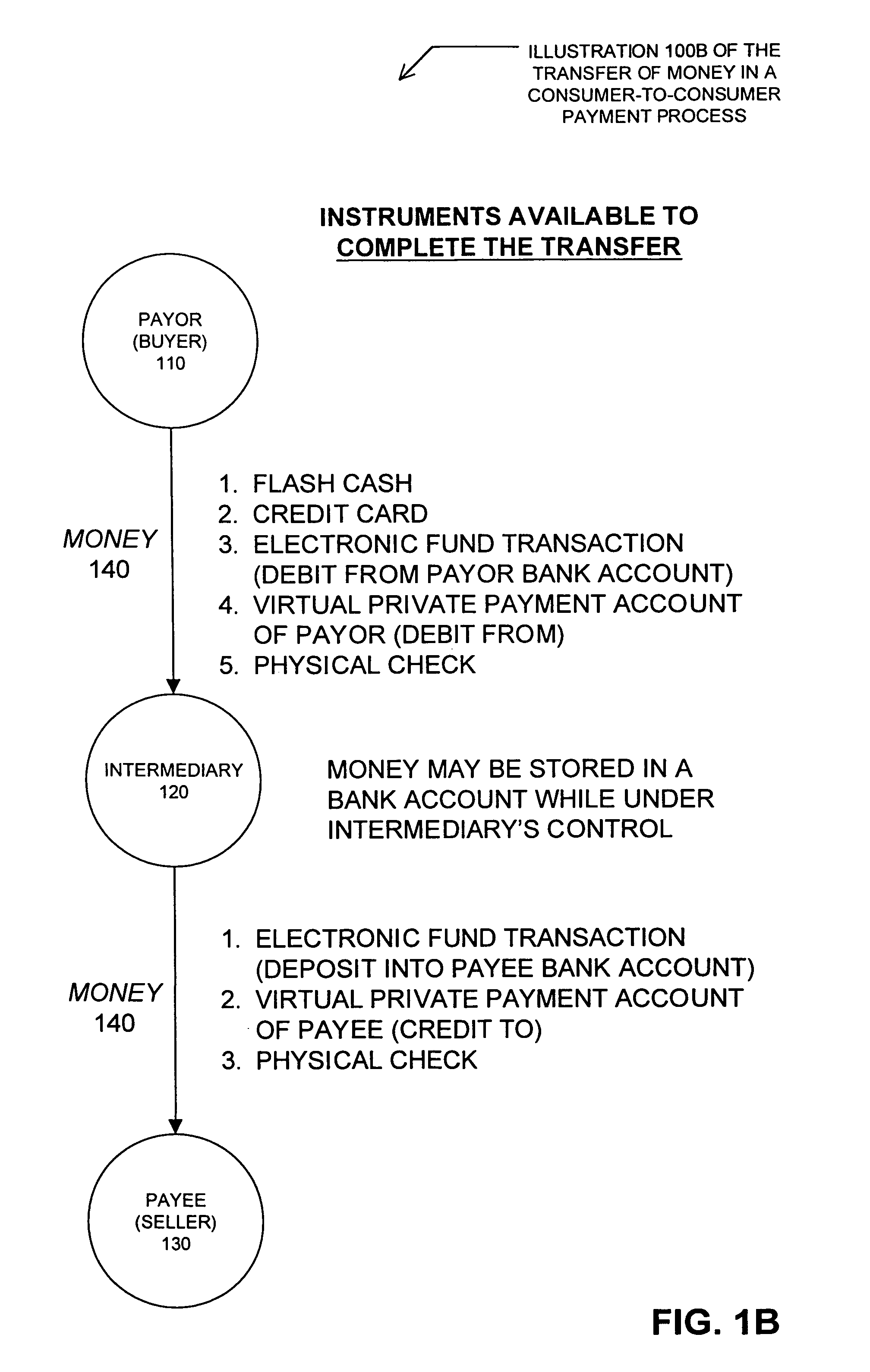

Method and system for facilitating financial transactions between consumers over the internet

InactiveUS7177836B1Reduce the risk of fraudFinanceBuying/selling/leasing transactionsPaymentThird party

A method for enabling two individual consumers to complete a transaction that includes payment from one consumer (the payor, or buyer) to another consumer (the payee, or seller). An intermediary typically operates the service over a computer network of nodes, such as the Internet. The buyer has the convenience of paying through a variety of different payment instruments. Likewise, the seller has the convenience of receiving payment through a variety of different disbursement instruments. For a fee, the intermediary collects the payment from the buyer and pays the seller. Although the intermediary may receive payment from the buyer before the intermediary transfers the payment to the seller, the intermediary may choose to pay the seller before receiving payment from the buyer. In this case, the intermediary assumes the risk of nonpayment by the buyer. Alternatively, the intermediary may pay a third party that specializes in processing transactions for the payment instrument chosen by the buyer to assume the risk of nonpayment by the buyer. In this case, the intermediary receives a promise of payment from the third party before the intermediary pays the seller. Such a promise of payment from the third party is referred to as an authorization.

Owner:THE WESTERN UNION CO +1

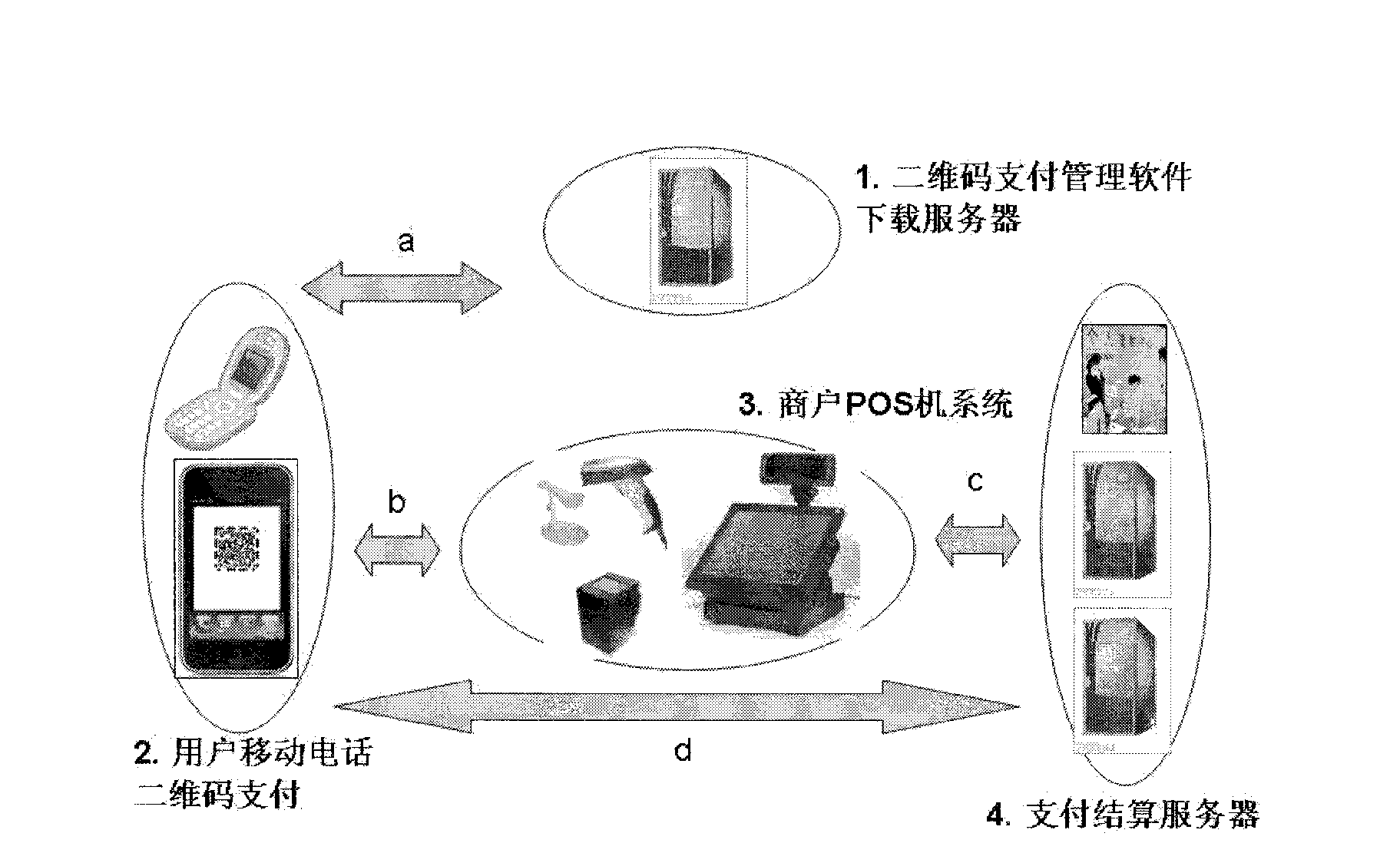

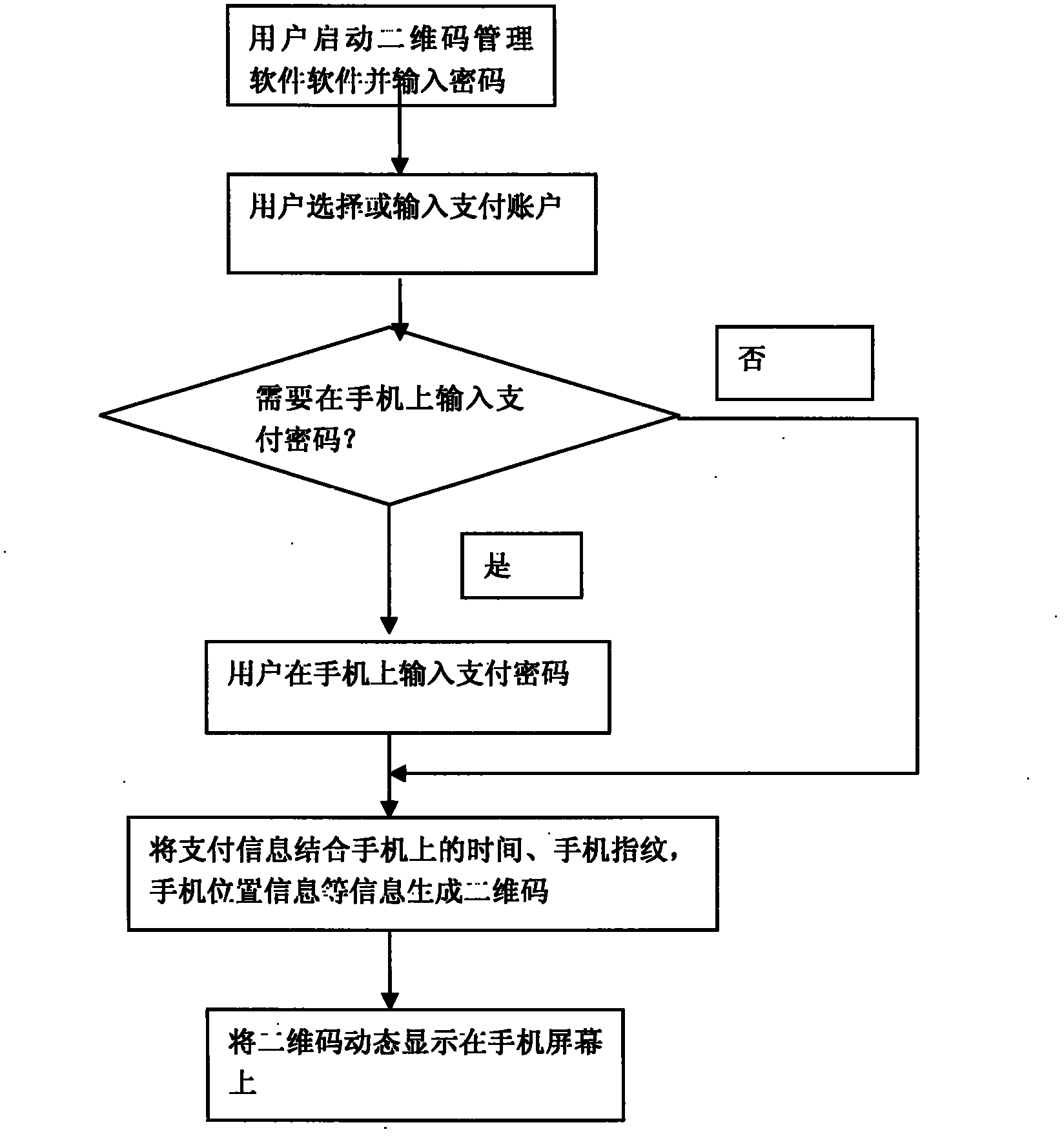

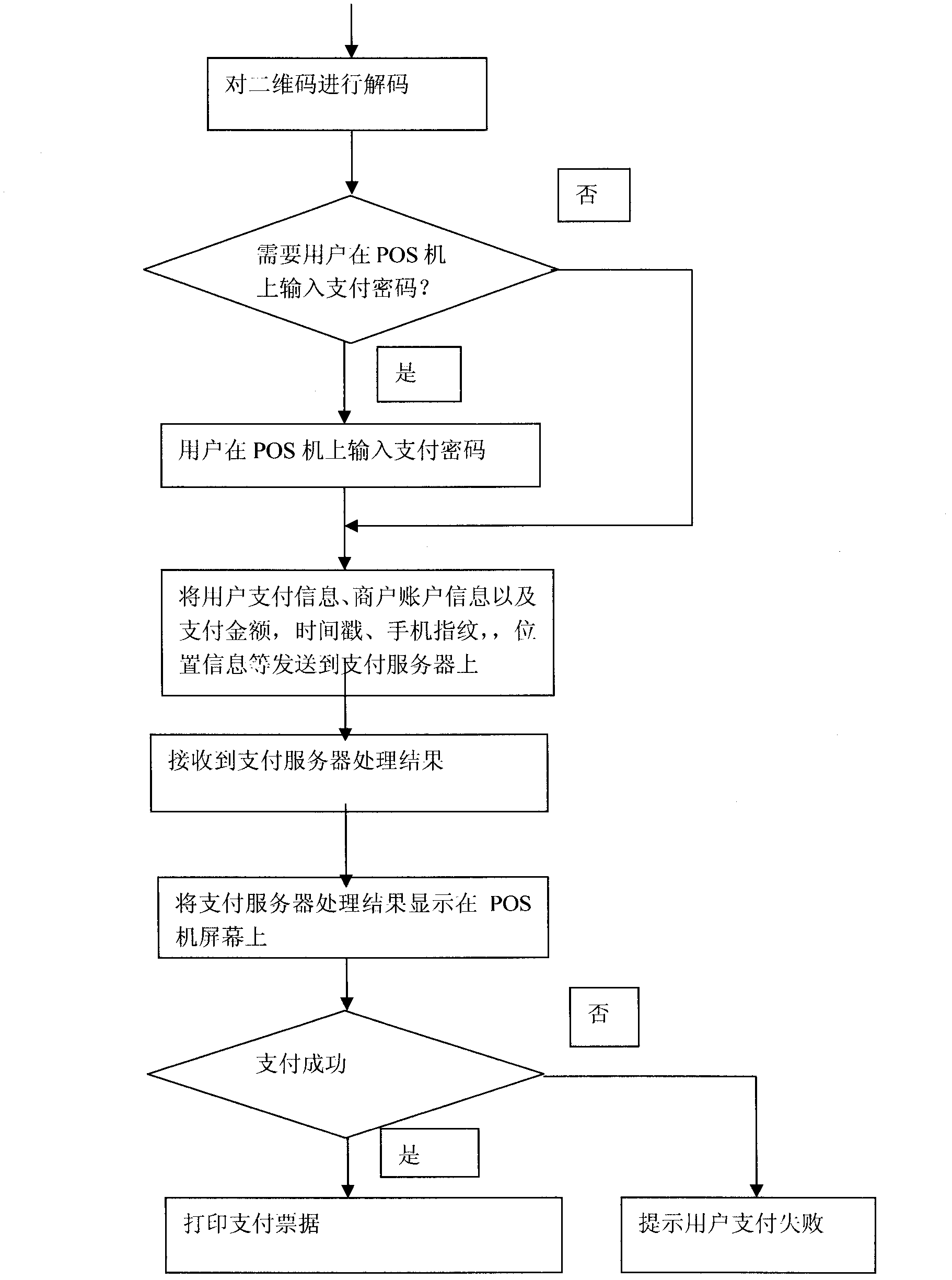

Method for generating two-dimensional code and implementing mobile payment by mobile phone

InactiveCN102842081AEnsure uniquenessEnsure safetyPayment protocolsCoded identity card or credit card actuationComputer hardwareCredit card

The invention relates to a method for generating a two-dimensional code and implementing mobile payment by a mobile phone. A user can input various payment card information (such as bank card account numbers, credit card account numbers, prepaid card account numbers, and third party payment user account numbers) into the mobile phone, the information is enciphered and stored, and then the two-dimensional code is generated and displayed on a screen of the mobile phone. A merchant scans a pattern of the two-dimensional code through a two-dimensional code identifying and reading device, and after user authentication information (such as two-dimensional code generation time, mobile phone fingerprints and mobile phone positions) and the payment card information are decoded, the user authentication information, the payment card information, consumption amount information of the user, merchant account number information and the like are enciphered and sent to a corresponding payment and settlement system. After receiving the information, a payment and settlement server confirms the payment card information to be true or false according to the two-dimensional code authentication information, and carries out payment transaction. The method has the main advantage that the user can save the information of various payment cards, consumption cards and the like in the mobile phone and realize no-card electronic payment transaction instead of the various payment cards.

Owner:上海易悠通信息科技有限公司

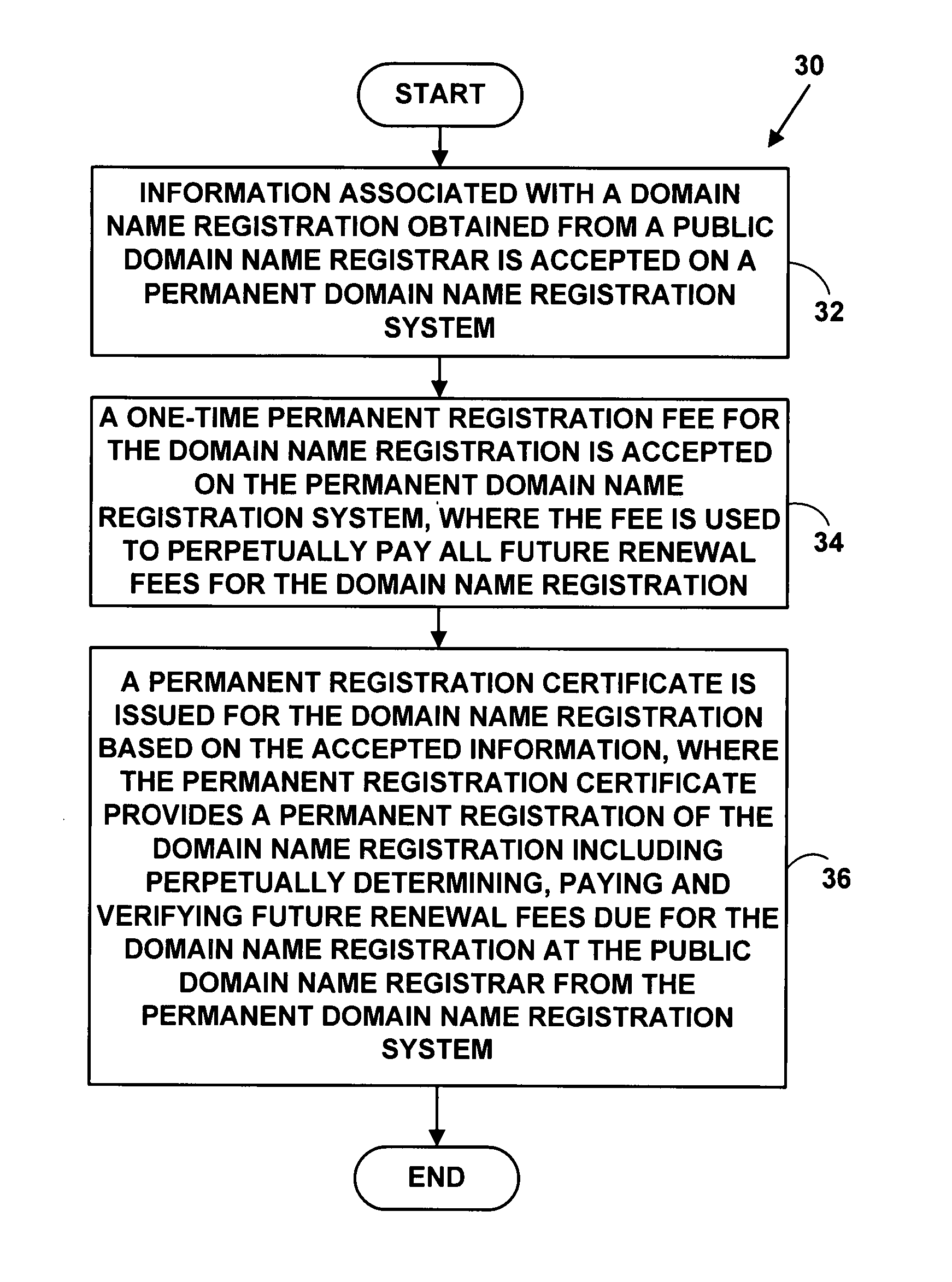

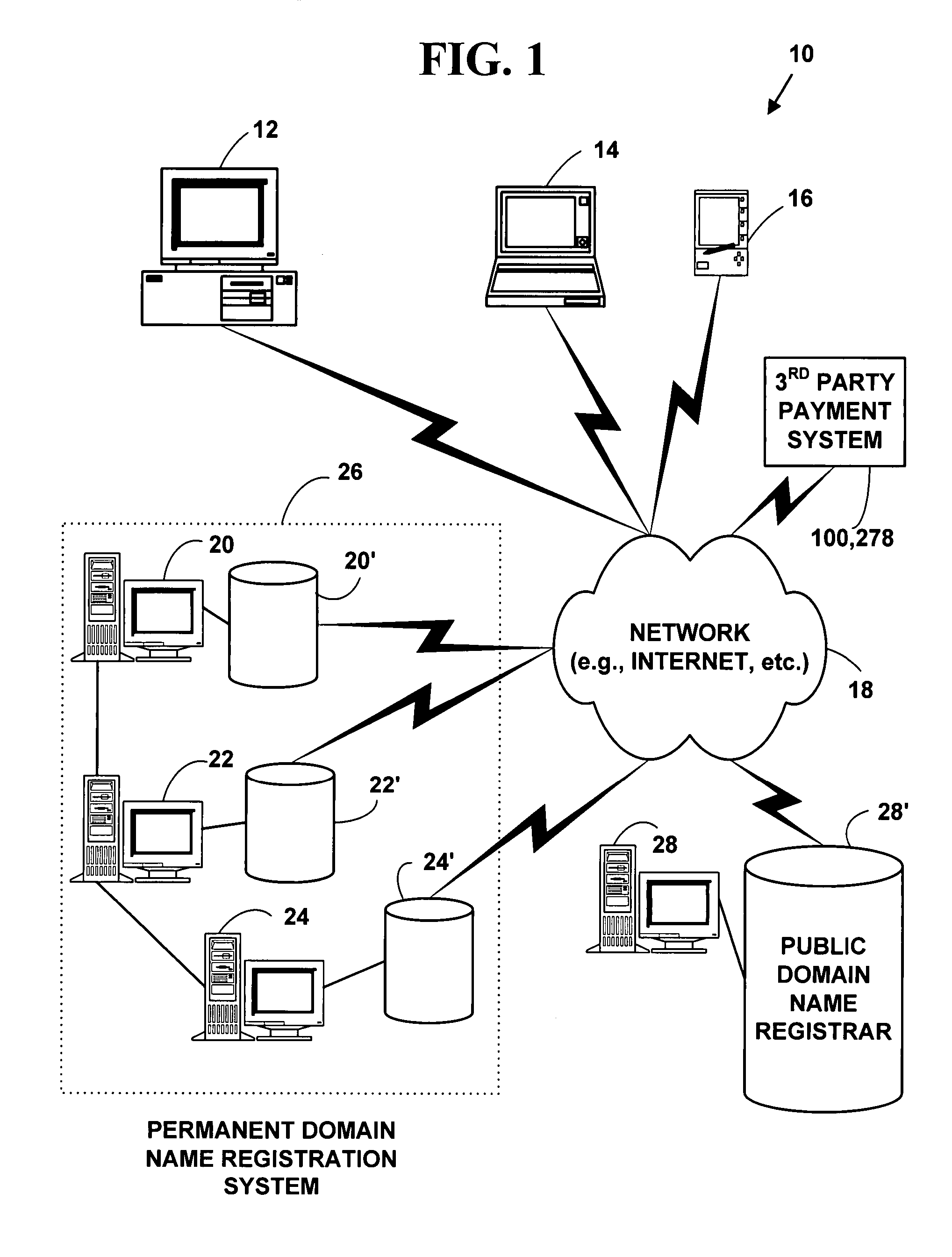

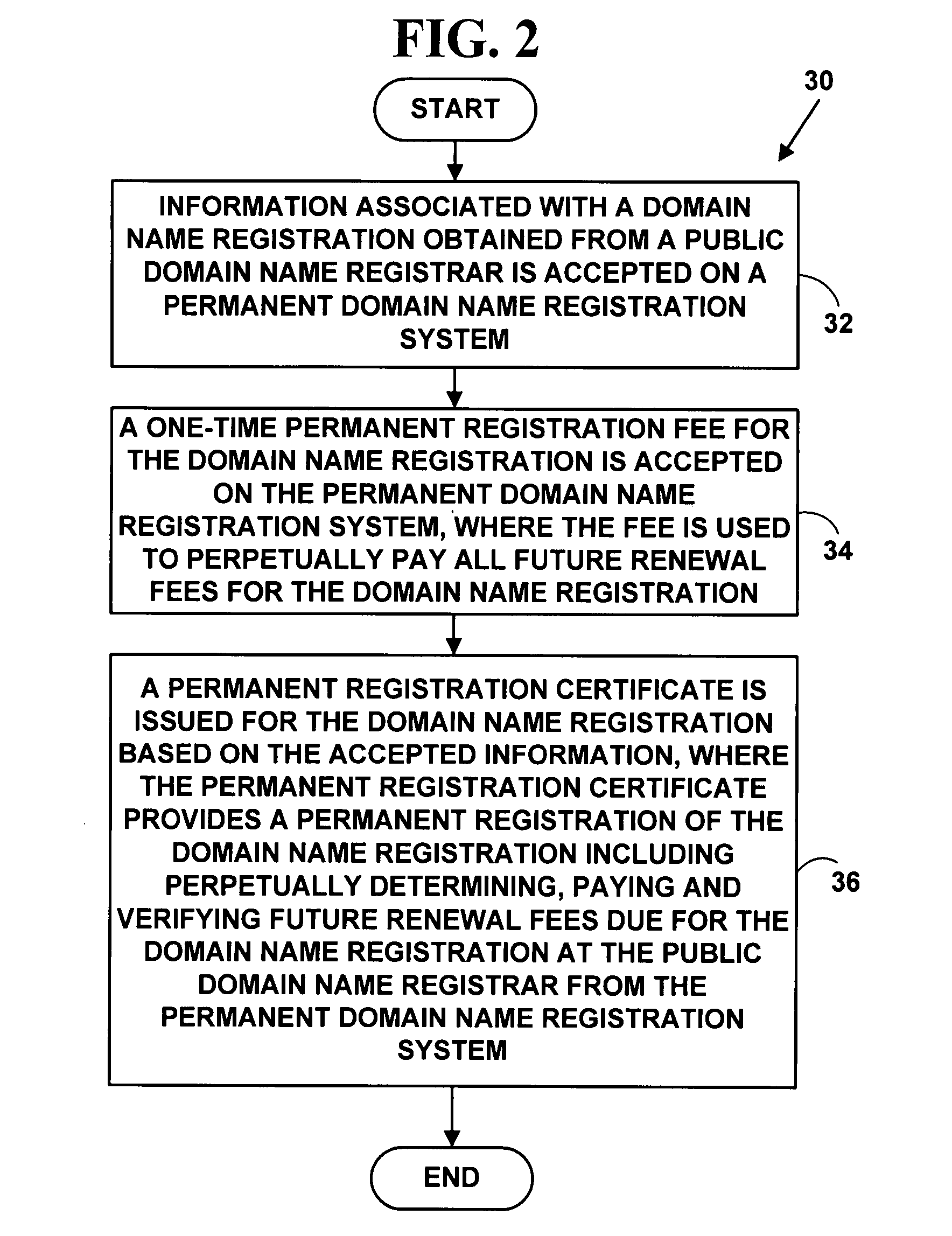

Method and system for protecting domain names via third-party systems

InactiveUS20080046340A1Digital data authenticationBuying/selling/leasing transactionsThird partyDomain name

A method and system for extending a permanent domain name registration service and / or website hosting service by third-party payment system. A third-party payment system enables a domain name / website hosting account holder to accept third-party payments; third parties may then view a payment section on their website and choose to make a payment for a specified period. The third-party payment system manages the funds and tracks the need to accept third-party payments and to make timely payments to the service provider. A beneficiary contact and a third-party contact method are included as means to help manage a website that may operate unattended and may remain online indefinitely thereby providing permanent domain name registration or permanent website hosting.

Owner:BROWN CHARLES P

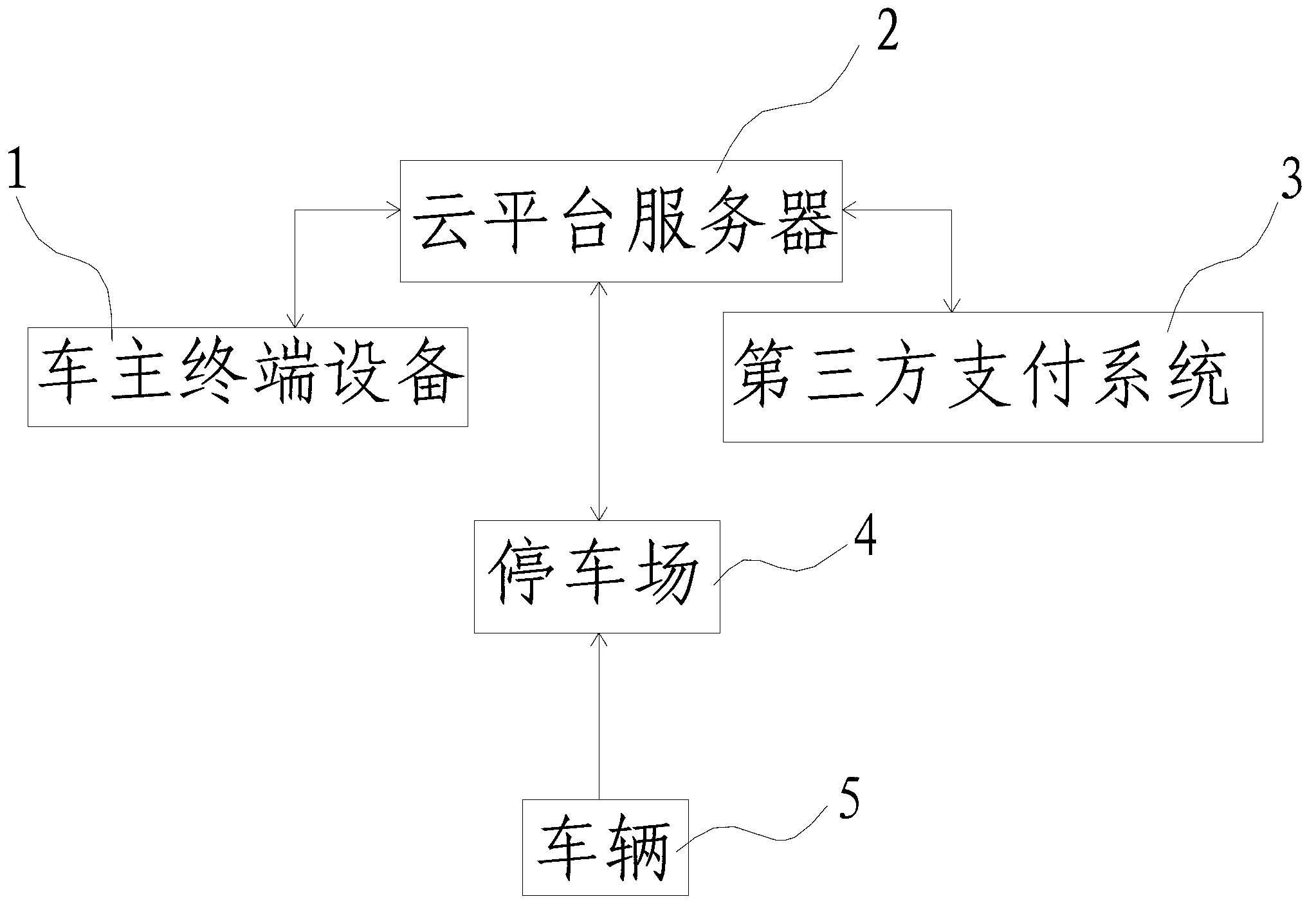

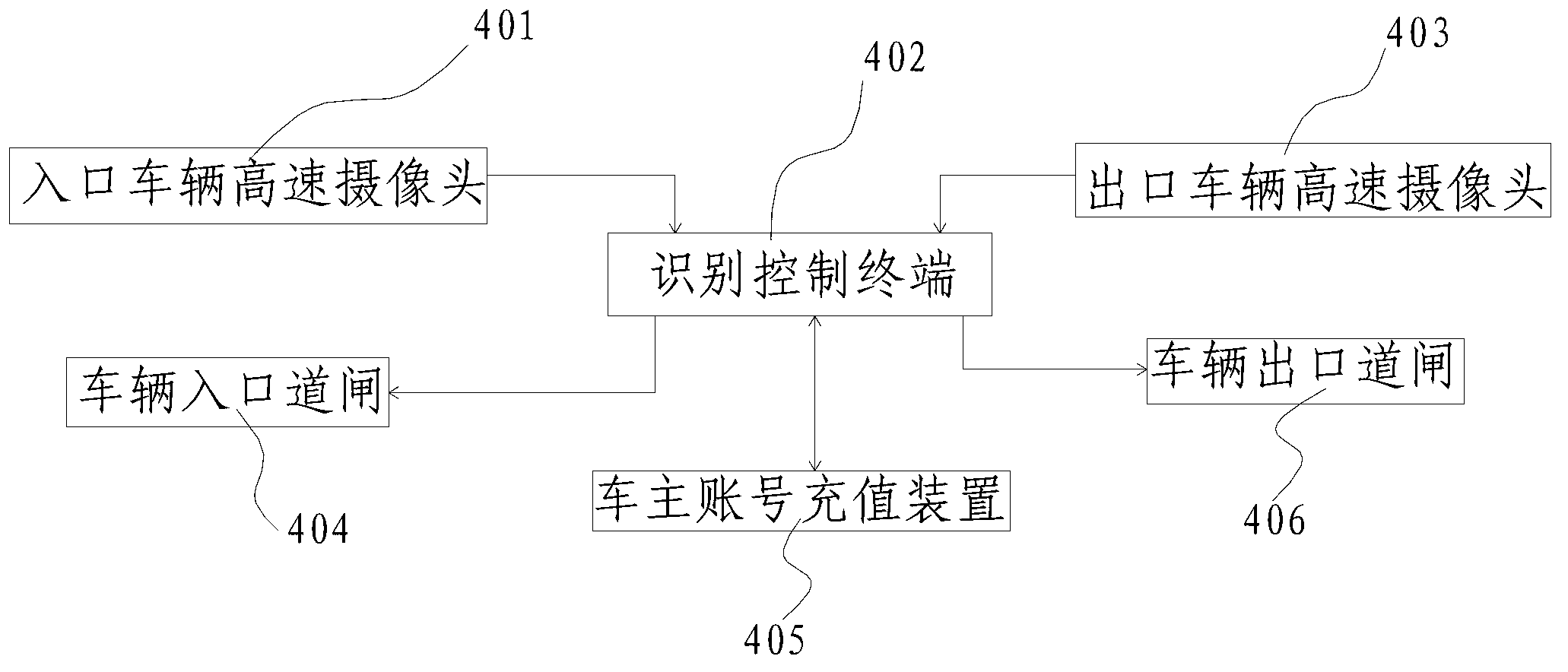

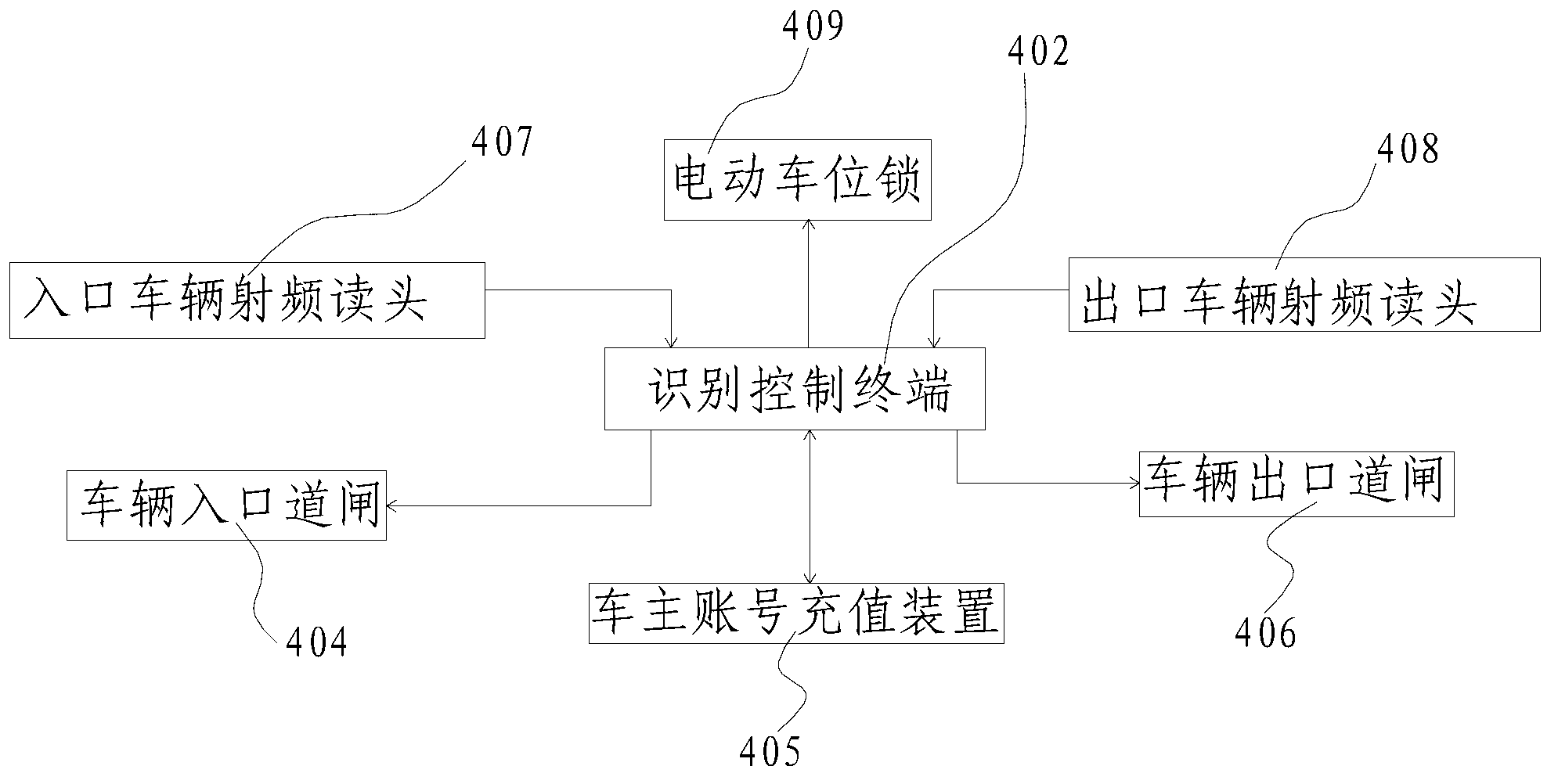

No-obstacle parking charging system and method thereof

InactiveCN102855671AShorten the timeImprove operational efficiencyTicket-issuing apparatusIntensive managementTerminal equipment

The invention relates to a charging system for automobiles and discloses a no-obstacle parking charging system, which comprises a cloud platform server, a plurality of parking lots being in data exchange with the cloud platform server through a network, a plurality of automobile owner terminal devices being in data exchange with the cloud platform server through the network, and a third-party payment system being in data exchange with the cloud platform server through the network. The invention also discloses a no-obstacle parking charging method, which comprises the following steps: S10, a member is registered; S30, an automobile enters the parking lot; and S40, the automobile is driven out of the parking lot. According to the system and the method disclosed by the invention, the time of passing through an entrance guard of the parking lot by the automobile is greatly saved, the process of parking charging is simplified, the operation efficiency of the parking lots is improved, and the parking lots are managed intensively through the cloud platform server, so that great convenience is brought to automobile owners.

Owner:陈淼

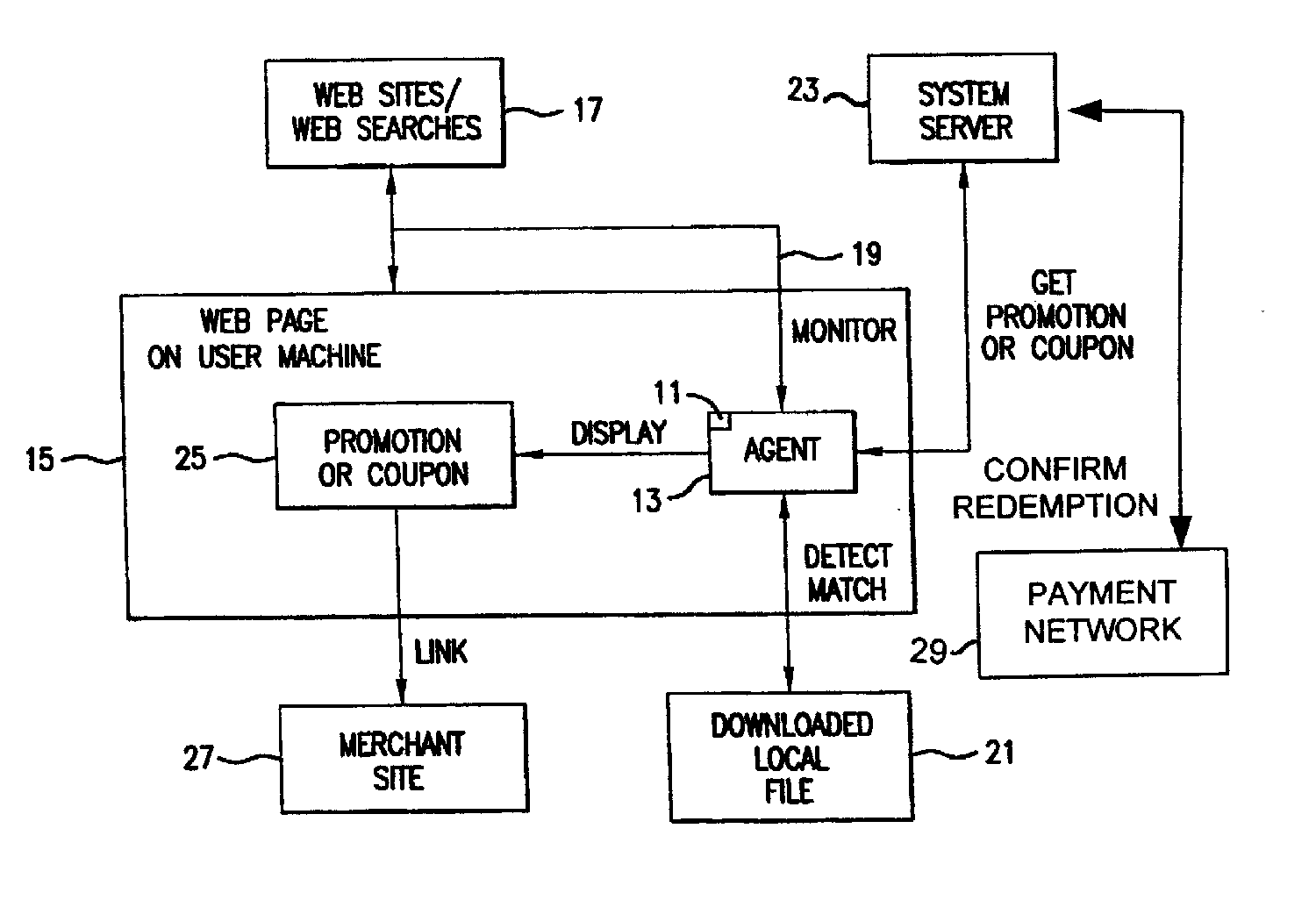

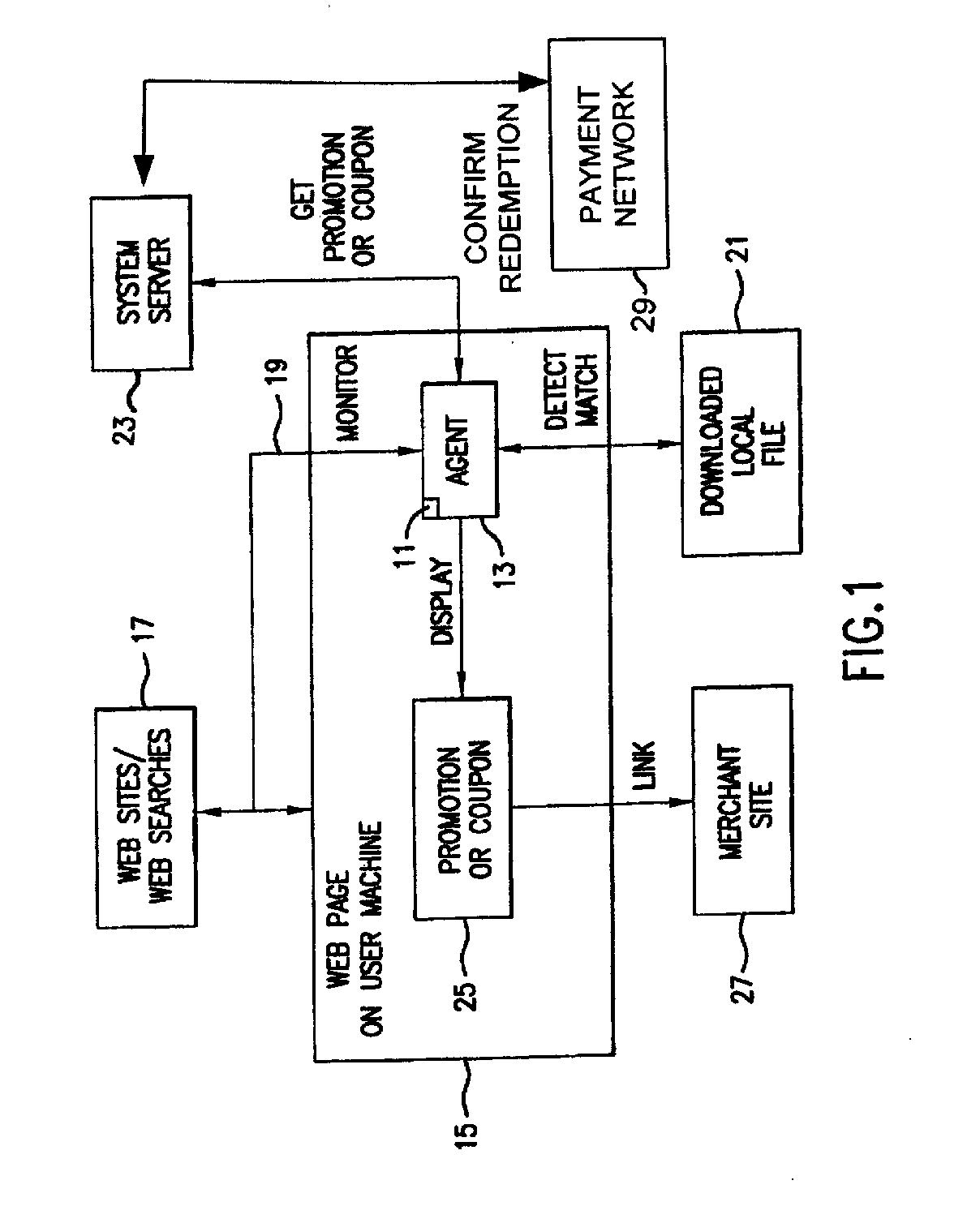

Software agent for facilitating electronic commerce transactions through display of targeted promotions or coupons

InactiveUS20060015405A1Easy to confirmAdvertisementsBroadcast information monitoringNetwork addressSoftware

A software agent for locally tracking a user's network interaction, such as web browsing, and providing targeted promotions with optional coupons to the user. The monitoring involves use of a downloaded file of network addresses and words potentially tailored to each individual user. The software agent locally compares network addresses and content of web sites accessed and search terms entered against the stored addresses and key words in the file. Upon detecting a match, the software agent contacts a system server to obtain a promotion with an optional coupon for the match, and displays an indication of the promotion or coupon to the user, providing the user with the option to view, decline, save, or defer the promotion. The user is provided with redeemable credits for viewing promotions, visiting the site of a merchant offering the promotion, completing a transaction, and spending at least a threshold dollar amount. The coupons can include coupons targeted to users geographically close to particular merchants so that the coupons can be printed and redeemed at the merchant's establishment. Transactions related to the promotions, whether completed online or in-store, are confirmed to demonstrate the efficacy of the promotions, award additional loyalty rewards to a user's account, or to compensate an advertiser or affiliate. Confirmation of in-store transactions may be accomplished by accessing transaction data routed through third-party payment networks used for credit and debit card transactions and cellular phone transactions and the like.

Owner:KNOWLEDGEFLOW

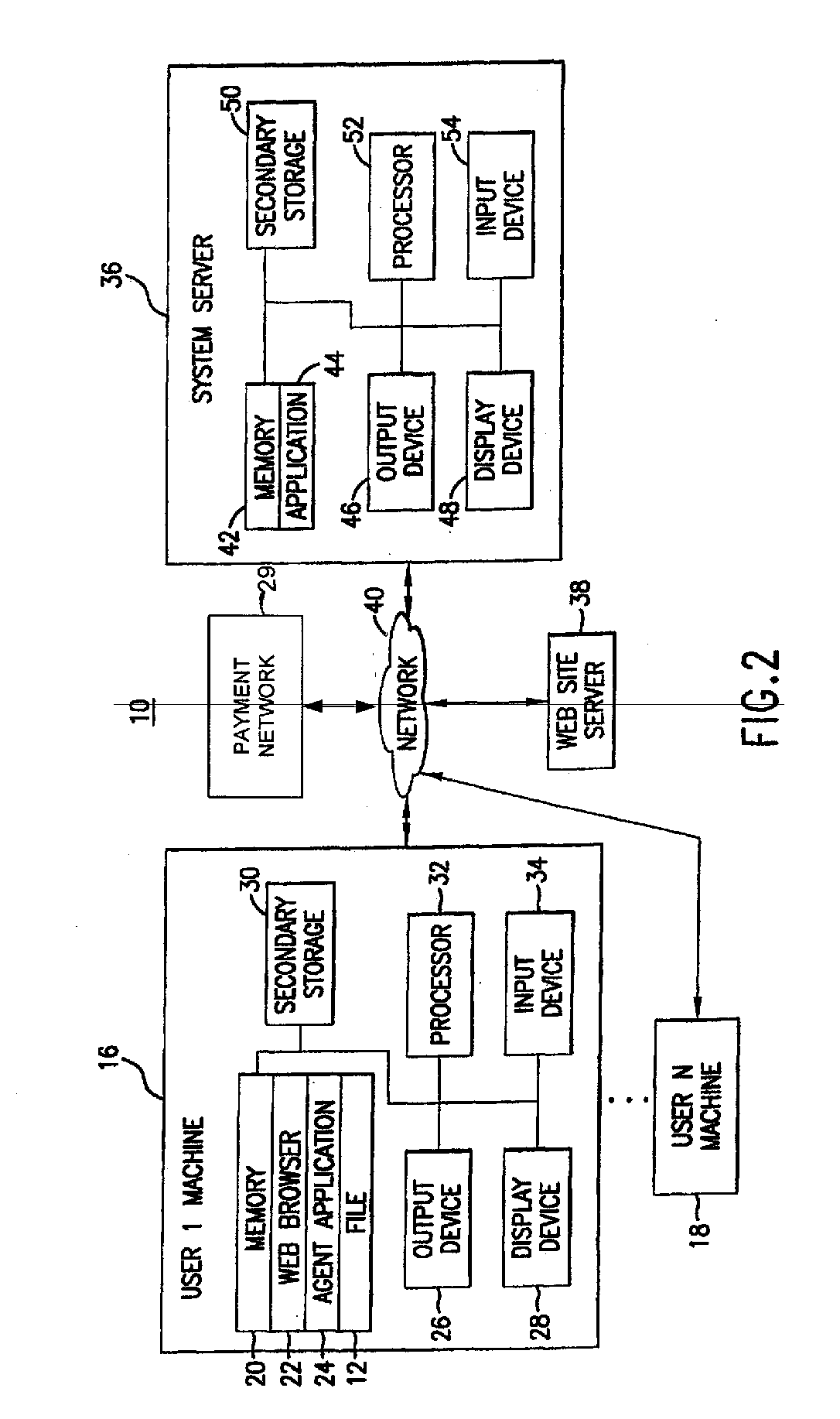

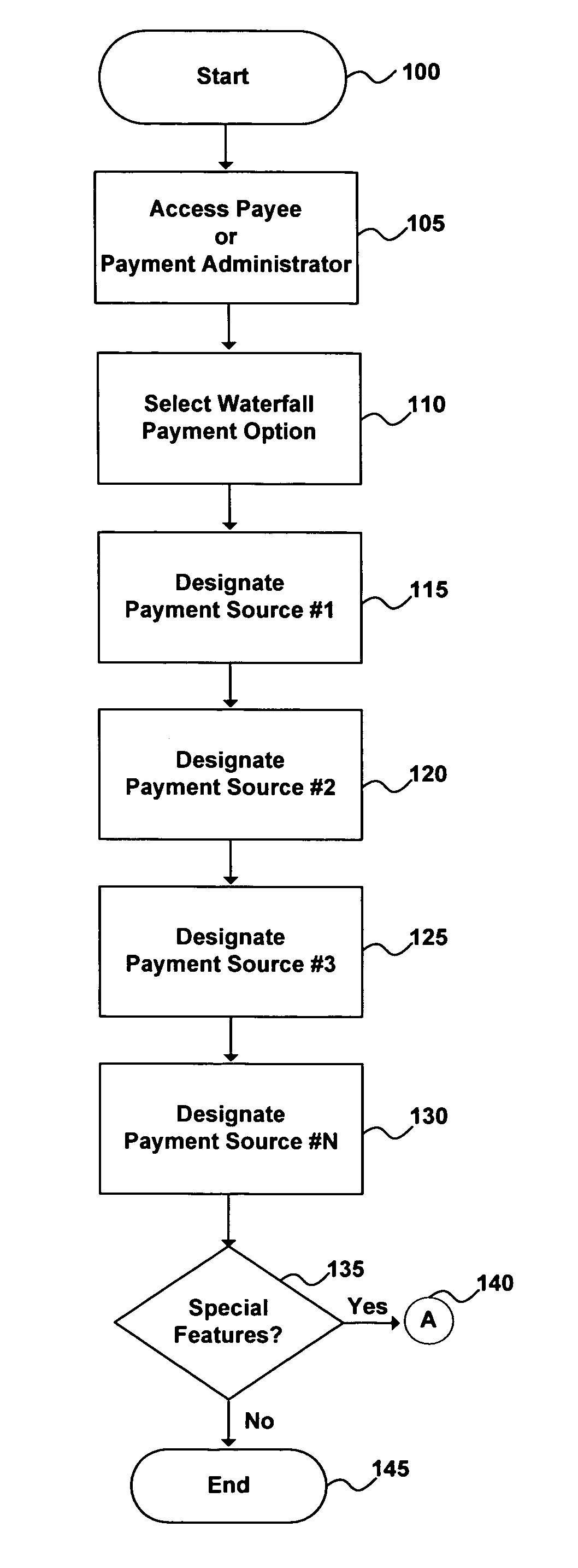

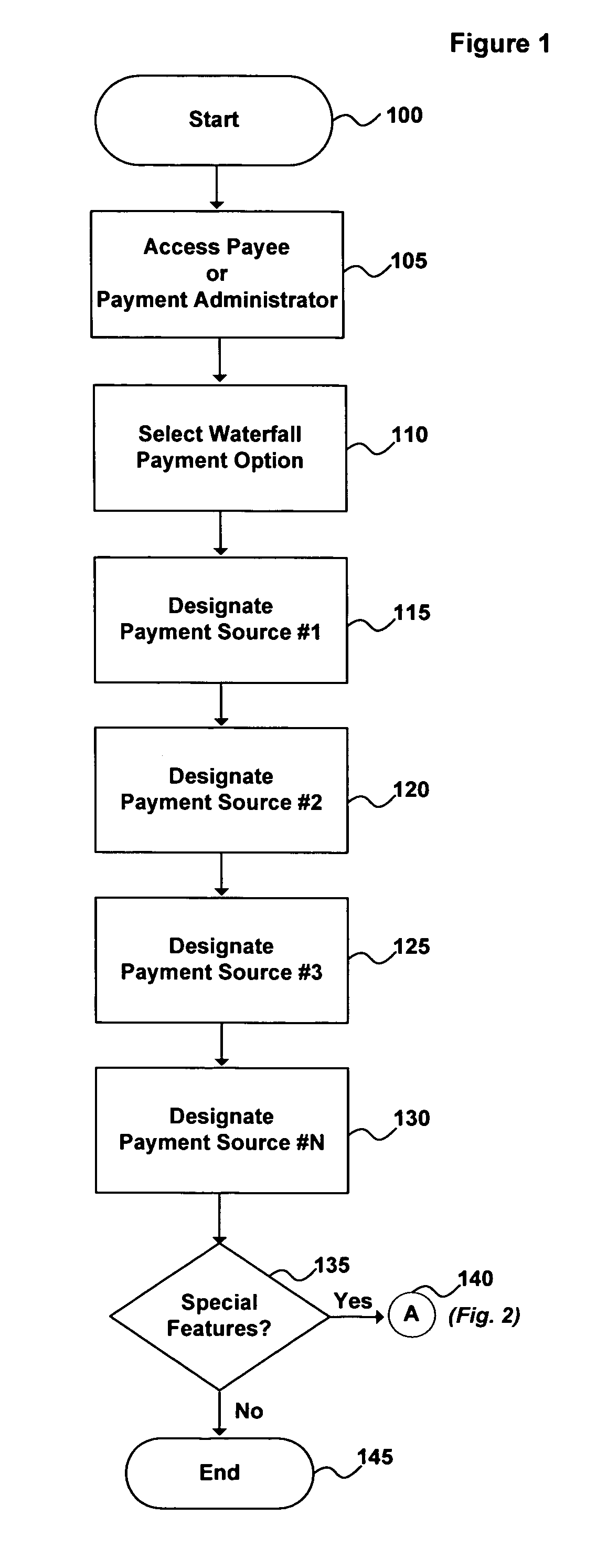

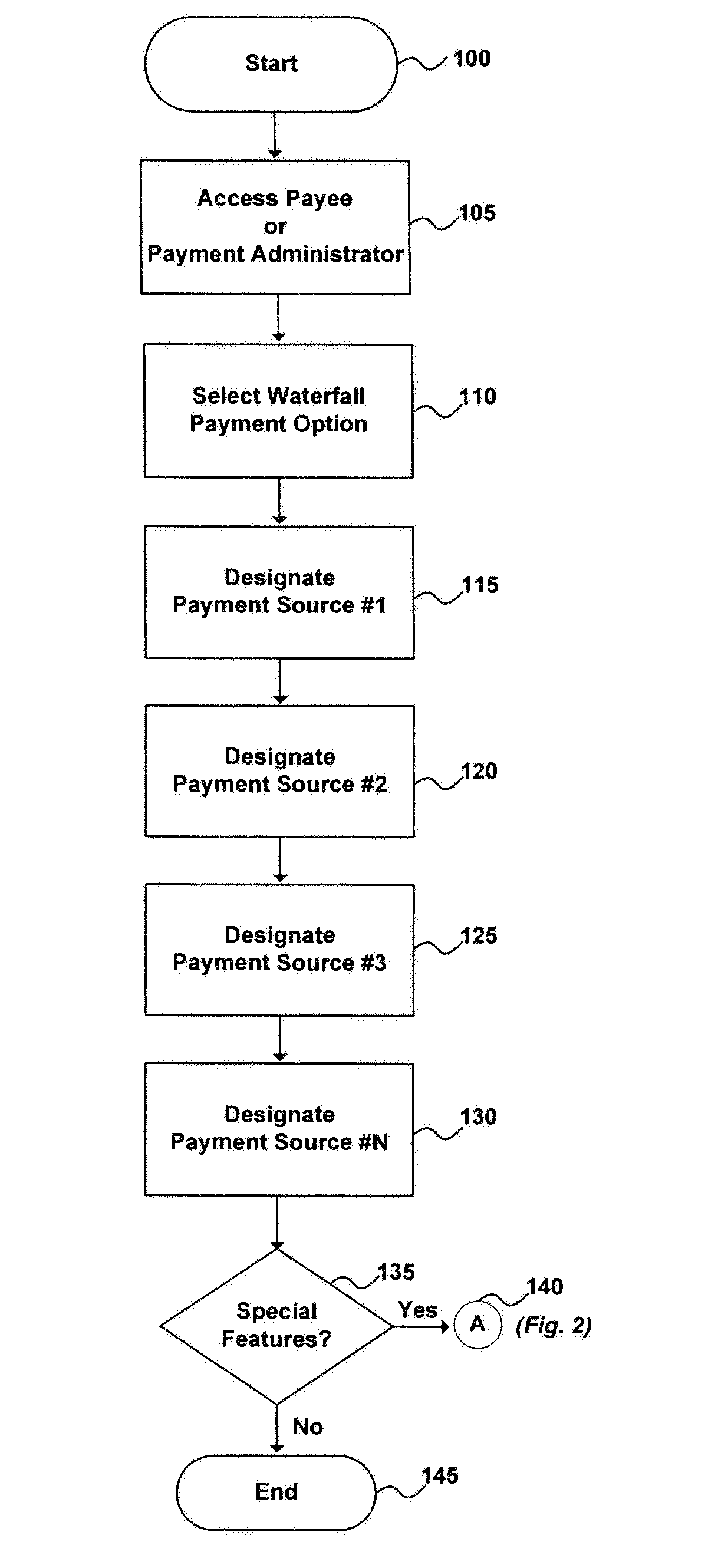

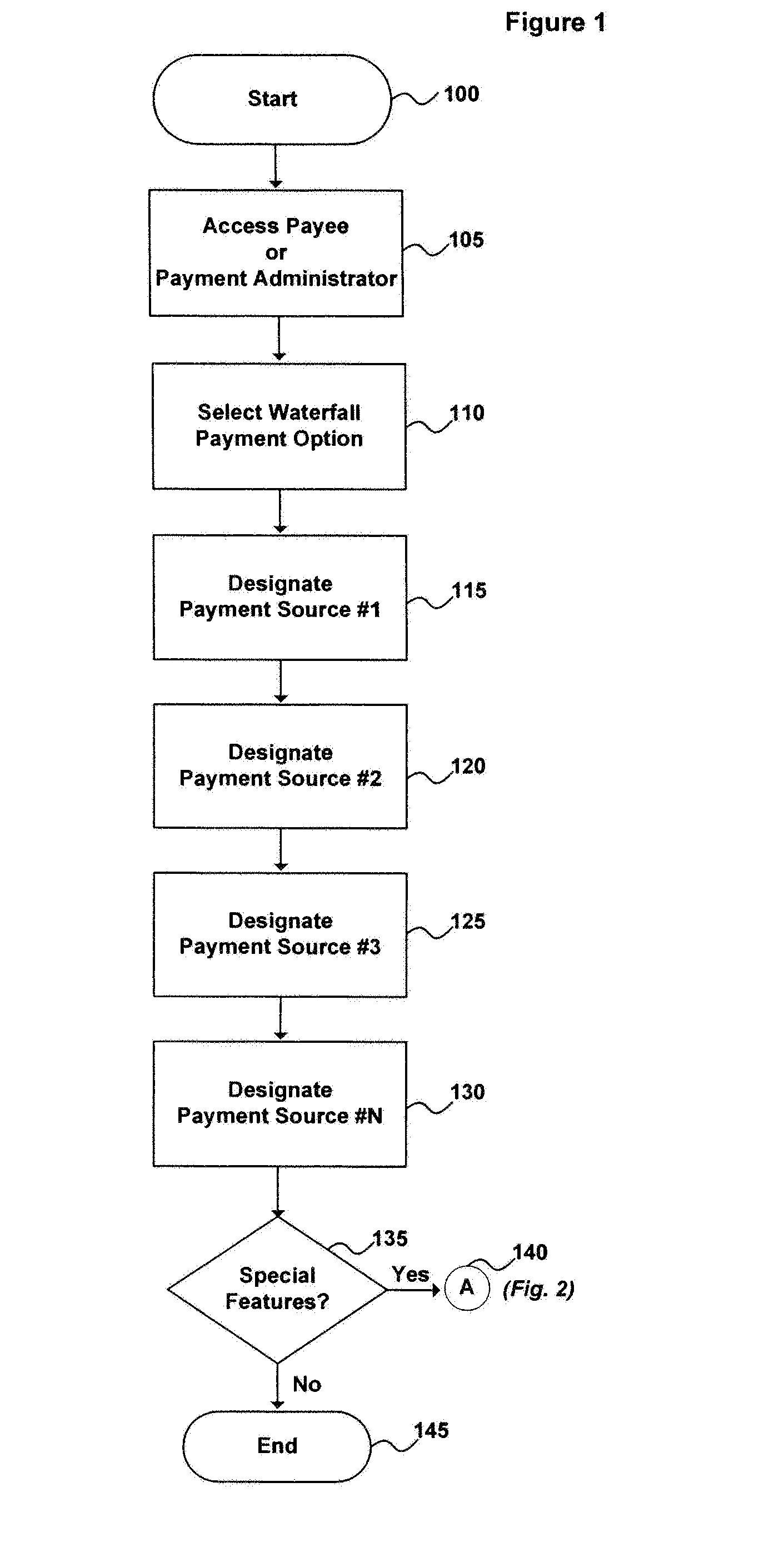

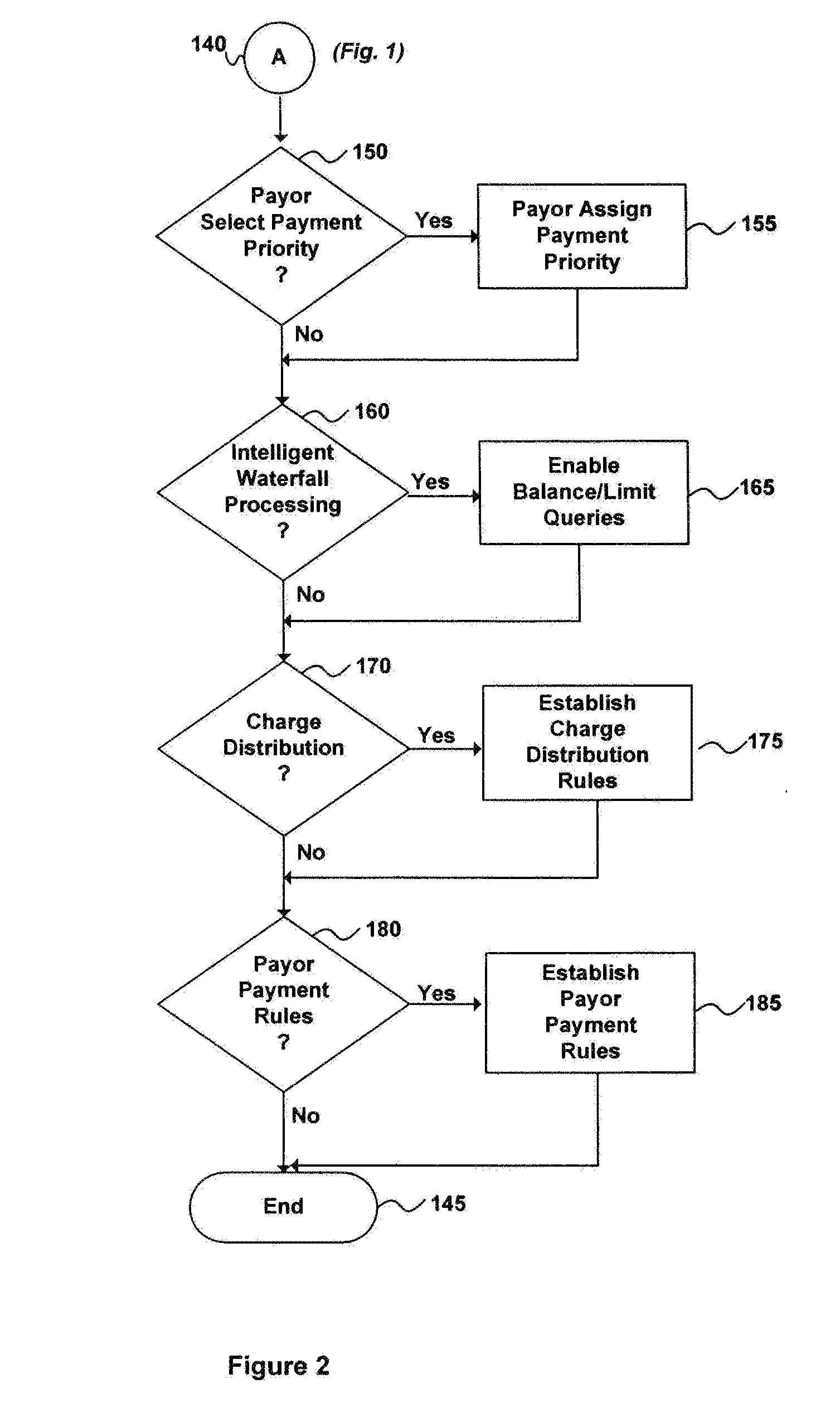

Waterfall prioritized payment processing

The invention comprises a system and method for “waterfall” type payment processing using multiple alternative payment sources. A payor provides account information for multiple payment sources, such as a bank checking account, savings account, first credit card account, second credit card account, and so forth. The multiple payment sources are prioritized so that one is a primary payment source, another is a secondary payment source, another is a tertiary payment source, and so forth. After setting up the waterfall payment arrangement, when a bill becomes due a payee or third party payment administrator submits transactions against the payment sources in their order of priority until the payment is satisfied. Other variations and enhancements are disclosed.

Owner:U S BANK NAT ASSOC +1

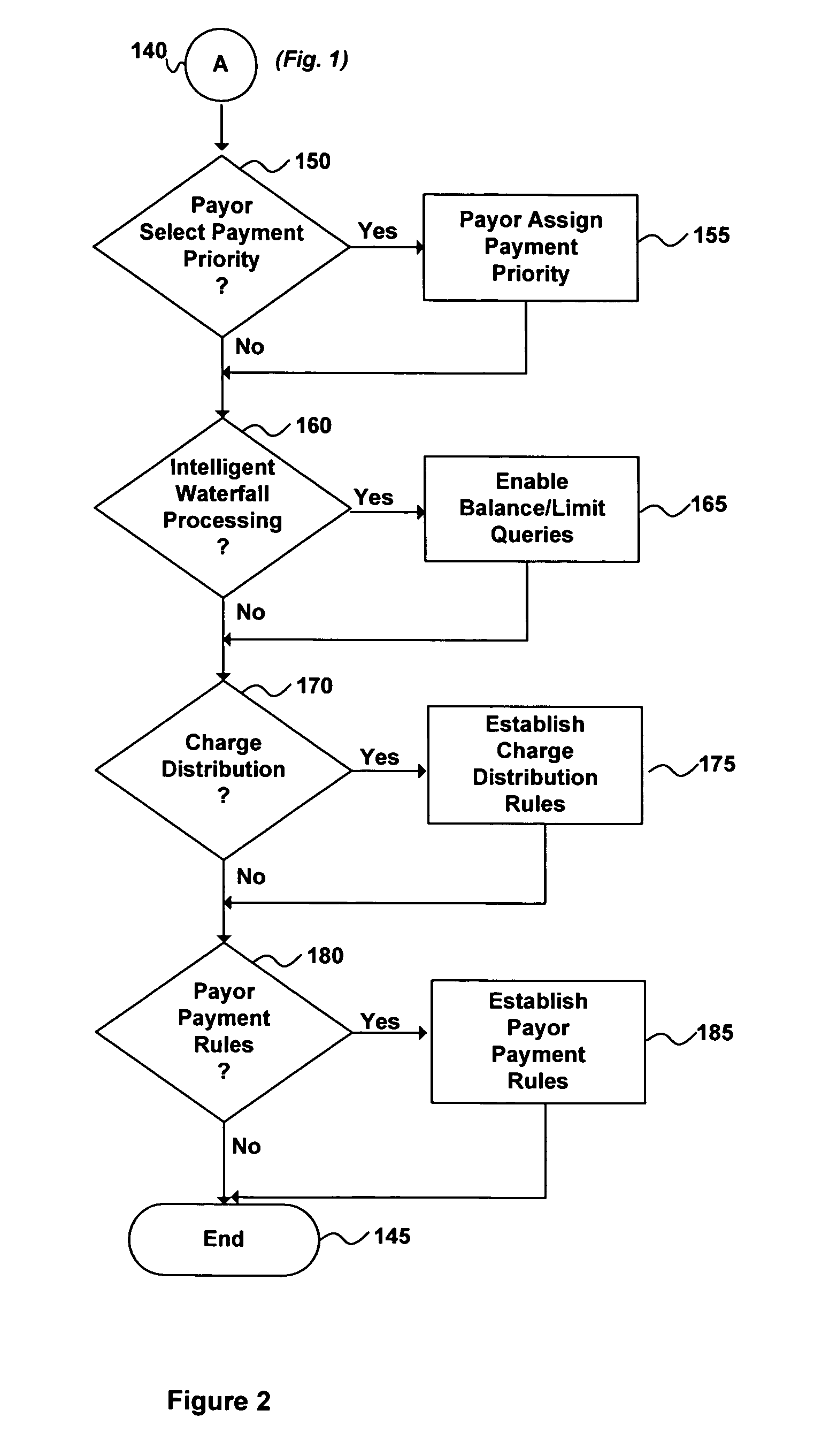

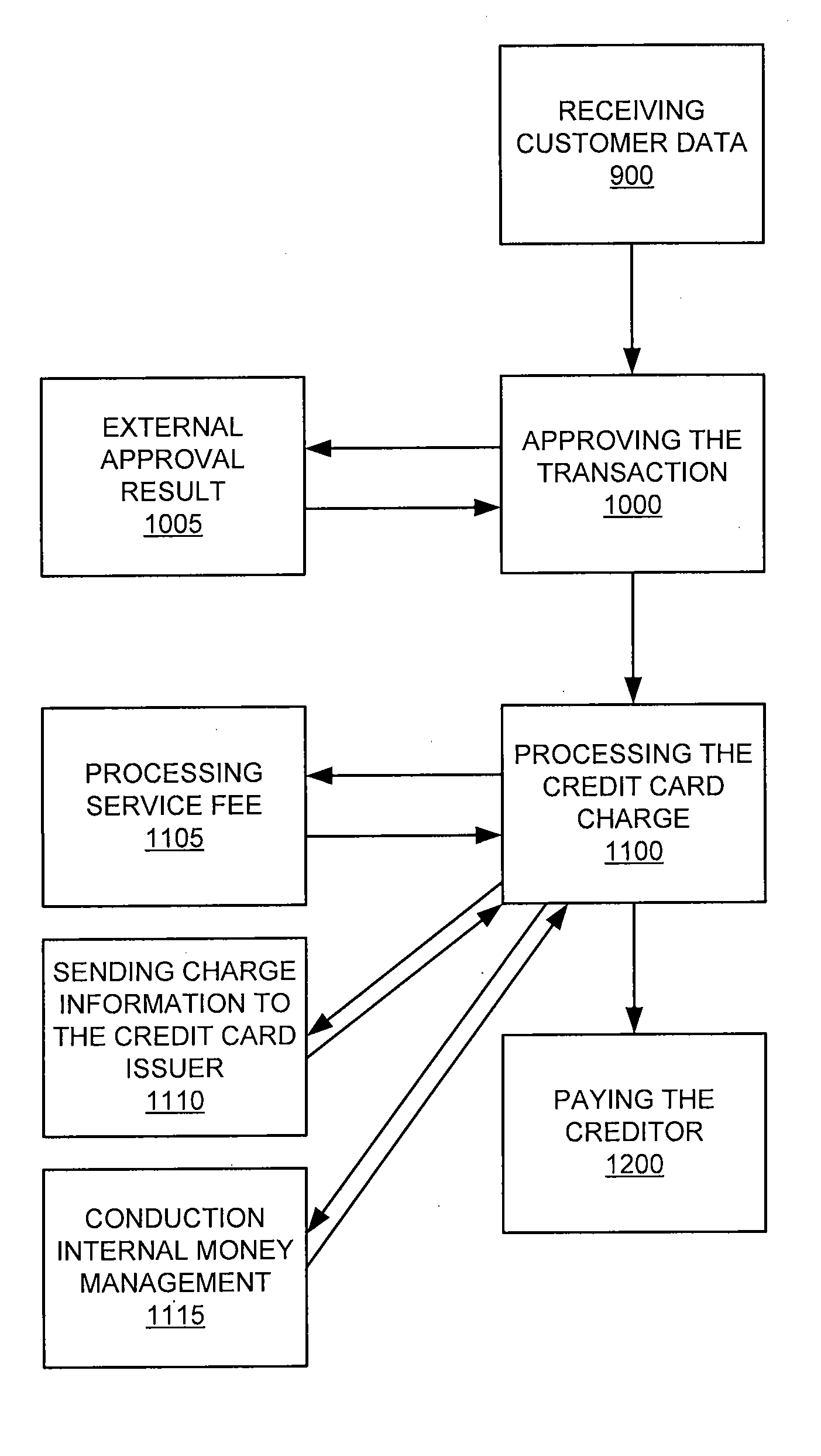

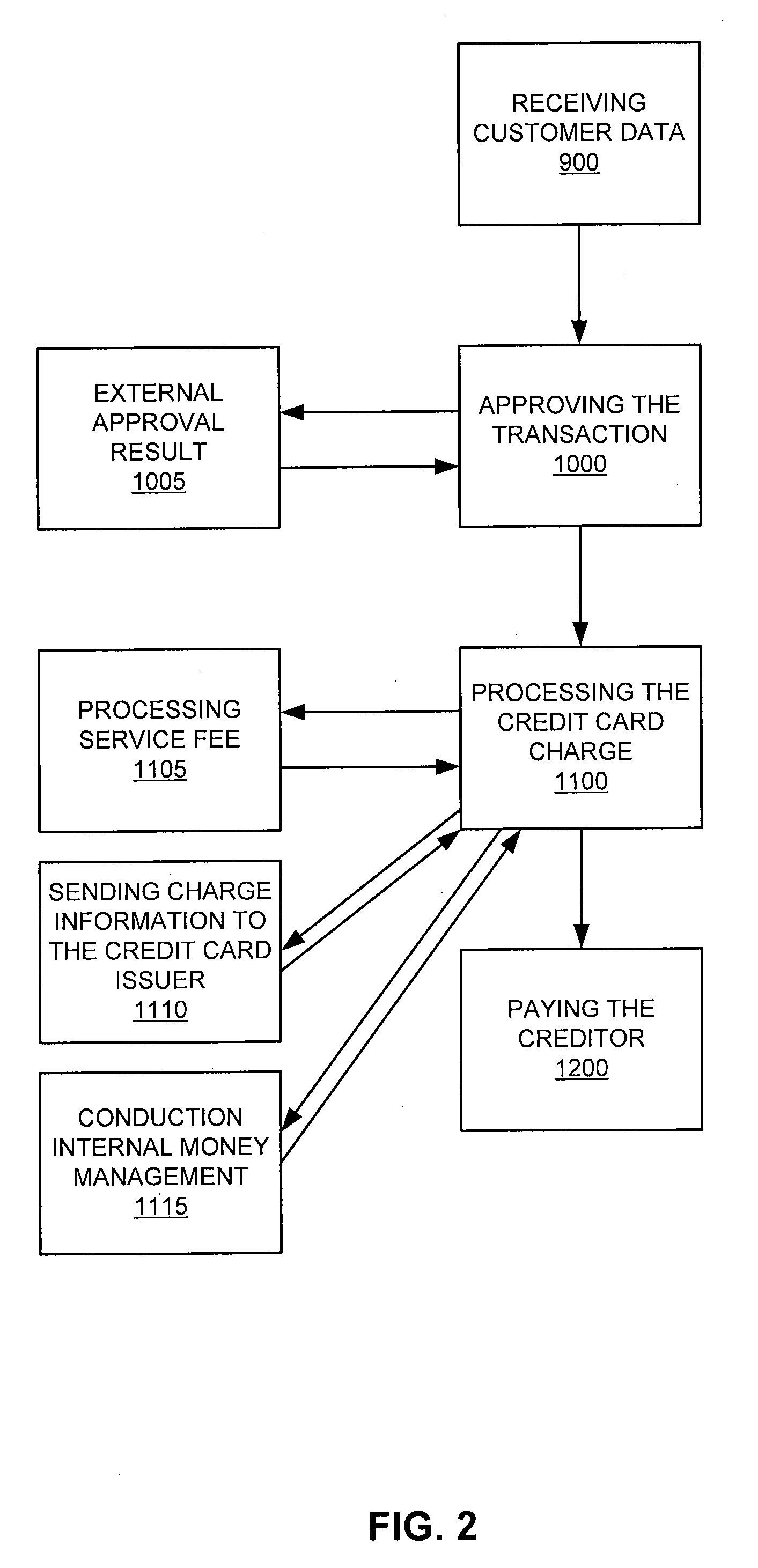

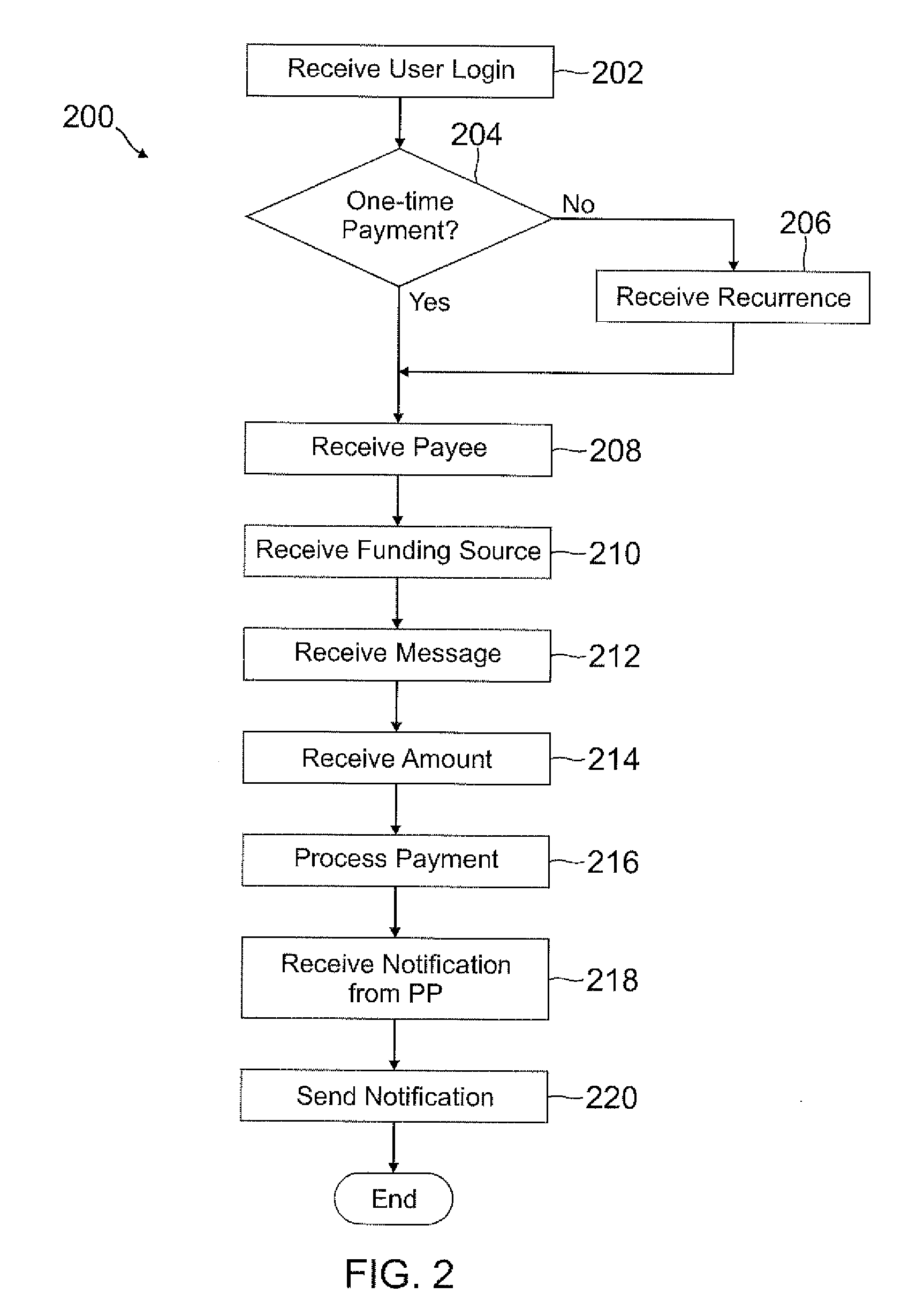

System and Method for Third Party Payment Processing of Credit Cards

A system and method for enabling a debtor to charge a payment to a credit card when a creditor does not accept credit card payments is provided. The system comprises a customer interface, an approval engine, a scheduling engine, a service fee engine and schedule, a currency engine and schedule, a payment engine, and a reporting engine. The method comprises the steps of receiving customer data, approving the transaction, processing the credit card charge, and paying the creditor.

Owner:CARDIT

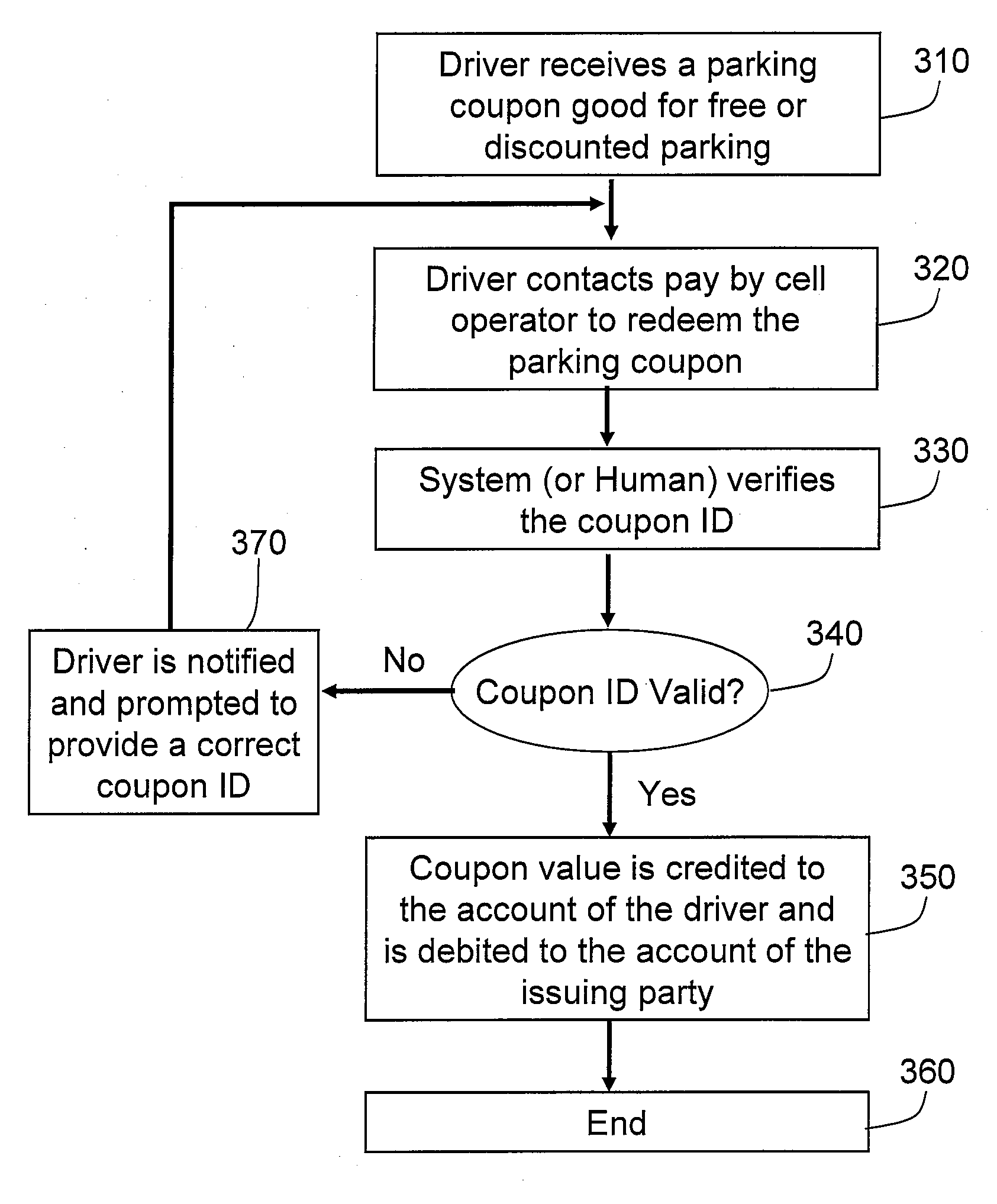

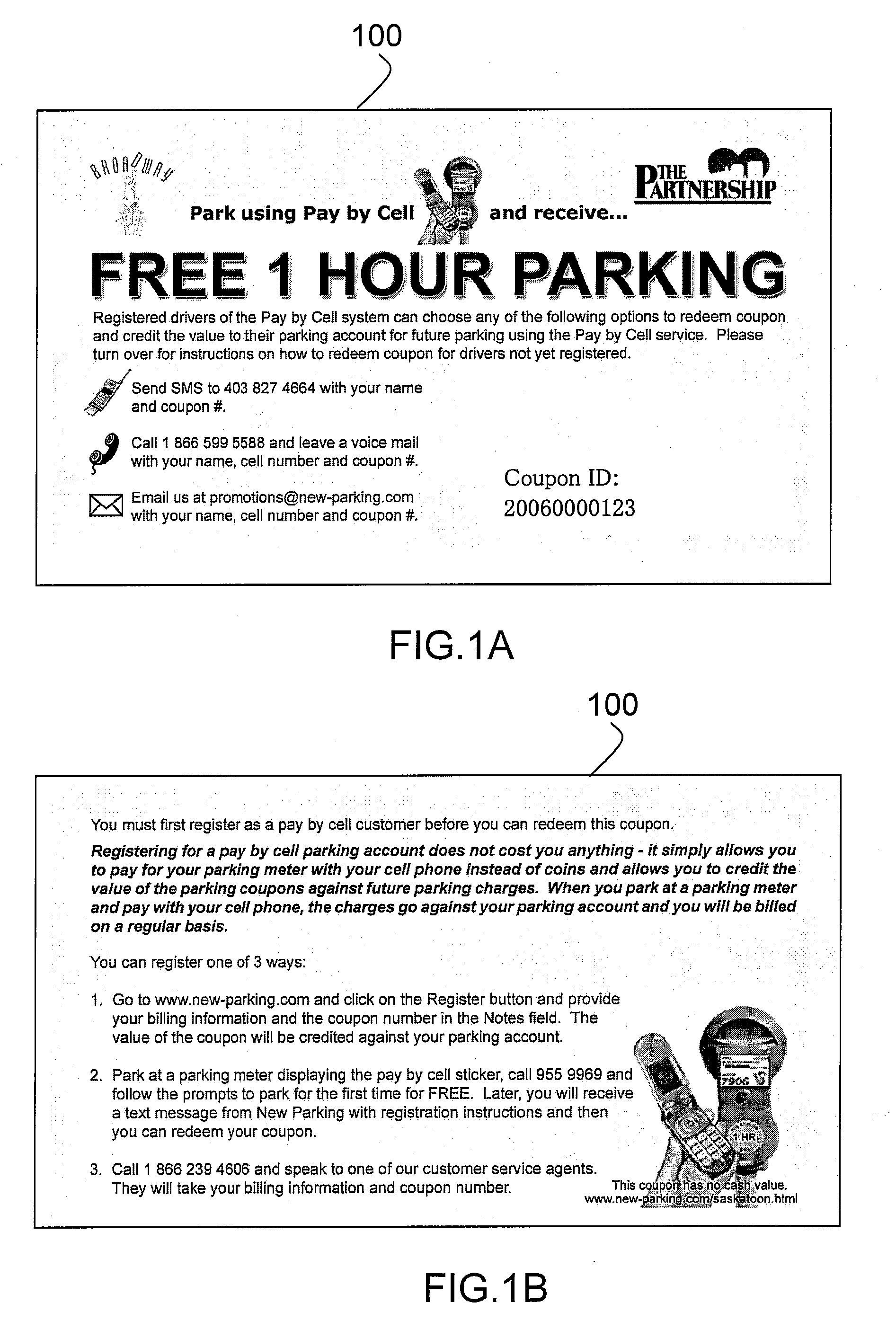

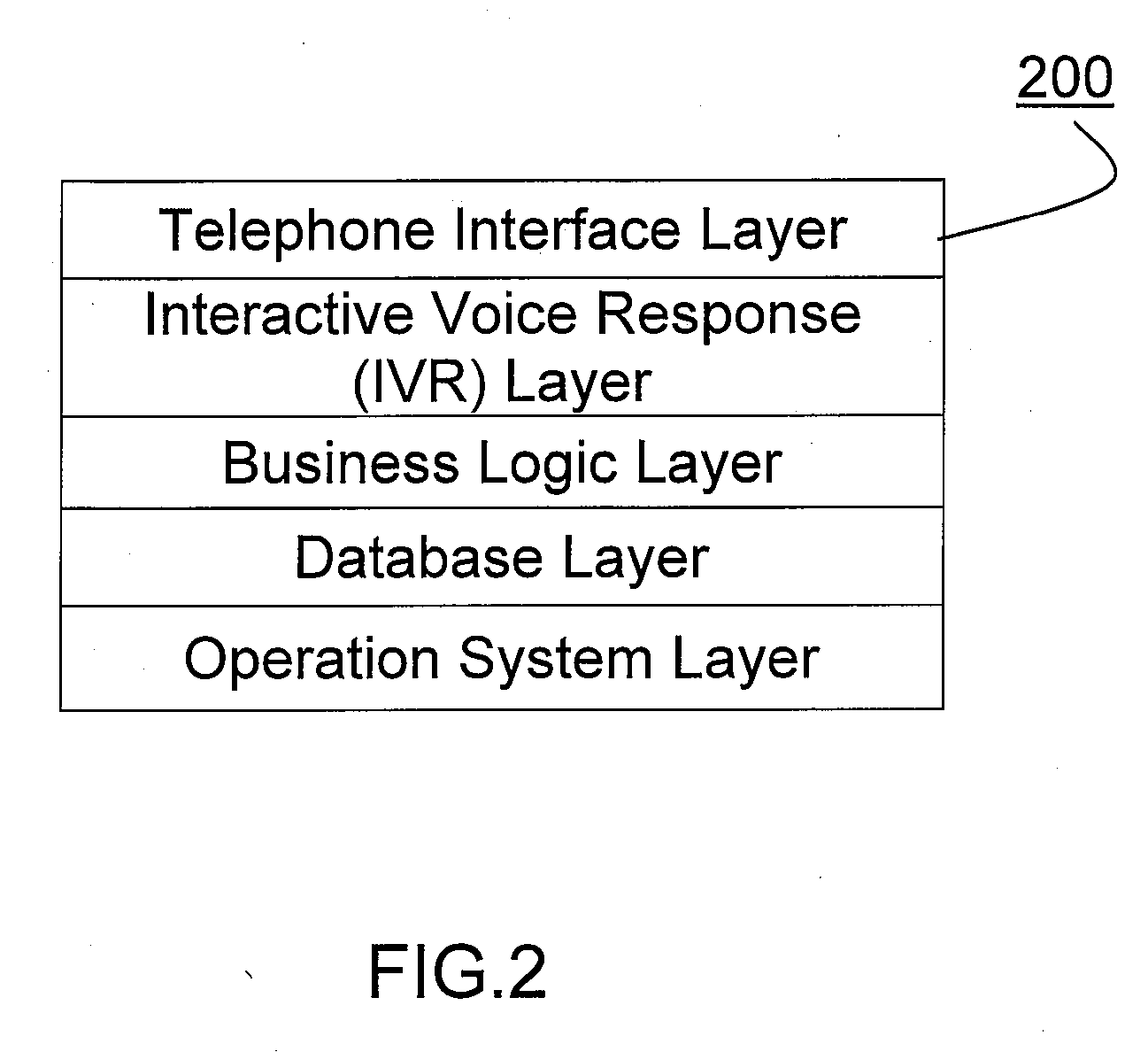

Method and system to provide electronic parking validation for drivers using a pay by cell parking system

A method and a system provide electronic parking validation using a pay by cell parking system is disclosed. The system allows any entity to offer instant parking credit covering a portion or the whole amount of parking charges. The credit is directly applicable to the current parking charges. The system has an operational pay-by-cell parking system in place and the recipient of the parking credit is a registered customer in good standing of the system. The system comprises a suite of computer programs residing on a server for remote wireless parking management and payment. The suite of computer programs verifies a third party payment request, such a third party using a wireless or landline telephone to request access. The suite of computer programs grants or rejects such access request based on a plurality of authentication rules defined within the server resident program suite.

Owner:JANACEK THOMAS ANDREW +1

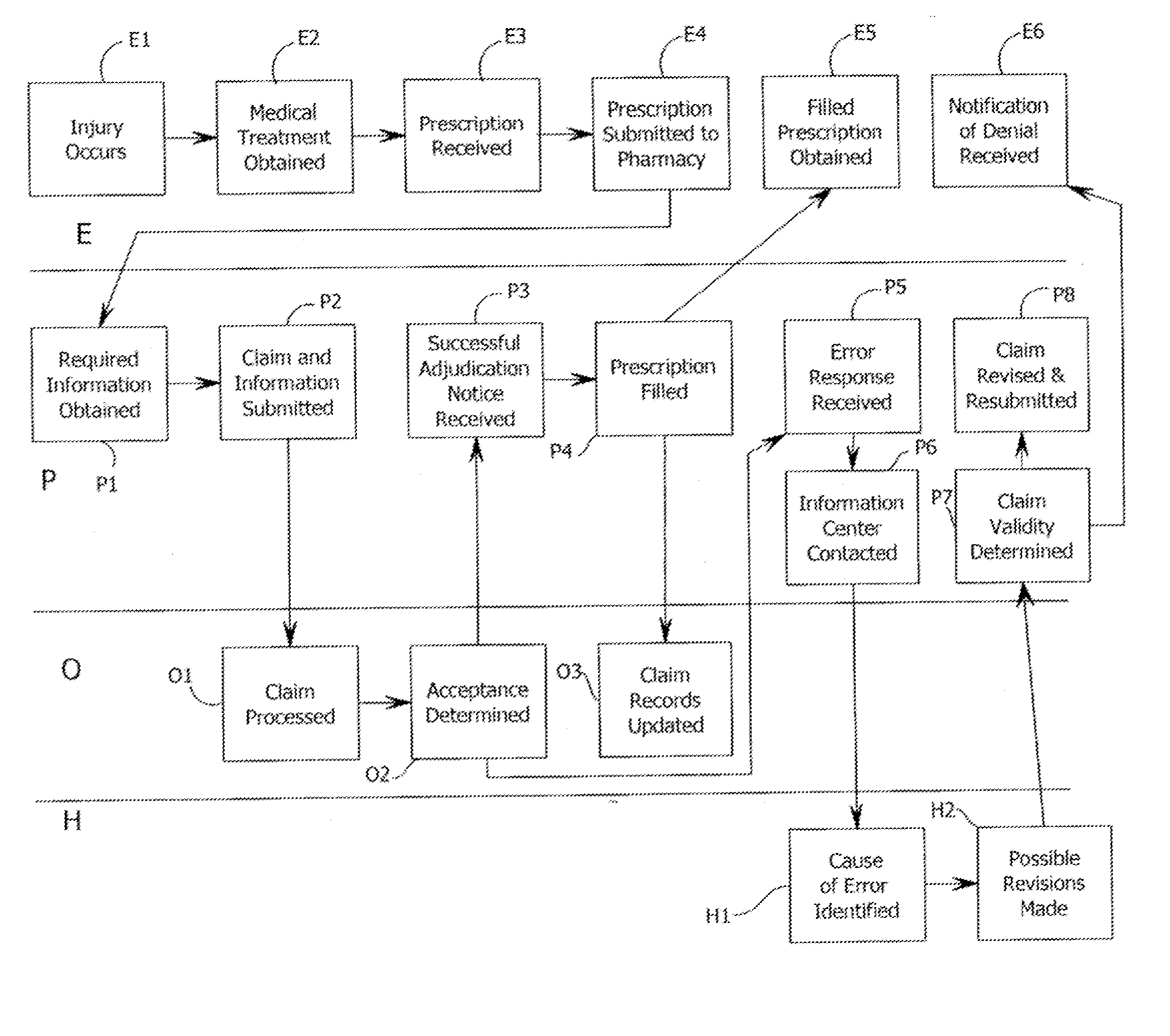

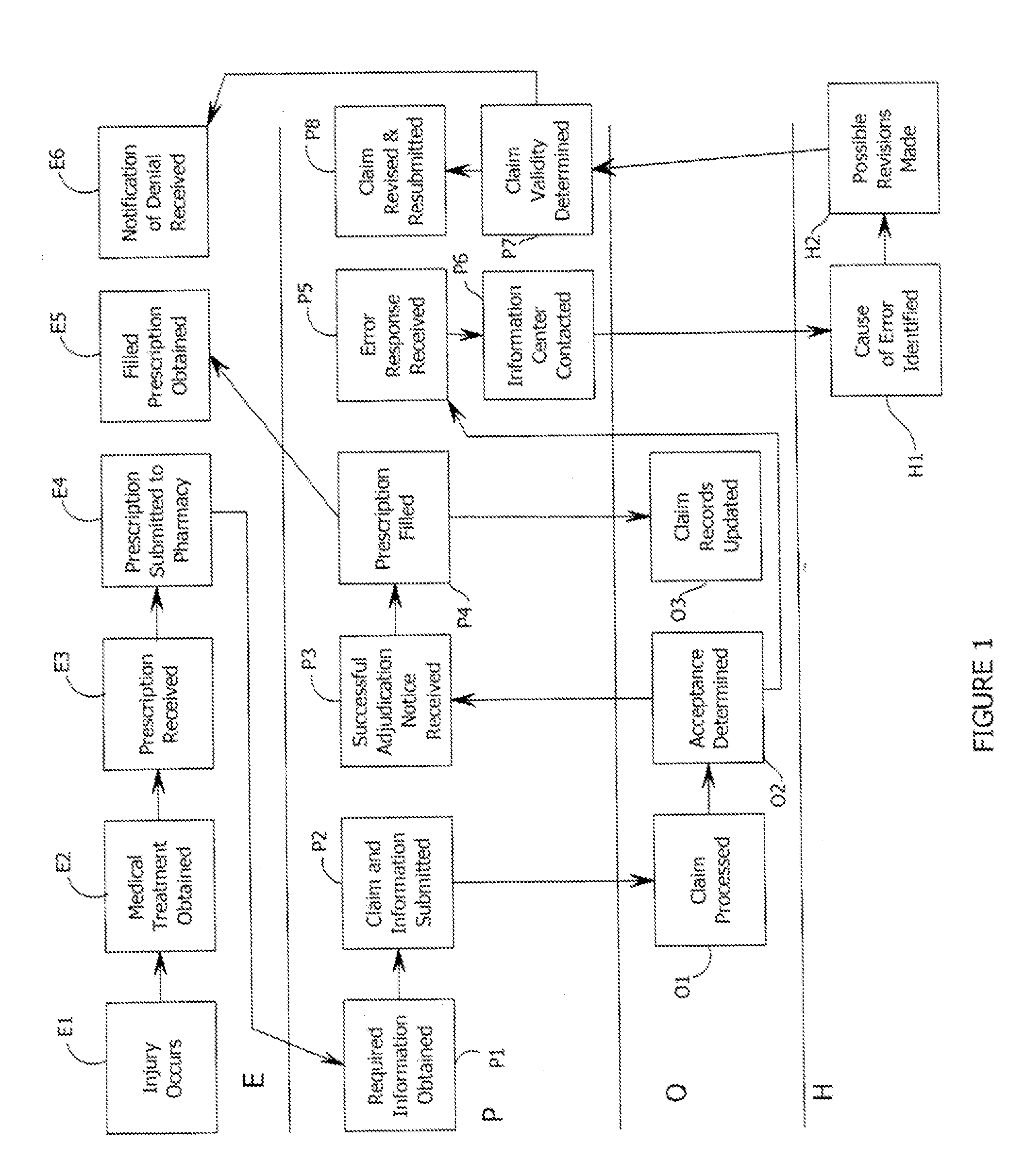

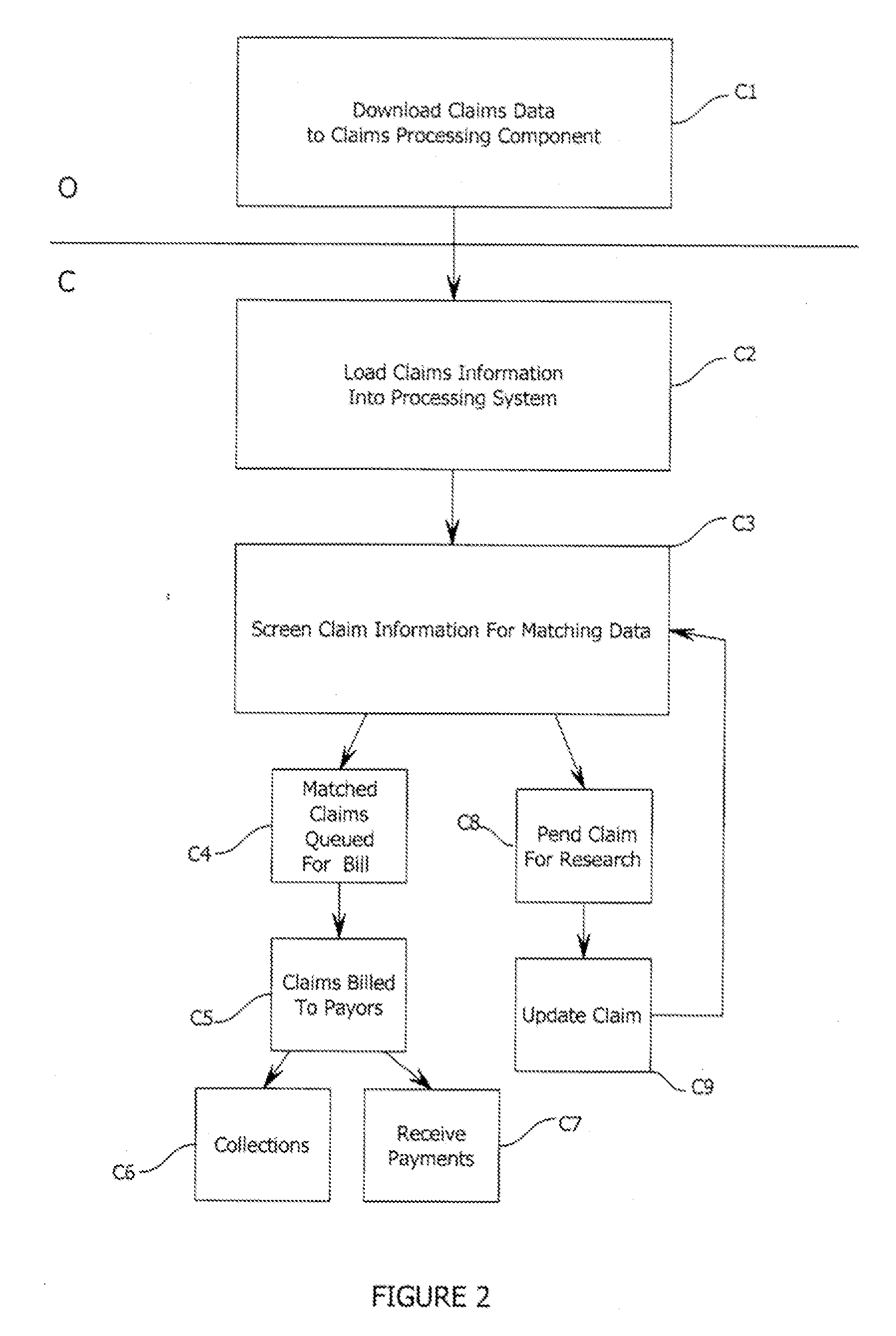

Systems and methods for accelerated payment of pharmacy prescription claims

Methods and systems are related to the payment of pharmacy benefits under an insurance policy. The system includes pharmacies, a real-time claims processing adjudication component, an information component and a claims processing or billing component. When a qualified patient submits a prescription to a participating pharmacy, the pharmacy collects identifying information from the patient and conveys a request to the real-time claims adjudication component, which screens the request for a match to data already loaded in the system and conveys a notification of acceptance or error to the pharmacy. The real-time claims adjudication component compiles records of the approved claims and the claims processing component processes the claims, bills third party payors and generates periodic files detailing payments owed to pharmacies. Funds are then made available to the pharmacy. The pharmacy may obtain the funds by initiating a transfer, such as a charge placed on a card issued by the system.

Owner:DAUGHERTY LORAINE +1

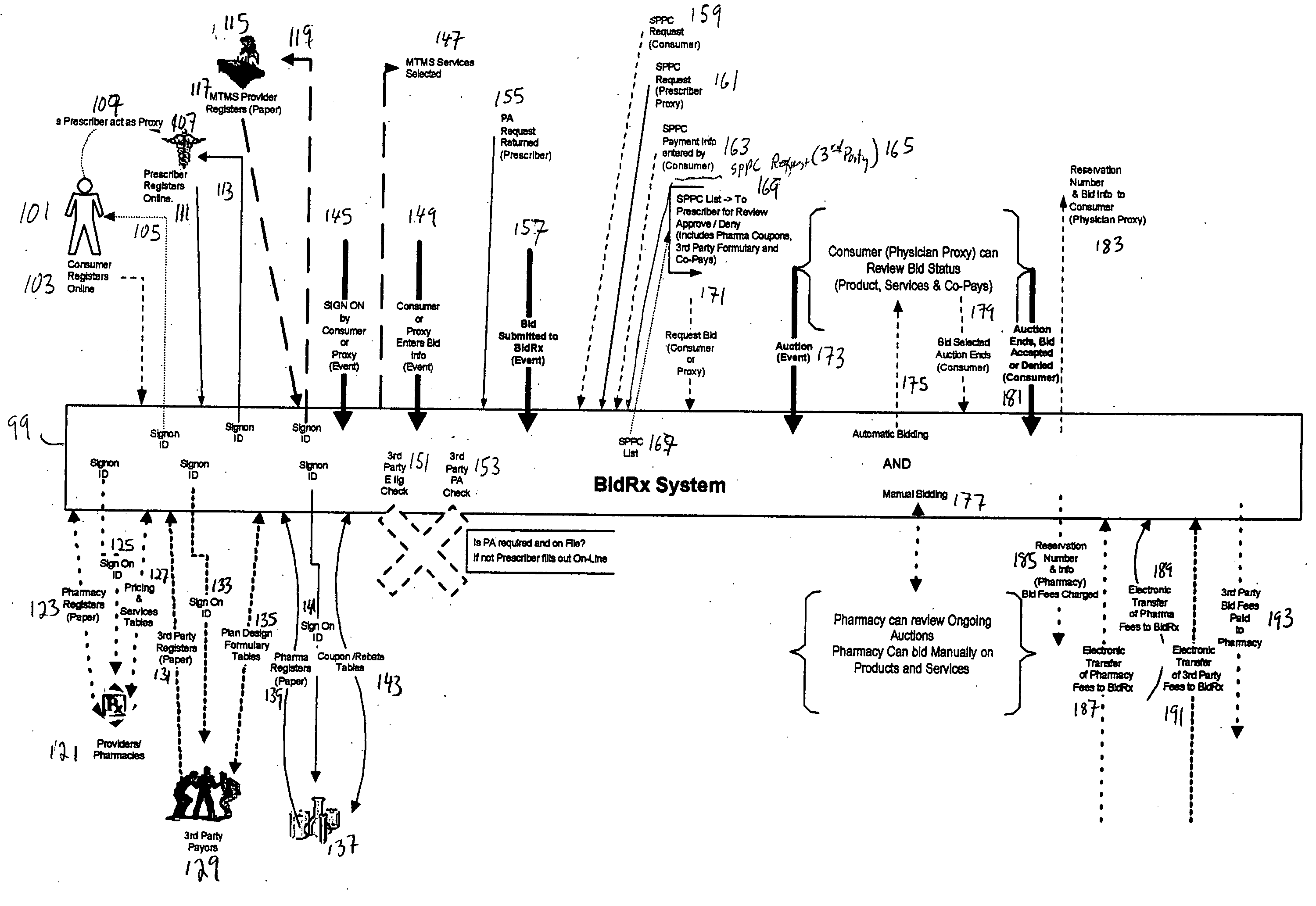

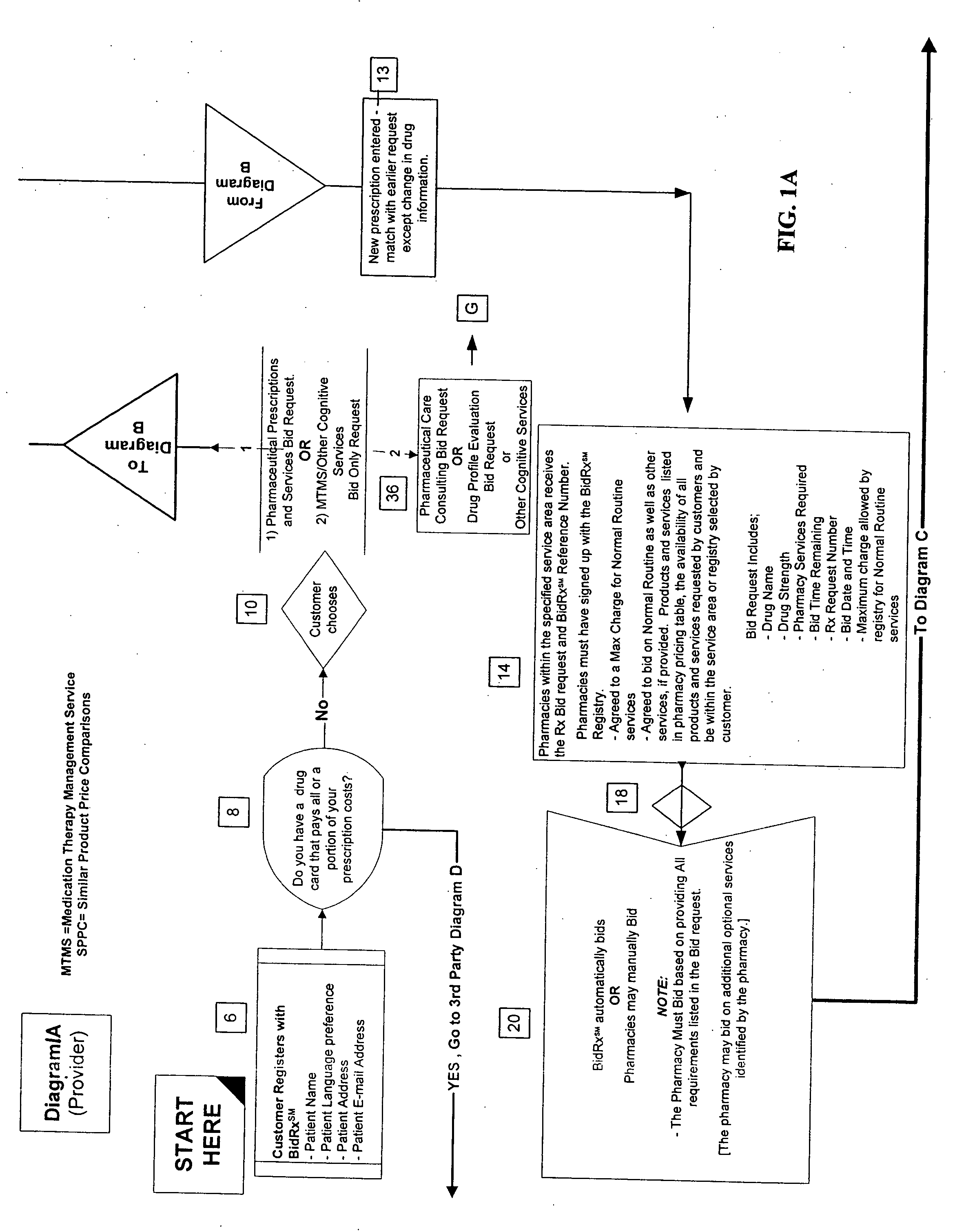

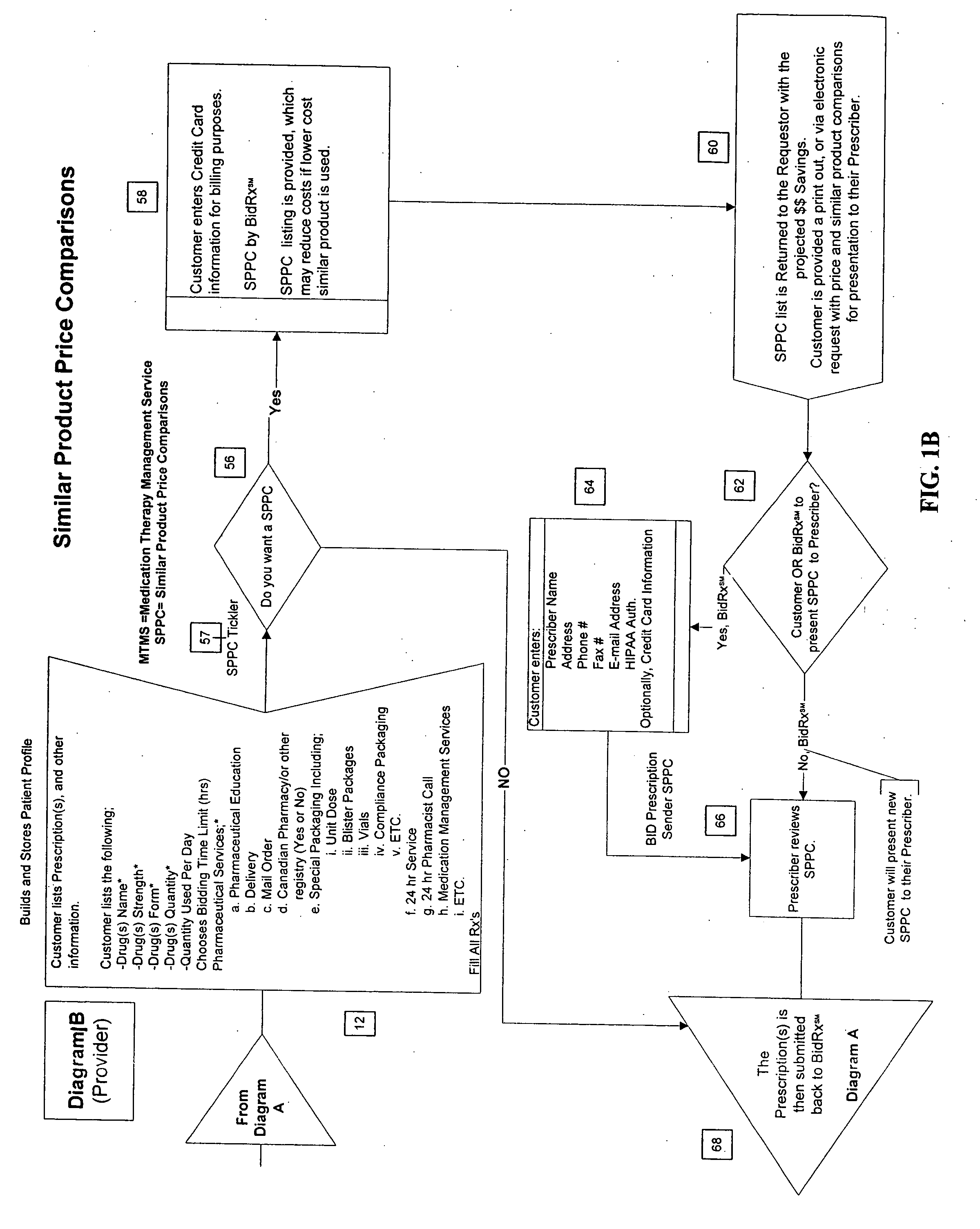

Method for competitive prescription drug and/or bidding service provider selection

Unfilled prescriptions are submitted to a registry comprising pre-qualified pharmacies for a “reverse auction” in which the pharmacies bid for the opportunity to fill the prescription. The pharmacies are allowed to bid based on price and / or offering ancillary services. The auction may also be used to bid on supplying specified pharmaceutical cognitive services. The method may also include obtaining cost comparisons with generic substitutes or similar alternative pharmaceutical products. The system may further comprise automatically requesting a review by the prescriber for a list of similar substitutes or prior-authorization for third-party payers. The winner of the reverse auction is selected by the customer.

Owner:TAG LLC (US)

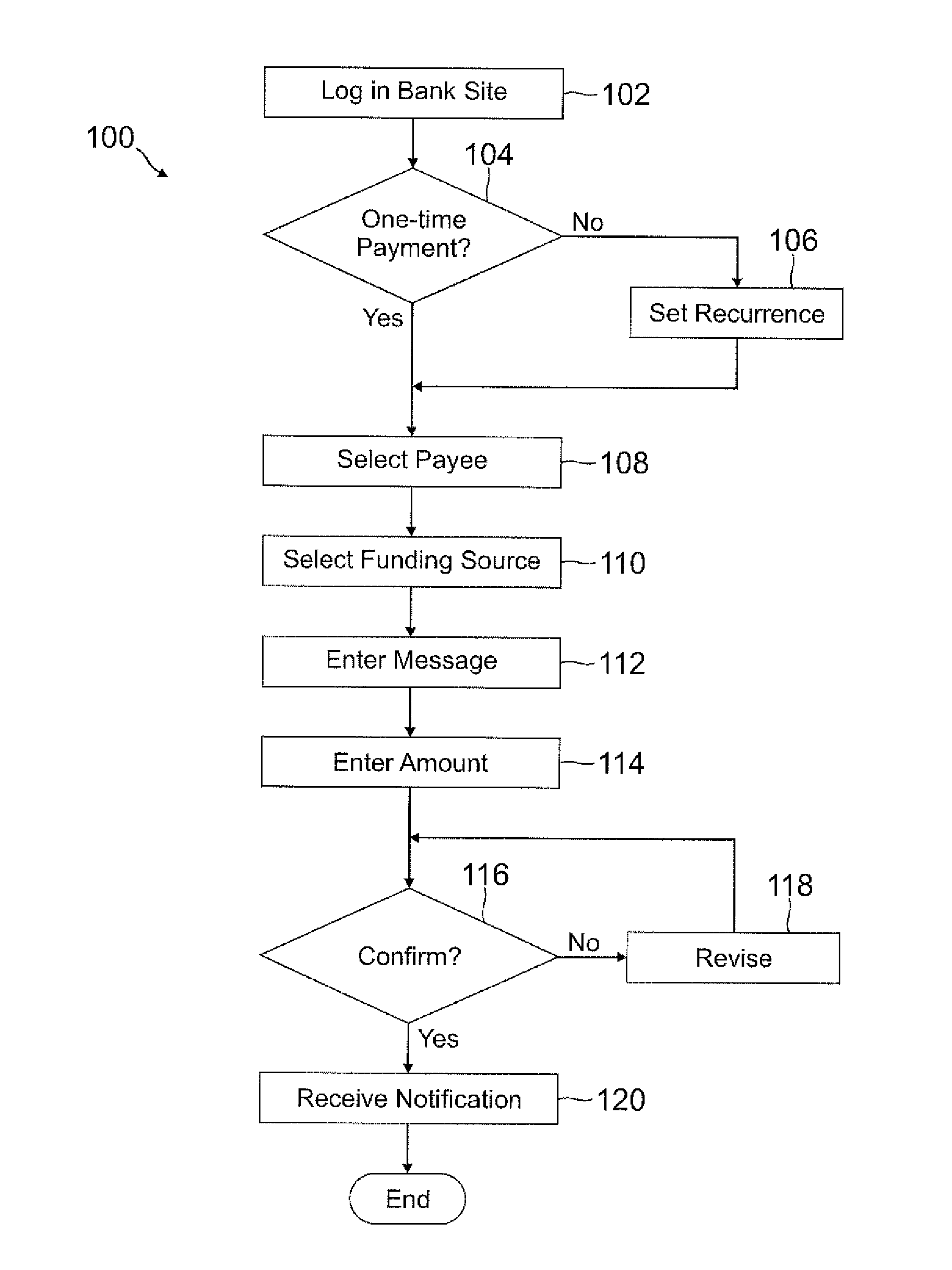

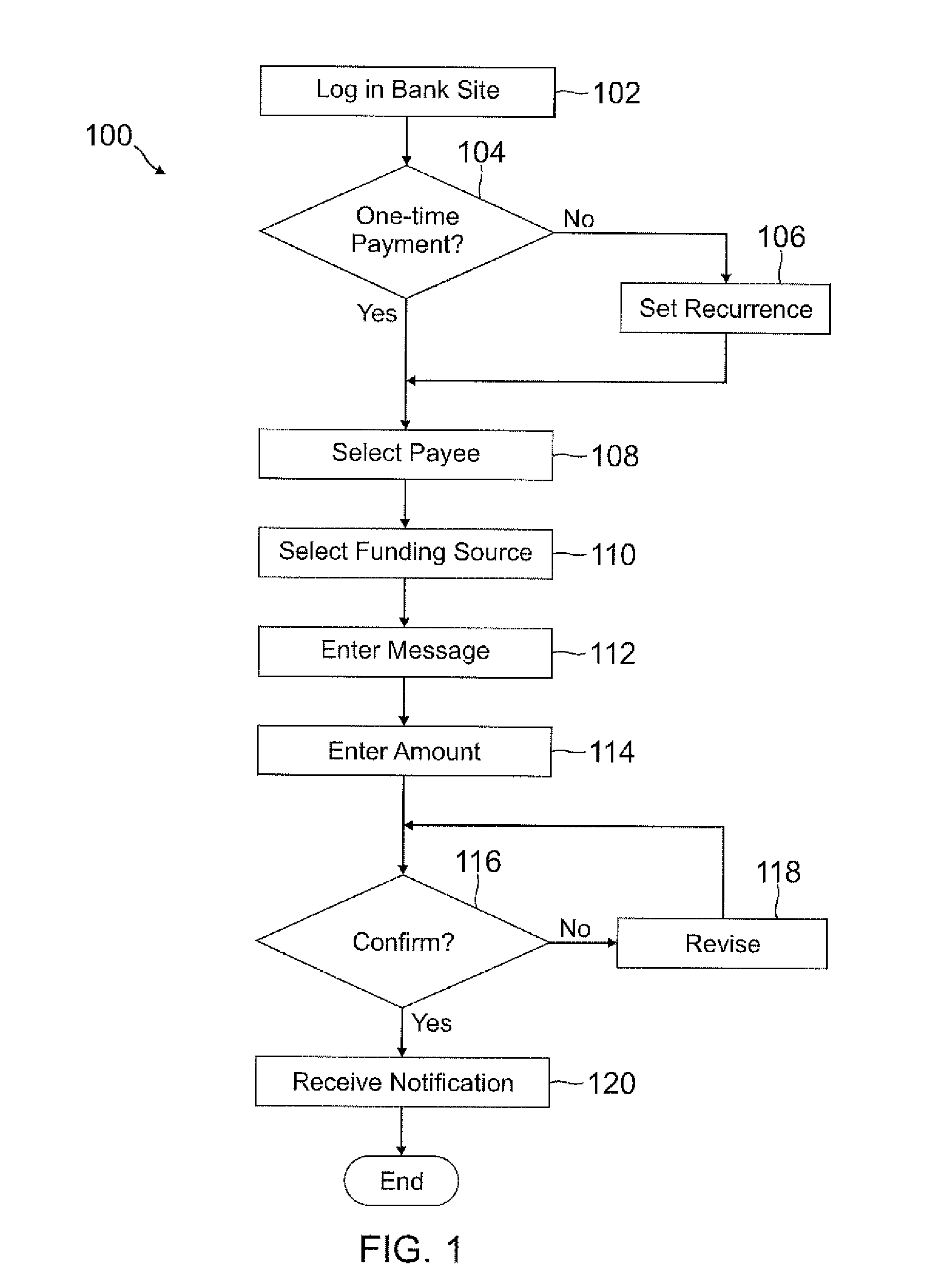

Real-time payments through financial institution

InactiveUS20120136781A1Significant retentionSignificant engagement toolFinanceCommerceThird partyEmail address

A payment provider uses bank rails to enable a bank customer to send real-time payments through the bank site by simply entering a recipient identifier, such as an email address or mobile number. The bank has an account with the payment provider. Thus, when the customer sends a payment through the bank, the payment provider transmits the payment to the recipient through the bank's payment provider account. The bank debits the amount from the user's bank account or from a third party, in which case the bank makes a payment to the third party. The sender does not have to have an account with the payment provider, just an account with the bank.

Owner:PAYPAL INC

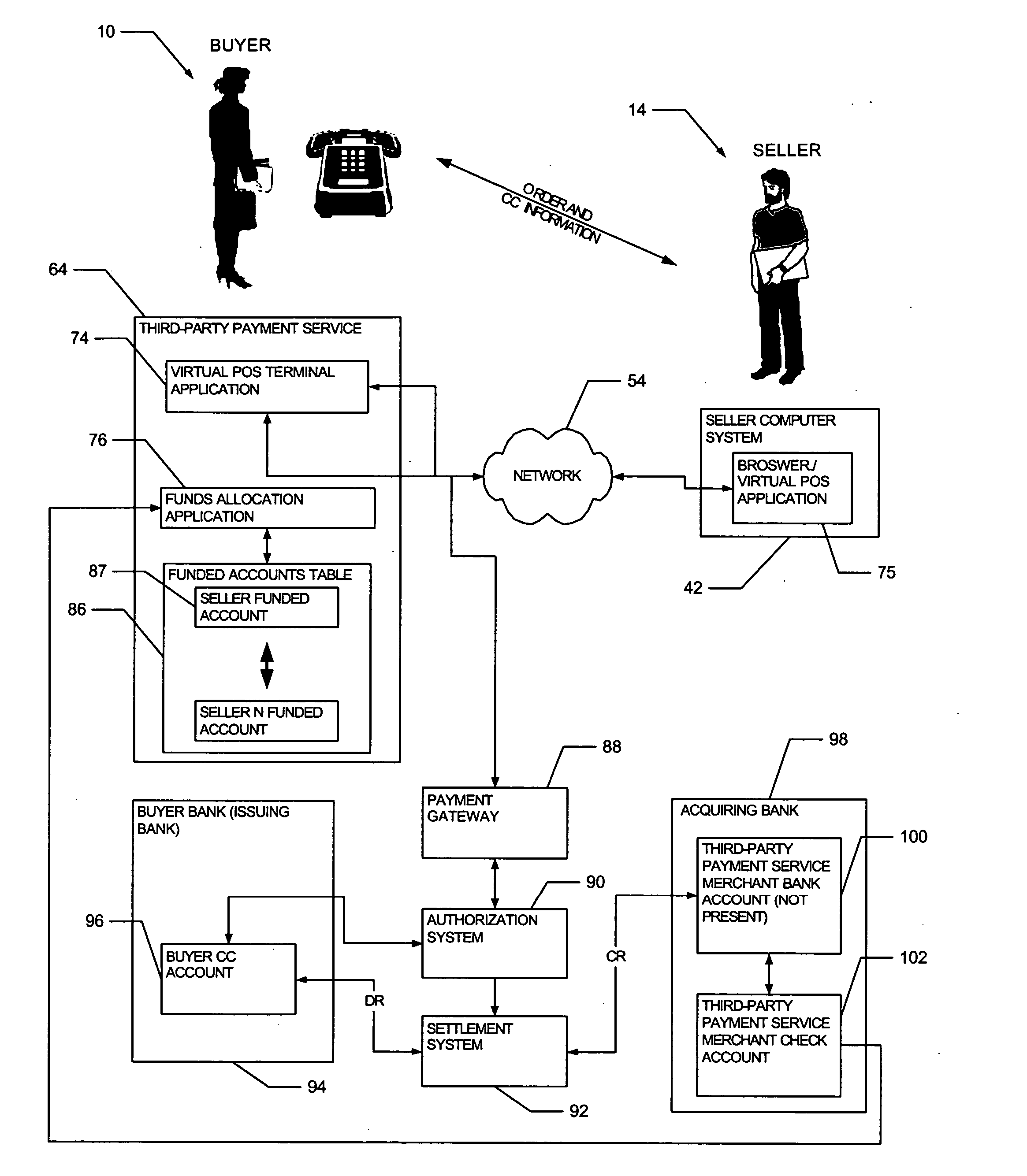

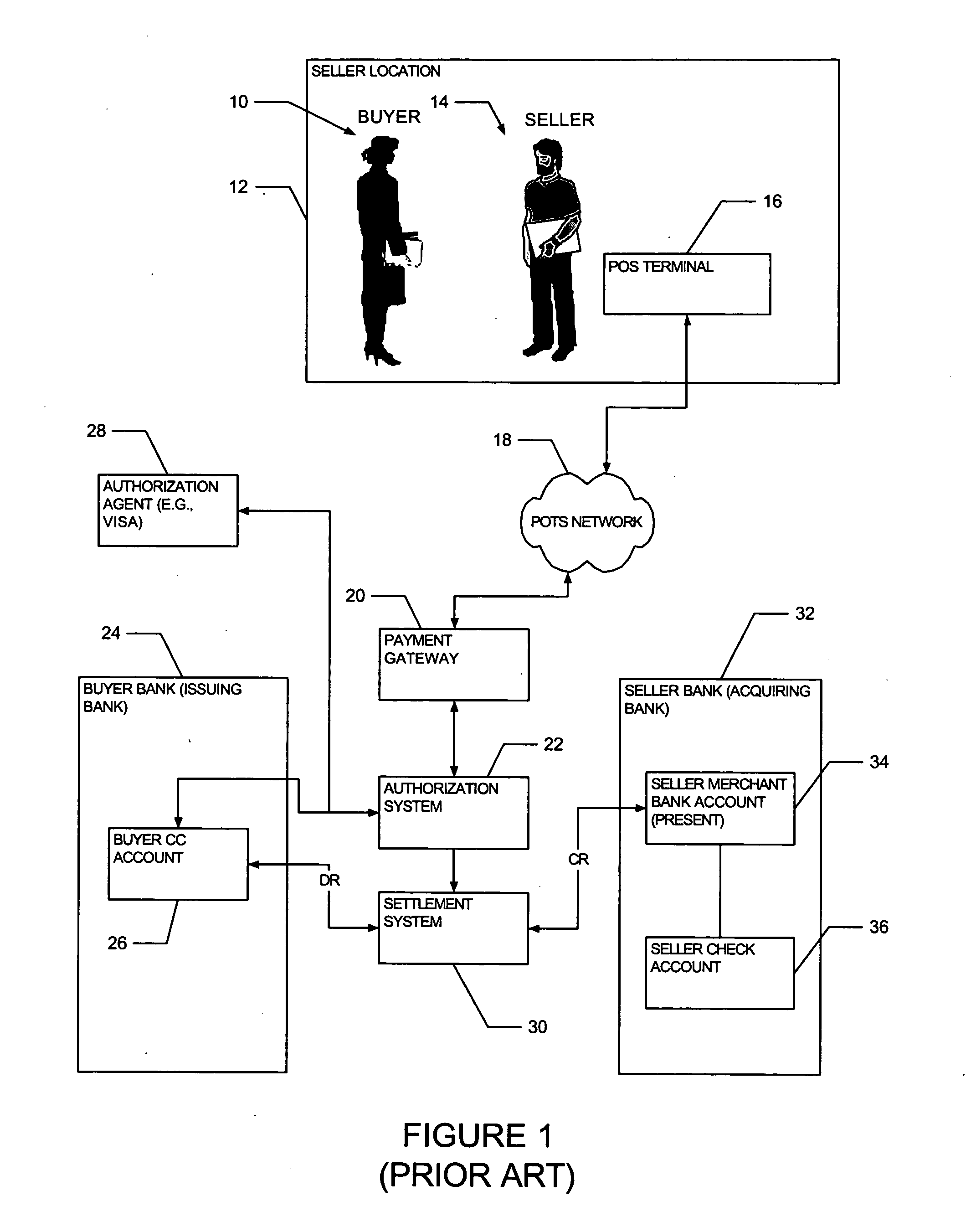

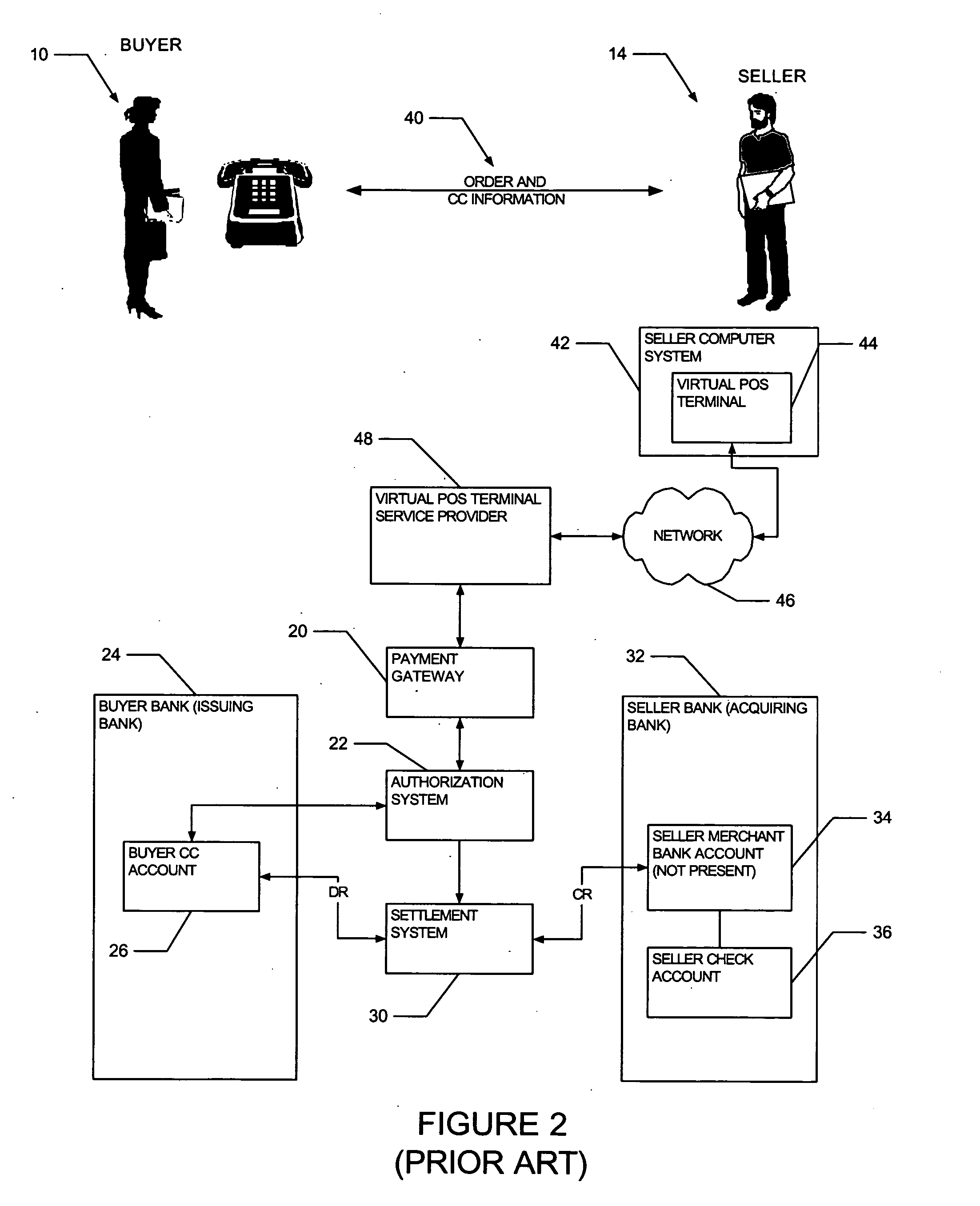

Method and system to process credit card payment transactions initiated by a merchant

A system, to process credit card payment transactions initiated by a merchant, includes an interface to receive a merchant-initiated request for a transfer of funds from a buyer credit card account. A credit card processing application initiates the transfer of funds from the buyer credit card account to a third-party merchant bank account, held by a third-party payment service. The third-party merchant bank account receives funds from the buyer credit card account on behalf of the merchant. A funds allocation application allocates the received funds to a receiving account of the merchant, the receiving account being maintained by the third-party payment service. The credit card processing application may be virtual point of sale (POS) terminal application, hosted at a server computer system operated by the third-party payment service, and accordingly may be accessible by the merchant via a network.

Owner:PAYPAL INC

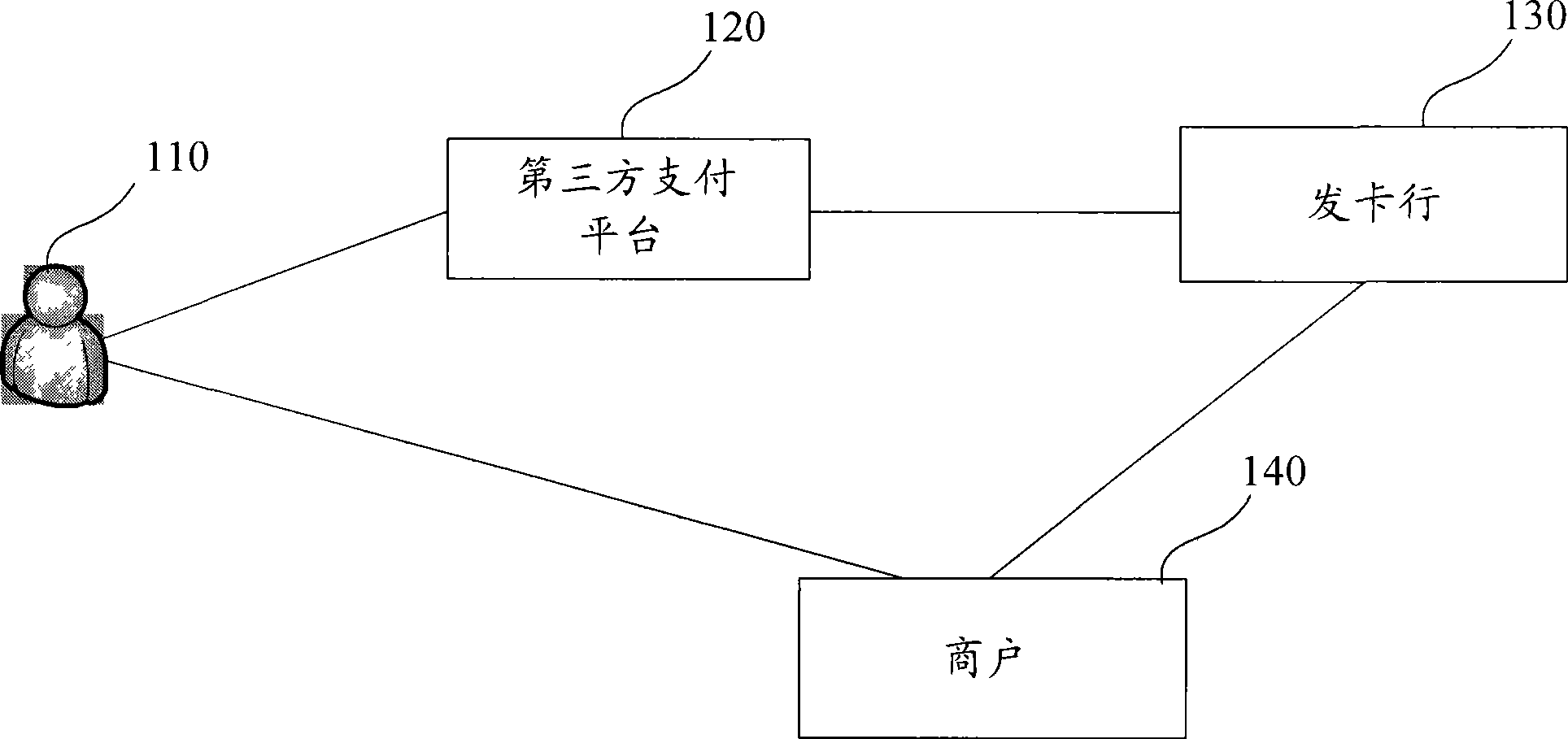

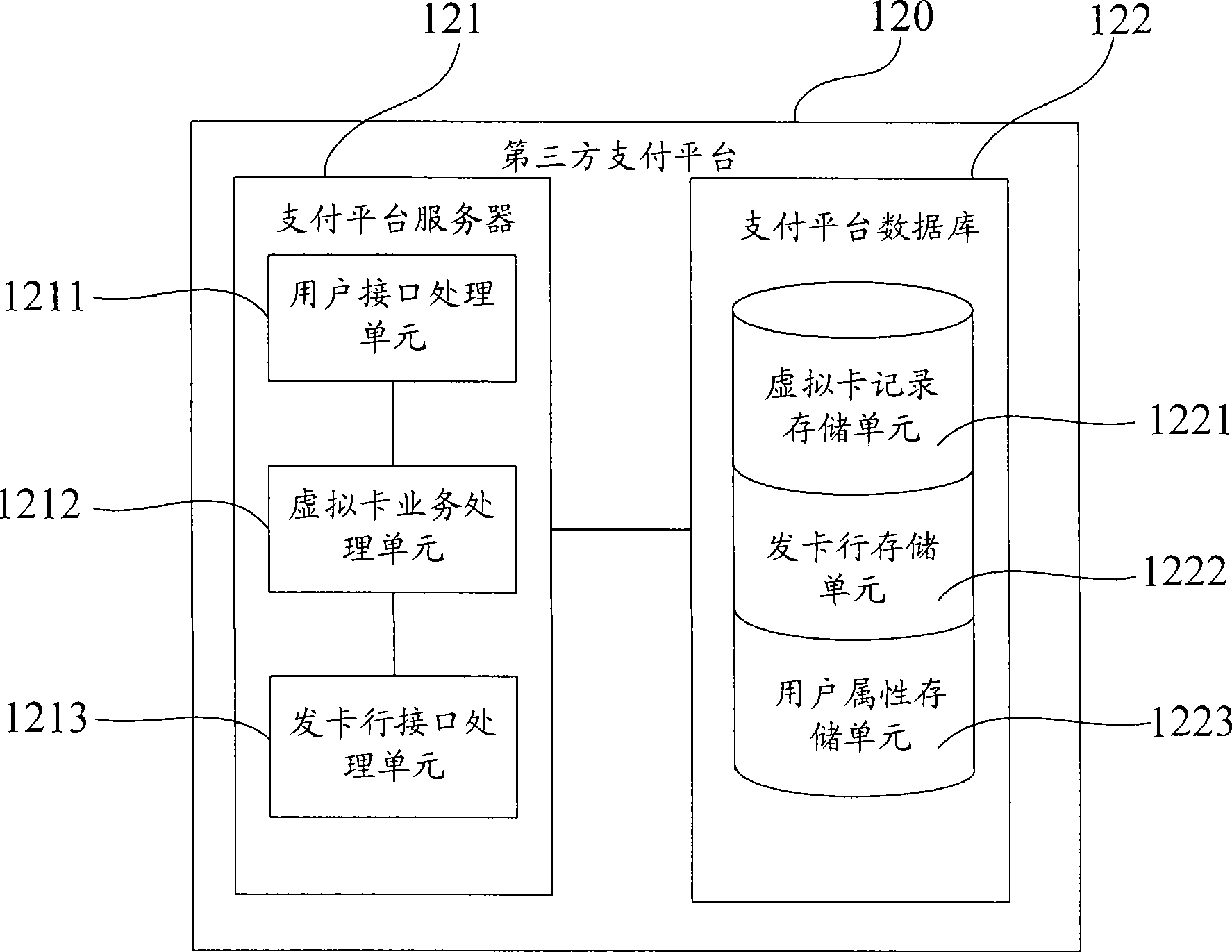

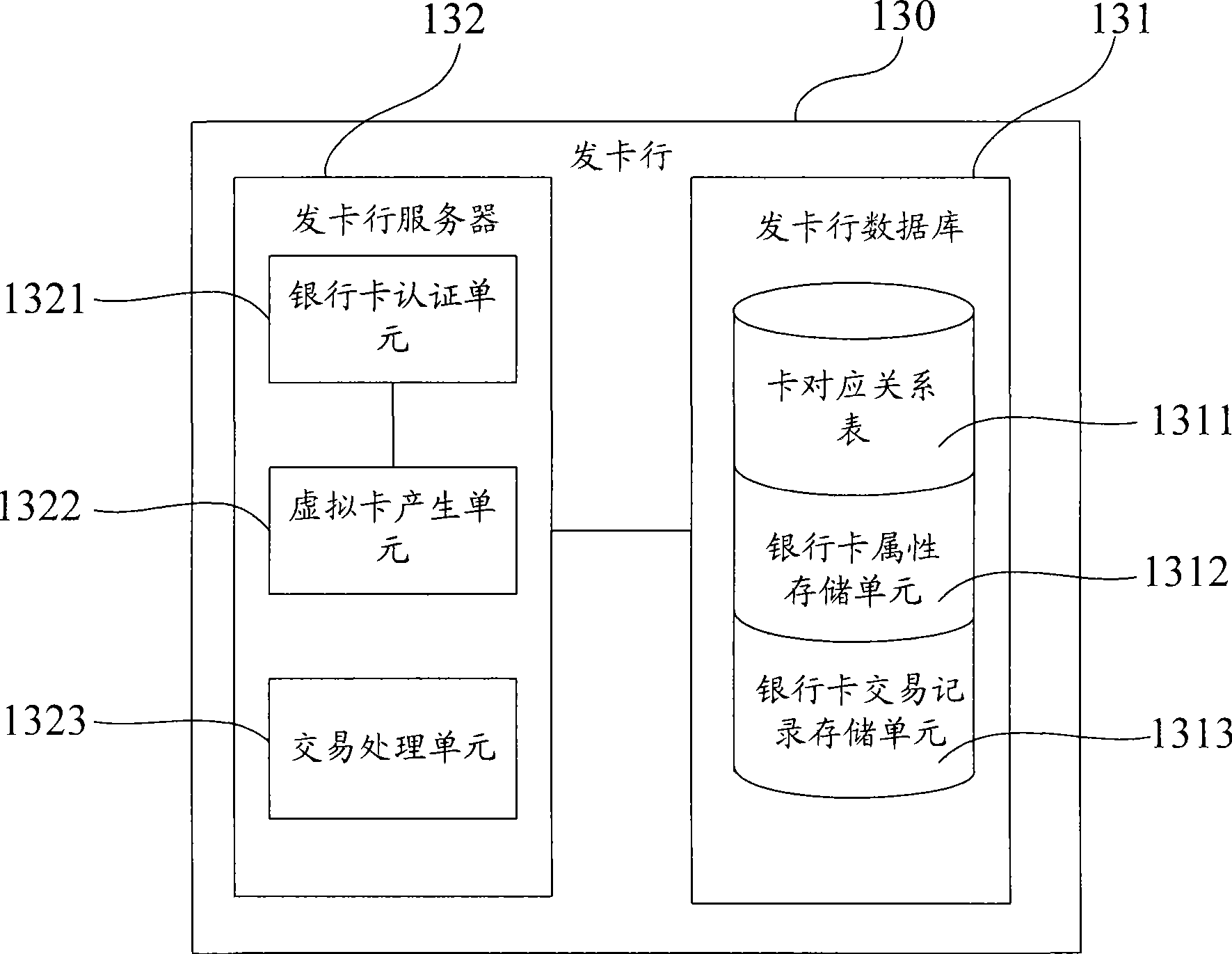

Payment method, system and payment platform capable of improving payment safety by virtual card

The invention provides a method of payment utilizing a virtual card to enhance payment safety and a system thereof, wherein, the method of payment includes the following steps : a third-party payment platform is provided; after receiving the application request of virtual card of a user, the third-party payment platform obtains the information of bank card of the user and sends the request of virtual card application to a corresponding issuing bank; the third-party payment platform returns the information of virtual card number sent by the issuing bank to the user; and when the issuing bank receives the request of payment including the information of virtual card number and payment amount, payment is successfully done, provided that the virtual card meets the service regulations of the virtual card and monetary amount on the corresponding bank card is no less than the payment amount. As the payment of the invention is carried out by the virtual card number, information security of the card can be enhanced when the bank card number and password are directly input.

Owner:ALIBABA GRP HLDG LTD

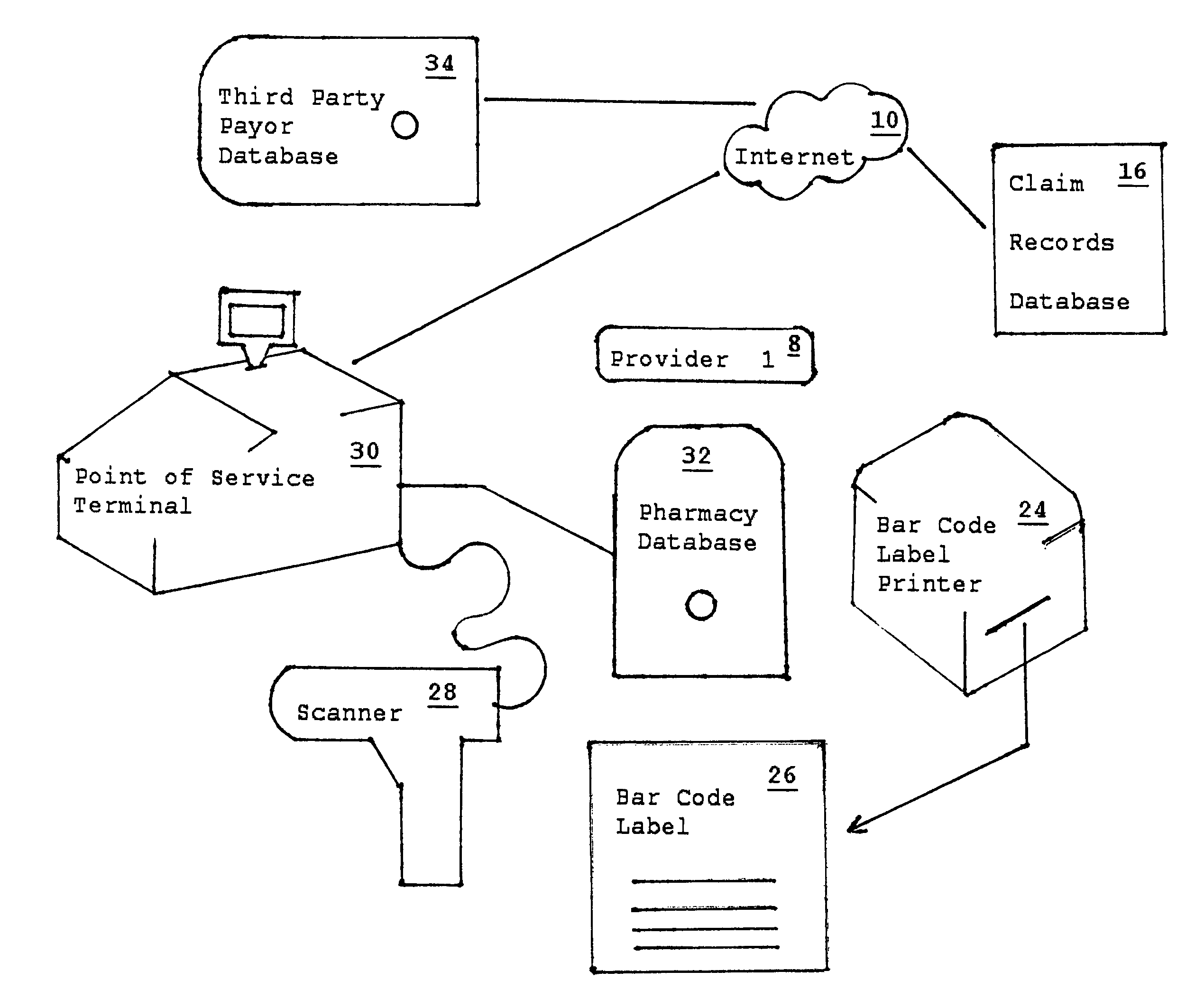

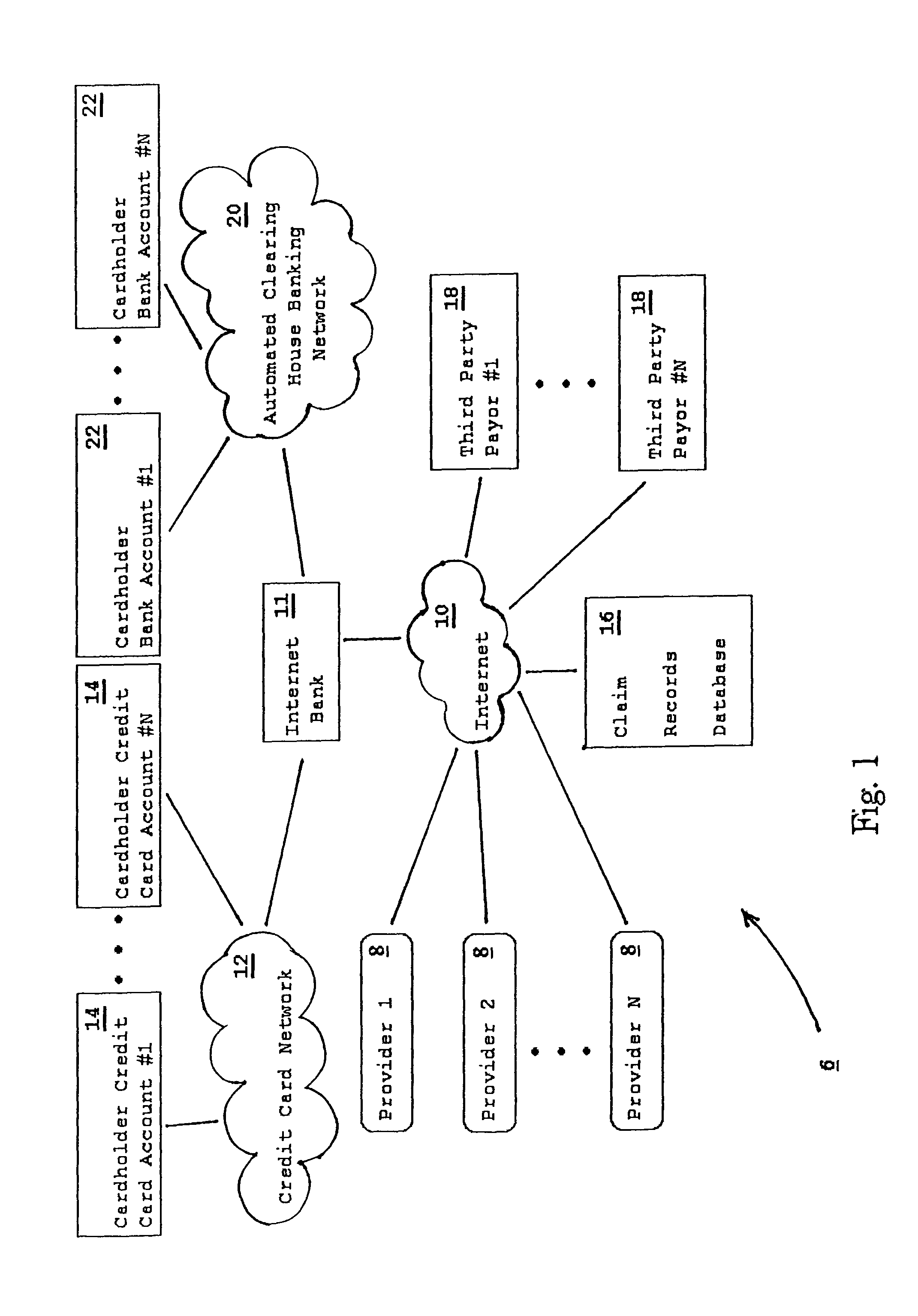

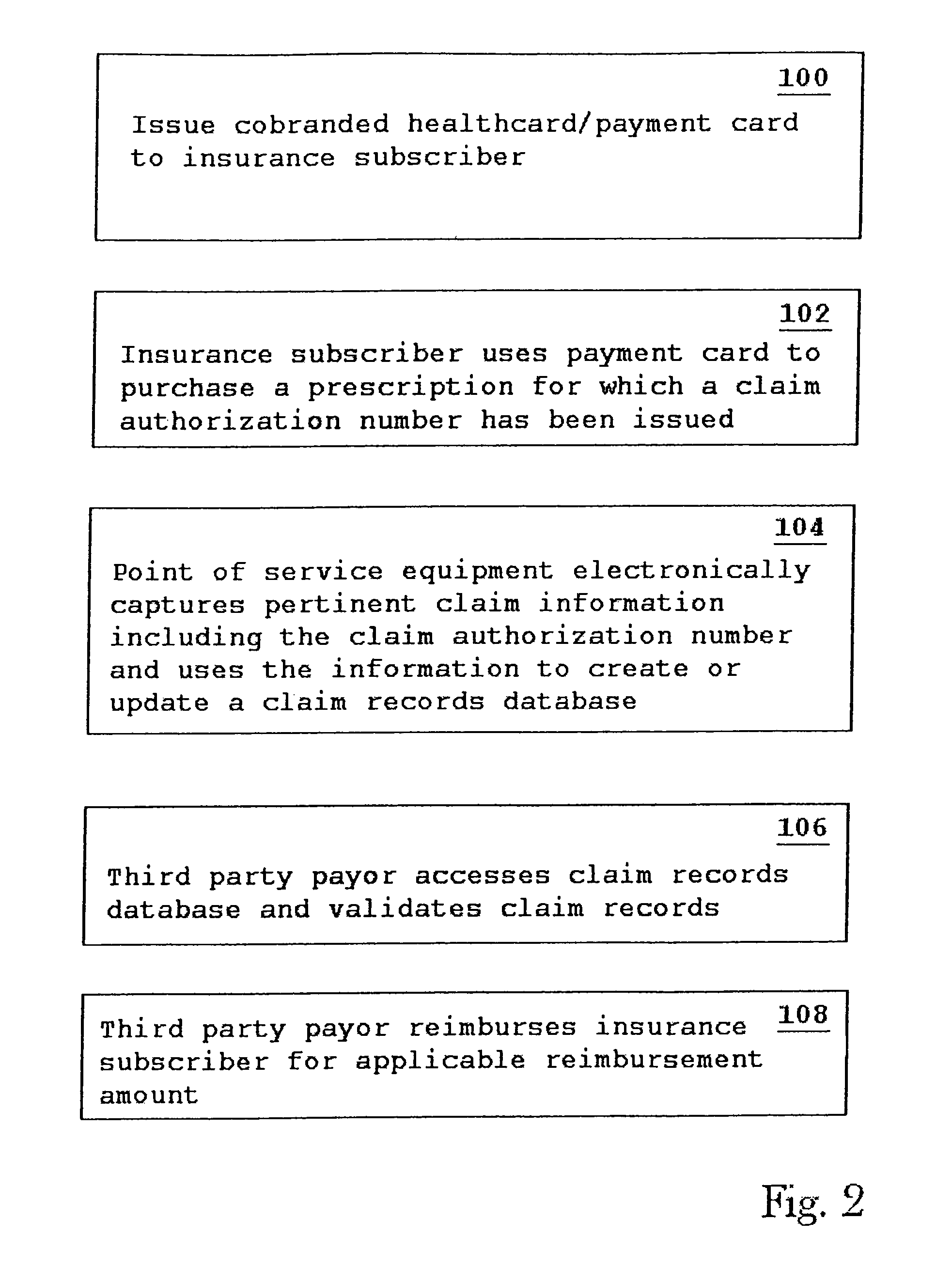

Automated system for filing prescription drug claims

ActiveUS7739127B1Takes effortSignificant monetary savingsDrug and medicationsOffice automationThird partyBank account

An automated system and method for filing prescription drug claims which includes a point of service terminal which accepts a payment system access card for payment for a purchase of a service and / or product by a customer, where at least part of the purchase is reimbursable by a third party payor. The point of service terminal creates a purchase transaction and during the transaction electronically captures pertinent claim information including a claim authorization or approval number. The point of service terminal uses the pertinent claim information to update a claim records database. The claim records database is accessed by the third party payor and the pertinent claim information is validated. The applicable reimbursement amount, which is determined by the third party payor, is issued as a credit to the customer payment card account or a customer bank account or as a check.

Owner:HALL BENEFITS

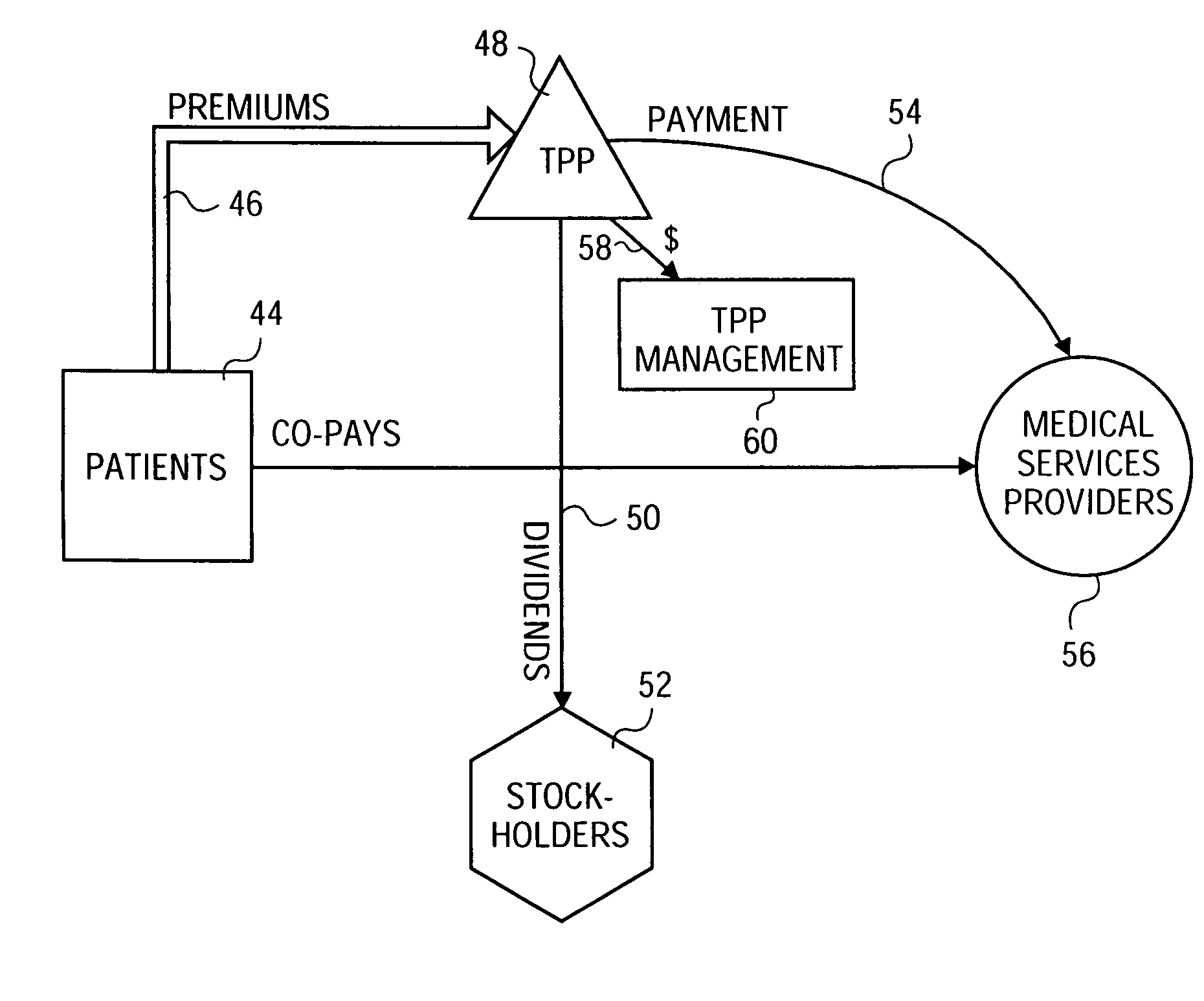

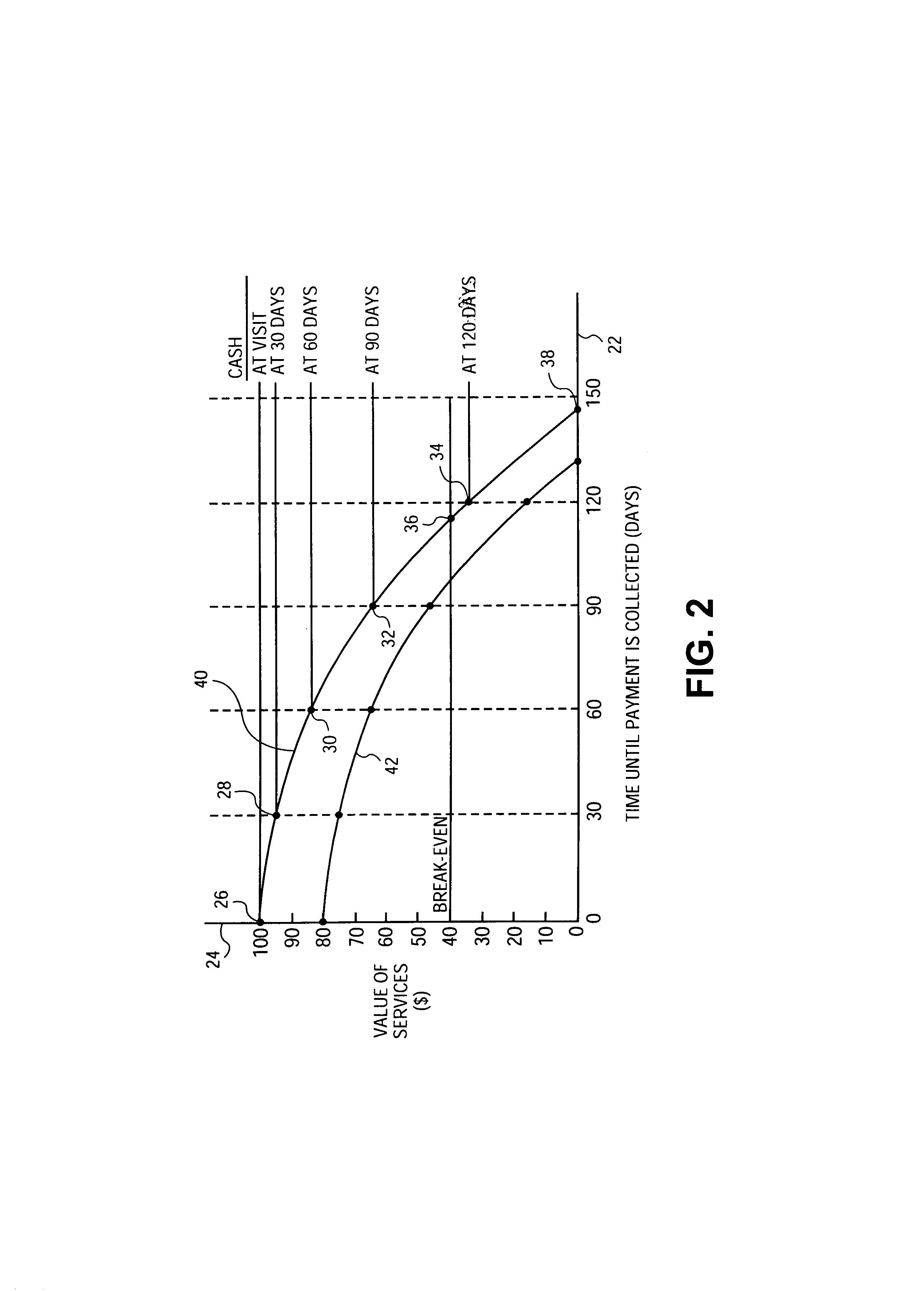

Method and apparatus for tracking the relative value of medical services

ActiveUS7702522B1Raise the possibilityMaximize profitabilityFinanceBilling/invoicingThird partyRelevant information

Methods and apparatus for tracking and evaluating the relative value, such as the net present value, of medical services provided to patients associated with third party payors (“TPPs”). Under various embodiments of the present invention, the relative value of medical services is considered in evaluating whether to enter into an agreement with a TPP, whether to accept a new patient, when and for how long to schedule a patient appointment, and how long a physician should meet with the patient. Methods and apparatus for improving the efficiency of a medical office are also disclosed whereby a physician may more effectively supply a patient with relevant information and provide prescriptions, record billing information, order supplies, and collect payment for services provided. Methods and apparatus for improving security within a medical office and reducing employee fraud are also disclosed.

Owner:SHOLEM STEVEN L

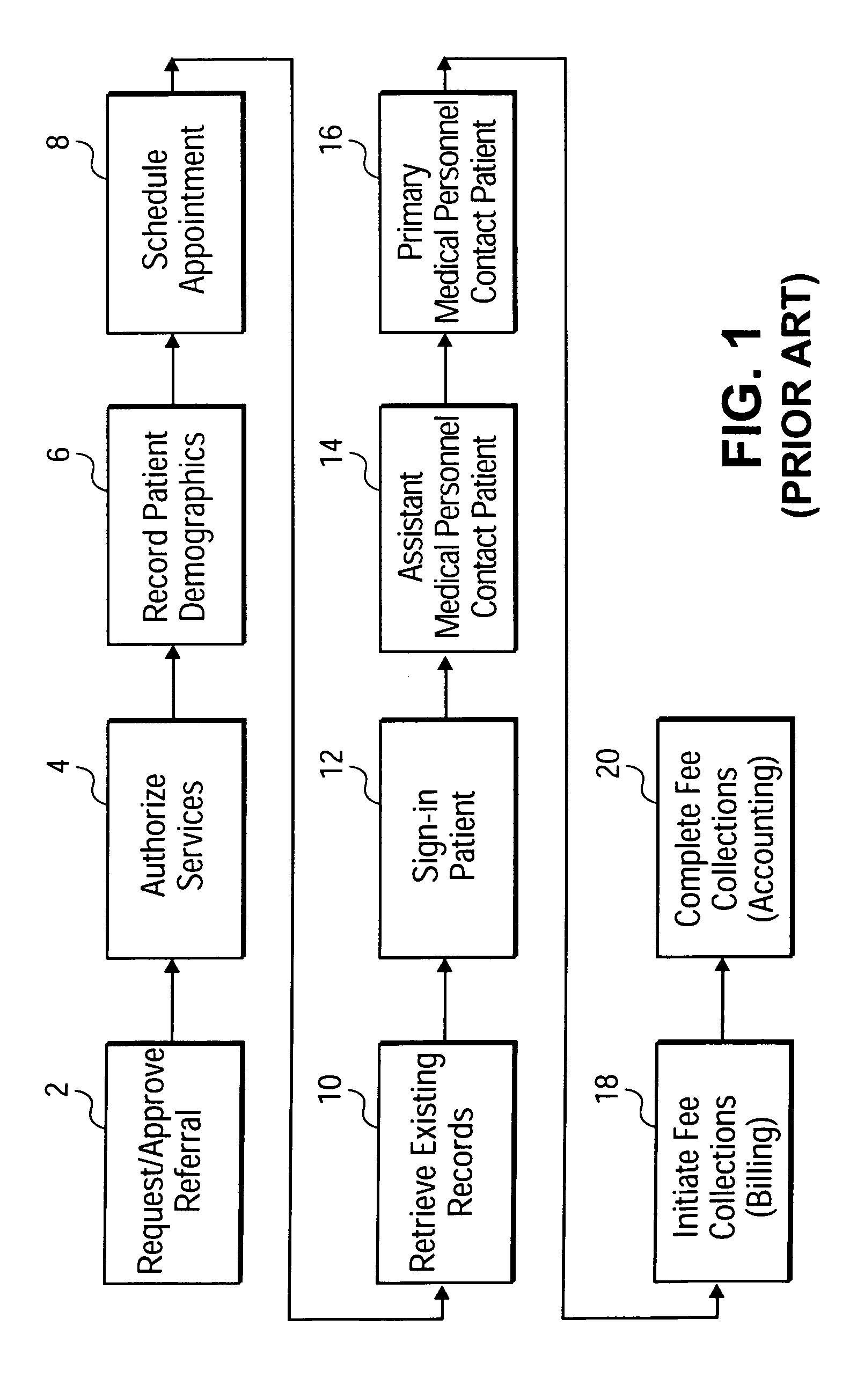

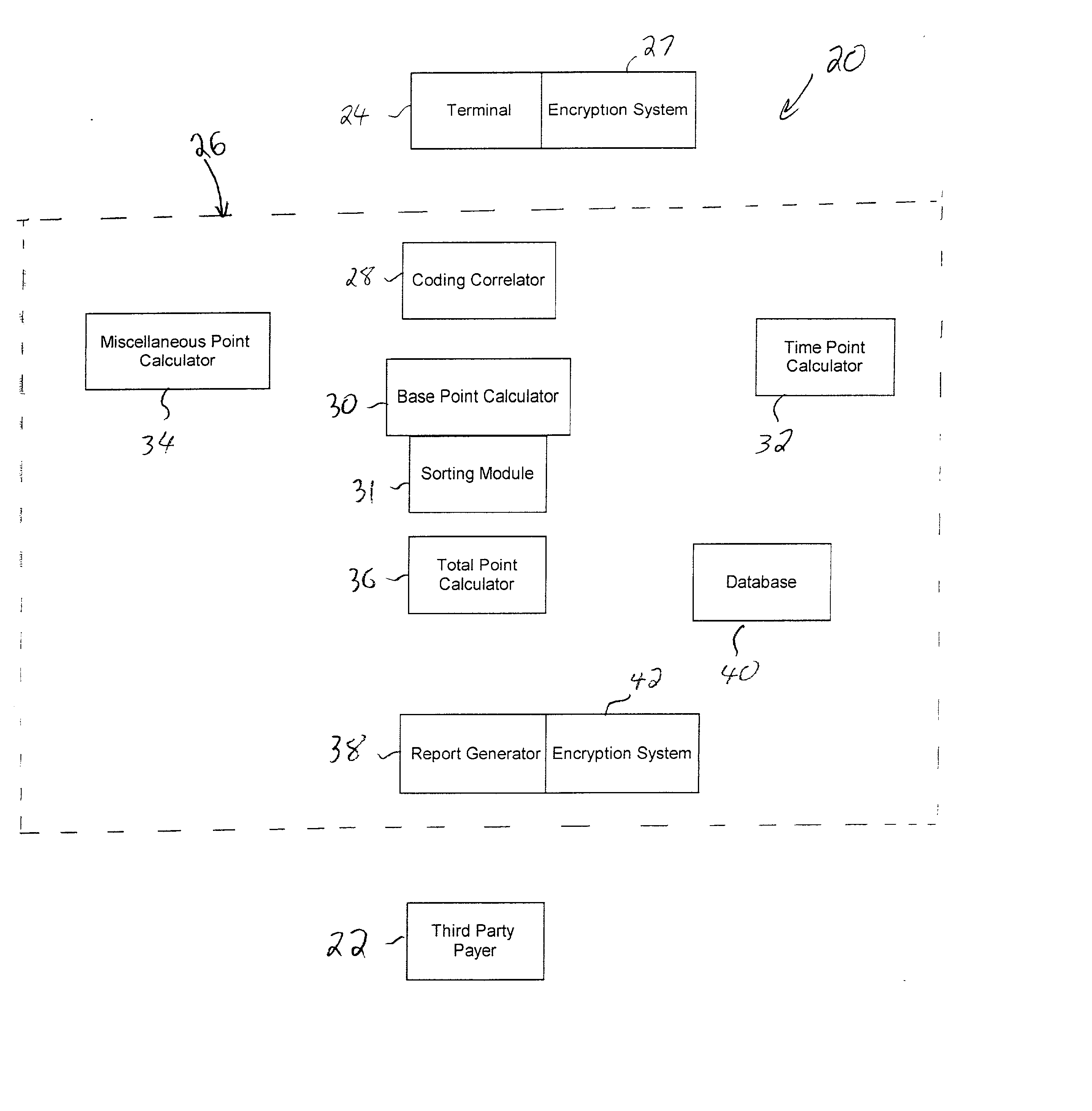

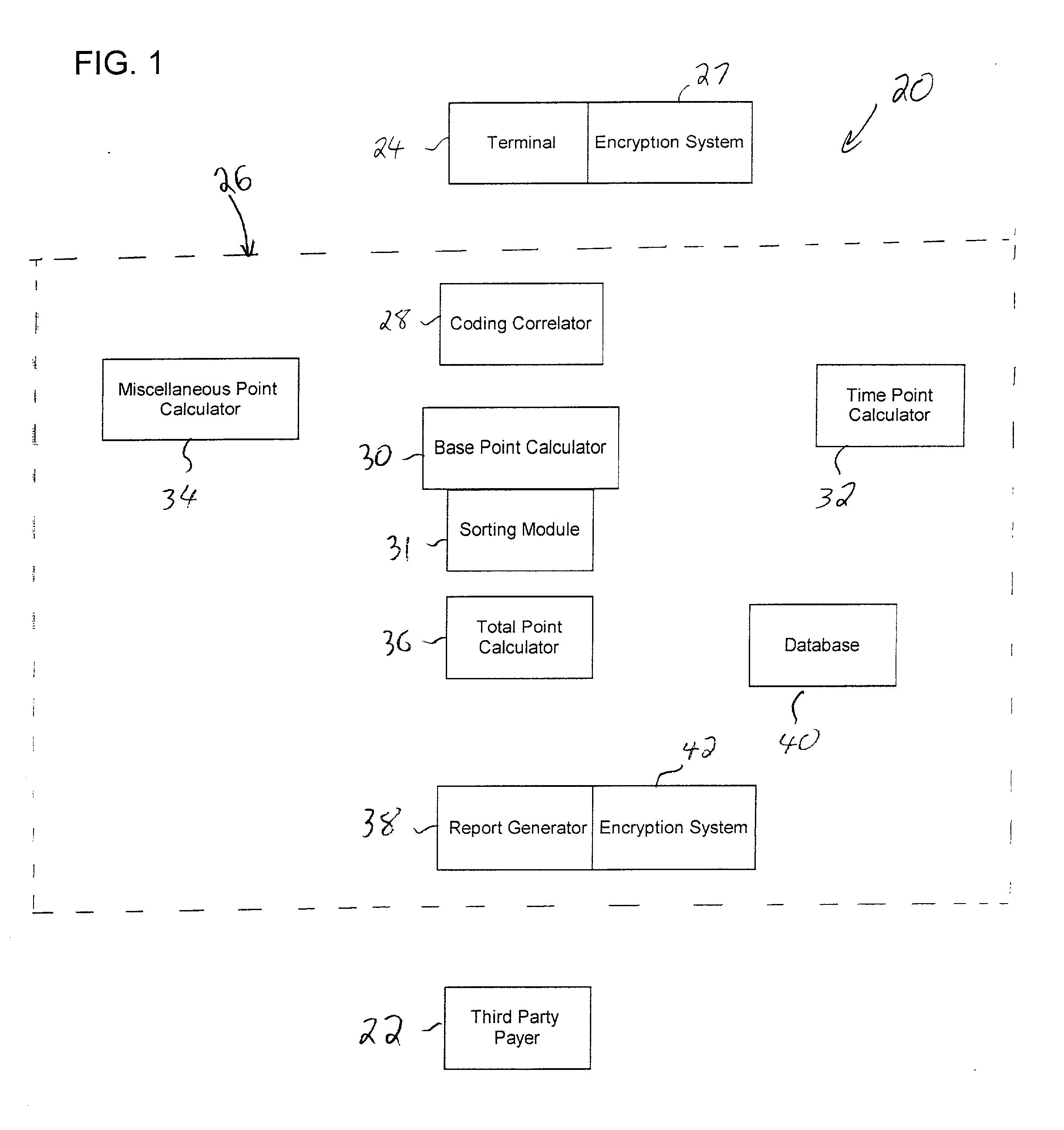

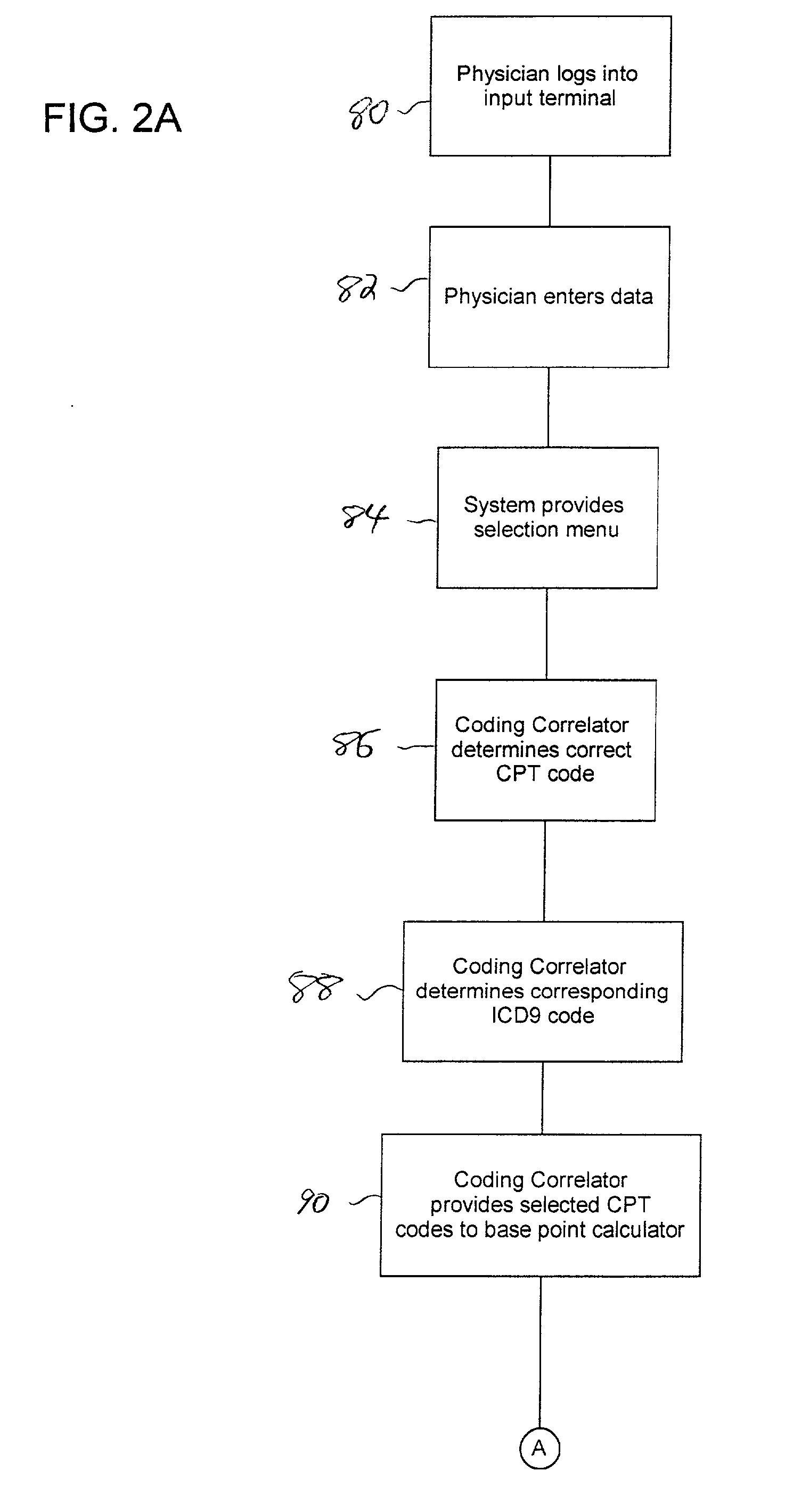

System and method for determining and reporting data codes for medical billing to a third party payer

A method and system for defining and reporting accurate medical codes of a patient for medical billing to a third party payer. The system includes an input terminal for inputting patient data by a physician. The system also include a computing system which assists the physician in determining a correct standardized code for a medical procedure performed by the physician on the patient. The system also includes a means for determining the point value of the selected standardized code. The system also creates a report including the selected standardized code, total point value, and relevant patient data for the third party payer.

Owner:HOSPITAL SUPPORT SERVICES

System and method for waterfall prioritized payment processing

The invention comprises a system and method for “waterfall” type payment processing using multiple alternative payment sources. A payor provides account information for multiple payment sources, such as a bank checking account, savings account, first credit card account, second credit card account, and so forth. The multiple payment sources are prioritized so that one is a primary payment source, another is a secondary payment source, another is a tertiary payment source, and so forth. After setting up the waterfall payment arrangement, when a bill becomes due a payee or third party payment administrator submits transactions against the payment sources in their order of priority until the payment is satisfied. Other variations and enhancements are disclosed.

Owner:U S BANK NAT ASSOC +1

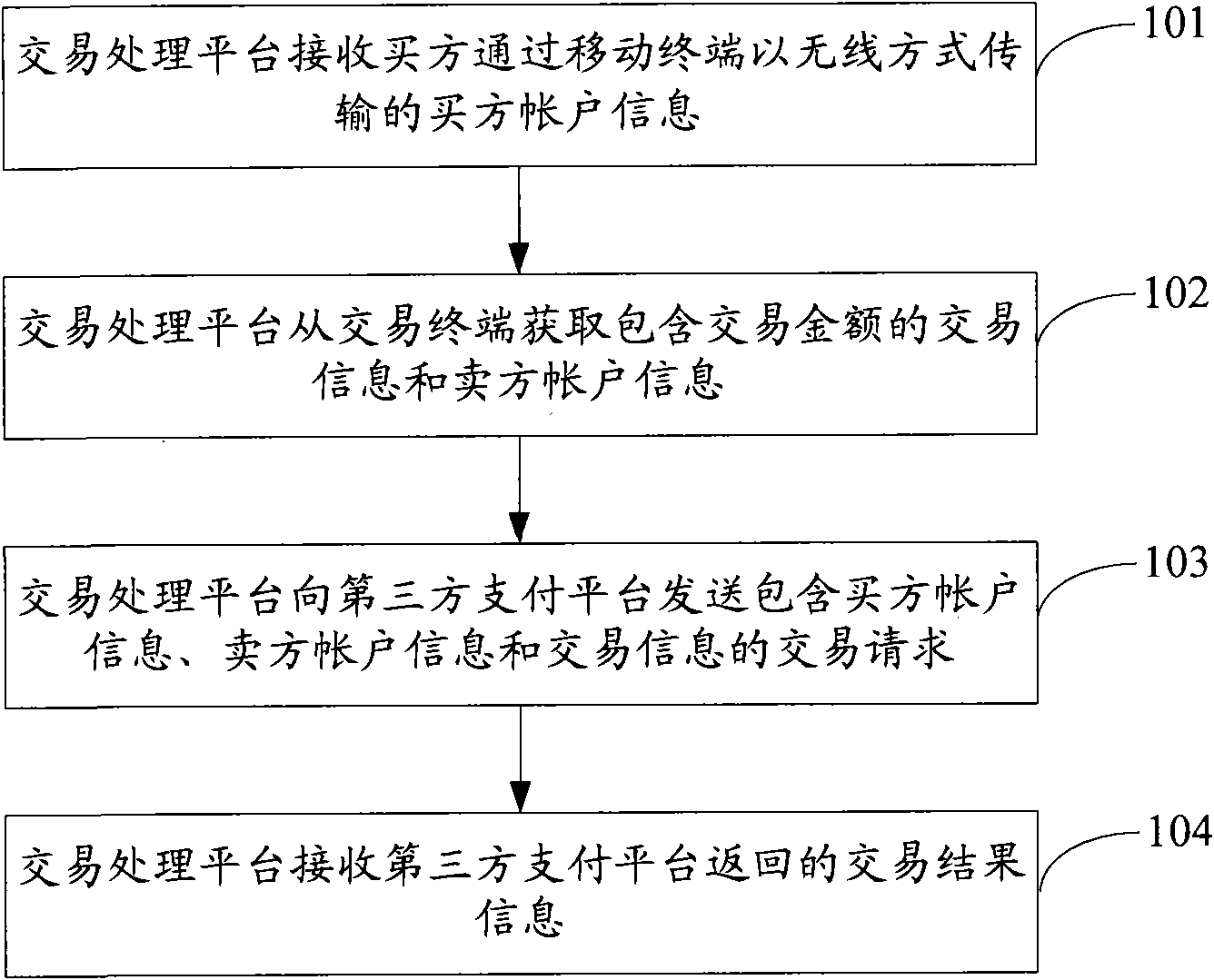

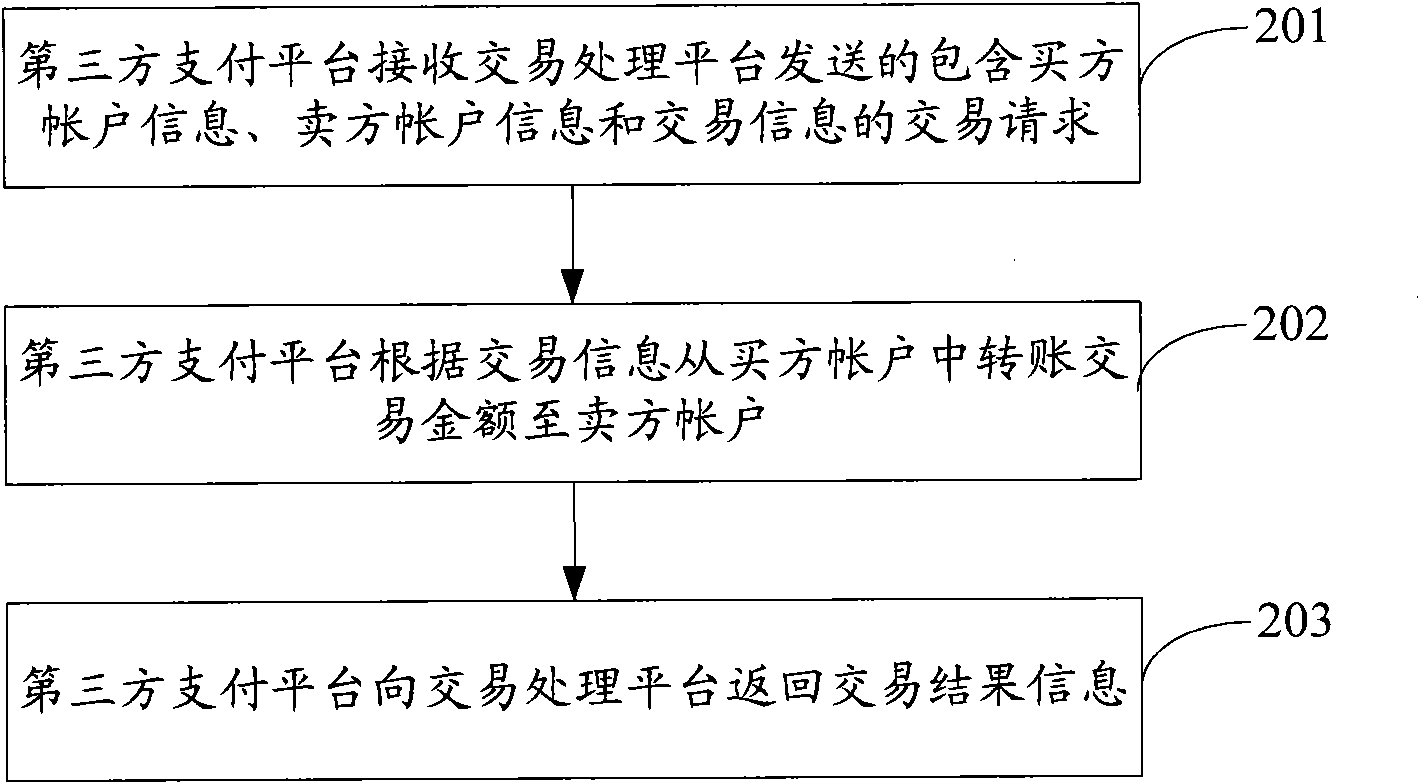

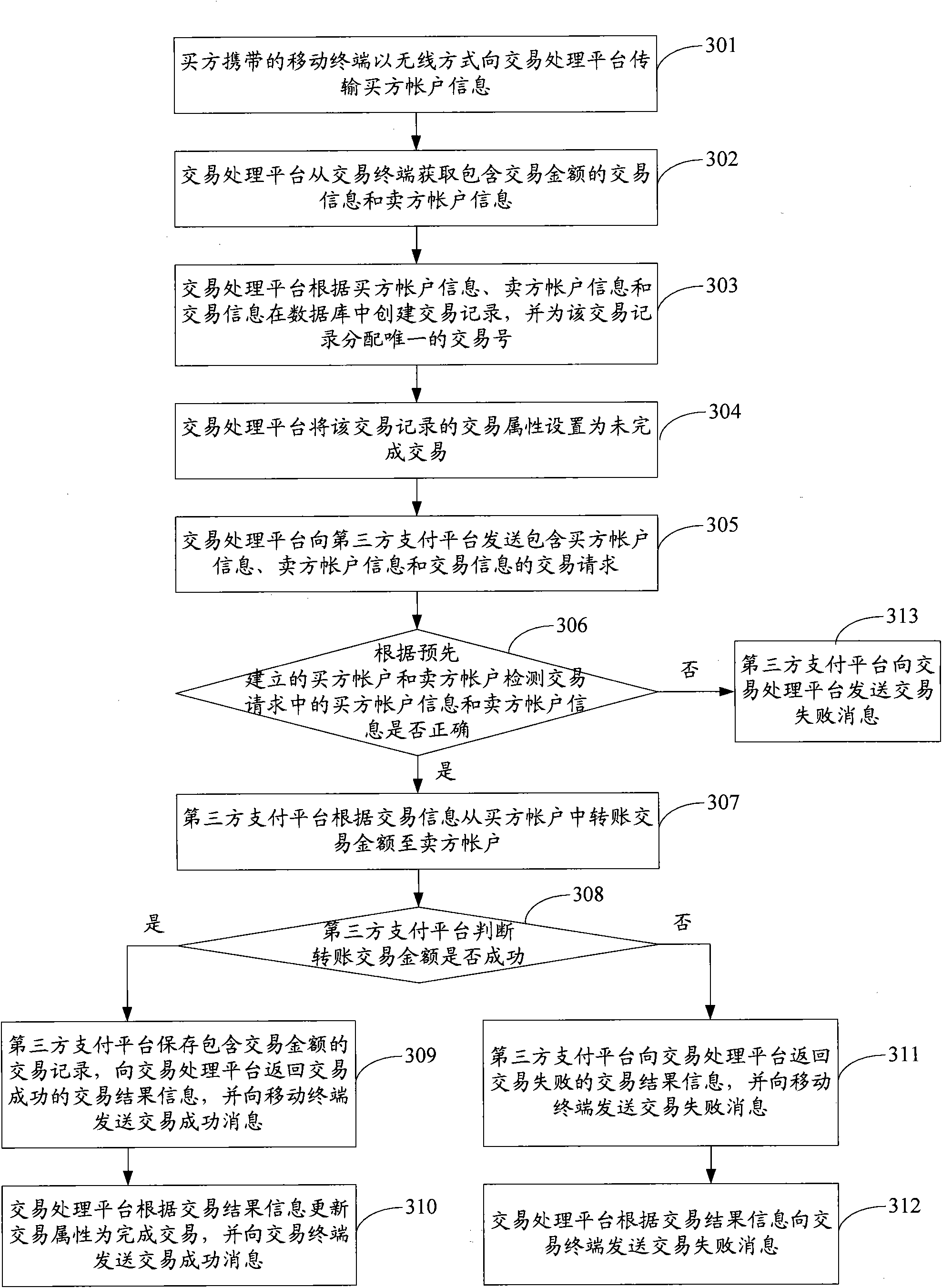

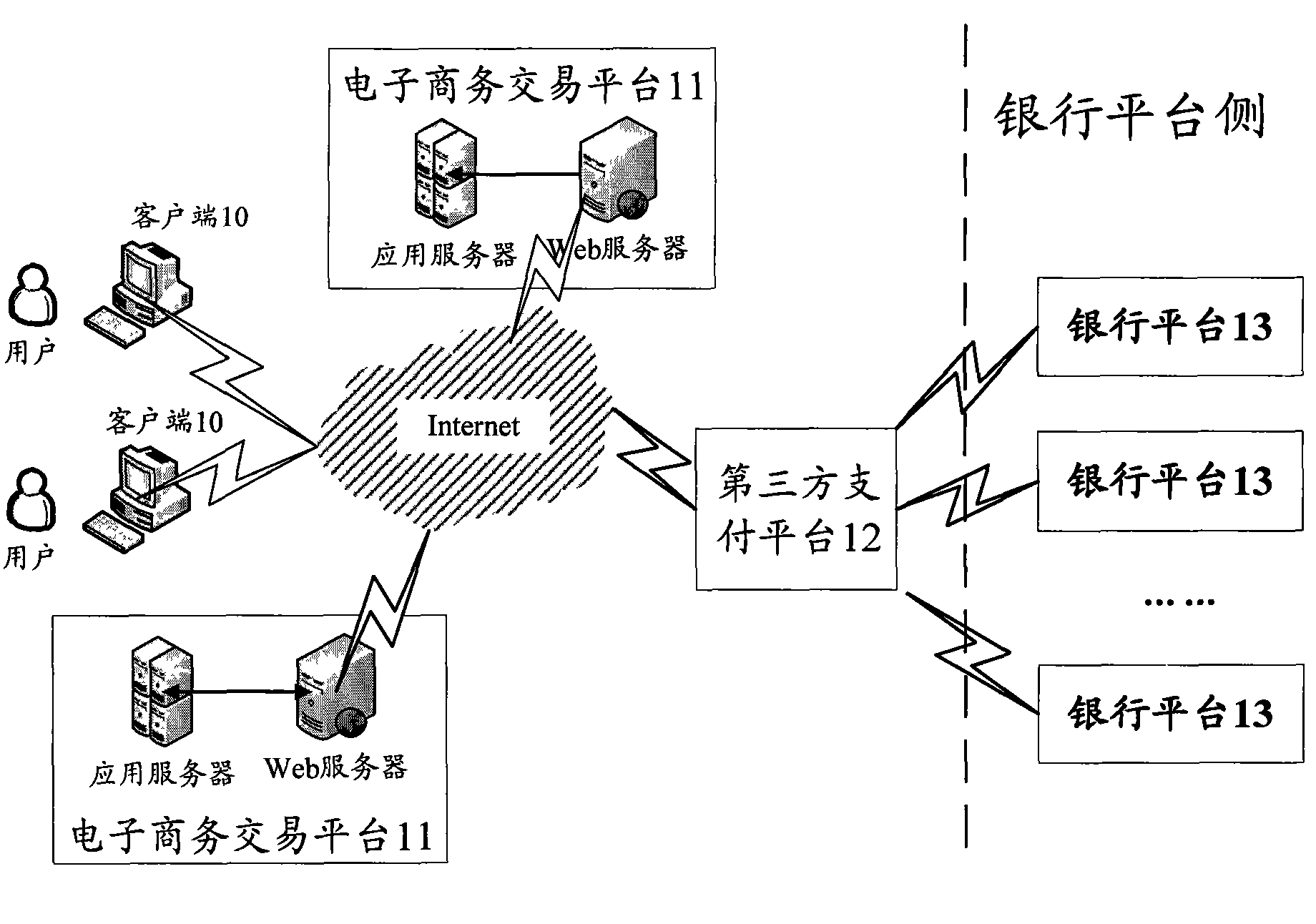

Method and system for processing transaction data, transaction processing system and third-party payment system

InactiveCN101604427AImprove securityImprove conveniencePayments involving neutral partyThird partyThird-Party Payments

The embodiment of the invention discloses a method and a system for processing transaction data, a transaction processing system and a third-party payment system which are based on a third-party payment platform. The method comprises the following steps: receiving buyer account information transmitted by a buyer in the wireless mode through a mobile terminal; acquiring transaction information and seller account information from a transaction terminal, wherein the transaction information at least comprises transaction amount; sending a transaction request to the third-party payment platform, wherein the transaction request comprises the buyer account information, the seller account information and the transaction information; and receiving transaction result information returned by the third-party payment platform, wherein the transaction result information is generated after the third-party payment platform transfers the transaction amount from a buyer account to a seller account according to the transaction information. The method and the system for processing the transaction data, the transaction processing system and the third-party payment system realize payment through the mobile terminal, so the payment convenience for a user is improved; in addition, the process for realizing the transaction payment is based on the third-party payment platform, so the payment security is improved.

Owner:ALIBABA GRP HLDG LTD

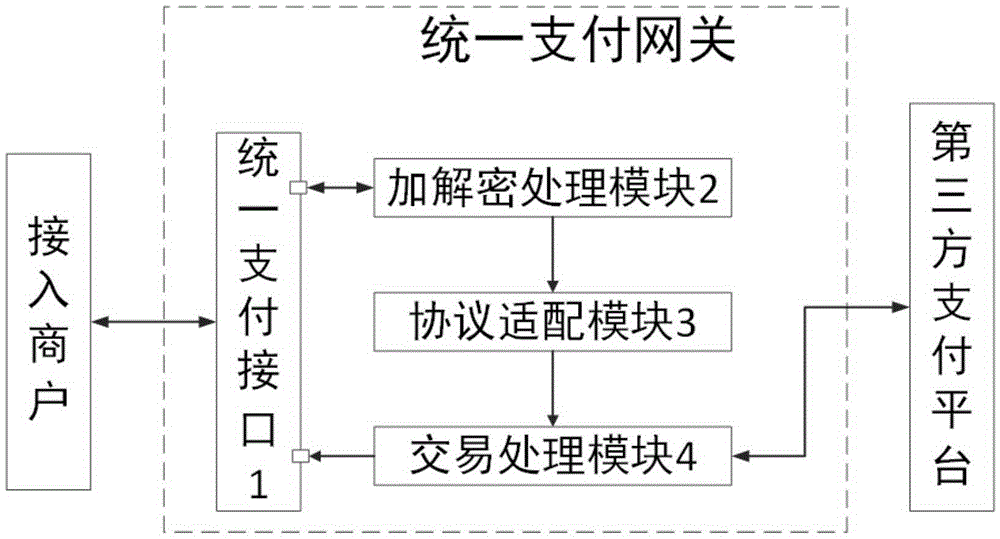

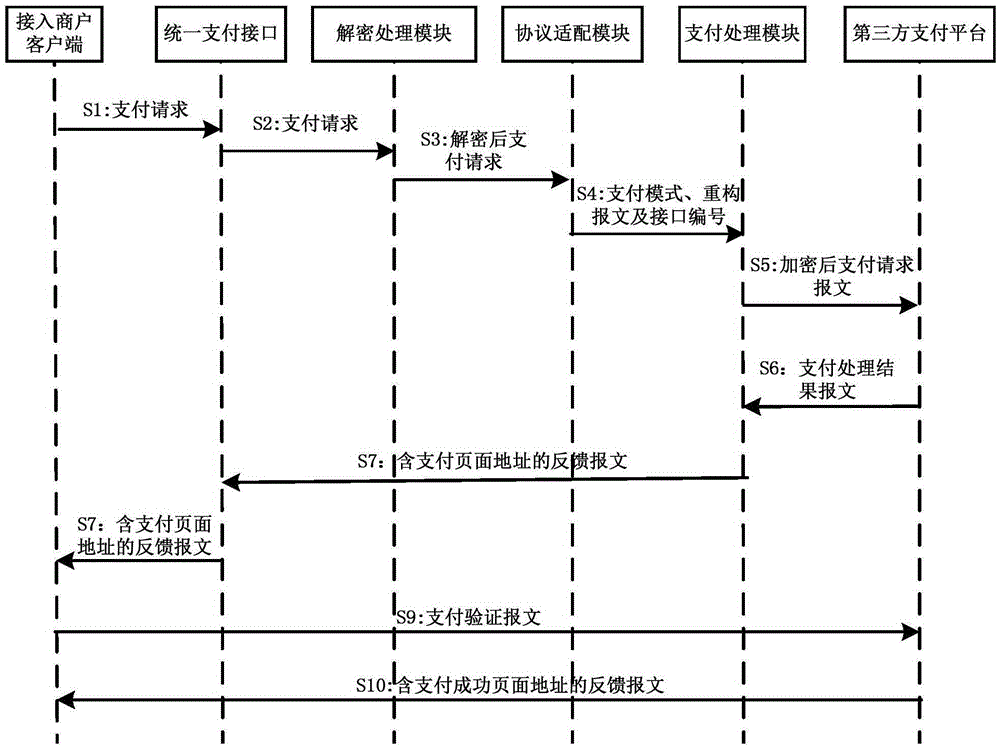

Unified payment access gateway supporting multiple payment channels

InactiveCN105427101AEasy to operateSimplify development workNetwork connectionsProtocol authorisationThird partyPayment order

The invention discloses a unified payment access gateway supporting multiple payment channels. A unified payment interface receives a payment request comprising a payment mode code and payment verification information sent by a client, and forwards the payment request and the payment verification information to a decryption processing module for decryption; a protocol adaption module extracts the payment mode code and corresponding third-party payment interface information from the decrypted payment request, and makes a query to obtain a payment mode; and a payment processing module re-packages a message, sends the message to a third-party payment platform, receives a processing result message of the third-party payment platform, constructs a feedback message according to an executive mode of the payment mode, and sends the feedback message to the client. According to the gateway, one-point access and multi-output-point payment services are provided for access merchants, so that the client operation is simplified.

Owner:CHENGDU LIANYIN INFORMATION TECH CO LTD

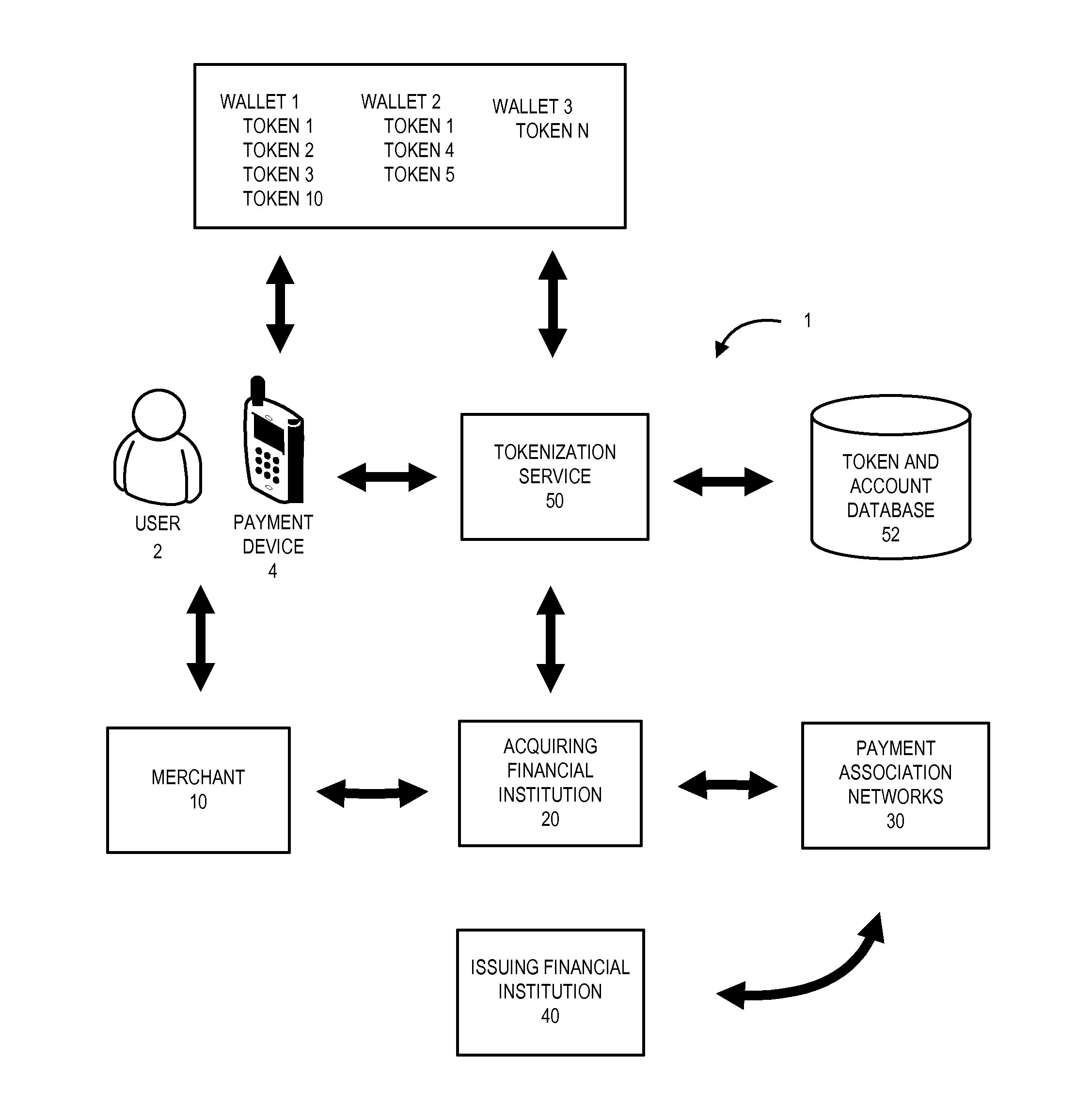

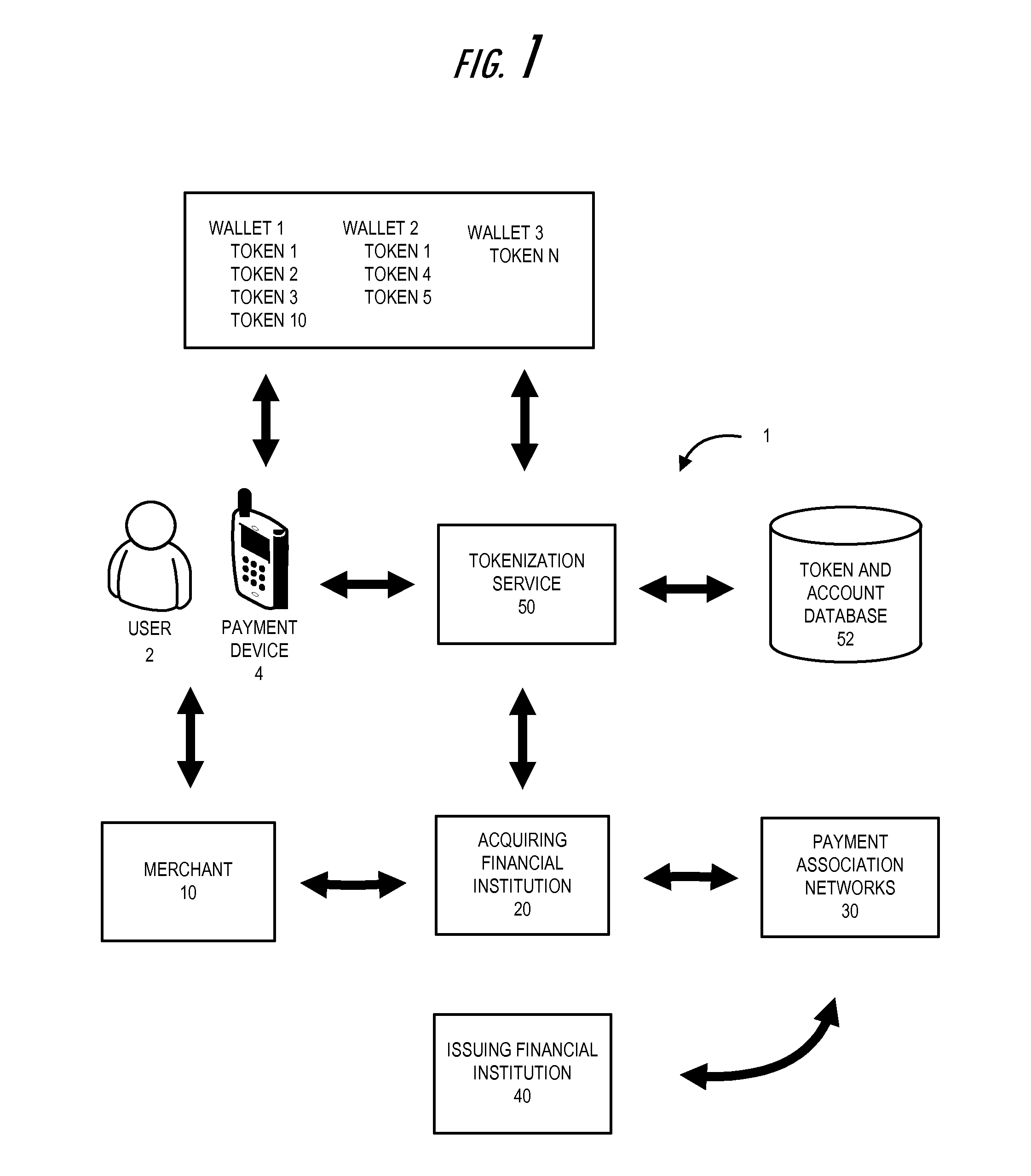

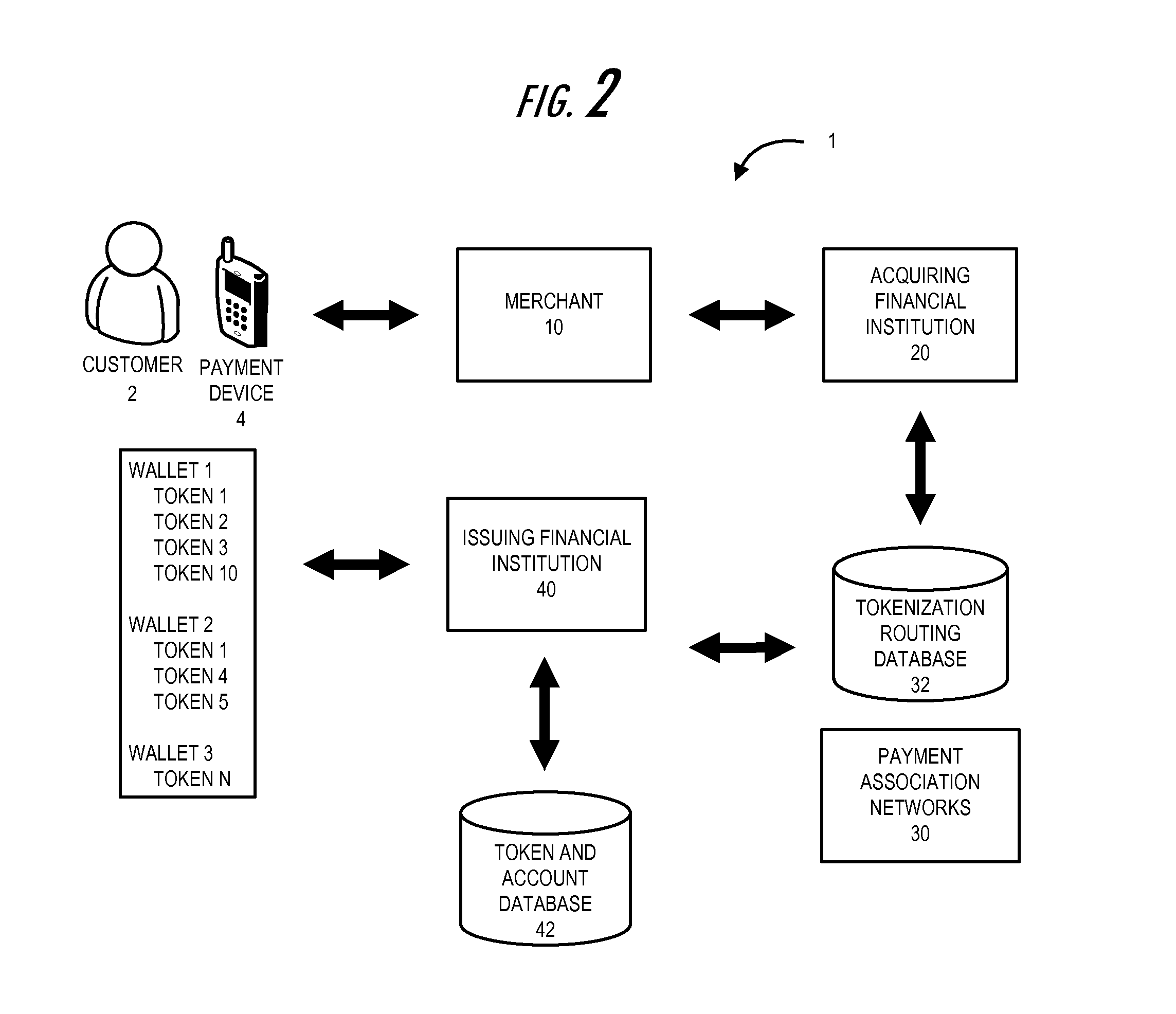

Tokenization of user accounts for direct payment authorization channel

Embodiments of the present invention disclose a financial institution system maintained by a financial institution and for tokenization of user accounts for using a direct payment authorization channel, whereby a third party payment authorization network is avoided. Embodiments establish a direct channel of communication between the system and a merchant or a merchant network in communication with the merchant; wherein the direct channel of communication comprises a network communication channel without a third party payment authorization system; receive a token issued by the financial institution and associated with a user account associated with a customer of the financial institution; receive transaction data comprising an amount associated with a transaction between the customer of the financial institution and the merchant; and determine whether to authorize the transaction based on the received token and the received transaction data.

Owner:BANK OF AMERICA CORP

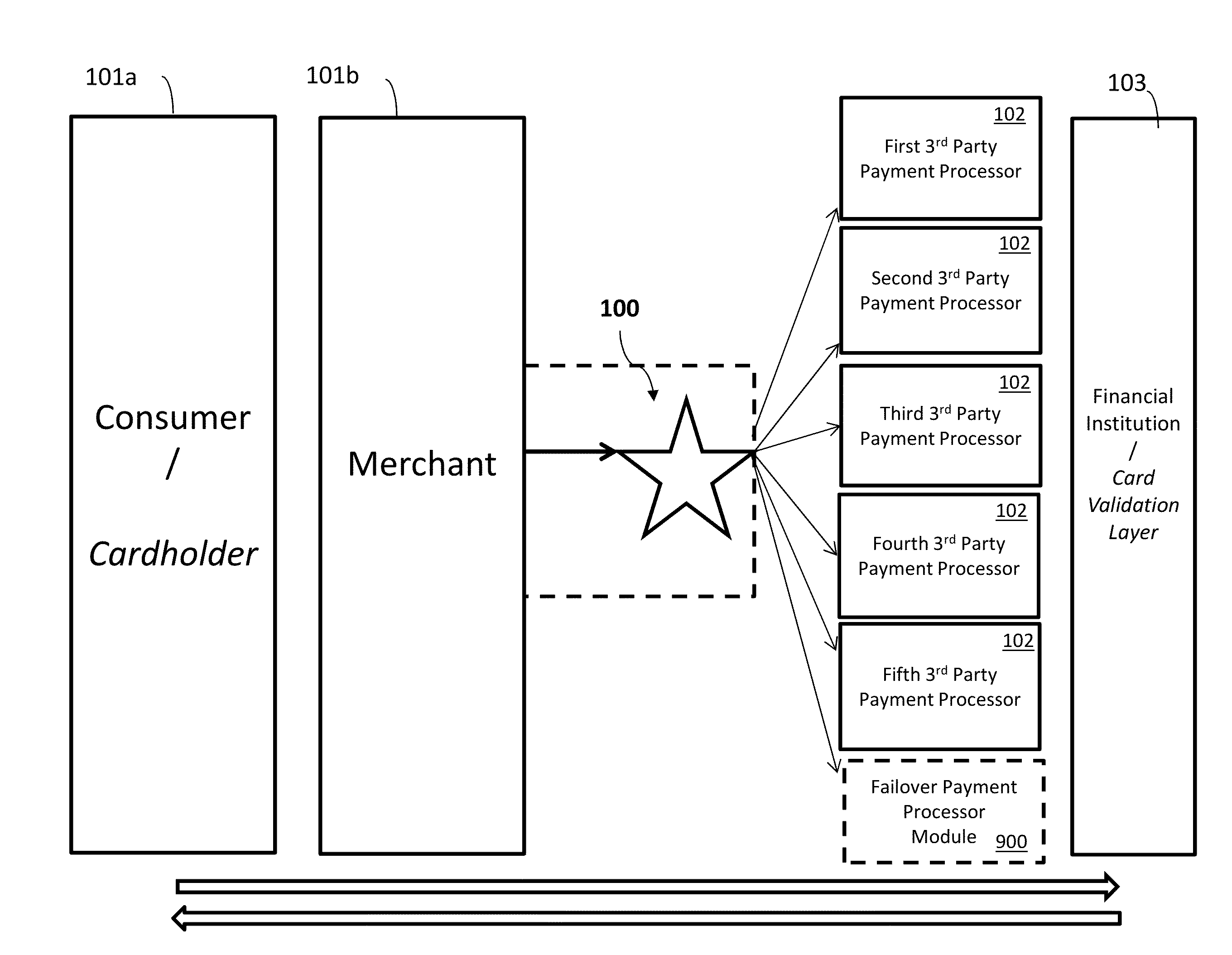

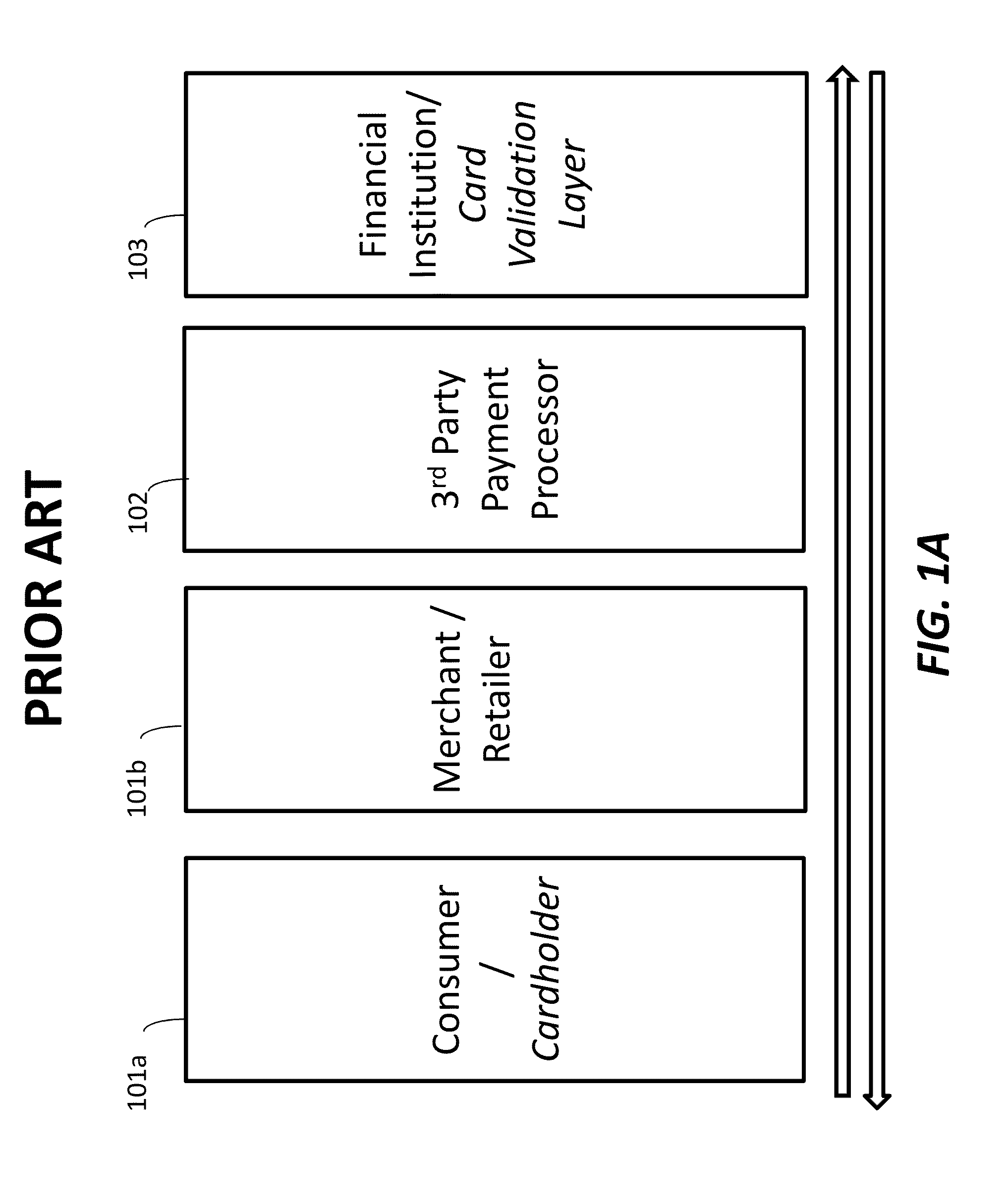

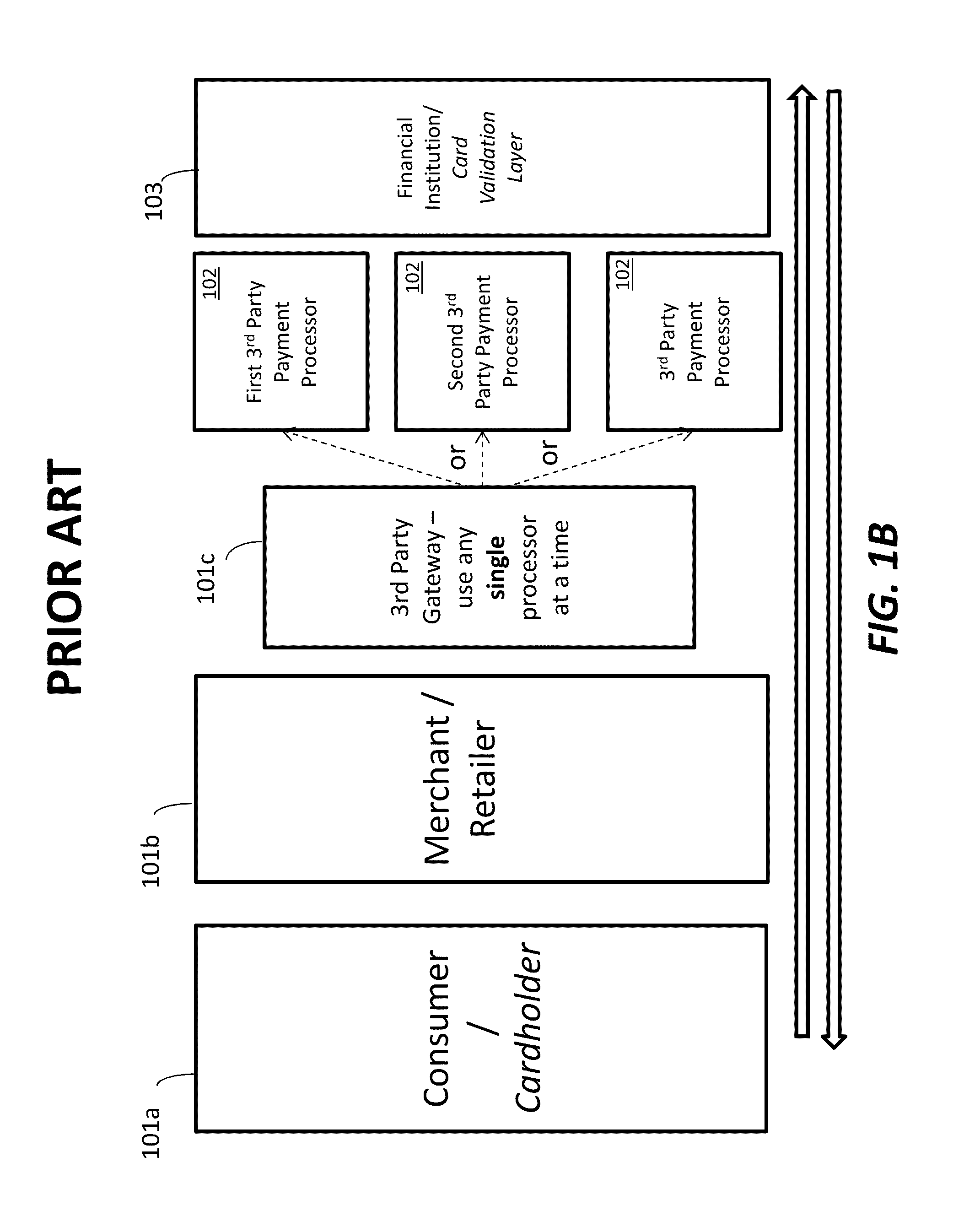

Dynamic payment processing gateway with rules based payment processing engine

Payment processing systems and gateways are configured to (a) accept payment transactions from a merchant in a plurality of disparate formats, (b) convert payment transaction to a format recognized by a payment gateway, (c) use a rules based engine to determine a first third party payment processor to process a payment transaction, and (d) convert the payment transaction into a format acceptable to the determined first third party payment processor.

Owner:REUTOV MAXIM

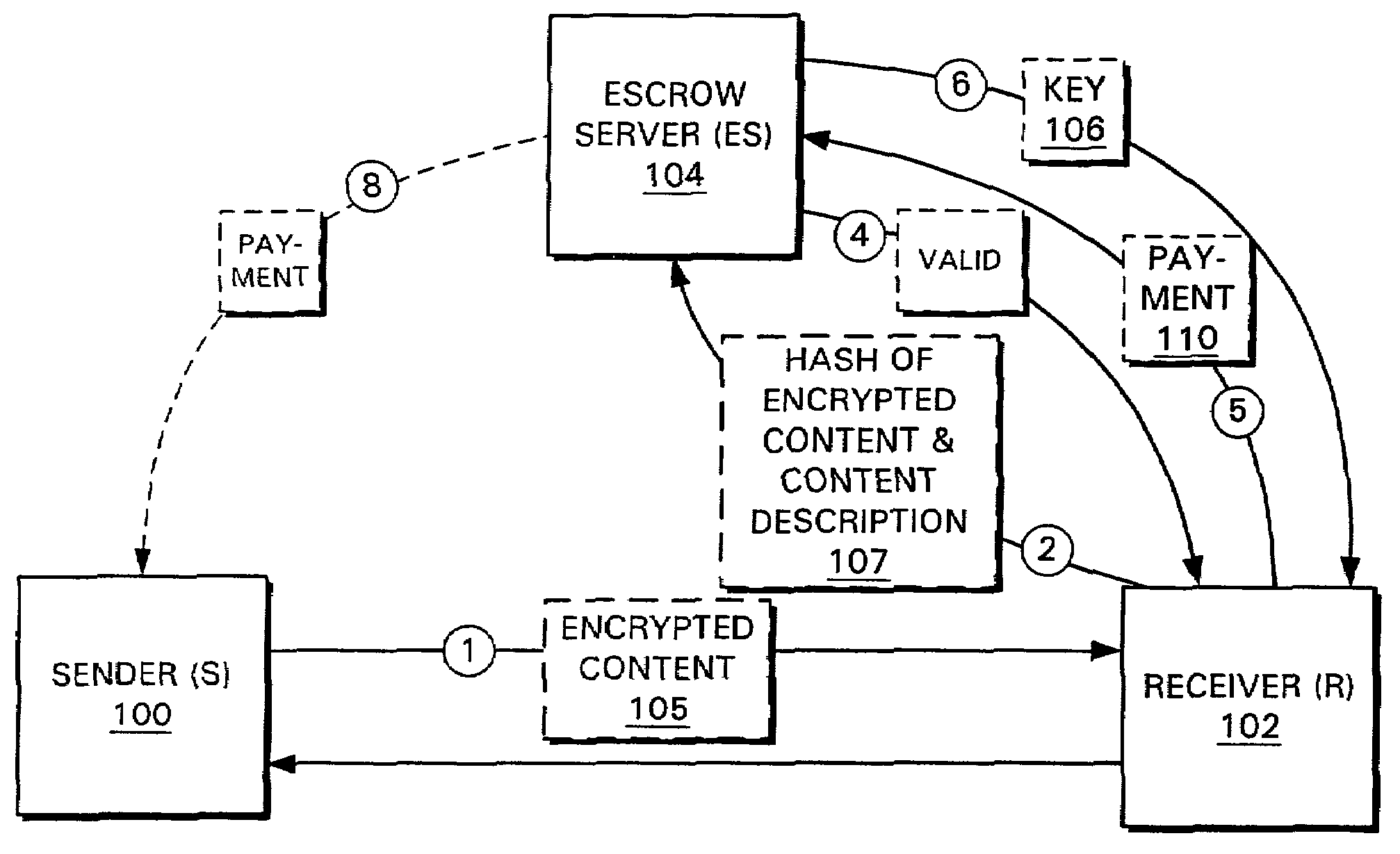

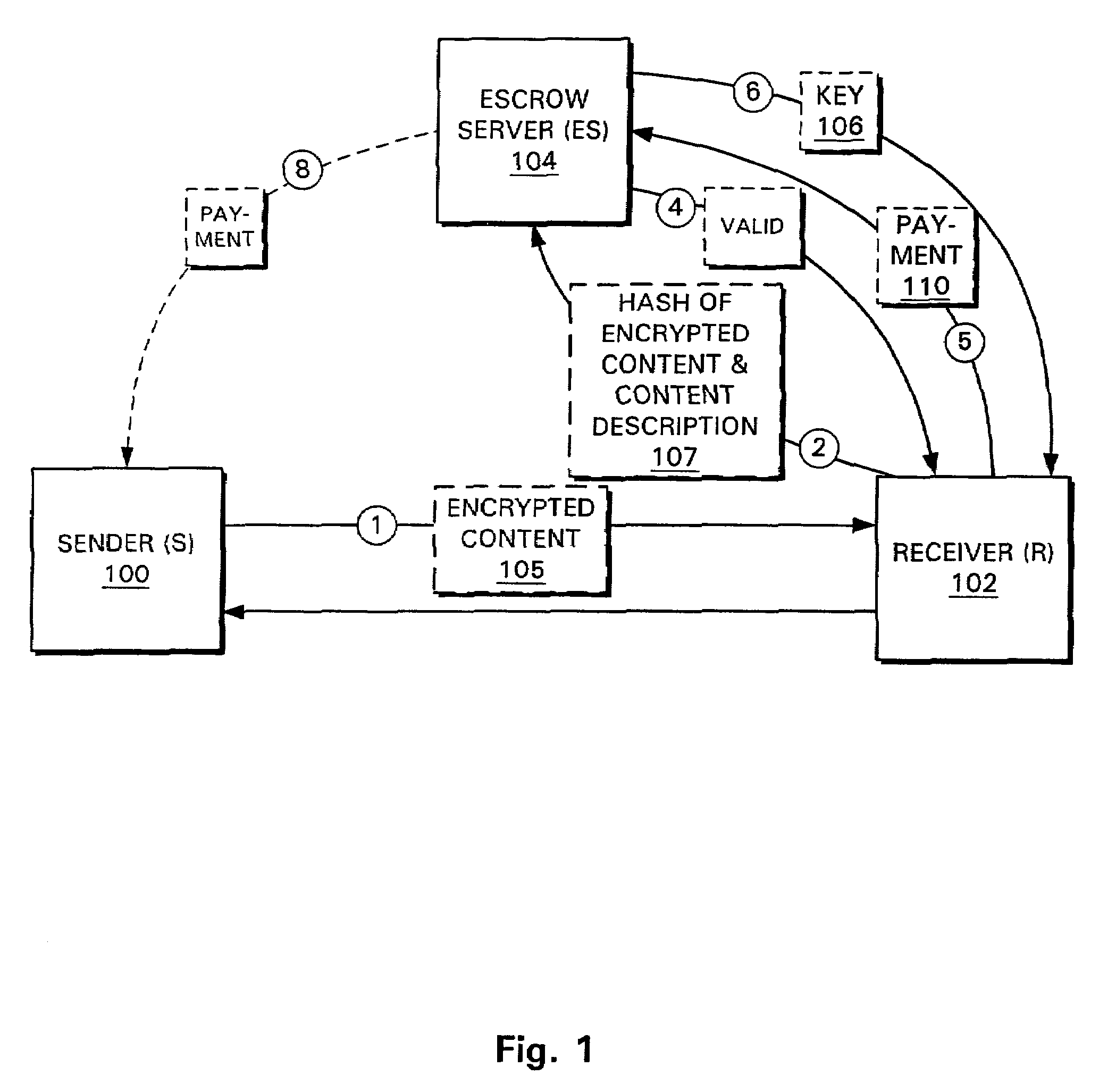

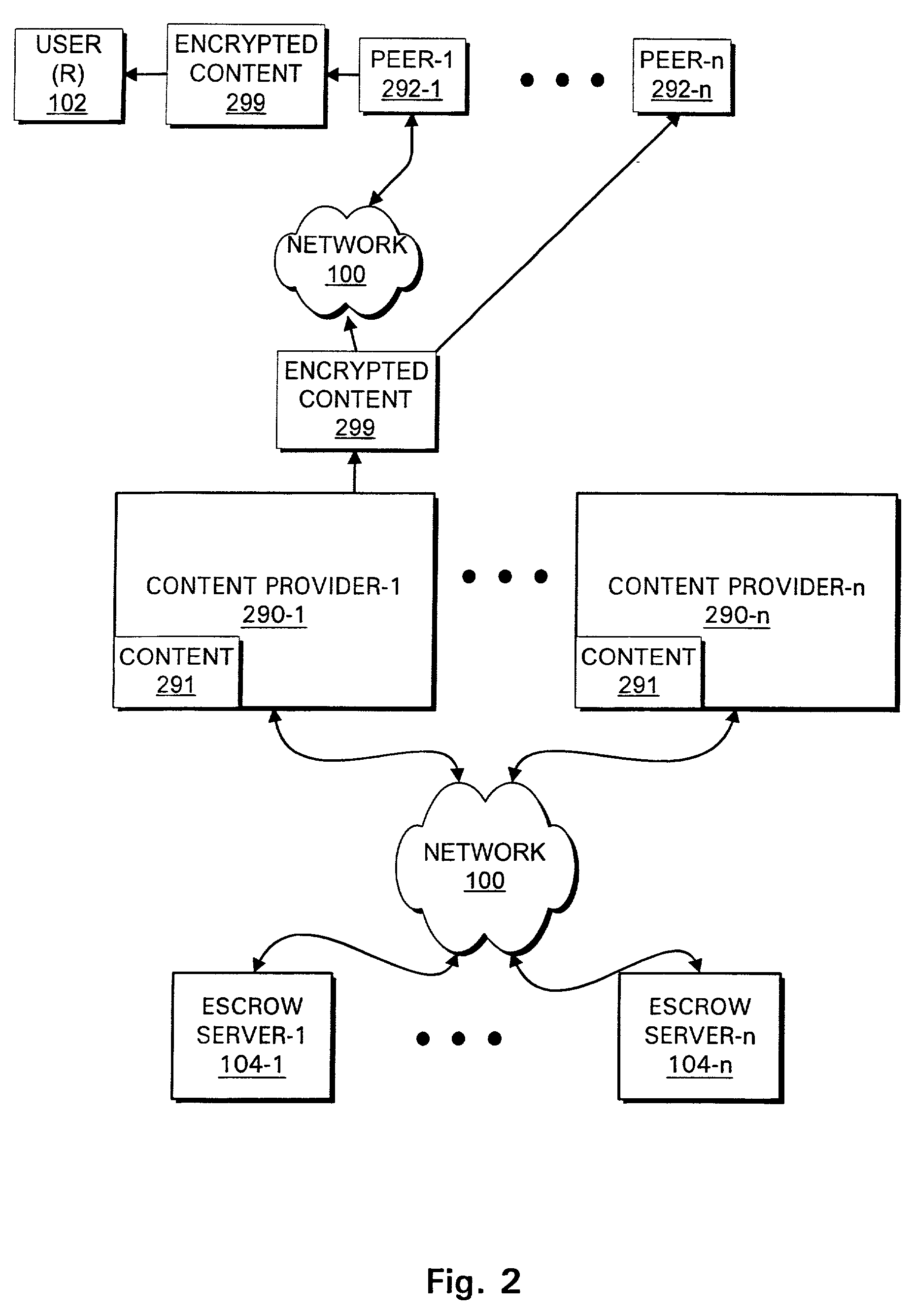

Systems and methods for conducting transactions and communications using a trusted third party

InactiveUS7136840B2Small overheadCryptography processingUser identity/authority verificationThird partyFile transmission

Systems and methods are provided for managing the transfer of electronic files. In one embodiment, a sender transfers an encrypted version of a file (such as a digitally encoded audio track, movie, document, or the like) to someone who wishes to receive it. The receiver computes a hash of the encrypted file, and sends it to a trusted third party. The trusted third party compares the hash that was computed by the receiver with another hash computed by the sender. If the two hashes match, the third party sends the file decryption key to the receiver. In some embodiments, the receiver may also send the third party payment information so that the sender, the content owner, and / or the third party can be paid for their role in the transaction. In a preferred embodiment, the payment information is only sent to, and / or used by, the third party once the third party has confirmed to the satisfaction of the receiver that the encrypted file in the receiver's possession will decrypt correctly. In some embodiments, the sender computes a hash of the encrypted version of the file and sends it directly to the third party. In other embodiments, the sender encrypts this hash using a key associated with the third party and sends the encrypted hash to the receiver, who then forwards it to the third party.

Owner:INTERTRUST TECH CORP

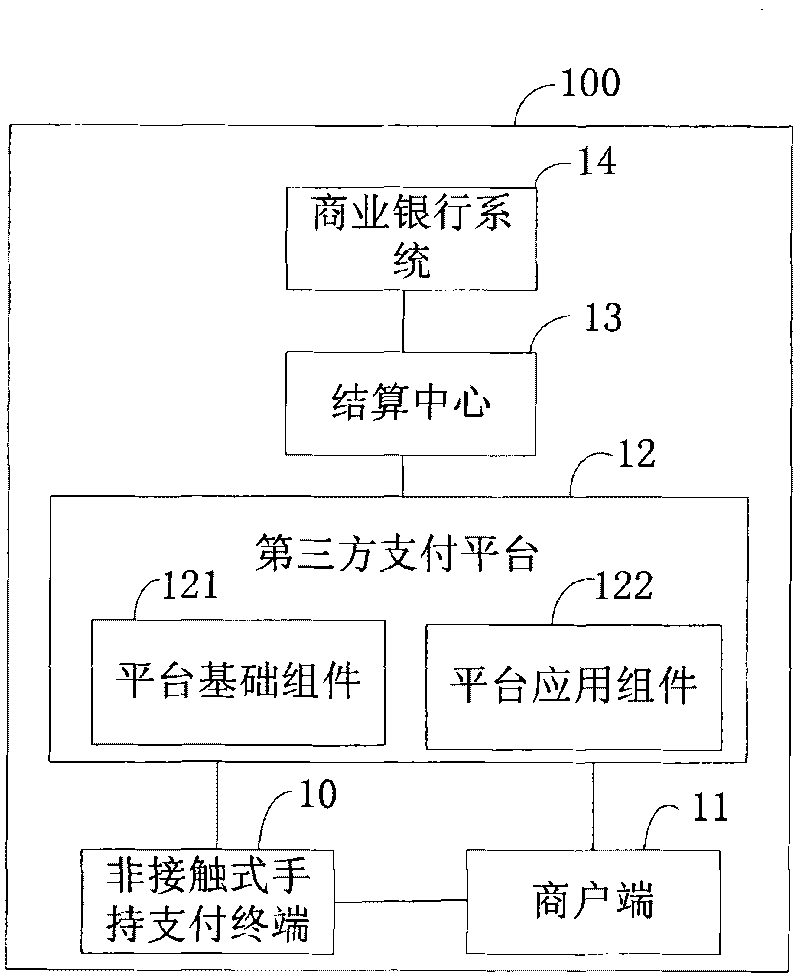

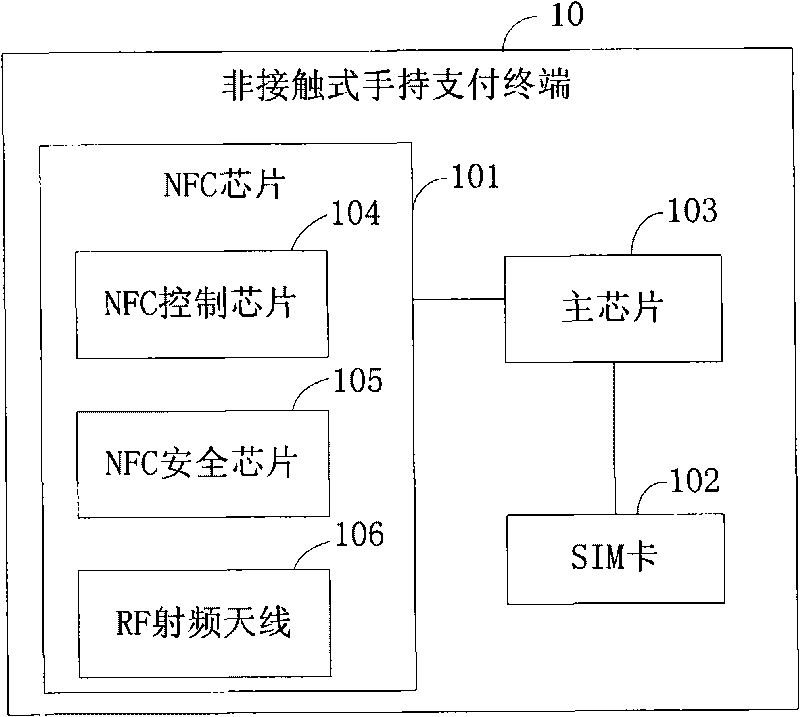

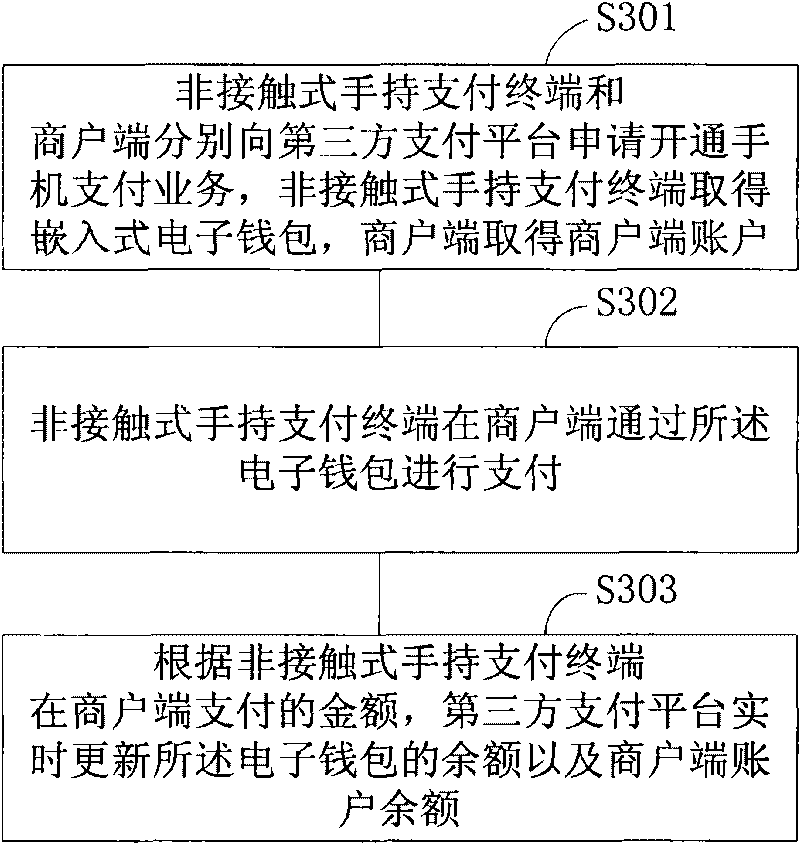

System and method for payment based on non-contact handheld payment terminal

InactiveCN101719247AAvoid safety hazardsInformation transmission is safe and reliablePayment architectureRecord carriers used with machinesThird partyComputer terminal

The invention discloses a method for payment based on non-contact handheld payment terminal, which comprises the following steps of: respectively applying opening non-contact payment services for a third party payment platform by a non-contact handheld payment terminal and a commercial tenant terminal, getting an embedded electronic purse by the non-contact handheld payment terminal, getting a commercial tenant terminal account by the commercial tenant terminal; paying at the commercial tenant terminal by the non-contact handheld payment terminal through the electronic purse; and updating the balance of the electronic purse and the balance of the commercial tenant terminal account in real time by the third party payment platform according to the paying amount of the non-contact handheld payment terminal at the commercial tenant terminal. The invention also provides a system for payment based on the non-contact handheld payment terminal correspondingly. Therefore, the invention can enable a user to be more convenient for payment more safely and reliably during the small payment.

Owner:刘宜云

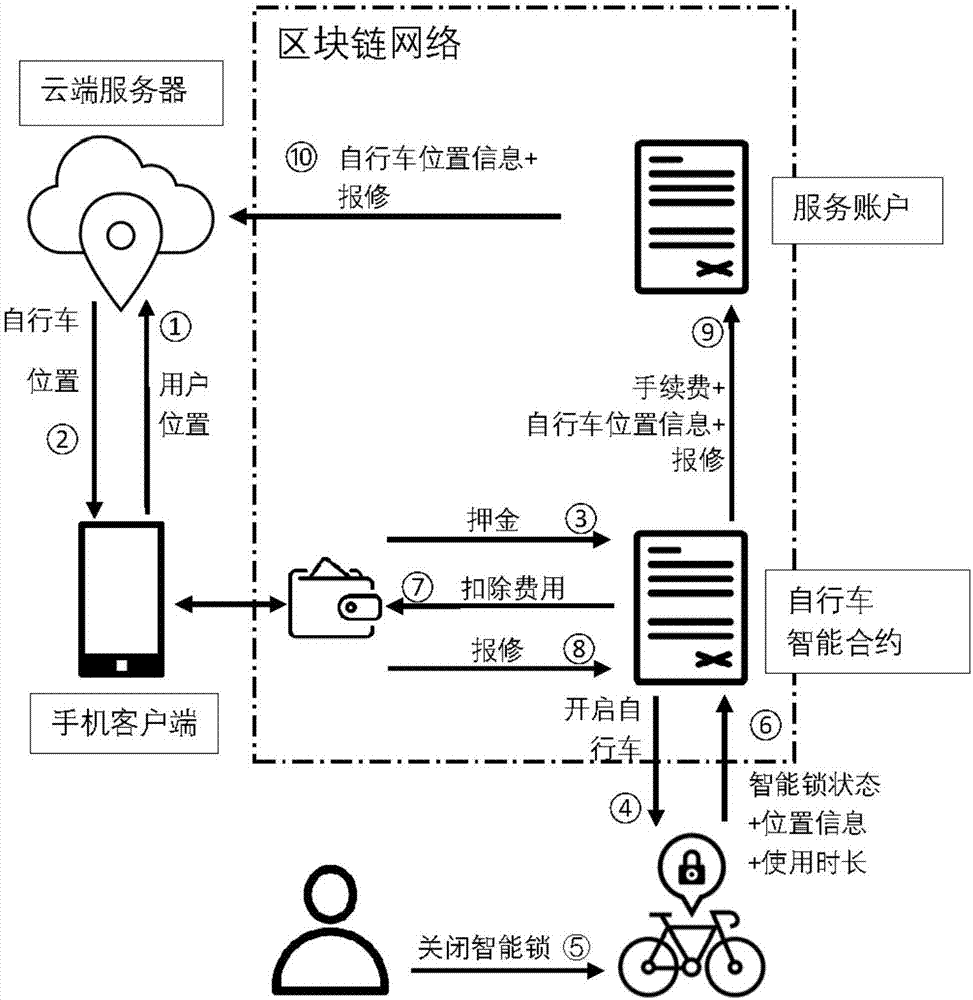

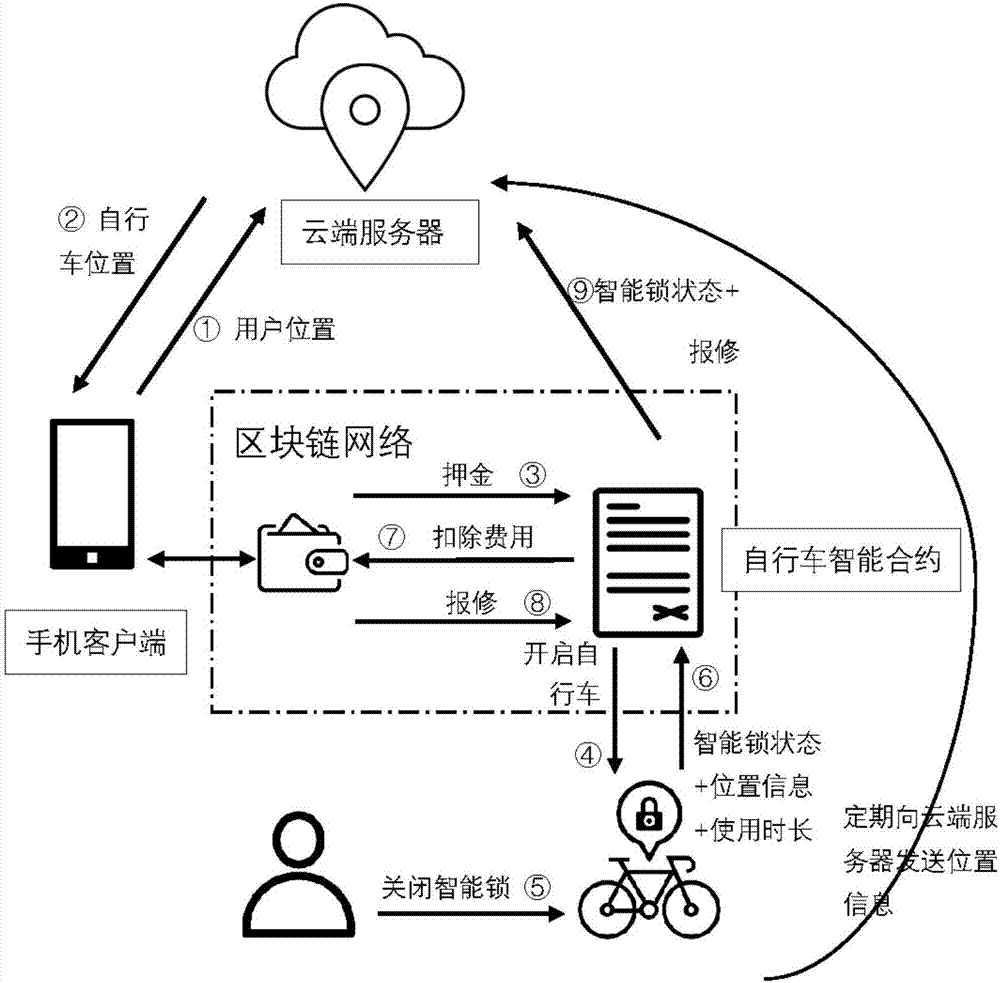

End-to-end bike sharing system and method based on blockchain

ActiveCN107993359AEnsure safetyLow costApparatus for meter-controlled dispensingTransmissionThird partyBike sharing

The invention discloses an end-to-end bike sharing system and method based on blockchain. The system comprises a system administrator, a cloud server, bike owners, bike users and a blockchain network;the blockchain network contains accounts, bike smart contracts and nodes; there is no need for the bike users to download multiple different applications any more, after registration, deposits are paid to the bike smart contracts, the blockchain network does not contain third parties, and the users only need to apply to the bike smart contracts when the deposits need to be returned, so that the phenomenon of difficult deposit returning is effectively avoided; the payment process does not rely on third-party payment software, so that needed commission charge is effectively reduced. Transactioninformation is stored by the nodes in the blockchain network together, each node stores all transaction data in the network totally redundantly, and once the data in one node is tampered with, othernodes raise objections, so that a whole database is high in safety, and private security of the bike users and the bike owners can be protected.

Owner:ZHEJIANG UNIV

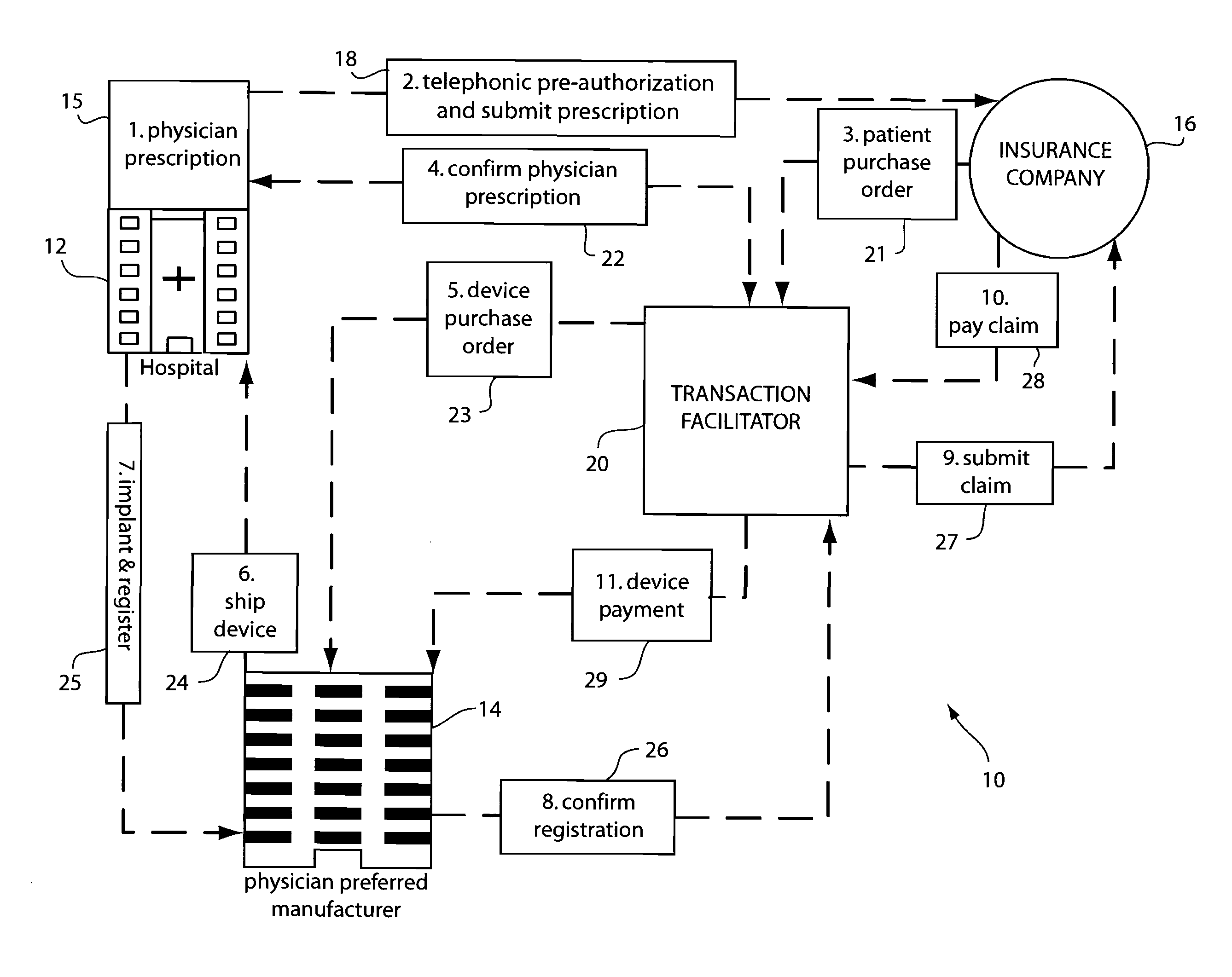

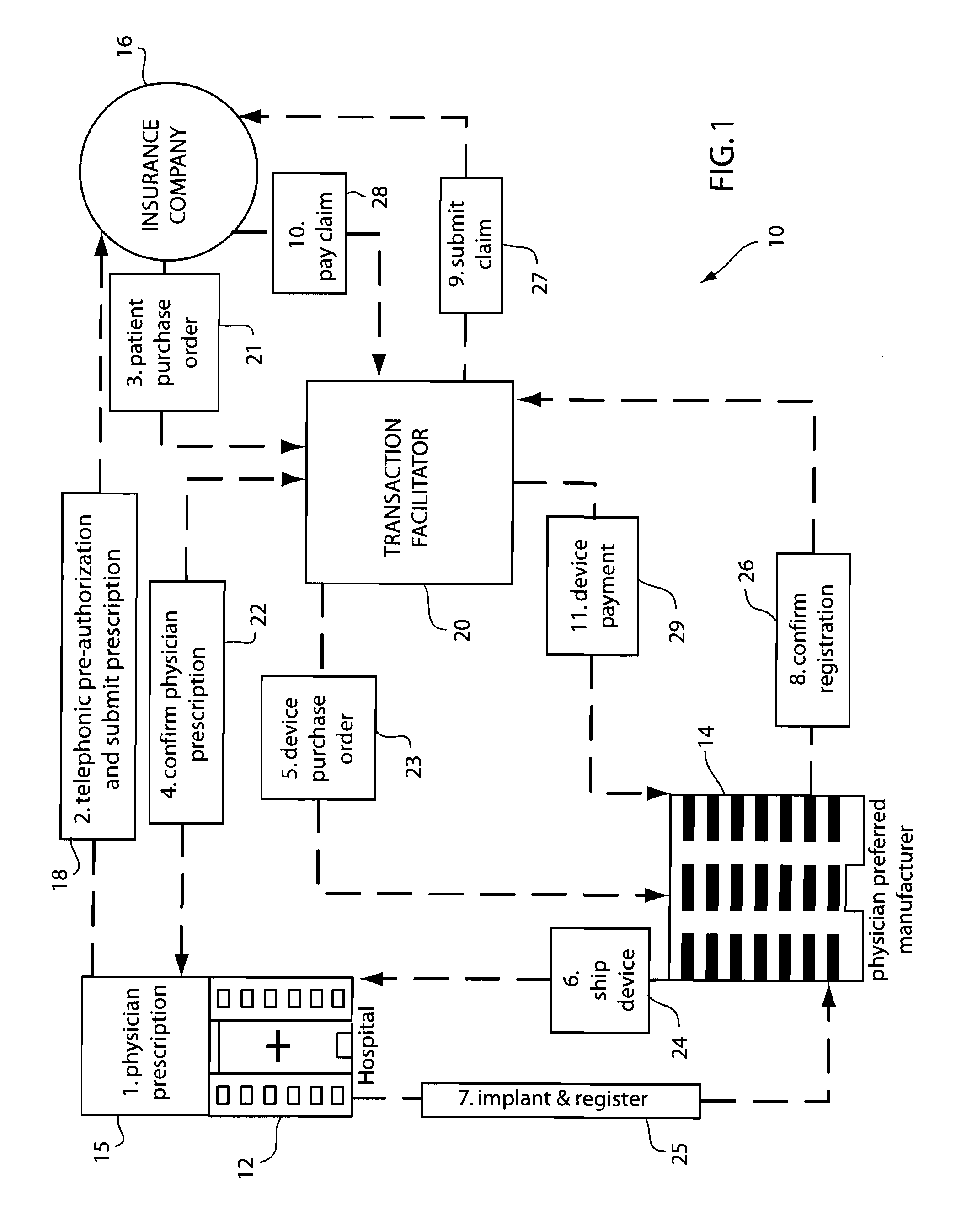

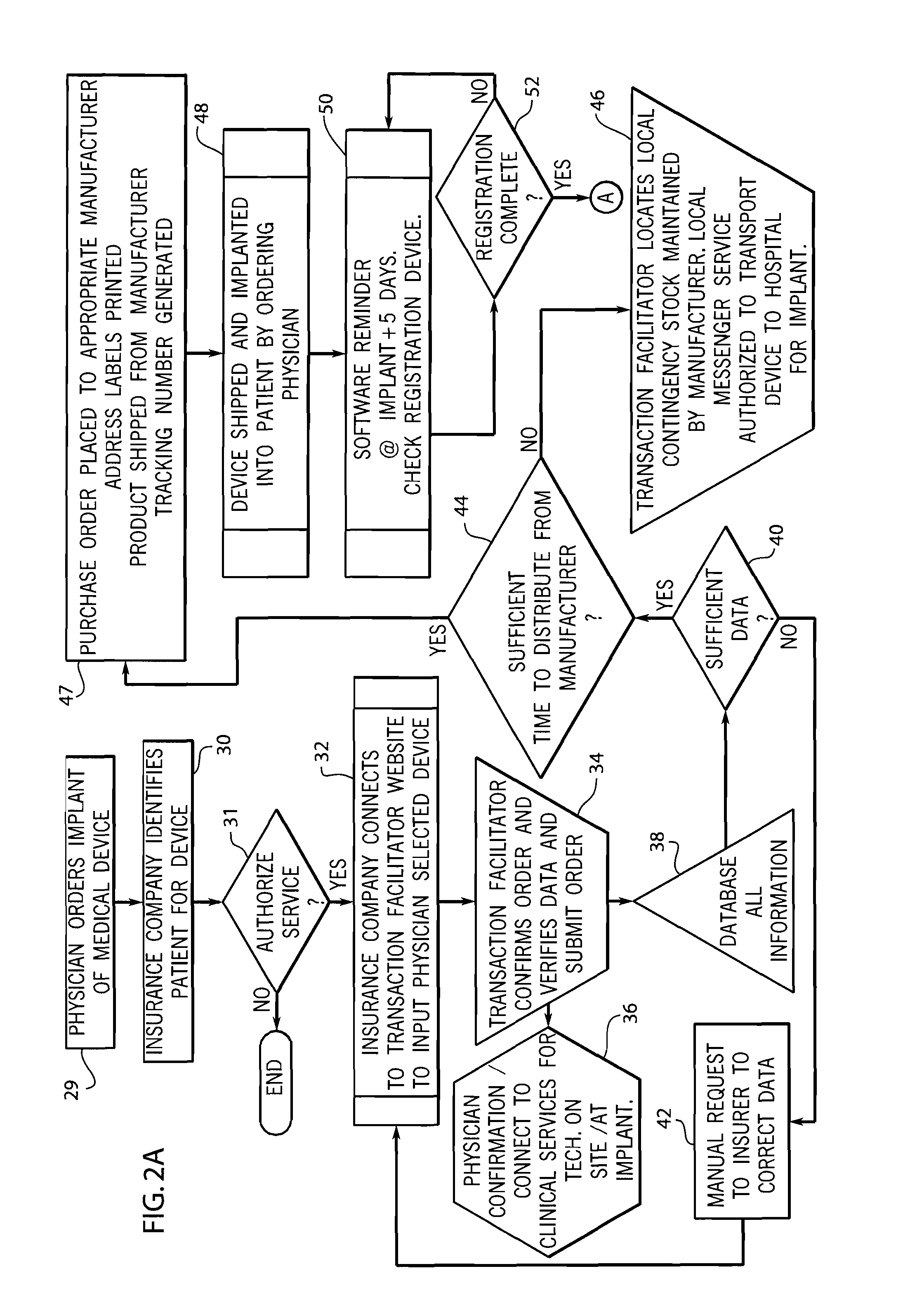

Method of product procurement and cash flow including a manufacturer, a transaction facilitator, and third party payor

A method of order placement and product delivery between a healthcare facility and a third party payor, such as an insurance provider, in which a transaction facilitator submits the order for a prescribed medical device and generates a claim from the transaction facilitator to the insurance company. The healthcare facility initially contacts the insurance provider to obtain authorization for a prescribed medical device and medical procedure. Upon granting authorization, the insurance provider contacts the transaction facilitator to select the medical device. The transaction facilitator orders the medical device and arranges for delivery from manufacturer to the healthcare facility. Upon implantation, the transaction facilitator bills the insurance provider. At no time does the healthcare facility receive a bill from the manufacturer, thereby eliminating the bill for the medical device from the healthcare facility to the insurance provider.

Owner:KOENIG MARTIN D +1

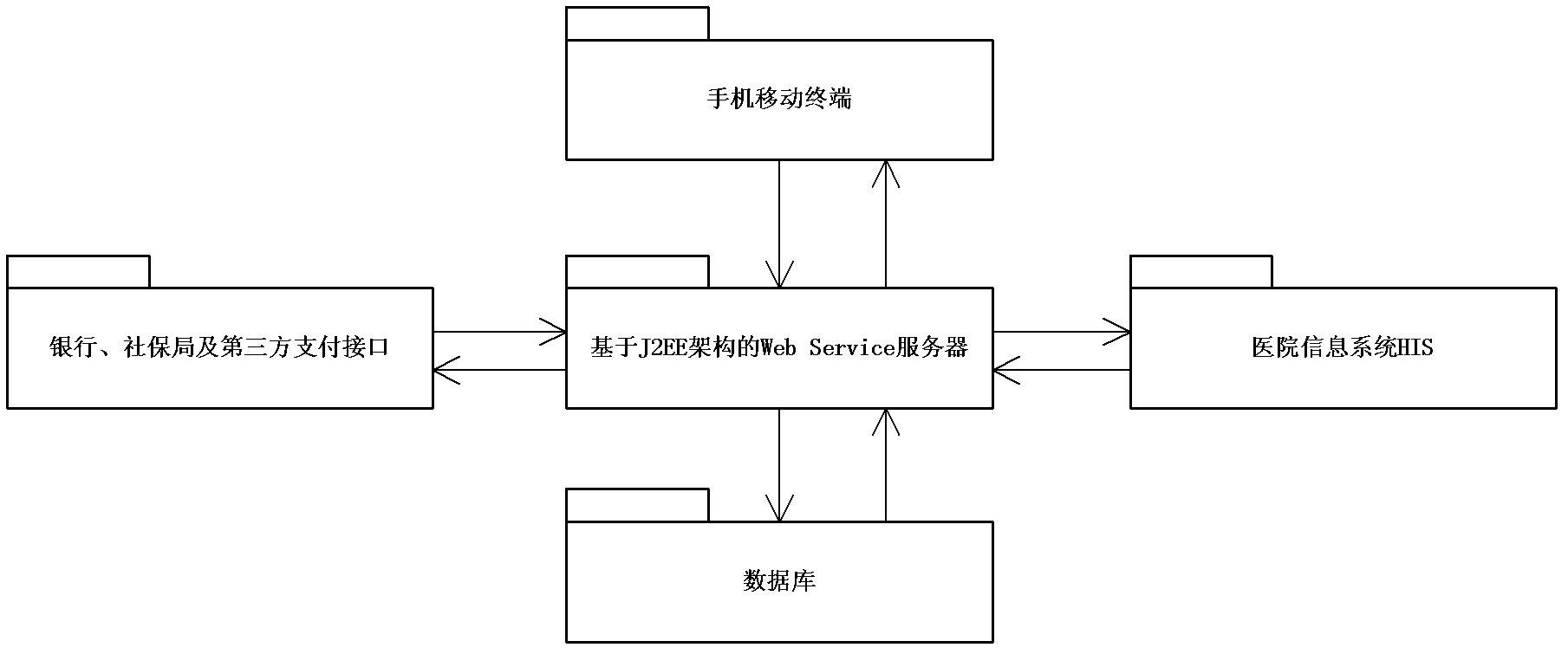

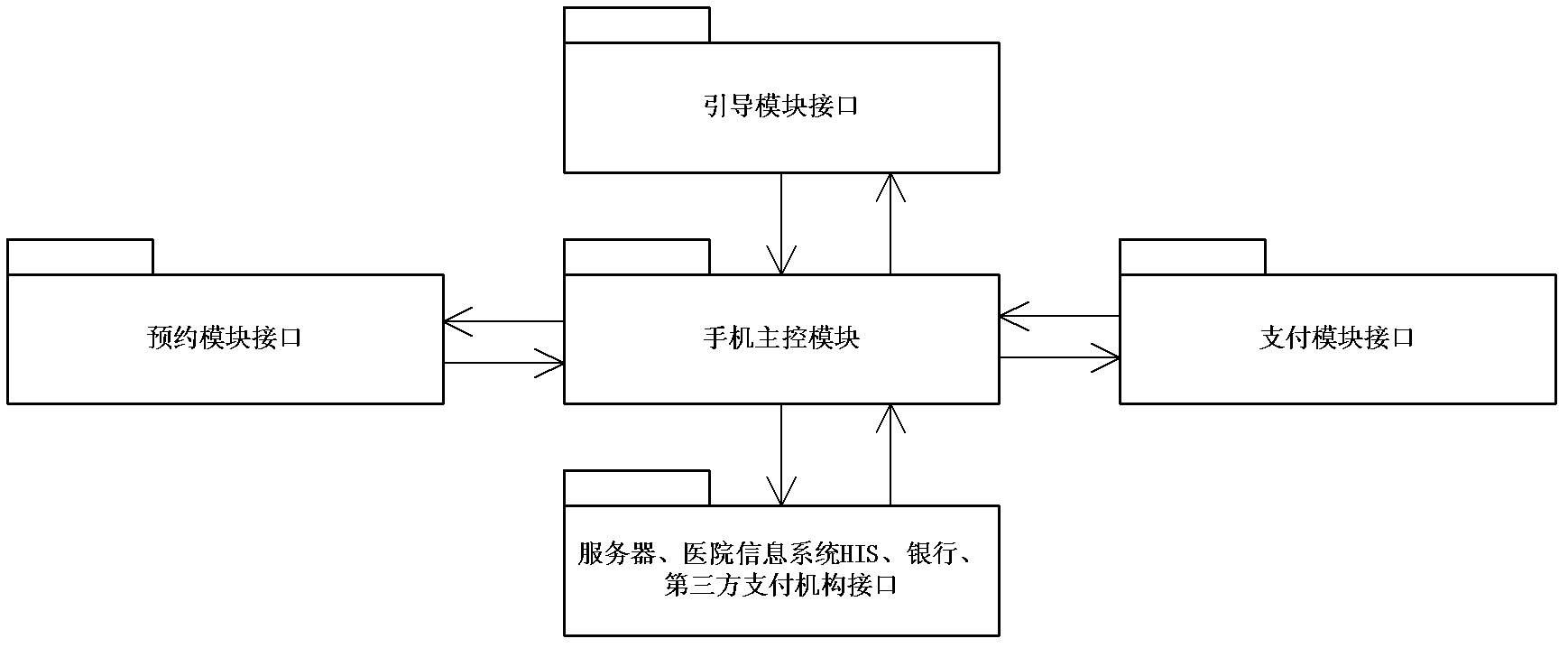

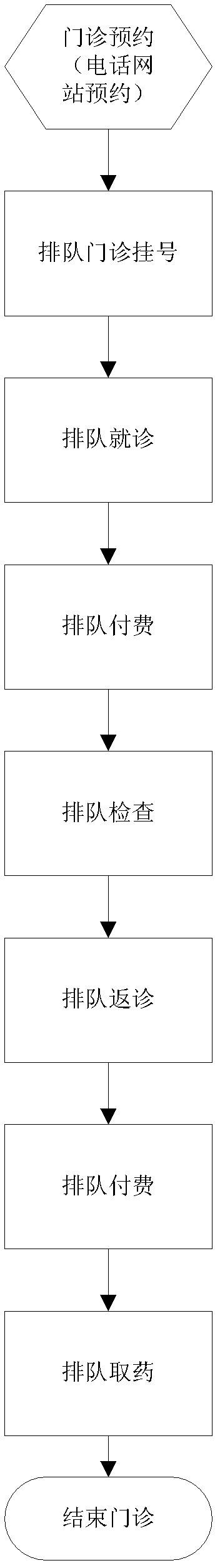

Mobile phone appointment guiding payment system for medical diagnosis

InactiveCN102324084AInstant paymentEasy to operatePayment architectureMedical diagnosisHospital information system

The invention discloses a mobile phone appointment guiding payment system for medical diagnosis, comprising a mobile phone termination, a server, a hospital information system and a bank, social security and third party payment interface, wherein the hospital information system comprises an appointment registration subsystem and a medical expense payment subsystem; the mobile phone termination is connected with the server in a communication way; the server is connected with the hospital information system and the bank, social security and third party payment interface in a wireless communication way; and the mobile phone termination comprises an out-patient appointment module, a diagnosis guiding module and a medical expense payment module, wherein the out-patient appointment module is used for importing the appointment registration subsystem of the hospital information system after identity authentication and displaying through a user interface and selecting an appointment, the diagnosis guiding module is used for displaying medical expense information and diagnosis steps and guiding a user to pay medical expenses according to the diagnosis steps and finish the diagnosis process, and the medical expense payment module is used for binding various bank cards or third part payment account numbers and communicating with the medical expense payment subsystem to finish medical expense payment subsystem. The mobile phone appointment guiding payment system is convenient to operate, high in work efficiency and strong in practical applicability.

Owner:SCHOOL OF OPHTHALMOLOGY & OPTOMETRY WENZHOU MEDICAL COLLEGE +1

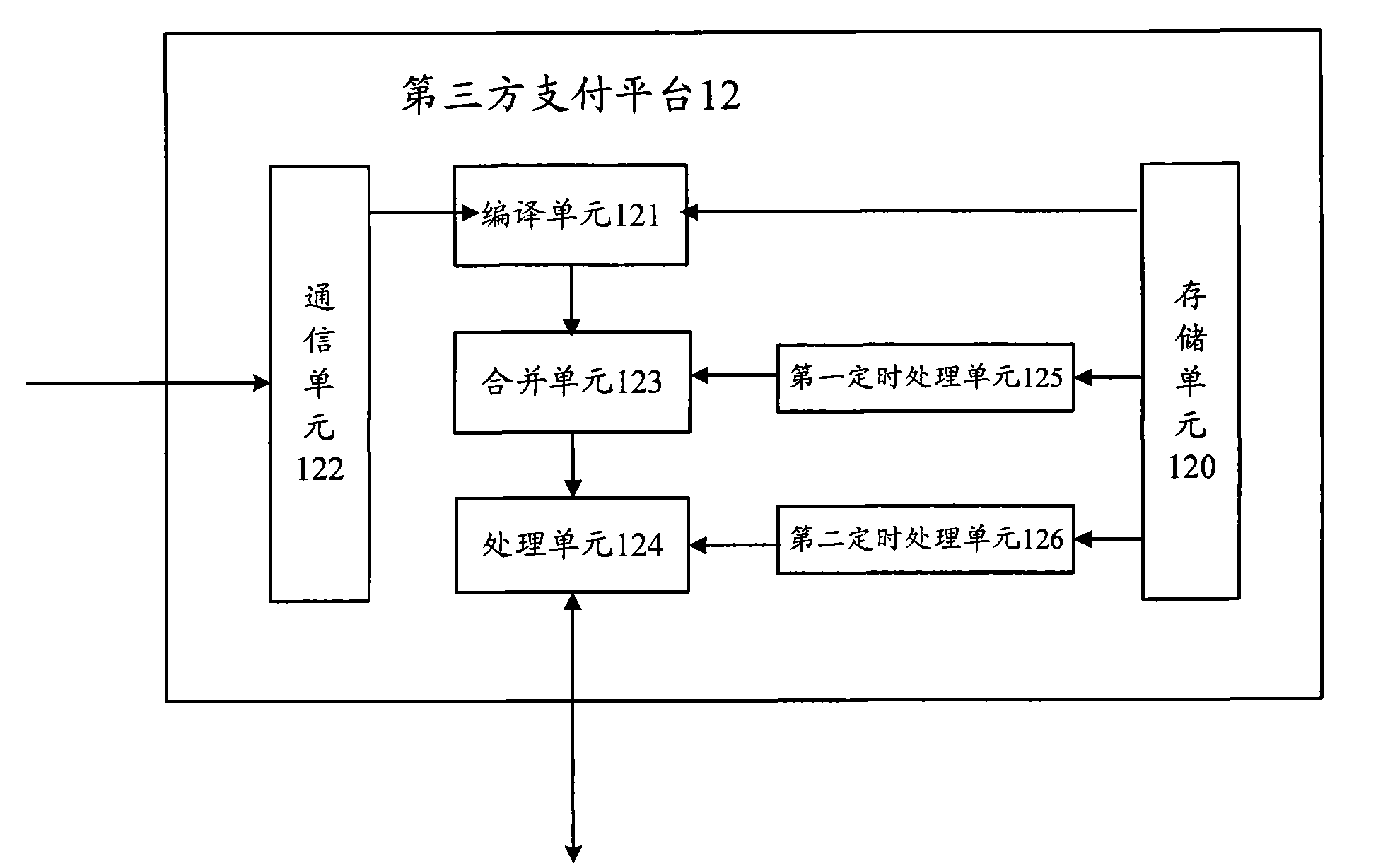

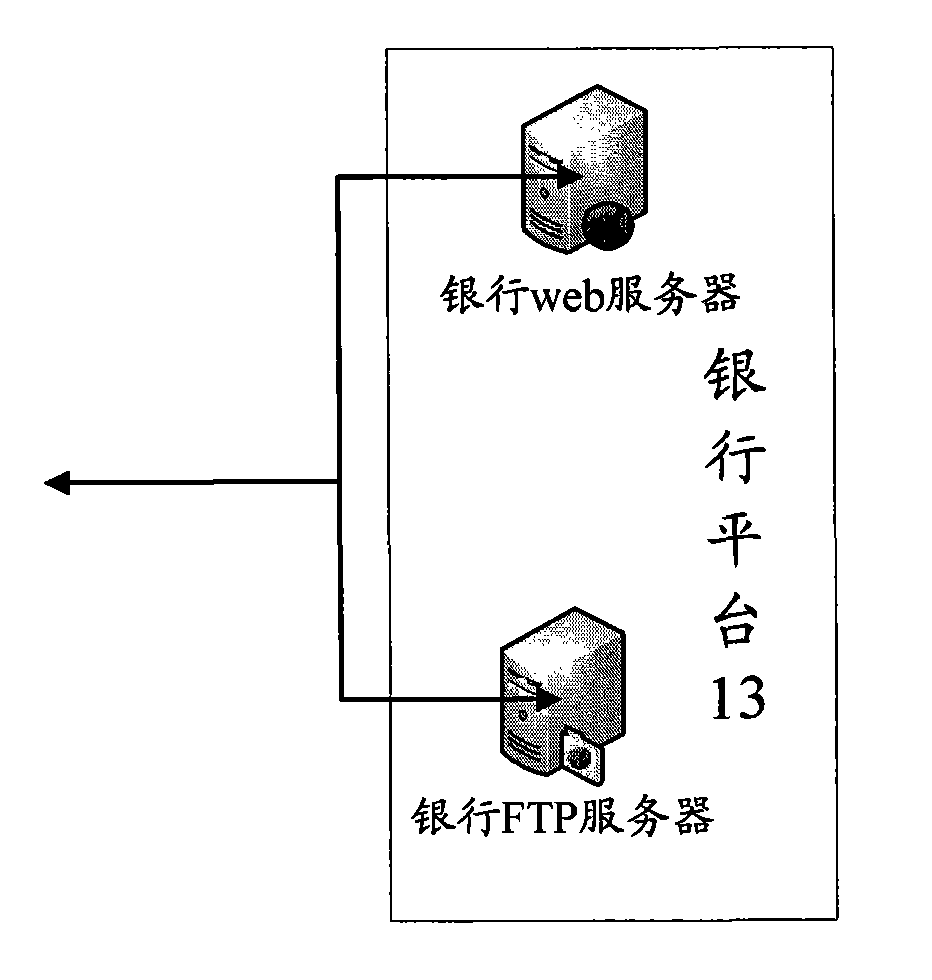

Method, device and system for realizing merging payment

InactiveCN101655950AImprove experienceReduce execution complexityCommercePayments involving neutral partyThird partyBank account

The invention discloses a method for realizing merging payment. The method comprises the following steps: receiving at least two trading information files in different formats sent by a user through an e-commerce trading platform by a third-party payment platform, converting the trading information files into files with the same format and storing a user ID corresponding to the user; when a payment requiring message which carries the user ID and is sent through a client is received, merging trading amounts which correspond to the at least two trading information files and are stored by the user ID so as to obtain a trading total amount; and sending a command for deducting the trading total amount from a bank account appointed by the user to a bank platform so as to finish a merging paymentflow. The user can finish payments aiming at different e-commerce trading platforms by only executing the merging payment flow once through the third-party payment platform, and the executive complexity of the whole payment flow is greatly reduced. The invention also discloses a system and a device for the merging payment business.

Owner:ALIBABA GRP HLDG LTD

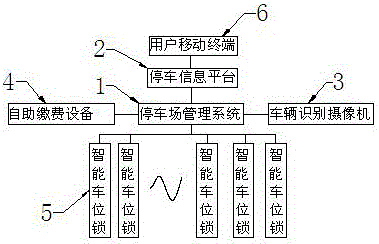

Parking information service system and parking information service method for realizing accurate parking space reservation

InactiveCN105957157ARealize early paymentIncrease traffic speedTicket-issuing apparatusReservationsThe InternetParking space

The present invention provides a parking information service system and method capable of accurately reserving parking spaces, including a parking information platform communicated with a parking lot management system, a license plate recognition camera, self-service toll payment equipment, and several intelligent parking locks. The parking information The platform communicates with the user's mobile terminal, and the beneficial effects of the present invention are: realizing the parking space reservation service based on the Internet platform, the parking lot charging function based on third-party payment, improving the parking space utilization rate of the parking lot, and avoiding artificial loopholes in manual charging , to ensure the income of the parking lot and reduce the management cost.

Owner:至库停车信息服务有限公司

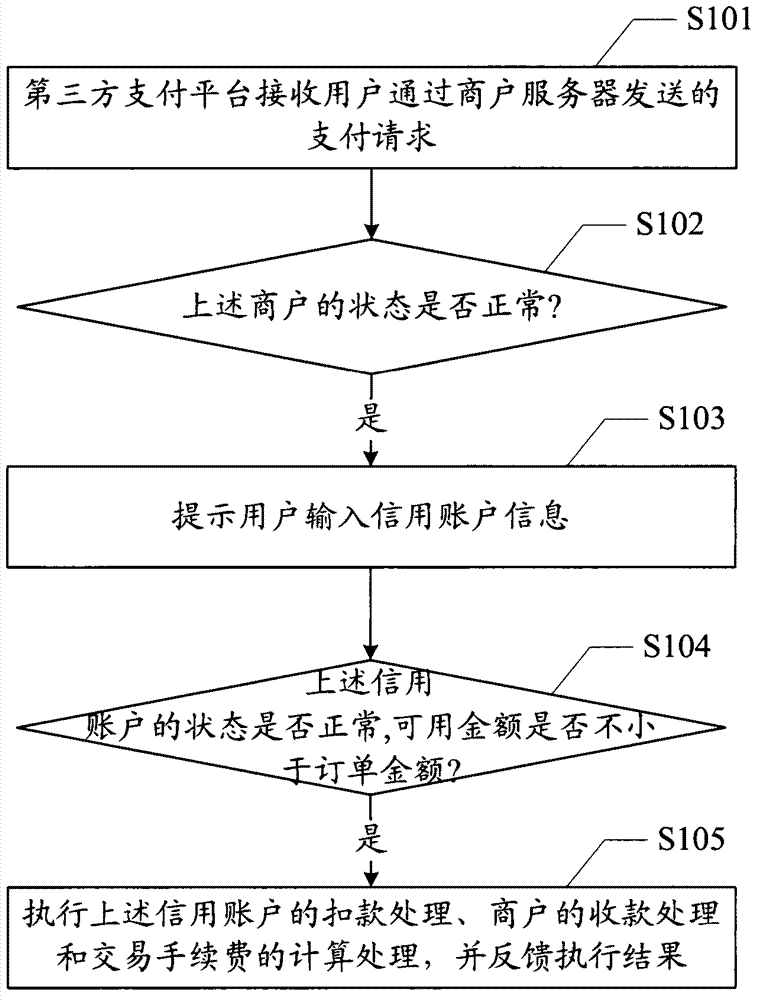

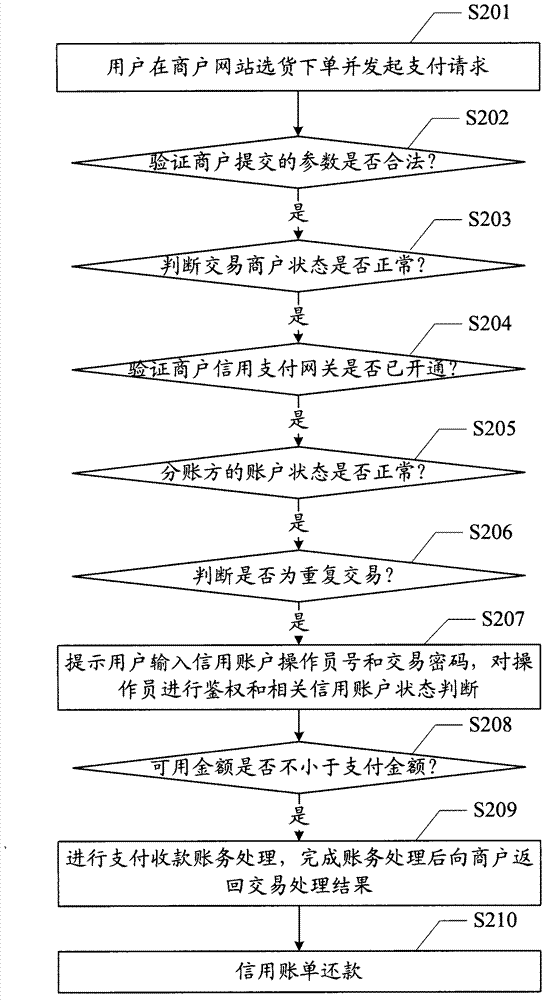

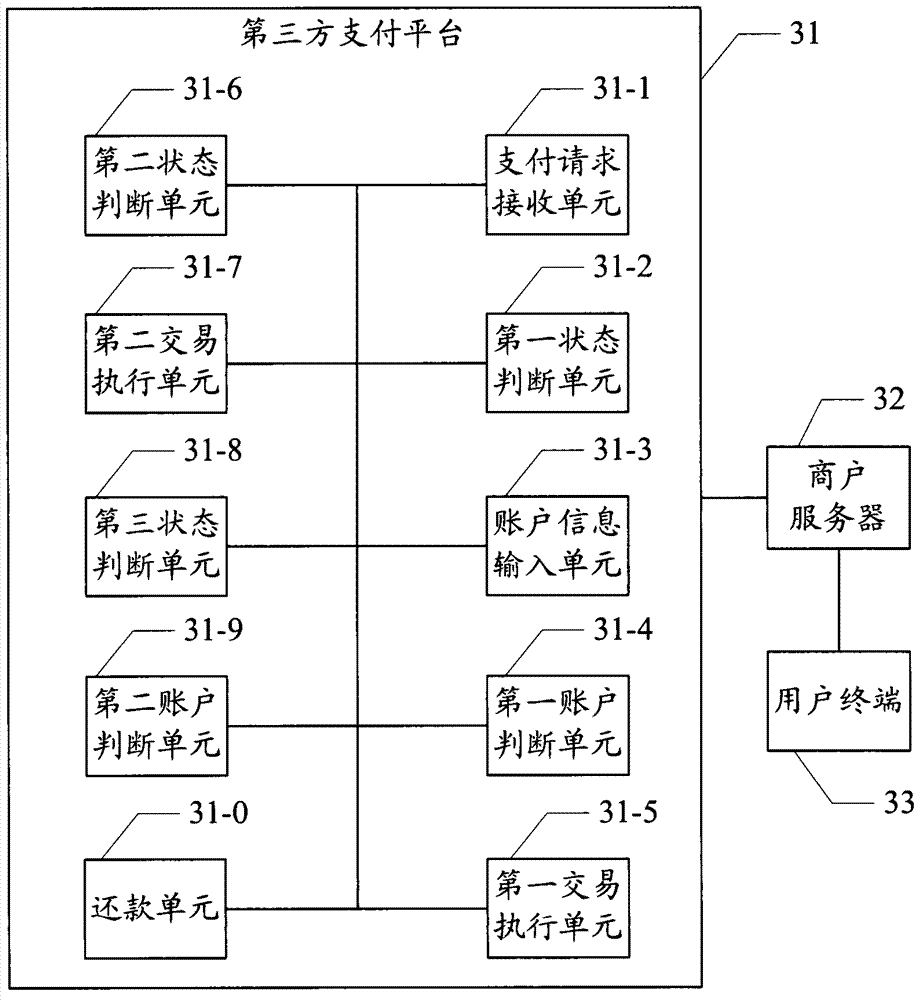

Payment control method and system based on credit data

ActiveCN102968715AImprove turnover efficiencyHigh yieldPayments involving neutral partyThird partyUser input

The invention provides a payment control method and a system based on credit data. The method includes that a third-party payment platform receives payment requests sent by a merchant server; whether the state of a merchant is normal is judged, if the state is normal, a user is prompted to input credit account information, whether the state of a credit account is normal and an available amount is larger than or equal to an order amount are judged, if the state is normal and the available amount is larger than or equal to an order amount, deduction treatment of the credit account, collection treatment of the merchant and calculation treatment of transaction procedure fees are performed. The third-party payment platform provides a credit account with a certain amount and a payment day for users at different merchants respectively according to parameter values of users, in an available amount, users can complete safe network transaction in the condition that actual cash payment is produced without banks, and accordingly, the capital turnover efficiency is accelerated, and fund yields of industry chains are improved.

Owner:汇付天下有限公司

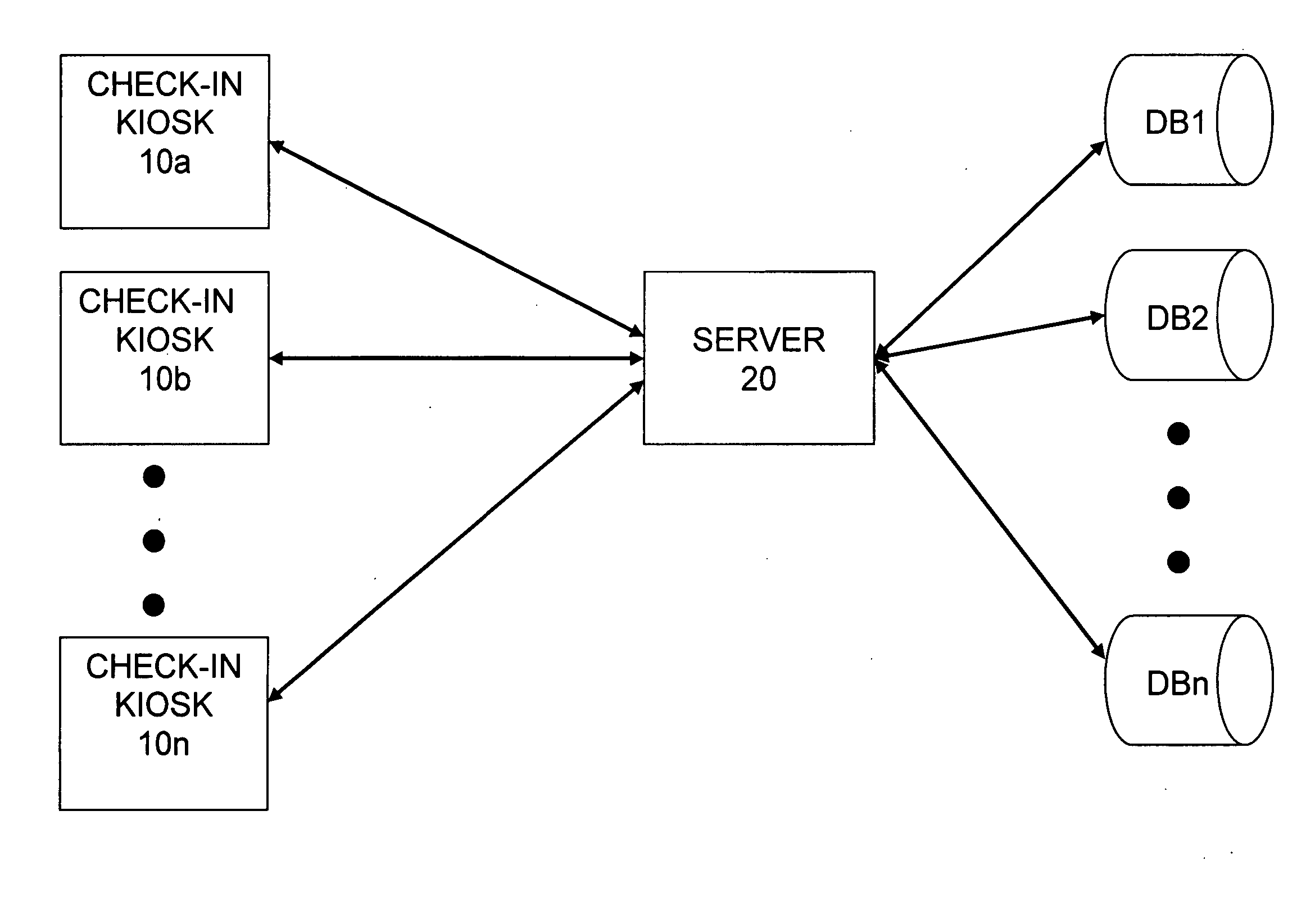

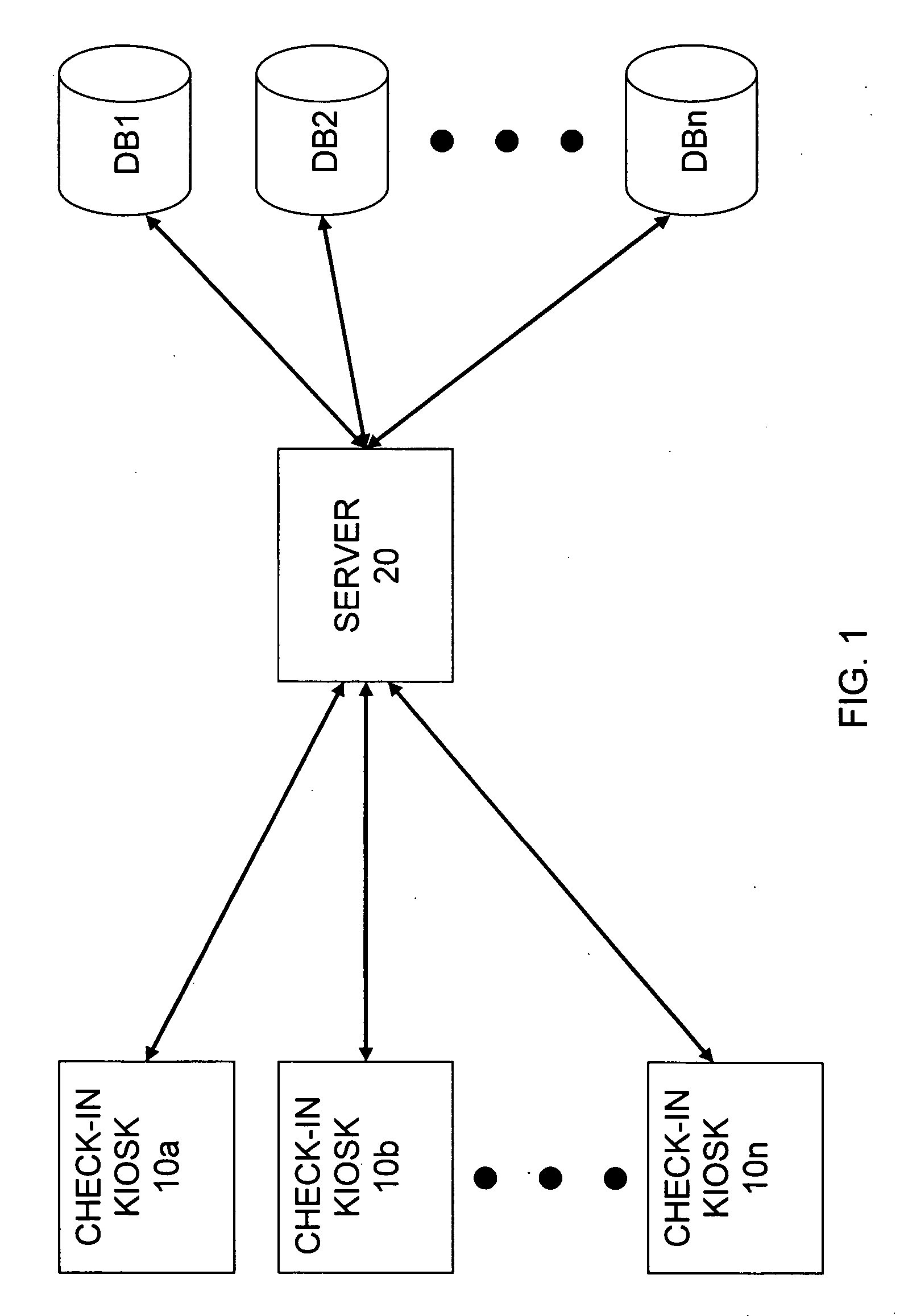

Self-serve patient check-in and preventive services kiosk

InactiveUS20050261942A1Effectively exchanging informationData efficientDigital data processing detailsHealthcare resources and facilitiesThird partyPreventive service

A medical check-in and data communication kiosk for efficiently checking-in patients at a medical facility and / or exchanging relevant data with the patient. A patient automatically provides initial identification information by swiping, scanning, etc., an I.D. card and the kiosk then accesses various legacy database systems to gather all relevant medical data corresponding to the particular patient. The patient is requested to verify and / or update any third party payer information, such as insurance information, and is also informed of suggested preventive healthcare actions.

Owner:UNITED STATES OF AMERICA THE AS REPRESENTED BY THE SEC OF THE ARMY

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com