Intelligent evaluation method of lines of credit

A credit limit and credit scoring technology, applied in data processing applications, instruments, complex mathematical operations, etc., can solve the problems of complex neural network algorithm implementation, low evaluation process efficiency, cumbersome parameter tuning, etc., so as to improve the performance of quota evaluation. , the effect of rapid credit limit evaluation and accurate credit limit evaluation

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0040] The present invention will be further described below in conjunction with the accompanying drawings and specific preferred embodiments, but the protection scope of the present invention is not limited thereby.

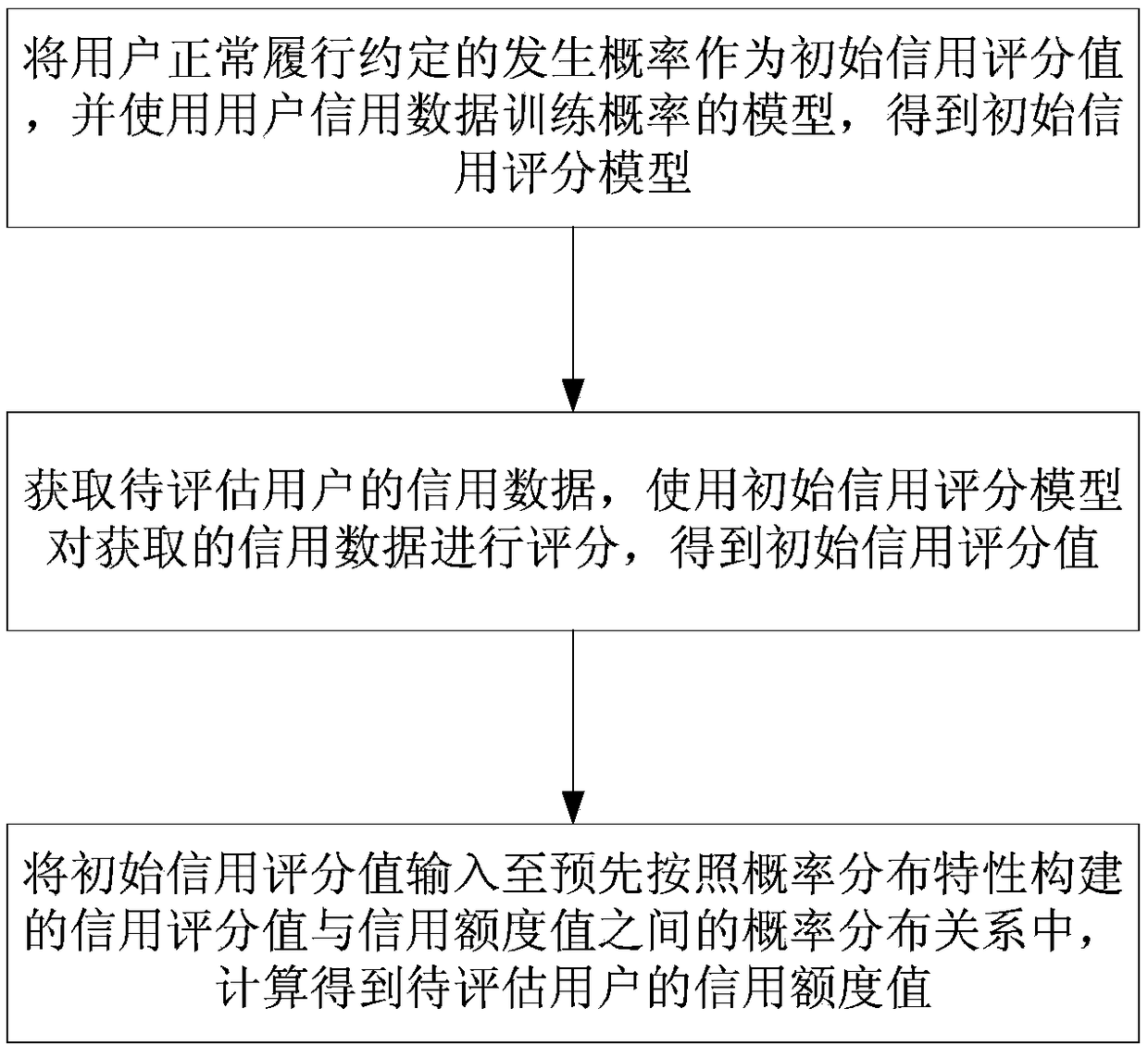

[0041] Such as figure 1 As shown, the credit limit intelligent evaluation method of this embodiment, the steps include:

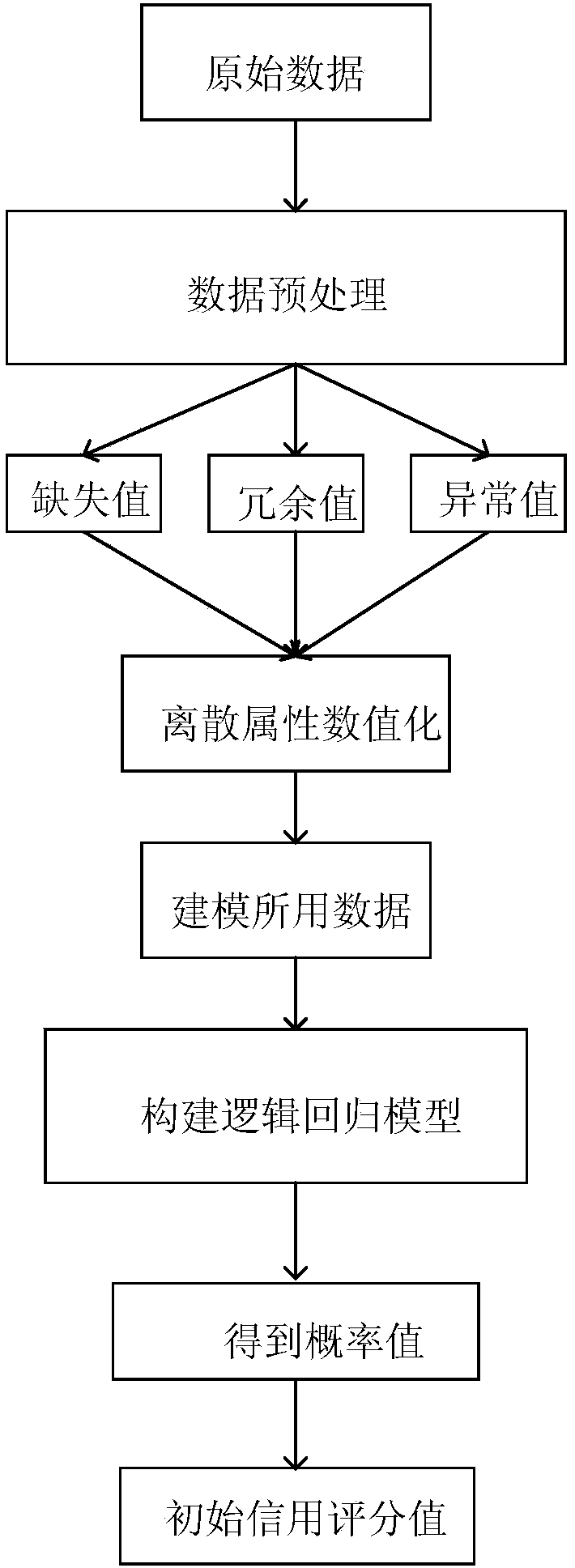

[0042] S1. Take the probability p of the user's normal fulfillment of the agreement as the initial credit score value, and use the user credit data to train the model of the probability p to obtain the initial credit score model;

[0043] S2. Obtain the credit data of the user to be evaluated, use the initial credit scoring model to score the acquired credit data, and obtain the initial credit scoring value;

[0044] S3. Input the initial credit score value into the distribution relationship between the credit score value and the credit limit value constructed in advance according to the probability distribution characteristics, and calculat...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com