Method and system for providing insurance protection against loss of retirement accumulations in a tax favored defined contribution plan in the event of a participant's disability

a defined contribution and retirement accumulation technology, applied in the field of employee benefits, can solve the problems of direct loss of retirement income to the employee, reducing the value of the employee's account, and not adequately addressing the needs of disabled employees, and achieve the effect of replacing lost contributions

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

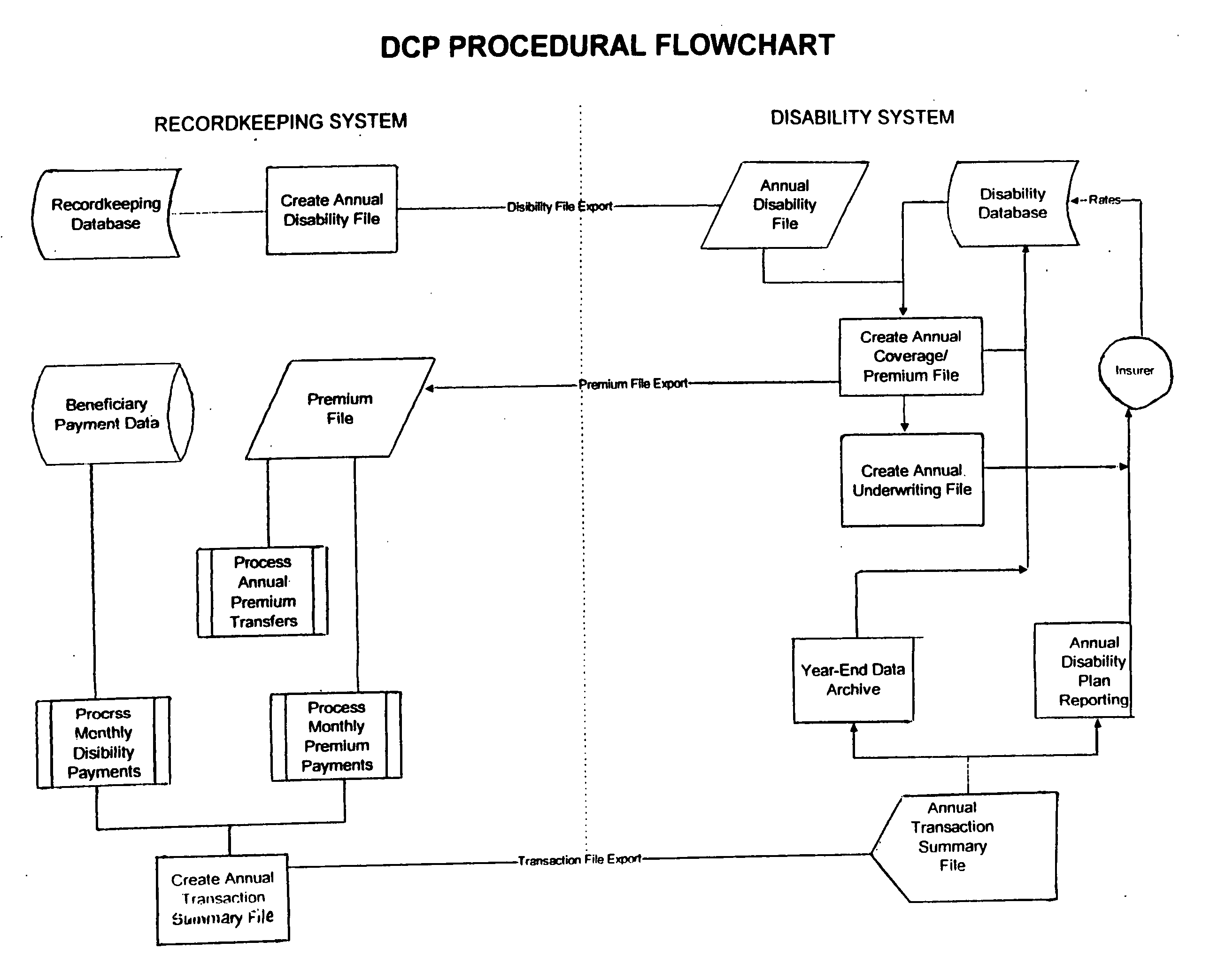

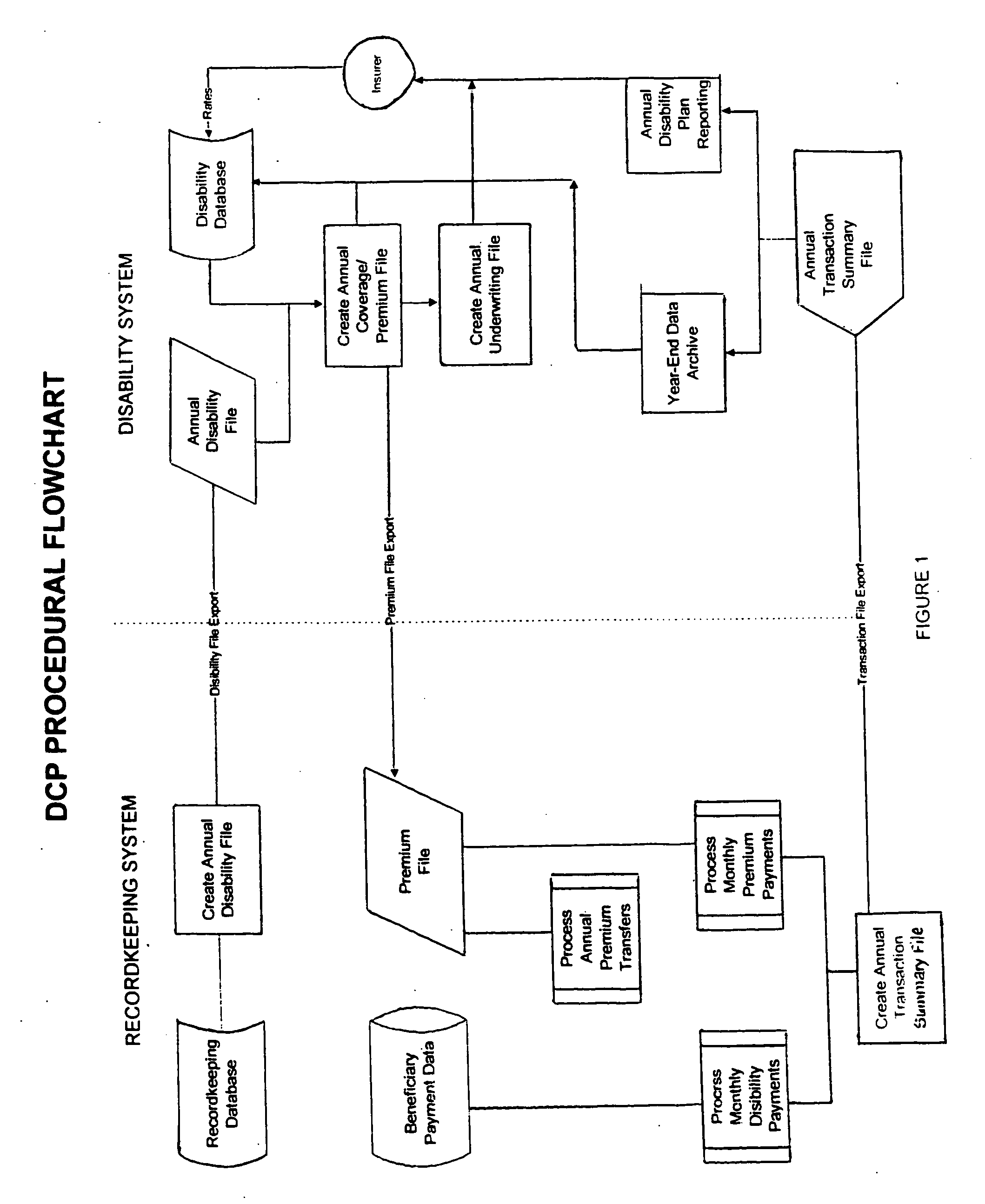

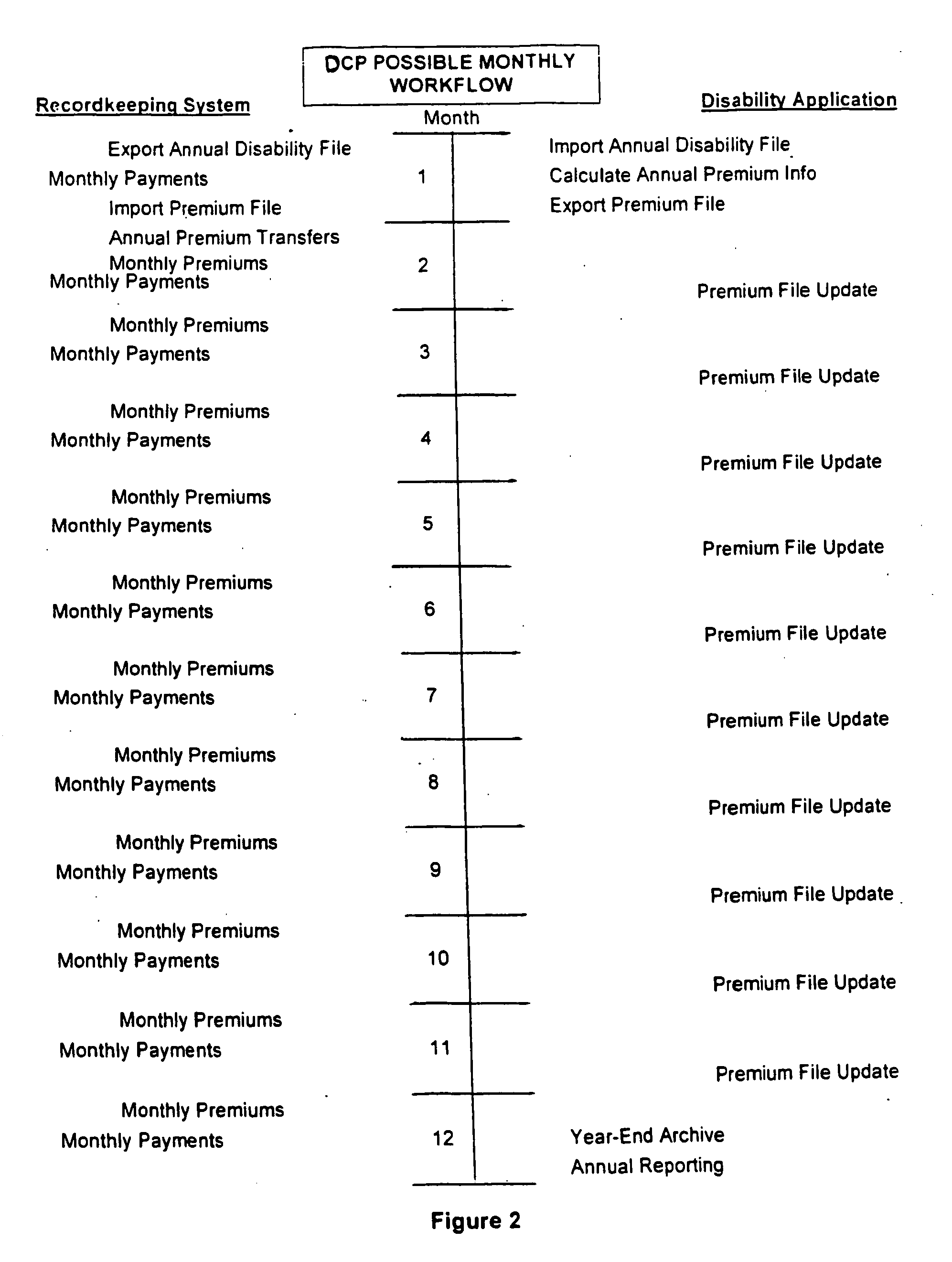

Method used

Image

Examples

example

[0078] An employer who has a 401(k) plan with a calendar plan year amends the plan on Nov. 30, 1998 to include disability insurance covering employee deferrals and the employer matching contributions for 1998. In addition, the employer chooses to make a special matching contribution to the plan to pay the premium. Therefore, the insureds are employees who had employee deferrals and employer matching contributions made to the 401(k) plan on their behalf for the 1998 plan year. The amount of coverage is equal to the amount of employee deferral and employer matching contributions for 1998 (excluding the special “premium” match), and the premium contribution is deposited to the plan as a 1998 contribution. The insurance is tested for non-discrimination with regard to the “benefits, rights, and features” test for 1998, and the special matching contribution is tested under IRC Section 401(m) for 1998. The effective date of the insurance would be Jan. 1, 1999 and the policy would provide i...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com