Self-service tax registration method based on Ali cloud

A technology of tax registration and Alibaba Cloud, which is applied in the fields of instruments, finance, and data processing applications. It can solve problems such as incomplete preparation of materials, waste of social resources, and space constraints, and achieve the effects of simplifying processes, saving social resources, and easy operation.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment

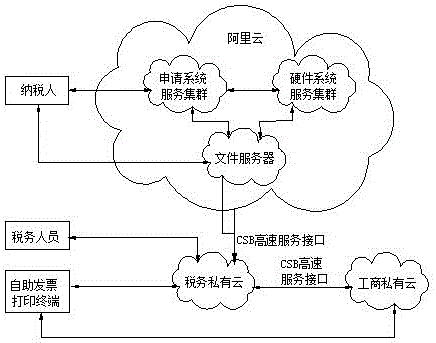

[0013] A self-service tax registration method based on Alibaba Cloud described in this embodiment uses a self-service tax registration system to integrate industrial and commercial system data, relevant data and verification rules in the tax system, and adopts the development model of Alibaba Cloud. The application of data cloud computing is extended to the taxation and industrial and commercial industries; taxpayers apply for tax registration through the external network, and after the industrial and commercial and taxation departments pass the internal network review, taxpayers can print tax registration certificates and related documents at a self-service tax terminal; thus Realize the effect that taxpayers can apply once, government officials can review it once, and taxpayers can complete the application once on-site evidence collection.

[0014] as attached figure 1 As shown, the self-service tax registration system includes application system service clusters, hardware s...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com