Method and system for automated transaction compliance processing

a technology of automated transaction and compliance, applied in the field of automated transaction compliance, can solve the problems of time-consuming process of examining and responding to transaction requests, inability to complete transaction checks, delay of employees, etc., and achieve the effect of quick resolution of compliance issues, more control over how and when investment decisions are made, and faster personal transaction processing

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

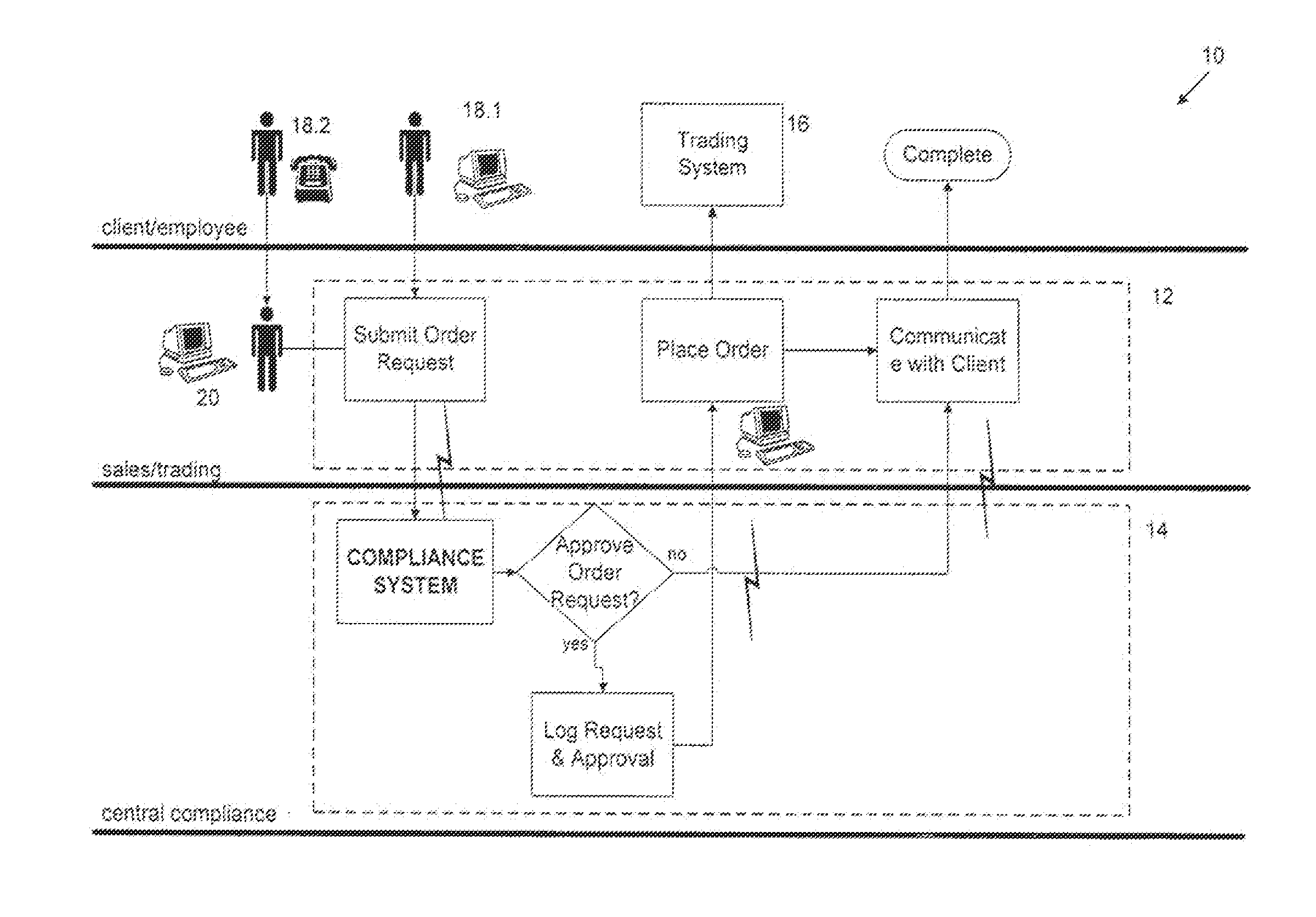

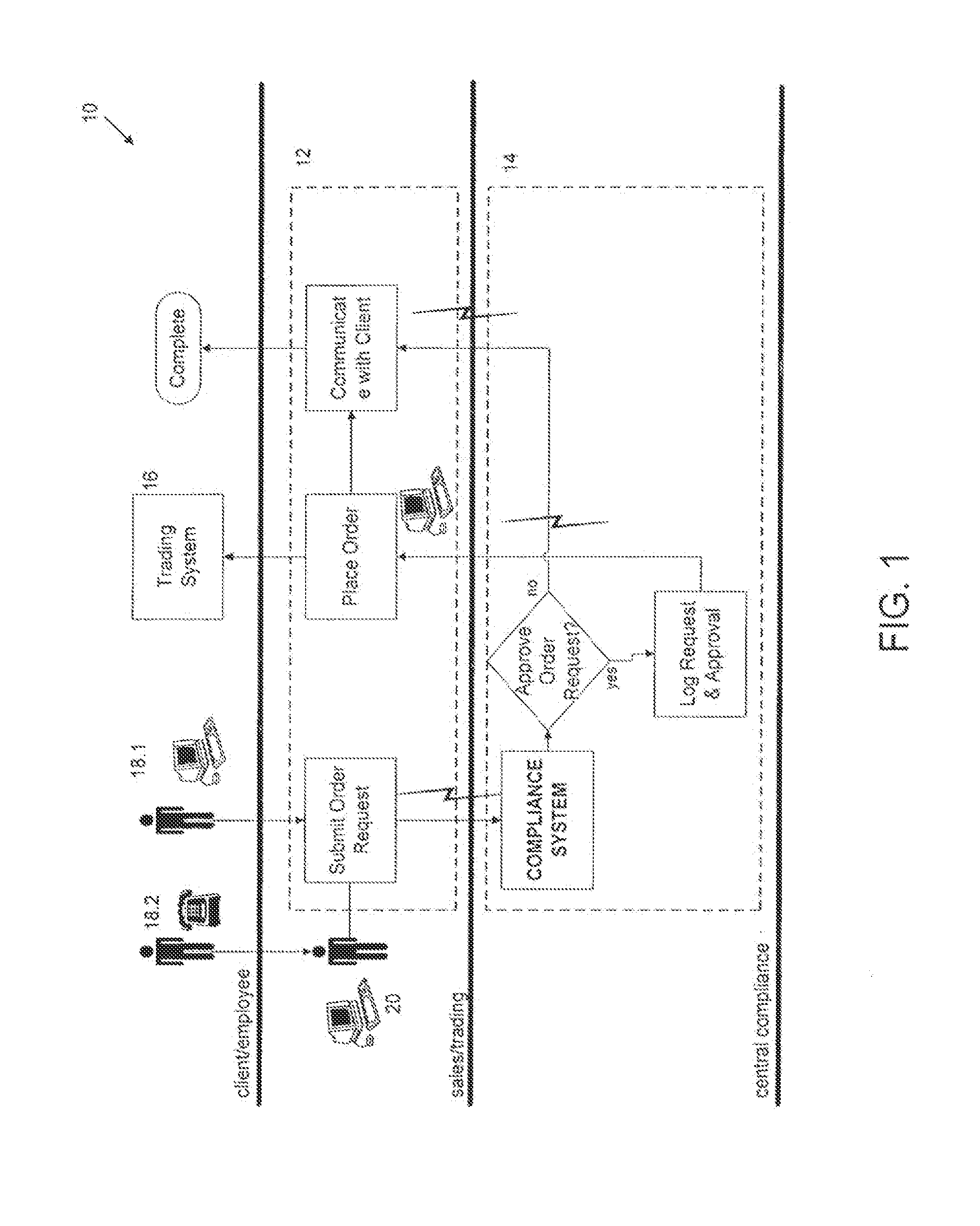

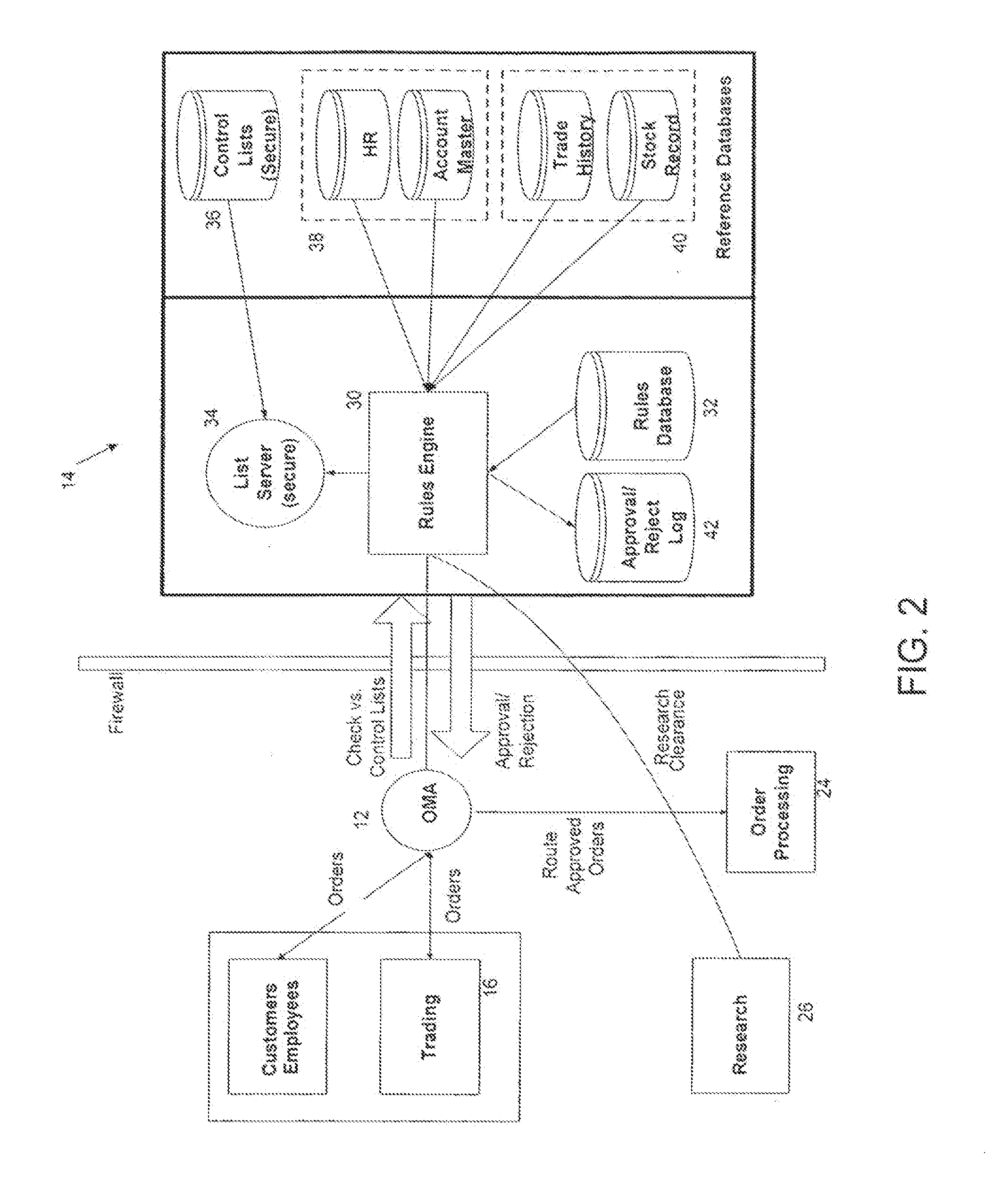

[0024]FIG. 1 is a high level illustration of an automated order approval system 10 further showing relevant data flow. The system 10 is comprised of an OMA module 12 and a compliance system 14 and is connected to a trading system 16. An employee, client, or other party uses a network access device, such as a computer 18.1, to submit a transaction request for a given account. Alternative mechanisms can be provided for submitting transaction requests, such as a telephonic interface 18.2 to an automated or manned input system 20, and the particular form of the input is not critical.

[0025]To standardize input, preferably a transaction request form is provided. This form can be in HTML, spreadsheet format, word processor format, or other desirable formats to simplify information transfer. The information provided with typically include the party's name, account number, the identity of the security at issue, and other information related to the transaction and which may be necessary to co...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com