Investment data processing method and device

A data processing and data technology, applied in the field of big data, can solve problems such as unfavorable calculation model promotion, complex model calculation process, etc., and achieve the effects of high model reliability, good investment reference function, and simple calculation.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

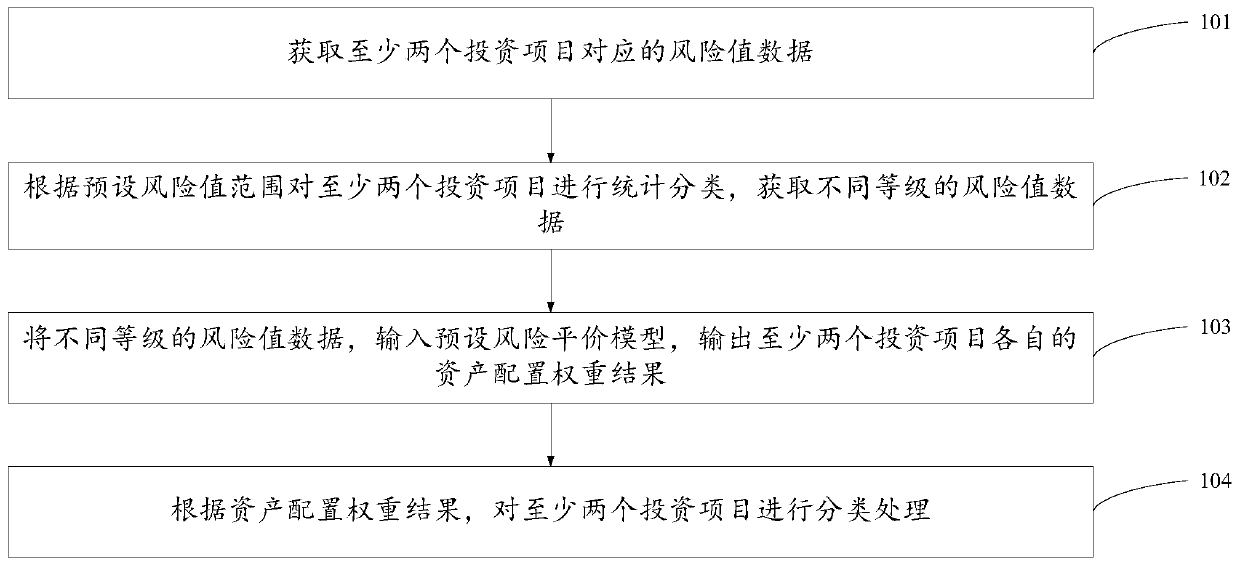

[0054] figure 1 It is a flowchart of the investment data processing method provided by Embodiment 1 of the present invention. like figure 1 As shown, the investment data processing method provided by the embodiment of the present invention includes the following steps:

[0055] 101. Acquire risk value data corresponding to at least two investment projects.

[0056] Specifically, historical volatility data corresponding to at least two investment projects is acquired, and risk value data corresponding to at least two investment projects is determined according to the historical volatility data. Obtain the historical daily rate of return data corresponding to at least two investment projects, calculate the standard deviation based on the historical daily rate of return data, calculate the reciprocal of the standard deviation of the historical daily rate of return data, and obtain the risk value V corresponding to at least two investment projects 1 ...V i , i is an integer ≥ ...

Embodiment 2

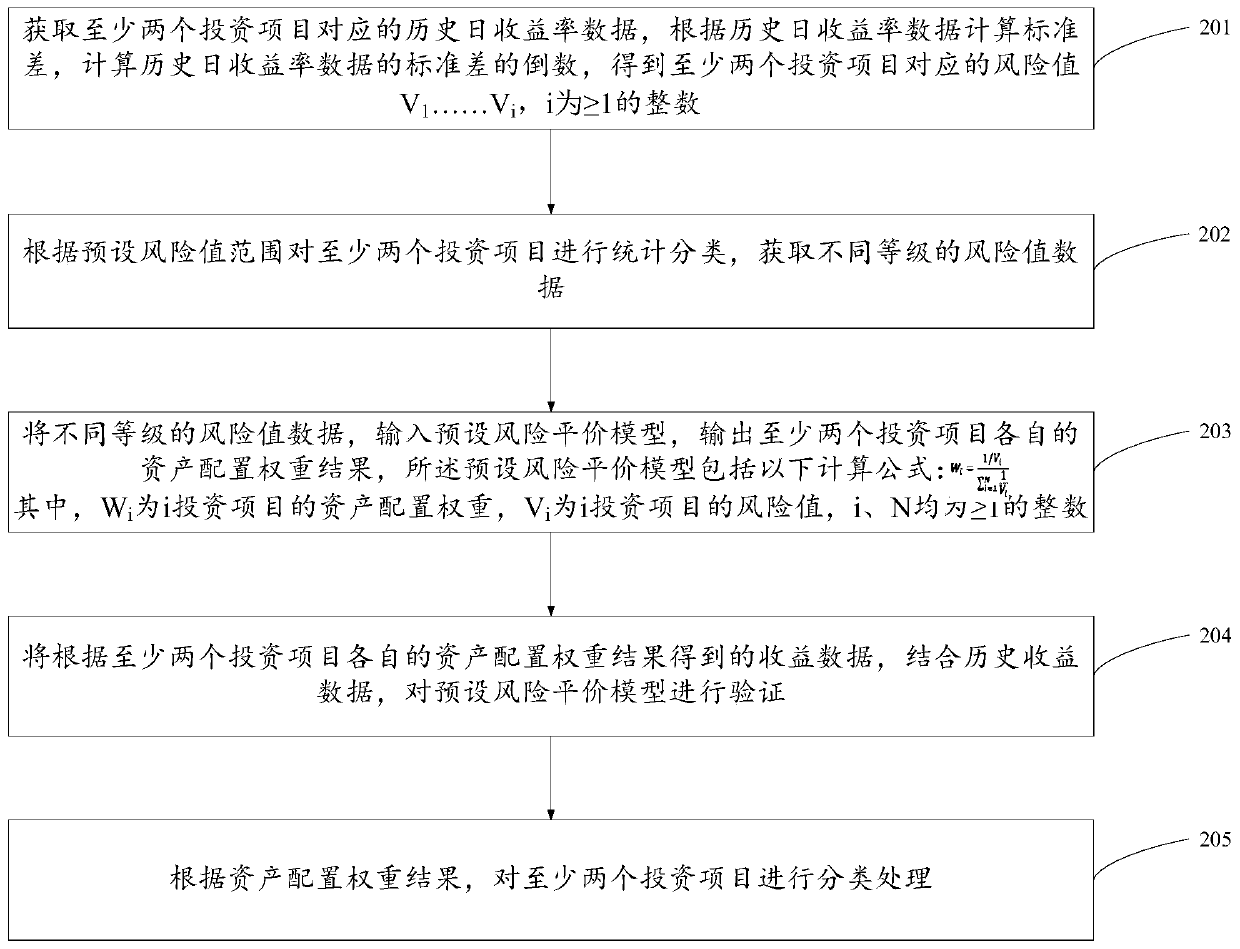

[0085] figure 2 It is a flow chart of the investment data processing method provided by Embodiment 2 of the present invention. like figure 2 As shown, the investment data processing method provided by the embodiment of the present invention includes the following steps:

[0086] 201. Obtain the historical daily rate of return data corresponding to at least two investment projects, calculate the standard deviation based on the historical daily rate of return data, calculate the reciprocal of the standard deviation of the historical daily rate of return data, and obtain the risk value V corresponding to at least two investment projects 1 ...V i , i is an integer ≥ 2.

[0087] The types of investment projects here include any possible investment projects in the financial industry such as stocks, bonds, and funds, which are not particularly limited in the embodiments of the present invention. In addition, the risk value corresponding to an investment project represents the d...

Embodiment 3

[0108] Figure 4 It is a schematic structural diagram of the investment data processing device provided by Embodiment 3 of the present invention, as Figure 4 As shown, the investment data processing device provided by the embodiment of the present invention includes a data acquisition module 31 , a statistical classification module 32 , a model calculation module 33 and a classification processing module 34 .

[0109] Wherein, the data obtaining module 31 is used for obtaining risk value data corresponding to at least two investment projects. Specifically, the data acquisition module 31 is configured to: acquire historical volatility data corresponding to at least two investment projects, and determine risk value data corresponding to at least two investment projects according to the historical volatility data. Further, the data acquisition module 31 includes an acquisition sub-module 311 and a calculation sub-module 312, the acquisition sub-module 311 acquires historical da...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com