Risk assessment method based on consumption loan scene, and system implementation

A technology for risk assessment and credit assessment, applied in instrumentation, finance, data processing applications, etc., can solve the problems of single assessment dimension and low accuracy of assessment results, so as to solve the problem of single assessment dimension, improve loan approval efficiency, and improve accuracy Effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

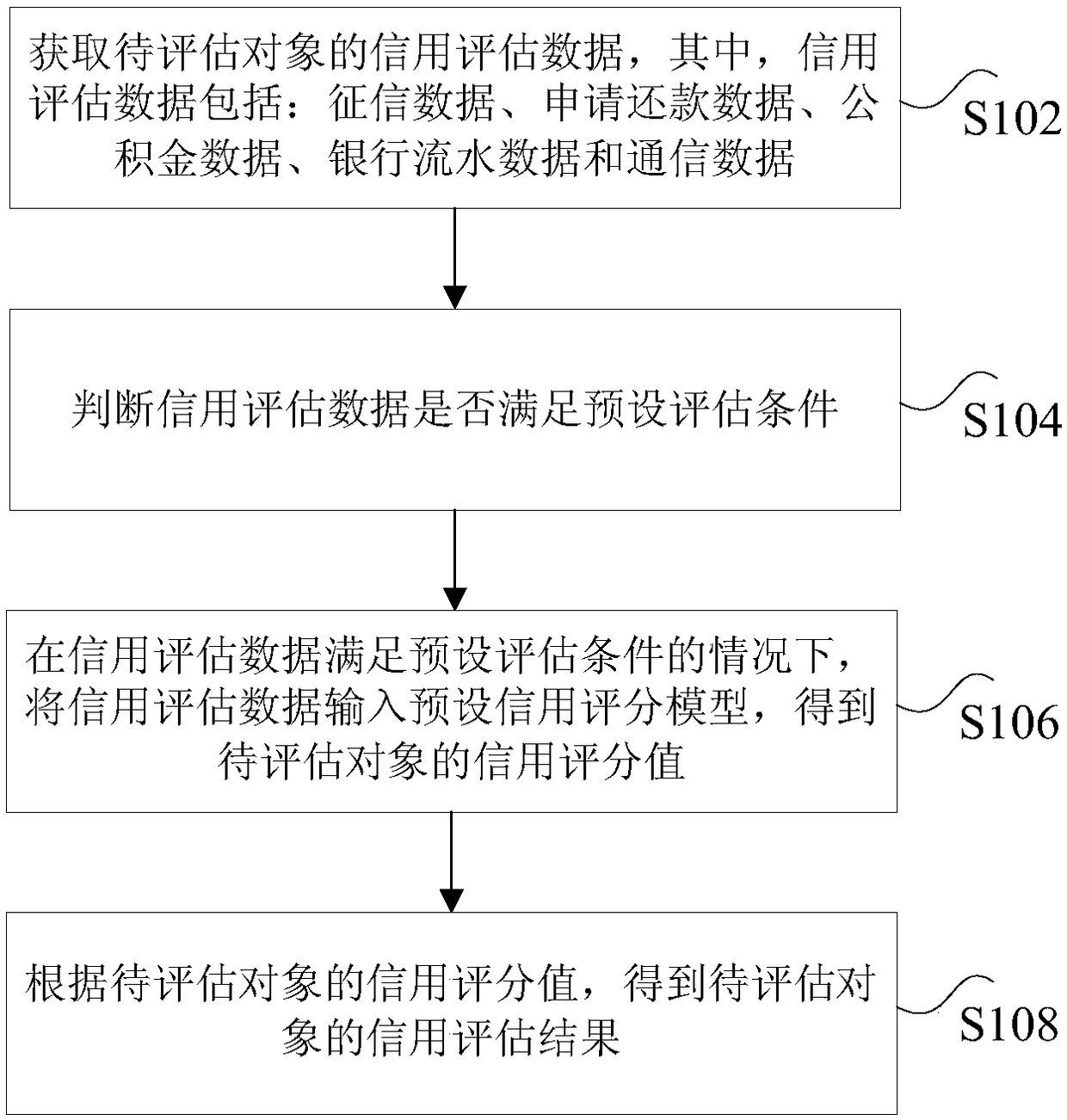

[0026] According to an embodiment of the present invention, an embodiment of a risk assessment method based on a consumer credit scenario is provided. It should be noted that the steps shown in the flow chart of the accompanying drawings can be implemented in a computer system such as a set of computer-executable instructions and, although a logical order is shown in the flowcharts, in some cases the steps shown or described may be performed in an order different from that shown or described herein.

[0027] figure 1 It is a flowchart of a risk assessment method based on a consumer credit scenario according to an embodiment of the present invention, such as figure 1 As shown, the method includes the following steps:

[0028] Step S102, obtaining credit evaluation data of the object to be evaluated, wherein the credit evaluation data includes: credit investigation data, repayment application data, provident fund data, bank statement data and communication data.

[0029] Speci...

Embodiment 2

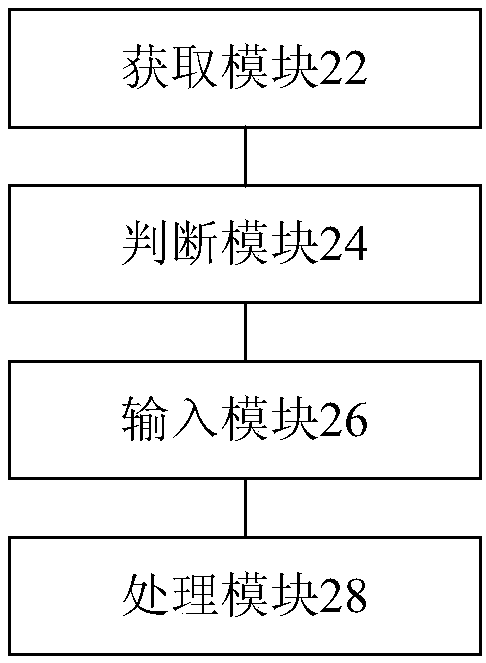

[0106] According to an embodiment of the present invention, an embodiment of a risk assessment device based on a consumer credit scenario is provided.

[0107] figure 2 is a schematic diagram of a risk assessment device based on a consumer credit scenario according to an embodiment of the present invention, such as figure 2 As shown, the device includes:

[0108] The obtaining module 22 is used to obtain the credit evaluation data of the object to be evaluated, wherein the credit evaluation data includes: credit investigation data, application repayment data, provident fund data, bank statement data and communication data.

[0109]Specifically, the above-mentioned object to be evaluated may be a loan applicant who applies for a loan. When the applicant applies for a loan from the bank, the applicant needs to provide a credit report (that is, the above-mentioned credit data), the monthly repayment amount of the loan (that is, The above-mentioned application repayment data),...

Embodiment 3

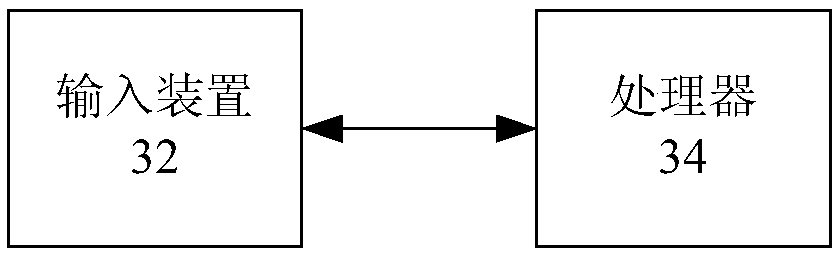

[0118] According to an embodiment of the present invention, an embodiment of a risk assessment system based on a consumer credit scenario is provided. It should be noted that the steps shown in the flow chart of the accompanying drawings can be implemented in a computer system such as a set of computer-executable instructions and, although a logical order is shown in the flowcharts, in some cases the steps shown or described may be performed in an order different from that shown or described herein.

[0119] image 3 is a schematic diagram of a risk assessment system based on a consumer credit scenario according to an embodiment of the present invention, such as image 3 As shown, the system includes the following steps: an input device 32 and a processor 34 .

[0120] Wherein, the input device 32 is used for inputting the credit evaluation data of the object to be evaluated, wherein the credit evaluation data includes: credit investigation data, application repayment data, p...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com