Supervised machine learning-based security financing account identification method

A technology of machine learning and identification methods, which is applied in the field of securities fund account identification, can solve the problems of lack of unified standards for screening and marking, legacy of screening work, lack of integration methods, etc., to reduce the workload of manual investigation and evidence collection, and reduce manpower The effect of investment and fast calculation speed

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0022] The present invention will be further described below in conjunction with the accompanying drawings and embodiments.

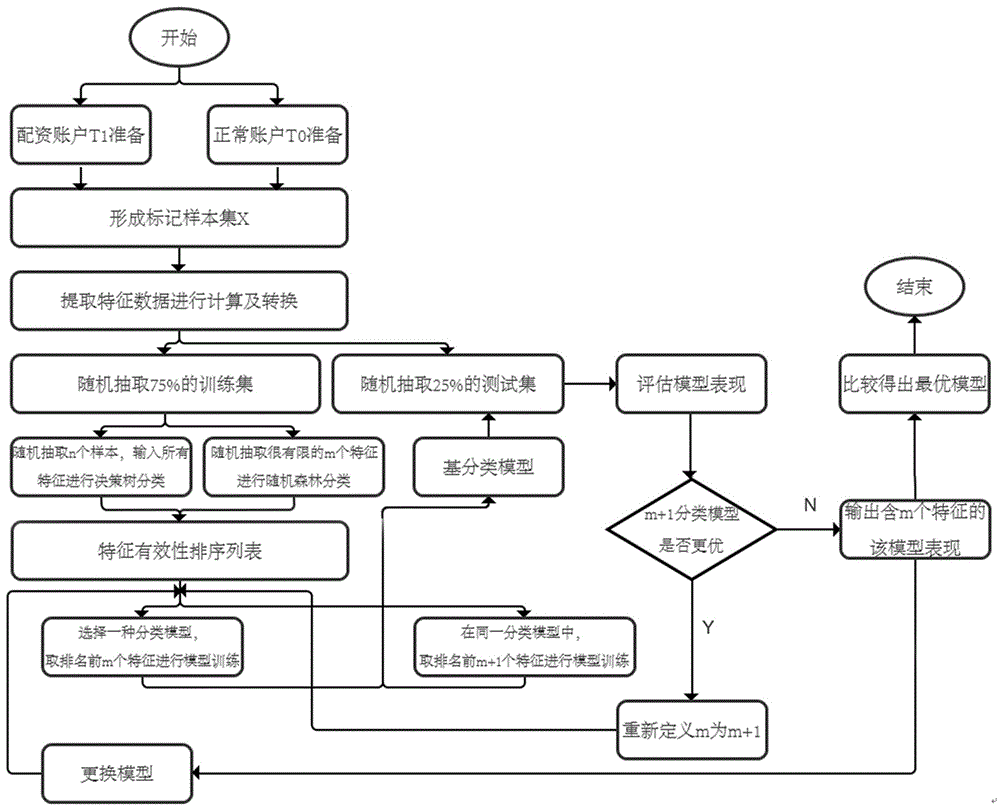

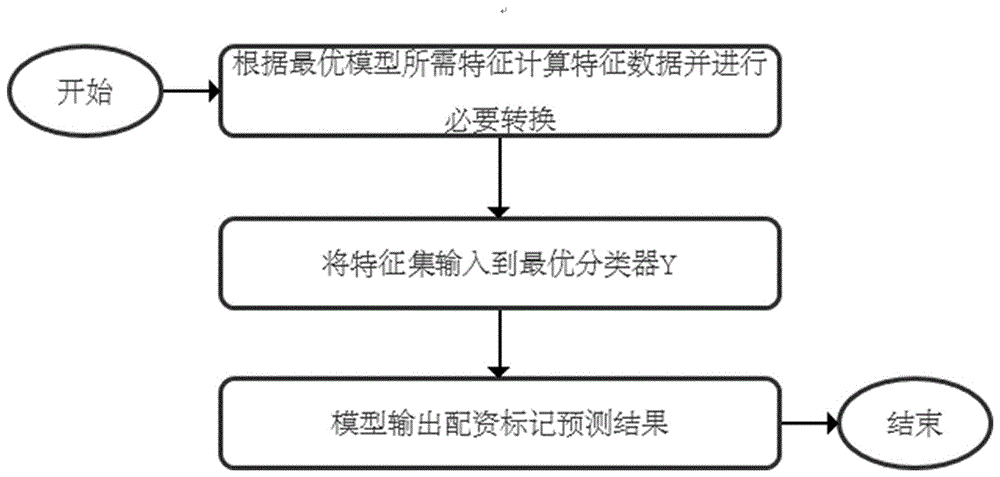

[0023] Such as figure 1 As shown, the flow chart of obtaining the optimal classification model in the securities allocation account identification method based on supervised machine learning of the present invention is given. The securities allocation account identification method based on supervised machine learning of the present invention, through the following steps to realise:

[0024] a). Collect samples and mark them, and collect account sets T that have been identified as illegal fund allocation accounts 1 , and add a certain number of normal accounts T according to the prior ratio of illegal fund allocation accounts and normal fund allocation accounts 0, forming a labeled sample set X={x 1 ,x 2 ,...,x N};

[0025] b). Extract and calculate the transaction characteristics, and select the characteristics related to the allocation of funds, ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com