Residential stock house tax basis price evaluation method and system based on GIS (Geographic Information System) grid data

A technology of price evaluation and grid data, which is applied in the field of real estate evaluation, can solve the problems of difficult data collection, high similarity requirements, and failure to meet the needs of real estate, so as to achieve visualization, eliminate unreliability, and improve intelligence and efficiency. Effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

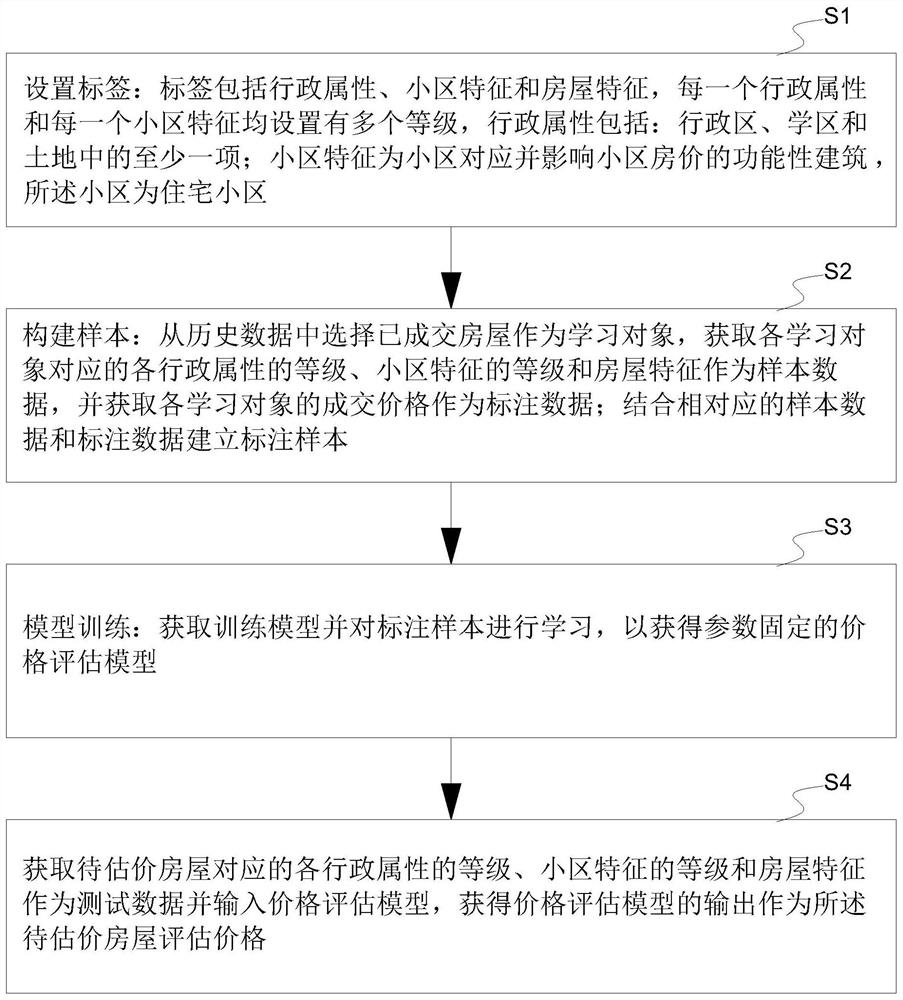

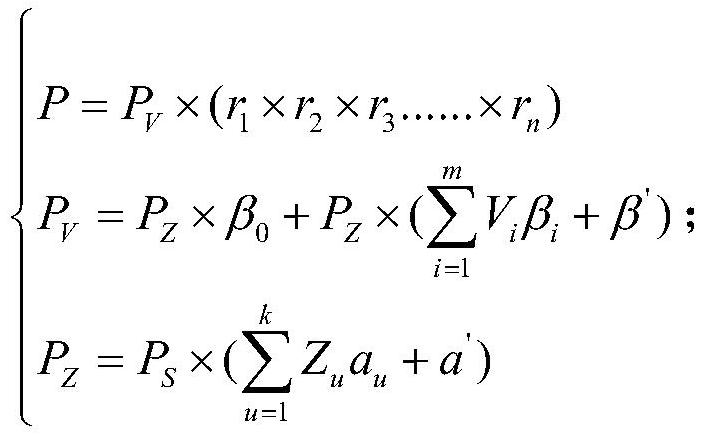

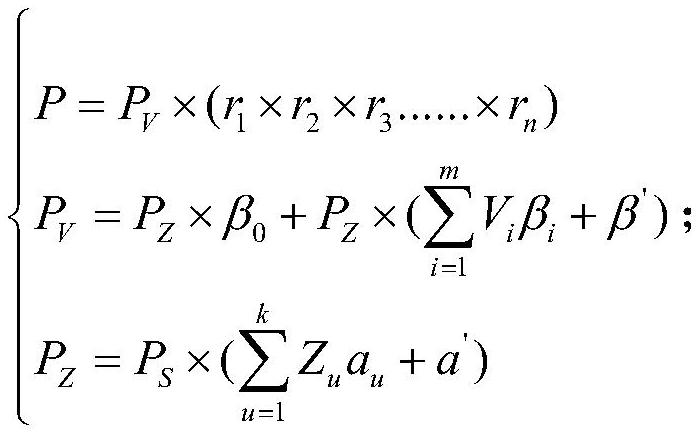

Method used

Image

Examples

Embodiment 1

[0056] In the residential housing inventory tax base price evaluation system based on GIS grid data proposed in this embodiment, the GIS map module is used to map the data in the GIS according to the administrative area boundary vector data, the land level area boundary vector data, and the school district boundary vector data, etc. The boundaries of administrative districts, land levels, and school districts are drawn on the map.

[0057] The GIS map module is also used to perform coordinate positioning on the GIS map of the acquired geographic location information of the cell. Combined with the existing technology, the operator only needs to mark the cell to the corresponding position in the GIS map according to the location of the cell, and the coordinate data is automatically generated.

[0058] The GIS map module is also used to mark on the GIS map the obtained community characteristics that affect the price of stock houses. For specific implementation, the characteristi...

Embodiment 2

[0062] In this embodiment, the administrative attributes include: administrative area, land and school district. In this embodiment, the GIS map module is used to mark each administrative attribute on the GIS map, as shown in Table 1 to Table 4 specifically.

[0063] Table 1: Data annotation format of administrative regions divided into districts and counties:

[0064] Numbering province city District / County boundary line coordinates

[0065] Table 2: Data label format divided into counties, districts and streets:

[0066] Numbering province city street / town street grade boundary line coordinates

[0067] Table 3: Data annotation format of land:

[0068] Numbering province city District / County land class name land level boundary line coordinates

[0069] Table 4: Data annotation format for school districts:

[0070]

[0071] The boundary line coordinates...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com