A real estate borrowing pre-loan remote risk control system and method

A real estate and remote technology, applied in the field of financial credit and financial service risk control, can solve the problems of long process, high cost of risk control, easy to be affected by subjective factors, etc., and achieve the effect of low difficulty and accurate identification

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0068] The technical solutions of the present invention will be further described in detail below through specific embodiments in conjunction with the drawings.

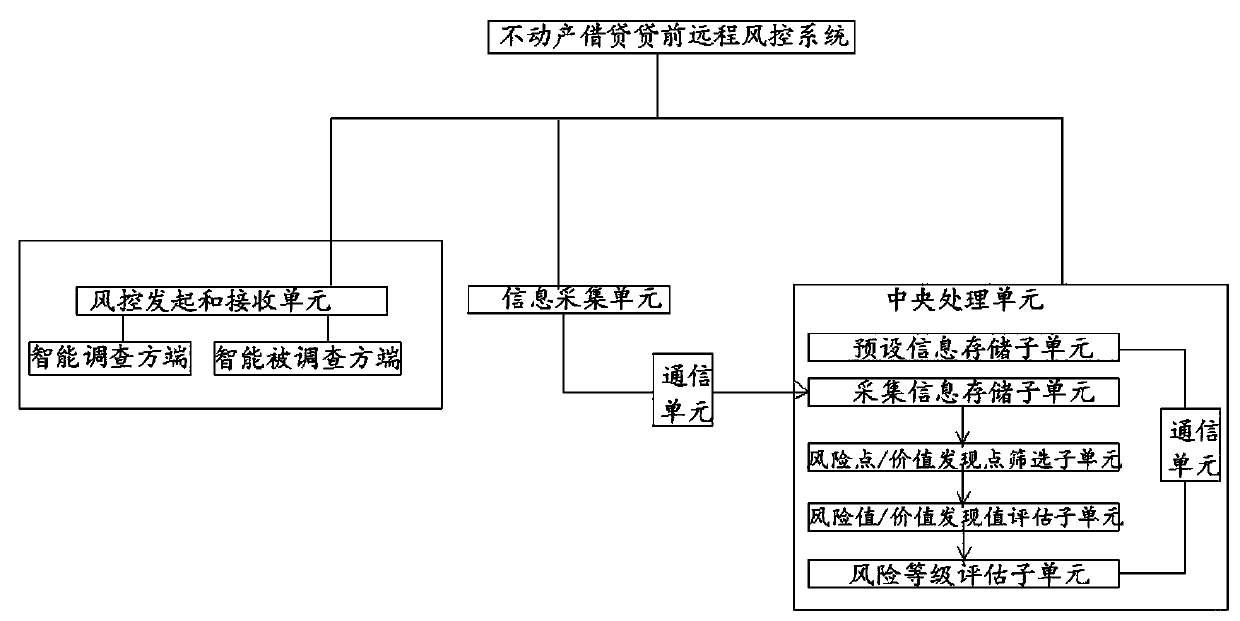

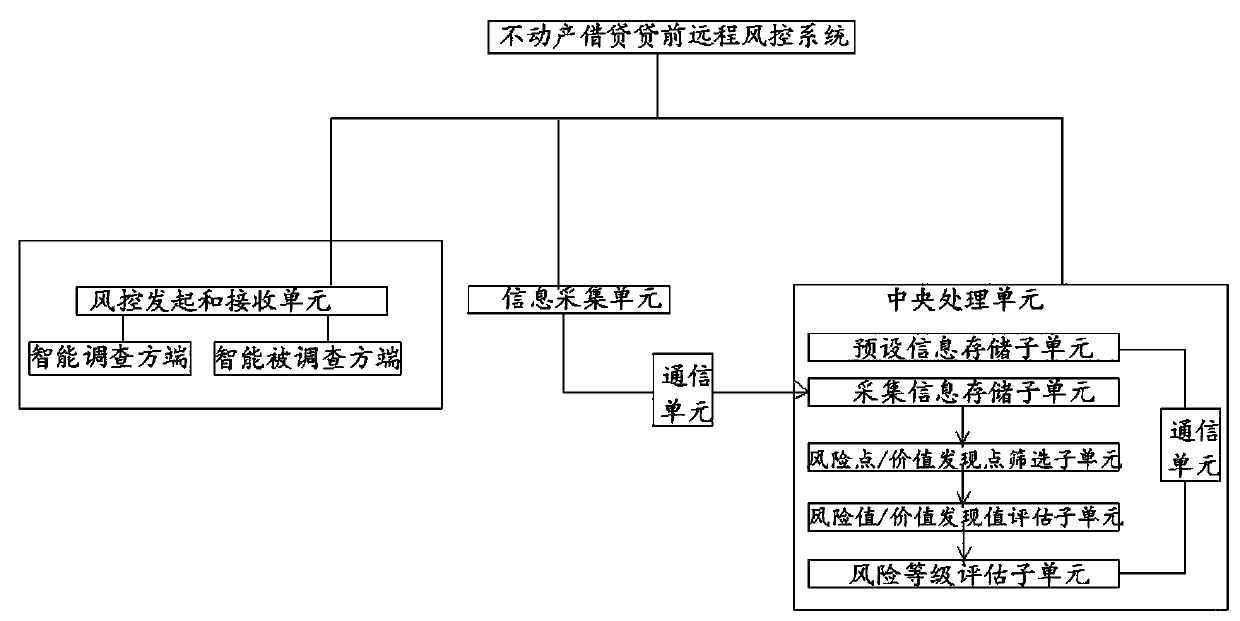

[0069] Such as figure 1 A remote risk control system before real estate lending is shown, the system includes:

[0070] Risk control initiation and receiving units, including the intelligent investigator and the investigated party;

[0071] The information collection unit, based on remote risk control equipment, is used to verify and re-collect the identity information of the borrower-related parties and real estate information;

[0072] Central processing unit, including preset information storage subunit, collected information storage subunit, risk point and value discovery point screening subunit, risk value and value discovery value evaluation subunit, and risk level evaluation subunit;

[0073] The preset information storage subunit is used to store preset risk level evaluation reference values;

[0074] The collection in...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com