Except valuation method, device, equipment, medium and product

A valuation and option technology, applied in the field of financial data analysis, can solve problems such as the large deviation of interest rate data, the need to optimize the financial data processing process, and the single calculation mode, so as to achieve the effect of accurate valuation results.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

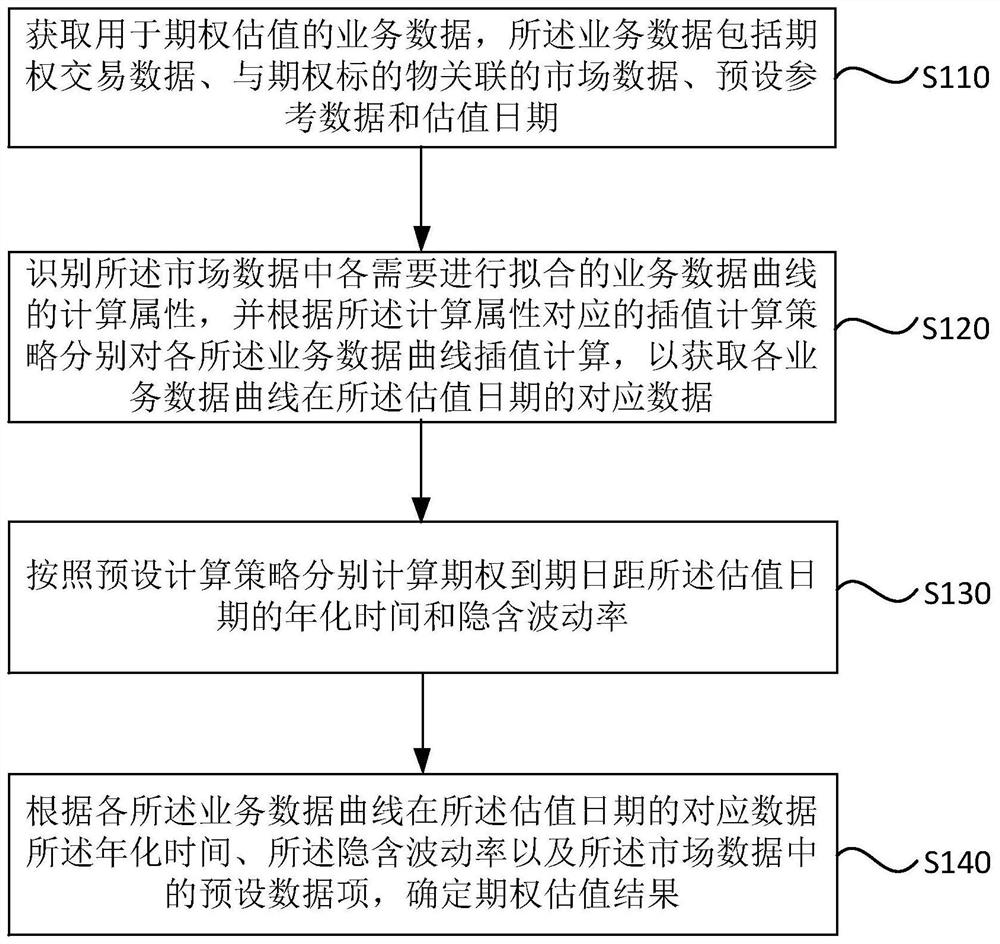

[0028] figure 1 This is a flowchart of an option valuation method provided in Embodiment 1 of the present invention, and this embodiment can be applied to a scenario of option valuation based on financial market data and transaction data. The method may be executed by an option valuation apparatus, which may be implemented in software and / or hardware, and integrated into a computer device with an application development function.

[0029] like figure 1 As shown, options valuation methods include the following:

[0030] S110. Acquire business data for option valuation, where the business data includes option transaction data, market data associated with the option subject matter, preset reference data, and valuation date.

[0031] Among them, the business data is the data obtained from the trading platform or the financial business platform, and is the data related to the option business. Specifically, it includes transaction data, market data, reference data and valuation i...

Embodiment 2

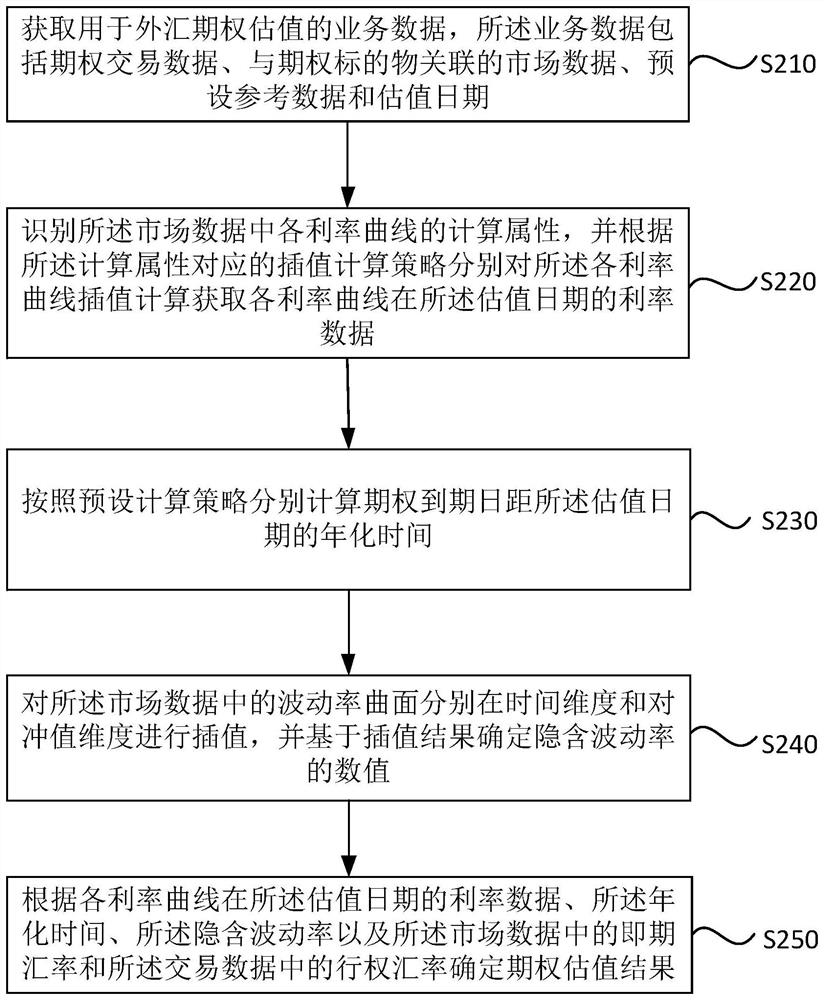

[0049] figure 2 This is a flowchart of an option valuation method provided in Embodiment 2 of the present invention. The technical solution provided by this embodiment and the option valuation method provided by the above-mentioned embodiments belong to the same inventive concept, and are further described in the option subject matter. For the option valuation process in foreign exchange, and optimize the calculation scheme of implied volatility. The method may be executed by an option valuation apparatus, which may be implemented in software and / or hardware, and integrated into a computer device with an application development function.

[0050] like figure 2 As shown, the option valuation method includes the following steps:

[0051] S210. Acquire business data for foreign exchange option valuation, where the business data includes option transaction data, market data associated with the option subject matter, preset reference data, and valuation date.

[0052] Among th...

Embodiment 3

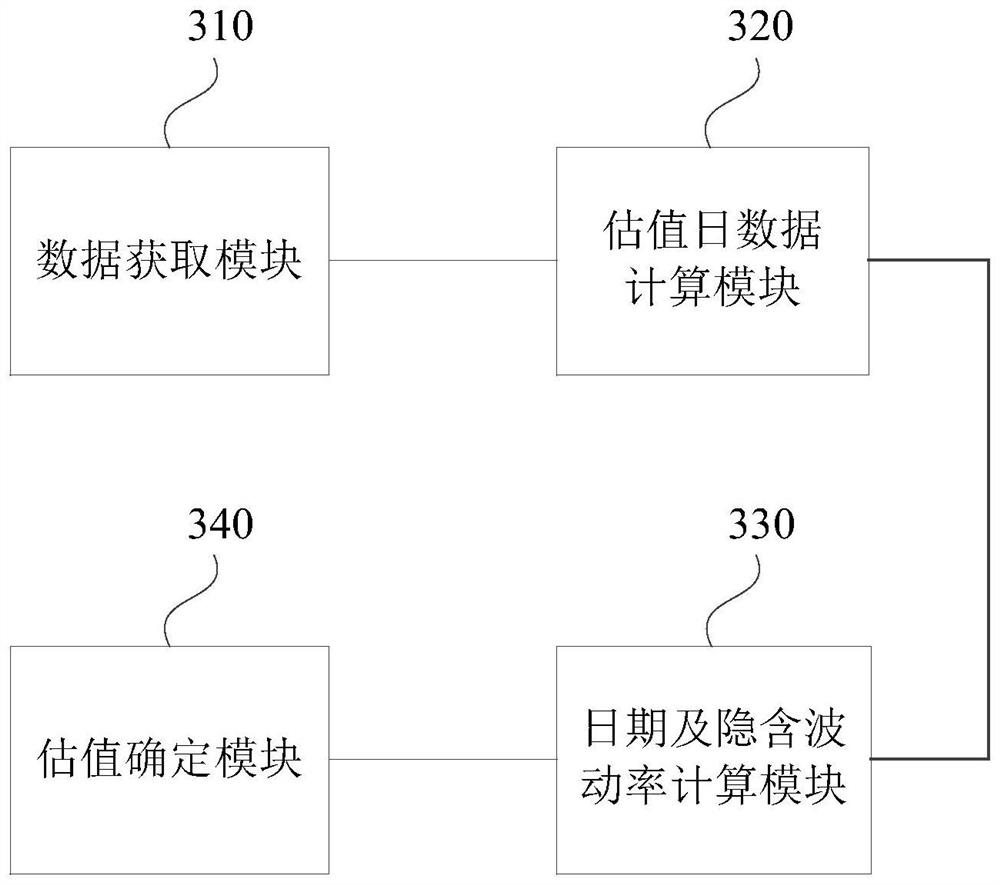

[0071] image 3This is a schematic structural diagram of the option valuation device provided in the third embodiment of the present invention. This embodiment is applicable to the scenario of option valuation based on financial market data and transaction data. The device can be implemented by software and / or hardware. Integrate into computer equipment with application development function.

[0072] like image 3 As shown, the option valuation device includes: a data acquisition module 310 , a valuation day data calculation module 320 , a date and implied volatility calculation module 330 and a valuation determination module 340 .

[0073] The data acquisition module 310 is used for acquiring business data for option valuation, the business data includes option transaction data, market data associated with the option subject matter, preset reference data and valuation date; valuation date data The calculation module 320 is configured to identify the calculation attribute of...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com