A credit rating default probability measurement and risk early warning method

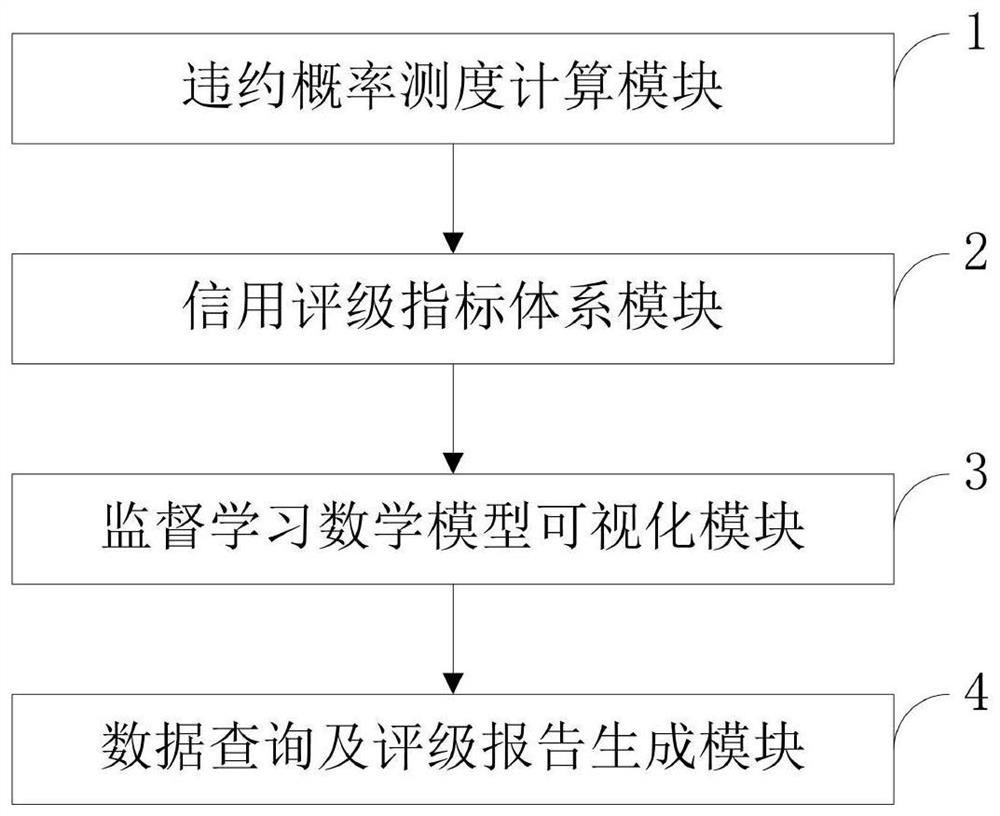

A risk early warning and probability measurement technology, applied in the field of financial information data management, can solve problems such as low timeliness of rating information, lagging risk early warning, missing data, etc., to achieve true and reliable credit evaluation results, accurate credit rating early warning strategies, and accurate ratings high degree of effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

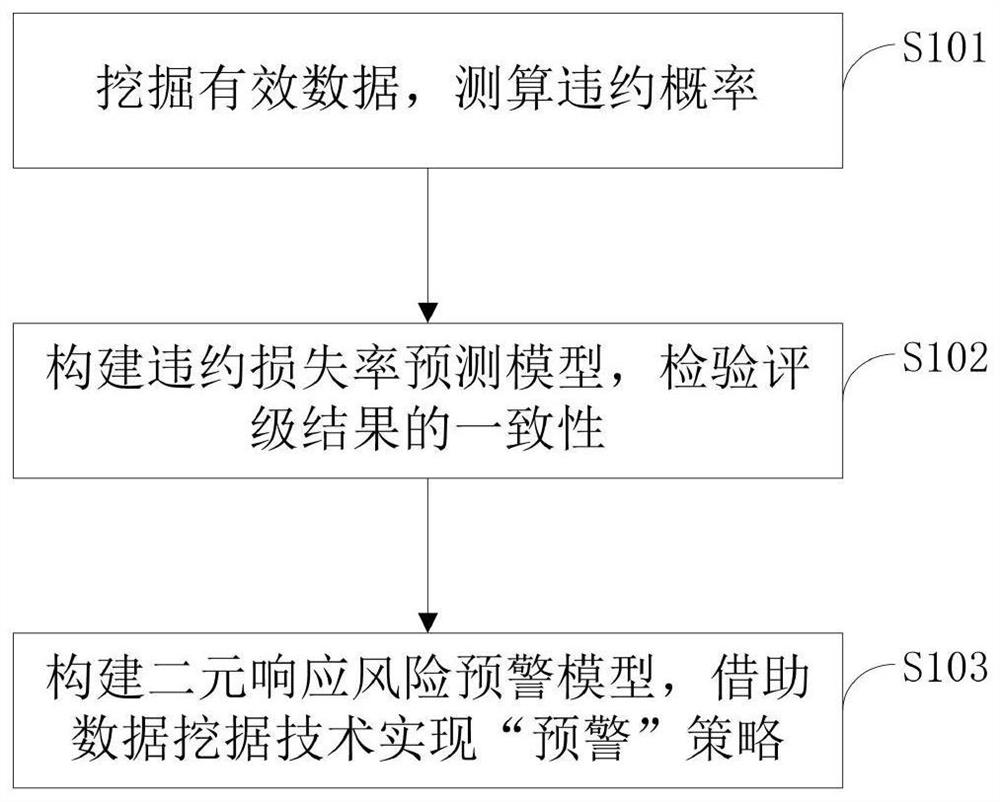

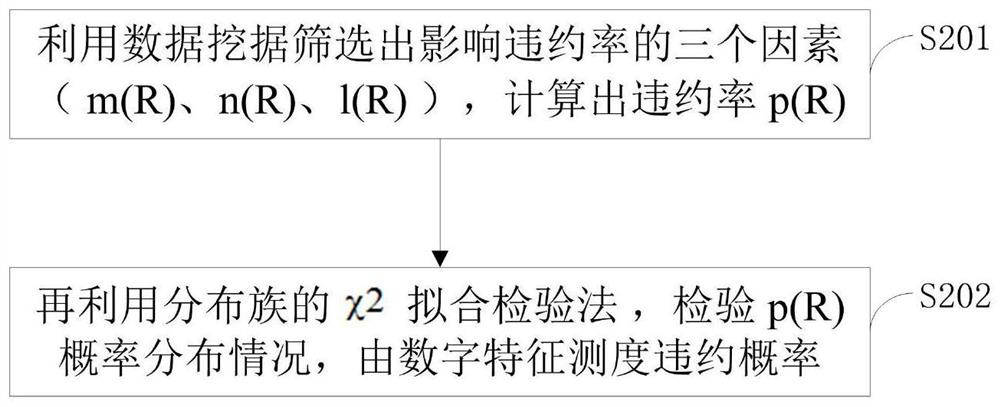

Method used

Image

Examples

Embodiment

[0157] Data mining 1020 effective sample data, select part of the data of the index system, set M=2, do binary classification prediction test, respectively use support vector machine SVM, neural network, logistic regression model to test the samples and get the following results:

[0158]

[0159] (1) Analysis of SVM running results, such as Figure 4 , Figure 5 As shown in Table 1 and Table 2.

[0160] Table 1 Various evaluation standard indicators of SVM test set

[0161]

[0162]

[0163] Table 2 Various evaluation standard indicators of SVM training set

[0164]

[0165] (2) Analysis of neural network operation results, such as Image 6 , Figure 7 As shown in Table 3 and Table 4.

[0166] Table 3 Various evaluation standard indicators of the neural network test set

[0167]

[0168] Table 4 Various evaluation standard indicators of neural network training set

[0169]

[0170] (3) Logistic regression operation result analysis, such as Figure 8 , ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com