Credit risk assessment method and device, electronic equipment and storage medium

A risk assessment and credit assessment technology, applied in the field of financial technology, which can solve the problems of unlisted companies’ forecast limitations, company default rate analysis limitations, and actual market discrepancies, so as to achieve more objective and reliable credit assessment results and reduce non-performing loans.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

[0041] According to an embodiment of the present invention, an embodiment of a credit risk assessment method is provided. It should be noted that the steps shown in the flowchart of the accompanying drawings may be executed in a computer system such as a set of computer-executable instructions, and although A logical order is shown in the flowcharts, but in some cases steps shown or described may be performed in an order different from that herein.

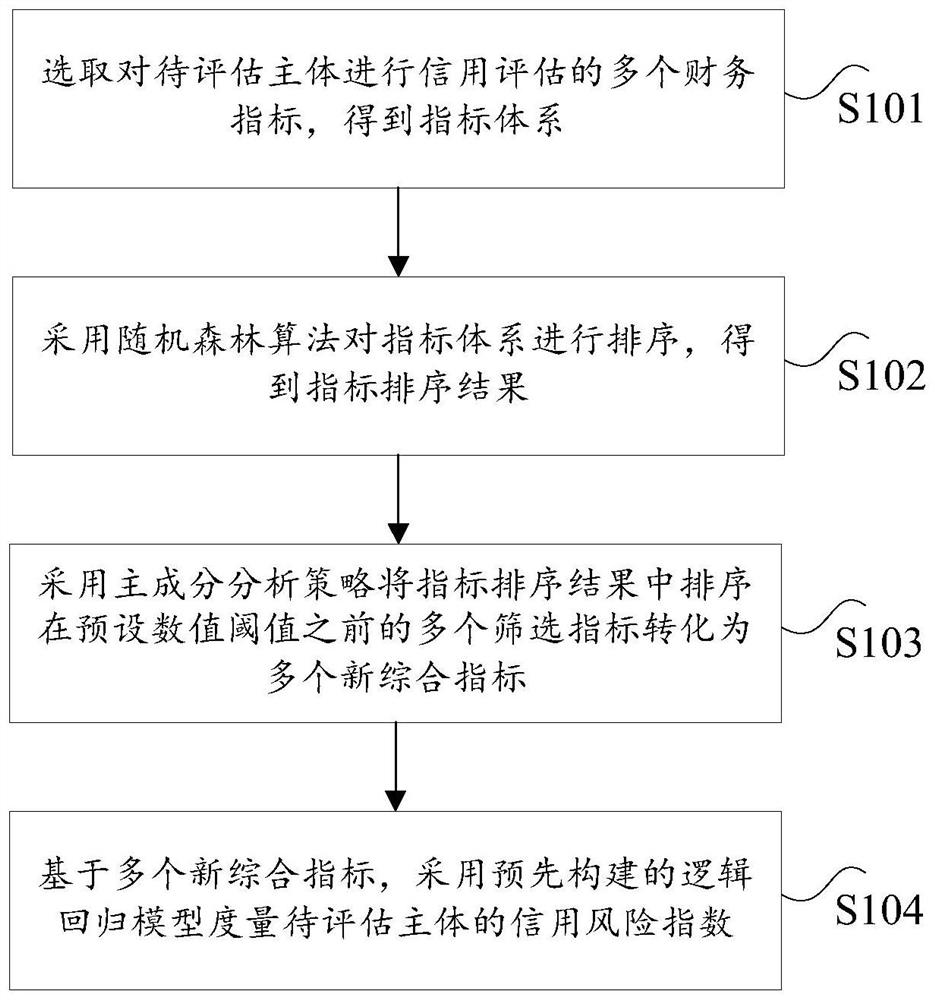

[0042] figure 1 is a flowchart of an optional credit risk assessment method according to an embodiment of the present invention, such as figure 1 As shown, the method includes the following steps:

[0043] Step S101, select a plurality of financial indicators for credit evaluation of the subject to be evaluated, and obtain an indicator system;

[0044] Step S102, using the random forest algorithm to sort the index system to obtain the index sorting result;

[0045] Step S103, adopting a principal component analysis strategy to ...

Embodiment 2

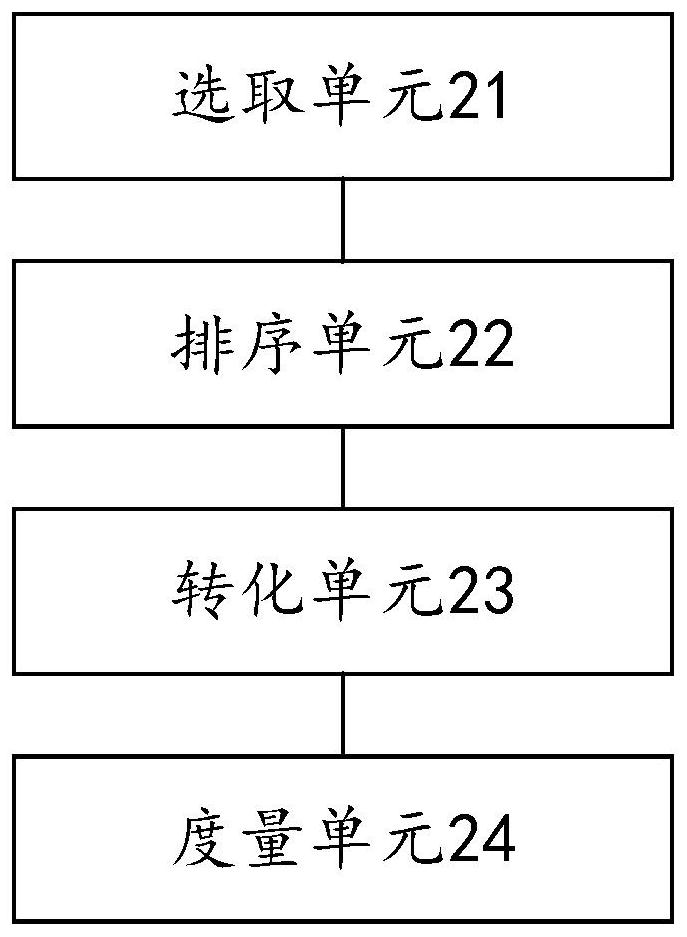

[0117] This embodiment provides a credit risk assessment device, and the multiple implementation units involved in the assessment device correspond to each implementation step in the above-mentioned first embodiment.

[0118] figure 2 is a schematic diagram of an optional credit risk assessment device according to an embodiment of the present invention, such as figure 2 As shown, the evaluation device may include: a selection unit 21, a sorting unit 22, a conversion unit 23, and a measurement unit 24, wherein,

[0119] The selection unit 21 is used for selecting a plurality of financial indicators for credit evaluation of the subject to be evaluated, and obtaining an indicator system;

[0120] The sorting unit 22 is configured to use the random forest algorithm to sort the index system to obtain the index sorting result;

[0121] The transformation unit 23 is used for adopting the principal component analysis strategy to convert the multiple screening indices sorted before...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com