Stock market investment decision-making method based on network analysis and multi-model fusion

A technology of network analysis and decision-making method, applied in the field of stock market investment decision-making based on network analysis and multi-model fusion, can solve problems such as negative returns, high investment risks, and limited information utilization

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0148] The present invention will be further described in detail below in conjunction with specific embodiments, which are explanations of the present invention rather than limitations.

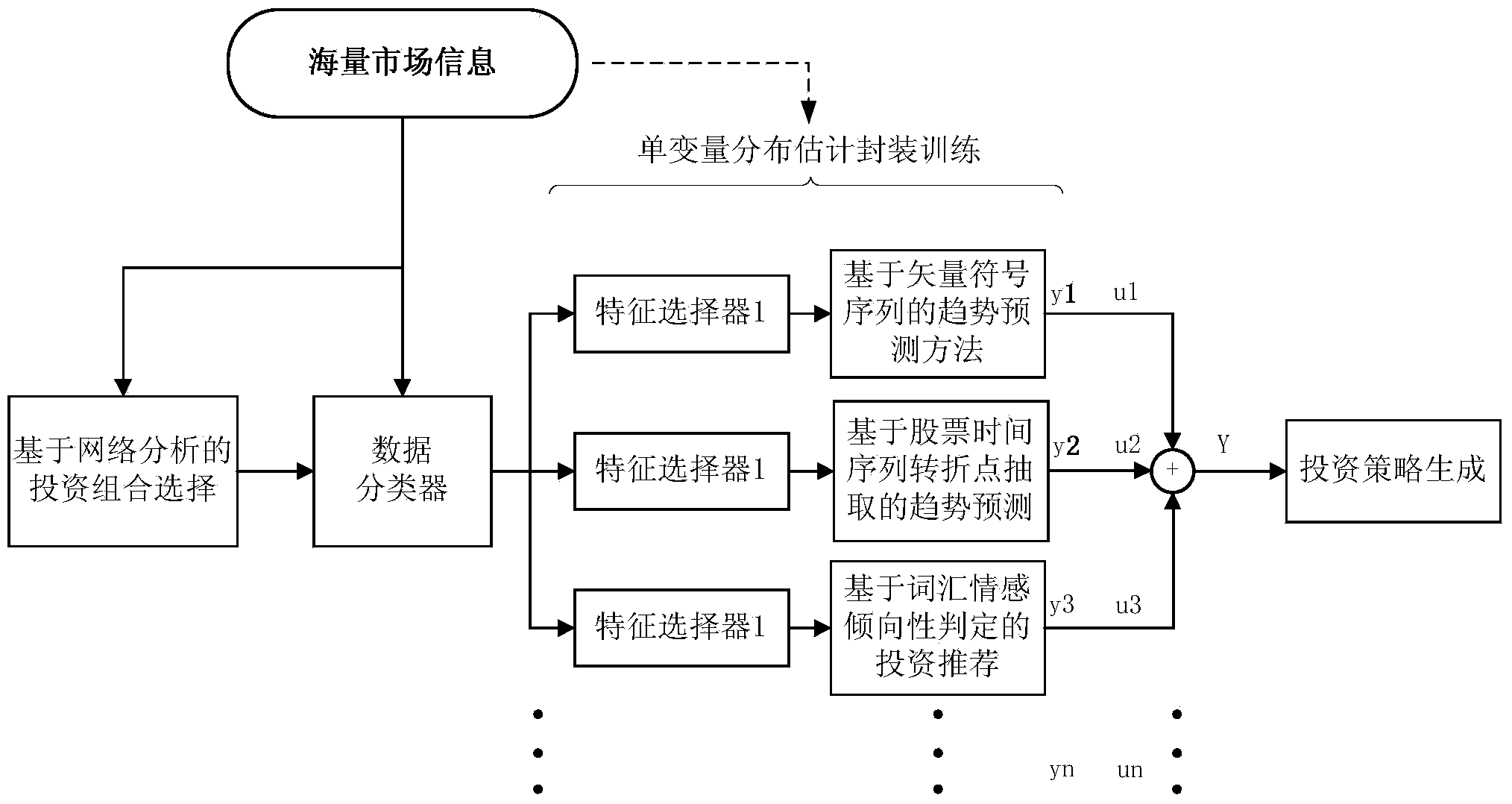

[0149] see figure 1 , first capture fundamental information from the network, build network nodes and network connections on this basis, and form a complex social network model; use network analysis methods to select investment portfolios, and then input the data involved in the investment portfolios into the multi-model fusion in the frame;

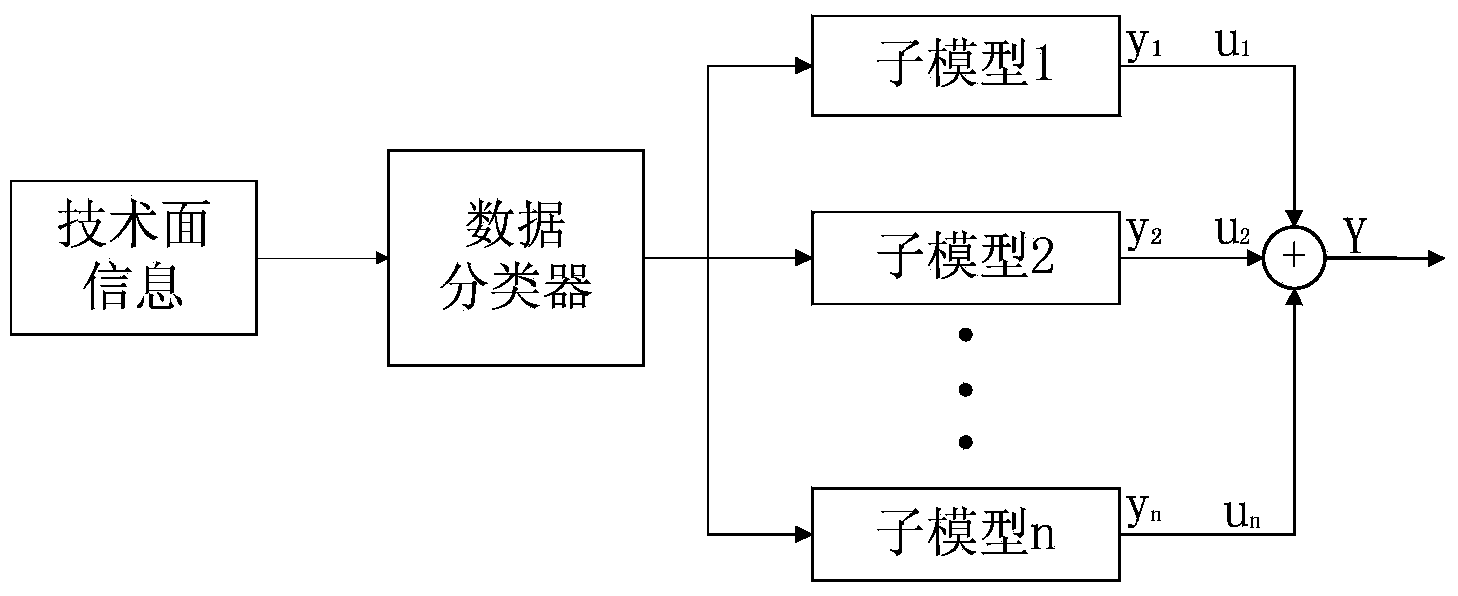

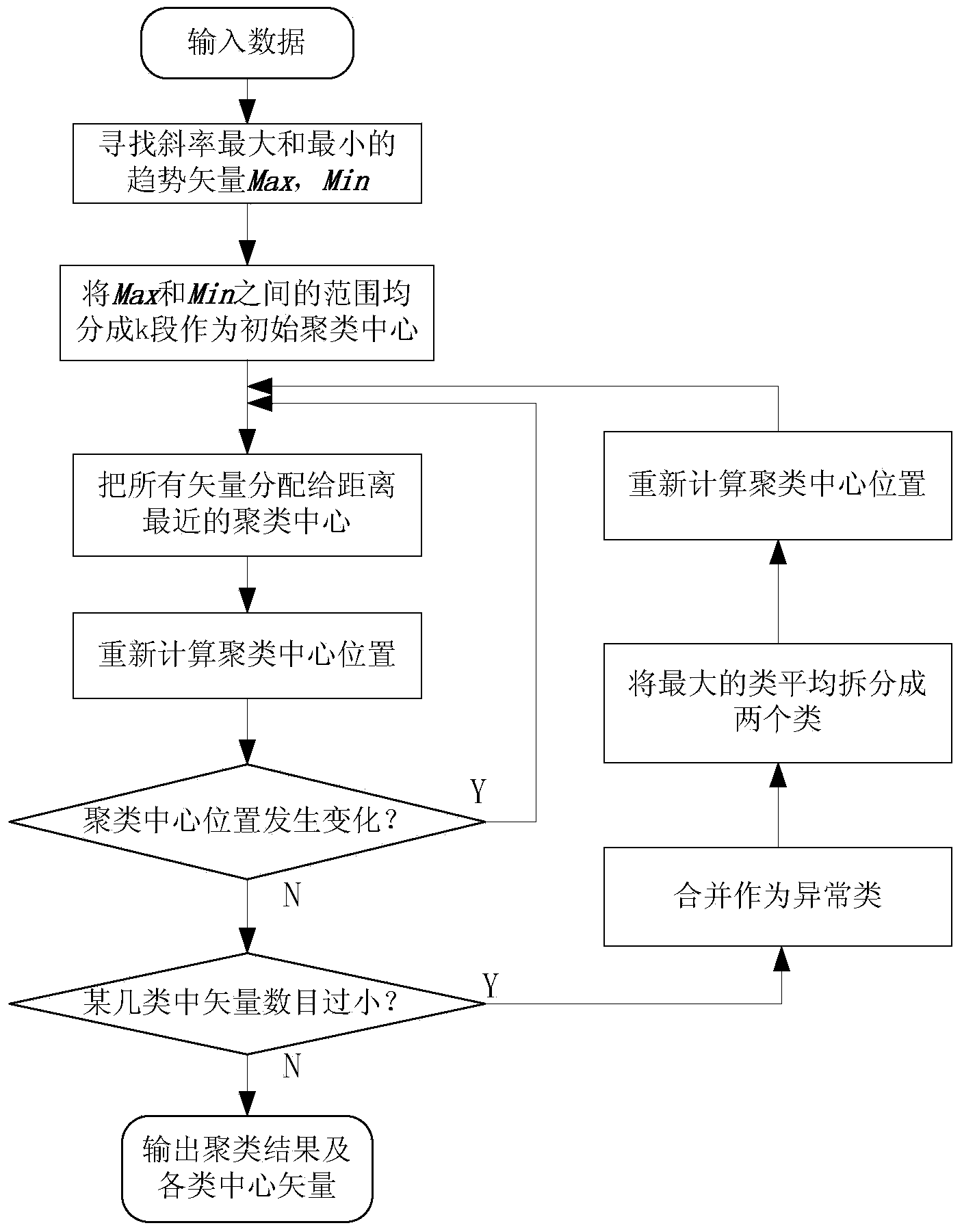

[0150] The multi-model fusion framework includes a plurality of sub-models, and each sub-model predicts market trends with different characteristics according to the technical information of different characteristics captured from the network, generates respective prediction values, and then weights the prediction values to obtain And, get the comprehensive market trend prediction value, and generate the corresponding investment strategy according to...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com