Method, device and equipment for predicting credit default probability of small and micro enterprises, and storage medium

A probabilistic prediction and enterprise technology, applied in the computer field, can solve problems such as data scarcity, insufficient accumulation of historical information, incompleteness, etc., and achieve the effect of improving the effect and risk identification ability

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0048] It should be understood that the specific embodiments described here are only used to explain the present invention, not to limit the present invention.

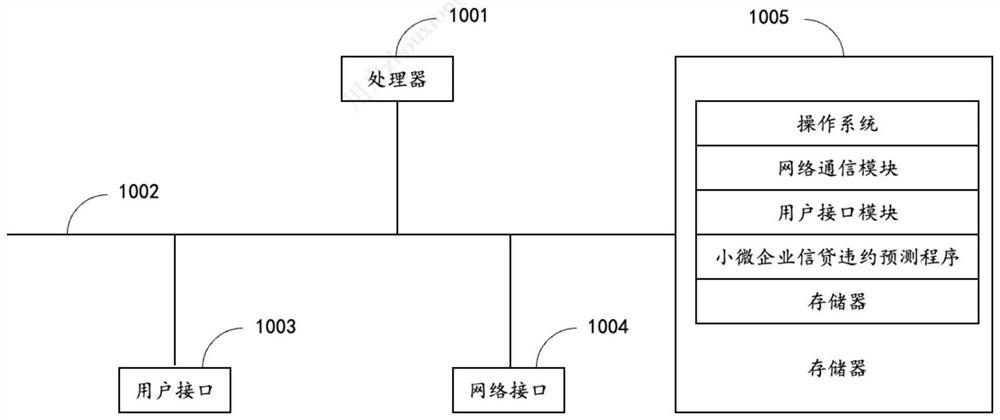

[0049] refer to figure 1 , figure 1 It is a schematic structural diagram of a small and micro enterprise credit default probability prediction device for the hardware operating environment involved in the solution of the embodiment of the present invention.

[0050] Such as figure 1 As shown, the small and micro enterprise credit default probability prediction device may include: a processor 1001, such as a central processing unit (Central Processing Unit, CPU), a communication bus 1002, a user interface 1003, a network interface 1004, and a memory 1005. Wherein, the communication bus 1002 is used to realize connection and communication between these components. The user interface 1003 may include a display screen (Display) and an input unit such as a button, and the optional user interface 1003 may also include a ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com