System for analyzing enterprise credit risk and application method thereof

A risk analysis and credit technology, applied in the field of enterprise credit risk analysis system, can solve problems such as low work efficiency and poor analysis quality, and achieve the effect of high work efficiency, improved accuracy and good analysis quality

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0023] The present invention will be described in further detail below in conjunction with the description of the drawings and specific embodiments.

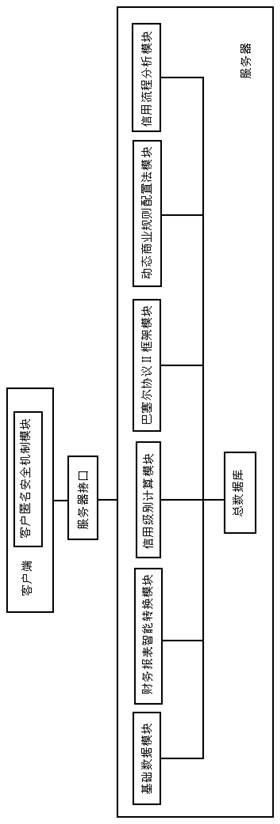

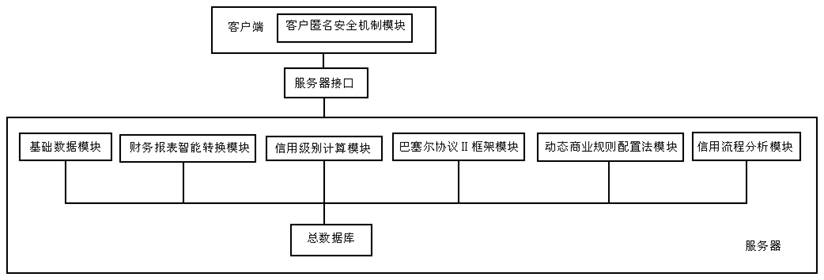

[0024] see figure 1 , an enterprise credit risk analysis system, which is special in that: the enterprise credit risk analysis system includes a client, a server and a total database, the client is connected with the server through a server interface, and the client is provided with There is a customer anonymous security mechanism module, and the server includes a basic data module, an intelligent conversion module for financial statements, a credit level calculation module, a Basel Agreement II framework module, a dynamic business rules configuration method module, a credit process analysis module and a general database, and the total is The database is connected with the basic data module, the financial statement intelligent conversion module, the credit level calculation module, the Basel Agreement II framework module, the dy...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com