A personalized recommendation method based on risk revenue management on a P2P platform

A recommended method and platform technology, applied in data processing applications, instruments, finance, etc., can solve problems such as unreachable and achieve good operational results

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

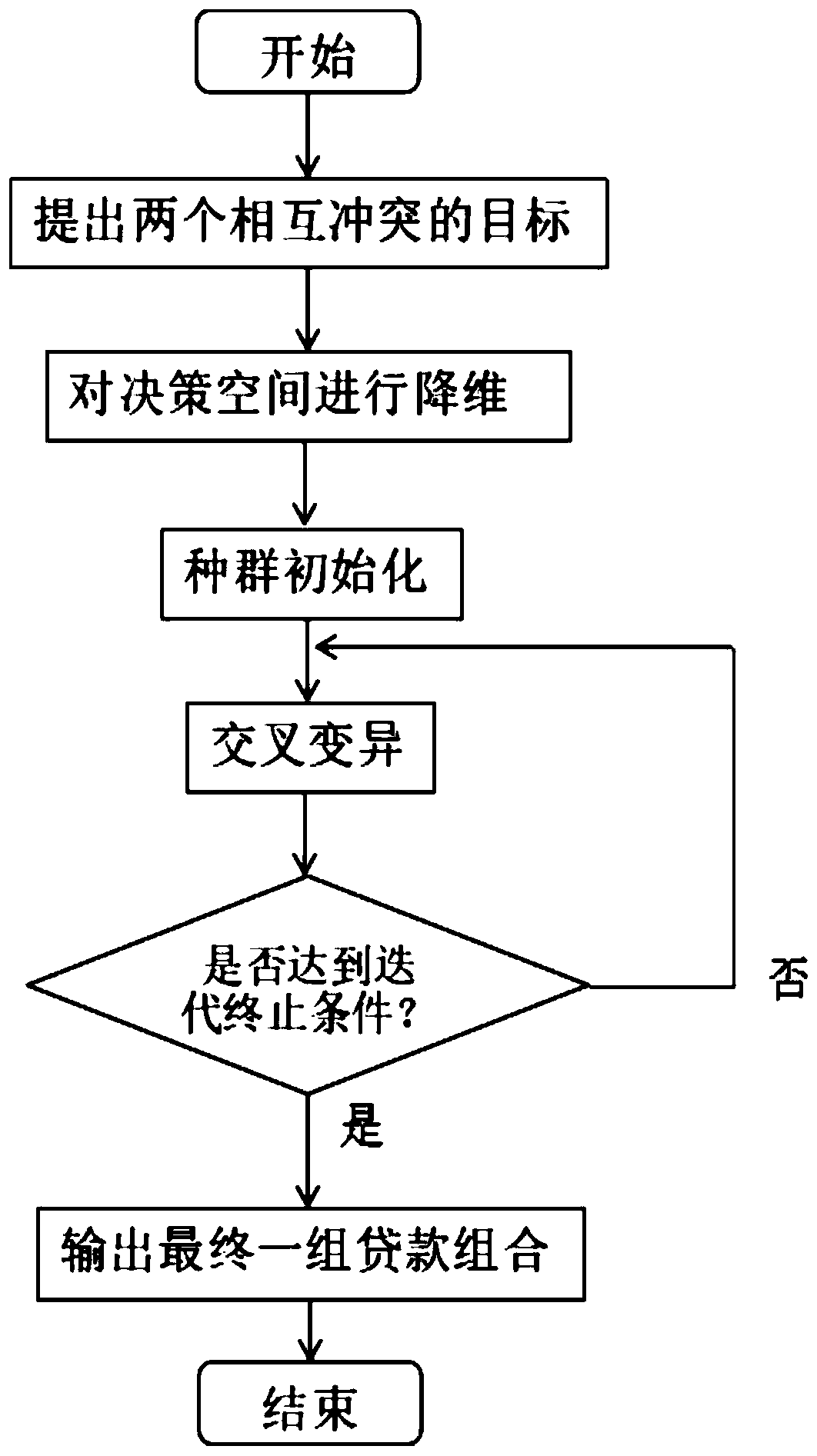

[0059] In this example, a personalized recommendation method based on risk-return management on the P2P platform transforms the loan recommendation problem in the P2P lending platform into a loan portfolio recommendation problem based on multi-objective optimization, and combines the NSGA-Ⅱ algorithm framework to solve the loan portfolio recommendation problem problem, so as to obtain a different set of optimal loan portfolios for each user in the platform; such as figure 1 As shown, specifically, proceed as follows:

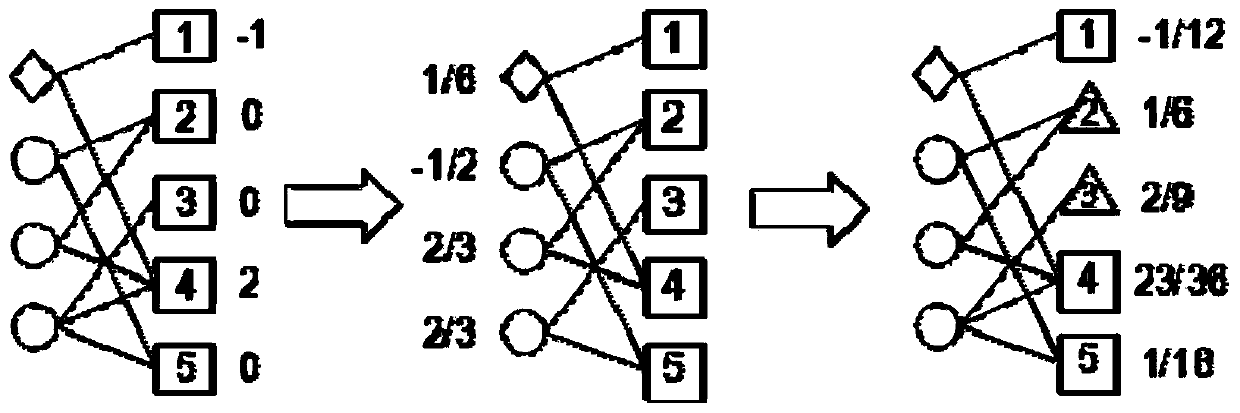

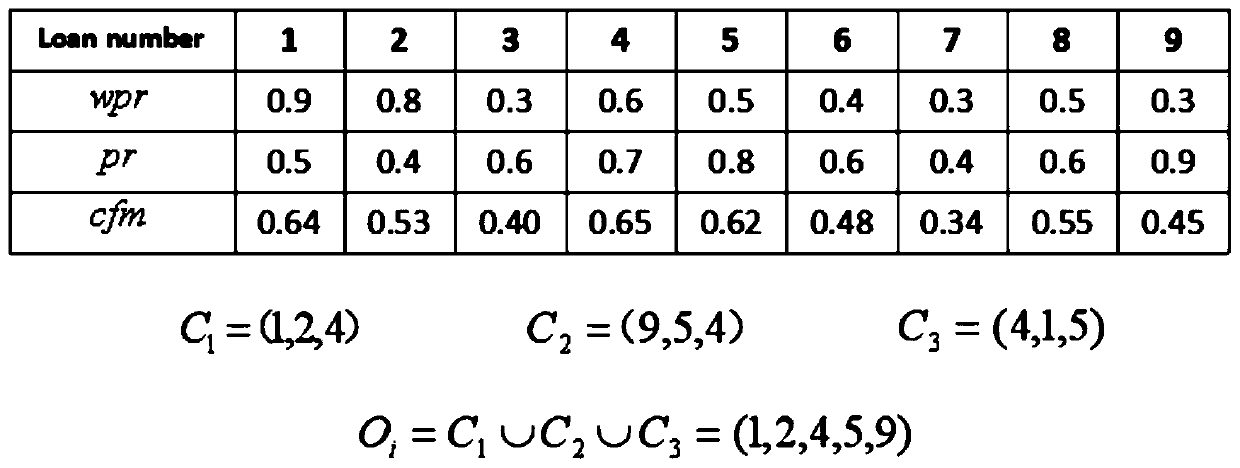

[0060] Step 1. Define the user set including all users in the P2P lending platform as U={u 1 ,u 2 ,...,u n}. Define the loan set including all loans in the platform as V={v 1 ,v 2 ,...,v m}. For any loan v j Both exist with a final state (Defaulted (-1), Canceled (0), Deferred (1), and Repaid (2)). The weighted probability propagation algorithm is obtained by improving the probability propagation algorithm to model and analyze the existing transaction d...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com