An internet financial user loan overdue prediction method based on big data

A forecasting method and Internet technology, applied in data processing applications, finance, forecasting, etc., can solve problems such as low efficiency, inability to carry out risk classification management, and affecting the ability and flexibility of risk control

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0047] The technical solutions in the embodiments of the present invention will be described clearly and in detail below with reference to the drawings in the embodiments of the present invention. The described embodiments are only some of the embodiments of the invention.

[0048] The technical scheme that the present invention solves the problems of the technologies described above is:

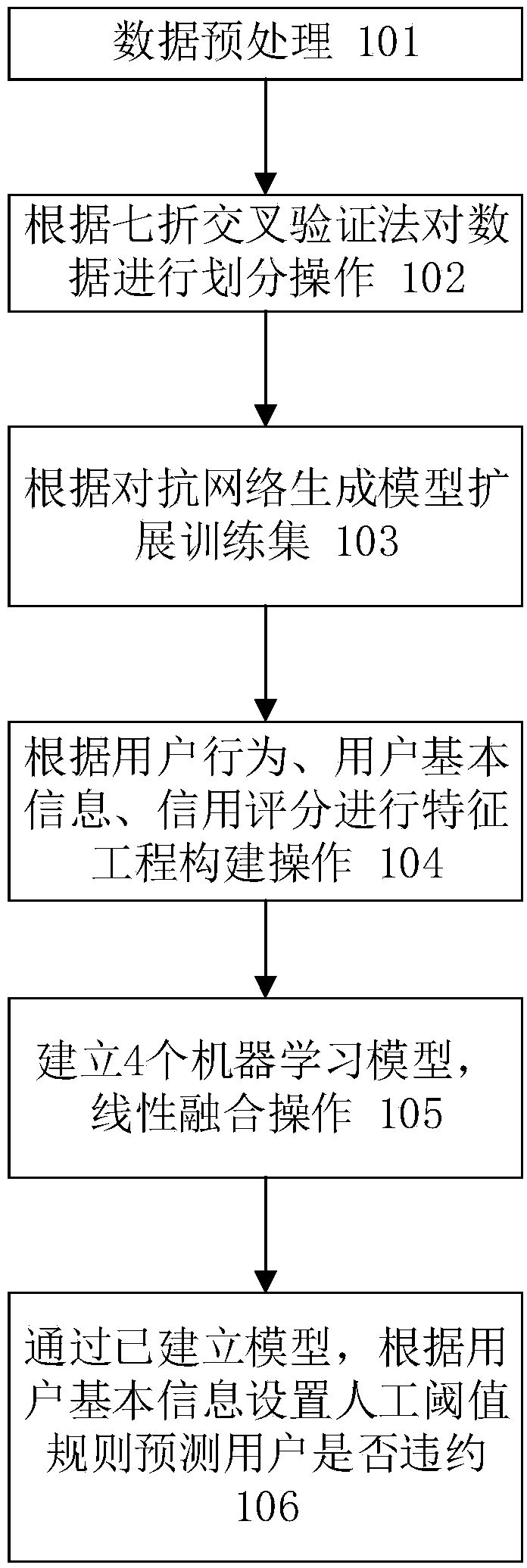

[0049] The technical scheme that the present invention solves the problems of the technologies described above is: figure 1 As shown, a method for predicting overdue loans of Internet financial users based on big data includes the following steps:

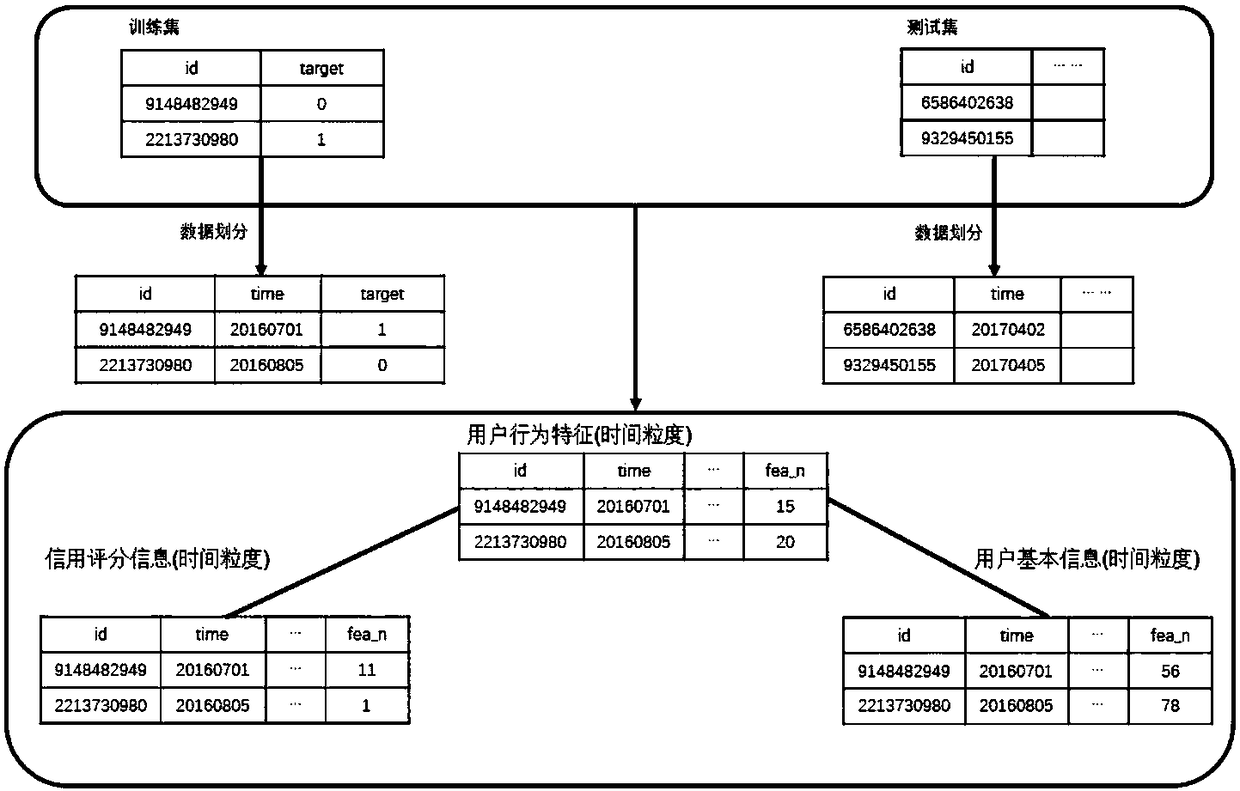

[0050] 101. Data preprocessing operations, performing data preprocessing operations based on user behavior, user basic information, and credit score data;

[0051] 102. Divide the data according to the seven-fold cross-validation method;

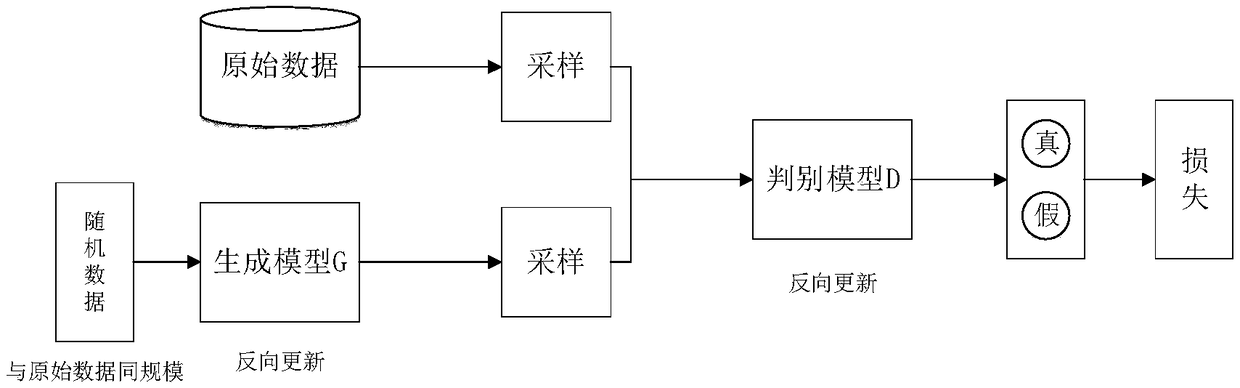

[0052] 103. Expand the training set according to the generation model of the confrontation network;

[0...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com