Payment system and method based on mobile internet sharing membership card

A mobile Internet and payment system technology, applied in the field of payment systems based on mobile Internet sharing membership cards, can solve the problems of members unable to lower the threshold, unable to automatically recover funds, and inconvenient time and space for card collection and return.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

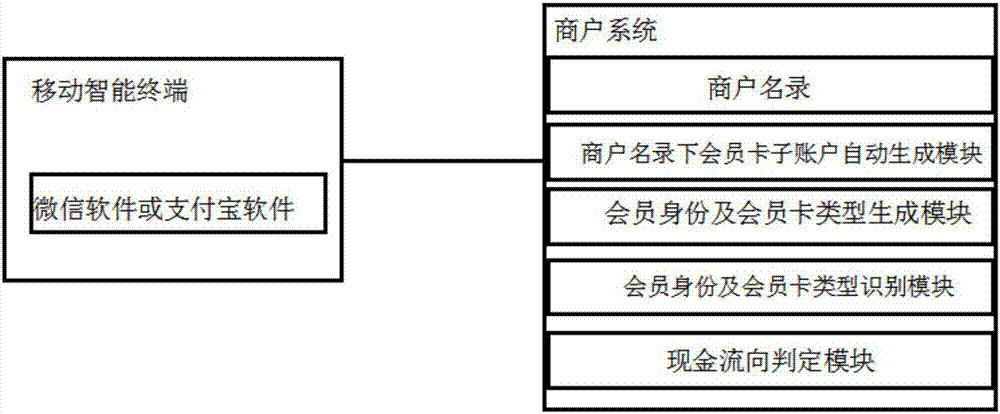

[0112]The payment system based on the mobile Internet shared membership card, including the electronic membership card configured for members, and also includes the mobile smart terminal configured for users including members, as well as the merchant system and the first QR code provided to merchants;

[0113] The mobile smart terminal communicates with the merchant system;

[0114] The mobile smart terminal includes WeChat payment software, bank or UnionPay payment software, Alipay software or other third-party payment software;

[0115] The merchant system includes a merchant directory, a member card sub-account automatic generation module under the merchant directory, a member identity and membership card type generation module, a member identity and membership card type identification module, and a cash flow determination module.

[0116] The method of the payment system based on the mobile Internet shared membership card includes the following steps:

[0117] Step 1: Whe...

Embodiment 2

[0135] The payment system based on the mobile Internet shared membership card, including the electronic membership card configured for members, and also includes the mobile smart terminal configured for users including members, as well as the merchant system and the first QR code provided to merchants;

[0136] The mobile smart terminal communicates with the merchant system;

[0137] The mobile smart terminal includes WeChat payment software, bank or UnionPay payment software, Alipay software or other third-party payment software;

[0138] The merchant system includes a merchant directory, a member card sub-account automatic generation module under the merchant directory, a member identity and membership card type generation module, a member identity and membership card type identification module, and a cash flow determination module.

[0139] The mobile intelligent terminal is a smart phone, a PDA, a notebook computer or a palmtop computer.

[0140]The merchant system includ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com