Systems and Methods for Portfolio Analysis

a portfolio and portfolio technology, applied in the field of portfolio tail risk measurement, can solve the problems of large losses, poor market return description of distribution, and inability to accurately predict the return of the market,

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

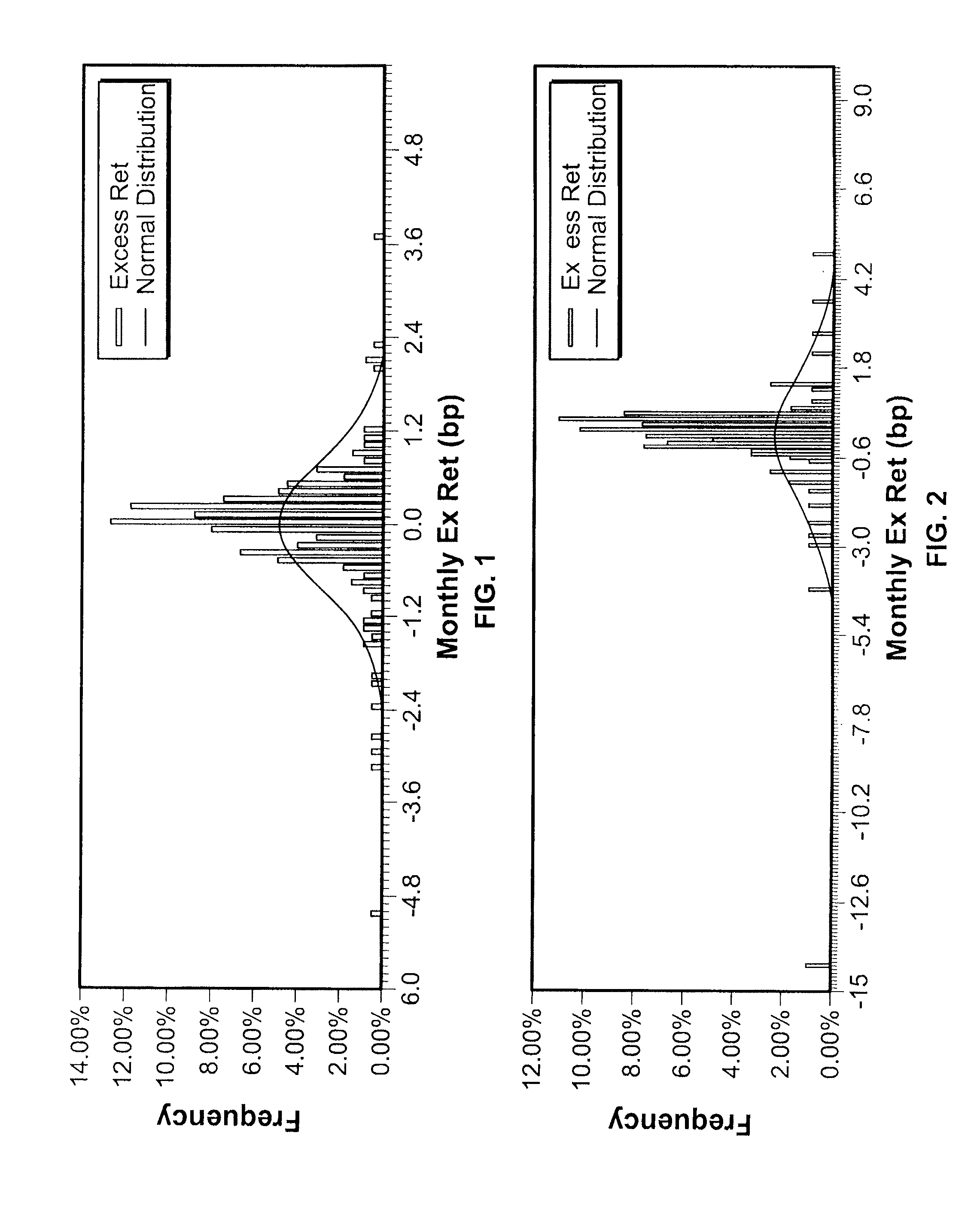

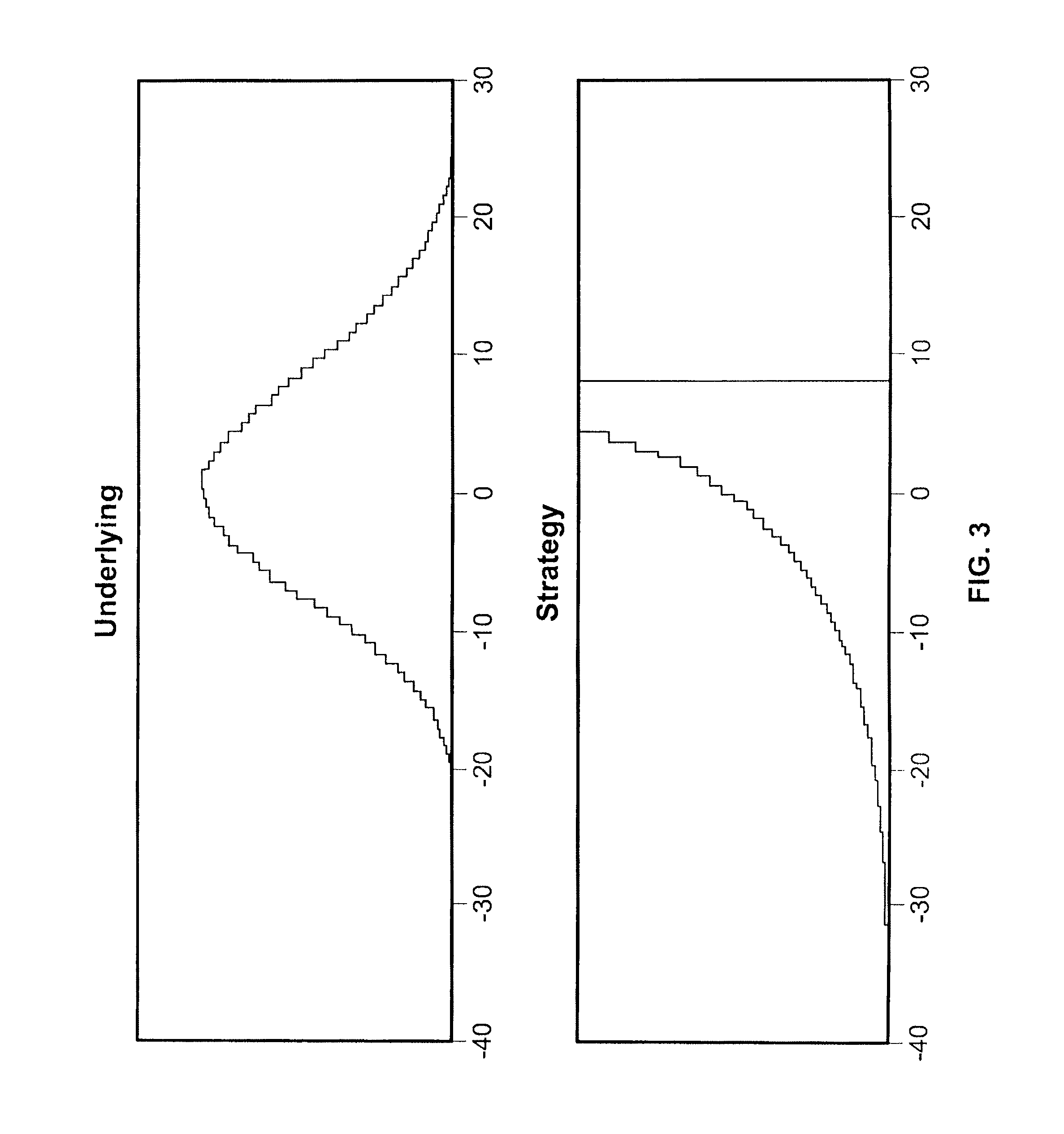

[0073]As mentioned above, Part 1 of this description illustrates the Tail risk Model's reports for several portfolios, first for a portfolio benchmarked against the Lehman Brothers Global Aggregate Index. We then discuss the tail risk report for the U.S. High Yield Index against a cash benchmark. Our final example is a highly skewed, highly non-normal negatively convex portfolio, which allows us to highlight the flexibility of our Tail Risk Model.

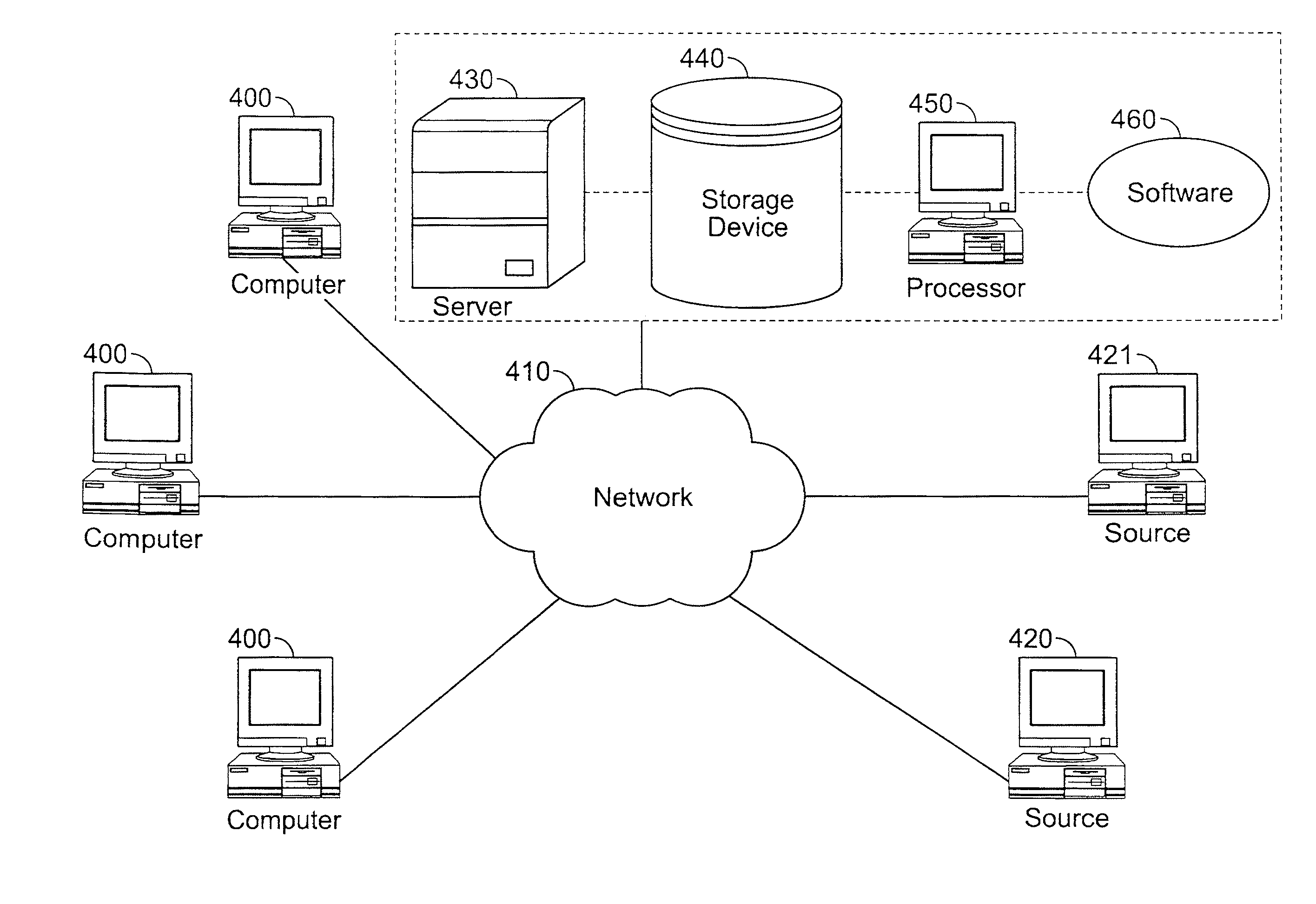

[0074]Part II discusses embodiments based on our tail risk models. In order to obtain the distribution of a portfolio's return (or P&L), four steps are preferably performed: identification of risk factors; pricing the securities at the investment horizon; producing a portfolio return distribution by aggregating the securities' distribution; and summarizing the wealth of information contained in the return (or P&L) distribution by means of a few significant statistics. We describe each step in detail.

[0075]Part I: Portfolio Applications

[0076...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com