Tax-related data layout file management system and method

A technology for formatted documents and management systems, applied in the field of data management, can solve the problems of difficult storage and access, repeated submission of data, and error-prone problems, so as to promote faster and better development, establish a conservation-oriented society, reduce circulation and other problems. effect used

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

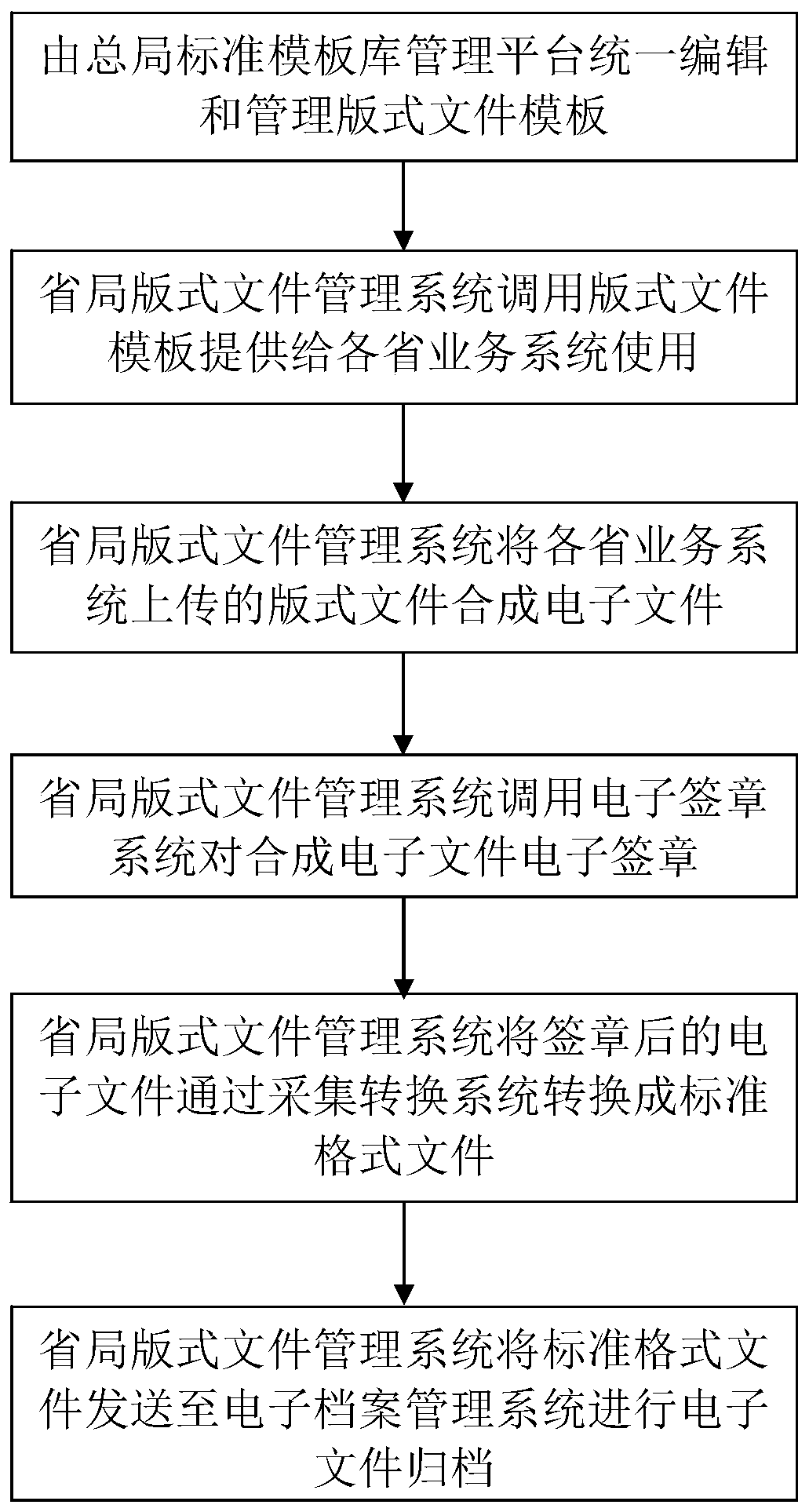

Method used

Image

Examples

Embodiment Construction

[0039] Preferred embodiments of the present disclosure will be described in more detail below with reference to the accompanying drawings. Although preferred embodiments of the present disclosure are shown in the drawings, it should be understood that the present disclosure may be embodied in various forms and should not be limited to the embodiments set forth herein. Rather, these embodiments are provided so that this disclosure will be thorough and complete, and will fully convey the scope of the disclosure to those skilled in the art.

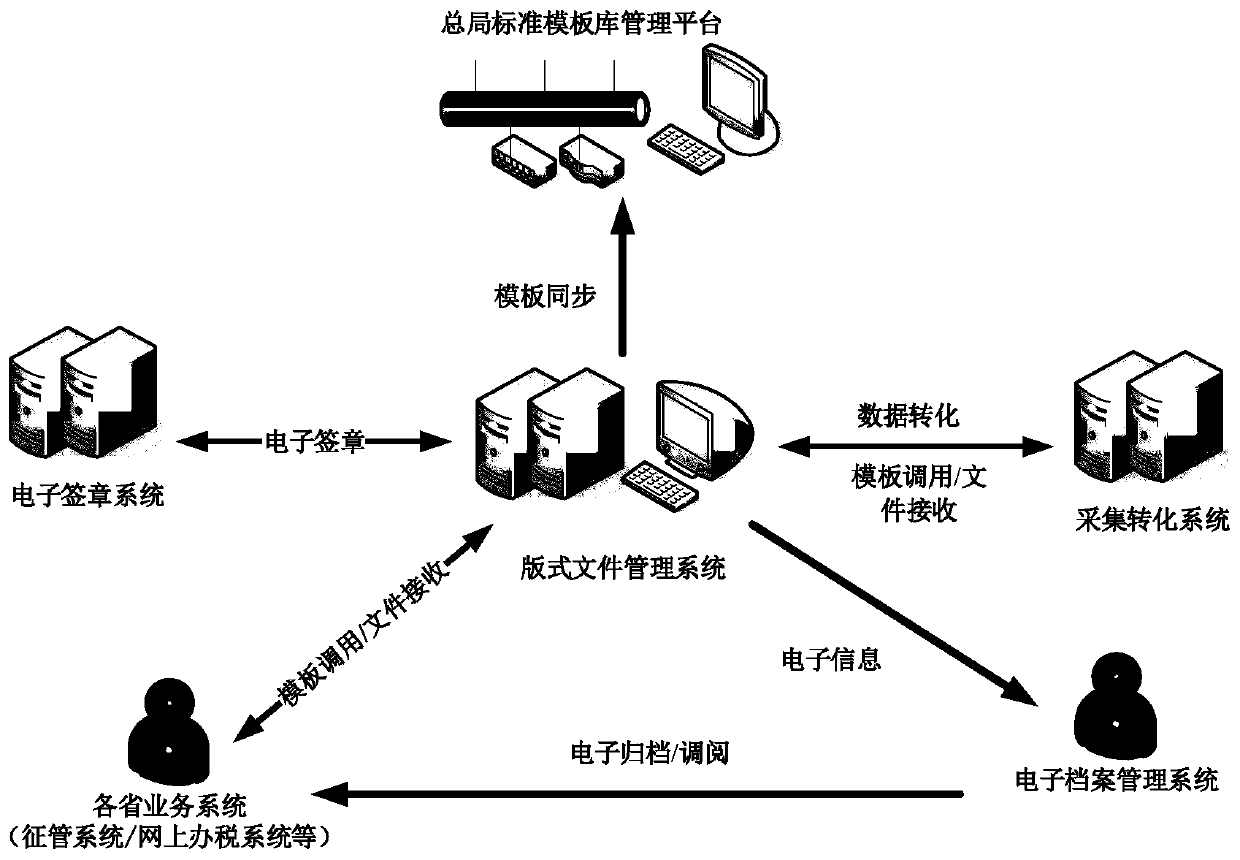

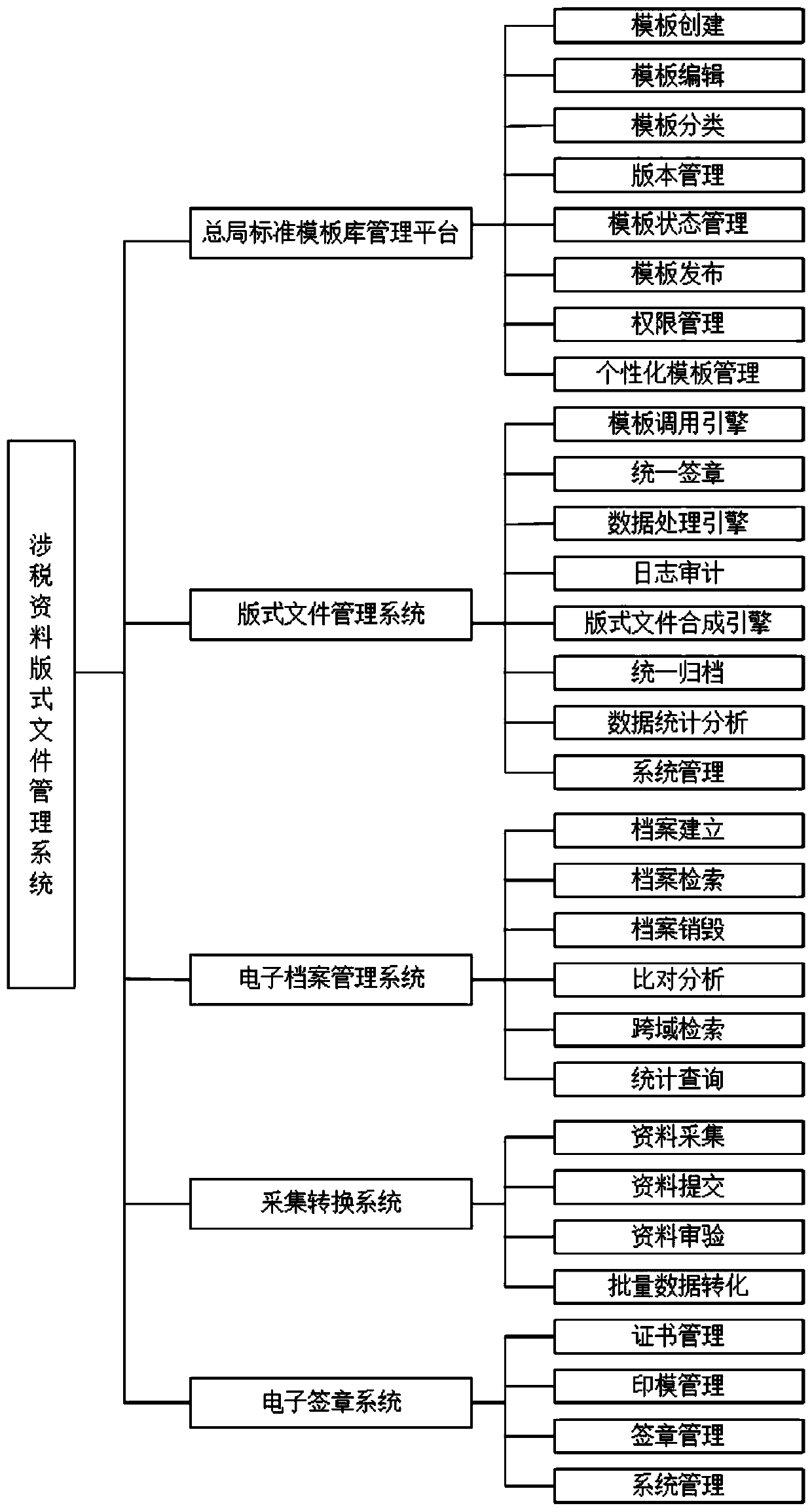

[0040] The present invention aims at the business requirements of format files of tax-related materials, and provides information support for more scientific archiving, convenient query, and in-depth analysis, so as to realize paperless tax-related business, digitization of electronic file information, and comprehensive archives and materials Efficiency in utilization, to achieve standardized collection and standardized circulation of data. ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com