Intelligent financial service platform and method

A service platform and service method technology, applied in the field of intelligent finance, can solve problems such as difficulty in guaranteeing borrower risks, failure to obtain loans in time, and high threshold for comprehensive credit granting, and achieve the effects of improving channel management capabilities, avoiding moral hazards, and visualizing progress

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

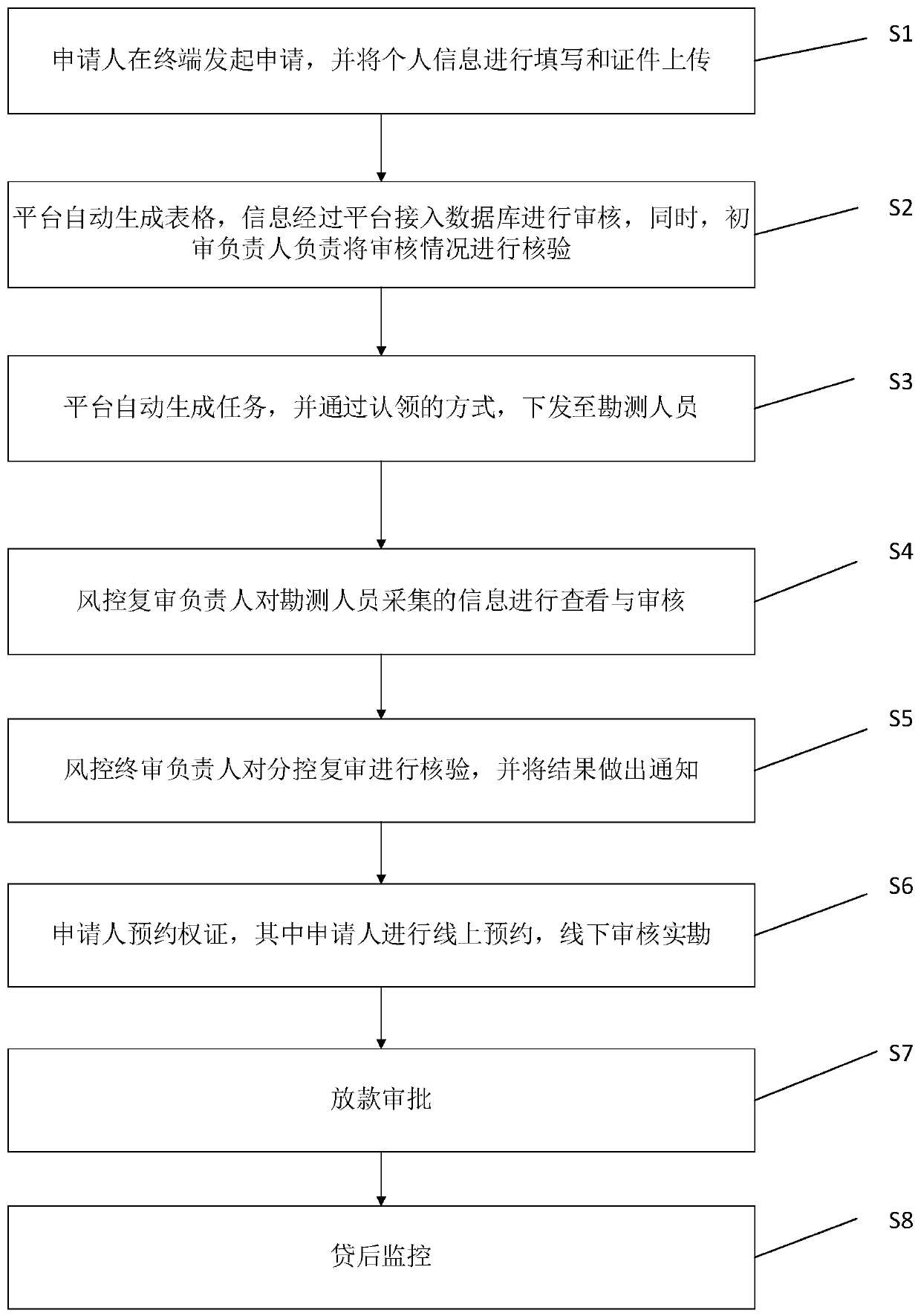

[0029] The present invention will be further described in detail below in conjunction with the accompanying drawings.

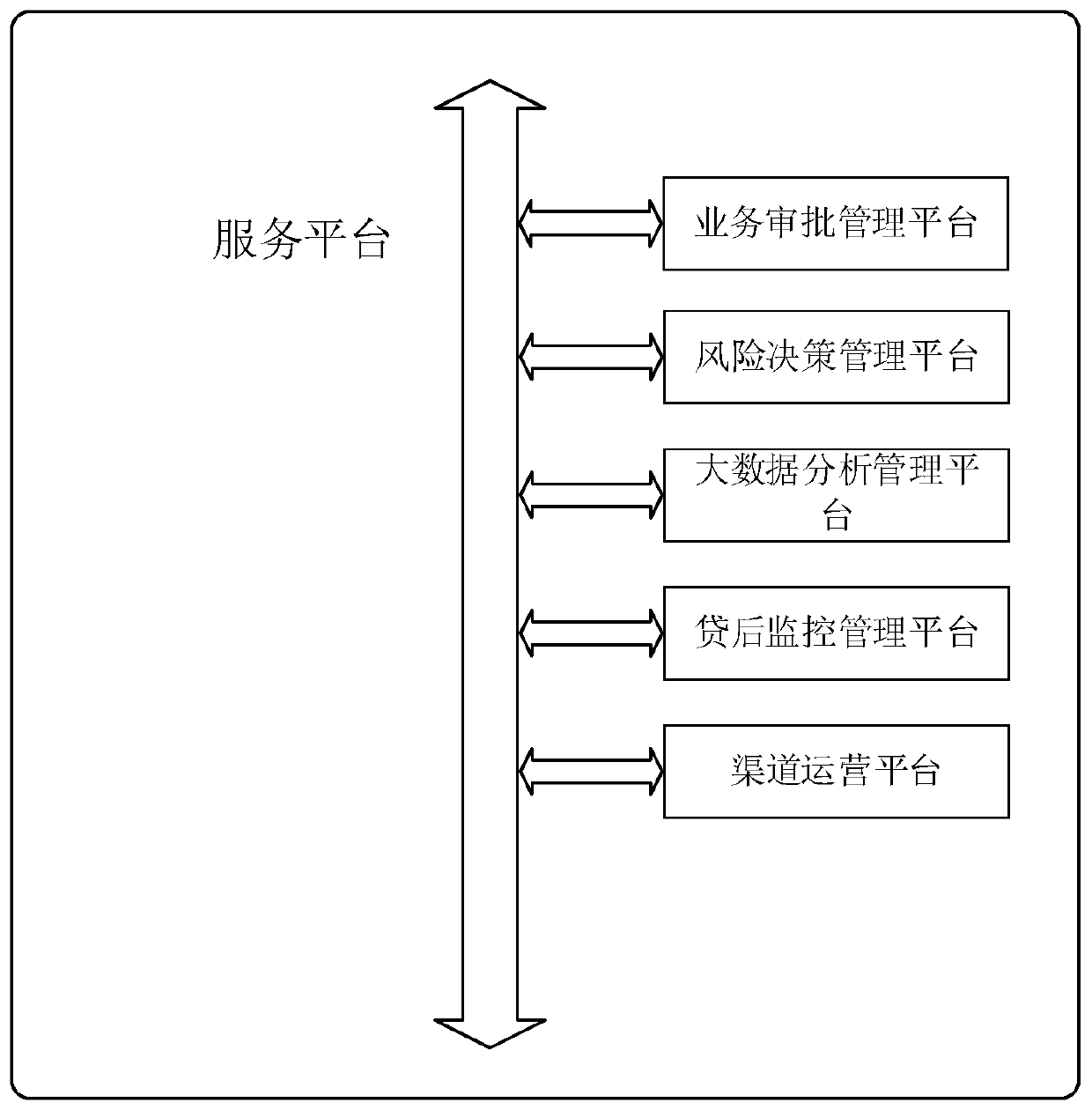

[0030] Such as figure 1 As shown, a smart financial service platform, including business approval management platform, risk decision-making management platform, big data analysis management platform, post-loan monitoring management platform and channel operation platform:

[0031] The business approval management platform is used to standardize the business process, to ensure that the business is smooth and the person in charge is clear from the beginning to the end of any link;

[0032] Risk decision-making management platform, which is used to assess the risk of borrowers and provide comprehensive online and offline monitoring;

[0033] Big data analysis and management platform, which is used to comprehensively control the risks of borrowers based on big data technology on the basis of traditional risk control personnel review;

[0034] The post-loan moni...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com