Risk control system

A risk control and sub-module technology, applied in the field of risk control system for loan risk assessment, can solve the problems of corruption of auditors, negligence of auditors, long cycle, etc., to reduce the interference of human factors, improve the level of comprehensive management, The effect of reducing the risk of errors

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

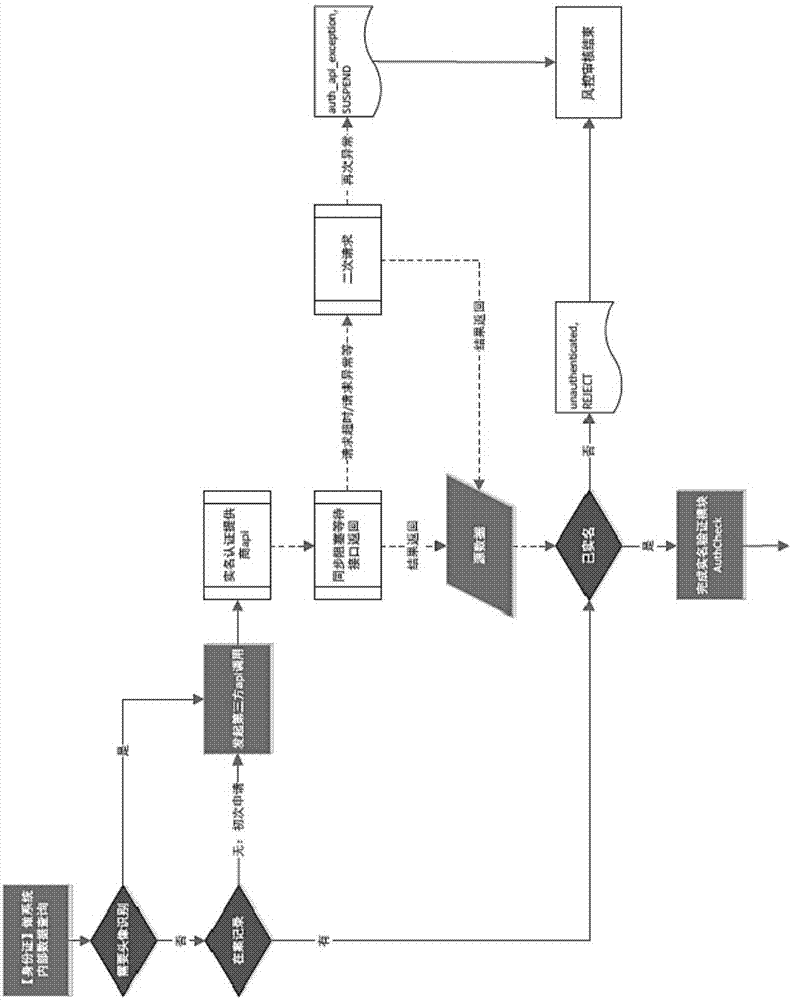

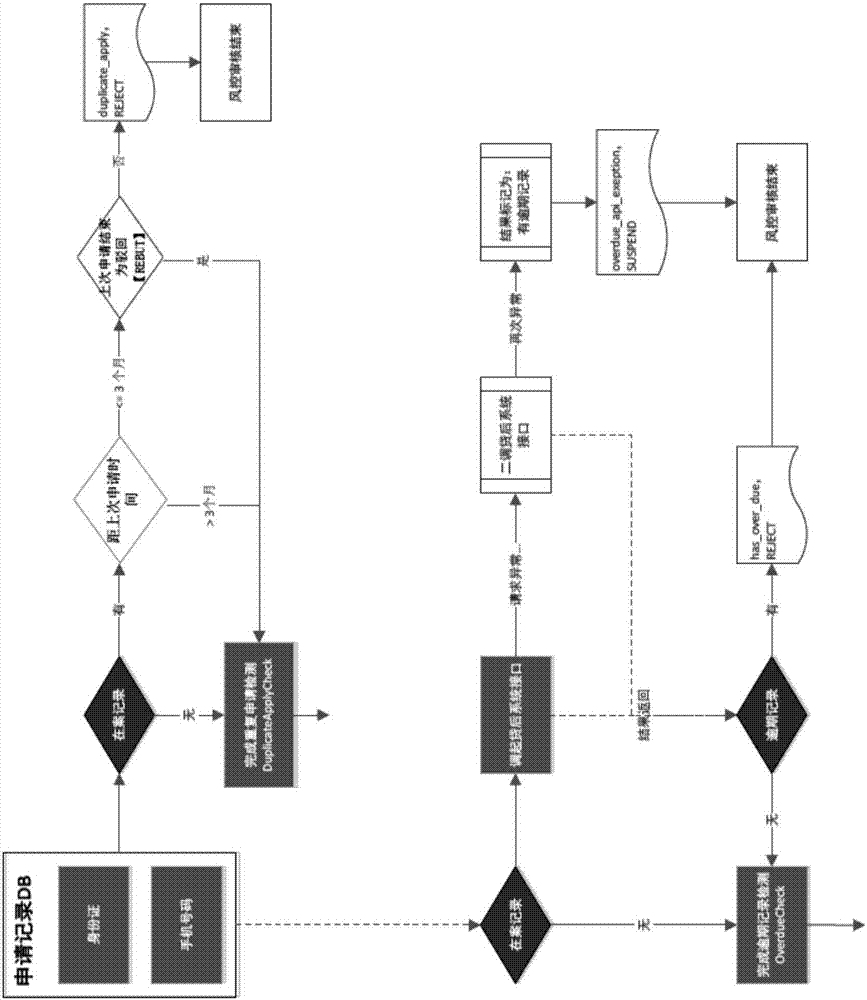

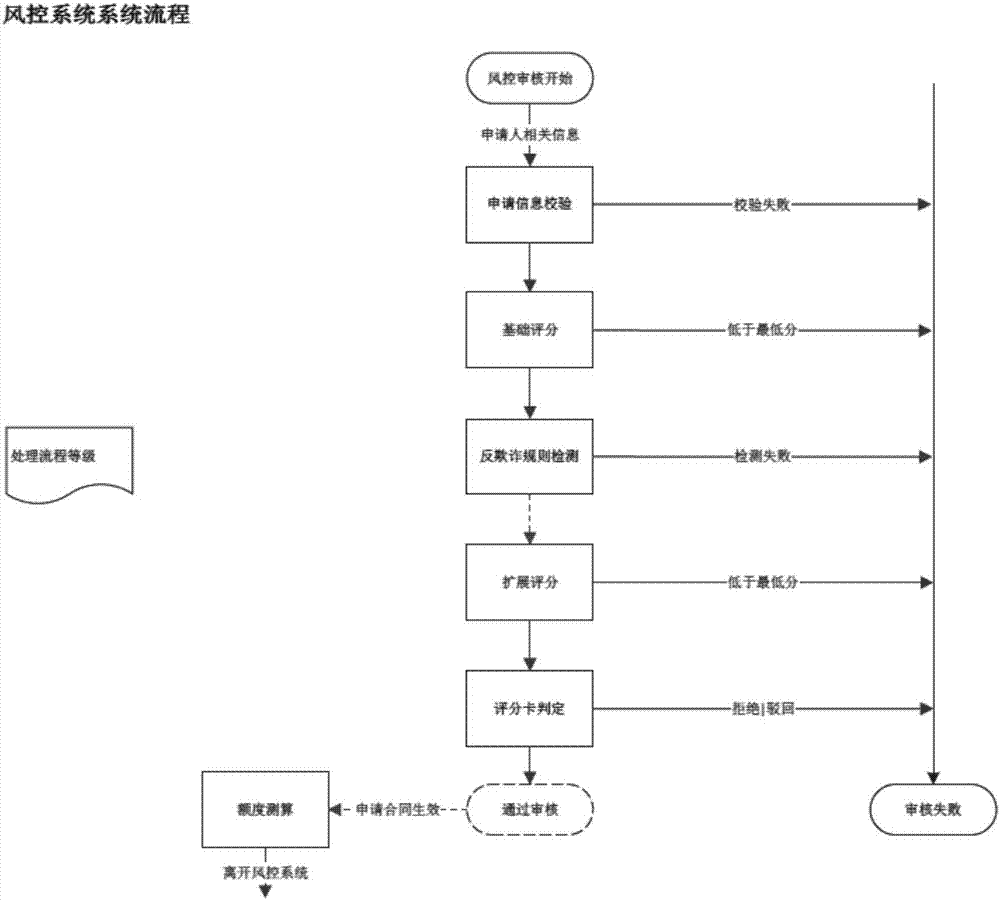

[0036] combine Figure 1-10 A risk control system as shown, such as figure 1 As shown, it includes the application information verification module, fraud prevention detection module, score card judgment module and local information storage module for risk control review of loan applicants, application information verification module, fraud prevention detection module, and score card judgment module. As the core component of the present invention, the large module assesses risks and avoids risks by checking applicant information fields, calling APIs of third-party credit reporting systems, and including system-defined scorecard rules.

[0037] The application information verification module verifies the application information of the loan applicant, such as figure 2 As shown, the application information verification module mainly includes a required field inspection sub-module, a blacklist inspection sub-module, a real-name authentication inspection sub-module, a duplicate ap...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com