Method and model for evaluating network e-commerce loan risk

A risk assessment model and risk assessment technology, applied in business, character and pattern recognition, customer relationship, etc., can solve the problems of non-linear structure of credit data, unbalanced credit data, and high rate of error and misjudgment

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

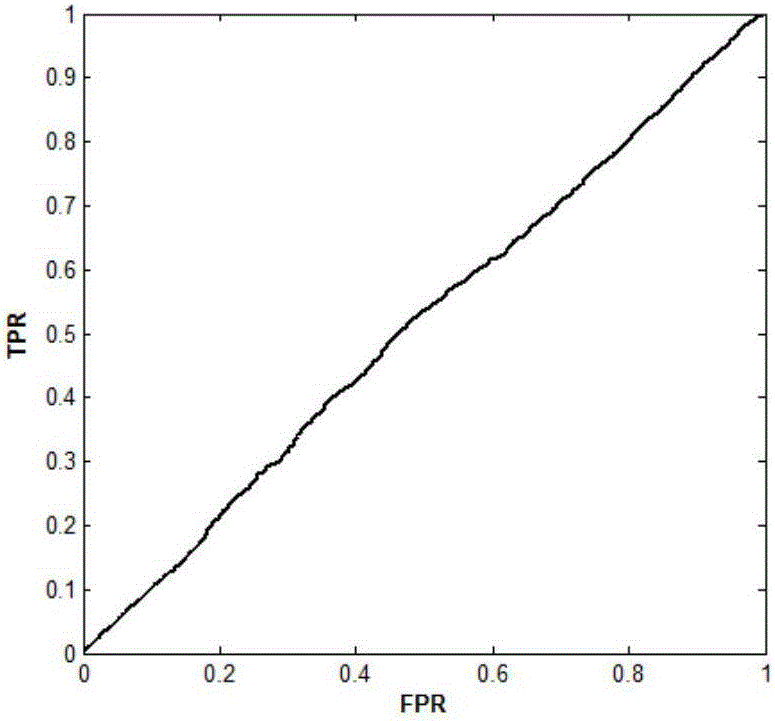

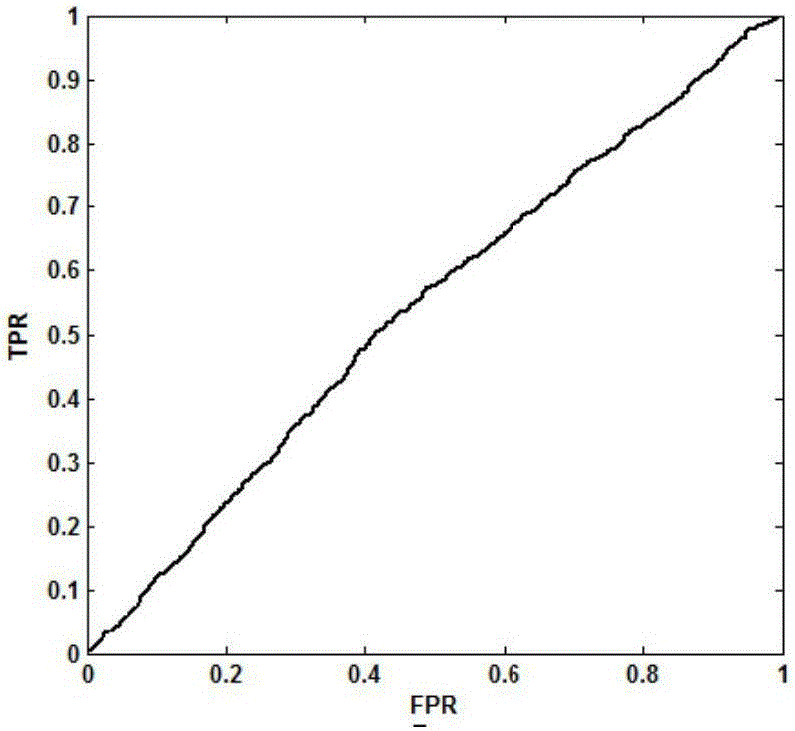

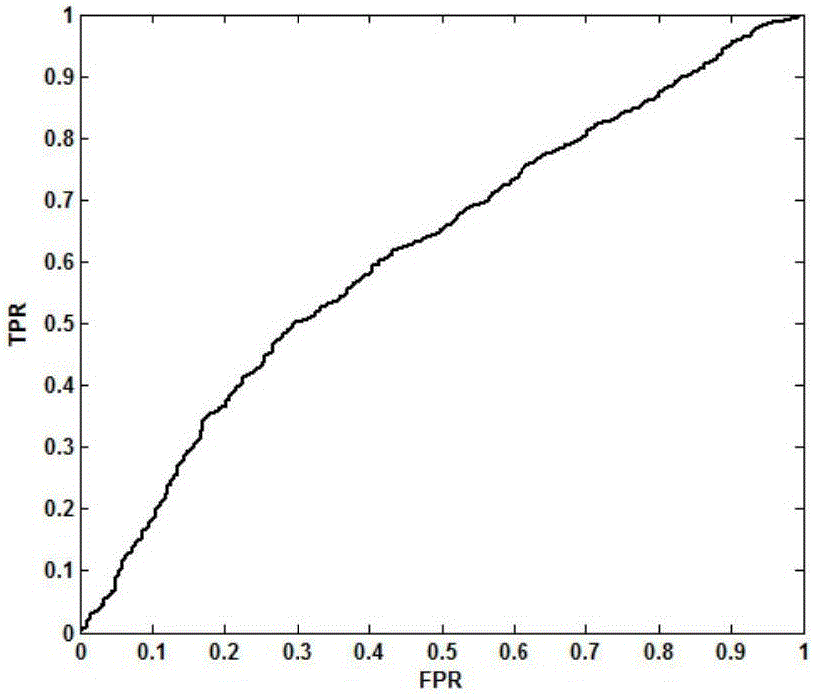

Image

Examples

Embodiment Construction

[0165] The present invention will be further described in detail below in conjunction with the accompanying drawings and specific embodiments.

[0166] In this embodiment, the loan risk data of the online lending industry in the "Magic Mirror Cup" risk control algorithm competition of Paipaidai is selected as the experimental data.

[0167] (1) Data set composition

[0168] According to the value of the default label target in the experimental data, the credit status of the borrower can be judged. target=1 represents loan default, and target=0 represents normal repayment. Loan data records are randomly selected from the experimental competition data to form the training set and test set of the model. The data set has six large field categories. After each large field type is subdivided, the data set has a total of 207 data dimensions. The training set and The data distribution of the test set is shown in Table 1.

[0169] Table 1 Data set composition

[0170]

[0171] (2...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com