Actuarial insurance method based on big data

A big data and actuarial technology, applied in the field of insurance analysis, can solve the problems of user calculation, inaccurate actuarial results, increase the risk of insurance companies, etc., to achieve the effect of improving accuracy, reducing risk, and improving profitability

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

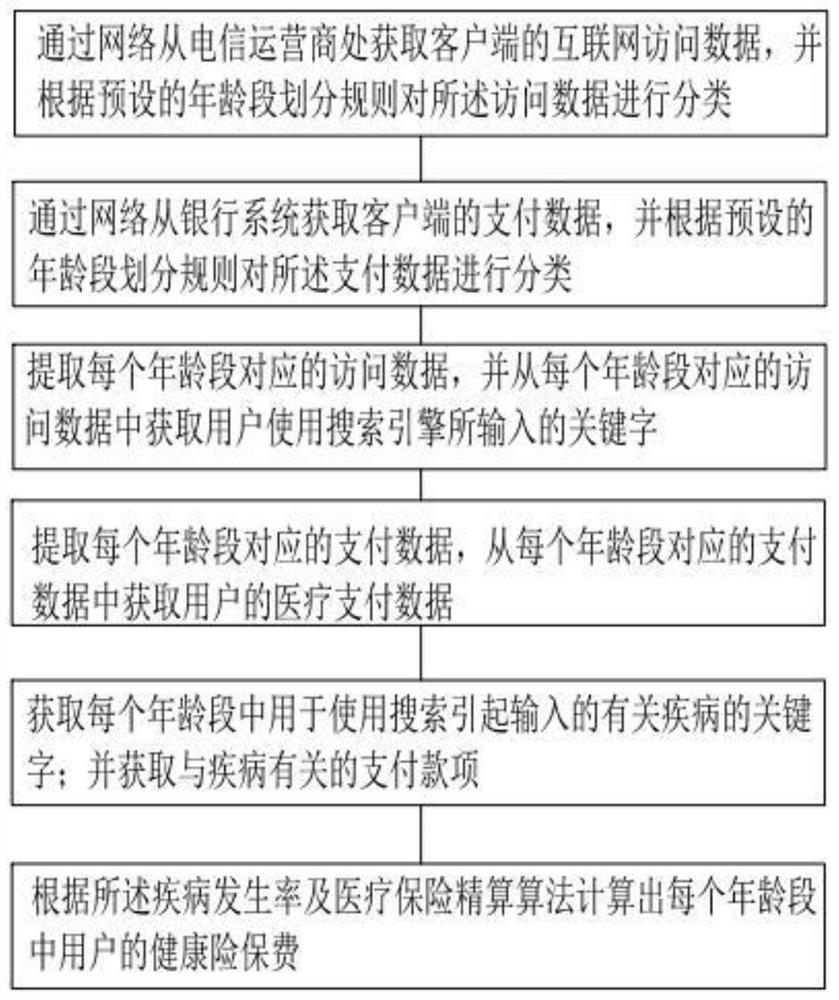

[0028] Such as figure 1 As shown, the embodiment of the present invention discloses a big data-based insurance actuarial method, the method runs in the data processing center, including the following steps:

[0029] Obtain the Internet access data of the client from the telecom operator through the network, and classify the access data according to the preset age division rules,

[0030] Obtain the payment data of the client from the banking system through the network, and classify the payment data according to the preset age division rules;

[0031] Extract the access data corresponding to each age group, and obtain the keywords entered by the user using the search engine from the access data corresponding to each age group;

[0032] Extract the payment data corresponding to each age group, and obtain the user's medical payment data from the payment data corresponding to each age group;

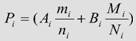

[0033] Analyze the keywords entered by the client using the search engine in each age ...

Embodiment 2

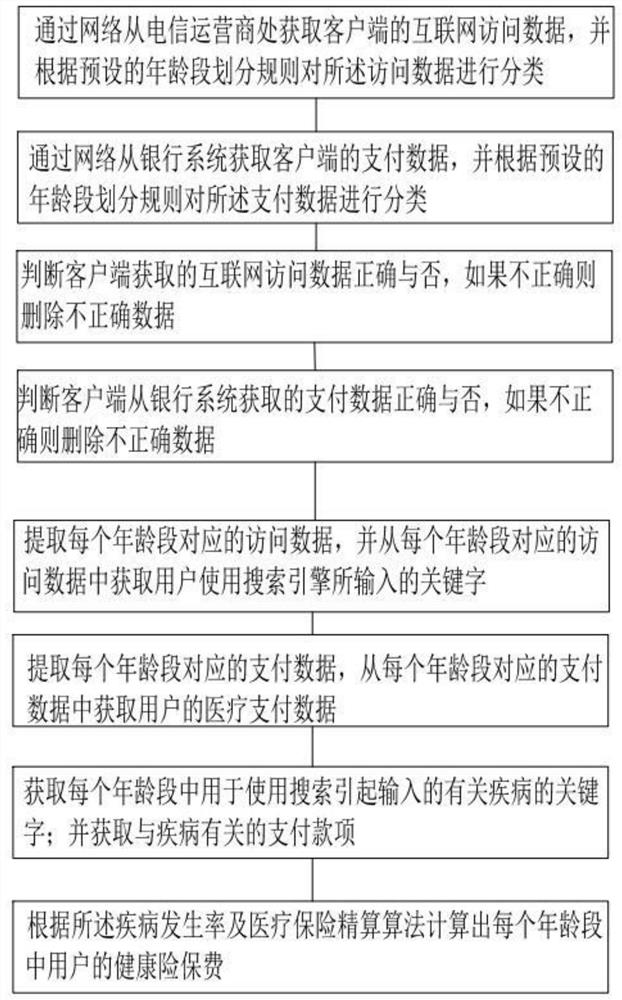

[0043] Such as figure 1 As shown, the embodiment of the present invention discloses a method for actuarial calculation based on big data, and the method runs in a data processing center, including the following steps:

[0044] Obtain the Internet access data of the client from the telecom operator through the network, and classify the access data according to the preset age division rules,

[0045] Obtain the payment data of the client from the banking system through the network, and classify the payment data according to the preset age division rules;

[0046] Determine whether the Internet access data obtained by the client is correct or not, and delete the incorrect data if it is incorrect;

[0047] Determine whether the payment data obtained by the client from the banking system is correct or not, and delete the incorrect data if it is incorrect.

[0048] Extract the access data corresponding to each age group, and obtain the keywords entered by the user using the search...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com