Habitual offender fraud detection method and system in finance credit audit business

A detection method and business technology, applied in the financial field, can solve problems such as management loopholes of untrustworthy users, reduce staff efficiency, and asset loss, so as to reduce the loss of financial institutions and social property resources, wide range of applications, and prevent financial fraud crimes Effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0039] In order to make the technical problems, technical solutions and beneficial effects to be solved by the present invention clearer and clearer, the present invention will be further described in detail below in conjunction with the accompanying drawings and embodiments. It should be understood that the specific embodiments described here are only used to explain the present invention, not to limit the present invention.

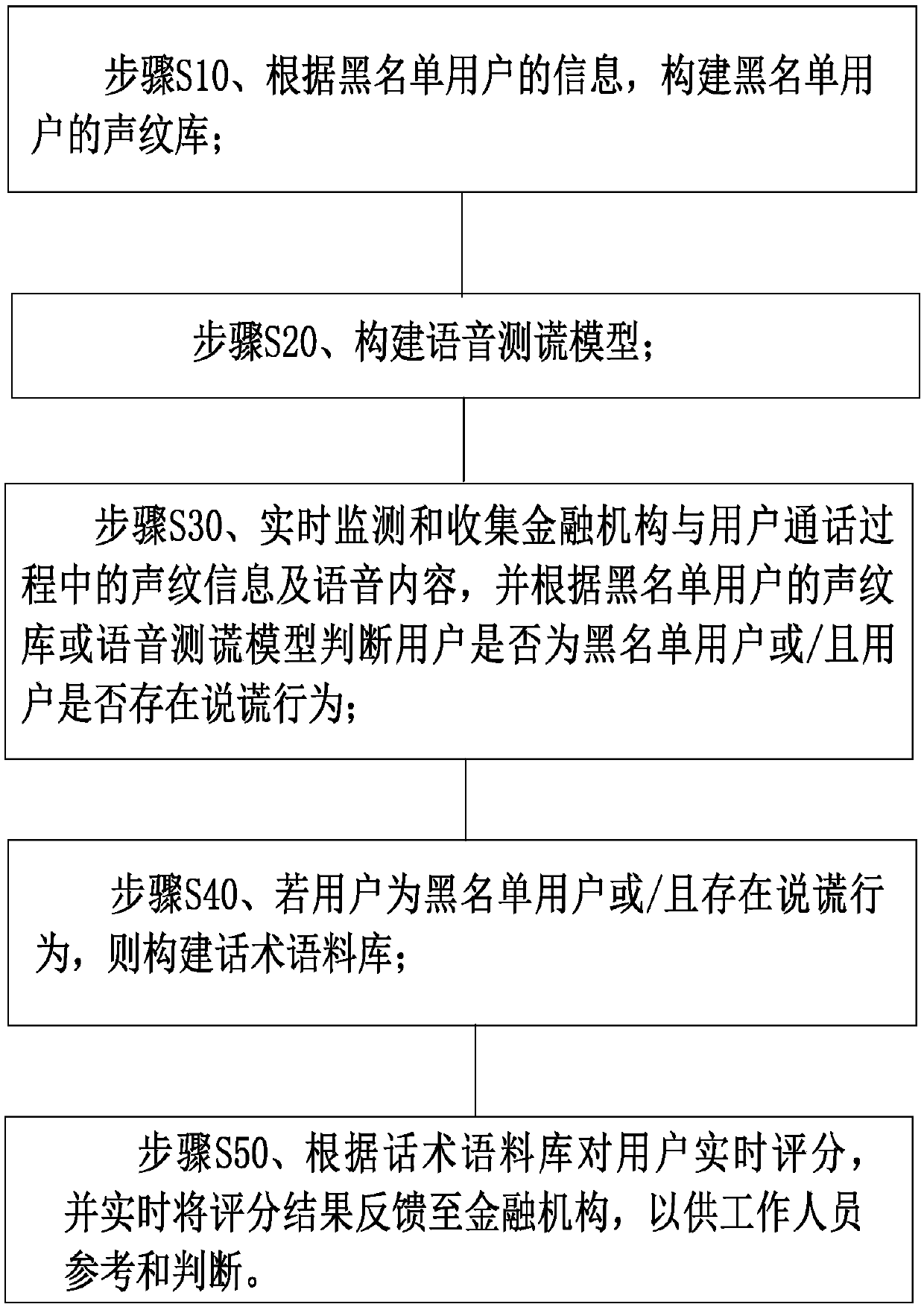

[0040] Such as figure 1 As shown, a detection method disclosed by the present invention to solve recidivist fraud in the financial credit examination business includes the following steps:

[0041] Step S10, according to the information of the blacklisted users, construct the voiceprint library of the blacklisted users; wherein, the blacklisted users are untrustworthy users and black intermediaries who have been discovered or verified;

[0042] Step S20, constructing a voice polygraph model;

[0043] Step S30, real-time monitoring and collection of vo...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com